Income Inclusions and Exclusions

Income Inclusions and Exclusions

Income Inclusions and Exclusions

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

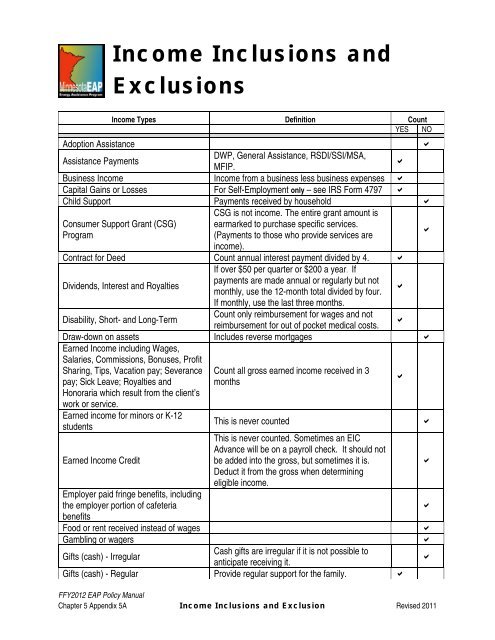

<strong>Income</strong> <strong>Inclusions</strong> <strong>and</strong><strong>Exclusions</strong><strong>Income</strong> Types Definition CountYES NOAdoption AssistanceAssistance PaymentsDWP, General Assistance, RSDI/SSI/MSA,MFIP.Business <strong>Income</strong> <strong>Income</strong> from a business less business expenses Capital Gains or Losses For Self-Employment only – see IRS Form 4797 Child Support Payments received by household CSG is not income. The entire grant amount isConsumer Support Grant (CSG) earmarked to purchase specific services.Program(Payments to those who provide services areincome).Contract for Deed Count annual interest payment divided by 4. Dividends, Interest <strong>and</strong> RoyaltiesIf over $50 per quarter or $200 a year. Ifpayments are made annual or regularly but notmonthly, use the 12-month total divided by four.If monthly, use the last three months.Disability, Short- <strong>and</strong> Long-TermCount only reimbursement for wages <strong>and</strong> notreimbursement for out of pocket medical costs.Draw-down on assets Includes reverse mortgages Earned <strong>Income</strong> including Wages,Salaries, Commissions, Bonuses, ProfitSharing, Tips, Vacation pay; Severancepay; Sick Leave; Royalties <strong>and</strong>Honoraria which result from the client’swork or service.Earned income for minors or K-12studentsEarned <strong>Income</strong> CreditEmployer paid fringe benefits, includingthe employer portion of cafeteriabenefitsFood or rent received instead of wagesGambling or wagersCount all gross earned income received in 3monthsThis is never countedThis is never counted. Sometimes an EICAdvance will be on a payroll check. It should notbe added into the gross, but sometimes it is.Deduct it from the gross when determiningeligible income.Gifts (cash) - IrregularCash gifts are irregular if it is not possible toanticipate receiving it.Gifts (cash) - Regular Provide regular support for the family. FFY2012 EAP Policy ManualChapter 5 Appendix 5A <strong>Income</strong> <strong>Inclusions</strong> <strong>and</strong> Exclusion Revised 2011

<strong>Income</strong> Types Definition CountYES NO<strong>Income</strong> passed through to creditors Such as: Forced sales. Indian per capita judgment paymentsIn-kind incomeInterest on Pre-Paid Burial AccountsInterest earned on pre-paid burial accounts isnot income for the Energy Assistance Program.Irregular <strong>Income</strong>Resulting from occasional work such as incomefrom lawn mowing or snow shoveling.Job-related expenses for non-selfemployedDeduct job-related expenses from gross incomefor employed individual who pays businessexpenses comparable to self-employment, suchas a sales person, truck driver, or cab driver.Jury duty payLoans Includes cash draw downs on credit cards. Lump sum payments -- Regular Consider the annual payment divided by four. Lump sum payments -- Non-recurringThese payments are for medically necessaryMinnesota Supplemental Aid (MSA)prescribed diets, guardian or conservator fees,Special Needs Paymentsnecessary nonrecurring home repairs, etc.Military or Ministerial Housing AllowanceMilitary payMilitary Combat Zone payWhen a household member is deployed, thatperson remains a household member. Only theincome that is made available to the householdshould be counted as income. Housingallowance is not considered income.<strong>Income</strong> received in error during any of theOverpaymentsprevious three months, which the householdmember is responsible to repay.Payments on behalf of the household Must provide regular support for the family. Title V of the Older Americans Act: ExperienceWorks, Senior Health Aides, SeniorCompanions. Domestic Volunteer Service Act:Program Participation incomeVISTA, AmeriCorps, UYA, Urban CrimePrevention Program, RSVP, Foster Gr<strong>and</strong>parentProgram, Senior Health Aides, SeniorCompanions, ACE.For example: repayment for job relatedRefunds <strong>and</strong> Reimbursementsexpenses such as mileage or uniforms; formedical expenses; income tax refunds orrebates.Relative Custody Assistance Payments Do not count income received from the RCAprogram.FFY2012 EAP Policy ManualChapter 5 Appendix 5A <strong>Income</strong> <strong>Inclusions</strong> <strong>and</strong> Exclusion Revised 2011

<strong>Income</strong> Types Definition CountYES NORental <strong>Income</strong>Consider rental to be a business. Rental incomeis rent collected minus expenses. Use incometax return or Self-Employment <strong>Income</strong>Worksheet: Cash Accounting Method. DetermineRetirement <strong>Income</strong>: Including 401s,403Bs, Annuities, IRAs, Pensions AndOther Retirement Plans And AccountsSection 8 Mortgage PaymentsSocial Security Benefitsequivalent 3-month income.Count “retirement payments” generally receivedat age 59½ or older. Do not count earlywithdrawals.If payments are not received monthly orquarterly, determine the 3-month averageincome.These payments may be cash payments to thehousehold or regular payments on behalf of thehousehold.Net amount of the check (gross amount minusamount deducted for Medicare <strong>and</strong> MedicarePart D). Count for all household members (evenminors <strong>and</strong> students).Social Security non-recurring lump sumpaymentsDo not include one-time lump sum SocialSecurity payments as income.Spousal support or alimony Payments received by the household Strike BenefitsStudent <strong>Income</strong> (Grants)Student <strong>Income</strong> (Loans)Student <strong>Income</strong> (Work Study)From federal <strong>and</strong> state employment programs,Training allowancesonly the portion that pays or reimburses for living expenses unless excluded by law.Tribal per capita payments from casinosTribal Judgment Funds above $2,000Trust DisbursementsTrust Disbursements for Special Needs(also known as Special Needs Trusts)If annual or regular lump sum payments, total forthe past 12 months then divided by four. Ifmonthly, use the last three months.Only annual payments above $2,000. Thisincome is rare in Minnesota <strong>and</strong> is related tol<strong>and</strong> acquisitions.If payments are made annual or regularly but notmonthly, use the 12-month total divided by four.If monthly, use the last three months.If payments are made regularly but not monthly,use the 12-month total divided by four. If mademonthly, use the last three months. Countpayments <strong>and</strong> distributions for regular support<strong>and</strong> income.Exclude payments <strong>and</strong> distributions for specialneeds/medical expenses from income.FFY2012 EAP Policy ManualChapter 5 Appendix 5A <strong>Income</strong> <strong>Inclusions</strong> <strong>and</strong> Exclusion Revised 2011

<strong>Income</strong> Types Definition CountYES NOUnemployment InsuranceSee the Unemployment Insurance <strong>Income</strong>Documentation section later in this chapter fordetails on documenting UnemploymentInsurance income.Veteran’s BenefitsWorker’s CompensationFFY2012 EAP Policy ManualChapter 5 Appendix 5A <strong>Income</strong> <strong>Inclusions</strong> <strong>and</strong> Exclusion Revised 2011