Annual Report 2007 - hci hammonia shipping ag

Annual Report 2007 - hci hammonia shipping ag

Annual Report 2007 - hci hammonia shipping ag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

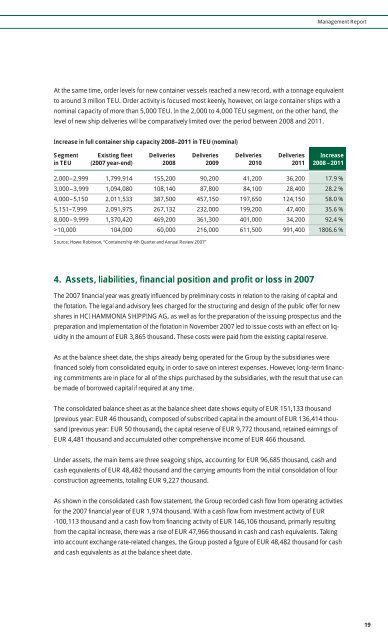

Man<strong>ag</strong>ement <strong>Report</strong>At the same time, order levels for new container vessels reached a new record, with a tonn<strong>ag</strong>e equivalentto around 3 million TEU. Order activity is focused most keenly, however, on large container ships with anominal capacity of more than 5,000 TEU. In the 2,000 to 4,000 TEU segment, on the other hand, thelevel of new ship deliveries will be comparatively limited over the period between 2008 and 2011.Increase in full container ship capacity 2008–2011 in TEU (nominal)Segment Existing fleet Deliveries Deliveries Deliveries Deliveries Increasein TEU (<strong>2007</strong> year-end) 2008 2009 2010 2011 2008 –20112,000–2,999 1,799,914 155,200 90,200 41,200 36,200 17.9 %3,000–3,999 1,094,080 108,140 87,800 84,100 28,400 28.2 %4,000–5,150 2,011,533 387,500 457,150 197,650 124,150 58.0 %5,151–7,999 2,091,975 267,132 232,000 199,200 47,400 35.6 %8,000–9,999 1,370,420 469,200 361,300 401,000 34,200 92.4 %>10,000 104,000 60,000 216,000 611,500 991,400 1806.6 %Source: Howe Robinson, “Containership 4th Quarter and <strong>Annual</strong> Review <strong>2007</strong>”4. Assets, liabilities, financial position and profit or loss in <strong>2007</strong>The <strong>2007</strong> financial year was greatly influenced by preliminary costs in relation to the raising of capital andthe flotation. The legal and advisory fees charged for the structuring and design of the public offer for newshares in HCI HAMMONIA SHIPPING AG, as well as for the preparation of the issuing prospectus and thepreparation and implementation of the flotation in November <strong>2007</strong> led to issue costs with an effect on liquidityin the amount of EUR 3,865 thousand. These costs were paid from the existing capital reserve.As at the balance sheet date, the ships already being operated for the Group by the subsidiaries werefinanced solely from consolidated equity, in order to save on interest expenses. However, long-term financingcommitments are in place for all of the ships purchased by the subsidiaries, with the result that use canbe made of borrowed capital if required at any time.The consolidated balance sheet as at the balance sheet date shows equity of EUR 151,133 thousand(previous year: EUR 46 thousand), composed of subscribed capital in the amount of EUR 136,414 thousand(previous year: EUR 50 thousand), the capital reserve of EUR 9,772 thousand, retained earnings ofEUR 4,481 thousand and accumulated other comprehensive income of EUR 466 thousand.Under assets, the main items are three se<strong>ag</strong>oing ships, accounting for EUR 96,685 thousand, cash andcash equivalents of EUR 48,482 thousand and the carrying amounts from the initial consolidation of fourconstruction <strong>ag</strong>reements, totalling EUR 9,227 thousand.As shown in the consolidated cash flow statement, the Group recorded cash flow from operating activitiesfor the <strong>2007</strong> financial year of EUR 1,974 thousand. With a cash flow from investment activity of EUR–100,113 thousand and a cash flow from financing activity of EUR 146,106 thousand, primarily resultingfrom the capital increase, there was a rise of EUR 47,966 thousand in cash and cash equivalents. Takinginto account exchange rate-related changes, the Group posted a figure of EUR 48,482 thousand for cashand cash equivalents as at the balance sheet date.19