QDRO Instruction Booklet (PDF) - IAM National Pension Fund

QDRO Instruction Booklet (PDF) - IAM National Pension Fund

QDRO Instruction Booklet (PDF) - IAM National Pension Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

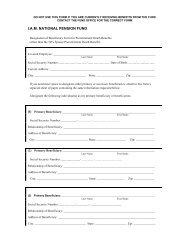

I.A.M.NATIONALPENSIONFUNDQualified DomesticRelations Orders<strong>Instruction</strong> <strong>Booklet</strong>THE I.A.M. NATIONAL 401(K) PLAN

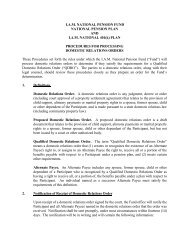

QUALIFIED DOMESTIC RELATIONS ORDERS AND THEI.A.M. NATIONAL PENSION FUND, I.A.M NATIONAL 401(K) PLANThe Employee Retirement Income Security Act (“ERISA”) provides that pension benefits may beallocated to a non-employee spouse, child, or other dependent of a Participant in an employee benefitfund by a “Qualified Domestic Relations Order” (“<strong>QDRO</strong>”). The individual who may receive suchbenefits is called an “Alternate Payee.” The I.A.M. <strong>National</strong> <strong>Pension</strong> <strong>Fund</strong> (“ <strong>Fund</strong>”) may pay benefitsdirectly to an Alternate Payee only in accordance with a domestic relations order which has beendetermined by the <strong>Fund</strong> to be a <strong>QDRO</strong>. It is the legal responsibility of the <strong>Fund</strong> to determine if aDomestic Relations Order is a <strong>QDRO</strong>. Therefore, any domestic relations order must be submittedto the <strong>Fund</strong> for a review and determination of its status.The purpose of this booklet is to provide some guidance to legal practitioners in the preparation ofa <strong>QDRO</strong> for the <strong>Fund</strong>. In the past, many orders submitted to the <strong>Fund</strong> have not been qualified largelybecause of misunderstandings about the nature of the <strong>Fund</strong> and the requirements of ERISA. As a result,many orders have been redrafted three or four times. It is hoped that the information in this booklet willhelp everyone to avoid the added costs of multiple drafts and reviews. There are many options toconsider and many decisions that must be made by the parties in establishing a <strong>QDRO</strong>. To achieveyour goals, the <strong>Fund</strong> strongly recommends that you read this entire booklet.In addition to consulting this booklet, you should also closely review the <strong>Fund</strong>’s Procedures forProcessing Domestic Relations Orders, a copy of which has been provided to you. The model domesticrelations order enclosed with the booklet can also be helpful to you in establishing a <strong>QDRO</strong>.INTRODUCTIONA domestic relations order is any court order under a state domestic relations law which concernsseparation, divorce, marital property rights, alimony or child support. A domestic relations order is a<strong>QDRO</strong> if it creates or recognizes an Alternate Payee’s right to receive all or a portion of the benefitspayable to a Participant in the <strong>Fund</strong>, contains the information required by ERISA and does not alter the1

amount or form of benefits otherwise provided by the <strong>Fund</strong>. The Participant is the employee who iseligible to receive a benefit from the <strong>Fund</strong>. The Alternate Payee is a spouse, former spouse, child orother dependent of the Participant who is recognized by a <strong>QDRO</strong> as having the right to receive all or aportion of the benefits payable by the <strong>Fund</strong> to the Participant.A domestic relations order must meet the following standards to qualify under ERISA:●●●●●●●The Participant and any Alternate Payee to whom benefits may be payable must bespecifically named and last-known addresses must be included. Social Security Numbersof each party should be included as available.The order must clearly specify the plan or plans to which it applies.The order must require the plan to make payments directly to the Alternate Payee.The order must clearly state what amount or portion the plan is to pay to the AlternatePayee and when and for how long it is to be paid.The order may not require benefits to be paid to the Alternate Payee in a form nototherwise provided by the plan.The order may not require benefits, determined on the basis of actuarial equivalence, to bepaid to the Alternate Payee which are greater than those to which the Participant is entitledunder the plan.The order may not require benefits to be paid to the Alternate Payee which are alreadyrequired to be paid to another Alternate Payee under a prior <strong>QDRO</strong>.A copy of the ERISA provisions on <strong>QDRO</strong>s [Section 206(d)] appears at the end of this booklet.The language in Section 206(d) is also found in Section 414(p) of the Internal Revenue Code.In accordance with ERISA, the <strong>Fund</strong> will review any court order received to determine whether itmeets the requirements of ERISA for a <strong>QDRO</strong>. The <strong>Fund</strong> will also review any proposed order submittedby a party or legal representative of the party, to determine if it would be a <strong>QDRO</strong> when issued by a court.The parties are free to write a <strong>QDRO</strong> to suit their particular needs, but it must satisfy the requirements ofERISA and be consistent with the provisions of the <strong>Fund</strong>’s Plan of Benefits. It is the responsibility of the<strong>Fund</strong> to determine if a domestic relations order satisfies the requirements of a <strong>QDRO</strong>.Many orders are not qualified orders under ERISA because the parties misunderstand the nature ofthe <strong>Fund</strong>. To avoid repeated filings with the court, it is advisable for the parties to send the <strong>Fund</strong> a draft2

Adjudicated and proposed orders should be sent to the following address:I.A.M. <strong>National</strong> <strong>Pension</strong> <strong>Fund</strong>1300 Connecticut Avenue, N.W.Suite 300Washington, D.C. 20036-1703The information in this booklet is designed to assist attorneys in the drafting of a domestic relations orderthat will satisfy the requirements for a <strong>QDRO</strong>. THE INFORMATION CONTAINED IN THISBOOKLET IS NOT LEGAL ADVICE TO PARTICIPANTS, PROSPECTIVE ALTERNATEPAYEES, THEIR ATTORNEYS OR OTHER REPRESENTATIVES. THE FUND STRONGLYSUGGESTS THAT THE PARTIES TO A DOMESTIC RELATIONS ORDER CONSULT THEIRATTORNEYS TO ENSURE THAT THEIR INTENTIONS ARE ACCURATELY REFLECTEDIN ANY ORDER.TYPE OF PLANThe I.A.M. <strong>National</strong> 401(k) Plan (“Plan”) is a defined contribution plan, funded exclusively byemployee contributions. Each Participant has an individual account, made up of contributions they haveelected to make to the Plan by having amounts withheld from their pay and sent to the Plan. TheParticipant’s individual account will also include his investment gains and losses. Participants personallydirect the investment of their individual accounts. Finally, the Participant’s individual account will beassessed his share of the Plan’s administrative expenses. The daily account balance of each account iscalculated based on the amount in the account as of the end of the previous business day, plus gains andany contributions deposited that day, minus investment losses, administrative expenses or other fees andany benefit payments made for that day.Benefits are payable to a Participant upon retirement, death, permanent disability or separationfrom employment covered by the Plan.4

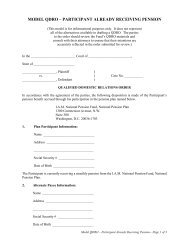

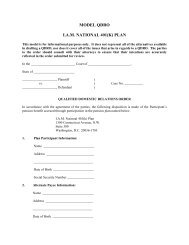

If the Participant participated in the Plan before July 1, 2001, he has had contributions made on hisbehalf by his employer. If the <strong>QDRO</strong> gives the Alternate Payee a portion of these contributions, thenthere are special rules which apply to the form in which benefits are paid to both the Participant and theAlternate Payee. If the amount of the Alternate Payee’s account is less than $5,000, her benefit will bepaid as a single lump sum. If the amount of the Alternate Payee’s account is at least $5,000, then it willbe paid to her as an annuity for her life, unless she rejects this form and chooses to receive her benefit as alump sum.BENEFIT ALLOCATION FORMULAUnder a Qualified Domestic Relations Order (“<strong>QDRO</strong>”), the Alternate Payee will be awardedsome portion of the Participant’s individual account. The portion assigned to her can be expressed eitheras a specific dollar amount or as some percentage of the Participant’s individual account. For example,the order could give the Alternate Payee the sum of $25,000 from the Participant’s individual account, aslong as the Participant had at least that amount of money in his individual account. Alternatively, theorder could say that the Alternate Payee would receive 50% of the Participant’s individual account as ofthe date the parties were divorced.The <strong>QDRO</strong> must also state the date as of which the Participant’s individual account is to bedivided. If the Alternate Payee’s account is to be divided as of December 31, 2006, the portion assignedto her will include the investment results on this amount from December 31, 2006 until the date anindividual account is established in the name of the Alternate Payee. Additionally, her individual accountwill be adjusted to reflect its share of the Plan’s administrative expenses since December 31, 2006.ALTERNATE PAYEE’S INDIVIDUAL ACCOUNTOnce a <strong>QDRO</strong> is established, an individual account will be established in the name of theAlternate Payee if required by the order. The amount in that individual account will be determined by the5

enefit allocation formula in the <strong>QDRO</strong> as discussed above. Once this individual account is established,the Alternate Payee will have the right to direct investment of it from among the options provided by thePlan.In addition to the right to direct investment of the individual account, the Alternate Payee willhave other rights in regards to that account, just as Participants do. These rights include the following:• The right to take a hardship withdrawal in accordance with the Plan of Benefits;• The right to designate a beneficiary to receive any benefits payable upon the AlternatePayee’s death.However, unless the Alternate Payee is herself working in employment covered by the Plan, theAlternate Payee will not have the right to make contributions to the Plan, to apply for a loan from the Planor to roll over contributions into the Plan from another plan or individual retirement account.COMMENCEMENT OF BENEFITS TO ALTERNATE PAYEEAn Alternate Payee can elect to receive benefits from the Plan on the earlier of the date theParticipant reaches age 50 or the date the Participant becomes eligible for a benefit from the Plan. TheAlternate Payee must complete the Plan’s application process to begin receiving benefits. The AlternatePayee must receive benefits no later than the April 1 following the calendar year in which the AlternatePayee reaches age 70½.The Alternate Payee should note that it is not the Plan’s responsibility to notify her when theParticipant becomes eligible for benefits, so that she can apply for her benefit. However, upon writtenrequest from the Alternate Payee, the Plan will inform her about whether a Participant is eligible forbenefits from the Plan at the time of the inquiry.FORM OF BENEFTS FOR ALTERNATE PAYEEThe Alternate Payee will receive her benefit as a single lump sum. The amount of that benefit willbe the value of the Alternate Payee’s individual account at the time of distribution. However, if the6

<strong>QDRO</strong> assigns to the Alternate Payee a portion of employer contributions made before July 1, 2001, thenthe Alternate Payee will automatically receive the benefit as a lump sum only if the amount of herindividual account is less than $5,000. If her individual account is at least $5,000, then it will be paid toher as an annuity for her life, unless she rejects this form and chooses to receive her benefit as a lumpsum.PRERETIREMENT DEATH BENEFITIf an Alternate Payee dies before receiving her individual account, the value of that account willbe distributed to her designated beneficiary as a lump sum. The Alternate Payee’s spouse will be thebeneficiary unless the Alternate Payee has named another beneficiary and the spouse has consented to thatdesignation. If there is no beneficiary, any benefits payable upon the Alternate Payee’s death will bedistributed in accordance with the Plan of Benefits.DETERMINATION LETTER AND RIGHT OF APPEALWhen the <strong>Fund</strong> completes its review of an order that has been submitted, it will provide adetermination letter to the parties and their legal representatives. That letter will explain the <strong>Fund</strong>’sconclusions about the order, identify any changes that need to be made and advise the parties of their rightto appeal this decision to the <strong>Fund</strong>’s Board of Trustees. This determination letter will explain your appealrights, which are also described in the Summary Plan Description, a copy of which has been providedyou.If immediate payment of benefits is pending, the <strong>Fund</strong> will include with its determination letter aDomestic Relations Order Response Form. By completing this form, the parties will advise the <strong>Fund</strong> ifthey intend to appeal the <strong>Fund</strong>’s determination to the Board of Trustees, have the order amended or wishto waive the 180-day period in which they may submit an appeal.7

(II)is made pursuant to a State domestic relations law (including a communityproperty law).(C)A domestic relations order meets the requirements of this subparagraph only if such orderclearly specifies—(i)the name and the last known mailing address (if any) of the participant and thename and mailing address for each alternate payee covered by the order.(ii)the amount or percentage of the participant’s benefit to be paid by the plan to eachsuch alternate payee, or the manner in which such amount or percentage is to bedetermined.(iii)(iv)the number of payments or period to which such order applies, andeach plan to which such order applies.(D)A domestic relations order meets the requirements of this subparagraph only if suchorder—(i)does not require a plan to provide any type or form of benefit, or any option, nototherwise provided under the plan,(ii)does not require the plan to provide increased benefits (determined on the basis ofactuarial value), and(iii)does not require the payment of benefits to an alternate payee which are required tobe paid to another alternate payee under another order previously determined to bea qualified domestic relations order.(E) (i) A domestic relations order shall not be treated as failing to meet the requirementsof clause (i) of subparagraph (D) solely because such order requires that paymentof benefits be made to an alternate payee—9

(I)in the case of any payment before a participant has separated from service,on or after the date on which the participant attains (or would have attained)the earliest retirement age,(II)as if the participant had retired on the date on which such payment is tobegin under such order (but taking into account only the present value ofbenefits actually accrued and not taking into account the present value ofany employer subsidy for early retirement), and(III)in any form in which such benefits may be paid under the plan to theparticipant (other than in the form of a joint and survivor annuity withrespect to the alternate payee and his or her subsequent spouse).For all purposes of subclause (II), the interest rate assumption used in determiningthe present value shall be the interest rate specified in the plan or, if no rate isspecified, 5 percent.(ii)For purposes of this subparagraph, the term “earliest retirement age” means theearlier of—(I)the date on which the participant is entitled to a distribution under the plan,or(II)the later of the date the participant attains age 50 or the earliest date onwhich the participant could begin receiving benefits under the plan if theparticipant separated from service.(F)To the extent provided in any qualified domestic relations order—(i)the former spouse of a participant shall be treated as a surviving spouse of suchparticipant for purposes of section 205 (regarding the Joint and Survivor Annuityand Preretirement Survivor Annuity) (and any spouse of the participant shall not betreated as a spouse of the participant for such purposes), and10

(ii)if married for at least 1 year, the surviving former spouse shall be treated asmeeting the requirements of section 205(f) (regarding the minimum term ofmarriage).(G) (i) In the case of any domestic relations order received by a plan—(I)the plan administrator shall promptly notify the participant and eachalternate payee of the receipt of such order and the plan’s procedures fordetermining the qualified status of domestic relations orders, and(II)within a reasonable period after receipt of such order, the plan administratorshall determine whether such order is a qualified domestic relations orderand notify the participant and each alternate payee of such determination.(ii)Each plan shall establish reasonable procedures to determine the qualified status ofdomestic relations orders and to administer distributions under such qualifiedorders. Such procedures—(I)(II)shall be in writing,shall provide for the notification of each person specified in the domesticrelations order as entitled to payments of benefits under the plan (at theaddress included in the domestic relations order) of such procedurespromptly upon receipt by the plan of the domestic relations order, and(III)shall permit an alternate payee to designate a representative for receipt ofcopies of notices that are sent to the alternate payee with respect to adomestic relations order.(H) (i) During any period in which the issue of whether a domestic relations order is aqualified domestic relations order is being determined (by the plan administrator,by a court of competent jurisdiction, or otherwise), the plan administrator shallseparately account for the amounts (hereinafter in this subparagraph referred to as11

the “segregated amount”) which would have been payable to the alternate payeeduring such period if the order had been determined to be a qualified domesticrelations order.(ii)If within the 18-month period described in clause (v) the order (or modificationthereof) is determined to be a qualified domestic relations order, the planadministrator shall pay the segregated amounts (including any interest thereon) tothe person or persons entitled thereto.(iii)If within the 18-month period described in clause (v)—(I)(II)it is determined that the order is not a qualified domestic relations order, orthe issue as to whether such order is a qualified domestic relations order isnot resolved, then the plan administrator shall pay the segregated amountsincluding any interest thereon) to the person or persons who would havebeen entitled to such amounts if there had been no order.(iv)Any determination that an order is a qualified domestic relations order which ismade after the close of the 18-month period described in clause (v) shall be appliedprospectively only.(v)For purposes of this subparagraph, the 18-month period described in this clause isthe 18-month period beginning with the date on which the first payment would berequired to be made under the domestic relations order.(I)If a plan fiduciary acts in accordance with part 4 {regarding Fiduciary Responsibility) ofthis subtitle in—(i)treating a domestic relations order as being (or not being) a qualified domesticrelations order, or(ii)taking action under subparagraph (H),12

then the plan’s obligation to the participant and each alternate payee shall be discharged tothe extent of any payment made pursuant to such act.(J)A person who is an alternate payee under a qualified domestic relations order shall beconsidered for purposes of any provision of this Act a beneficiary under the plan. Nothingin the preceding sentence shall permit a requirement under section 4001 of the payment ofmore than 1 premium with respect to a participant for any period.(K)The term “alternate payee” means any spouse, former spouse, child or other dependent of aparticipant who is recognized by a domestic relations order as having a right to receive all,or a portion of, the benefits payable under a plan with respect to such participant.(L)(M)This paragraph shall not apply to any plan to which paragraph (1) does not apply.Payment of benefits by a pension plan in accordance with the applicable requirements of aqualified domestic relations order shall not be treated as garnishment for purposes of section 303(a) of theConsumer Credit Protection Act.161682_113