CONTENTS

Delta-State-Bond-Shelf-Prospectus

Delta-State-Bond-Shelf-Prospectus

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

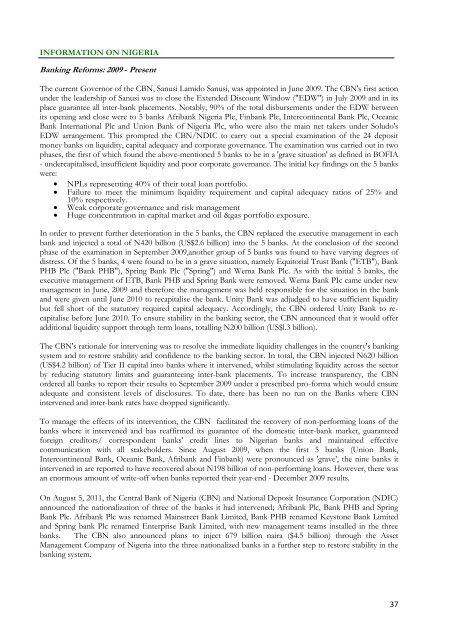

INFORMATION ON NIGERIABanking Reforms: 2009 - PresentThe current Governor of the CBN, Sanusi Lamido Sanusi, was appointed in June 2009. The CBN's first actionunder the leadership of Sanusi was to close the Extended Discount Window ("EDW") in July 2009 and in itsplace guarantee all inter-bank placements. Notably, 90% of the total disbursements under the EDW betweenits opening and close were to 5 banks Afribank Nigeria Plc, Finbank Plc, Intercontinental Bank Plc, OceanicBank International Plc and Union Bank of Nigeria Plc, who were also the main net takers under Soludo'sEDW arrangement. This prompted the CBN/NDIC to carry out a special examination of the 24 depositmoney banks on liquidity, capital adequacy and corporate governance. The examination was carried out in twophases, the first of which found the above-mentioned 5 banks to be in a 'grave situation' as defined in BOFIA- undercapitalised, insufficient liquidity and poor corporate governance. The initial key findings on the 5 bankswere: NPLs representing 40% of their total loan portfolio. Failure to meet the minimum liquidity requirement and capital adequacy ratios of 25% and10% respectively. Weak corporate governance and risk management Huge concentration in capital market and oil &gas portfolio exposure.In order to prevent further deterioration in the 5 banks, the CBN replaced the executive management in eachbank and injected a total of N420 billion (US$2.6 billion) into the 5 banks. At the conclusion of the secondphase of the examination in September 2009,another group of 5 banks was found to have varying degrees ofdistress. Of the 5 banks, 4 were found to be in a grave situation, namely Equitorial Trust Bank ("ETB"), BankPHB Plc ("Bank PHB"), Spring Bank Plc ("Spring") and Wema Bank Plc. As with the initial 5 banks, theexecutive management of ETB, Bank PHB and Spring Bank were removed. Wema Bank PIc came under newmanagement in June, 2009 and therefore the management was held responsible for the situation in the bankand were given until June 2010 to recapitalise the bank. Unity Bank was adjudged to have sufficient liquiditybut fell short of the statutory required capital adequacy. Accordingly, the CBN ordered Unity Bank to recapitalisebefore June 2010. To ensure stability in the banking sector, the CBN announced that it would offeradditional liquidity support through term loans, totalling N200 billion (US$l.3 billion).The CBN's rationale for intervening was to resolve the immediate liquidity challenges in the country's bankingsystem and to restore stability and confidence to the banking sector. In total, the CBN injected N620 billion(US$4.2 billion) of Tier II capital into banks where it intervened, whilst stimulating liquidity across the sectorby reducing statutory limits and guaranteeing inter-bank placements. To increase transparency, the CBNordered all banks to report their results to September 2009 under a prescribed pro-forma which would ensureadequate and consistent levels of disclosures. To date, there has been no run on the Banks where CBNintervened and inter-bank rates have dropped significantly.To manage the effects of its intervention, the CBN facilitated the recovery of non-performing loans of thebanks where it intervened and has reaffirmed its guarantee of the domestic inter-bank market, guaranteedforeign creditors/ correspondent banks' credit lines to Nigerian banks and maintained effectivecommunication with all stakeholders. Since August 2009, when the first 5 banks (Union Bank,Intercontinental Bank, Oceanic Bank, Afribank and Finbank) were pronounced as 'grave', the nine banks itintervened in are reported to have recovered about N198 billion of non-performing loans. However, there wasan enormous amount of write-off when banks reported their year-end - December 2009 results.On August 5, 2011, the Central Bank of Nigeria (CBN) and National Deposit Insurance Corporation (NDIC)announced the nationalization of three of the banks it had intervened; Afribank Plc, Bank PHB and SpringBank Plc. Afribank Plc was renamed Mainstreet Bank Limited, Bank PHB renamed Keystone Bank Limitedand Spring bank Plc renamed Enterprise Bank Limited, with new management teams installed in the threebanks. The CBN also announced plans to inject 679 billion naira ($4.5 billion) through the AssetManagement Company of Nigeria into the three nationalized banks in a further step to restore stability in thebanking system.37