ACC 205 WEEK 4 EXERCISE ASSIGNMENT LIABILITY(NEW)/Uoptutorial

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

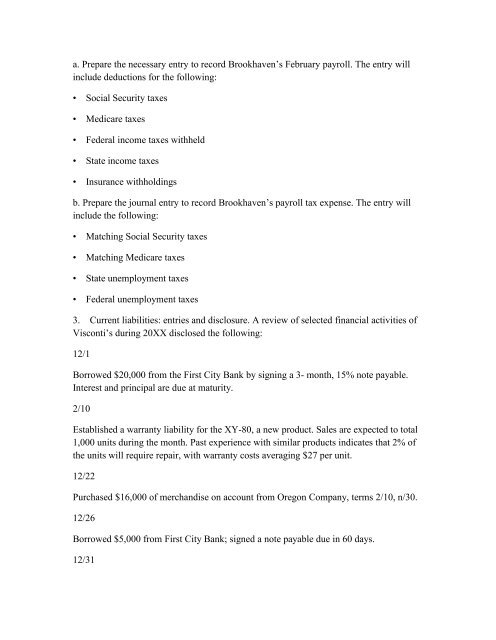

a. Prepare the necessary entry to record Brookhaven’s February payroll. The entry will<br />

include deductions for the following:<br />

• Social Security taxes<br />

• Medicare taxes<br />

• Federal income taxes withheld<br />

• State income taxes<br />

• Insurance withholdings<br />

b. Prepare the journal entry to record Brookhaven’s payroll tax expense. The entry will<br />

include the following:<br />

• Matching Social Security taxes<br />

• Matching Medicare taxes<br />

• State unemployment taxes<br />

• Federal unemployment taxes<br />

3. Current liabilities: entries and disclosure. A review of selected financial activities of<br />

Visconti’s during 20XX disclosed the following:<br />

12/1<br />

Borrowed $20,000 from the First City Bank by signing a 3- month, 15% note payable.<br />

Interest and principal are due at maturity.<br />

2/10<br />

Established a warranty liability for the XY-80, a new product. Sales are expected to total<br />

1,000 units during the month. Past experience with similar products indicates that 2% of<br />

the units will require repair, with warranty costs averaging $27 per unit.<br />

12/22<br />

Purchased $16,000 of merchandise on account from Oregon Company, terms 2/10, n/30.<br />

12/26<br />

Borrowed $5,000 from First City Bank; signed a note payable due in 60 days.<br />

12/31