September 2011 - MINDA Malaysian Directors Academy ...

September 2011 - MINDA Malaysian Directors Academy ...

September 2011 - MINDA Malaysian Directors Academy ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

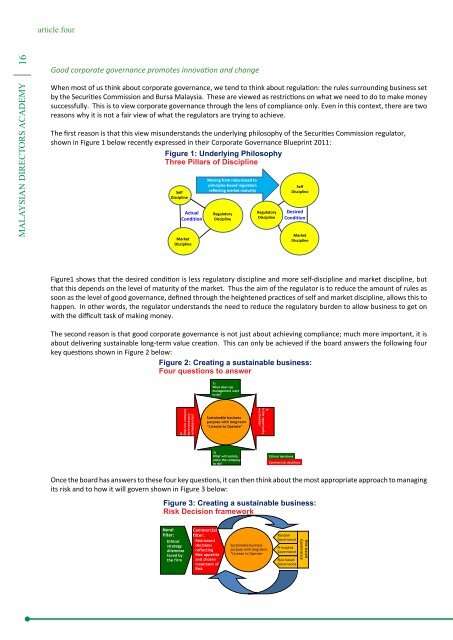

article fourMALAYSIAN DIRECTORS ACADEMY 16Good corporate governance promotes innovation and changeWhen most of us think about corporate governance, we tend to think about regulation: the rules surroundingWhen most of us think about corporate governance, we tend to think about rules surrounding business setbusiness set by the Securities Commission and Bursa Malaysia. These are viewed as restrictions on what weby the Securities Commission and Bursa Malaysia. These are viewed as restrictions on what we need to do to make moneyneed to do to make money successfully. This is to view corporate governance through the lens of compliancesuccessfully. This is to view corporate only. governance Even in this context, through there are two the reasons lens why of it is compliance not a fair view of what only. the regulators Even in are trying this to context, there are tworeasons why it is not a fair view of what achieve. the regulators are trying to achieve.The first reason is that this view misunderstands the underlying philosophy of the Securities CommissionThe first reason is that this view misunderstandsregulator, shown in Figurethe1underlyingbelow recently expressedphilosophyin their Corporateof theGovernanceSecuritiesBlueprint <strong>2011</strong>:Commission regulator,shown in Figure 1 below recently expressed in their Corporate Governance Blueprint <strong>2011</strong>:Figure Figure 1: Underlying 1: Underlying Philosophy PhilosophyThree PillarsThreeof DisciplinePillars of DisciplineSelfDisciplineActualConditionMarketDisciplineMoving from rules-based toprinciples-based regulationreflecting market maturityRegulatoryDisciplineRegulatoryDisciplineSelfDisciplineDesiredConditionMarketDisciplineFigure1 shows that the desired condition is less regulatory discipline and more self-discipline and marketdiscipline, but that this depends on the level of maturity of the market. Thus the aim of the regulator is toreduce the amount of rules as soon as the level of good governance, defined through the heightened practicesof self and market discipline, allows this to happen. In other words, the regulator understands the need toreduce the regulatory burden to allow business to get on with the difficult task of making money.Figure1 shows that the desired condition is less regulatory discipline and more self-discipline and market discipline, butthat this depends on the level of maturity of the market. Thus the aim of the regulator is to reduce the amount of rules assoon as the level of good governance, defined through the heightened practices of self and market discipline, allows this tohappen. In other words, the regulator understands the need to reduce the regulatory burden to allow business to get onwith the difficult task of making money.The second reason is that good corporate governance is not just about achieving compliance; much moreimportant, it is about delivering sustainable long-term value creation. This can only be achieved if the boardanswers the following four key questions shown in Figure 2 below:The second reason is that good corporate governance is not just about achieving compliance; much more important, it isabout delivering sustainable long-term value creation. This can only be achieved if the board answers the following fourkey questions shown in Figure 2 below: Figure 2: Creating a sustainablebusiness: Four questions to answerFigure 2: Creating a sustainable business:1)Four business: questions Four questions to answerto answer4)Does the companyhave necessary 4)competencies? Does the companyhave necessarycompetencies?management wantto do?1)What does topmanagement wantto do?Sustainable businesspurpose with long-term“License to Operate”2)What will societyallow the companyto do?2)What will societyallow the companyto do?3)Is the opportunityworthwhile? 3)Is the opportunityworthwhile?Ethical decisionsCommercial decisionsOnce the board has answers to these four key questions, it can then think about the most appropriateapproach to managing its risk and to how it will govern shown in Figure 3 below:Once the board has answers to these four key questions, it can then think about the most appropriateapproach to managing its risk and to how it will govern shown in Figure 3 below:Once the board has answers to these four key questions, it can then think about the most appropriate approach to managingits risk and to how it will govern shown in Figure 3 below:Figure 3: Creating a sustainablebusiness: Figure 3: Creating Risk Decision a sustainable frameworkbusiness:Figure Risk 3: Decision Creating frameworka sustainablebusiness: Risk Decision frameworkMoral Commercialfilter: filter:Ethical Risk-basedMoral strategy decisionsCommercialfilter:dilemmas reflectingfilter:faced by Risk appetiteEthical the firmRisk-based and chosenstrategy decisions treatment ofdilemmas reflecting Riskfaced by Risk appetitethe firm and chosentreatment ofRiskWhat does topSustainable businesspurpose with long-term“License to Operate”Sustainable businesspurpose with long-term“License to Operate”Sustainable businesspurpose with long-term“License to Operate”Ethical decisionsCommercial decisionsRandomGovernancePrincipledRandom GovernanceGovernanceRule basedPrincipled GovernanceGovernanceRule basedGovernanceRisk-basedGovernanceRisk-basedGovernance7Figure 3 shows those elements of governance that matter if long-term value is to be created. The companymust:Figure 3 shows 1. Look those at its elements business of purpose governance through that a moral matter filter if long-term to ensure value that it is to not be doing created. things The that company are wrong;