ANNUAL REPORT 2004 - Breevast

ANNUAL REPORT 2004 - Breevast

ANNUAL REPORT 2004 - Breevast

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

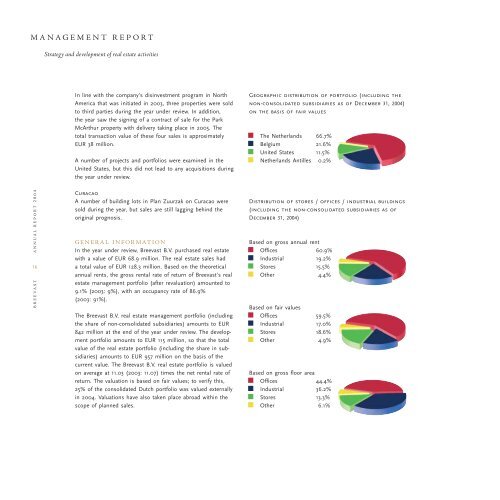

MANAGEMENT <strong>REPORT</strong>Strategy and development of real estate activitiesIn line with the company’s disinvestment program in NorthAmerica that was initiated in 2003, three properties were soldto third parties during the year under review. In addition,the year saw the signing of a contract of sale for the ParkMcArthur property with delivery taking place in 2005. Thetotal transaction value of these four sales is approximatelyEUR 38 million.A number of projects and portfolios were examined in theUnited States, but this did not lead to any acquisitions duringthe year under review.Geographic distribution of portfolio (including thenon-consolidated subsidiaries as of December 31, <strong>2004</strong>)on the basis of fair valuesThe Netherlands 66.7%Belgium 21.6%United States 11.5%Netherlands Antilles 0.2%BREEVAST <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>2004</strong>16CuracaoA number of building lots in Plan Zuurzak on Curacao weresold during the year, but sales are still lagging behind theoriginal prognosis.GENERAL INFORMATIONIn the year under review, <strong>Breevast</strong> B.V. purchased real estatewith a value of EUR 68.9 million. The real estate sales hada total value of EUR 128.3 million. Based on the theoreticalannual rents, the gross rental rate of return of <strong>Breevast</strong>’s realestate management portfolio (after revaluation) amounted to9.1% (2003: 9%), with an occupancy rate of 86.9%(2003: 91%).The <strong>Breevast</strong> B.V. real estate management portfolio (includingthe share of non-consolidated subsidiaries) amounts to EUR842 million at the end of the year under review. The developmentportfolio amounts to EUR 115 million, so that the totalvalue of the real estate portfolio (including the share in subsidiaries)amounts to EUR 957 million on the basis of thecurrent value. The <strong>Breevast</strong> B.V. real estate portfolio is valuedon average at 11.03 (2003: 11.07) times the net rental rate ofreturn. The valuation is based on fair values; to verify this,25% of the consolidated Dutch portfolio was valued externallyin <strong>2004</strong>. Valuations have also taken place abroad within thescope of planned sales.Distribution of stores / offices / industrial buildings(including the non-consolidated subsidiaries as ofDecember 31, <strong>2004</strong>)Based on gross annual rentOffices 60.9%Industrial 19.2%Stores 15.5%Other 4.4%Based on fair valuesOffices 59.5%Industrial 17.0%Stores 18.6%Other 4.9%Based on gross floor areaOffices 44.4%Industrial 36.2%Stores 13.3%Other 6.1%