CHRISTOPHER ROBERT DUNN

Chris Dunn - Canadian Defence Lawyers

Chris Dunn - Canadian Defence Lawyers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

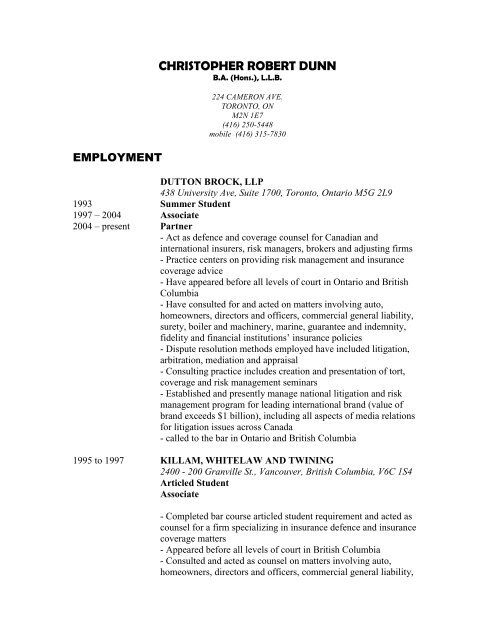

EMPLOYMENT<strong>CHRISTOPHER</strong> <strong>ROBERT</strong> <strong>DUNN</strong>B.A. (Hons.), L.L.B.224 CAMERON AVE.TORONTO, ONM2N 1E7(416) 250-5448mobile (416) 315-7830DUTTON BROCK, LLP438 University Ave, Suite 1700, Toronto, Ontario M5G 2L91993 Summer Student1997 – 2004 Associate2004 – present Partner- Act as defence and coverage counsel for Canadian andinternational insurers, risk managers, brokers and adjusting firms- Practice centers on providing risk management and insurancecoverage advice- Have appeared before all levels of court in Ontario and BritishColumbia- Have consulted for and acted on matters involving auto,homeowners, directors and officers, commercial general liability,surety, boiler and machinery, marine, guarantee and indemnity,fidelity and financial institutions’ insurance policies- Dispute resolution methods employed have included litigation,arbitration, mediation and appraisal- Consulting practice includes creation and presentation of tort,coverage and risk management seminars- Established and presently manage national litigation and riskmanagement program for leading international brand (value ofbrand exceeds $1 billion), including all aspects of media relationsfor litigation issues across Canada- called to the bar in Ontario and British Columbia1995 to 1997 KILLAM, WHITELAW AND TWINING2400 - 200 Granville St., Vancouver, British Columbia, V6C 1S4Articled StudentAssociate- Completed bar course articled student requirement and acted ascounsel for a firm specializing in insurance defence and insurancecoverage matters- Appeared before all levels of court in British Columbia- Consulted and acted as counsel on matters involving auto,homeowners, directors and officers, commercial general liability,

surety, boiler and machinery, marine, guarantee and indemnity andfidelity insurance policies1994 CASSELS, BROCK AND BLACKWELL2100 - 40 King St. W, Toronto, Ontario, M5H 3C2Summer Student – Insurance Defence GroupEDUCATION- Researched and co-authored leading Canadian legal referencetext (sections on auto insurance and insurance contract law)May, 1998May, 1996LAW SOCIETY OF UPPER CANADAAdmitted to the Ontario BarLAW SOCIETY OF BRITISH COLUMBIAAdmitted to the British Columbia Bar1992 to 1995 DALHOUSIE UNIVERSITY LAW SCHOOLBachelor of Laws (L.L.B.)Major in civil litigation1988 to 1992 RICHARD IVEY SCHOOL OF BUSINESS AT THEUNIVERSITY OF WESTERN ONTARIOHonours degree in Business Administration and Management(HBA)Major in marketing managementDean’s Honour List (Top 10% standing)

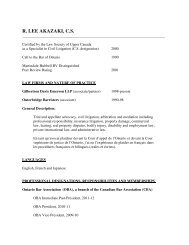

SCHOLARSHIPS AND AWARDS1992, 1993 LANG, MICHENER, LAWRENCE AND SHAW PRIZEAwarded to first year Dalhousie University Law School student onthe basis of superior academic performance1992 DEAN’S HONOUR LISTAwarded to students with top 10% standing in the HonoursBusiness Administration program at the Richard Ivey School ofBusiness, University of Western Ontario1991, 1992 EVALD TOROKVEI FOUNDATION SCHOLARSHIPAwarded annually to a student in the Honours BusinessAdministration program at the Richard Ivey School of Business,University of Western Ontario with top quartile standing and arecord of extra-curricular and community achievement1988 to 1991 UNIVERSITY OF WESTERN ONTARIO ENTRANCESCHOLARSHIPS (3)Honours Business Administration program entrance awardUniversity of Western Ontario Senate ScholarshipPAPERS AND ARTICLES1995 Insurance Law Section, Ontario and Western EditionCo-authorCanadian Encyclopedic Digest1999 Ontario Consumer Protection LegislationAuthor2001 Lost Policy FoundAuthorCanadian Defence Lawyer’s Journal- Paper was cited as a leading commentary on the subject byMarcus Snowden and Mark Lichty in their text, The AnnotatedCommercial General Liability Policy2001 Canada‟s Supreme Court Tribunal Council‟s View on the Duty toDefendAuthor2002 Should You Subrogate For Property LossAuthor

2003 Creature From The Black Lagoon, First Party and Third PartyMould Liability ClaimsAuthor2004 An Update on the Pollution Liability Exclusion and Liability forToxic Mould Claims and Other Naturally Occurring SubstancesAuthorThe Canadian Institute’s Annual Insurance Coverage DisputesSeminar2004 The First Time Ever I Saw Your Claim, A Guide to Initial FileHandling and Coverage IssuesAuthor2005 You Build A Billion Dollar Empire By Staying On Top of YourGame: Recent Developments Respecting CGL Policies and theDuty to DefendAuthor2005 The Insurance Bureau of Canada‟s Proposed Changes to the Form2100 Commercial General Liability Policy – A CommentaryAuthorThe Canadian Institute’s Annual Insurance Coverage DisputesSeminar2005 It Ain‟t Over „Til It‟s Over” The Ontario Court of Appeal‟sDramatic Reversal in the Total Loss Salvage CasesAuthorCanadian Underwriter, July, 2005 edition2005 Primary and Excess Insurance Coverage and the Duty to DefendAuthorOntario Bar Association – Hot topics in Motor Vehicle Insurance2006 Top 10 Coverage Cases from 2005 That Insurers Ought to KnowAboutAuthorDutton Brock Annual Client Seminar2006 Toward Personal Responsibility – Supreme Court Shuts the Door –But Not Entirely – On Social Host ResponsibilityAuthorCanadian Underwriter, July, 2006 edition2007 Top 10 Coverage Cases from 2006 That Insurers Ought to KnowAbout

AuthorDutton Brock Annual Client Seminar2007 Keeping the Cap on Tight…The Supreme Court of Canada hasrefused leave to appeal in a case that attacked the $100,000 cap onnon-pecuniary general damagesAuthorCanadian Underwriter, January, 2007 edition2007 The All-Risk Property Policy and the Faulty Design Exclusion, ACanadian PerspectiveAn analysis and critique of the Ontario Court of Appeal‟s 2007Decision in C.N. Rail v. Royal and SunallianceAuthorCanadian Defence Lawyers’ Audioconference2008 Top 10 Coverage Cases from 2007 That Insurers Ought to KnowAboutAuthorDutton Brock Annual Client Seminar2008 Top 10 Insurance Coverage Decisions – The Cases You ShouldKnown About from 2007AuthorClaims Canada – Official Journal of the Canadian IndependentAdjusters’ Association – February, March, 2008 edition2008 The Sky is Not Falling – The Revised CGL‟s Montrose ProvisionAuthorB.C. Broker Magazine – August, 20082009 Finding Fault with „Faulty Design‟, “All is not lost” An analysis ofthe Supreme Court of Canada‟s Decision in C.N. Rail v. RoyalSunallianceAuthorCanadian Underwriter, January, 2009 edition2009 Top 10 Insurance Coverage Decisions – The Cases You ShouldKnown About from 2008AuthorClaims Canada – Official Journal of the Canadian IndependentAdjusters’ Association – February, March, 2009 edition2009 Land of ExclusionsCraig Harris, AuthorCanadian Underwriter – October, 2009

- cited as an expert on CGL policies in Canada2009 Civil Justice ChangesAuthorClaims Canada – December/January, 20092010 A Tale of Two Provinces….No MoreThe Supreme Court of Canada formulates a national approach tocoverage for construction deficiency claims under the CGL PolicyAuthorCanadian Underwriter – December, 20092008 Top 10 Insurance Coverage Decisions – The Cases You ShouldKnown About from 2010AuthorClaims Canada – Official Journal of the Canadian IndependentAdjusters’ Association – February, March, 2011 editionPRESENTATIONS AND SEMINARSFeb. 1998 toPresentNov 6, 2000Dutton Brock Annual Client SeminarAnnual keynote speaker at Dutton Brock’s client seminarsFirst and Third Party Claim Issues Arising From Toxic MouldKeynote speakerDisaster Kleen-up International Seminar for Insurers and RiskManagers, SkyDome HotelJune 24, 2004 4 th Annual Advanced Forum on Insurance Coverage Disputes –The Latest Developments in Property ClaimsKeynote speakerManaging and Litigating Insurance Coverage DisputesThe Canadian Institute, Sutton Place Hotel, Toronto, OntarioNov 9, 2004April 13, 2005An Update On Recent Case Law Developments and CommercialGeneral Liability Policy Coverage IssuesKeynote speaker and workshop moderatorRoyal and Sunalliance Insurance Company, Mississauga, OntarioAre You At RiskKeynote speakerCanadian Independent Insurance Adjusters Association ContinuingEducation SeminarIntercontinental Hotel, Toronto, Ontario

Apr 27, 28, 2005June 22, 23, 2005Nov. 11, 2005January 27, 2006March 15, 2006April 19, 2006November 23, 2006November 23, 2007November, 2008November 12, 2009January 26, 2007Advanced Forum on Identifying, Managing and Preventing MouldClaimsModerator – Panel discussion on first and third partyinsurance coverage issuesThe Canadian Institute, The Old Mill, Toronto, OntarioNavigating the Commercial General Liability Policy: MasteringTroublesome Standard Policy Wordings and Examining theInsurance Bureau of Canada‟s New ProposalKeynote speakerManaging and Litigating Insurance Coverage DisputesThe Canadian Institute, Sutton Place Hotel, Toronto, OntarioThe Latest Developments in the Relationship Between Primary andExcess InsurersKeynote speakerHot Topics in Motor Vehicle Insurance – The RelationshipBetween Primary and Excess Carriers and the Duty to DefendOntario Bar Association – Insurance SectionTop 10 Coverage Cases from 2005 That Insurers Ought to KnowAboutKeynote speakerLiberty Grand Conference CentreDutton Brock Annual Client SeminarThe Duty to Defend As Between Primary and Excess Insurers andthe Apportionment of Defence Costs Between Insured andUninsured ClaimKeynote speakerAviva Canada Lunch’n’Learn SeminarAviva Canada Downtown Office, 121 King St. W.Legal Actions and Civil Case ManagementKeynote speakerING Continuing Education Seminar, Bodily InjuryEast Toronto Branch, Ajax, OntarioUnderstanding the Tri-partite Relationship, and Related InsuranceCoverage IssuesKeynote speakerCanadian Defence Lawyers Bootcamp for New LawyersOsgoode Hall, TorontoTop 10 Coverage Cases from 2006 That Insurers Ought to KnowAbout

Keynote speakerLiberty Grand Conference CentreDutton Brock Annual Client SeminarNovember 14, 2007December 11, 2007January 25, 2008An Introduction to the CGL PolicyKeynote speakerInsurance Institute18 King St. E., 16th FloorToronto, ON CanadaThe All-Risk Property Policy and the Faulty Design Exclusion, ACanadian PerspectiveAn analysis and critique of the Ontario Court of Appeal‟s 2007Decision in C.N. Rail v. Royal and SunallianceHostCanadian Defence Lawyers’ AudioconferenceTop 13 Coverage Cases from 2007 That Insurers Ought to KnowAboutKeynote speakerLiberty Grand Conference CentreDutton Brock Annual Client SeminarFebruary 6, 2008 An Update and Analysis of the Updated IBC Form 2100Commercial General Liability Insurance PolicyKeynote speakerOntario Mutual Insurance AssocationCambridge, OntarioFebruary 26, 2008June 5, 2008June 17 & 18, 2008Auto Bodily Injury Update – the Litigation ProcessKeynote SpeakerOntario Insurance Institute18 King St. E., 16th FloorToronto, OntarioReview of Leading Canadian Insurance Coverage CasesKeynote SpeakerCanadian Defence Lawyers Annual SeminarLitigating and Managing Insurance Coverage DisputesPost Conference Interactive Workshop Co-chairSucceeding in Defending Construction Defect CasesMarriott Bloor-Yorkville HotelToronto, Ontario

November 24, 2008January 29, 2009November 19, 2009October 25, 2010Top 10 Coverage Cases From 2008 That You Ought to KnowAboutKeynote SpeakerWillis Corroon Brokers’ SeminarAn Introduction to the CGL Policy – Recent leading CGL decisionsKeynote speakerInsurance Institute18 King St. E., 16th FloorToronto, ON CanadaLeasing and Non-owned Auto Exposures in a post – Bill 18 WorldKeynote SpeakerWillis Corroon Brokers’ SeminarLegal Update 2010 – What Insurers Should KnowKeynote SpeakerOntario Mutual Insurance Association Annual ConferenceDeerhurst ResortHuntsville, OntarioJUDICIAL DECISIONSSpintex Yarns v. Liberty International Canada, [1999] O.J. No. 4545 (S.C.J.)Legal Issues – appeal on the issue of the propriety of questions on an examinationfor discovery- legal issues included propriety of questions calling for legal conclusions andtouching on issues of solicitor-client privilegejjBarnicke Limited v. Commercial Union Assurance Company (1998), 40 O.R. (3d) 726(Gen. Div.), affirmed on appeal [2000] I.L.R 1-3865Legal issues - plaintiff sought indemnification under a fidelity bond issued by thedefendant in response to losses suffered due to employee fraud- legal issues included vicarious liability, misrepresentation on an application forinsurance and insurance agency lawFederated Insurance Co. of Canada v. Reliance Insurance Co., [2001] O.J. No. 4676(Gen. Div.)Legal issues – primary insurer sought a declaration that the excess insurer wasobligated to share in funding of insured’s defence costs- legal issues included apportionment of defence costs and expenses betweenprimary and excess insurer, duty to defend and appropriateness of summaryjudgment

Bank of Nova Scotia v. Liberty Mutual Insurance Company (2003), 67 O.R. (3d) 699(Div. Ct.)Legal issues - plaintiff financial institution claimed indemnification under apolicy of residual value insurance issued by the defendant– legal issues included standard of review to be applied on appeal from a CaseManagement MasterBywater v. Toronto Transit Commission (1999), 43 O.R. (3d) 367 (Gen. Div.)Legal issues – defendant brought a motion for contempt against plaintiff’s counselin a class action arising out of a TTC subway fire- legal issues included breach of notice provisions of the Class Proceedings Act,1992 and the standard of proof required to prove civil and criminal contempt ofcourtGore Mutual Insurance Co. v. 1443249 Ontario Ltd. (c.o.b. Enroute Towing), [2004] O.J.No. 4822 (C.A.)Legal issues – plaintiff insurer brought an application for a declaration that it hadno duty to defend its insured under a standard Ontario automobile insurancepolicy- legal issues included the standard of proof required to demonstrate acceptance ofa OPCF 28A endorsement to the standard Ontario Automobile Policy and theinsurer’s duty to defend in the face of an insured’s breach of policy conditionJama (Litigation Guardian of) v. McDonald‟s Restaurants of Canada Ltd., [2003] O.J.No. 2247 (S.C.J.)Legal issues – defendant corporation brought a motion to strike the Statement ofClaim against the directors and officers of the corporation- legal issues included the standard of review on a motion to dismiss, whether anindependent actionable tort on the part of the directors and officers is required,and various pleadings related issuesTaub v. Manufacturer‟s Life Insurance Co., [1999] O.J. No. 2658 (Gen. Div.)Legal Issues – plaintiffs brought a motion to certify a class action against theowner of a building in which they were tenants- legal issues included the elements required for certification of a class action,whether multiple claimants are required to have suffered injury in order to certifyand whether a common issue was establishedEconomical Mutual Insurance Co. v. 1072871 Ontario Ltd. (c.o.b. Lakeview Lunch),[1998] O.J. No. 4180 (Gen. Div.), affirmed on appeal

Legal issues – defendant tenant brought a motion for judgment in an actionagainst it by the landlord’s subrogating insurer- legal issues included landlord/tenant subrogation, the standard to meet in orderto become a third party beneficiary of a property insurance policy and impliedwaivers of subrogationLiberty Mutual Insurance Co. v. Hollinger Inc., [2002] O.J. No. 5419 (S.C.J.), affirmedon appeal [2004] O.J. No. 481 (C.A.)Legal issues – plaintiff CGL insurer brought an application to determine itsobligation to defend its insured in a civil rights/wrongful dismissal actioncommenced in Michigan- legal issues included the test for determining the duty to defend, the obligationof an insurer to defend allegations of discrimination and the interaction of thefortuity principle with the plain language of the policyCanadian Gas Association v. Guardian Insurance Co. of Canada, [1998] O.J. No. 5260(Gen. Div.)Legal Issues – applicant regulatory body applied for a declaration that it only hadto pay one deductible in respect of a claim under an errors and omissions policy- legal issues included the application of single or multiple retentions under aprofessional errors and omissions policy in response to multiple actions byaggrieved homeowners and coverage under a commercial general liability policyfor allegations of professional negligenceClaus v. Wolfman (1999), 52 O.R. (3d) 673 (Gen. Div.)Legal Issues – plaintiff sued various doctors and a hospital for injuries sufferedduring childbirth- legal issues included the standard to obtain summary judgment in a medicalmalpractice action and the obligation of the plaintiff to establish a genuine issuefor trialOlmstead v. Greenberg, [2001] O.J. No. 4545 (Gen. Div.)Legal Issues – defendant homeowner brought a motion to dismiss claims fornuisance and breach of building code- legal issues included the standard of review on a motion to dismiss, theinteraction of Ontario Municipal Board decisions and court decisions and theapplication of the law of nuisanceLiberty International a Division of Liberty Mutual Insurance Company v. The Bank ofNova Scotia, [2008] O.J. No. 2929 (S.C.J.)

Legal Issues – Appeal from the decision of an arbitrator on two questions of law- legal issues included the jurisdiction of a judge on appeal from the decision of aprivate arbitrator, material misrepresentation/omission on an application for anincrease in coverage and the onus of proving that a claim falls within coverageunder an insurance policy