You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

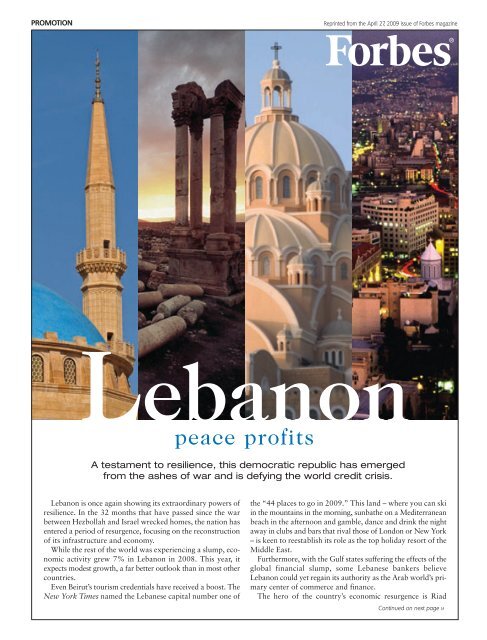

PROMOTIONReprinted from the April 27, 2009 issue of Forbes magazine<strong>Lebanon</strong>peace profitsA testament to resilience, this democratic republic has emergedfrom the ashes of war and is defying the world credit crisis.<strong>Lebanon</strong> is once again showing its extraordinary powers ofresilience. In the 32 months that have passed since the warbetween Hezbollah and Israel wrecked homes, the nation hasentered a period of resurgence, focusing on the reconstructionof its infrastructure and economy.While the rest of the world was experiencing a slump, economicactivity grew 7% in <strong>Lebanon</strong> in 2008. This year, itexpects modest growth, a far better outlook than in most othercountries.Even Beirut’s tourism credentials have received a boost. TheNew York Times named the Lebanese capital number one ofthe “44 places to go in 2009.” This land – where you can skiin the mountains in the morning, sunbathe on a Mediterraneanbeach in the afternoon and gamble, dance and drink the nightaway in clubs and bars that rival those of London or New York– is keen to reestablish its role as the top holiday resort of theMiddle East.Furthermore, with the Gulf states suffering the effects of theglobal financial slump, some Lebanese bankers believe<strong>Lebanon</strong> could yet regain its authority as the Arab world’s primarycenter of commerce and finance.The hero of the country’s economic resurgence is RiadContinued on next page >>

2 LEBANON PROMOTIONProtectivemeasures andfuture goalsGhazi KraytemGGhazi Kraytem, president of theChamber of Commerce, Industryand Agriculture of Beirut andMount <strong>Lebanon</strong>, believes that thecountry will fare better than mostin coping with the global downturn,thanks to the strict controlsimposed by its central bank andthe fact that the Lebanese areused to coping with economic andpolitical problems.“It would be naive to maintainthat the unfolding global financialcrisis will not affect <strong>Lebanon</strong> in anyway,” he says.He adds, however, that a numberof factors are converging tomitigate the impact: “These includetight controls imposed on banksand financial institutions; a veryconservative credit policy resultingin leverages being kept quite low,as far as balance sheets are concerned;and an exaggerated preferencefor high liquidity andunderdeveloped local capital markets.”The chamber’s goals, he says, are“higher efficiency and a largerdegree of transparency andaccountability at all levels of government.In that context, we deemprivatization to be an inevitablerecourse.”The chamber facilitates smoothrelationships between the privateand public sectors, lobbies thegovernment for administrativereforms, works to stimulate economicgrowth, and is seeking toexpand information technologyand communications. ❖Salameh, governor of the central bank,Banque du Liban. In 2005, he barred anyLebanese bank from investing in mortgagebackedsecurities, thereby neatly sidesteppingthe repercussions that have left bankselsewhere concussed.“The Lebanese banking sector is liquidand well regulated,” he says. “Provided thatthis peaceful environment remains, 2009should show a very positive growth in<strong>Lebanon</strong>.”A political accord reached in May of lastyear brought to power a government ofnational unity that has successfully heldtogether, despite a failed coup attempt byHezbollah militants and clashes betweengovernment forces and Palestinian refugeeinsurgents.Business leaders believe that if parliamentaryelections, scheduled to take place in June,pass off safely and effectively,<strong>Lebanon</strong> will not only be able toconsolidate its economic progress,but also will enhance it further,reaping rich dividends.“Our period in office has beenmarked by hardship, but we havemanaged to navigate throughthese times and keep the unity ofthe Lebanese,” says Prime Minister FouadSiniora. “There have been many restrainingfactors, but we have been able to provide theLebanese and the international communitywith a feeling of confidence in our economy.”Lebanese from every section of this4-million-strong society, made up of 18 differentethnic and religious communities, certainlyhave great faith in their country, inspite of having lived through a 15-year-longcivil war, several invasions and frequentinternal conflict.F1online digitale Bildagentur GmbH / AlamyNabil el-Jisr, the president of the country’sCouncil of Development and Reconstruction,says that in the past 17 years thecouncil has overseen more than 4,000reconstruction projects worth more than“There have been many restraining factors,but we have been able to provide theLebanese and the internationalcommunity with a feeling ofconfidence in our economy.”$8.5 billion. “The Lebanese have a provenability to absorb shocks and move forward,”he says.Saad Hariri, the majority leader inParliament and the son of Rafik Hariri, theprime minister assassinated in 2005, sumsup this optimistic spirit: “Every Lebaneseperson wants to build two or three houses.What they don’t want is to keep rebuildingthe same house three or four times.” ❖All monetary figures are stated in U.S. dollars unless otherwise indicated.Prime Minister Fouad SinioraBy Michael KnipeDirector: Lucas Montes de OcaManaging Editor: Beverley Blythe; Editor: Michael Knipe; Art Director: Lisa PampilloniaProject Managers: Jesse Egger, Simmone Park and Corinne FrenzelProject Development: Clinton Cossette and Charlotte Saint-Arroman Commercial Director: Carolina MateoCover Photos: Megapress/Alamy; Roger Wood/Corbis; Christian Kober/Alamy; Anzenberger Agency/Jupiter ImagesThis special advertising feature was produced by Insight Publications, a division of Impact Media International Ltd.150 East 55th Street, 7th Floor, NY, NY 10022, USA. Tel: +1 212 751 1900 Fax: +1 212 751 0088www.insight-publications.com e-mail: publisher@insight-publications.comDJ Paco / Alamy Freeman Patterson / Masterfile

LEBANONPROMOTION3© Images.com/CorbisNo bust here – just boomThe governor of <strong>Lebanon</strong>’s centralbank is being hailed as a hero forhis prudent actions, which savedthe country’s financial sector fromthe credit crunch.WWhile many financial institutions elsewherewere suffering or facing bankruptcy,Lebanese banks saw their deposits grow by12% and their profits by 10% last year.They owe this satisfactory state of affairsto the measures taken by Riad Salameh, thegovernor of Banque du Liban, the nation’scentral bank.Four years ago, he bucked internationaltrends and defied pressure from the businesscommunity by ordering Lebanesebanks not to invest in mortgage-backedsecurities. This move put <strong>Lebanon</strong> in a positionto regain its status as the Middle East’spreeminent banking and finance center, andits financial institutions have taken steps tosecure that position. Banks have restructured,invested in new technologies, refinedtheir markets and extended their horizonstoward Syria, Iraq, Turkey and Kurdistanas well as the Gulf states.Allied Bank, Saudi Lebanese Bank andBankMed have been integrated and restructuredunder the title BankMed to becomethe fourth largest of <strong>Lebanon</strong>’s banks.<strong>Lebanon</strong> & Gulf Bank (LGB) has enhancedits IT infrastructure as it pursues a policyof international expansion, while the newlyrebranded Emirates <strong>Lebanon</strong> Bank is utilizingits links to the Gulf states and preparingto advance into Syria and Kurdistan.Meanwhile, Audi Bank, <strong>Lebanon</strong>’slargest, is expanding into Jordan, Syria andEgypt. At the same time, BLOM Bank, thesecond largest, has focused on organicgrowth.“Dubai was gradually asserting itself asthe region’s financial center, but today, withthe deepening financial crisis in the emirate,Beirut is regaining that role,” says SamerItani, the vice chairman and general managerof LGB. “In this context, we expectmore capital inflows to <strong>Lebanon</strong> and arefully geared to accommodate these at<strong>Lebanon</strong> & Gulf Bank.”He says LGB has the ability to absorbmore business and serve a wider range ofclients because of its approach to businessdevelopment through its increasing branchnetwork. The bank is privately owned, witha shareholders’ base in <strong>Lebanon</strong> and theGulf, a branch in Cyprus and strong relationshipsthroughout the Middle East. Itwas the first bank in <strong>Lebanon</strong> to issue creditcards.Itani describes LGB’s growth strategy as“conservative yet assertive expansion,”enabling it to develop locally and abroad.Continued on next page >>With Middle East Airlines, you are justa few clicks away from enjoying your flight.Book and purchase e-tickets through the Internet at any timeand place with your credit card. Visit us at www.mea.com.lb

4 LEBANON PROMOTIONContinued from previous pageHe says LGB has demonstrated this principlewith its recent successful closure of acapital increase and its adoption of a cautiouslending policy and sound risk management,giving the bank immunity fromthe world financial crisis.“In 2008, LGB actually grew above the<strong>Lebanon</strong> banking sector average andreported a record profits increase of 78%,”he says, adding that it has set an even highergrowth target for this year.LGB aims to be one of the country’s topten banks within the next three years. “Weintend to increase our branch networkthreefold within five years,” says Itani.LGB is developing new services to meetthe needs of the Lebanese diaspora and tolink them with their home country. “Thereare around 14 million Lebanese livingabroad, and their estimated wealth isaround $100 billion,” says Itani. “Withsuch wealth and the reducing trust in foreignbanks, many are turning back to<strong>Lebanon</strong> as a sound financial banking hub.So the inflow of money is actually increasing,not decreasing.”The bank will initially direct its expansionabroad to Iraq and Syria, and eventuallyto other countries in the Middle Eastand Africa. “Our choice of Iraq as a firsttarget market is the result of our strongtrade-finance business with that countryand its businessmen,” says Itani. “A stableIraq is a very promising market for us.”Another of the nation’s banks that hasa strong connection with the Gulf states isthe Emirates <strong>Lebanon</strong> Bank (ELB). InOctober of last year, it acquired theLebanese branches of Banque Nationale deParis Intercontinentale (BNPI), which hadmaintained a presence in <strong>Lebanon</strong> since1944. At the time of the acquisition,BNPI was engaged in commercial bankingactivities through a network of fivebranches serving 13,500 individual clientsand 1,300 corporate ones.ELB is a fully owned subsidiary of theBank of Sharjah (BOS), a leading providerof commercial retail and investment bankingin the United Arab Emirates.Varouj Nerguizian, the executive directorand general manager of BOS, says one reasonfor the move into <strong>Lebanon</strong> was the factthat one-third of the bank’s customers areLebanese people based in the Gulf states:“We saw an opportunity to acquire theassets of BNPI in <strong>Lebanon</strong>, which enable usto serve those customers without having toestablish entirely new facilities.”BOS raised the share capital of thenewly branded ELB to $50 million andinjected a cash contribution of $100 million.“Now we are effectively the best bankto help our Lebanese customers in theUAE,” says Nerguizian.It took four years to finalize the acquisition,he says: “The first year we agreedon the price but not the strategy. The nextyear, the death of Prime Minister [Rafik]Hariri delayed matters. But finally, we completedthe deal.”One challenge brought about by theacquisition has been language. “The BNPIwas a French institution, and English is spokenin the Gulf,” says Nerguizian. Frenchremains the primary European language in<strong>Lebanon</strong>, so a special language departmentis being established to resolve these complications.“We know we’re in an area wherewe can benefit both customers and ourselves,”he says. “Today, a lot of Lebanesecompanies are going to the Gulf.”ELB is now undergoing a transformationof its operations and will be used as a platformfor BOS’ future expansion in theYour Promising DestinationAt <strong>Lebanon</strong> andGulfBanks.a.l.,our customer-centric philosophy drives ourpassiontogothat extramile with you to create long-lasting relationships, rewarding partnerships and enduring commitments.Whateveryouaspirefor from yourbanking relationship,weunitetheenergyandexpertiseofourhuman capital to offer you tailored financial solutions that meet your specific needs.Learn more about your promising destination at www.lgb.com.lb

LEBANONPROMOTION5Levant, where it intends to benefit fromexceptionally strong synergies with itsGulf-based clientele. “This year we’relooking to Syria,” says Nerguizian. “Thereis also pressure on us to go to Kurdistan,where we already have a very active presence.”The transformation of financial institutionsis a delicate task that has to beundertaken with care and precision.BankMed’s consolidation, reorganizationand rebranding have taken place over twoyears. “Historically, BankMed was a corporatebank that would deal with specialclients,” says Mohammad Hariri, the chairmanand general manager. “Three years ago,we changed this image completely andbecame a consumer-friendly retail bank,while retaining our well-established corporatesector.”The bank has added new divisions anddepartments, relocated existing branchesand opened new ones, developed newproducts, revamped and modernized IT systemsand hired top executives.Bank Med now has a network of44 branches in <strong>Lebanon</strong> and one in Cyprusjointly with Turkland Bank in Turkey;SaudiMed, an investment-banking arm inSaudi Arabia; and BankMed (Suisse) inSwitzerland.“We now have 10% of the banking sector’sassets, and we are opening three newbranches in <strong>Lebanon</strong> this year,” saysHariri. What differentiates BankMed fromits competitors, he says, “is our strongalliance to our group, and the highqualityservice and personalized attentionwe can offer to our clients.” ❖In safe hands“The Lebanese banking sectoris liquid and well regulated,”says Riad Salameh,the governor of Banque duLiban, the nation’s centralbank. “Our model is conservativeand did not allow overleveragingor the acquisitionof toxic assets.”The government, he says,has laid out a comprehensiveplan that encompasses fiscalreform and privatization: “Weare starting to see progress. Ifthe plan is implemented effectively,it will generate more liquidityto the private sector, andconsequently more growth.”Salameh points out thatsince <strong>Lebanon</strong>'s creation ithas been a free-enterprisesociety with total freedom forcapital movement.“Of the deposits in ourcountry, 72% are in foreigncurrency, and the shares inour stock market are traded indollars, which eliminates currencyrisk,” he says. “If youadd the undervaluation ofassets in <strong>Lebanon</strong>, you’ll seea multitude of opportunitiesin services, real estate andother sectors.”<strong>Lebanon</strong>’s competitiveadvantage, he says, is thetop quality of its humanresources and its geographicallocation, equidistant fromthe African, European andAsian continents.“Our proximity to the Arabworld makes us a great accesspoint and a base for businessfor this growing market,” hesays.All of these factors are givingrise to the belief that Beirutcould reclaim its role as theMiddle East’s preeminentbanking and finance center, aposition it lost as a result ofthe civil war that raged from1975 to 1990. ❖T. +961 1 965000 F. +961 1 965599E.info@lgb.com.lb |Allenby Street,Beirut Central District, <strong>Lebanon</strong>

6LEBANONPROMOTIONremains of the Roman period in the BekaaValley, 60 miles northeast of Beirut – is asure sign of confidence and curiosityregained.For more than two decades, internationalsymphony orchestras, ballet companiesand artists such as Plácido Domingo andElla Fitzgerald performed before audiencesof 4,000 amid the floodlit Temples ofJupiter and Bacchus.Brought to an end by the civil war and subsequentconflicts, the festival was firstrestaged in 2008. This year it is scheduled totake place for a month starting on July 3.The Casino du Liban is an equallyfamous icon. Distinguished visitors in thegolden years of the 1960s and early 1970sincluded Lyndon Johnson, Omar Sharif andthe Shah of Iran. Modeled on the MonteCarlo Casino, the Casino du Liban formerlyinsisted that men wear jackets and ties, butrecently agreed to allow chic sports clothes.With facilities that include two theaters,a night club, five restaurants and cocktailbars, and three gaming rooms with 60 tablesand around 400 slot machines, the estabwithover 50 years experience,SAYFCO has become the leadingreal estate developer inlebanon.all-season faqra club resortfeatures 11-ultra luxuriousvillas.covering an area of over 500acres, featuring a boutiquehotel, golf, polo, a countryclub, and a variety of summerand winter activitiesThe will to win<strong>Lebanon</strong> is spreading its wings torestore its position as the gambling,leisure and culture capital of theArab world.IInternational festivals of culture are onceagain being staged in the stunning settingof the Roman Acropolis at Baalbeck.Visitors are flocking to the Casino duLiban, the celebrated gaming house perchedbetween sky, sea and mountains above theresort town of Jounieh.With <strong>Lebanon</strong> showing signs of regainingits role as the most popular leisure centerin the Arab world, Middle East Airlines,the country’s flagship carrier, is buying newaircraft and expanding its routes. MoreWesterners are gradually returning to a landwhere you can ski on mountain snow in themorning and swim in the Mediterranean inthe afternoon.“Many European expats who live in theGulf states visit us, and we have started seeingan influx from Europe as well,” saysJoost Komen, the acting general manager ofthe InterContinental Mzaar <strong>Lebanon</strong>Mountain Resort & Spa, which is situatednext to the ski slopes among the peaks ofMount <strong>Lebanon</strong>.The revival of the annual BaalbeckFestival – set against some of the finestNabil Mounzer/epa/CorbisPaul Doyle / Alamy

LEBANONPROMOTION7lishment attracts about 3,000 visitors a day.Dr. Khater Abi Habib, an economistwith experience in the financial sector andthe chairman of the casino’s managementboard, says that its contract gives the casinoa monopoly on all gambling in <strong>Lebanon</strong>,and in return the government receives ashare of the revenue. One of the conditionsis that the casino present cultural performancesby top entertainers, operas, symphoniesand ballet companies.“In 2006, when we took over from theprevious board, gross revenue grew 17% innine months, in spite of the war during thesummer, and was the highest ever by 7%,”says Dr. Habib. “Last year we grew 19%,and this year we are hoping to grow 35%.”“Many European expats who livein the Gulf states visit us, and wehave started seeing an influx fromEurope as well.”Joost Komen, InterContinental Mzaar<strong>Lebanon</strong> Mountain Resort & SpaFuture plans include enlarging the premisesby adding two more gambling areas sothat the casino can accommodate 1,200people.The Casino du Liban is renowned amongthe Lebanese for the fact that it managed toremain open for all but the last spell of thecivil war. Middle East Airlines (MEA)demonstrated similar resilience during thewar between Hezbollah and Israel in 2006,when Israel bombed Beirut InternationalAirport.Mohamad A. El-Hout, the airline’s chairmanand director general, recalls that whenit was given 24 hours to evacuate its planes,within four days the airline had moved itsoperations to Larnaca International Airportin Cyprus. A day later, it resumed half of itsregular flight schedule, but from Damascusrather than Beirut.“Operating from Damascus was nonprofitable,but it sent a message to our customersthat we were a reliable airline in good timesand bad times,” he says. Despite the disruptions,the airline ended the year with a profitof $40 million.“This is the Lebanese mentality,” says El-Hout. “Whenever we have a crisis, we areable to cope with the situation. Whileother airlines have suffered losses, MEA hasmanaged to hold on to impressive growth,with 2008 fiscal profits expected to bearound $70 million.”MEA’s corporate message, says El-Hout,is to always preserve the highest standards ofsafety and security by flying modern aircraftserviced exclusively by Lebanese crews. ❖

8 LEBANON PROMOTIONWhere real estate is on the up and upWhile many parts of the world aresuffering a property slump,designers and developers in<strong>Lebanon</strong> have their heads in theClouds.IIn good times and bad times, throughwars and bombardments, the Lebanesehave found reassurance in one thing: Thevalue of real estate has never dropped.While property prices elsewhere in theworld may be sinking and project developmentsstalling, the value of business locationsand residential homes in <strong>Lebanon</strong>remains firm, and project developmentcontinues apace.This is reflected in a $1.2 billion jointventure signed recently to develop a highprofile,multifaceted high-rise project indowntown Beirut. Called Beirut Gate, itwill overlook the Mediterranean and thefamous Martyrs’ Square, the symbolicheart of the city.In another prestigious project calledClouds, 17 luxurious residential villas havebeen built in the heart of Faqra, a plushupmarket ski resort, situated high up in themountains 30 miles from the capital.“I believe the real estate sector in<strong>Lebanon</strong> will keep its robustness for at leastthe next five years,” says Chahe Yerevanian,the chairman and general manager ofSayfco, a leading property developmentcompany responsible for the Beirut Gateand Clouds projects.“I believe the real estate sector in<strong>Lebanon</strong> will keep its robustness forat least the next five years.”Yerevanian’s father created Sayfco in the1960s. After his father’s death in 2000,Yerevanian restructured the companywhile maintaining its traditional roots.Sayfco has now handled projects worthmore than $1 billion.Since completing Clouds, the companyhas launched a 200-unit gated-villagedevelopment and this year is planninganother mountain resort project that willfeature 500 villas, a country club and a boutiquehotel.“It is going to be the project of thedecade,” says Yerevanian. His vision is toextend the company’s range and take it toa corporate governance level.Another successful family-run contractingcompany is Matta, which operates inthe field of building construction and publicworks. Ranked as oneof the top four consultanciesin <strong>Lebanon</strong>, Mattahas just signed a $9 millioncontract to construct andmaintain a cable factory.Matta is now active inDubai and Turkmenistan and has workedon projects in Qatar.Created in 1944, the company it is nowrun by Jacques Matta, whose son Fadi isthe administrative and financial manager.“For us, the market with the greatestpotential is Syria,” says Fadi Matta. “It isonly 60 miles away and there is so muchwork to be done there. Jordan also haspotential.”Matta’s optimistic outlook is shared byKhatib & Alami, an architectural andengineering consultancy ranked amongthe top 100 international design firms.Khatib & Alami is active throughout 23countries across the Middle East and NorthAfrica. To balance its geographic presenceand avoid market dependence, it has alsoestablished a small company in Californiafor engineering, IT applications and utilitysolutions for infrastructure services.However, Dr. Najib Khatib, the directorgeneral and partner, who is the son of oneof the founding members of the firm,believes <strong>Lebanon</strong> will become increasinglyimportant for the partnership, alongwith Saudi Arabia, Kuwait and Qatar.“The firm has been growing substantiallyin the last five years and is looking at acquisitionsin an active manner,” says Dr.Khatib.Among <strong>Lebanon</strong>’s visual delights are theremnants of its architectural heritage.Greenstone, a division of Johnny R. SaadeHoldings, is in the process of returning toits former glory a 100-year-old, six-storybuilding located in the Achrafieh district ofthe capital.Johnny Saade, chairman, says the integratedproject, scheduled for completion in2011, has been named L’Armonial toreflect the notions of art and harmony thatit will embody. ❖Chahe Yerevanian, Sayfco

LEBANONPROMOTION9Masters ofmanagementHaving turned Beirut’s seaportinto a superefficient containerterminal, IPM is spreading itsexpertise to new shores.Within nine months of taking control of theBeirut Container Terminal at <strong>Lebanon</strong>’smajor seaport, International PortManagement (IPM) had recruited andtrained a workforce consistingentirely ofLebanese men andwomen and reducedthe number of expatriatesworking in the terminalto about 15.That was four yearsago. “Now we are theonly port in the region that has 100% localemployment,” says Ammar Kanaan, chairmanand general manager of IPM.Today, the container port handles 1 millionunits, up from 300,000 three years ago,and employs more than 600 people whoare specialists in port operations. By usingsubcontractors and service companies,the port has increased the volume of containertraffic in Beirut, creating more than3,000 jobs in the local economy.“Most members of our staff are below27 years of age,” says Kanaan. “They areyoung and ambitious and are doing a verygood job. They are proud of this terminaland what has been achieved. They haveinvested in it and seen it grow from nothing,and this has had a direct effect on productivity.”Two of the world’s largest containershippingcompanies chose Beirut as atransshipment hub for the region, eventhough it adds a day’s journey to thedirect route through the Mediterraneanfrom Gibraltar to the Suez Canal.“If you look at the geographic location of<strong>Lebanon</strong>, it may not seem to make senseto use Beirut as a transshipment hubbecause the deviation off the main routewill cost ships a minimum of $100,000,”says Kanaan. The reason shipping lines doso, he explains, is because the efficiency ofthe port management, the facilities and thequality of the workforce more than makeup for the cost of the additional sailing time.COMPANY PROFILETo maintain this high standard, IPMinvests substantially in its research anddevelopment arm, which often works incooperation with the American Universityof Beirut on issues ranging from technologicalproficiencies to maximizing workeroutput.“In terms of productivity, we are one ofthe best container ports in the region,”says Kanaan.The company is now expanding internationally.“We have signed an agreement toundertake a long-term project in Turkey,”he says. “We have started work inLithuania, and we have done subcontractingwork in Trinidad, Malta, Ukraineand Kuwait. Currently, we are undertakinga number of ambitious projects [in countries]around the globe, includingArgentina.”FAITH IN LEBANON100% COMMITMENT CUSTOMER SATISFACTIONOUR SUCCESS HAS THREE FACESSince 1944, BankMed has grown to become one of <strong>Lebanon</strong>'s top banks, alwaysthriving to best serve its customers. As a universal, trustworthy leading Lebanesebanking group, we bring you a diverse service, including retail and corporatebanking as well as investment opportunities… all in the context of an internationalexpertise with operations spreading to Cyprus, Switzerland, Turkey and theKingdom of Saudi Arabia.

LEBANONPROMOTION11Earning high marksWith 41 universities, innovative programs and highstandards, <strong>Lebanon</strong> has one of the best educationalsystems in the region.TThe Suliman S. Olayan School of Business’s move into its newpremises this year has brought the high profile of university-levelbusiness education in <strong>Lebanon</strong> into sharp focus.The American University of Beirut (AUB) separated businessstudies from arts and sciences to create the Olayan School ofBusiness as its sixth independent faculty in 2003. It was able todo so and to build the new facility as the result of a substantialgift from the family of Suliman S. Olayan, the founder and chairmanof the Olayan Group. It is a fitting tribute that the schoolbears his name.Olayan, a Saudi billionaire, turned his small trucking companyinto a diversified, multinational distribution, manufacturingand investment business.George Najjar, a professor and the dean of the businessschool, has created three innovative business programs – MM&E(management, marketing and entrepreneurship), FAME (finance,accounting and managerial economics) and BIDS (businessinformation and decision systems). Departments work in clustersto enable the sharing of expertise.“Within these tracks there is a high level of cooperation,” saysNajjar. “Currently, we have 52 faculty members, up from just tena few years ago, representing a 500%growth.”The business school has also completelyrevamped its undergraduate curriculumand M.B.A. degree program tobring them up to the highest standards.The AUB, the most prestigious educationalinstitution in the Arab world, wasfounded as a private, nondenominationaluniversity in 1866. Its current president,Dr. Peter Dorman, a distinguished American professor ofEgyptology, is the great-great-grandson of its founder, Daniel Bliss.The AUB first introduced business education in 1900, and overthe next 100 years its graduates included many business and politicalleaders, such as <strong>Lebanon</strong>’s Prime Minister Fouad Siniora andseveral of his predecessors.Bahia Hariri, the minister of education and a sister of the lateprime minister, Rafik Hariri, emphasizes the importance attachedto schooling in <strong>Lebanon</strong> and the links between education and theeconomy.When she was appointed, she held an unprecedented meetingwith 15 former education ministers to devise her goals and strategies,which included drafting a new curriculum and launchingteacher-training workshops.With 125,000 students enrolled in its 41 universities and morethan 2,100 Lebanese students studying in the U.S., the countrycan lay claim to having one of the best educational systems in theMiddle East. It introduced free primary education in 1960, butabout two-thirds of all students attend private schools. ❖American University of Beirut Suliman S. OlayanSchool of BusinessEstablished in 1866, the American University of Beirut (AUB) in Beirut,<strong>Lebanon</strong> is the premier institution of liberal-arts-based higher learningin the Middle East. More than 7,000 students from 60 countries are enrolledin 100 undergraduate, master’s, and select PhD programs across six the Commission on Higher Education of the Middle States Association ofColleges and Schools and is registered with the Board of Education in the AUB also boasts a Medical Center that includes a 420 bed hospital andprovides comprehensive tertiary/quaternary medical care and referralservices for <strong>Lebanon</strong> and the region.Many of AUB’s 500 full-time faculty are involved in research, regionalconsultancy, and outreach activities that enhance the academic experienceof students on campus—and the quality of life for communitiesthroughout the region.Although we are located in the Middle East, our more than 40,000 alumnilive and work around the world—often in leadership positions in government,business, medicine, and the arts.For more information, contact us at:information@aub.edu.lb www.aub.edu.lbThe Suliman S. Olayan School ofBusiness offers strong BBA andMBA programs to more than 1,400fulltime students at the AmericanUniversity of Beirut (AUB) inBeirut, <strong>Lebanon</strong>. The OlayanSchool also provides rigorous academicand professional EMBA andcorporate EMBA programs anda range of executive educationalservices for a select group of menand women from the Middle Eastregion and beyond.Its 50 faculty members from 15 nationalitieshave strong regional andinternational links with the public andprivate sectors. With a new state-ofthe-artbuilding that is scheduled forcompletion in spring 2009, AUB issetting the pace for business educationin the region—something it hasbeen doing since 1900.

© Benoit Tessier / Reuters12 LEBANON PROMOTIONA cut aboveDespite the economic downturn,when it comes to businessenterprise, optimism, flair andfortitude are the fashion in<strong>Lebanon</strong>.AAs Angelina Jolie glided along the redcarpet at the Oscars and Whitney Houstonmade an appearance at the GrammyAwards this year, both owed more than alittle of the impact they made to Lebanesedress designers.Jolie was wearing a black strapless gownby Elie Saab and Houston a soft aquaticcoloreddress by Zuhair Murad. Both ofthese <strong>Lebanon</strong>-born designers have takeninternational haute couture by storm.Their success is an example of theLebanese people’s irrepressible entrepreneurialspirit and confident optimism,which extends through a range of businesssectors, undimmedby either domesticsetbacks or the globaldownturn.When asked howhe envisions thefuture, Johnny R.Saade, chairman ofJohnny R. SaadeHoldings, a disparategroup of companiesactive in wine-making,tourism and realestate, says: “We are© Jamal Saidi / Reutersexpanding in all fields, here and abroad.”Patchi, a Lebanese chocolate maker,sells its handmade luxury confectionerybrand in 35 countries. Its chairman andfounder, Nizar Choucair, is equally bullishabout the future. “We are opening verysoon in Azerbaijan and negotiating withSouth Africa,” he says.Raymond Abou Adal, the chairman ofHoldal, a company with 60 years of experiencein distributing hundreds of highqualityinternational brands, says<strong>Lebanon</strong>’s strength lies in the mentality ofits people: “They have a willingness to live.Each day for them is a marvelous day. Weare not a depressed people. We are reallyoptimistic.” ❖WEB DIRECTORYAmerican Uni Beirut www.aub.edu.lbBank du Liban www.bdl.gov.lbBank Med www.bankmed.com.lbBank of Sharjah www.bankofsharjah.comBML Istisharat SAL www.istisharat.comCasino du Liban www.cdl.com.lbChateau Kefraya www.chateaukefraya.comChateau Ksara www.chateauksara.comInt'l Port Management www.portmanagers.netKhatib & Alami www.khatibalami.com<strong>Lebanon</strong> & Gulf Bank www.lgb.com.lbMatta www.mattacontracting.comMiddle East Airlines www.mea.com.lbSayfco Holding www.sayfco.com