ACCT 346 Week 4 Midterm 2 / acct346dotcom

For more course tutorials visit www.acct346.com 3. Question : (TCO 4) Randy Company produces a single product that is sold for $85 per unit. If variable costs per unit are $26 and fixed costs total $47,500, how many units must Randy sell in order to earn a profit of $100,000? 4. Question : (TCO 5) In full costing, when does fixed manufacturing overhead become an expense? 5. Question : (TCO 5) Variable costing income is a function of:

For more course tutorials visit

www.acct346.com

3. Question :

(TCO 4) Randy Company produces a single product that is sold for $85 per unit. If variable costs per unit are $26 and fixed costs total $47,500, how many units must Randy sell in order to earn a profit of $100,000?

4. Question :

(TCO 5) In full costing, when does fixed manufacturing overhead become an expense?

5. Question :

(TCO 5) Variable costing income is a function of:

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

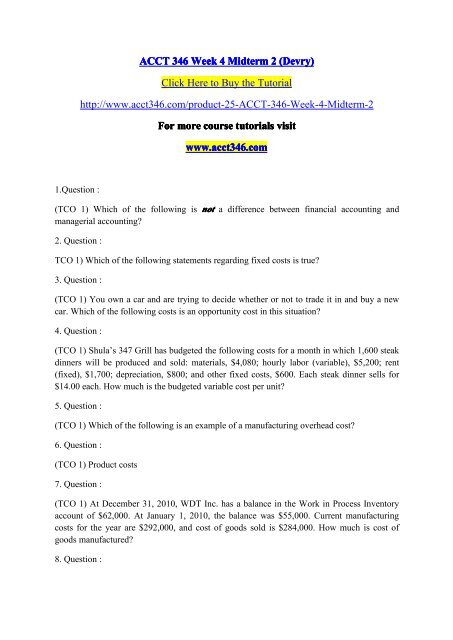

<strong>ACCT</strong> <strong>346</strong> <strong>Week</strong> 4 <strong>Midterm</strong> 2 (Devry)Click Here to Buy the Tutorialhttp://www.acct<strong>346</strong>.com/product-25-<strong>ACCT</strong>-<strong>346</strong>-<strong>Week</strong>-4-<strong>Midterm</strong>-2For more course tutorials visitwwwww.acct<strong>346</strong>..acct<strong>346</strong>.cocom1.Question :(TCO 1) Which of the following is not a difference between financial accounting andmanagerial accounting?2. Question :TCO 1) Which of the following statements regarding fixed costs is true?3. Question :(TCO 1) You own a car and are trying to decide whether or not to trade it in and buy a newcar. Which of the following costs is an opportunity cost in this situation?4. Question :(TCO 1) Shula’s 347 Grill has budgeted the following costs for a month in which 1,600 steakdinners will be produced and sold: materials, $4,080; hourly labor (variable), $5,200; rent(fixed), $1,700; depreciation, $800; and other fixed costs, $600. Each steak dinner sells for$14.00 each. How much is the budgeted variable cost per unit?5. Question :(TCO 1) Which of the following is an example of a manufacturing overhead cost?6. Question :(TCO 1) Product costs7. Question :(TCO 1) At December 31, 2010, WDT Inc. has a balance in the Work in Process Inventoryaccount of $62,000. At January 1, 2010, the balance was $55,000. Current manufacturingcosts for the year are $292,000, and cost of goods sold is $284,000. How much is cost ofgoods manufactured?8. Question :

(TCO 2) BCS Company applies manufacturing overhead based on direct labor hours.Information concerning manufacturing overhead and labor for August follows:EstimatedActual9. Question :(TCO 2) Citrus Company incurred manufacturing overhead costs of $300,000. Totaloverhead applied to jobs was $306,000. What was the amount of overapplied or underappliedoverhead?10. Question :(TCO 3) Companies in which of the following industries would notbe likely to use processcosting?11.Question :(TCO 3) The Blending Department began the period with 20,000 units. During the period thedepartment received another 80,000 units from the prior department and at the end of theperiod 30,000 units remained, which were 40% complete. How much are equivalent units inThe Blending Department’s work in process inventory at the end of the period?12. Question :(TCO 3) Ranger Glass Company manufactures glass for French doors. At the start of May,2,000 units were in-process. During May, 11,000 units were completed and 3,000 units werein process at the end of May. These in-process units were 90% complete with respect tomaterial and 50% complete with respect to conversion costs. Other information is as follows:Calculate the cost per equivalent unit for conversion costs.13. Question :(TCO 4) Clearance Depot has total monthly costs of $8,000 when 2,500 units are producedand $12,400 when 5,000 units are produced. What is the estimated total monthly fixed cost?1. Question :(TCO 4) Which of the following will have no effect on the break-even point in units?2. Question :

(TCO 4) Circle K Furniture has a contribution margin ratio of 16%. If fixed costs are$176,800, how many dollars of revenue must the company generate in order to reach thebreak-even point?3. Question :(TCO 4) Randy Company produces a single product that is sold for $85 per unit. If variablecosts per unit are $26 and fixed costs total $47,500, how many units must Randy sell in orderto earn a profit of $100,000?4. Question :(TCO 5) In full costing, when does fixed manufacturing overhead become an expense?5. Question :(TCO 5) Variable costing income is a function of:6. Question :(TCO 5) Peak Manufacturing produces snow blowers. The selling price per snow blower is$100. Costs involved in production are:7. Question :(TCO 6) Which of the following is not a reason that companies allocate costs?8. Question :(TCO 6) Which of the following statements about cost pools is nottrue?9. Question :(TCO 6) The building maintenance department for Jones Manufacturing Company budgetsannual costs of $4,200,000 based on the expected operating level for the coming year. Thecosts are allocated to two production departments. The following data relate to the potentialallocation bases:Production Dept. 110. Question :(TCO 7) A company is currently making a necessary component in house (the company isproducing the component for its own use). The company has received an offer to buy thecomponent from an outside supplier. A machine is being rented to make the component. Ifthe company were to buy the component, the machine would no longer be rented. The rent onthe machine, in relation to the decision to make or buy the component, is:11. Question :

(TCO 7) Ricket Company has 1,500 obsolete calculators that are carried in inventory at a costof $13,200. If these calculators are upgraded at a cost of $9,500, they could be sold for$22,500. Alternatively, the calculators could be sold "as is" for $9,000. What is the netadvantage or disadvantage of reworking the calculators?12. Question :(TCO 7) YXZ Company’s market for the Model 55 has changed significantly, and YXZ hashad to drop the price per unit from $275 to $135. There are some units in the work in processinventory that have costs of $160 per unit associated with them. YXZ could sell these units intheir current state for $100 each. It will cost YXZ $10 per unit to complete these units so thatthey can be sold for $135 each.When the incremental revenues and expenses are analyzed, what is the financial impact?1. Question :(TCO 3) What are transferred-in costs? Which departments will never have transferred-incosts?2. Question :(TCO 7) Computer Boutique sells computer equipment and home office furniture. Currently,the furniture product line takes up approximately 50% of the company's retail floor space.The president of Computer Boutique is trying to decide whether the company shouldcontinue offering furniture or just concentrate on computer equipment. If furniture is dropped,salaries and other direct fixed costs can be avoided. In addition, sales of computer equipmentcan increase by 13%. Allocated fixed costs are assigned based on relative sales.ComputerHome OfficeEquipmentFurniture3. Question :(TCO 4) The following monthly data are available for RedEx, which produces only oneproduct that it sells for $84 each. Its unit variable costs are $28 and its total fixed expensesare $64,960. Sales during April totaled 1,600 units.