Commercial Property - North Star Mutual Insurance Company

Commercial Property - North Star Mutual Insurance Company

Commercial Property - North Star Mutual Insurance Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

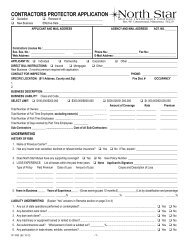

INTRODUCTIONCOMMERCIAL PROPERTY PROGRAM (CP)This program is designed to provide Fire and Extended Coverage for risks where no liability is desired or whereliability must be written as a separate policy. <strong>North</strong> <strong>Star</strong> <strong>Mutual</strong> subscribes to the ISO <strong>Commercial</strong> Fire and AlliedLines program for loss costs, rules and forms. The loss costs are subject to our company multiplier as filed withthe <strong>Insurance</strong> Department.The Causes of Loss-Basic Form can be written on a no coinsurance basis which is very useful on large, olderbuildings that are in good shape but have a low market value. The Causes of Loss-Broad Form and the Causes ofLoss-Special Form must be written to at least 80% of the building's actual cash value or its replacement cost ifreplacement cost coverage is desired.UNDERWRITING RULES1. <strong>Property</strong> should be at least in average condition and should be well kept.2. Only risks with a solid financial history or excellent prospects for the future should be submitted.3. Vacant properties are not acceptable.4. <strong>Commercial</strong> buildings are not eligible for coverage if they have wood burning equipment.5. Refer to the COMMERCIAL PROPERTY FIRE LINE GUIDE AND PROHIBITED LIST in the GeneralInformation Section for eligibility and line limit.6. Complete a <strong>North</strong> <strong>Star</strong> <strong>Commercial</strong> <strong>Property</strong> Application for each risk. A photo of the risk is also very helpfulfor underwriting and rating purposes.PROPERTY COVERAGE SECTIONCP 1010 - Causes of Loss-Basic Form. This form may be written on a replacement cost or actual cash valuebasis. It covers loss to property caused by:Fire or LightningWindstorm or HailAircraft or VehiclesVandalism and Malicious MischiefSinkhole CollapseExplosionSmokeRiot or Civil CommotionSprinkler LeakageVolcanic ActionCP 1020 - Causes of Loss-Broad Form. This form may be written on either a replacement cost or an actualcash value basis. It provides coverage for covered property against loss by:All the perils listed for CP 1010, plus:Falling ObjectsWater DamageWeight of Ice, Snow and SleetCP 1030 - Causes of Loss-Special Form. This form may be written on either a replacement cost or an actualcash value basis. It covers property against risk of direct physical loss unless the loss is excluded. When SpecialForm is written, coverage for Equipment Breakdown is included (CF-1821).IA, MN, ND, SD New Business 01-01-09<strong>North</strong> <strong>Star</strong> <strong>Mutual</strong> Ins. Co. NSCP - 1 Renewals 01-01-09

OPTIONAL COVERAGESMany optional coverages can be added to our <strong>Commercial</strong> <strong>Property</strong> policy. Inland Marine, Time Element, Crime,and other optional property coverages are all available. Please call us here at the Home Office if you have anyquestions on optional coverages.DEDUCTIBLEA $500 per occurrence deductible is standard. Higher deductibles are available. A buy-back to a $250 deductibleis also available.RATES AND QUOTES<strong>North</strong> <strong>Star</strong> does not publish any rates for its CP Program. However, we have excellent turnaround time on ourquotes. Please send us a completed application and we will be happy to provide you with a quick quote on therisk.POLICY TERMPolicies are written on a 1 year basis. The policy will be automatically renewed each year with an updateddeclarations page. The policy will be subject to the premiums, rules and forms in effect at the time of renewal.Policyholders will initially receive copies of all policy forms. Upon renewal they will receive only an updateddeclarations and forms that are new or revised. Policyholders may receive all policy forms upon request.MINIMUM PREMIUMThe minimum annual policy premium under our CP Program is $275.00.INDIVIDUAL RISK PREMIUM MODIFICATION (IRPM)Premium credits or debits may be applied at the discretion of the Home Office. Please call our Home Office<strong>Commercial</strong> Underwriters to determine credits or debits. After the IRPM Plan has been applied, the annualpremium cannot be less than the minimum premium.IA, MN, ND, SD New Business 03-01-14<strong>North</strong> <strong>Star</strong> <strong>Mutual</strong> Ins. Co. NSCP - 2 Renewals 03-01-14