Income Inclusions and Exclusions

Income Inclusions and Exclusions

Income Inclusions and Exclusions

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

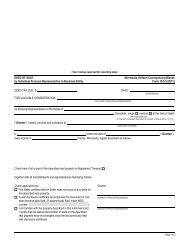

<strong>Income</strong> Types Definition CountYES NO<strong>Income</strong> passed through to creditors Such as: Forced sales. Indian per capita judgment paymentsIn-kind incomeInterest on Pre-Paid Burial AccountsInterest earned on pre-paid burial accounts isnot income for the Energy Assistance Program.Irregular <strong>Income</strong>Resulting from occasional work such as incomefrom lawn mowing or snow shoveling.Job-related expenses for non-selfemployedDeduct job-related expenses from gross incomefor employed individual who pays businessexpenses comparable to self-employment, suchas a sales person, truck driver, or cab driver.Jury duty payLoans Includes cash draw downs on credit cards. Lump sum payments -- Regular Consider the annual payment divided by four. Lump sum payments -- Non-recurringThese payments are for medically necessaryMinnesota Supplemental Aid (MSA)prescribed diets, guardian or conservator fees,Special Needs Paymentsnecessary nonrecurring home repairs, etc.Military or Ministerial Housing AllowanceMilitary payMilitary Combat Zone payWhen a household member is deployed, thatperson remains a household member. Only theincome that is made available to the householdshould be counted as income. Housingallowance is not considered income.<strong>Income</strong> received in error during any of theOverpaymentsprevious three months, which the householdmember is responsible to repay.Payments on behalf of the household Must provide regular support for the family. Title V of the Older Americans Act: ExperienceWorks, Senior Health Aides, SeniorCompanions. Domestic Volunteer Service Act:Program Participation incomeVISTA, AmeriCorps, UYA, Urban CrimePrevention Program, RSVP, Foster Gr<strong>and</strong>parentProgram, Senior Health Aides, SeniorCompanions, ACE.For example: repayment for job relatedRefunds <strong>and</strong> Reimbursementsexpenses such as mileage or uniforms; formedical expenses; income tax refunds orrebates.Relative Custody Assistance Payments Do not count income received from the RCAprogram.FFY2012 EAP Policy ManualChapter 5 Appendix 5A <strong>Income</strong> <strong>Inclusions</strong> <strong>and</strong> Exclusion Revised 2011