Credit Opinion: Turk Ekonomi Bankasi AS - Teb.com

Credit Opinion: Turk Ekonomi Bankasi AS - Teb.com

Credit Opinion: Turk Ekonomi Bankasi AS - Teb.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

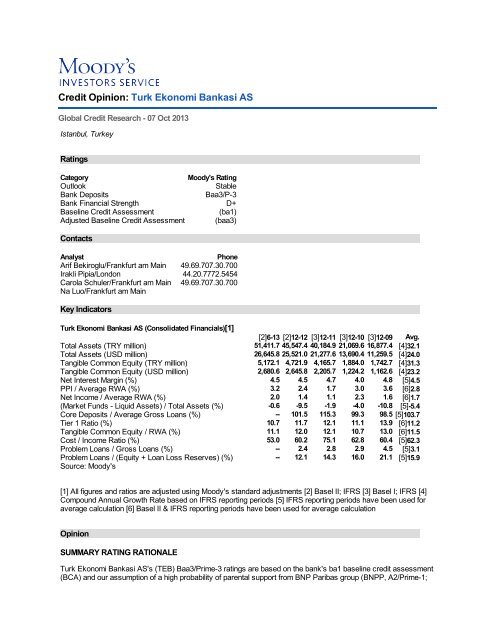

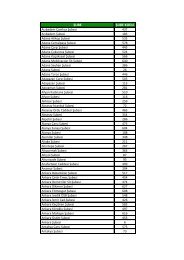

<strong>Credit</strong> <strong>Opinion</strong>: <strong>Turk</strong> <strong>Ekonomi</strong> <strong>Bankasi</strong> <strong>AS</strong>Global <strong>Credit</strong> Research - 07 Oct 2013Istanbul, <strong>Turk</strong>eyRatingsCategoryMoody's RatingOutlookStableBank DepositsBaa3/P-3Bank Financial Strength D+Baseline <strong>Credit</strong> Assessment(ba1)Adjusted Baseline <strong>Credit</strong> Assessment (baa3)ContactsAnalystPhoneArif Bekiroglu/Frankfurt am Main 49.69.707.30.700Irakli Pipia/LondonCarola Schuler/Frankfurt am Main44.20.7772.545449.69.707.30.700Na Luo/Frankfurt am MainKey Indicators<strong>Turk</strong> <strong>Ekonomi</strong> <strong>Bankasi</strong> <strong>AS</strong> (Consolidated Financials)[1][2]6-13 [2]12-12 [3]12-11 [3]12-10 [3]12-09 Avg.Total Assets (USD million) 26,645.8 25,521.0 21,277.6 13,690.4 11,259.5Total Assets (TRY million) 51,411.7 45,547.4 40,184.9 21,069.6 16,877.4 [4]32.1[4]24.0Tangible Common Equity (TRY million) 5,172.1 4,721.9 4,165.7 1,884.0 1,742.7 [4]31.3Tangible Common Equity (USD million)Net Interest Margin (%)2,680.64.52,645.84.52,205.74.71,224.24.01,162.64.8[4]23.2[5]4.5Net In<strong>com</strong>e / Average RWA (%) 2.0 1.4 1.1 2.3PPI / Average RWA (%) 3.2 2.4 1.7 3.0 3.61.6[6]2.8[6]1.7(Market Funds - Liquid Assets) / Total Assets (%) -0.6 -9.5 -1.9 -4.0 -10.8 [5]-5.4Core Deposits / Average Gross LoansTier 1 Ratio (%)--10.7101.511.7115.312.199.311.1(%) [5]103.7[6]11.298.513.9Tangible Common Equity / RWA (%)Cost / In<strong>com</strong>e Ratio (%)11.153.012.060.212.175.110.762.813.060.4[6]11.5[5]62.3Problem Loans / Gross Loans (%) -- 2.4 2.8 2.9 4.5Problem Loans / (Equity + Loan Loss Reserves) (%) -- 12.1 14.3 16.0 21.1[5]3.1[5]15.9Source: Moody's[1] All figures and ratios are adjusted using Moody's standard adjustments [2] Basel II; IFRS [3] Basel I; IFRS [4]Compound Annual Growth Rate based on IFRS reporting periods [5] IFRS reporting periods have been used foraverage calculation [6] Basel II & IFRS reporting periods have been used for average calculation<strong>Opinion</strong>SUMMARY RATING RATIONALE<strong>Turk</strong> <strong>Ekonomi</strong> <strong>Bankasi</strong> <strong>AS</strong>'s (TEB) Baa3/Prime-3 ratings are based on the bank's ba1 baseline credit assessment(BCA) and our assumption of a high probability of parental support from BNP Paribas group (BNPP, A2/Prime-1;

C-/baa2), indirectly owning 67.5% of TEB.We assign a D+ standalone bank financial strength rating (BFSR) to TEB which maps to a BCA of ba1. The BFSRreflects the bank's (1) satisfactory capitalization; (2) strengthened and broader retail and <strong>com</strong>mercial bankingfranchise following its merger with previous Fortis-<strong>Turk</strong>ey some years ago; and (3) improving deposit fundingbase, thereby providing the bank with flexibility to fund its future business growth.However, the BSFR is constrained by the bank's (1) modest profitability and efficiency (albeit with an improvingtrend) with anticipated further net interest margin (NIM) pressures from upward funding cost prevalent in thesystem, as well as rising regulatory pressures for consumer protection, which affects the pricing power andearnings stability of all banks; (2) moderate asset quality which reflects the bank's emphasis on higher-riskconsumer lending to small and medium enterprises (SMEs); (3) considerable asset-liability maturity mismatches,notwithstanding large liquidity buffers.Rating Drivers- Improving profitability, which continues to lag the system average- Sound liquidity on the back of an improving deposit funding base and modest reliance on wholesale funds- Leaner core capitalisation than its peers; supported by subordinated debt that could constrain franchise growthaspirations over the medium term- Moderate asset quality, which is in line with that of the banking system- Mid-sized <strong>com</strong>mercial banking franchise benefits from its recent merger and improving <strong>com</strong>mercial leverageRating OutlookThe outlook on all ratings is stable.What Could Change the Rating - UpThere is currently no upward pressure on the BFSR as indicated by the stable outlook.Upwards pressure on the bank's BCA could develop over long term from (1) significant franchise growth withincreased earnings diversification and quality; and (2) core capitalization strengthens through internal capitalgeneration, thereby supporting franchise expansion and asset growth.Any upgrade of BNPP's standalone BFSR could result in the upgrade of TEB's global local currency (GLC)deposit and its foreign currency debt rating, though we believe there is a low probability of such rating action due tothe stable outlook assigned on the parent's rating. A raising of the ceiling for foreign currency deposit above Baa3in <strong>com</strong>bination with an upgrade of TEB's GLC deposit rating would lead to an upgrade of the respective ratings.What Could Change the Rating - DownDownward pressure could be exerted on TEB's BFSR should any of the following occur: (1) the bank's profitabilityand efficiency indicators weaken; (2) its asset quality deteriorates materially beyond our current expectations orrisk appetite increases significantly; (3) its capital growth fails to align with asset growth; and (4) its core depositbase growth fails to align with loan growth, resulting in high reliance on market funding.Downward pressure would be exerted on the GLC deposit ratings in the event of (1) a weakening in TEB'sintrinsic standalone financial strength; or (2) any adverse changes in the parental support assumptions; or (3) aweakening of BNPP's creditworthiness.A lower ceiling for foreign currency deposit rating, as well as a significant downgrade of TEB's ratings, would exertdownward pressures for the foreign currency deposit rating.DETAILED RATING CONSIDERATIONSIMPROVING PROFITABILITY CONTINUES TO LAG SYSTEM AVERAGETEB's overall profitability is recovering after merger-related integration alignment and cost, which required somenetwork adjustments, while at the same time targeting focused capacity investments in branch expansions. With

the smooth transition to post-merger operations without cost or schedule overruns, TEBs profitability hasrecovered further during the first half of 2013; however it continues to lag peers and system average.According to 2013 half-year local GAAP (BRSA) numbers, TEB's reported pre-provisioning in<strong>com</strong>e (PPI) and netin<strong>com</strong>e increased by 60% <strong>com</strong>pared to half-year 2012, above system average growth. The strong growth inprofitability is attributed to the successful execution of its merger with Fortis-<strong>Turk</strong>ey, which almost doubled TEB'smarket share in loans and further diversified its revenue stream into retail segment.In addition, a number of factors contributed to the improvement in profitability including the bank's (1) increasing<strong>com</strong>mercial leverage; (2) rising share of higher-yielding lending activities in SME and unsecured consumer loans,which we view as riskier segments that are more vulnerable to economical swings; and (3) reduction in depositfunding cost, benefiting from more granular deposit collections as well as rate cuts in the system up to H1 2013.We <strong>com</strong>pute TEB's annualized NIM to be 4.6% down from 4.7% of YE 2012 according to BRSA, stronger than thesystem average of 4.0%. The maintenance of stronger margins with a relatively low decline is a particularachievement given that the bank's deposit base expanded twice as fast as the overall system and furtherevidence of the effective leveraging of its enlarged network.However, on risk-adjusted indicators, TEB's profitability still lags the system average, as measured by PPI overaverage reported risk-weighted assets (RWA) at 3.3% (3.8% for the system), and net-in<strong>com</strong>e over average RWAof 1.7% (2.3% for the system). In particular, TEB's efficiency metrics, with the cost-to-in<strong>com</strong>e ratio at 55% in Q22013 (2011: 75%), is still weaker than the system average of 44% where the larger banks are benefiting fromeconomies of scale.While we believe that TEB has further franchise exploitation potential, and its <strong>com</strong>mercial leverage is likely toimprove only at very moderate level going forward, due to headwinds into 2014 from (1) projected resumption of amore moderate economic growth <strong>com</strong>pared highs of 2010/11 and further seasoning of the loan book with anassociated potential for higher provisioning; (2) <strong>com</strong>petition for deposits in the system, with limited room for lowerpolicy and deposit rates and upward funding cost prevalent in the system, therefore shrinking NIM; and (3) risingconsumer-protection pressures, affecting the pricing power of all banks. However, TEB's established track recordin SME banking should enable the bank to adapt to the evolving regulatory environments .Over the medium term,one of the main challenges for TEB, as well as for banks in the system, will be to preserve its risk disciplinedespite the intense <strong>com</strong>petition and profitability pressures.SOUND LIQUIDITY; IMPROVING DEPOSIT FUNDING B<strong>AS</strong>E AND MODEST RELIANCE ON WHOLESALEFUNDSWe consider TEB's liquidity as adequate, although the system's typically short-term deposit profile represents aninherent systemic risk. As of half-year 2013,retail deposits fund 58% of TEB's balance sheet whereby half matureswithin one month. The bank mitigates these risks by holding an adequate portfolio of liquid assets that account foraround 26% of its total balance sheet; half of which <strong>com</strong>prises <strong>Turk</strong>ish government securities. While their liquidityduring times of stress is untested, these securities are freely traded and repo eligible with the central bank.More recently, TEB successfully expanded its deposit funding base, prompting an improvement in its total loan todeposit ratio (LTD) to 110%, and in particular for the LTD in local currency (LC) to 126% as of half-year 2013 from114% and 142% respectively. It is now more in lined with system average for deposit taking banks of 113% (LTD)and 126% (LC LTD). We believe that the improvement in the funding profile of the bank reduces its sensitivity todepositors behavior and the pricing dynamics of peers.TEB's balance sheet is funded by 37% in foreign-currency, including of the deposits where one third is in foreigncurrency - reflecting customer deposit preferences and that are primarily resident accounts. Due to lower foreigncurrency assets at 25%, TEB hedges it's on balance sheet short position against FX volatility. The bank's marketfunding base is diversified, with no significant reliance on intra-group funding; as of H1 2013.LEANER CORE CAPITALISATION THAN ITS PEERSAs of H1 2013, TEB's consolidated Basel II total capital adequacy ratio (CAR) was 14.8%, unchanged to year-end2012, while its Core Tier 1 capital ratio was 10.9%, up from 11.7% at year end 2012, and is at the lower end of thepeer group and system averages of 16.3% and 12.9% respectively. While the group <strong>com</strong>fortably meets theminimum target regulatory CAR of 12% (for banks targeting expansion via new branch openings), we note thatTEB's capital is of <strong>com</strong>paratively lower quality. Its total capital benefits from the provision of subordinated capitalinstruments; (3% of balance sheet majority from BNPP) with maturities between 2015-24.

However, the bank's lower capital quality will likely affect its capacity to retain earnings for future capital growthdue to the <strong>com</strong>paratively higher cost of capital for its mixed capital, consisting of equity and subordinated debt<strong>com</strong>ponents. This places the bank at a disadvantage to some of its peers that have more leeway for future growthand market share expansion. We believe that the bank's future internal capital generation will be key in keepingpace with the continued strong growth in the system. We acknowledge shareholders' <strong>com</strong>mitment to supportingthe bank's adequate capitalisation and growth prospects.MODERATE <strong>AS</strong>SET QUALITY WHICH IS IN LINE WITH THAT OF THE BANKING SYSTEMCompared with other <strong>Turk</strong>ish banks, TEB has greater exposure to an economic slowdown because of its SMEand unsecured retail loan exposure - which we view as more vulnerable to economic swings - <strong>com</strong>prising around46% of its total performing loans <strong>com</strong>pared with a system average of around 25% as of half-year 2013.As of half-year 2013, TEB reported a non-performing loan (NPL) ratio of 2.1% (2.3% in 2012) versus the systemaverage of 2.8% (2.9% in 2012). During the first half of 2013, TEB sold TRY117 million of non-performing loans,amounting to less than 1% of its total loans. In addition, about 5.2% of TEB's loans (in line with the average forMoody's rated banks) were fewer than 90 days delinquent and/or whose payment terms had been modified andwere not captured by the NPL ratios, indicating the potential for further asset-quality deterioration as they season.According to the bank's in<strong>com</strong>e statement, the increase in provisions for loan-losses was 102% in Q2 2013<strong>com</strong>pared to the 50% increase reported for the system. In our view, the key factor of this development was TEB'sresumption of consumer lending which requires <strong>com</strong>paratively higher general reserves since 2011. TEB's NPLcoverage ratio is 58%, versus the system average of 75%.With a stronger but moderate GDP growth forecast <strong>com</strong>pared to 2012, we can expect that TEB's loan lossprovisioning will gradually increase but remain within TEB's provisioning capacity and its capital should provide forsufficient loan loss-absorption as the high growth at 16% YTD 2013 in 2012 (system average 19% and 4%respectively) and <strong>com</strong>paratively higher-risk loan book seasons.MID-SIZED COMMERCIAL BANKING FRANCHISE WITH IMPROVING COMMERCIAL LEVERAGETEB belongs to the second tier of <strong>Turk</strong>ish <strong>com</strong>mercial banks, ranking ninth in terms of market share. The bank<strong>com</strong>manded a loans and deposits market shares of 4% at half-year 2013 and higher market shares in selectedbusinesses, such as trade finance. Overall, we consider the merger with previous Fortis-<strong>Turk</strong>ey in 2011 to havebeen largely <strong>com</strong>plementary with limited overlap in their businesses.TEB has always focused on corporate and <strong>com</strong>mercial banking; its 70% share still accounts for the lion's share ofits portfolio. The bank is particularly strong in SME lending, accounting for about 30% of its overall <strong>com</strong>mercialbanking book. The merger of TEB and Fortis-<strong>Turk</strong>ey has allowed the bank to expand into the retail bankingbusiness. Fortis-<strong>Turk</strong>ey's more established mortgage portfolio contributed positively to TEB's loan bookdiversification; retail mortgages accounted for 13% as of half-year 2013 and effectively grew 12% in the first half of2013 (system average mortgage portfolio growth was 17%).In the past, TEB encountered strong <strong>com</strong>petition from other domestic banks while it was developing its retailbanking business. This <strong>com</strong>petition included banks with strong retail franchises that accelerated their networkexpansion plans. We believe that TEB's post-merger, larger branch network, and a doubling of its overall marketshare, will have the potential to improve the <strong>com</strong>mercial leverage for all of TEB's businesses.Besides intense <strong>com</strong>petition, especially in retail banking, there are rising regulatory pressures for consumerprotection; these can potentially affect banks' product distribution and pricing power capabilities, which will requirestricter risk selection and risk discipline. These pressures are evidenced by the recent fines levied on 13 <strong>Turk</strong>ishbanks, including TEB, for violating <strong>com</strong>petition rules. The banks were accused of colluding on maximum depositrates, interest-rate increases on credit cards, and <strong>com</strong>missions and fees for card services.Global Local Currency Deposit Rating (Joint Default Analysis)We assign a global local-currency deposit rating of Baa3/Prime-3 to TEB. The rating is supported by (1) TEB's D+standalone BFSR (with stable outlook) mapping to a baseline credit assessment of ba1; and (2) a high likelihood ofparental support on the back of BNPP's standalone BFSR/BCA of C-/baa2.Our high parental support assumptions from BNPP in the event of need are based on the latter's 67.5% ownershipof TEB and on the significant brand association of TEB with BNPP. (jointly controlled by Colakoglu Group 27.5%ownership,)

We assess a high likelihood of systemic support based on TEB's importance to the domestic financial system andon the <strong>Turk</strong>ish financial authorities' track record of providing support to domestic banks in case of need. However,this does not provide additional rating uplift on top of the one notch due to our parental support assumption.Foreign Currency Deposit RatingTEB's foreign-currency deposit ratings are at Baa3/Prime-3 with a stable outlook.ABOUT MOODY'S BANK RATINGSBank Financial Strength RatingMoody's Bank Financial Strength Ratings (BFSRs) represent Moody's opinion of a bank's intrinsic safety andsoundness and, as such, exclude certain external credit risks and credit support elements that are addressed byMoody's Bank Deposit Ratings. BFSRs do not take into account the probability that the bank will receive suchexternal support, nor do they address risks arising from sovereign actions that may interfere with a bank's abilityto honor its domestic or foreign currency obligations. Factors considered in the assignment of BFSRs includebank-specific elements such as financial fundamentals, franchise value, and business and asset diversification.Although BFSRs exclude the external factors specified above, they do take into account other risk factors in thebank's operating environment, including the strength and prospective performance of the economy, as well as thestructure and relative fragility of the financial system, and the quality of banking regulation and supervision.Global Local Currency Deposit RatingA deposit rating, as an opinion of relative credit risk, incorporates the BFSR as well as Moody's opinion of anyexternal support. Specifically, Moody's Bank Deposit Ratings are opinions of a bank's ability to repay punctuallyits deposit obligations. As such, they are intended to incorporate those aspects of credit risk relevant to theprospective payment performance of rated banks with respect to deposit obligations, which includes: intrinsicfinancial strength, sovereign transfer risk (in the case of foreign currency deposit ratings), and both implicit andexplicit external support elements. Moody's Bank Deposit Ratings do not take into account the benefit of depositinsurance schemes which make payments to depositors, but they do recognize the potential support fromschemes that may provide assistance to banks directly.According to Moody's joint default analysis (JDA) methodology, the global local currency deposit rating of a bankis determined by the incorporation of external elements of support into the bank's Baseline <strong>Credit</strong> Assessment. Incalculating the Global Local Currency Deposit rating for a bank, the JDA methodology also factors in the rating ofthe support provider, in the form of the local currency deposit ceiling for a country, Moody's assessment of theprobability of systemic support for the bank in the event of a stress situation and the degree of dependencebetween the issuer rating and the Local Currency Deposit Ceiling.National Scale RatingNational scale ratings are intended primarily for use by domestic investors and are not <strong>com</strong>parable to Moody'sglobally applicable ratings; rather they address relative credit risk within a given country. A Aaa rating on Moody'sNational Scale indicates an issuer or issue with the strongest creditworthiness and the lowest likelihood of creditloss relative to other domestic issuers. National Scale Ratings, therefore, rank domestic issuers relative to eachother and not relative to absolute default risks. National ratings isolate systemic risks; they do not address lossexpectation associated with systemic events that could affect all issuers, even those that receive the highestratings on the National Scale.Foreign Currency Deposit RatingMoody's ratings on foreign currency bank obligations derive from the bank's local currency rating for the sameclass of obligation. The implementation of JDA for banks can lead to high local currency ratings for certain banks,which could also produce high foreign currency ratings. Nevertheless, it should be noted that foreign currencydeposit ratings are in all cases constrained by the country ceiling for foreign currency bank deposits. This mayresult in the assignment of a different, and typically lower, rating for the foreign currency deposits relative to thebank's rating for local currency obligations.Foreign Currency Debt RatingForeign currency debt ratings are derived from the bank's local currency debt rating. In a similar way to foreign

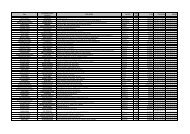

currency deposit ratings, foreign currency debt ratings may also be constrained by the country ceiling for foreigncurrency bonds and notes; however, in some cases the ratings on foreign currency debt obligations may beallowed to pierce the foreign currency ceiling. A particular mix of rating factors are taken into consideration in orderto assess whether a foreign currency bond rating pierces the country ceiling. They include the issuer's global localcurrency rating, the foreign currency government bond rating, the country ceiling for bonds and the debt's eligibilityto pierce that ceiling.About Moody's Bank Financial Strength ScorecardMoody's bank financial strength model (see scorecard below) is a strategic input in the assessment of the financialstrength of a bank, used as a key tool by Moody's analysts to ensure consistency of approach across banks andregions. The model output and the individual scores are discussed in rating <strong>com</strong>mittees and may be adjusted up ordown to reflect conditions specific to each rated entity.Rating Factors<strong>Turk</strong> <strong>Ekonomi</strong> <strong>Bankasi</strong> <strong>AS</strong>Rating Factors [1] A B C D E Total Score TrendQualitative Factors (70%) DFactor: Franchise Value D+ NeutralMarket share and sustainability xGeographical diversification xEarnings stability xEarnings Diversification [2]Factor: Risk Positioning D NeutralCorporate Governance [2]- Ownership and Organizational Complexity- Key Man Risk- Insider and Related-Party RisksControls and Risk Management x- Risk Management x- Controls xFinancial Reporting Transparency x- Global Comparability x- Frequency and Timeliness x- Quality of Financial Information x<strong>Credit</strong> Risk Concentration x- Borrower Concentration x- Industry Concentration xLiquidity Management xMarket Risk Appetite xFactor: Operating Environment D NeutralEconomic Stability xIntegrity and Corruption xLegal System xFinancial Factors (30%) CFactor: Profitability C WeakeningPPI % Average RWA (Basel II) 2.07%Net In<strong>com</strong>e % Average RWA (Basel II) 1.39%Factor: Liquidity C Neutral(Market Funds - Liquid Assets) % Total Assets -5.16%Liquidity Management xFactor: Capital Adequacy B+ Neutral

Tier 1 Ratio (%) (Basel II) 9.97%Tangible Common Equity % RWA (Basel II) 9.94%Factor: Efficiency D NeutralCost / In<strong>com</strong>e Ratio 66.02%Factor: Asset Quality C+ WeakeningProblem Loans % Gross Loans 2.69%Problem Loans % (Equity + LLR) 14.12%Lowest Combined Financial Factor Score (9%) C-Economic Insolvency Override NeutralAggregate BFSR Score D+Aggregate BCA Score baa3/ba1Assigned BFSR D+Assigned BCA baa3[1] - Where dashes are shown for a particular factor (or sub-factor), the score is based on non-public information.[2] - A blank score under Earnings Diversification or Corporate Governance indicates the risk is neutral.© 2013 Moody's Investors Service, Inc. and/or its licensors and affiliates (collectively, "MOODY'S"). All rightsreserved.CREDIT RATINGS ISSUED BY MOODY'S INVESTORS SERVICE, INC. ("MIS") AND ITS AFFILIATES AREMOODY'S CURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDITCOMMITMENTS, OR DEBT OR DEBT-LIKE SECURITIES, AND CREDIT RATINGS AND RESEARCHPUBLICATIONS PUBLISHED BY MOODY'S ("MOODY'S PUBLICATIONS") MAY INCLUDE MOODY'SCURRENT OPINIONS OF THE RELATIVE FUTURE CREDIT RISK OF ENTITIES, CREDIT COMMITMENTS,OR DEBT OR DEBT-LIKE SECURITIES. MOODY'S DEFINES CREDIT RISK <strong>AS</strong> THE RISK THAT ANENTITY MAY NOT MEET ITS CONTRACTUAL, FINANCIAL OBLIGATIONS <strong>AS</strong> THEY COME DUE AND ANYESTIMATED FINANCIAL LOSS IN THE EVENT OF DEFAULT. CREDIT RATINGS DO NOT ADDRESS ANYOTHER RISK, INCLUDING BUT NOT LIMITED TO: LIQUIDITY RISK, MARKET VALUE RISK, OR PRICEVOLATILITY. CREDIT RATINGS AND MOODY'S OPINIONS INCLUDED IN MOODY'S PUBLICATIONS ARENOT STATEMENTS OF CURRENT OR HISTORICAL FACT. CREDIT RATINGS AND MOODY'SPUBLICATIONS DO NOT CONSTITUTE OR PROVIDE INVESTMENT OR FINANCIAL ADVICE, ANDCREDIT RATINGS AND MOODY'S PUBLICATIONS ARE NOT AND DO NOT PROVIDERECOMMENDATIONS TO PURCH<strong>AS</strong>E, SELL, OR HOLD PARTICULAR SECURITIES. NEITHER CREDITRATINGS NOR MOODY'S PUBLICATIONS COMMENT ON THE SUITABILITY OF AN INVESTMENT FORANY PARTICULAR INVESTOR. MOODY'S ISSUES ITS CREDIT RATINGS AND PUBLISHES MOODY'SPUBLICATIONS WITH THE EXPECTATION AND UNDERSTANDING THAT EACH INVESTOR WILL MAKEITS OWN STUDY AND EVALUATION OF EACH SECURITY THAT IS UNDER CONSIDERATION FORPURCH<strong>AS</strong>E, HOLDING, OR SALE.ALL INFORMATION CONTAINED HEREIN IS PROTECTED BY LAW, INCLUDING BUT NOT LIMITED TO,COPYRIGHT LAW, AND NONE OF SUCH INFORMATION MAY BE COPIED OR OTHERWISEREPRODUCED, REPACKAGED, FURTHER TRANSMITTED, TRANSFERRED, DISSEMINATED,REDISTRIBUTED OR RESOLD, OR STORED FOR SUBSEQUENT USE FOR ANY SUCH PURPOSE, IN

WHOLE OR IN PART, IN ANY FORM OR MANNER OR BY ANY MEANS WHATSOEVER, BY ANY PERSONWITHOUT MOODY'S PRIOR WRITTEN CONSENT. All information contained herein is obtained by MOODY'Sfrom sources believed by it to be accurate and reliable. Because of the possibility of human or mechanical error aswell as other factors, however, all information contained herein is provided "<strong>AS</strong> IS" without warranty of any kind.MOODY'S adopts all necessary measures so that the information it uses in assigning a credit rating is of sufficientquality and from sources Moody's considers to be reliable, including, when appropriate, independent third-partysources. However, MOODY'S is not an auditor and cannot in every instance independently verify or validateinformation received in the rating process. Under no circumstances shall MOODY'S have any liability to anyperson or entity for (a) any loss or damage in whole or in part caused by, resulting from, or relating to, any error(negligent or otherwise) or other circumstance or contingency within or outside the control of MOODY'S or any ofits directors, officers, employees or agents in connection with the procurement, collection, <strong>com</strong>pilation, analysis,interpretation, <strong>com</strong>munication, publication or delivery of any such information, or (b) any direct, indirect, special,consequential, <strong>com</strong>pensatory or incidental damages whatsoever (including without limitation, lost profits), even ifMOODY'S is advised in advance of the possibility of such damages, resulting from the use of or inability to use,any such information. The ratings, financial reporting analysis, projections, and other observations, if any,constituting part of the information contained herein are, and must be construed solely as, statements of opinionand not statements of fact or re<strong>com</strong>mendations to purchase, sell or hold any securities. Each user of theinformation contained herein must make its own study and evaluation of each security it may consider purchasing,holding or selling. NO WARRANTY, EXPRESS OR IMPLIED, <strong>AS</strong> TO THE ACCURACY, TIMELINESS,COMPLETENESS, MERCHANTABILITY OR FITNESS FOR ANY PARTICULAR PURPOSE OF ANY SUCHRATING OR OTHER OPINION OR INFORMATION IS GIVEN OR MADE BY MOODY'S IN ANY FORM ORMANNER WHATSOEVER.MIS, a wholly-owned credit rating agency subsidiary of Moody's Corporation ("MCO"), hereby discloses that mostissuers of debt securities (including corporate and municipal bonds, debentures, notes and <strong>com</strong>mercial paper) andpreferred stock rated by MIS have, prior to assignment of any rating, agreed to pay to MIS for appraisal and ratingservices rendered by it fees ranging from $1,500 to approximately $2,500,000. MCO and MIS also maintain policiesand procedures to address the independence of MIS's ratings and rating processes. Information regarding certainaffiliations that may exist between directors of MCO and rated entities, and between entities who hold ratings fromMIS and have also publicly reported to the SEC an ownership interest in MCO of more than 5%, is posted annuallyat www.moodys.<strong>com</strong> under the heading "Shareholder Relations — Corporate Governance — Director andShareholder Affiliation Policy."For Australia only: Any publication into Australia of this document is pursuant to the Australian Financial ServicesLicense of MOODY'S affiliate, Moody's Investors Service Pty Limited ABN 61 003 399 657AFSL 336969 and/orMoody's Analytics Australia Pty Ltd ABN 94 105 136 972 AFSL 383569 (as applicable). This document is intendedto be provided only to "wholesale clients" within the meaning of section 761G of the Corporations Act 2001. Bycontinuing to access this document from within Australia, you represent to MOODY'S that you are, or areaccessing the document as a representative of, a "wholesale client" and that neither you nor the entity yourepresent will directly or indirectly disseminate this document or its contents to "retail clients" within the meaning ofsection 761G of the Corporations Act 2001. MOODY'S credit rating is an opinion as to the creditworthiness of adebt obligation of the issuer, not on the equity securities of the issuer or any form of security that is available toretail clients. It would be dangerous for retail clients to make any investment decision based on MOODY'S creditrating. If in doubt you should contact your financial or other professional adviser.