Annual Report-FY 2011-12 - Timex Group India

Annual Report-FY 2011-12 - Timex Group India

Annual Report-FY 2011-12 - Timex Group India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

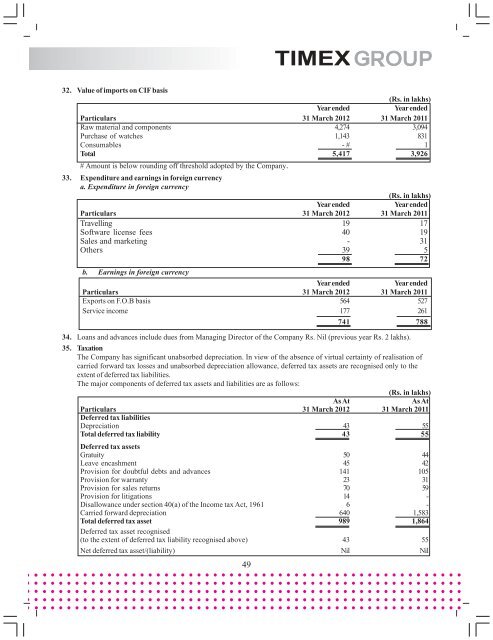

32. Value of imports on CIF basis(Rs. in lakhs)Year endedYear endedParticulars 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Raw material and components 4,274 3,094Purchase of watches 1,143 831Consumables - # 1Total 5,417 3,926# Amount is below rounding off threshold adopted by the Company.33. Expenditure and earnings in foreign currencya. Expenditure in foreign currency(Rs. in lakhs)Year endedYear endedParticulars 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Travelling 19 17Software license fees 40 19Sales and marketing - 31Others 39 598 72b. Earnings in foreign currencyYear endedYear endedParticulars 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Exports on F.O.B basis 564 527Service income 177 261741 78834. Loans and advances include dues from Managing Director of the Company Rs. Nil (previous year Rs. 2 lakhs).35. TaxationThe Company has significant unabsorbed depreciation. In view of the absence of virtual certainty of realisation ofcarried forward tax losses and unabsorbed depreciation allowance, deferred tax assets are recognised only to theextent of deferred tax liabilities.The major components of deferred tax assets and liabilities are as follows:(Rs. in lakhs)As AtAs AtParticulars 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Deferred tax liabilitiesDepreciation 43 55Total deferred tax liability 43 55Deferred tax assetsGratuity 50 44Leave encashment 45 42Provision for doubtful debts and advances 141 105Provision for warranty 23 31Provision for sales returns 70 59Provision for litigations 14 -Disallowance under section 40(a) of the Income tax Act, 1961 6 -Carried forward depreciation 640 1,583Total deferred tax asset 989 1,864Deferred tax asset recognised(to the extent of deferred tax liability recognised above) 43 55Net deferred tax asset/(liability) Nil Nil49