- Page 1 and 2: e c o n o m i cr e p o r to f t h e

- Page 4 and 5: C O N T E N T SECONOMIC REPORT OF T

- Page 6 and 7: economic report of the presidentTo

- Page 8 and 9: Because of these and other steps, w

- Page 11 and 12: usinesses and farmers. And by harne

- Page 13 and 14: the annual reportof thecouncil of e

- Page 15 and 16: C O N T E N T SPageCHAPTER 1. TO RE

- Page 17 and 18: Commercial Real Estate ............

- Page 19 and 20: CHAPTER 8. STRENGTHENING THE AMERIC

- Page 21 and 22: list of figures1-1. House Prices Ad

- Page 23 and 24: 7-3. Child and Infant Mortality Acr

- Page 25 and 26: C H A P T E R 1TO RESCUE, REBALANCE

- Page 27 and 28: Figure 1-1House Prices Adjusted for

- Page 29 and 30: emain in achieving a full recovery.

- Page 31 and 32: esult of this rebalancing will be a

- Page 33 and 34: Rebuilding a Stronger EconomyEven b

- Page 35 and 36: Chapter 7 describes the actions the

- Page 37 and 38: slowing the emission of greenhouse

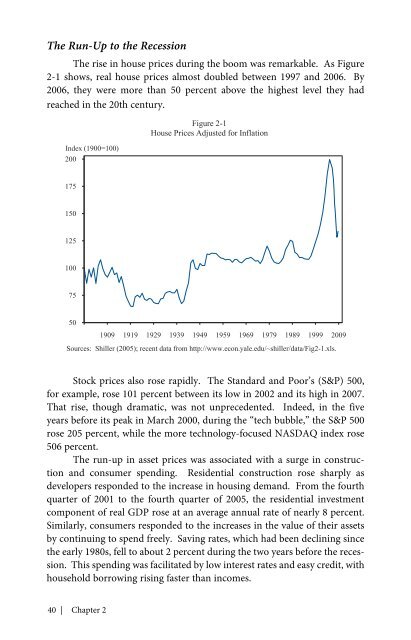

- Page 39: C H A P T E R 2RESCUING THE ECONOMY

- Page 43 and 44: Figure 2-3TED Spread and Moody’s

- Page 45 and 46: The basic reason for these policies

- Page 47 and 48: Monetary PolicyThe first line of de

- Page 49 and 50: The flip side of the large increase

- Page 51 and 52: There were two other key components

- Page 53 and 54: would be spent by the end of the th

- Page 55 and 56: In November, the Worker, Homeowners

- Page 57 and 58: stimulus. And both direct estimates

- Page 59 and 60: the mortgage market. Another market

- Page 61 and 62: composition of mortgage finance. In

- Page 63 and 64: 105Figure 2-9FHFA and LoanPerforman

- Page 65 and 66: Figure 2-11Real GDP: Actual and Sta

- Page 67 and 68: market policies were surely importa

- Page 69 and 70: One can again use the VAR described

- Page 71 and 72: Initial unemployment insurance clai

- Page 73 and 74: Table 2-2Forecast and Actual Macroe

- Page 75 and 76: appears to have contracted somewhat

- Page 77 and 78: Box 2-1, continuedThe normal or pot

- Page 79 and 80: The Administration has also support

- Page 81 and 82: C H A P T E R 3CRISIS AND RECOVERYI

- Page 83 and 84: Figure 3-1Interbank Market RatesPer

- Page 85 and 86: avoid risky investments at the heig

- Page 87 and 88: The Collapse of World TradeDespite

- Page 89 and 90: strongly correlated with the extent

- Page 91 and 92:

strong and swift in most countries

- Page 93 and 94:

to be 5.5 percent over 2009 and is

- Page 95 and 96:

sheet on a similar scale. 5 While i

- Page 97 and 98:

were fully collateralized with fore

- Page 99 and 100:

appear to have adopted less discret

- Page 101 and 102:

The second G-20 leaders’ summit t

- Page 103 and 104:

downward through the winter and spr

- Page 105 and 106:

Figure 3-13Outperforming Expectatio

- Page 107 and 108:

losses in the level of output in th

- Page 109 and 110:

asset prices in those economies. Th

- Page 111 and 112:

former levels but rather that they

- Page 113 and 114:

This chapter lays out a picture of

- Page 115 and 116:

Indeed, some of the factors should

- Page 117 and 118:

Percent, seasonally adjusted14Figur

- Page 119 and 120:

saving rate will eventually stabili

- Page 121 and 122:

Figure 4-6Homeownership RatePercent

- Page 123 and 124:

new investment in this sector. Firs

- Page 125 and 126:

mortgage-backed securities (CMBS),

- Page 127 and 128:

Percent, seasonally adjusted6.5Figu

- Page 129 and 130:

and unemployment was low. In a boom

- Page 131 and 132:

The Current Account in the Recovery

- Page 133 and 134:

Figure 4-11Growth of U.S. Exports a

- Page 135 and 136:

C H A P T E R 5ADDRESSING THE LONG-

- Page 137 and 138:

The key message of the figure, howe

- Page 139 and 140:

Figure 5-3Budgetary Cost of Previou

- Page 141 and 142:

substantial assets in preparation.

- Page 143 and 144:

The Effects of Budget DeficitsTwo f

- Page 145 and 146:

grows. Thus, the key to a sustainab

- Page 147 and 148:

2 percent per year, nominal GDP gro

- Page 149 and 150:

ate of roughly 6 percent during the

- Page 151 and 152:

Figure 5-7Top Statutory Tax RatesPe

- Page 153 and 154:

with different incomes—the differ

- Page 155 and 156:

The Administration understands that

- Page 157 and 158:

a strategic plan. Throughout this p

- Page 159 and 160:

will decide to use the money for so

- Page 161 and 162:

Figure 6-3Share of Financial Sector

- Page 163 and 164:

These private mortgage pools issue

- Page 165 and 166:

or the failure of a major bank. The

- Page 167 and 168:

taking a macroprudential approach,

- Page 169 and 170:

Classic bank runs were commonplace

- Page 171 and 172:

Figure 6-6Coordination ContagionNEG

- Page 173 and 174:

economy if they failed. No regulato

- Page 175 and 176:

justifiable. In particular, the gro

- Page 177 and 178:

thrifts eventually followed suit, w

- Page 179 and 180:

The Current State of theU.S. Health

- Page 181 and 182:

with the growth eventually turning

- Page 183 and 184:

common sense suggest that purchasin

- Page 185 and 186:

When individuals are healthy, their

- Page 187 and 188:

compared with an average of 80.7 in

- Page 189 and 190:

Figure 7-4Insurance Rates of Non-El

- Page 191 and 192:

prohibitively high for them. Furthe

- Page 193 and 194:

Small Businesses. As described earl

- Page 195 and 196:

in private health insurance coverag

- Page 197 and 198:

Enrollment (millions)5251Figure 7-9

- Page 199 and 200:

legislation lays the groundwork for

- Page 201 and 202:

obtain and provide insurance, and w

- Page 203 and 204:

Senate bills, subsidies would be av

- Page 205 and 206:

Both bills also include measures th

- Page 207 and 208:

price competitively. And to the ext

- Page 209 and 210:

C H A P T E R 8STRENGTHENING THEAME

- Page 211 and 212:

ut have given up looking for work a

- Page 213 and 214:

years, backed by a union that barga

- Page 215 and 216:

Figure 8-4Share of Pre-Tax Income G

- Page 217 and 218:

Reform of the immigration system ca

- Page 219 and 220:

widespread expansion of state colle

- Page 221 and 222:

Box 8-1, continuedfunding is being

- Page 223 and 224:

Mean scale score out of 50032017-ye

- Page 225 and 226:

many aid-eligible students from eve

- Page 227 and 228:

Box 8-2, continued(GED) preparation

- Page 229 and 230:

Providing incentives for schools id

- Page 231 and 232:

C H A P T E R 9TRANSFORMING THE ENE

- Page 233 and 234:

to atmospheric concentrations. And

- Page 235 and 236:

typhoons is likely to grow, as are

- Page 237 and 238:

Box 9-1, continuedAlthough warmer t

- Page 239 and 240:

Jump-Starting the Transition to Cle

- Page 241 and 242:

keep it from entering the atmospher

- Page 243 and 244:

Other Domestic Actions toMitigate C

- Page 245 and 246:

emission allowances. These allowanc

- Page 247 and 248:

prices above certain thresholds tri

- Page 249 and 250:

Box 9-3, continuedfirms subject to

- Page 251 and 252:

International Action on Climate Cha

- Page 253 and 254:

analysis under clearly defined guid

- Page 255 and 256:

C H A P T E R 1 0FOSTERING PRODUCTI

- Page 257 and 258:

For too many years, our Nation has

- Page 259 and 260:

A more subtle message is that the a

- Page 261 and 262:

workers and capital are likely to b

- Page 263 and 264:

Box 10-1, continuedThe second is a

- Page 265 and 266:

Private Research and Experimentatio

- Page 267 and 268:

system of patents and copyrights th

- Page 269 and 270:

in governmental policymaking proces

- Page 271 and 272:

While the act of specializing shoul

- Page 273 and 274:

currently exports on net and instea

- Page 275 and 276:

use less advanced technology and pr

- Page 277 and 278:

Administration has continued pressi

- Page 279 and 280:

who do not benefit from these advan

- Page 281 and 282:

REFERENCESChapter 1To Rescue, Rebal

- Page 283 and 284:

Sahm, Claudia R., Matthew D. Shapir

- Page 285 and 286:

Benartzi, Shlomo, and Richard Thale

- Page 287 and 288:

————. 2009g. A Preliminary

- Page 289 and 290:

————. 2009b. Letter to the

- Page 291 and 292:

Sisko, Andrea, et al. 2009. “Heal

- Page 293 and 294:

Hair, Elizabeth, et al. 2006. “Ch

- Page 295 and 296:

Rouse, Cecilia, et al. 2007. “Fee

- Page 297 and 298:

Intergovernmental Panel on Climate

- Page 299 and 300:

————. 2002. “Sources of U

- Page 302 and 303:

letter of transmittalCouncil of Eco

- Page 304:

Council Members and Their Dates of

- Page 307 and 308:

The Members of the CouncilThe other

- Page 309 and 310:

Many of the reports issued by the C

- Page 311 and 312:

Christopher D. Carroll ............

- Page 313 and 314:

Benjamin N. Dennis (Department of t

- Page 315 and 316:

C O N T E N T SNATIONAL INCOME OR E

- Page 317 and 318:

PRODUCTION AND BUSINESS ACTIVITYB-5

- Page 319 and 320:

AGRICULTURE—ContinuedB-101. Agric

- Page 321 and 322:

National Income or ExpenditureTable

- Page 323 and 324:

Table B-2. Real gross domestic prod

- Page 325 and 326:

Table B-3. Quantity and price index

- Page 327 and 328:

Table B-5. Contributions to percent

- Page 329 and 330:

Table B-6. Chain-type quantity inde

- Page 331 and 332:

Table B-7. Chain-type price indexes

- Page 333 and 334:

Table B-8. Gross domestic product b

- Page 335 and 336:

Table B-10. Gross value added by se

- Page 337 and 338:

Table B-12. Gross domestic product

- Page 339 and 340:

Table B-13. Real gross domestic pro

- Page 341 and 342:

Table B-14. Gross value added of no

- Page 343 and 344:

Table B-16. Personal consumption ex

- Page 345 and 346:

Table B-18. Private fixed investmen

- Page 347 and 348:

Table B-20. Government consumption

- Page 349 and 350:

QuarterTable B-22. Private inventor

- Page 351 and 352:

Table B-24. Foreign transactions in

- Page 353 and 354:

Table B-26. Relation of gross domes

- Page 355 and 356:

Table B-28. National income by type

- Page 357 and 358:

Year or quarterPersonalincomeTable

- Page 359 and 360:

Table B-30. Disposition of personal

- Page 361 and 362:

Table B-32. Gross saving and invest

- Page 363 and 364:

Table B-33. Median money income (in

- Page 365 and 366:

Table B-35. Civilian population and

- Page 367 and 368:

Table B-36. Civilian employment and

- Page 369 and 370:

Table B-38. Unemployment by demogra

- Page 371 and 372:

Table B-40. Civilian labor force pa

- Page 373 and 374:

Table B-42. Civilian unemployment r

- Page 375 and 376:

Table B-44. Unemployment by duratio

- Page 377 and 378:

Table B-46. Employees on nonagricul

- Page 379 and 380:

Table B-47. Hours and earnings in p

- Page 381 and 382:

Table B-49. Productivity and relate

- Page 383 and 384:

Production and Business ActivityTab

- Page 385 and 386:

Table B-53. Industrial production i

- Page 387 and 388:

Table B-55. New construction activi

- Page 389 and 390:

Table B-57. Manufacturing and trade

- Page 391 and 392:

Table B-59. Manufacturers’ new an

- Page 393 and 394:

Table B-61. Consumer price indexes

- Page 395 and 396:

Table B-62. Consumer price indexes

- Page 397 and 398:

Table B-64. Changes in consumer pri

- Page 399 and 400:

Table B-65. Producer price indexes

- Page 401 and 402:

Table B-67. Producer price indexes

- Page 403 and 404:

Year ormonthTable B-68. Changes in

- Page 405 and 406:

Table B-70. Components of money sto

- Page 407 and 408:

Table B-71. Aggregate reserves of d

- Page 409 and 410:

Table B-73. Bond yields and interes

- Page 411 and 412:

Table B-74. Credit market borrowing

- Page 413 and 414:

Table B-75. Mortgage debt outstandi

- Page 415 and 416:

Table B-77. Consumer credit outstan

- Page 417 and 418:

Table B-79. Federal receipts, outla

- Page 419 and 420:

Table B-81. Federal receipts, outla

- Page 421 and 422:

Table B-83. Federal and State and l

- Page 423 and 424:

Table B-85. State and local governm

- Page 425 and 426:

Table B-87. U.S. Treasury securitie

- Page 427 and 428:

Table B-89. Estimated ownership of

- Page 429 and 430:

Table B-91. Corporate profits by in

- Page 431 and 432:

Table B-93. Sales, profits, and sto

- Page 433 and 434:

Table B-95. Historical stock prices

- Page 435 and 436:

YearTotal 1AgricultureTable B-97. F

- Page 437 and 438:

Table B-99. Farm output and product

- Page 439 and 440:

Table B-101. Agricultural price ind

- Page 441 and 442:

Year or quarterExportsInternational

- Page 443 and 444:

Table B-104. U.S. international tra

- Page 445 and 446:

Table B-106. U.S. international tra

- Page 447 and 448:

Table B-108. Industrial production

- Page 449 and 450:

Period456 | Appendix BTable B-110.

- Page 451:

Table B-112. Growth rates in real g