Annual Report 2007 - hci hammonia shipping ag

Annual Report 2007 - hci hammonia shipping ag

Annual Report 2007 - hci hammonia shipping ag

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

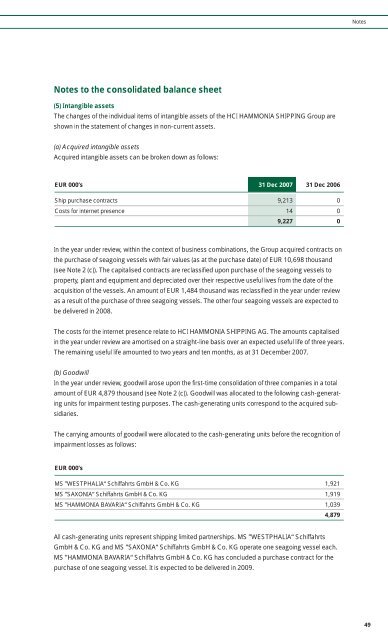

NotesNotes to the consolidated balance sheet(5) Intangible assetsThe changes of the individual items of intangible assets of the HCI HAMMONIA SHIPPING Group areshown in the statement of changes in non-current assets.(a) Acquired intangible assetsAcquired intangible assets can be broken down as follows:EUR 000’s 31 Dec <strong>2007</strong> 31 Dec 2006Ship purchase contracts 9,213 0Costs for internet presence 14 09,227 0In the year under review, within the context of business combinations, the Group acquired contracts onthe purchase of se<strong>ag</strong>oing vessels with fair values (as at the purchase date) of EUR 10,698 thousand(see Note 2 (c)). The capitalised contracts are reclassified upon purchase of the se<strong>ag</strong>oing vessels toproperty, plant and equipment and depreciated over their respective useful lives from the date of theacquisition of the vessels. An amount of EUR 1,484 thousand was reclassified in the year under reviewas a result of the purchase of three se<strong>ag</strong>oing vessels. The other four se<strong>ag</strong>oing vessels are expected tobe delivered in 2008.The costs for the internet presence relate to HCI HAMMONIA SHIPPING AG. The amounts capitalisedin the year under review are amortised on a straight-line basis over an expected useful life of three years.The remaining useful life amounted to two years and ten months, as at 31 December <strong>2007</strong>.(b) GoodwillIn the year under review, goodwill arose upon the first-time consolidation of three companies in a totalamount of EUR 4,879 thousand (see Note 2 (c)). Goodwill was allocated to the following cash-generatingunits for impairment testing purposes. The cash-generating units correspond to the acquired subsidiaries.The carrying amounts of goodwill were allocated to the cash-generating units before the recognition ofimpairment losses as follows:EUR 000’sMS ”WESTPHALIA“ Schiffahrts GmbH & Co. KG 1,921MS ”SAXONIA“ Schiffahrts GmbH & Co. KG 1,919MS ”HAMMONIA BAVARIA“ Schiffahrts GmbH & Co. KG 1,0394,879All cash-generating units represent <strong>shipping</strong> limited partnerships. MS ”WESTPHALIA“ SchiffahrtsGmbH & Co. KG and MS ”SAXONIA“ Schiffahrts GmbH & Co. KG operate one se<strong>ag</strong>oing vessel each.MS ”HAMMONIA BAVARIA“ Schiffahrts GmbH & Co. KG has concluded a purchase contract for thepurchase of one se<strong>ag</strong>oing vessel. It is expected to be delivered in 2009.49