ACCT 346 Week 4 Midterm 2 / acct346dotcom

For more course tutorials visit www.acct346.com 3. Question : (TCO 4) Randy Company produces a single product that is sold for $85 per unit. If variable costs per unit are $26 and fixed costs total $47,500, how many units must Randy sell in order to earn a profit of $100,000? 4. Question : (TCO 5) In full costing, when does fixed manufacturing overhead become an expense? 5. Question : (TCO 5) Variable costing income is a function of:

For more course tutorials visit

www.acct346.com

3. Question :

(TCO 4) Randy Company produces a single product that is sold for $85 per unit. If variable costs per unit are $26 and fixed costs total $47,500, how many units must Randy sell in order to earn a profit of $100,000?

4. Question :

(TCO 5) In full costing, when does fixed manufacturing overhead become an expense?

5. Question :

(TCO 5) Variable costing income is a function of:

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

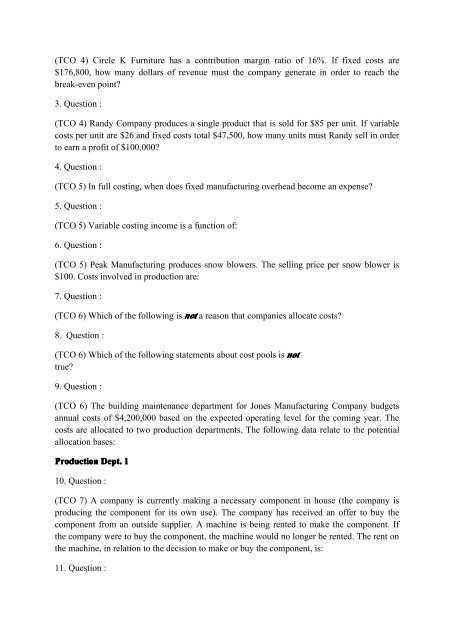

(TCO 4) Circle K Furniture has a contribution margin ratio of 16%. If fixed costs are$176,800, how many dollars of revenue must the company generate in order to reach thebreak-even point?3. Question :(TCO 4) Randy Company produces a single product that is sold for $85 per unit. If variablecosts per unit are $26 and fixed costs total $47,500, how many units must Randy sell in orderto earn a profit of $100,000?4. Question :(TCO 5) In full costing, when does fixed manufacturing overhead become an expense?5. Question :(TCO 5) Variable costing income is a function of:6. Question :(TCO 5) Peak Manufacturing produces snow blowers. The selling price per snow blower is$100. Costs involved in production are:7. Question :(TCO 6) Which of the following is not a reason that companies allocate costs?8. Question :(TCO 6) Which of the following statements about cost pools is nottrue?9. Question :(TCO 6) The building maintenance department for Jones Manufacturing Company budgetsannual costs of $4,200,000 based on the expected operating level for the coming year. Thecosts are allocated to two production departments. The following data relate to the potentialallocation bases:Production Dept. 110. Question :(TCO 7) A company is currently making a necessary component in house (the company isproducing the component for its own use). The company has received an offer to buy thecomponent from an outside supplier. A machine is being rented to make the component. Ifthe company were to buy the component, the machine would no longer be rented. The rent onthe machine, in relation to the decision to make or buy the component, is:11. Question :