Case: 2:10-cv-01160-ALM-TPK Doc #: 1 Filed: 12/22/10 Page: 1 of ...

Case: 2:10-cv-01160-ALM-TPK Doc #: 1 Filed: 12/22/10 Page: 1 of ...

Case: 2:10-cv-01160-ALM-TPK Doc #: 1 Filed: 12/22/10 Page: 1 of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

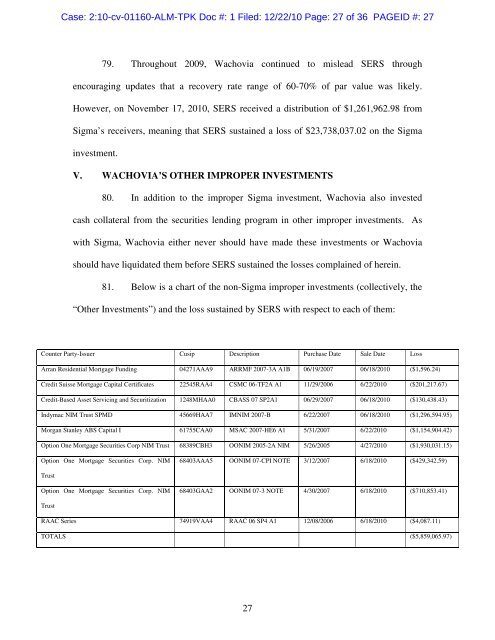

<strong>Case</strong>: 2:<strong>10</strong>-<strong>cv</strong>-<strong>01160</strong>-<strong>ALM</strong>-<strong>TPK</strong> <strong>Doc</strong> #: 1 <strong>Filed</strong>: <strong>12</strong>/<strong>22</strong>/<strong>10</strong> <strong>Page</strong>: 27 <strong>of</strong> 36 PAGEID #: 2779. Throughout 2009, Wachovia continued to mislead SERS throughencouraging updates that a recovery rate range <strong>of</strong> 60-70% <strong>of</strong> par value was likely.However, on November 17, 20<strong>10</strong>, SERS received a distribution <strong>of</strong> $1,261,962.98 fromSigma’s receivers, meaning that SERS sustained a loss <strong>of</strong> $23,738,037.02 on the Sigmainvestment.V. WACHOVIA’S OTHER IMPROPER INVESTMENTS80. In addition to the improper Sigma investment, Wachovia also investedcash collateral from the securities lending program in other improper investments. Aswith Sigma, Wachovia either never should have made these investments or Wachoviashould have liquidated them before SERS sustained the losses complained <strong>of</strong> herein.81. Below is a chart <strong>of</strong> the non-Sigma improper investments (collectively, the“Other Investments”) and the loss sustained by SERS with respect to each <strong>of</strong> them:Counter Party-Issuer Cusip Description Purchase Date Sale Date LossArran Residential Mortgage Funding 04271AAA9 ARRMF 2007-3A A1B 06/19/2007 06/18/20<strong>10</strong> ($1,596.24)Credit Suisse Mortgage Capital Certificates <strong>22</strong>545RAA4 CSMC 06-TF2A A1 11/29/2006 6/<strong>22</strong>/20<strong>10</strong> ($201,217.67)Credit-Based Asset Servicing and Securitization <strong>12</strong>48MHAA0 CBASS 07 SP2A1 06/29/2007 06/18/20<strong>10</strong> ($130,438.43)Indymac NIM Trust SPMD 45669HAA7 IMNIM 2007-B 6/<strong>22</strong>/2007 06/18/20<strong>10</strong> ($1,296,594.95)Morgan Stanley ABS Capital I 61755CAA0 MSAC 2007-HE6 A1 5/31/2007 6/<strong>22</strong>/20<strong>10</strong> ($1,154,904.42)Option One Mortgage Securities Corp NIM Trust 68389CBH3 OONIM 2005-2A NIM 5/26/2005 4/27/20<strong>10</strong> ($1,930,031.15)Option One Mortgage Securities Corp. NIM68403AAA5 OONIM 07-CPI NOTE 3/<strong>12</strong>/2007 6/18/20<strong>10</strong> ($429,342.59)TrustOption One Mortgage Securities Corp. NIM68403GAA2 OONIM 07-3 NOTE 4/30/2007 6/18/20<strong>10</strong> ($7<strong>10</strong>,853.41)TrustRAAC Series 74919VAA4 RAAC 06 SP4 A1 <strong>12</strong>/08/2006 6/18/20<strong>10</strong> ($4,087.11)TOTALS ($5,859,065.97)27