connected transaction subscription of new shares proposed grant of ...

connected transaction subscription of new shares proposed grant of ...

connected transaction subscription of new shares proposed grant of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Hong Kong Exchanges and Clearing Limited and The Stock Exchange <strong>of</strong> HongKong Limited take no responsibility for the contents <strong>of</strong> this announcement, make norepresentation as to its accuracy or completeness and expressly disclaim any liabilitywhatsoever for any loss howsoever arising from or in reliance upon the whole or anypart <strong>of</strong> the contents <strong>of</strong> this announcement.This announcement appears for information purpose only and does not constitute aninvitation or <strong>of</strong>fer to acquire, purchase or subscribe for the securities <strong>of</strong> the Company.(Incorporated in Bermuda with limited liability)(Stock Code: 8306)CONNECTED TRANSACTIONSUBSCRIPTION OF NEW SHARESPROPOSED GRANT OF SPECIFIC MANDATEAPPLICATION FOR THE GRANT OF THE WHITEWASH WAIVERRESUMPTION OF TRADINGFinancial Adviser to the CompanySubscription <strong>of</strong> <strong>new</strong> SharesOn 29 August 2012 (after trading hours), the Company entered into the SubscriptionAgreement with the Subscriber pursuant to which the Subscriber has agreed tosubscribe for 3,750,000,000 Subscription Shares at HK$0.08 per Subscription Share(with a total <strong>subscription</strong> price <strong>of</strong> HK$300,000,000).The Subscription Shares represent approximately (i) 74.90% <strong>of</strong> the existing issuedshare capital <strong>of</strong> the Company; and (ii) 42.83% <strong>of</strong> the issued share capital <strong>of</strong> theCompany as enlarged by the Subscription Shares. The issue <strong>of</strong> the Subscription Shareswill be made under the Specific Mandate.1

The Board intends to apply the net proceeds from the Subscription <strong>of</strong> approximatelyHK$297.5 million for pursuing suitable acquisition and/or investment opportunity(ies)(which the Group has not identified any specific acquisition targets and/or investmentopportunities as at the date <strong>of</strong> this announcement and is currently actively exploring)that are complementary or <strong>of</strong>fer synergy to the Group’s existing business or areconsidered to be advantageous to or in line with the long-term business strategies<strong>of</strong> the Group. To the extent that such net proceeds allocated for acquisition and/orinvestment purposes is not required to be fully utilized, it would be used to fund thegeneral working capital <strong>of</strong> the Group.Implication <strong>of</strong> the GEM Listing RulesThe Subscriber (which is solely and beneficially owned by Mr Mei Wei), is asubstantial shareholder <strong>of</strong> the Company. Accordingly, the Subscriber is a <strong>connected</strong>person <strong>of</strong> the Company and the Subscription constitutes a non-exempt <strong>connected</strong><strong>transaction</strong> for the Company under, and is subject to reporting, announcement andIndependent Shareholders’ approval requirements pursuant to the GEM Listing Rules.Implication <strong>of</strong> the Takeovers CodeThe Subscriber (together with its concert parties, including Mr Mei Wei) isbeneficially interested in 1,471,508,530 Shares as at the date <strong>of</strong> this announcement,representing approximately 29.39% <strong>of</strong> the existing entire issued share capital <strong>of</strong>the Company. Assuming completion <strong>of</strong> the Subscription and upon the allotmentand issue <strong>of</strong> the Subscription Shares to the Subscriber, the shareholding <strong>of</strong> theSubscriber (together with its concert parties) would be increased to approximately59.63% (assuming the <strong>subscription</strong> rights attaching to the Outstanding Options or theconversion rights attaching to the Outstanding CB were not exercised at all). This willrender the Subscriber (together with parties acting in concert with it) to be obliged tomake an unconditional mandatory general <strong>of</strong>fer for all the Shares not already ownedor will be acquired by the Subscriber (together with its concert parties) under Rule26.1 <strong>of</strong> the Takeovers Code unless a waiver from strict compliance with Rule 26.1 hasbeen obtained from the Executive.The Subscriber will make an application to the Executive pursuant to Note 1 onDispensations from Rule 26 <strong>of</strong> the Takeovers Code for the Whitewash Waiver, the<strong>grant</strong> <strong>of</strong> which will be subject to, among others, the approval <strong>of</strong> the IndependentShareholders taken by way <strong>of</strong> a poll at the SGM.The Executive may or may not <strong>grant</strong> the Whitewash Waiver. The Subscriptioncontemplated under the Subscription Agreement will not proceed if the WhitewashWaiver is not obtained by the Subscriber.2

GeneralAn Independent Board Committee (comprising all the independent non-executiveDirectors) has been formed to advise the Independent Shareholders as to the fairnessand reasonableness <strong>of</strong> the Subscription Agreement and the <strong>transaction</strong>s contemplatedthereunder (including the allotment and issue <strong>of</strong> the Subscription Shares to theSubscriber pursuant to the Subscription) and the Whitewash Waiver. REORIENTFinancial Markets Limited has been appointed by the Independent Board Committeeas an independent financial adviser to advise the Independent Board Committee andthe Independent Shareholders in this regard.A circular containing, among other matters, further information on (i) the SubscriptionAgreement and the <strong>transaction</strong>s contemplated thereunder (including the allotmentand issue <strong>of</strong> the Subscription Shares to the Subscriber pursuant to the Subscription),the <strong>proposed</strong> <strong>grant</strong> <strong>of</strong> the Specific Mandate, and the Whitewash Waiver; (ii)the recommendation <strong>of</strong> the Independent Board Committee to the IndependentShareholders; (iii) a letter from the Independent Financial Adviser containing itsadvice to the Independent Board Committee and the Independent Shareholders; and(iv) a notice <strong>of</strong> the SGM will be despatched to the Shareholders in accordance with theGEM Listing Rules and the Takeovers Code, and is expected to be despatched on orbefore 21 September 2012.Completion <strong>of</strong> the Subscription is conditional upon, among other matters, theSubscription Agreement becoming unconditional in all respects and havingbeen completed in accordance with its terms, and may or may not proceed.Shareholders <strong>of</strong> the Company and investors are advised to exercise caution whendealing in the securities <strong>of</strong> the Company and if they are in any doubt about theirposition, they should consult their pr<strong>of</strong>essional advisers.Suspension and resumption <strong>of</strong> trading in SharesAt the request <strong>of</strong> the Company, trading in the Shares on GEM was suspended from9:00 a.m. on 30 August 2012 pending the release <strong>of</strong> this announcement. Applicationhas been made to the Stock Exchange for the resumption <strong>of</strong> trading in the Shares onGEM from 9:00 a.m. on 3 September 2012.3

THE SUBSCRIPTION AGREEMENT DATED 29 AUGUST 2012IssuerThe CompanySubscriberRuffy Investments Limited (a substantial shareholder <strong>of</strong> the Company)Number <strong>of</strong> Subscription SharesPursuant to the Subscription Agreement, the Subscriber has agreed to subscribe for3,750,000,000 <strong>new</strong> Shares, representing approximately (i) 74.90% <strong>of</strong> the existingissued share capital <strong>of</strong> the Company; and (ii) 42.83% <strong>of</strong> the issued share capital <strong>of</strong> theCompany as enlarged by the Subscription Shares.The aggregate nominal value <strong>of</strong> the Subscription Shares (with a par value <strong>of</strong> HK$0.0004each) is HK$1,500,000.Subscription PriceThe issue price per Subscription Share is HK$0.08, which represents:(i)a premium <strong>of</strong> approximately 23.08% over the closing price <strong>of</strong> HK$0.065 per Shareas quoted on the Stock Exchange on the Last Trading Day;(ii) a premium <strong>of</strong> approximately 34.68% over the average closing price <strong>of</strong> HK$0.0594per Share for the last ten trading days up to and including the Last Trading Day;(iii) a premium <strong>of</strong> approximately 39.62% over the average closing price <strong>of</strong>approximately HK$0.0573 per Share for the last thirty trading days up to andincluding the Last Trading Day;(iv) a premium <strong>of</strong> approximately 26.58% over the average closing price <strong>of</strong>approximately HK$0.0632 per Share for the last three months up to and includingthe Last Trading Day;(v)a premium <strong>of</strong> approximately 196.30% over the unaudited consolidated net tangibleasset value <strong>of</strong> the Company <strong>of</strong> approximately RMB0.022 (which is equivalent toapproximately HK$0.027) per Share as at 30 June 2012; and(vi) a discount <strong>of</strong> approximately 72.41% to the unaudited consolidated net assetvalue <strong>of</strong> the Company <strong>of</strong> approximately RMB0.236 (which is equivalent toapproximately HK$0.290) per Share as at 30 June 2012.4

The Subscription Price was determined after arm’s length negotiation between theCompany and the Subscriber with reference to the prevailing share price and the futureprospects <strong>of</strong> the Group. The Directors (other than the independent non-executiveDirectors whose views will be given after taken into account the advice from theIndependent Financial Adviser) consider that the issue price per Subscription Share isfair and reasonable.The total <strong>subscription</strong> monies amounted to HK$300,000,000. The Subscription Sharesare valued at HK$243,750,000 based on the closing price <strong>of</strong> HK$0.065 per Share as atthe Last Trading Day.Ranking <strong>of</strong> the Subscription SharesThe Subscription Shares, when issued and fully paid, will rank equally amongthemselves and with all other Shares in issue on the date <strong>of</strong> allotment and issue <strong>of</strong> theSubscription Shares.Disposal and lock-up restrictionThe Subscription Shares are not subject to any lock-up or other disposal restrictionunder the terms <strong>of</strong> the Subscription Agreement.No change in members or composition <strong>of</strong> the BoardNo agreement has been reached between the Company and the Subscriber to change themembers or composition <strong>of</strong> the Board as a result <strong>of</strong> the Subscription.Conditions PrecedentCompletion <strong>of</strong> the Subscription is conditional on, among others, the followingConditions Precedent being fulfilled or, if applicable, waived by the Longstop Date:(a)the <strong>grant</strong>ing by the Executive to the Subscriber <strong>of</strong> the Whitewash Waiver;(b) the passing <strong>of</strong> the necessary resolution by the Independent Shareholders at theSGM, voting by poll, to approve the Subscription Agreement and the <strong>transaction</strong>scontemplated thereunder (including the allotment and issue <strong>of</strong> the SubscriptionShares to the Subscriber pursuant to the Subscription), the <strong>proposed</strong> <strong>grant</strong> <strong>of</strong> theSpecific Mandate and the Whitewash Waiver;(c)(d)the Listing Committee <strong>of</strong> the Stock Exchange <strong>grant</strong>ing, and not having withdrawnor revoked up to completion <strong>of</strong> the Subscription, the listing <strong>of</strong> and permission todeal in the Subscription Shares on GEM (either unconditionally or subject to suchconditions as the Subscriber may reasonably agree);the Shares remaining listed and traded on GEM at all times from the date <strong>of</strong> theSubscription Agreement and up to the date <strong>of</strong> fulfilment <strong>of</strong> the last in time to befulfilled <strong>of</strong> the Conditions Precedent (other than this Condition Precedent); and5

(e) as at the date <strong>of</strong> fulfilment or waiver <strong>of</strong> the last in time to be fulfilled <strong>of</strong> theConditions Precedent (other than this Condition Precedent) to completion <strong>of</strong> theSubscription Agreement, no legal proceedings shall have been brought by anyperson (other than any <strong>of</strong> the parties to the Subscription Agreement) in any court<strong>of</strong> competent jurisdiction against any <strong>of</strong> the parties thereto challenging the legalityor validity <strong>of</strong> the Subscription Agreement or restraining any <strong>of</strong> the parties theret<strong>of</strong>rom proceeding to completion <strong>of</strong> the Subscription Agreement.Save for the Condition Precedent <strong>of</strong> (d) above which may be waived only by theSubscriber, none <strong>of</strong> the other Conditions Precedent may be waived by any party to theSubscription Agreement.If the Subscription Agreement has not become unconditional by the Longstop Date,all rights, obligations and liabilities <strong>of</strong> the parties under the Subscription Agreementin relation to the Subscription shall cease and terminate and none <strong>of</strong> the parties shallhave any claim against any other in respect <strong>of</strong> the Subscription save for any antecedentbreaches <strong>of</strong> the Subscription Agreement.CompletionCompletion <strong>of</strong> the Subscription shall take place on the Subscription Completion Date orsuch other time as the parties to the Subscription Agreement may agree.Mandate for the issue <strong>of</strong> the Subscription SharesThe Company will seek the <strong>grant</strong> <strong>of</strong> the Specific Mandate from the IndependentShareholders to cater for the allotment and issue <strong>of</strong> the Subscription Shares. The generalmandate to allot and issue Shares <strong>grant</strong>ed at the annual general meeting <strong>of</strong> the Companyheld on 7 May 2012 by the then Shareholders will not be utilized for the allotment andissue <strong>of</strong> the Subscription Shares.Application for listingThe Company will apply to the Listing Committee <strong>of</strong> the Stock Exchange for the listing<strong>of</strong>, and permission to deal in, the Subscription Shares on GEM.INFORMATION ON THE SUBSCRIBERThe Subscriber is a company incorporated in the British Virgin Islands on 10 September2007 and an investment holding company.The entire issued share capital <strong>of</strong> the Subscriber is solely and beneficially owned by itssole director, Mr Mei Wei. Mr Mei Wei is the brother <strong>of</strong> Mr Mei Ping, the chairman <strong>of</strong>the Company and an executive Director. As at the date <strong>of</strong> this announcement, Mr MeiPing does not have any interest in the securities <strong>of</strong> the Company.6

Except as disclosed above and for being the general manager <strong>of</strong> the mining division<strong>of</strong> the Group and a director <strong>of</strong> a wholly-owned subsidiary <strong>of</strong> the Company, Mr MeiWei has no other relationship with the Company or its subsidiaries or their respectiveassociates nor holds any position with any members <strong>of</strong> the Group as at the date <strong>of</strong> thisannouncement.Following completion <strong>of</strong> the Subscription, the Subscriber intends that the Group willcontinue to operate and develop its existing business.REASONS FOR THE SUBSCRIPTIONThe Company is an investment holding company and its principal subsidiaries areengaged in the mining, processing and trading <strong>of</strong> mineral resources.It is the intention <strong>of</strong> the Group to expand its business by way <strong>of</strong> investment in qualitycompanies in the PRC mining industry and/or increase the scale <strong>of</strong> its existing operation.To achieve these expansion strategies, the Group has from time to time been exploringinternal expansion alternatives as well as suitable acquisition and/or investmentopportunities that are complementary or <strong>of</strong>fer synergy to the Group’s existing businessor are considered to be advantages to or in line with the long-term business strategies <strong>of</strong>the Group.Based on the unaudited condensed consolidated statement <strong>of</strong> financial position <strong>of</strong> theGroup as at 30 June 2012, the aggregate balance <strong>of</strong> the cash and bank balances andcurrent borrowings <strong>of</strong> the Group were approximately RMB29.7 million and RMB55.5million respectively. The Directors consider that it is necessary for the Group to increaseits capital for the Group to capture potential acquisition and investment opportunities asand when they arise and to meet its ongoing working capital requirements.In view <strong>of</strong> the above, the Board has considered various fund raising methods apartfrom the Subscription such as debt financing, placement <strong>of</strong> <strong>new</strong> Shares to independentinvestors as well as rights issue or open <strong>of</strong>fer. As regards debt financing, havingconsidered that it would increase the gearing level <strong>of</strong> the Group and the interestexpenses incurred which would impose additional financial burden to the Group’sfuture cash flows, the Board considers that such fund raising method is currently notthe most appropriate method to the Group. In considering equity financing throughplacement <strong>of</strong> <strong>new</strong> Shares to independent investors, the Company has encountereddifficulties in engaging a placing agent which is believed to be due to relative smallmarket capitalization and the low trading volume <strong>of</strong> the Shares under the current marketsentiment. As regards the viability <strong>of</strong> a rights issue or an open <strong>of</strong>fer, the Company hasfound it difficult to find an independent underwriter in Hong Kong which is interestedto underwrite a rights issue or open <strong>of</strong>fer <strong>of</strong> the Company. The Directors considerthat even if such an independent underwriter were identified, the rights issue or open<strong>of</strong>fer would incur costly underwriting commission and the process would be relativelytime consuming. The Directors believe that the Company would have difficulties tocomplete a rights issue or an open <strong>of</strong>fer, in particular at an issue price comparable to7

the Subscription Price (which is above the prevailing market price <strong>of</strong> the Shares), andis reasonably perceived to be less attractive to the general public Shareholders whencompared with rights issue or open <strong>of</strong>fer with issue price lower than the prevailingmarket price.In light <strong>of</strong> the above, the Board is <strong>of</strong> the view that equity financing by way <strong>of</strong> theSubscription is the most appropriate mean <strong>of</strong> raising additional capital as (i) it is morepracticable and direct under a volatile market and the uncertain global market conditionscurrently prevailing; (ii) it is less costly and no interest burden is imposed; (iii) it is lesstime consuming; and (iv) the Subscription Price is higher than the prevailing marketprice <strong>of</strong> the Shares which would make other means <strong>of</strong> equity financing to be impractical.The Board is <strong>of</strong> the views that it is in the interest <strong>of</strong> the Group and the IndependentShareholders as a whole to raise funds by the Subscription, which allows the Groupto strengthen its capital position and equip the Group with the financial flexibility toachieve the Group’s business objectives and to issue the Subscription Shares at an issueprice higher than the prevailing market price <strong>of</strong> the Shares.In addition, the Subscription signifies the confidence <strong>of</strong> the Substantial Shareholder inthe existing and future development potentials <strong>of</strong> the Group. With the continuing support<strong>of</strong> the Substantial Shareholder <strong>of</strong> the Company, this will ensure business stability andcontinuity <strong>of</strong> the Group which is crucial and beneficial to the long-term development <strong>of</strong>the Group.Overall, the Directors (excluding the independent non-executive Directors whoseviews will be given after taken into account the advice from the Independent FinancialAdviser) consider that the terms <strong>of</strong> the Subscription Agreement are fair and reasonableand in the interests <strong>of</strong> the Company and the Shareholders as a whole.USE OF PROCEEDSThe gross proceeds <strong>of</strong> the Subscription will amount to HK$300 million. The netproceeds from the Subscription, after the deduction <strong>of</strong> the pr<strong>of</strong>essional and other relatedexpenses, are estimated to be approximately HK$297.5 million, representing a net issueprice <strong>of</strong> approximately HK$0.079 per Subscription Share.The Board intends to apply the net proceeds for pursuing suitable acquisition and/orinvestment opportunity(ies) (which the Group has not identified any specific acquisitiontargets and/or investment opportunities as at the date <strong>of</strong> this announcement and iscurrently actively exploring) that are complementary or <strong>of</strong>fer synergy to the Group’sexisting business or are considered to be advantages to or in line with the long-termbusiness strategies <strong>of</strong> the Group. Appropriate announcement will be made by theCompany as and when appropriate and in accordance with the GEM Listing Rules if anyspecific acquisition and/or investment opportunity is identified. To the extent that suchnet proceeds allocated for acquisition and/or investment purposes is not required to befully utilized, it would be used to fund the general working capital <strong>of</strong> the Group.8

EFFECT ON THE SHAREHOLDING STRUCTUREAs at the date <strong>of</strong> this announcement:(1) the Company had an issued share capital <strong>of</strong> HK$2,002,615.8988 (representing atotal <strong>of</strong> 5,006,539,747 Shares);(2) there were Outstanding Options <strong>grant</strong>ed under the Share Option Scheme conferringrights to subscribe for an aggregate <strong>of</strong> 586,710,000 <strong>new</strong> Shares upon exercise <strong>of</strong>the <strong>subscription</strong> rights attaching thereto;(3) there were Outstanding CB conferring rights to subscribe for a maximum <strong>of</strong>1,736,537,245 <strong>new</strong> Shares upon exercise <strong>of</strong> the conversion rights attaching thereto;(4) apart from the Outstanding Options and the Outstanding CB, the Company has noother outstanding convertible securities, options, warrants or other derivatives inissue which are convertible or exchangeable into Shares;(5) the Subscriber was beneficially interested in the following securities <strong>of</strong> theCompany:(i)1,415,458,530 Shares; and(ii) 1,692,264,518 Shares which may fall to be allotted and issued upon exercisein full <strong>of</strong> the conversion rights attaching to the Outstanding CB held by theSubscriber;(6) Mr Mei Wei, being a party acting in concert with the Subscriber under theTakeovers Code, was:(i)deemed to be interested in the Shares and underlying Shares held by theSubscriber under Part XV <strong>of</strong> the SFO;(ii) personally interested in (a) 56,050,000 Shares; and (b) 363,510,000underlying Shares by virtue <strong>of</strong> options <strong>grant</strong>ed to him by the Company underthe Share Option Scheme;(7) save as disclosed in the preceding paragraphs (5) and (6) above, neither theSubscriber nor any person acting in concert with it owns or has control or directionover any voting rights or rights over the Shares or convertible securities, options,warrants or derivatives <strong>of</strong> the Company;9

(8) save as disclosed in the preceding paragraphs (5) and (6) above and the warrantsissued on 13 March 2012 by the Subscriber to Merry Intake Limited, a whollyowned subsidiary <strong>of</strong> CCB International Group Holdings Limited, conferring rightsto subscribe for 350,000,000 Shares held by the Subscriber at the initial exerciseprice <strong>of</strong> HK$0.12 per Share, there is no outstanding derivative in respect <strong>of</strong>securities in the Company entered into by the Subscriber or any person acting inconcert with it;(9) save as disclosed in the preceding paragraphs (5) and (6) above, neither theSubscriber nor any person acting in concert with it holds any other <strong>shares</strong>,convertible securities, warrants or options <strong>of</strong> the Company, or any outstandingderivative in respect <strong>of</strong> the relevant securities (as defined in note 4 to Rule 22 <strong>of</strong>the Takeovers Code) <strong>of</strong> the Company;(10) there was no arrangement (whether by way <strong>of</strong> option, indemnity or otherwise) inrelation to <strong>shares</strong> <strong>of</strong> the Subscriber or <strong>of</strong> the Company which may be material tothe Subscription Agreement and/or the Whitewash Waiver;(11) there was no agreements or arrangements to which the Subscriber is a party whichrelated to the circumstances in which it may or may not invoke or seek to invokea pre-condition or a condition to the Subscription Agreement and the WhitewashWaiver, other than those set out in the section headed “Conditions Precedent”above;(12) the Subscriber or any party acting in concert with it has not received anyirrevocable commitment or arrangements to vote in favour <strong>of</strong> or against theresolutions in respect <strong>of</strong> the Subscription Agreement together with the <strong>transaction</strong>scontemplated thereunder and/or the Whitewash Waiver; and(13) neither the Subscriber nor any person acting in concert with it has borrowed or lentany relevant securities (as defined in note 4 to Rule 22 <strong>of</strong> the Takeovers Code) inthe Company.The effect <strong>of</strong> the Subscription on the shareholding structure <strong>of</strong> the Companyimmediately upon (i) completion <strong>of</strong> the Subscription; (ii) full exercise <strong>of</strong> the<strong>subscription</strong> rights attaching to the Outstanding Options; and (iii) full exercise <strong>of</strong> theconversion rights attaching to the Outstanding CB is set out below (assuming thatthere is no change in (a) the shareholding structure <strong>of</strong> the Company; and (b) the terms10

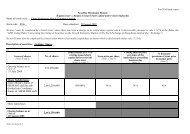

<strong>of</strong> the exercise or conversion (as the case may be) <strong>of</strong> any <strong>of</strong> its outstanding optionsor convertible securities from the date <strong>of</strong> this announcement to immediately prior tocompletion <strong>of</strong> the Subscription):Assuming (i)Assuming (i)completion <strong>of</strong> theAssuming (i) completion <strong>of</strong> the Subscription (Note 3);completion <strong>of</strong> the Subscription (Note 3); (ii) full exercise <strong>of</strong>Subscription; and (ii) full exercise <strong>of</strong> the <strong>subscription</strong>(ii) the <strong>subscription</strong> the <strong>subscription</strong> rights attachingrights attaching to the rights attaching to to the OutstandingOutstanding Options or the Outstanding Options (Note 4);the conversion rights Options (Note 4); and and (iii) full exerciseattaching to the (iii) the conversion <strong>of</strong> the conversionOutstanding CB were rights attaching to the rights attachingAs at the date <strong>of</strong> not exercised at all Outstanding CB were to the OutstandingShareholders this announcement (Note 3) not exercised at all CB (Note 6)(No. <strong>of</strong> Shares) (%) (No. <strong>of</strong> Shares) (%) (No. <strong>of</strong> Shares) (%) (No. <strong>of</strong> Shares) (%)Subscriber (Note 1) 1,415,458,530 28.27 5,165,458,530 58.99 5,165,458,530 55.29 6,857,723,048 61.89Mr Mei Wei(Note 1 and Note 2) 56,050,000 1.12 56,050,000 0.64 419,560,000 4.49 419,560,000 3.79(Note 5) (Note 5)Sub-total <strong>of</strong> theSubscriber and itsconcert parties: 1,471,508,530 29.39 5,221,508,530 59.63 5,585,018,530 59.78 7,277,283,048 65.68Director(s):Mr Ng Tang – – – – 3,000,000 0.03 3,000,000 0.03Mr Kang Hongbo 11,400,000 0.23 11,400,000 0.13 22,900,000 0.25 22,900,000 0.20Ms Han Qiong – – – – 4,000,000 0.04 4,000,000 0.04Public:Grantees <strong>of</strong> OutstandingOptions (other thanMr Mei Wei andthe Directors)(Note 7) – – – – 204,700,000 2.19 204,700,000 1.85Holders <strong>of</strong> Outstanding CB(other than the Subscriber)(Note 8) – – – – – – 44,272,727 0.40Other public Shareholders 3,523,631,217 70.38 3,523,631,217 40.24 3,523,631,217 37.71 3,523,631,217 31.80Total 5,006,539,747 100.00 8,756,539,747 100.00 9,343,249,747 100.00 11,079,786,992 100.0011

Note 1: The Subscriber, which is a substantial shareholder <strong>of</strong> the Company, is solely and beneficiallyowned by Mr Mei Wei. Mr Mei Wei is deemed to be interested in the Shares held by theSubscriber by virtue <strong>of</strong> Part XV <strong>of</strong> the SFO.Note 2: Mr Mei Wei is a party acting in concert with the Subscriber under the Takeovers Code.Note 3: Completion <strong>of</strong> the Subscription would involve the allotment and issue <strong>of</strong> an aggregate <strong>of</strong>3,750,000,000 <strong>new</strong> Shares to the Subscriber.Note 4: Full exercise <strong>of</strong> the <strong>subscription</strong> rights attaching to the Outstanding Options would result in amaximum <strong>of</strong> 586,710,000 <strong>new</strong> Shares being fallen to be allotted and issued to its holders.Note 5: These Shares comprise (i) 56,050,000 Shares held by Mr Mei Wei before exercising any <strong>of</strong> the<strong>subscription</strong> rights attaching to the Outstanding Options <strong>grant</strong>ed to him; and (ii) 363,510,000 <strong>new</strong>Shares which may fall to be allotted and issued to Mr Mei Wei upon his exercise in full <strong>of</strong> the<strong>subscription</strong> rights attaching to such Outstanding Options.Note 6: Full exercise <strong>of</strong> the conversion rights attaching to the Outstanding CB would result in amaximum <strong>of</strong> 1,736,537,245 <strong>new</strong> Shares being allotted and issued to its respective holders (as to1,692,264,518 <strong>new</strong> Shares to the Subscriber and the remaining 44,272,727 to other holders <strong>of</strong> theOutstanding CB).Note 7: None <strong>of</strong> these <strong>grant</strong>ees <strong>of</strong> the Outstanding Options is a director, chief executive or substantialshareholder <strong>of</strong> the Company, or any <strong>of</strong> their respective associates or parties acting in concert withthe Subscriber.Note 8: None <strong>of</strong> these holders <strong>of</strong> Outstanding CB is a director, chief executive or substantial shareholder<strong>of</strong> the Company, or any <strong>of</strong> their respective associates or parties acting in concert with theSubscriber.Note 9: The above table is for illustration purpose only.IMPLICATION OF THE GEM LISTING RULESGiven that the Subscriber is a substantial shareholder <strong>of</strong> the Company, the Subscriberis a <strong>connected</strong> person <strong>of</strong> the Company. Accordingly, the Subscription constitutesa non-exempt <strong>connected</strong> <strong>transaction</strong> for the Company and is subject to reporting,announcement and Independent Shareholders’ approval requirements under the GEMListing Rules.TAKEOVERS CODE IMPLICATIONSAs illustrated in the table under the section headed “Effect on the ShareholdingStructure” above, assuming successful completion <strong>of</strong> the Subscription, the allotment andissue <strong>of</strong> the Subscription Shares to the Subscriber would result in the shareholding <strong>of</strong> theSubscriber and parties acting in concert with it being increased:(a)from approximately 29.39% to approximately 59.63% (assuming the <strong>subscription</strong>rights attaching to the Outstanding Options or the conversion rights attaching tothe Outstanding CB were not exercised at all);12

(b)(c)from approximately 29.39% to approximately 59.78% (assuming the <strong>subscription</strong>rights attaching to the Outstanding Options were exercised in full but theconversion rights attaching to the Outstanding CB were not exercised at all); andfrom approximately 29.39% to approximately 65.68% (assuming the <strong>subscription</strong>rights attaching to the Outstanding Options and the conversion rights attaching tothe Outstanding CB were both exercised in full).Consequently, this will render the Subscriber together with parties acting in concert withit to be obliged to make an unconditional mandatory general <strong>of</strong>fer for all the Shares notalready owned or will be acquired by the Subscriber (together with its concert parties)under Rule 26.1 <strong>of</strong> the Takeovers Code unless a waiver from strict compliance with Rule26.1 has been obtained from the Executive.An application will be made by the Subscriber to the Executive for the <strong>grant</strong> <strong>of</strong> theWhitewash Waiver to waive the obligation <strong>of</strong> the Subscriber to make a mandatorygeneral <strong>of</strong>fer for all the issued securities <strong>of</strong> the Company not already owned or agreed tobe acquired by the Subscriber (including the Subscription Shares) and parties acting inconcert with it which would otherwise arise as a result <strong>of</strong> the issue <strong>of</strong> the SubscriptionShares to the Subscriber pursuant to the Subscription Agreement as soon as possible.The Whitewash Waiver, if <strong>grant</strong>ed by the Executive, would be subject to the approval <strong>of</strong>the Independent Shareholders at the SGM by way <strong>of</strong> poll.The Subscriber, its associates and concert parties (including Mr Mei Wei) and thoseparties who are involved or interested in the Subscription Agreement together withthe <strong>transaction</strong>s contemplated thereunder, the <strong>grant</strong> <strong>of</strong> the Specific Mandate and theWhitewash Waiver (basically only Independent Shareholders can vote) will abstainfrom voting on the resolutions to be <strong>proposed</strong> at the SGM to approve, among others,the Subscription Agreement and the <strong>transaction</strong>s contemplated thereunder (includingthe allotment and issue <strong>of</strong> the Subscription Shares pursuant to the Subscription and theWhitewash Waiver).The Executive may or may not <strong>grant</strong> the Whitewash Waiver. The Subscriptioncontemplated under the Subscription Agreement will not proceed if the WhitewashWaiver is not <strong>grant</strong>ed to the Subscriber.The Subscriber and the parties acting in concert with it have confirmed to the Companythat they have not acquired any voting rights in the Company in the six-month periodprior to the date <strong>of</strong> the Subscription Agreement but subsequent to negotiations,discussions or the reaching <strong>of</strong> understandings or agreements with the Directors inrelation to the Subscription contemplated under the Subscription Agreement.13

FUND RAISING ACTIVITY OF THE COMPANY IN THE 12 MONTHSIMMEDIATELY PRECEDING THE DATE OF THIS ANNOUNCEMENTThe Company had not undertaken any fund raising exercise in the 12 monthsimmediately prior to the date <strong>of</strong> this announcement.GENERALAn Independent Board Committee (comprising all the independent non-executiveDirectors) has been formed to advise the Independent Shareholders (i) as to whetherthe Subscription Agreement and the <strong>transaction</strong>s contemplated thereunder (includingthe allotment and issue <strong>of</strong> the Subscription Shares to the Subscriber pursuant to theSubscription), the <strong>proposed</strong> <strong>grant</strong> <strong>of</strong> the Specific Mandate and the Whitewash Waiverare on normal commercial terms, in the ordinary and usual course <strong>of</strong> business, fair andreasonable and in the interests <strong>of</strong> the Company and the Shareholders as a whole, and (ii)on how to vote, taking into account the recommendations <strong>of</strong> the Independent FinancialAdviser.In this connection, the Independent Financial Adviser has been appointed to advise theIndependent Board Committee and the Independent Shareholders. The appointment<strong>of</strong> the Independent Financial Adviser has been approved by the Independent BoardCommittee. The Independent Board Committee will formally provide their views in thecircular to be sent to the Independent Shareholders after considering the advice <strong>of</strong> theIndependent Financial Adviser.A circular containing, among other matters, further information on (i) the SubscriptionAgreement and the <strong>transaction</strong>s contemplated thereunder (including the allotment andissue <strong>of</strong> the Subscription Shares pursuant to the Subscription), the <strong>proposed</strong> <strong>grant</strong> <strong>of</strong>the Specific Mandate and the Whitewash Waiver); (ii) the recommendation <strong>of</strong> theIndependent Board Committee to the Independent Shareholders; (iii) a letter fromthe Independent Financial Adviser containing their advice to the Independent BoardCommittee and the Independent Shareholders; and (iv) a notice <strong>of</strong> the SGM will bedespatched to the Shareholders in accordance with the GEM Listing Rules and theTakeovers Code, and is expected to be despatched on or before 21 September 2012.Completion <strong>of</strong> the Subscription is conditional upon, among other matters, theSubscription Agreement becoming unconditional in all respects and having beencompleted in accordance with its terms, and may or may not proceed. Shareholders<strong>of</strong> the Company and investors are advised to exercise caution when dealing in thesecurities <strong>of</strong> the Company and if they are in any doubt about their position, theyshould consult their pr<strong>of</strong>essional advisers.SUSPENSION AND RESUMPTION OF TRADING IN SHARESAt the request <strong>of</strong> the Company, trading in the Shares on GEM was suspended from 9:00a.m. on 30 August 2012 pending the release <strong>of</strong> this announcement. Application has beenmade to the Stock Exchange for the resumption <strong>of</strong> trading in the Shares on GEM from9:00 a.m. on 3 September 2012.14

DEFINITIONSIn this announcement, unless the context otherwise requires, the following expressionsshall have the following meanings when used herein:“acting in concert”“associate(s)”“Board”“Business Day”“Company”“Conditions Precedent”“<strong>connected</strong> person(s)”“Director(s)”“Executive”“GEM”“GEM Listing Rules”“Group”“Hong Kong”has the meaning ascribed to it by the TakeoversCode and the expression “concert part(ies)” shall beconstrued accordinglyhas the meaning ascribed to it under the GEM ListingRulesthe board <strong>of</strong> Directorsany day (excluding Saturday) on which licensed banksin Hong Kong are open for businessChina Nonferrous Metals Company Limited, anexempted company incorporated in Bermuda withlimited liability and whose issued <strong>shares</strong> are listed onGEMthe conditions precedent to completion <strong>of</strong> theSubscription as set out in the Subscription Agreementand summarized in this announcementhas the meaning ascribed to it under the GEM ListingRulesdirector(s) <strong>of</strong> the Companythe Executive Director <strong>of</strong> the Corporate FinanceDivision <strong>of</strong> the Securities and Futures Commission orany delegate <strong>of</strong> the Executive Directorthe Growth Enterprise Market operated by the StockExchangethe Rules Governing the Listing <strong>of</strong> Securities on GEMthe Company and its subsidiariesThe Hong Kong Special Administrative Region <strong>of</strong> thePRC15

“Independent BoardCommittee”“Independent FinancialAdviser”“Independent Shareholders”“Last Trading Day”“Listing Committee”“Longstop Date”a board comprising all the independent non-executiveDirectors (namely Mr Liu Yaosheng, Mr Chan Siu Lunand Mr Chen Mingxian) to make a recommendation(i) as to whether the Subscription Agreement andthe <strong>transaction</strong>s contemplated thereunder (includingthe allotment and issue <strong>of</strong> the Subscription Shares tothe Subscriber pursuant to the Subscription) and theWhitewash Waiver are, or are not, fair and reasonable;and (ii) as to votingREORIENT Financial Markets Limited, a corporationlicensed to carry on Type 1 (dealing in securities),Type 4 (advising on securities), Type 6 (advisingon corporate finance), Type 7 (providing automatedtrading services) and Type 9 (asset management)regulated activities under the SFO, and the independentfinancial adviser to the Independent Board Committeeand the Independent Shareholders for giving adviceas to whether the Subscription Agreement and the<strong>transaction</strong>s contemplated thereunder (including theallotment and issue <strong>of</strong> the Subscription Shares tothe Subscriber pursuant to the Subscription) and theWhitewash Waiver are, or are not, fair and reasonableand as to votingShareholders, other than the Subscriber and itsassociates and/or their respective concert parties andthose parties who are involved or interested in theSubscription Agreement together with the <strong>transaction</strong>scontemplated thereunder (including and the allotmentand issue <strong>of</strong> the Subscription Shares to the Subscriberpursuant to the Subscription), the <strong>grant</strong> <strong>of</strong> the SpecificMandate and the Whitewash Waiver29 August 2012, being the last trading day for theShares before the suspension <strong>of</strong> trading in the Shareson the Stock Exchange pending the issue <strong>of</strong> thisannouncementthe listing sub-committee <strong>of</strong> the Stock Exchange30 October 2012 (or such other date as may be agreedby the Subscriber and the Company)16

“Outstanding CB”“Outstanding Options”“PRC”“RMB”“SFO”“SGM”“Share(s)”“Shareholder(s)”“Share Option Scheme”“Specific Mandate”the convertible bonds due in 2015 issued by theCompany with the outstanding principal sum <strong>of</strong>HK$382,038,194 as at the date <strong>of</strong> this announcement,which may be convertible into a maximum <strong>of</strong>1,736,537,245 <strong>new</strong> Shares at the conversion price <strong>of</strong>HK$0.22 each upon exercise <strong>of</strong> the conversion rightsattaching thereto (<strong>of</strong> which HK$372,298,194 was dueto the Subscriber and convertible into a maximum <strong>of</strong>1,692,264,518 <strong>new</strong> Shares)the options <strong>grant</strong>ed by the Company to subscribe for anaggregate <strong>of</strong> 586,710,000 <strong>new</strong> Shares under the ShareOption Scheme, which were outstanding as at the date<strong>of</strong> this announcementthe People’s Republic <strong>of</strong> ChinaReminbi, the lawful currency <strong>of</strong> the PRCSecurities and Futures Ordinance (Chapter 571 <strong>of</strong> theLaws <strong>of</strong> Hong Kong) as amended from time to timea special general meeting <strong>of</strong> the Company to beconvened and held to consider and, if thought fit,approve (among other matters) the SubscriptionAgreement and the <strong>transaction</strong>s contemplatedthereunder (including the allotment and issue <strong>of</strong> theSubscription Shares to the Subscriber pursuant to theSubscription), the <strong>grant</strong> <strong>of</strong> the Specific Mandate andthe Whitewash Waiver (or any adjournment there<strong>of</strong>)ordinary share(s) <strong>of</strong> HK$0.0004 each in the sharecapital <strong>of</strong> the Companyholder(s) <strong>of</strong> the Sharesthe share option scheme currently in force and adoptedby the Company on 16 February 2005a specific mandate to allot, issue or otherwise deal inadditional Shares to be sought from the IndependentShareholders to satisfy the allotment and issue <strong>of</strong> theSubscription Shares to the Subscriber upon completion<strong>of</strong> the Subscription17

“Stock Exchange”“Subscriber”“Subscription”The Stock Exchange <strong>of</strong> Hong Kong LimitedRuffy Investments Limited, a company incorporatedin the British Virgin Islands whose entire issued sharecapital is solely and beneficially owned by Mr MeiWeithe <strong>subscription</strong> <strong>of</strong> the Subscription Shares subject toand upon the terms and conditions <strong>of</strong> the SubscriptionAgreement“Subscription Agreement” the conditional <strong>subscription</strong> agreement dated 29August 2012 entered into between the Company andthe Subscriber in relation to the Subscription“SubscriptionCompletion Date”“Subscription Price”“Subscription Shares”“substantial shareholder”“Takeovers Code”“Whitewash Waiver”the third Business Day next following the date on whichthe last condition precedent set out in the SubscriptionAgreement are fulfilled or, as the case may be, waived(or such other date as the parties to the SubscriptionAgreement may mutually agree)HK$0.08 per Subscription Sharea total <strong>of</strong> 3,750,000,000 <strong>new</strong> Shares, for which theSubscriber will subscribe upon the terms and subject tothe conditions <strong>of</strong> the Subscription Agreementhas the meaning ascribed thereto in the GEM ListingRulesThe Hong Kong Code on Takeovers and Mergersa waiver from the Executive pursuant to Note 1 onDispensations from Rule 26 <strong>of</strong> the Takeovers Code inrespect <strong>of</strong> the obligations <strong>of</strong> the Subscriber and partiesacting in concert with it (including Mr Mei Wei) tomake a mandatory general <strong>of</strong>fer for all the securities<strong>of</strong> the Company not already owned or acquired bythe Subscriber and parties acting in concert with itunder Rule 26 <strong>of</strong> the Takeovers Code which wouldotherwise arise as a result <strong>of</strong> the Subscriber subscribingfor the Subscription Shares under the terms <strong>of</strong> theSubscription Agreement18

“HK$ and cents”Hong Kong dollars and cents, the lawful currency <strong>of</strong>Hong Kong“%” per cent.Unless otherwise specified, translations <strong>of</strong> HK$ into RMB and RMB into HK$ in this announcement arebased on the rate <strong>of</strong> HK$1.23 to RMB1.00. No representation is made that any amounts in RMB and HK$can be or could have been converted at the relevant dates at the above rates or any other rates or at all.Hong Kong, 31 August 2012By order <strong>of</strong> the BoardChina Nonferrous Metals Company LimitedMei PingChairmanAs at the date <strong>of</strong> this announcement, the executive Directors <strong>of</strong> the Company are Mr MeiPing, Ms Xie Yi Ping, Dr Yu Heng Xiang, Mr Ng Tang, Mr Kang Hongbo and Ms HanQiong and the independent non-executive Directors are Mr Liu Yaosheng, Mr Chan SiuLun and Mr Chen Mingxian.This announcement, for which the Directors collectively and individually accept fullresponsibility, includes particulars given in compliance with the GEM Listing Rules forthe purposes <strong>of</strong> giving information with regard to the Company. The Directors, havingmade all reasonable enquiries, confirm that to the best <strong>of</strong> their knowledge and belief,the information contained in this announcement is accurate and complete in all materialrespects and not misleading or deceptive, and there are no other matters, the omission<strong>of</strong> which would make any statement herein or this announcement misleading.The Directors jointly and severally accept full responsibility for the accuracy <strong>of</strong> theinformation contained in this announcement and confirm, having made all reasonableinquiries, that to the best <strong>of</strong> their knowledge, opinions expressed in this announcementhave been arrived at after due and careful consideration and there are no other facts notcontained in this announcement, the omission <strong>of</strong> which would make any statement in thisannouncement misleading.This announcement will be published on the GEM website at http://www.hkgem.comon the “Latest Company Announcement” page for at least 7 days from the date <strong>of</strong>publication and on the Company’s website www.cnm.com.hk.* For identification purpose only19