8 FEATURE<strong>The</strong> <strong>Malaysian</strong> Accountantgoverning bilateral credit. <strong>The</strong> credit allowed shall not exceed halfof the foreign tax payable on the foreign income. Unilateral creditcan be claimed by a person resident in Malaysia for the basis yearfor a year of assessment. However, in the case of an employee whois charged to tax in Malaysia and in a foreign jurisdiction in respectof the same income from an employment exercised outsideMalaysia, the employee is eligible to claim unilateral reliefirrespective of whether or not he was a resident for the basis yearfor the year of assessment.Public Ruling 12/2011 (PR12/2011) – Tax Exemption OnEmployment Income <strong>Of</strong> Non-Citizen Individuals WorkingFor Certain Companies In Malaysia<strong>The</strong> tax treatment of employment income derived by noncitizenindividuals working for an Operational HeadquartersCompany (OHQ), Regional <strong>Of</strong>fice (RO), International ProcurementCentre Company (IPC) and Regional Distribution Centre Company(RDC) are explained in this PR, which is effective from the year ofassessment 2011.Non-citizen individuals deriving employment income from anOHQ, RO, IPC and RDC are taxed only on the portion of theirchargeable income attributable to the number of days theyexercise their employment in Malaysia. In order to substantiate aclaim for this exemption, a copy of the employment contract and aconfirmation from the employer as to the number of days theemployment is exercised in Malaysia and outside Malaysia isrequired.Income derived by non-citizen individuals from anemployment with an OHQ, RO, IPC or RDC exercised in Malaysiafor a period or periods not exceeding 60 days in a basis year or foreach of the overlapping basis years, as the case may be, would betax exempt in accordance with the provisions of Paragraph 21,Schedule 6 of the ITA.Public Ruling 1/2012 (PR1/2012) – Compensation For Loss<strong>Of</strong> EmploymentPursuant to Section 13(1)(e) of the ITA, compensation forloss of employment is treated as gross income from anemployment and is taxable. Compensation for loss of employmentwould include salary or wages in lieu of notice, compensation forbreach of a contract of service, payments to obtain release from acontingent liability (employer’s obligation) under a contract ofservice, ex-gratia or contractual payments such as redundancypayments or a payment in consideration of a covenant.<strong>The</strong> PR (which is effective from the year of assessment 2012)explains the different modes in which payment of compensation forloss of employment may be made. <strong>The</strong>re is a need to distinguishbetween compensation for loss of employment and gratuity as thetax exemption accorded to each category differs. As a general rule,where a contract of employment is for a specific number of yearsand the employment ends at the specified time or at retirementage, any lump sum paid to the employee should be regarded ascompensation for loss of employment and not gratuity.Compensation received for loss of employment (includingcompensation received under a separation scheme) is given a fullor a partial exemption pursuant to the provisions of Paragraph 15,Schedule 6 of the ITA, as follows:-• Full exemption is given if the DG is satisfied that the payment ismade on account of loss of employment due to ill health• Partial exemption is given in the case of a payment made inconnection with a period of employment with the sameemployer or with companies in the same group, as follows:-- RM10,000 for each completed year of service (with effectfrom July 1, 2008);- RM6,000 for each completed year of service (for the yearsof assessment 2003 – 2008)- RM4,000 for each completed year of service (for the yearsof assessment 1987 – 2002)- RM2,000 for each completed year of service (for the year ofassessment 1986 and prior years)<strong>The</strong> partial exemption will not apply to compensation paid by acontrolled company and received by a director of the companywho is not a full-time service director.Payment received by an employee from an employer for an earlytermination of an employment contract under a separationscheme is eligible for the partial exemption provided that suchscheme does not expressly or impliedly provide for the employeeto be reemployed under any other scheme of employment by thesame or any other employer.M a r c h - A p r i l 2 0 1 2 w w w . m i c p a . c o m . m y

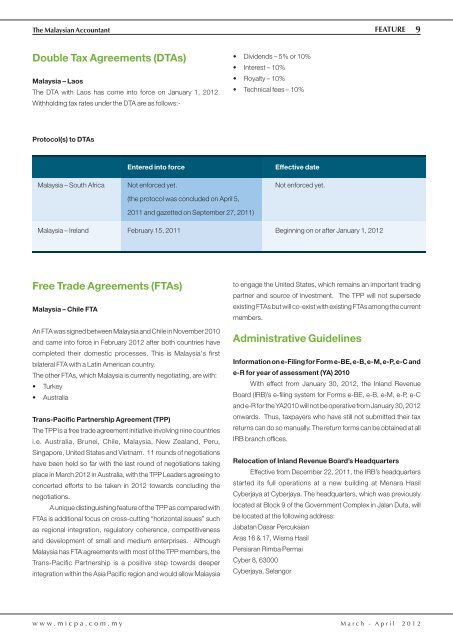

<strong>The</strong> <strong>Malaysian</strong> Accountant FEATURE 9Double Tax Agreements (DTAs)Malaysia – Laos<strong>The</strong> DTA with Laos has come into force on January 1, 2012.Withholding tax rates under the DTA are as follows:-• Dividends – 5% or 10%• Interest – 10%• Royalty – 10%• Technical fees – 10%Protocol(s) to DTAsEntered into forceEffective dateMalaysia – South Africa Not enforced yet. Not enforced yet.(the protocol was concluded on April 5,2011 and gazetted on September 27, 2011)Malaysia – Ireland February 15, 2011 Beginning on or after January 1, 2012Free Trade Agreements (FTAs)Malaysia – Chile FTAAn FTA was signed between Malaysia and Chile in November 2010and came into force in February 2012 after both countries havecompleted their domestic processes. This is Malaysia's firstbilateral FTA with a Latin American country.<strong>The</strong> other FTAs, which Malaysia is currently negotiating, are with:• Turkey• AustraliaTrans-Pacific Partnership Agreement (TPP)<strong>The</strong> TPP is a free trade agreement initiative involving nine countriesi.e. Australia, Brunei, Chile, Malaysia, New Zealand, Peru,Singapore, United States and Vietnam. 11 rounds of negotiationshave been held so far with the last round of negotiations takingplace in March 2012 in Australia, with the TPP Leaders agreeing toconcerted efforts to be taken in 2012 towards concluding thenegotiations.A unique distinguishing feature of the TPP as compared withFTAs is additional focus on cross-cutting “horizontal issues” suchas regional integration, regulatory coherence, competitivenessand development of small and medium enterprises. AlthoughMalaysia has FTA agreements with most of the TPP members, theTrans-Pacific Partnership is a positive step towards deeperintegration within the Asia Pacific region and would allow Malaysiato engage the United States, which remains an important tradingpartner and source of investment. <strong>The</strong> TPP will not supersedeexisting FTAs but will co-exist with existing FTAs among the currentmembers.Administrative GuidelinesInformation on e-Filing for Form e-BE, e-B, e-M, e-P, e-C ande-R for year of assessment (YA) 2010With effect from January 30, 2012, the Inland RevenueBoard (IRB)’s e-filing system for Forms e-BE, e-B, e-M, e-P, e-Cand e-R for the YA2010 will not be operative from January 30, 2012onwards. Thus, taxpayers who have still not submitted their taxreturns can do so manually. <strong>The</strong> return forms can be obtained at allIRB branch offices.Relocation of Inland Revenue Board’s HeadquartersEffective from December 22, 2011, the IRB’s headquartersstarted its full operations at a new building at Menara HasilCyberjaya at Cyberjaya. <strong>The</strong> headquarters, which was previouslylocated at Block 9 of the Government Complex in Jalan Duta, willbe located at the following address:Jabatan Dasar PercukaianAras 16 & 17, Wisma HasilPersiaran Rimba PermaiCyber 8, 63000Cyberjaya, Selangorw w w . m i c p a . c o m . m y M a r c h - A p r i l 2 0 1 2