Credit Opinion: Turk Ekonomi Bankasi AS - Teb.com

Credit Opinion: Turk Ekonomi Bankasi AS - Teb.com

Credit Opinion: Turk Ekonomi Bankasi AS - Teb.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

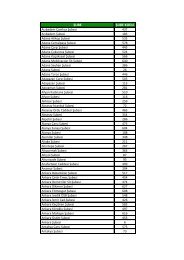

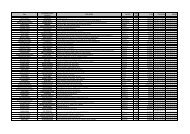

currency deposit ratings, foreign currency debt ratings may also be constrained by the country ceiling for foreigncurrency bonds and notes; however, in some cases the ratings on foreign currency debt obligations may beallowed to pierce the foreign currency ceiling. A particular mix of rating factors are taken into consideration in orderto assess whether a foreign currency bond rating pierces the country ceiling. They include the issuer's global localcurrency rating, the foreign currency government bond rating, the country ceiling for bonds and the debt's eligibilityto pierce that ceiling.About Moody's Bank Financial Strength ScorecardMoody's bank financial strength model (see scorecard below) is a strategic input in the assessment of the financialstrength of a bank, used as a key tool by Moody's analysts to ensure consistency of approach across banks andregions. The model output and the individual scores are discussed in rating <strong>com</strong>mittees and may be adjusted up ordown to reflect conditions specific to each rated entity.Rating Factors<strong>Turk</strong> <strong>Ekonomi</strong> <strong>Bankasi</strong> <strong>AS</strong>Rating Factors [1] A B C D E Total Score TrendQualitative Factors (70%) DFactor: Franchise Value D+ NeutralMarket share and sustainability xGeographical diversification xEarnings stability xEarnings Diversification [2]Factor: Risk Positioning D NeutralCorporate Governance [2]- Ownership and Organizational Complexity- Key Man Risk- Insider and Related-Party RisksControls and Risk Management x- Risk Management x- Controls xFinancial Reporting Transparency x- Global Comparability x- Frequency and Timeliness x- Quality of Financial Information x<strong>Credit</strong> Risk Concentration x- Borrower Concentration x- Industry Concentration xLiquidity Management xMarket Risk Appetite xFactor: Operating Environment D NeutralEconomic Stability xIntegrity and Corruption xLegal System xFinancial Factors (30%) CFactor: Profitability C WeakeningPPI % Average RWA (Basel II) 2.07%Net In<strong>com</strong>e % Average RWA (Basel II) 1.39%Factor: Liquidity C Neutral(Market Funds - Liquid Assets) % Total Assets -5.16%Liquidity Management xFactor: Capital Adequacy B+ Neutral