InternetQ

InternetQ

InternetQ

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

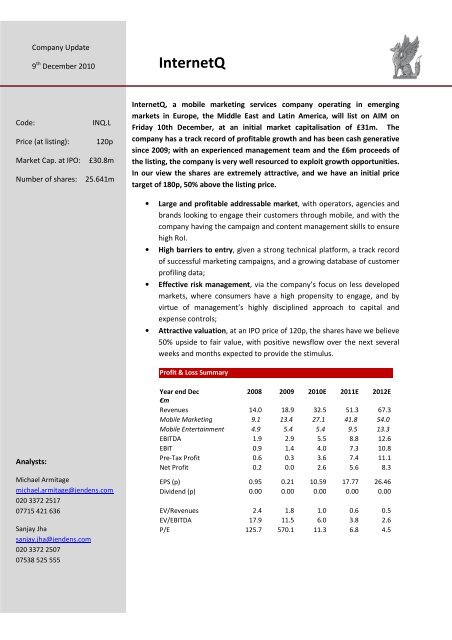

Company Update9 th December 2010<strong>InternetQ</strong>Code:INQ.LPrice (at listing): 120pMarket Cap. at IPO: £30.8mNumber of shares: 25.641m<strong>InternetQ</strong>, a mobile marketing services company operating in emergingmarkets in Europe, the Middle East and Latin America, will list on AIM onFriday 10th December, at an initial market capitalisation of £31m. Thecompany has a track record of profitable growth and has been cash generativesince 2009; with an experienced management team and the £6m proceeds ofthe listing, the company is very well resourced to exploit growth opportunities.In our view the shares are extremely attractive, and we have an initial pricetarget of 180p, 50% above the listing price.• Large and profitable addressable market, with operators, agencies andbrands looking to engage their customers through mobile, and with thecompany having the campaign and content management skills to ensurehigh RoI.• High barriers to entry, given a strong technical platform, a track recordof successful marketing campaigns, and a growing database of customerprofiling data;• Effective risk management, via the company’s focus on less developedmarkets, where consumers have a high propensity to engage, and byvirtue of management’s highly disciplined approach to capital andexpense controls;• Attractive valuation, at an IPO price of 120p, the shares have we believe50% upside to fair value, with positive newsflow over the next severalweeks and months expected to provide the stimulus.Profit & Loss SummaryAnalysts:Michael Armitagemichael.armitage@jendens.com020 3372 251707715 421 636Sanjay Jhasanjay.jha@jendens.com020 3372 250707538 525 555Year end Dec 2008 2009 2010E 2011E 2012E€mRevenues 14.0 18.9 32.5 51.3 67.3Mobile Marketing 9.1 13.4 27.1 41.8 54.0Mobile Entertainment 4.9 5.4 5.4 9.5 13.3EBITDA 1.9 2.9 5.5 8.8 12.6EBIT 0.9 1.4 4.0 7.3 10.8Pre-Tax Profit 0.6 0.3 3.6 7.4 11.1Net Profit 0.2 0.0 2.6 5.6 8.3EPS (p) 0.95 0.21 10.59 17.77 26.46Dividend (p) 0.00 0.00 0.00 0.00 0.00EV/Revenues 2.4 1.8 1.0 0.6 0.5EV/EBITDA 17.9 11.5 6.0 3.8 2.6P/E 125.7 570.1 11.3 6.8 4.5

1. Clear business strategy:Large addressable market – <strong>InternetQ</strong> operates within a very large segment ofthe mobile – Mobile Advertising & Marketing is estimated to grow to become a$50bn+ market, as the mobile device is slated to become ‘the fourth screen’ foradvertising (after the cinema, TV and PC). Mobile is reckoned by many torepresent the holy grail for active consumer engagement – personal &targetable, measureable, and immediate, far more than any other advertisingmedia.A pragmatic approach to the market – Mobile Advertising has, for all sorts ofreasons, not fully lived up to the early hype, and many companies that havebuilt their business model on the expectation of rapid adoption of mobile intoagency spending have been disappointed. <strong>InternetQ</strong>’s approach has been morepragmatic – addressing the immediate needs of mobile operators, which facestatic subscriber levels and high customer churn, and with a clear and urgentneed to engage with their customers. <strong>InternetQ</strong>’s service platform combinedwith management’s content management skills and intelligent risk-takingenables Internetq to be the partner of, not merely provider to, operatormarketing campaigns – resulting in higher returns for <strong>InternetQ</strong> (i.e. not acommoditised, ‘off-the-shelf’ software service, like many of its competitors),and more repeat business.High barriers to entry – a) <strong>InternetQ</strong>’s €8m investment in the technologyplatform is not trivial; b) its track record of successful campaigns reflects, andhas resulted in, trusted relationships with multiple operators; and c) itsexpanding database of customer numbers and profiles, accumulated overmultiple campaigns and supplemented by the Akazoo venture, represent avaluable strategic asset.A complementary content strategy – Akazoo is an important part of the overallstrategy – Although it has been somewhat underplayed, Akazoo provides themeans to develop, refine and refresh content management skills, and to buildthe strategic asset of customer profiling data.Clear focus on less developed and competitive markets – Poland, Russia andthe CIS, Brazil and Middle Eastern countries all play to company’s uniquestrengths, they all represent big markets, and in consumer marketing terms theyare relatively un-developed, with high proportions of young, aspirational,mobile pre-paid consumers.2

2. Experienced management team.<strong>InternetQ</strong> has an internationally experienced, and seasoned, managementteam: founder Panagiotis Dimitropoulos, with 10 years’ industry experience;CEO Konstantinos Korletis, with extensive media experience; Kostas Papoutsis,former VP of Global Marketing at Velti; plus local Polish, Russian, Turkish etc.managers (‘all advertising is local’!)3. Bottom-line-oriented management teamThe company has a track record of profitable expansion, with 2006-09 revenueand EBITDA growth of 33% and 68% pa, and turning free cashflow positive in2009. The company boasts exceptionally strong employee productivity, its 85staff generating revenues/employee of ca. €400,000, compared with industrypeers of typically less than €200,000. The company has consistentlydemonstrated very efficient use of capital, reflecting past capital scarcity, andhas developed strong risk control procedures. By way of reminder, all proceedsof the IPO have gone to the company, with no selling shareholders: additionalfunds will support the company’s accelerated expansion across multiple newterritories.4. Positive newsflow anticipatedWe can reasonably expect a succession of positive news developments from thecompany over the coming months – a year-end trading update, Akazoosubscriber numbers, new campaign wins, new market entries, etc. – and thisshould support a positive share price performance. In particular we note theclear possibility of a positive year-end trading review from the company and aconsequent earnings estimate revision.5. Attractive valuationAt the IPO price of 120p, we think the shares represent extremely good value.On the basis of current forecasts, the shares were priced at less than 4 and 7times next year’s EBITDA and earnings.Risk factorsThe company faces a number of risk factors, including technology obsolescence,regulatory change, consumer unpredictability, market uncertainty, etc. Webelieve the company has acquired considerable regulatory, campaign andoperational experience across multiple markets, and that the inherentadaptability of the business model helps protect the company against adverseexternal trends.3

NB This note is derived from the pre-IPO research published on 14 th October 2010, copiesof which are available.Research DisclaimerThis document is issued by Jendens Securities Limited (Incorporated in England No. 5572232)(“Jendens”), which is authorised and regulated in the United Kingdom by the Financial ServicesAuthority (“FSA”) for designated investment business, (Reg No. 445457) and is a member of theLondon Stock Exchange.This document is a marketing communication and has not been prepared in accordance with legalrequirements designed to promote the independence of investment research and is not subject toany prohibition on dealing ahead of the dissemination of investment researchThis document is for information purposes only and should not be regarded as an offer orsolicitation to buy the securities or other instruments mentioned in it. It or any part of it do notform the basis of and should not be relied upon in connection with any contract.Jendens uses reasonable efforts to obtain information from sources which it believes to bereliable but the contents of this document have been prepared without any substantive analysisbeing undertaken into the companies concerned or their securities and it has not beenindependently verified. No representation or warranty, either express or implied, is made norresponsibility of any kind is accepted by Jendens, its directors or employees either as to theaccuracy or completeness of any information stated in this document. Opinions expressed areour current opinions as of the date appearing on this material only. The information and opinionsare provided for the benefit of Jendens’s clients as at the date of this document and are subject tochange without notice. There is no regular update series for research issued by Jendens.No personal recommendation is being made to you; the securities referred to may not be suitablefor you and should not be relied upon in substitution for the exercise of independent judgement.Neither past performance nor forecasts are a reliable indication of future performance andinvestors may realise losses on any investments.Jendens and any company or persons connected with it (including its officers, directors andemployees) may have a position or holding in any investment mentioned in this document or arelated investment and may from time to time dispose of any such securities or instrument.Jendens may have been a manager in the underwriting or placement of securities to the issuers ofsecurities mentioned in this document within the last 12 months, or have received compensationfor investment banking services from such companies within the last 12 months, or expect toreceive or may intend to seek compensation for investment banking services from suchcompanies within the next 3 months. Accordingly recipients of this document should not rely onthis document being impartial and information may be known to Jendens or persons connectedwith it which is not reflected in this material. Jendens has a policy in relation to the managementof the firm’s conflicts of interest which is available upon request.Jendens shall not be liable for any direct or indirect damages, including lost profits arising in anyway from the information contained in this material. This material is for the use of intendedrecipients only and only for distribution to professional and institutional investors, i.e. personswho are authorised persons or exempted persons within the meaning of the Financial Services4

and Markets Act 2000 of the United Kingdom, or persons who have been categorised asprofessional customers or eligible counterparties under the rules of the FSA. It is specifically notintended for retail or private customers.This document is being supplied to you solely for your information and may not be reproduced,re-distributed or passed to any other person or published in whole or in part for any purpose. Thematerial in this document is not intended for distribution or use outside the United Kingdom. Thismaterial is not directed at you if Jendens is prohibited or restricted by any legislation or regulationin any jurisdiction from making it available to you and persons into whose possession this materialcomes should inform themselves about, and observe, any such restrictions.Jendens may distribute research in reliance on Rule 15a-6(a)(2) of the Securities and Exchange Act1934 to persons that are major US Institutional investors, however, transactions in any securitiesmust be effected through a US registered broker-dealer. Any failure to comply with this restrictionmay constitute a violation of the relevant country’s laws for which Jendens does not acceptresponsibility.By accepting this document you agree that you have read the above disclaimer and to be boundby the foregoing limitations / restrictions.Research Recommendation DisclosuresMichael Armitage is the co-author of this Investment Research. Michael Armitage is employed byJendens Securities Ltd as an Investment Research Analyst. Tel: 020 3372 2517Email:.michael.armitage@jendens.comSanjay Jha is the co-author of this Investment Research. Sanjay Jha is employed by JendensSecurities Ltd as an Investment Research Analyst. Tel: 020 3372 2507Email:.sanjay.jha@jendens.comThe investment analysts have received (or will receive) compensation linked to the general profitsof Jendens.There is a planned update to this research recommendation.Unless otherwise stated the share price used in this publication is taken at the close of businessfor the day prior to the date of publication.This is a commissioned or a non-objective research note/documentIn the past 12 months Jendens have had corporate finance mandates or managed or co-manageda public offering of the relevant issuer’s securities or received compensation for corporate financeservices from the relevant issuer, excluding acting as a corporate broker, on a retained basis, forthe relevant issuer.Jendens expects to receive or intend to seek compensation for corporate finance services fromthis company in the next 6 months, excluding acting as a corporate broker, on a retained basis, forthe relevant issuer.Jendens acts as a corporate broker, on a retained basis, for the relevant issuer.5

Copies of the Jendens policy on the management of material interests and conflicts of interest ininvestment research can be obtained from the Jendens Compliance Department by emailingcompliance@jendens.com.6