Annual Report-FY 2011-12 - Timex Group India

Annual Report-FY 2011-12 - Timex Group India

Annual Report-FY 2011-12 - Timex Group India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

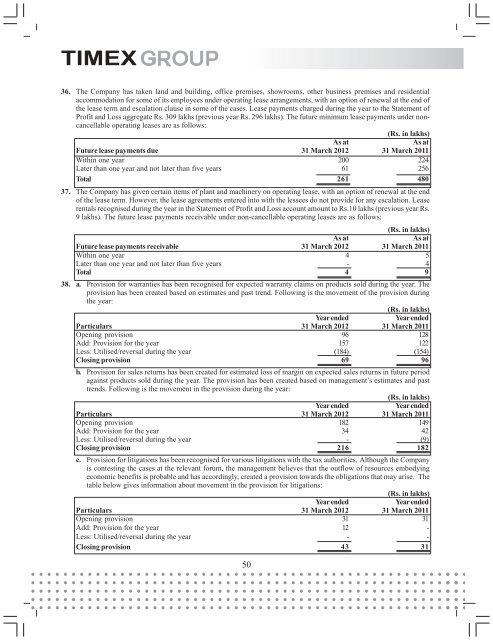

36. The Company has taken land and building, office premises, showrooms, other business premises and residentialaccommodation for some of its employees under operating lease arrangements, with an option of renewal at the end ofthe lease term and escalation clause in some of the cases. Lease payments charged during the year to the Statement ofProfit and Loss aggregate Rs. 309 lakhs (previous year Rs. 296 lakhs). The future minimum lease payments under noncancellableoperating leases are as follows:(Rs. in lakhs)As atAs atFuture lease payments due 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Within one year 200 224Later than one year and not later than five years 61 256Total 261 48037. The Company has given certain items of plant and machinery on operating lease, with an option of renewal at the endof the lease term. However, the lease agreements entered into with the lessees do not provide for any escalation. Leaserentals recognised during the year in the Statement of Profit and Loss account amount to Rs.10 lakhs (previous year Rs.9 lakhs). The future lease payments receivable under non-cancellable operating leases are as follows:(Rs. in lakhs)As atAs atFuture lease payments receivable 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Within one year 4 5Later than one year and not later than five years - 4Total 4 938. a. Provision for warranties has been recognised for expected warranty claims on products sold during the year. Theprovision has been created based on estimates and past trend. Following is the movement of the provision duringthe year:(Rs. in lakhs)Year endedYear endedParticulars 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Opening provision 96 <strong>12</strong>8Add: Provision for the year 157 <strong>12</strong>2Less: Utilised/reversal during the year (184) (154)Closing provision 69 96b. Provision for sales returns has been created for estimated loss of margin on expected sales returns in future periodagainst products sold during the year. The provision has been created based on management’s estimates and pasttrends. Following is the movement in the provision during the year:(Rs. in lakhs)Year endedYear endedParticulars 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Opening provision 182 149Add: Provision for the year 34 42Less: Utilised/reversal during the year - (9)Closing provision 216 182c. Provision for litigations has been recognised for various litigations with the tax authorities. Although the Companyis contesting the cases at the relevant forum, the management believes that the outflow of resources embodyingeconomic benefits is probable and has accordingly, created a provision towards the obligations that may arise. Thetable below gives information about movement in the provision for litigations:(Rs. in lakhs)Year endedYear endedParticulars 31 March 20<strong>12</strong> 31 March <strong>2011</strong>Opening provision 31 31Add: Provision for the year <strong>12</strong> -Less: Utilised/reversal during the year - -Closing provision 43 3150