AR 2009-10 - Centre for Studies in Social Sciences, Calcutta

AR 2009-10 - Centre for Studies in Social Sciences, Calcutta

AR 2009-10 - Centre for Studies in Social Sciences, Calcutta

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

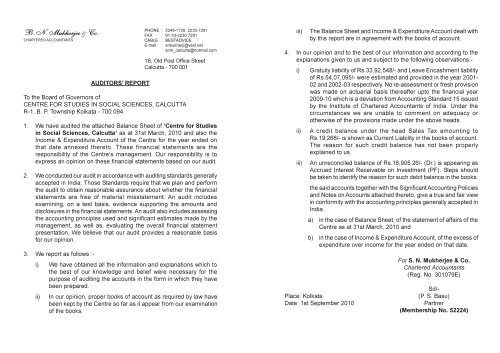

B. N. Mukherjee & Co.CH<strong>AR</strong>TERED ACCOUNTANTSAUDITORS’ REPORTPHONE : 2248-1726, 2230-7281FAX : 91-33-2230 7281CABLE : BESTADVICEE-mail : snkukherji@vsnl.netsnm_calcutta@hotmail.com1B, Old Post Office Street<strong>Calcutta</strong> - 700 001To the Board of Governors ofCENTRE FOR STUDIES IN SOCIAL SCIENCES, CALCUTT<strong>AR</strong>-1, B. P. Township Kolkata - 700 0941. We have audited the attached Balance Sheet of ‘<strong>Centre</strong> <strong>for</strong> <strong>Studies</strong><strong>in</strong> <strong>Social</strong> <strong>Sciences</strong>, <strong>Calcutta</strong>’ as at 31st March, 20<strong>10</strong> and also theIncome & Expenditure Account of the <strong>Centre</strong> <strong>for</strong> the year ended onthat date annexed thereto. These f<strong>in</strong>ancial statements are theresponsibility of the <strong>Centre</strong>’s management. Our responsibility is toexpress an op<strong>in</strong>ion on these f<strong>in</strong>ancial statements based on our audit.2. We conducted our audit <strong>in</strong> accordance with audit<strong>in</strong>g standards generallyaccepted <strong>in</strong> India. Those Standards require that we plan and per<strong>for</strong>mthe audit to obta<strong>in</strong> reasonable assurance about whether the f<strong>in</strong>ancialstatements are free of material misstatement. An audit <strong>in</strong>cludesexam<strong>in</strong><strong>in</strong>g, on a test basis, evidence support<strong>in</strong>g the amounts anddisclosures <strong>in</strong> the f<strong>in</strong>ancial statements. An audit also <strong>in</strong>cludes assess<strong>in</strong>gthe account<strong>in</strong>g pr<strong>in</strong>ciples used and significant estimates made by themanagement, as well as, evaluat<strong>in</strong>g the overall f<strong>in</strong>ancial statementpresentation. We believe that our audit provides a reasonable basis<strong>for</strong> our op<strong>in</strong>ion.3. We report as follows :-i) We have obta<strong>in</strong>ed all the <strong>in</strong><strong>for</strong>mation and explanations which tothe best of our knowledge and belief were necessary <strong>for</strong> thepurpose of audit<strong>in</strong>g the accounts <strong>in</strong> the <strong>for</strong>m <strong>in</strong> which they havebeen prepared.ii) In our op<strong>in</strong>ion, proper books of account as required by law havebeen kept by the <strong>Centre</strong> so far as it appear from our exam<strong>in</strong>ationof the books.iii)The Balance Sheet and Income & Expenditure Account dealt withby this report are <strong>in</strong> agreement with the books of account.4. In our op<strong>in</strong>ion and to the best of our <strong>in</strong><strong>for</strong>mation and accord<strong>in</strong>g to theexplanations given to us and subject to the follow<strong>in</strong>g observations:-i) Gratuity liability of Rs.33,92,548/- and Leave Encashment liabilityof Rs.54,07,095/- were estimated and provided <strong>in</strong> the year 2001-02 and 2002-03 respectively. No re-assessment or fresh provisionwas made on actuarial basis thereafter upto the f<strong>in</strong>ancial year<strong>2009</strong>-<strong>10</strong> which is a deviation from Account<strong>in</strong>g Standard 15 issuedby the Institute of Chartered Accountants of India. Under thecircumstances we are unable to comment on adequacy orotherwise of the provisions made under the above heads.ii) A credit balance under the head Sales Tax amount<strong>in</strong>g toRs.19,268/- is shown as Current Liability <strong>in</strong> the books of account.The reason <strong>for</strong> such credit balance has not been properlyexpla<strong>in</strong>ed to us.iii) An unreconciled balance of Rs.16,905.26/- (Dr.) is appear<strong>in</strong>g asAccrued Interest Receivable on Investment (PF). Steps shouldbe taken to identify the reason <strong>for</strong> such debit balance <strong>in</strong> the books:the said accounts together with the Significant Account<strong>in</strong>g Policiesand Notes on Accounts attached thereto, give a true and fair view<strong>in</strong> con<strong>for</strong>mity with the account<strong>in</strong>g pr<strong>in</strong>ciples generally accepted <strong>in</strong>India.a) <strong>in</strong> the case of Balance Sheet, of the statement of affairs of the<strong>Centre</strong> as at 31st March, 20<strong>10</strong> andb) <strong>in</strong> the case of Income & Expenditure Account, of the excess ofexpenditure over <strong>in</strong>come <strong>for</strong> the year ended on that date.Place: KolkataDate: 1st September 20<strong>10</strong>For S. N. Mukherjee & Co.Chartered Accountants(Reg. No. 30<strong>10</strong>79E)Sd/-(P. S. Basu)Partner(Membership No. 52224)