Pricing Convertible Securities - The Malaysian Institute Of Certified ...

Pricing Convertible Securities - The Malaysian Institute Of Certified ...

Pricing Convertible Securities - The Malaysian Institute Of Certified ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

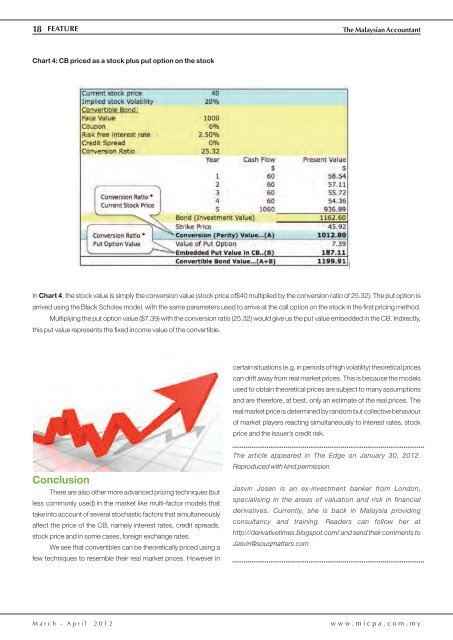

18 FEATURE<strong>The</strong> <strong>Malaysian</strong> AccountantChart 4: CB priced as a stock plus put option on the stockIn Chart 4, the stock value is simply the conversion value (stock price of$40 multiplied by the conversion ratio of 25.32). <strong>The</strong> put option isarrived using the Black Scholes model, with the same parameters used to arrive at the call option on the stock in the first pricing method.Multiplying the put option value ($7.39) with the conversion ratio (25.32) would give us the put value embedded in the CB. Indirectly,this put value represents the fixed income value of the convertible.certain situations (e.g. in periods of high volatility) theoretical pricescan drift away from real market prices. This is because the modelsused to obtain theoretical prices are subject to many assumptionsand are therefore, at best, only an estimate of the real prices. <strong>The</strong>real market price is determined by random but collective behaviourof market players reacting simultaneously to interest rates, stockprice and the issuer’s credit risk.Conclusion<strong>The</strong>re are also other more advanced pricing techniques (butless commonly used) in the market like multi-factor models thattake into account of several stochastic factors that simultaneouslyaffect the price of the CB, namely interest rates, credit spreads,stock price and in some cases, foreign exchange rates.We see that convertibles can be theoretically priced using afew techniques to resemble their real market prices. However in<strong>The</strong> article appeared in <strong>The</strong> Edge on January 30, 2012.Reproduced with kind permissionJasvin Josen is an ex-investment banker from London,specialising in the areas of valuation and risk in financialderivatives. Currently, she is back in Malaysia providingconsultancy and training. Readers can follow her athttp://derivativetimes.blogspot.com/ and send their comments toJasvin@souqmatters.comM a r c h - A p r i l 2 0 1 2 w w w . m i c p a . c o m . m y