Download PDF - Columbia Valley Pioneer

Download PDF - Columbia Valley Pioneer

Download PDF - Columbia Valley Pioneer

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

14 • The <strong>Columbia</strong> <strong>Valley</strong> <strong>Pioneer</strong> March 2, 2007<br />

Brendan Donahue<br />

Investment Advisor<br />

Phone: 342-2112 YOUR MONEY<br />

GIC Rates as of Feb. 26 th<br />

cashable 4.00%<br />

90 days 4.16%<br />

1 yr 4.25%<br />

2 yrs 4.26%<br />

3 yrs 4.30%<br />

4 yrs 4.30%<br />

5 yrs 4.30%<br />

New High Interest Savings Accounts<br />

No minimum balances 3.85%<br />

No fees<br />

Interest calculated daily, paid monthly<br />

Redeemable at any time<br />

RRSP and RRIF eligible<br />

Investments<br />

GICs, Stocks, Bonds, Preferred Shares,<br />

Income Trusts, Mutual Funds,<br />

High Interest Savings, RRSPs<br />

Rates subject to change without notice.<br />

Subject to availability.<br />

Brendan Donahue,<br />

BCOMM, CIM, FMA<br />

Investment Advisor<br />

Berkshire Securities Inc.<br />

342-2112<br />

Jason Elford,<br />

CFP<br />

Investment Advisor<br />

Berkshire Investment Group Inc.<br />

342-5052<br />

The <strong>Columbia</strong> <strong>Valley</strong>’s<br />

Premiere Wealth<br />

Management Firm<br />

Planning<br />

Estate Planning, Retirement Planning,<br />

Retirement Projections,<br />

Income Splitting,<br />

Registered Educational Savings Plans<br />

Services<br />

RSP Loans, Mortgage Referrals,<br />

Pension Transfers, Group RRSPs,<br />

Complimentary Portfolio Reviews<br />

Baby boomers should discuss<br />

Most people review their Investment portfolio regularly!<br />

When was the last time you reviewed your Life Insurance Portfolio?<br />

In our ever changing world it is<br />

important that your<br />

insurance is reviewed<br />

constantly to ensure that it<br />

is the best and most<br />

appropriate coverage<br />

available.<br />

needs of aging parents<br />

Th e population is aging faster than ever before.<br />

In 1997, there were 390 million people over the<br />

age of 65, comprising 6.6 percent of the world’s population.<br />

By 2025, this number is expected to exceed 800<br />

million, or about 10 percent of the population.<br />

Th is demographic shift will soon become a serious<br />

challenge for our society. In addition to taking care of<br />

their children, baby boomers may well be responsible<br />

for the care of their aging parents.<br />

Add to this the growing concerns about the longterm<br />

fi nancial viability of government-sponsored medical<br />

care, and you have the makings of a full-fl edged<br />

crisis.<br />

Most people tend to avoid a discussion around<br />

health care planning, simply because they prefer not<br />

to face their own mortality or the diffi cult decisions<br />

surrounding it.<br />

Th e truth is, discussing the topic early with your<br />

parents can save you and your family problems in the<br />

future. Here’s how:<br />

• Talk to your parents about their wishes:<br />

Find out their perspectives on housing arrangements<br />

and medical procedures. Support them in building<br />

a comfortable future. Be sensitive when discussing<br />

their concerns and wishes—the subject of long-term<br />

care can touch on a variety of intensely personal issues,<br />

so you’ll want to initiate the conversation with<br />

sensitivity and empathy.<br />

• Get the whole family involved:<br />

Taking care of your aging parents is usually more<br />

Market Action<br />

As of Feb. 12 th , 2007 Weekly Gain/(Loss) YTD<br />

S&P/TSX Composite Index 13,404 211.46 3.85%<br />

Dow Jones Industrial Average 12,632 -67.74 1.36%<br />

Nikkei 17,940 275.35 5.18%<br />

Oil (New York) $61.39 $2.00 (0.57%)<br />

Gold (New York) $689.00 $17.00 7.66%<br />

Canadian Dollar (in US dollars) $0.8588 0.0006 3.38%<br />

As one of the valley’s only<br />

truly independent Life<br />

Insurance brokers, I have<br />

access to most of the major<br />

carriers and can help you to<br />

ensure that you have the best<br />

products to suit your needs.<br />

For a complimentary review<br />

and to see if we can lower your<br />

cost or improve the quality of<br />

your existing coverage call me at<br />

342-5052 or just stop in to the<br />

Berkshire offi ce and ask to see<br />

Jason.<br />

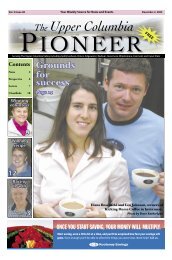

Jason Elford has been a wealth management specialist in Calgary for more than 9 years. Now a full time resident of Invermere,<br />

Jason recently joined the Berkshire offi ce with Brendan Donahue and Bruce McLaughlin.<br />

work than one person can handle. Th at’s why it’s a<br />

good idea to discuss the topic with your siblings and<br />

other members of the family if appropriate. Find out<br />

what their positions on the subject are. Are they able<br />

to help fi nancially? Or perhaps with their time?<br />

• Clarify your parents’ fi nancial situation:<br />

To create a viable caring strategy, you’ll need to<br />

know exactly where your parents stand fi nancially. Reviewing<br />

fi nances early will enable you to take appropriate<br />

action if required.<br />

• Look for help outside of the family:<br />

Caring for elderly parents is a popular topic, and<br />

it’s sure to become even more so as the population<br />

ages. Keep an eye out for services and seminars in your<br />

community that address the topic. Look into seniors’<br />

organizations, churches or community centres for assistance—you<br />

never know where you’ll fi nd help.<br />

• Financing long-term care:<br />

Th ere may come a day when your parents require<br />

fi nancial assistance so you’ll want to be prepared.<br />

Most Canadians will have three main options: government-sponsored<br />

care, in which case you will have<br />

little control over the care provided; private funding,<br />

where you may have to dip into your savings or home<br />

equity; or long-term care insurance.<br />

Long-term care insurance is a sensible choice for<br />

many families.<br />

However, with so many variables to consider, it’s<br />

a decision that’s best made after a thorough discussion<br />

with a qualifi ed fi nancial professional.<br />

Jason Elford<br />

Certifi ed Financial Planner<br />

Insurance Advisor<br />

712 - 10th Street, Invermere<br />

Phone: 342-5052