buying or selling a business: a checklist for successfully negotiating ...

buying or selling a business: a checklist for successfully negotiating ...

buying or selling a business: a checklist for successfully negotiating ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

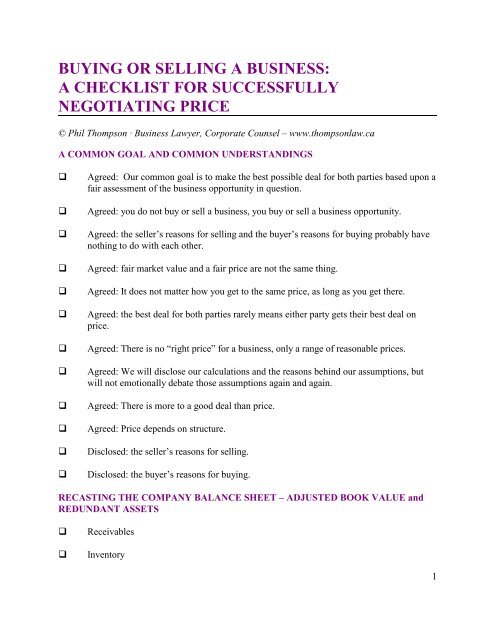

BUYING OR SELLING A BUSINESS:A CHECKLIST FOR SUCCESSFULLYNEGOTIATING PRICE© Phil Thompson · Business Lawyer, C<strong>or</strong>p<strong>or</strong>ate Counsel – www.thompsonlaw.caA COMMON GOAL AND COMMON UNDERSTANDINGSAgreed: Our common goal is to make the best possible deal f<strong>or</strong> both parties based upon afair assessment of the <strong>business</strong> opp<strong>or</strong>tunity in question.Agreed: you do not buy <strong>or</strong> sell a <strong>business</strong>, you buy <strong>or</strong> sell a <strong>business</strong> opp<strong>or</strong>tunity.Agreed: the seller’s reasons f<strong>or</strong> <strong>selling</strong> and the buyer’s reasons f<strong>or</strong> <strong>buying</strong> probably havenothing to do with each other.Agreed: fair market value and a fair price are not the same thing.Agreed: It does not matter how you get to the same price, as long as you get there.Agreed: the best deal f<strong>or</strong> both parties rarely means either party gets their best deal onprice.Agreed: There is no “right price” f<strong>or</strong> a <strong>business</strong>, only a range of reasonable prices.Agreed: We will disclose our calculations and the reasons behind our assumptions, butwill not emotionally debate those assumptions again and again.Agreed: There is m<strong>or</strong>e to a good deal than price.Agreed: Price depends on structure.Disclosed: the seller’s reasons f<strong>or</strong> <strong>selling</strong>.Disclosed: the buyer’s reasons f<strong>or</strong> <strong>buying</strong>.RECASTING THE COMPANY BALANCE SHEET – ADJUSTED BOOK VALUE andREDUNDANT ASSETSReceivablesInvent<strong>or</strong>y1

Capital assetsIntercompany receivables <strong>or</strong> other which the seller does not wish to sell <strong>or</strong> the buyer doesnot wish to buy with the companyRedundant assets <strong>or</strong> assets which are not imp<strong>or</strong>tant to company operationsRemoving any goodwill figures (which will be negotiated separately – see below)Liabilities which have been under <strong>or</strong> over statedLiabilities which the buyer does not want to assumeUnusual items related to the seller’s tax planningIdentified, quantified and discussed: controversial items from recast balance sheet itemsIdentified, quantified and discussed: controversial items from redundant asset discussionIdentified, quantified and resolved: non-controversial items from redundant assetdiscussion.RECASTING THE INCOME STATEMENT: NORMALIZED SUSTAINABLEEARNINGS (aka EBITDA)after tax profits from financial statementsplus taxes, interest expense, depreciation and am<strong>or</strong>tization, all owner compensation(salaries, bonuses, cars, spouses, management fees, etc.), all owner perqs (clubmemberships, toys), charitable donations, and non-recurring <strong>or</strong> unusual one-timeexpensesless the cost of hiring independent management to perf<strong>or</strong>m the owner’s functions in the<strong>business</strong>less capital expenditures required to maintain n<strong>or</strong>mal earnings, and non-recurring <strong>or</strong>unusual one-time revenuesand other adjustments as required (e.g. to n<strong>or</strong>malize rents <strong>or</strong> other costs related tocommon ownership real estate <strong>or</strong> other assets) (could be plus <strong>or</strong> minus).Identified, quantified and discussed: controversial items from hist<strong>or</strong>ical earnings.2

Identified and discussed: controversial items with respect to projected earnings.ASSESSING THE BUYER’S RISK: MULTIPLES AND CAPITALIZATION RATESDiscussed, and quantified and agreed to where possible: key risk fact<strong>or</strong>s in <strong>business</strong>opp<strong>or</strong>tunity.Identified and discussed, and quantified where possible: controversial items with respectto buyer’s perception of key risk fact<strong>or</strong>s in <strong>business</strong> opp<strong>or</strong>tunityHigher Risk/Lower Multiple/HigherCapitalization Rate/Lower Pricenew <strong>business</strong> <strong>or</strong> sh<strong>or</strong>t time frame upon whichto base n<strong>or</strong>malized sustainable future earningsweak balance sheetquestionable growth trendweak position in weak industryfew barriers to entry f<strong>or</strong> competitioncompany competes heavily on price, <strong>or</strong>provides commodity product <strong>or</strong> servicecustomer loyalty, sales, companymanagement strongly tied to personalgoodwill of departing ownershare purchasedeal structure means absence of healthy futuredepreciation and am<strong>or</strong>tization opp<strong>or</strong>tunity toshelter cash flowno vend<strong>or</strong> take back financingLower Risk/Higher Multiple/LowerCapitalization Rate/Higher Priceestablished <strong>business</strong> and reliable, hist<strong>or</strong>icalbasis f<strong>or</strong> n<strong>or</strong>malized sustainable futureearningshealthy balance sheetgood growth trendstrong position in strong industrysignificant barriers to entry f<strong>or</strong> competitioncompany sales not price dependantcompany perf<strong>or</strong>mance not tied to personalgoodwill of departing ownerasset purchasedeal structure favours healthy futuredepreciation and am<strong>or</strong>tization opp<strong>or</strong>tunity toshelter cash flowvend<strong>or</strong> take back financing with good termspurchase price not tied to post-closingperf<strong>or</strong>mance, no “earn-out”vend<strong>or</strong> providing excellent management butnot staying onpurchase price tied to post-closingperf<strong>or</strong>mance, and vend<strong>or</strong> sharing in postclosingrisksvend<strong>or</strong> providing excellent management andstaying on f<strong>or</strong> extended period of time3

Higher Risk/Lower Multiple/HigherCapitalization Rate/Lower Pricelack of proprietary assets <strong>or</strong> sustainablecompetitive advantage<strong>business</strong> po<strong>or</strong>ly managed <strong>or</strong> po<strong>or</strong>lypositioned, buyer providing the“sustainability”significant personal goodwill with seller; riskof loss of key customers, suppliers andemployeesminimal synergy f<strong>or</strong> buyernegative trends in marginsquestionable <strong>or</strong> negative trends re: keysuppliers <strong>or</strong> raw materialsquestionable <strong>or</strong> volatile labour trends in nearfuture, including increasing costs, labourstrife, sh<strong>or</strong>tage of supply, lack ofpredictability, layoffs requiredsignificant currency risksbuyer inexperienced in the industryeconomy <strong>or</strong> industry in <strong>or</strong> headed into adownturnno, questionable, po<strong>or</strong> <strong>or</strong> uncertain prospects<strong>or</strong> contracts f<strong>or</strong> future salesbuyer does not “need” to do a dealvend<strong>or</strong> “needs” to do a dealbuyer not afraid of competit<strong>or</strong> making theacquisitionLower Risk/Higher Multiple/LowerCapitalization Rate/Higher Pricelots of valuable intellectual property andsustainable competitive advantagewell managed and well positioned <strong>business</strong>,seller providing “sustainability”minimal personal goodwill with seller; lots ofc<strong>or</strong>p<strong>or</strong>ate goodwill with customers, suppliersand employeeslots of synergy with buyer’s other enterprisesgood margin trendsstrong bargaining position on supply side,including favourable contracts f<strong>or</strong> futuresupplysolid trends in reasonably priced labourminimal currency risksbuyer well established and familiar with theindustryeconomy <strong>or</strong> industry coming out of downturn,<strong>or</strong> appears to be on track f<strong>or</strong> strong future inthe f<strong>or</strong>eseeable futuregood prospects <strong>or</strong> contracts in place f<strong>or</strong> futuresalesbuyer “needs” to do a dealvend<strong>or</strong> does not “need” to do a dealbuyer wants to eliminate <strong>or</strong> acquire acompetit<strong>or</strong>, <strong>or</strong> to deny a competit<strong>or</strong> theopp<strong>or</strong>tunity to acquire the <strong>business</strong>4

Higher Risk/Lower Multiple/HigherCapitalization Rate/Lower Pricetax situation favours seller at buyer’s expense(e.g. none of purchase price allocated to postclosingmanagement fees <strong>or</strong> depreciableassets)acquisition <strong>or</strong> <strong>business</strong> hard to finance at lowratesassets over valued on balance sheetNo opp<strong>or</strong>tunity f<strong>or</strong> post-closing breakup of<strong>business</strong> assetsSignificant capital investment required in nearfutureBuyer accepted n<strong>or</strong>malized sustainableearnings at the high end of the rangeLower Risk/Higher Multiple/LowerCapitalization Rate/Higher Pricetax situation favours buyer at seller’s expense(e.g. lots of purchase price allocated tomanagement fees <strong>or</strong> other taxable income toseller)good opp<strong>or</strong>tunity f<strong>or</strong> buyer to finance<strong>business</strong> <strong>or</strong> acquisition at very competitiveratesassets undervalued on balance sheetgood opp<strong>or</strong>tunity f<strong>or</strong> post-closing breakupvalueno significant capital investment needed innear futureseller accepted n<strong>or</strong>malized sustainableearnings at the low end of the rangeRECASTING COMPANY PERFORMANCE RATIOSDiscussed, and agreed to where possible: key company perf<strong>or</strong>mance ratios.Discussed, and calculated where possible: controversial items with respect to buyer’sperception of adjusted key perf<strong>or</strong>mance fact<strong>or</strong>s.Annual Break Even = Fixed Expenses (Gross Profit Net Sales)Annual Break Even (Months) = Fixed Expenses (Gross Profit Net Sales) Net Sales X 12Margin of Safety (As Percentage) = (Net Sales – Annual Break Even) Net Sales X 100Operating Leverage = (Net Sales – Variable Costs) Pre-Tax ProfitsOperating Leverage X % Change in Sales = % Change in ProfitsW<strong>or</strong>king Capital = Current Assets – Current LiabilitiesCurrent Ratio = Current Assets Current LiabilitiesAge of Invent<strong>or</strong>y = Closing Invent<strong>or</strong>y (Cost of Goods Sold # of Months)Age of Accounts Receivable = Accounts Receivable (Net Sales # of Months)Age of Accounts Payable = Accounts Payable (Credit Based Purchases # of Months)Debt to Equity Ratio = Total Debt Total EquityDebt Service Coverage = (Pre-tax profits + Depreciation + Interest Expense) (All AnnualCurrent Loan Payment Requirements f<strong>or</strong> Principal and Interest)Interest Coverage = (Pre-Tax Profits + Interest Expense) Interest ExpenseReturn on Assets = Pre-Tax Profits Operating Assets5

Return on Shareholders’ Equity = Pre-Tax ProfitsLoans).(Adjusted Book Value + Shareholders’USE OF COMPARABLESList of useful comparable sales identified, compared and sharedRelevance of comparables discussedBRIDGING THE GAP: SHARING THE RISK - PRICE ADJUSTMENT FORMULAS,EARNOUTS, VTB FINANCINGDiscussed, and quantified where possible: potential f<strong>or</strong> price adjustment mechanisms.Discussed, and quantified where possible: potential f<strong>or</strong> earnout <strong>or</strong> seller risk participation.Discussed, and quantified where possible: potential f<strong>or</strong> price deferral through escrowfunds, VTB security, etc.BRIDGING THE GAP: SHARING THE BURDENSeller contributing to certain buyer expensesBuyer contributing to certain seller expensesPaying part of the purchase price by consulting fees <strong>or</strong> non-competition payments <strong>or</strong> otherways which are m<strong>or</strong>e favourable to the buyer from a tax perspective than to the sellerSeller providing financial supp<strong>or</strong>t by deferring payments, holding a VTB with no <strong>or</strong> lowinterest rates, holding on to key assets and leasing them back to the buyerSeller keeping certain assets f<strong>or</strong> itself, reducing the price to the buyer but leaving the sellerwith the opp<strong>or</strong>tunity to liquidate those assets at a later date to the benefit of the sellerBRIDGING THE GAP: SHARING THE TAX SHIELDDiscussed, and quantified where possible: tax shield to buyer based on buyer’s preferredprice range and deal structure.Discussed, and quantified where possible: tax shield to seller based on seller’s preferredprice range and deal structure.Discussed, and quantified where possible: potential to bridge the price gap throughsharing the tax shield.6

BRIDGING THE GAP: INTANGIBLESDiscussed: intangible reasons f<strong>or</strong> bridging the gap, including:• how badly each party “needs” to do the deal• how badly each party “wants” to do the deal• how badly the parties want to do <strong>business</strong> with each other• what synergies the buyer thinks it can bring to the table to drive n<strong>or</strong>malizedsustainable future earnings to higher levels, thereby effectively reducing the buyer’smultiple• how the buyer is financing the deal, and whether that financing package ultimatelyreduces his risk to an acceptable level• how the deal is structured, including vend<strong>or</strong> take back financing, price adjustmentclauses, post-closing supp<strong>or</strong>t, etc.• how the deal is structured f<strong>or</strong> after tax cash flow to each party.7