Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

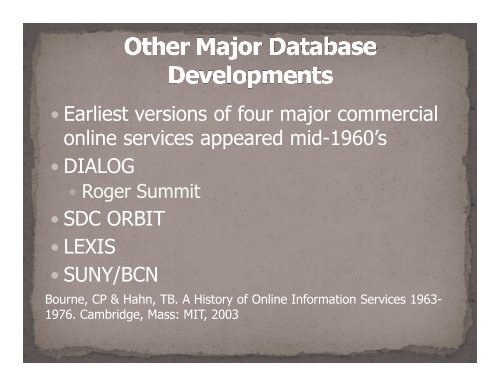

DIALOG SDC ORBIT BLAISE NLM (Medlars/Medline) Not mentioned: LEXIS, SUNY/BRS ALL required a different commandlanguage

Chemical Abstracts #1 Engineering Index “some way behind” Science Abstracts “some way behind” “Business and management uses areapparently limited or non-existent”Online User News Issue 3 June 1980

Regular discussions of practical problems Many respondents have already undergonebasic training Needs: Advanced training Refresher coursesOnline User News Issue 3, June 1980

2. is deducted by the employer from a payment of earnings as a contribution toan occupational pension scheme for that period or3. a person contributes towards a personal pension scheme for that period.ExamplePatricia earns £50 a week and is paid weekly. She pays £26 a month into a personalpension scheme. Her normal pay period is a week. Her pension contribution ischanged into a weekly figure (£26 x 12 ÷ 52 = £6 pw) and half of this weekly figure(£6 ÷ 2 = £3) is deducted from her gross weekly earnings (£50 - £3 = £47).V4031Occupational pension schemes 1 are arrangements by which an employer providesbenefits for employees based on service. The benefits may be provided by theemployer or through a pension provider. Benefits are1. normally in the form of a pension, all or part of which may be taken as a lumpsum2. payable on death or retirement.1 ESA Regs 13, reg 2; PS Act 93, s 1V4032 - V4033V4034Personal pension schemes 1 are1. a scheme under certain pension and taxation legislation 2 or2. an annuity contract or trust scheme under certain taxation legislation 3 .They provide benefits independently of any employer (although an employer may stillmake contributions to such a scheme). Benefits are payable as annuities which mayprovide lump sum and pension payments payable on death or retirement.1 ESA Regs 13, reg 2; 2 PS Act 93, s 1; Income and Corporation Taxes Act 1988, Chapter 4 of <strong>Part</strong> 14 & Finance Act 2004, Sch 36, para 1(1)(g); 3 Income and Corporations Taxes Act 1988, s 620 or s 621; Finance Act 2004, Sch 36, para 1(1)(f) & Income & Corporation Taxes Act 1988, s 622(3)V4035Where a person pays contributions into both an occupational and a personalpension scheme, the deduction from gross earnings should be one half of the totalpayments made for the pay period 1 .Expenses not reimbursed by employer1 R(FC) 1/90V4036An expense that is not repaid to an employee by the employer should be deductedfrom earnings if it is incurred in the performance of the duties of the employment andis wholly, exclusively and necessarily incurred 1 .1 R(IS) 16/93V4037Examples of expenses for which deductions may be made under V4036 are1. equipment, tools and stationery2. overalls and specialist clothing

“1.3 If the user has his own PAD (a device forconverting the equipment protocol to X.25), orhis computer has an X.25 interface, an X.25 linkwill be required (1.3.1), in which case section 2must also be completed. However in cases whereonly an asynchronous terminal exists, applicationshould be made for a connection to one ofSAPONET’s TRIPLE-X PADS.”A Guide to Applying for Packet-Switching Services. SAPONET Brochure No. 2, Issue 1. Sept 1983.