Report and Financial Statements Adactus Housing Group Limited

Report and Financial Statements Adactus Housing Group Limited

Report and Financial Statements Adactus Housing Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

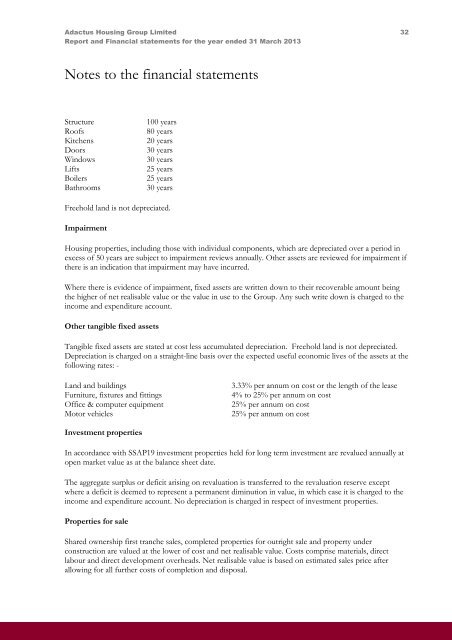

<strong>Adactus</strong> <strong>Housing</strong> <strong>Group</strong> <strong>Limited</strong> 32<strong>Report</strong> <strong>and</strong> <strong>Financial</strong> statements for the year ended 31 March 2013Notes to the financial statementsStructureRoofsKitchensDoorsWindowsLiftsBoilersBathrooms100 years80 years20 years30 years30 years25 years25 years30 yearsFreehold l<strong>and</strong> is not depreciated.Impairment<strong>Housing</strong> properties, including those with individual components, which are depreciated over a period inexcess of 50 years are subject to impairment reviews annually. Other assets are reviewed for impairment ifthere is an indication that impairment may have incurred.Where there is evidence of impairment, fixed assets are written down to their recoverable amount beingthe higher of net realisable value or the value in use to the <strong>Group</strong>. Any such write down is charged to theincome <strong>and</strong> expenditure account.Other tangible fixed assetsTangible fixed assets are stated at cost less accumulated depreciation. Freehold l<strong>and</strong> is not depreciated.Depreciation is charged on a straight-line basis over the expected useful economic lives of the assets at thefollowing rates: -L<strong>and</strong> <strong>and</strong> buildingsFurniture, fixtures <strong>and</strong> fittingsOffice & computer equipmentMotor vehicles3.33% per annum on cost or the length of the lease4% to 25% per annum on cost25% per annum on cost25% per annum on costInvestment propertiesIn accordance with SSAP19 investment properties held for long term investment are revalued annually atopen market value as at the balance sheet date.The aggregate surplus or deficit arising on revaluation is transferred to the revaluation reserve exceptwhere a deficit is deemed to represent a permanent diminution in value, in which case it is charged to theincome <strong>and</strong> expenditure account. No depreciation is charged in respect of investment properties.Properties for saleShared ownership first tranche sales, completed properties for outright sale <strong>and</strong> property underconstruction are valued at the lower of cost <strong>and</strong> net realisable value. Costs comprise materials, directlabour <strong>and</strong> direct development overheads. Net realisable value is based on estimated sales price afterallowing for all further costs of completion <strong>and</strong> disposal.