innovation and SUSTAINABLE COMMITMENTS

English Version - Groupama Insurances

English Version - Groupama Insurances

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

usiness REPORT2008<strong>innovation</strong> <strong>and</strong><strong>SUSTAINABLE</strong> <strong>COMMITMENTS</strong>

contentsGROuPaMa, an eFFiCienT eCOnOMiC MOdeL01_Profile02_Message from the Chairman04_Interview with the Chief Executive Officer06_Group governance12_A European leadership strategy18_Profitable growth <strong>and</strong> financial soundness (key figures)25 - FOCus On innOvaTiOnGROuPaMa, an insuReR COMMiTTedTO THe LOnG TeRM36_Groupama, a story of sustainable development38_ A mutual insurance group with strong principles of action,dedicated to satisfying its customers <strong>and</strong> members40_Prevention, a culture of responsibility48_ A human resources policy based on commitment,<strong>innovation</strong> <strong>and</strong> responsibility49_Groupama, a responsible investor51_Groupama, an insurer committed to society53_Sports sponsorshipsusTainabLe GROWTH based OndiveRsiFied aCTiviTies54_Increasing our leadership in France76_Stepping up our international growth86_ Solid fundamentals in asset management<strong>and</strong> financial activities

GRoupama, a benchmaRk playeRwith stRonG, diveRsified positionsc5.6 billionIn EquITy CAPITAl (GrOuP SCOPE)c16.2 billionIn rEvEnuES(uP +9.2% In 2008 – GrOuP SCOPE)PrEMIuM InCOME FrOM InSurAnCE:(GrOuP SCOPE)52%FOr PrOPErTy And CASuAlTy InSurAnCE48%FOr lIFE And hEAlTh InSurAnCEc342 millionIn nET PrOFIT (GrOuP SCOPE)(KEy FIGurES AS AT 31 dECEMbEr 2008)business activities in fRancenumber 1AGrICulTurE, hOME, lOCAl AuThOrITIES,IndIvIduAl hEAlTh*, EvErydAy ACCIdEnTSAnd lEGAl PrOTECTIOn InSurErnumber 2MArInE And TrAnSPOrT InSurEr**number 3MOTOr And COMMErCIAl InSurEr* Excluding mutual insurance companies coming under French code 45<strong>and</strong> provident insurance institutions** Including inward business.

International business activities31.6%of the consolidated revenuesof Groupama S.A.13 countriesin Europe, Asia <strong>and</strong> Africa: Italy, Spain,Great Britain, Portugal, Turkey, Greece,Hungary, Romania, Slovakia, Bulgaria,China, <strong>and</strong> Vietnam. 35% stake in Tunisia’snumber 1 insurance companyASSET MANAGEMENTc81.3 billionmanaged by Groupama Asset Management(as at 31 December 2008)Simplified organisation chartof the GroupmembersNb 1mutual insurance company in France15 thEuropean insurer38,500employees6 thranking French insurer16millionmembers <strong>and</strong> customersLocal mutualsRegional mutuals99.9% (1)GroupamaNationalFederationGroupama S.A.100Subsidiaries(France, International,Finance)Reinsurance relationshipMembershipEquity management relationship–– Group scopeThe combined financial statements relate to the Group, which is composed of all thelocal mutuals, the regional mutuals, Groupama SA <strong>and</strong> its subsidiaries.–– Consolidated scope: future listed vehicleThe consolidated financial statements of Groupama SA include the insurance cededby the regional mutuals (40% of their premium income) <strong>and</strong> the business of the subsidiaries.(1) The regional mutuals are held by Groupama S.A. through controlling holdingcompanies.

A EUROPEAN LEADERFOCUSED ON CUSTOMERSATISFACTIONThe mutual insurance company created on the initiative of farmers at thebeginning of the last century has now become a multi-line, multi-channelinsurance <strong>and</strong> banking group, with services for everyone – individuals,professionals, businesses <strong>and</strong> local authorities. First <strong>and</strong> foremost, Groupamaupholds member <strong>and</strong> customer satisfaction as the prime requirement for itssuccess. The Group’s entire strategy is guided by the objective of offering,through economic performance, the best service at the best price.➜ An efficient economic model➜ An insurer committed to the long term➜ Sustainable growth based ondiversified activitiesGroupama’s growth is based on the principle of shared initiatives, whichoriginated with agricultural mutual insurance. Local presence <strong>and</strong> humancontact, individual <strong>and</strong> shared responsibility as well as solidarity, arepart <strong>and</strong> parcel of our approach at every level of the company’s organisation<strong>and</strong> in all our activities, as is clear to our elected representatives,members, customers <strong>and</strong> employees. Groupama has become aninternational Group, which is exp<strong>and</strong>ing in France <strong>and</strong> in the buoyantmarkets of Southern, Central <strong>and</strong> Eastern Europe <strong>and</strong> Asia. It is guidedby a long-term vision favouring prudent management. The Group hasclearly opted for sustainable <strong>and</strong> profitable growth in an approachencompassing social responsibility <strong>and</strong> risk diversification, to guaranteeits long-term development <strong>and</strong> independence.

002 GROUPAMA2008 Activity ReportMESSAGE fromJean-Luc baucherelChairman of Groupama“A Group movingforward but stayingtrue to its values„

GROUPAMA2008 Activity Report003MessageResults which validateour choicesWhile the first financial cracks appeared in2007, the year 2008 was marked by the accelerationof the financial <strong>and</strong> economic crisis.Despite this situation, Groupama continuedto produce quality results which once againsupport the appropriateness of its choices <strong>and</strong>economic model: Group business is up more than9%, economic operating income is up 66.1%,continued financial soundness, <strong>and</strong> net incomewhich dropped due to the financial crisis but isstable at +€342 million.Underlying trends unchangedThe current economic situation has not modifiedthe underlying trends on which we have built ourdevelopment strategy. Current social changessuch as longer life expectancy, increasingurbanisation, growing consumerism, newtechnologies <strong>and</strong> the financial difficulties of majorsocial security schemes generate growing needs,particularly in terms of life <strong>and</strong> health insuranceproducts – retirement savings, health <strong>and</strong> providentinsurance – <strong>and</strong> services. In addition,a European insurance market is progressivelyemerging.Moreover, given the increasing pressure fromcompetition, gaining a significant size on theEuropean market will enable Groupama to increaseits investment capacities <strong>and</strong> therefore developits <strong>innovation</strong>s, in order to offer its customersefficient solutions.The current turmoil will probably require us tomake some adjustments, while preserving ourambition to become one of Europe’s top teninsurance companies. With determination, wewill push ahead with the implementation of ourdeployment strategy in France <strong>and</strong> the Group’sinternational development, while improving theefficiency of our management. Our objective isto continue to produce sustainable profitablegrowth year after year, by offering innovative,quality services which meet the expectations ofour members <strong>and</strong> customers. This is the onlyway to guarantee the ongoing development <strong>and</strong>independence of our Group.The quality of our governance, characterised bythe sharing of responsibilities among executive<strong>and</strong> non-executive managers, is a precious assetto ensure our long-term development. To this end,we welcomed a fourth independent director to theBoard of Groupama S.A. in 2008.A commitment to proximity,responsibility <strong>and</strong> solidarityThe quality of our Group is not solely appreciatedthrough figures <strong>and</strong> strategic policies.It is also expressed in the values behind the dailyperformance of our activities. In our actions, wehave always remained true to our principleswhich are proximity, solidarity <strong>and</strong> responsibility.The h<strong>and</strong>ling of the damage left by thesevere storm which hit the southwest of Franceon 24 January this year is a concrete illustrationof this. Our employees, our elected representatives,our inspectors <strong>and</strong> our appraisers immediatelymoved into action to reassure people,find solutions <strong>and</strong> deploy the required resourcesto enable each of our policyholders to face thefuture with confidence.These collective successes <strong>and</strong> commitmentswould not have been possible without everyone’scommitment, which is a proof of our solidity.2008 / 2009Groupama pushes aheadwith its strategyIn 2008, the Board of Directors confirmedthe strategy which has been resolutelyimplemented over the past few years:• to consolidate <strong>and</strong> strengthen theGroup’s market positions in France;• to develop the Group internationallythrough organic growth as well asacquisitions.While increasing efficiency, in order toconstantly achieve a high performancelevel.

004 GROUPAMA2008 Activity ReportInterviewJEAN azémaChief Executive Officer of Groupama“Quality resultsdespite the crisis”

GROUPAMA2008 Activity Report005InterviewUnder the current unstableeconomic <strong>and</strong> financialconditions, how do you analyseGroupama’s results?Given the period we are going through, it isimportant to put everything into perspective.The pace of growth of our revenues doubledbetween 2007 <strong>and</strong> 2008. Over the space of fouryears, it increased from €13.4 billion to €16.2 billionfor the combined Group scope. In 2005, oureconomic operating income was €157 million.It now st<strong>and</strong>s at €661 million. The combinedratio dropped 1 point in 2008 to 98.7%. While itwas affected by the financial market downturn,the net income remained positive, thereby maintaininga satisfactory return on equity. The Groupis still financially sound.These results are the fruit of the sustainable profitablegrowth policy that we have been steadilyimplementing over the past few years.What performance hasGroupama achievedon its domestic <strong>and</strong>international markets?In France, we recorded a 2.2% rise in revenues.Life <strong>and</strong> health insurance revenues grew2.3%, while the market recorded an 8.7% drop(source: FFSA). As at 31 December 2008, theretail bank had 445,000 customers. We haveinvested in a policy focused on a stronger br<strong>and</strong>name <strong>and</strong> major national campaigns. We havealso opened new branches, particularly in Paris,based on a new concept <strong>and</strong> we have updatedthe Regional Mutuals’ website.In addition we are continuing to innovate, forexample with Groupama Renfort – the antisetbackinsurance – <strong>and</strong> the launch of the newInternet trademark www.amaguiz.com. Over15,000 motor insurance contracts were signedin the space of a few months. Soon, this channelwill also be offering home insurance, healthinsurance <strong>and</strong> other products.International growth was up +39%, thanks tonew acquisitions. We have entered into a strategicpartnership with the Hungarian OTP Bankfor all of the Central <strong>and</strong> Eastern Europe zone<strong>and</strong> we have acquired its insurance subsidiariesin Hungary, Romania, Slovakia <strong>and</strong> Bulgaria. Wehave acquired Asiban in Romania <strong>and</strong> strengthenedour presence in Turkey with the purchaseof Güven. We have also acquired a 35% stake inStar, Tunisia’s leading insurance company.The investments made in the Group’s variouscompanies have also contributed to its growth;examples include the development of direct sellingon the Internet in Spain <strong>and</strong> Great Britain <strong>and</strong>the launch of new products. Good performancewas achieved in the main activities such as motorinsurance (+5.4%), home insurance (+9%), <strong>and</strong> inseveral countries (Spain +12.2%; Turkey +20.7%;Great Britain: +6%).There is therefore no reasonto change policies in 2009?We are keeping to the same principles. In October2006, we had targeted the tripling of our 2005economic operating income, the stabilising ofthe combined ratio between 98% <strong>and</strong> 102%<strong>and</strong> growth in revenues of 7% a year between2005 <strong>and</strong> 2009. By the end of 2008, we hadexceeded our objectives in terms of operatingincome. The combined ratio is within the targetedrange. Only the growth in revenues is below target– but market conditions changed since then –with average annual growth of 6.5%.Our priorities for 2009: we are clearly focused oncontinued organic growth in France <strong>and</strong> internationally,by consolidating the companies wehave just acquired, by investing in distribution,networks, the Internet <strong>and</strong> product <strong>innovation</strong><strong>and</strong> by continuing to develop our banking activity;we will improve <strong>and</strong> consolidate synergies,particularly with regard to finance, reinsurance,IT systems, the sharing of business expertise<strong>and</strong> the creation of common platforms. We willalso continue to mobilise our employees aroundour objectives with an ongoing concern for oursocial responsibility.Our Group’s ambitions remain intact. Groupamais aiming for growth <strong>and</strong> profitability, so that it canrank among Europe’s top 10 insurance playersby 2012.2008HIGHLIGHTS• +9.2%: individual life insurancepremiums in France (written premiums).• +39%: international revenues(€3.9 billion).• +66.1%: Group’s economic operatingincome (€661 million).• +€342 million: net profit despitethe crisis.• Prudent management, to ensurethe Group’s soundness <strong>and</strong> protectthe interests of those who put theirtrust in us: concerning bonds, over 93%of the portfolio is composed of securitiesrated > A; no “toxic” products suchas subprimes; high-quality equity<strong>and</strong> real-estate portfolios.

006 GROUPAMA2008 Activity ReportGROUP GOVERNANCEA governAncemethod whichempowerseveryoneThe Group has a governancemethod which empowers everyoneinvolved within the organisation.Members elect their representativesat the local level (68,000 electedrepresentatives), <strong>and</strong> they in turnelect their representatives atthe regional <strong>and</strong> national levels.The board members, who areall policyholders of the mutualinsurance company, controlall the Boards of Directors of theentities within the mutual insuranceGroup. They select the managerswho h<strong>and</strong>le operating activities.The elected representatives thusparticipate in all of the Group’sdecision-making bodies, whetherlocal (5,400 local mutuals),regional (11 regional mutualsin Metropolitan France, 2 overseasmutuals <strong>and</strong> 2 specialised mutuals)or national through the federations<strong>and</strong> the Boards of Directorsof Groupama S.A. <strong>and</strong>its subsidiaries.Rthe chAiRmen’scommitteeAnd the boARdcommittee37 Jean-yves lHÉRIAUGroupama Loire Bretagne38 Rémy lOssERGroupama Alsace39 Jean-Claude NIGONGroupama Rhône-Alpes Auvergne1 2 43 5 6 710 Michel HABIGGroupama Alsace11 Jérôme ZANETTACCIGroupama Alpes-Méditerranée12 Régis BlONdyGroupama Centre-AtlantiqueRdiRectoRs27 2829 30 3140 Guy PEllETIERGroupama Centre Manche41 yves PERRINGroupama Centre-Atlantique13 Georges CHARRONGroupama Loire Bretagne14 Jean-Charles COURTOIsGroupama Centre Manche15 Jean-Pierre dECOOlGroupama Nord-Est19 2010 11122127 François dEsNOUEsGroupama Paris Val de Loire28 Marie-Ange dUBOsTGroupama Centre Manche29 didier FOUCQUEGroupama Océan Indien19 Monique ARAVECCHIAGroupama Alpes-Méditerranée20 Olivier dE BAGlIONGroupama Centre-Atlantique21 Jean-louis BARTHOdGroupama Gr<strong>and</strong> Est30 dominique GOURRAsGroupama Sud31 Jean-luc HENRyGroupama Sud37 38 39 40 41

GROUPAMA2008 Activity Report007Group governance8 91 Jean-luc BAUCHERElchairman,Groupama Loire Bretagne2 Francis AUssATActing chairman,Groupama d’Oc3 Robert dROUETActing Vice-chairman,Groupama Centre Manche4 Jean BAlIGANdVice-chairman,Groupama Rhône-Alpes Auvergne13 14 15 16 17 1822 Guy BERNARdIEGroupama d’Oc23 daniel BOITTINGroupama Centre Manche24 Alain BRUNETGroupama Paris Val de Loire32 3342 Jean-louis PIVARdGroupama Rhône-Alpes Auvergne43 Pascal POMMIERGroupama Paris Val de Loire44 Jean-Pierre RAMAGETGroupama Gr<strong>and</strong> Est25 Jean-yves dAGÈsGroupama d’Oc26 Hugues dAZARdGroupama Nord-Est34 35 3645 Bernard ROUssEAUXGroupama Nord-Est46 Patrick sEGUINGroupama Rhône-Alpes Auvergne47 lionel VEQUAUdGroupama Centre-Atlantique5 Michel BAylETVice-chairman,Groupama Centre-Atlantique6 Annie BOCQUETVice-chairman,Groupama Nord-Est7 Amaury CORNUT-CHAUVINCVice-chairman, secretary of the board,Groupama Sud8 s olange lONGUETVice-chairman treasurer,Groupama Paris Val de Loire16 Jean-Marc FABREGroupama d’Oc22 23 24 25 2632 Jean JARNACGroupama Antilles-Guyane33 Michel l’HOsTIsGroupama Loire Bretagne34 Jean-louis lAFFRATGroupama Nord-Est17 Jean-Paul NIEUTINGroupama Paris Val de Loire18 Jean-Jacques ROZIERGroupama Rhône-Alpes Auvergne35 didier lAlUETGroupama d’Oc36 Jean-yves lE dROMAGUETGroupama Loire Bretagne42 43 44 45 46 479 François sCHMITTVice-chairman,Groupama Gr<strong>and</strong> EstBoard of Directors of Fédération nationale Groupama at 31 March 2009.Fédération nationaleGroupamaThe association that groups together the regionalmutuals, constitutes the institutional centre: it representsthe members <strong>and</strong> is thus responsible fordefining <strong>and</strong> controlling the main strategies of theGroup. It also performs the role of a ProfessionalAgricultural Organisation (Organisation ProfessionnelleAgricole - OPA) <strong>and</strong> ensures that mutual insuranceprinciples are developed <strong>and</strong> promoted.the BoArd of directorsIt has 47 directors, with 5* representatives perregional mutual in Metropolitan France, <strong>and</strong> onerepresentative for each of the two overseas mutuals.Two representatives of the Young Farmers sit onthe Board as non-voting members. This Boardmet 8 times in 2008.The Board’s activities are enhanced by the studies<strong>and</strong> assessments carried out by committees.compensAtion of directorsThe directors provide their services free ofcharge. During the year ended 31 December2008, Fédération nationale granted the membersof its Board of Directors €580,788 (taxablegross) in the form of compensatory paymentsfor time spent. Directors are also reimbursed fortheir expenses.the executive committeeImplementation of the decisions of the Board ofDirectors <strong>and</strong> management of Fédération nationaleare the responsibility of the Chief ExecutiveOfficer of Groupama S.A., who is also the ChiefExecutive Officer of Fédération nationale.* The target plan for the merging the regional mutualsin Metropolitan France specifies a total of 9 mutuals.

008 GROUPAMA2008 Activity ReportGROUP GOVERNANCEGroupama S.A.Groupama S.A. is a limited company that is almostwholly owned, indirectly, by the regional mutuals.Its business activitiesare the following• to define <strong>and</strong> implement the Group’s operationalstrategy in collaboration with the regionalmutuals <strong>and</strong> in line with the strategies definedby Fédération Nationale Groupama;• to reinsure the regional mutuals <strong>and</strong> the subsidiaries(internal reinsurance);• to direct all subsidiaries;• to introduce the Group’s external reinsuranceprogramme.Groupama S.A. is in charge of directing, overseeing<strong>and</strong> coordinating the Group’s policies.Financial statementsof the Group <strong>and</strong> of Groupama S.A.The Group’s financial statements (combinedscope) cover all business activities of all Groupentities <strong>and</strong> regional mutuals; the consolidatedfinancial statements of Groupama S.A. includethe reinsurance business ceded by the regionalmutuals (approximately 40% of their revenues) aswell as the business activities of the subsidiaries.This entity will be listed on the stock exchange ifthe Group’s future growth requires it.Administration<strong>and</strong> general managementGroupama S.A. is administered by a Board ofDirectors whose function is to determine the company’sbusiness strategies <strong>and</strong> ensure that theyare implemented by the Executive Management.Groupama S.A.’s Board of Directors consists of17 directors of whom 11 represent the controllingshareholder, 4 are independent external directors,appointed by the Ordinary General Meeting for aperiod of 6 years, <strong>and</strong> 2 are elected by the company’semployees for a period of 4 years.The Board of Directors met 11 times in 2008.Groupama S.A.’s Board of Directors has establishedthree specialized committees whose functionis to prepare for the Board’s work: the Audit<strong>and</strong> Accounts Committee, the Agreements Committee<strong>and</strong> the Compensation <strong>and</strong> AppointmentsCommittee; the first two are presided over by anindependent external director.In keeping with its original principle of sharedresponsibility, the Board of Directors has optedfor the separation of the duties of Chairman <strong>and</strong>Chief Executive Officer. The company’s generalmanagement is entrusted to an Executive ManagingDirector within the meaning of the NRE Act*.Balanced, lasting <strong>and</strong> exlusivefinancial ties between GroupcompaniesIn addition to the internal reinsurance agreement(see page 38), there are distribution agreementsthat control the ties between Groupama S.A., itssubsidiaries <strong>and</strong> the regional mutuals, particularlyfor life insurance products <strong>and</strong> retail banking. Allof those agreements are established under thecontrol of the Agreements Committee, chairedby an independent external director who ensuresthat the agreements are legally sound <strong>and</strong> that theinterest of each of the parties is respected.* French New Economic Regulations Act (loi sur les nouvellesrégulations économiques - NRE) of 15 May 2001.Committees of the board:• Audit <strong>and</strong> accounts committee: Michel Baylet,Amaury Cornut-Chauvinc, Frédéric Lemoine(chairman), Anne Bouverot, Philippe Vassor.• Compensation <strong>and</strong> appointments committee:Francis Aussat (chairman), Robert Drouet, AnnieBocquet, Solange Longuet, Frédéric Lemoine.• Agreements committee: Jean Balig<strong>and</strong>,François Schmitt, Jean Salmon, PhilippeVassor (chairman).

GROUPAMA2008 Activity Report009Group governanceR1 2 31 Jean-Luc BAUCHERELChairman,Groupama Loire Bretagne3 Francis AUSSATDirector,Groupama d’Ocboardof directors2 Michel BAYLETVice-Chairman,Groupama Centre-Atlantique4 Jean BALIGANDDirector,Groupama Rhône-Alpes Auvergne45 66 Amaury Cornut-chauvincDirector,Groupama Sud5 Annie BOCQUETDirector,Groupama Nord-EstIN 20087 Robert DROUETDirector,Groupama Centre Manche8 Michel HABIGDirector,Groupama Alsace9 Solange LONGUETDirector,Groupama Paris Val de Loire10 Francois SCHMITTDirector,Groupama Gr<strong>and</strong> Est11 Jérôme ZANETTACCI*Director,Groupama Alpes-Méditerranée78 91011To improve its operation, the Board of Directorsof Groupama S.A. welcomed a 4 th independentexternal director, Ms Anne Bouverot.121314 1512 Anne BOUVEROTIndependent non executuve Director,14 Jean SALMONIndependent non executuve Director,13 Frédéric LEMOINEIndependent non executuve Director,15 Philippe VASSORIndependent non executuve Director,16 1716 Henri Dur<strong>and</strong>Director elected by Groupama S.A employees,Groupama S.A.17 Christian GARINDirector elected by Groupama S.A employees,Groupama S.A.*Nomination submitted for notification by the General Assembly of 27 May 2009.Corporate governance, the compensation ofdirectors, the organisation of internal control<strong>and</strong> risk management are described in theRegistration Document.

010 GROUPAMA2008 Activity ReportGroup governanceTHE GROUP EXECUTIVE COMMITTEEpArticipAtionin theprepArAtionAnd operAtinggroup’sstrAtegyThe Group Executive Committee (GEC) participatesin the preparation <strong>and</strong> operational monitoringof the Group’s strategy. It implements thestrategy <strong>and</strong> ensures operational coordination ofall the entities’ activities.The Group Executive Committee is composedof the managing directors of the regional mutuals<strong>and</strong> the principal directors of Groupama S.A.It is chaired by the Managing Director ofGroupama S.A. It meets once a month for a day.There are specialised operating committees(COMOP) — business lines, development,information technology, finance <strong>and</strong> humanresources — whose members include the appropriateexecutives from the Group’s entities. Theycontribute to the preparation of project files for theGroup Executive Committee <strong>and</strong> propose stepsto be taken on an operational level in accordancewith the strategies.1234567891011121314151617181_Olivier BlONdEl managing director Groupama Paris Val de Loire 2_Christophe BUsO managing director Groupama centre-Atlantique 3_Philippe CARRAUd managing director Groupama d’oc 4_Patrice CHEREAU* managing director GroupamaLoire bretagne 5_Claude dOllÉ managing director Groupama Alsace 6_yves EVENO managing director Groupama Alpesméditerranée7_daniel GABORIAU managing director Groupama nord-est 8_Francois GOUTAGNEUX managing director GroupamaRhône-Alpes Auvergne 9_Jean-Paul HUE managing director Groupama centre manche 10_Gérard JOAllANd managing directorGroupama Gr<strong>and</strong> est 11_Alain KAHN managing director Groupama sud 12_Jean AZÉMA chief executive officer Groupama s.A.13_Christian COllIN corporate secretary - strategy & hR Group (Groupama s.A.) 14_Jean-François lEMOUX managing directorinternational (Groupama s.A.) 15_Helman le PAs de sÉCHEVAl Group chef financial officer (Groupama s.A.) 16_Thierry MARTElmanaging director insurance france (Groupama s.A.) 17_Francis THOMINE managing director, it division 18_Jean-Marc VERVEllEmanaging director commercial <strong>and</strong> institutional insurance (Groupama s.A.) // *christian cochennec from June, 10 th 2009 onwards.

GROUPAMA2008 Activity Report011Group governanceGroup governanceTHE GROUPAMA s.A.’s sTEERING COMMITTEEgroupAmA s.A.steeringAuthorityThe Steering Committee (Comité de DirectionGénérale - CDG) assists Groupama S.A.’s ChiefExecutive Officer in the management ofGroupama S.A. It implements the strategy ofGroupama S.A. within the framework of the Group’sgeneral strategies <strong>and</strong> coordinates the French<strong>and</strong> international subsidiaries. As the entity thatprepares <strong>and</strong> approves the operating decisionsmade by Groupama S.A., it sets the major prioritiesfor the work of the various divisions of GroupamaS.A. <strong>and</strong> monitors the implementation of thesedecisions.1_Jean AZÉMA chief executive officer 2_Christian COllIN corporatesecretary - strategy & hR Group 3_Jean-François lEMOUX managingdirector international 4_Helman le PAs de sÉCHEVAl Group chie ffinancial officer 5_Thierry MARTEl managing director insurance france6_Francis THOMINE managing director, Groupama it division 7_René CAdOGroup general audit <strong>and</strong> actuarial director 8_Maurice FAURE directorfédération nationale Groupama 9_Frédérique GRANAdO director, externalcommunications 10_Benoît MAEs managing director Gan Assurances11_Jean-Marc VERVEllE managing director commercial <strong>and</strong> institutionalinsurance1234567891011The Committee is made up of 11 members <strong>and</strong>meets every 2 weeks with the representatives ofGroupama S.A.’s major divisions <strong>and</strong> the ChiefExecutive Officer.compensAtion of the memBersof the steering committeeThe members of the Groupama S.A. SteeringCommittee received total gross compensation,including benefits in kind, of €4,706,415, including€1,062,500 in variable compensation.

012 GROUPAMAActivity Report 2008A EUROPEANDEVELOPMENT STRATEGYAn unchangedambition :to be rankedamong Europe’stop 10 insurancecompaniesGroupama aims to become oneof Europe’s leading insurancecompanies by 2012. This ambitionwhich has been at the heart of theGroup’s strategy for several yearsis once again reasserted. The linesof action to achieve this goal areclearly defined: to consolidate <strong>and</strong>develop our positions in France,accelerate our organic <strong>and</strong> externalinternational growth, <strong>and</strong> improveour profitability through increasedefficiency. Given the more difficulteconomic <strong>and</strong> financial conditions,the challenge is to use our assetsto even greater advantage, primarilyour size <strong>and</strong> our economic model.The financial crisis<strong>and</strong> Groupama’smanagementA prudent approach whichreinforces the Group’sfinancial soundnessThe financial crisis which prevailed in 2008 gaverise to a considerable rise in the cost of credit forprivate issuers <strong>and</strong> a drop of nearly 43% on thestock markets (CAC 40 in Paris). Like all otherinsurance companies, Groupama was affected bythis turmoil, particularly because of IFRS. Thesest<strong>and</strong>ards require that the fair value of certainfinancial assets be recognised through financialincome <strong>and</strong>/or equity even if they haven’t beensold. Despite this, the Group’s business <strong>and</strong> fundamentalsremain very sound. This soundnesspartly rests on a prudent <strong>and</strong> stringent assetmanagement policy which follows strict prudentialrules in terms of diversification, spread <strong>and</strong> liquidity.Groupama thus kept away from the so-called“toxic” structured, simple or complex products;moreover, hedge funds account for less than 1%of its investments. For the past four years, theGroup had deemed American subprime investmentsin the real estate sector extremely risky;accordingly, it did not invest in them <strong>and</strong> is notaffected by that particular downturn. Likewise, theGroup is not exposed to American monolines ormortgage refinancing agencies. For over a yearnow, the Group’s discerning financial experts havefavoured securities which are the least sensitiveto market fluctuations, to the detriment of financial-sectorsecurities. Their approach resultedin the keeping of a large proportion of liquidities<strong>and</strong> investments in businesses with healthybalance sheets <strong>and</strong> little debt.In terms of investment, our mode of operationinvolves financial committees for each entity,then for the Group as a whole. We have developeda comprehensive system of checks whichhave been further reinforced in 2008.Higher rate of returnon life insuranceDespite the difficult economic situation,in 2008 the Group provided its customerswith higher rates of return on its lifeinsurance contracts than in 2007. Throughstringent management targeting steadysustainable growth, these rates variedbetween 4.5 <strong>and</strong> 4.6%.• Groupama Vie achieved a rate of returnof 4.5% for the euro range <strong>and</strong> 4.6% forthe euro fund of Groupama Modulation.• Gan Assurances achieved the sameperformance levels: 4.5% for Libertance 95<strong>and</strong> 4.6% for Chromatys (Actif Général fund).This increased return on savings issignificant for policyholders, given thelower performance of the life insurancemarket in 2008.Hurricane reinsurance coverageVia the reinsurance company Swiss Re,Groupama issued a “cat bond” of€200 million on the financial market.This securitisation operation is aimed atcovering part of the Group’s “hurricane” riskin France. This innovative arrangement –the first product of its kind in France focusedon covering hurricane risk – is also asupplement to traditional reinsurance.For Groupama, the objective is to be bettercovered in the event of a catastrophic stormin France, within a financial arrangementthat protects the reinsurer against defaulting.The cover is rated AAA.

GROUPAMAActivity Report 2008013A Europe<strong>and</strong>evelopment strategyGroupama, a sound Group• Limited asset depreciation (€159 million,net of profit sharing <strong>and</strong> corporate tax)in view of the financial market downturn.• The Group’s statutory solvency margin(using the same method as in 2007)is 122% covered, despite the sharp dropin the markets <strong>and</strong> the Group’s significantinternational growth.If the additional elements of assessment weretaken into account, as published by ACAM (1) ,the margin would st<strong>and</strong> at 149%.(1)Taking account of the subordinated debt excludeddue to statutory capping, equalisation reserves,a high prudential margin for non-life insurancereserves, <strong>and</strong> the profit-sharing reserve.Insurance business in France :a satisfactory yearfor Groupama2008 has been a satisfactory year for theGroup in France. In fact, the Group was lessaffected by the drop in business due to thecrisis than the market as a whole. Revenuesfrom current operations increased 2.2%while the market receded 6.2%*. This growthis the fruit of the ambitious developmentplans launched in 2006/2007 <strong>and</strong> whichare now operational: +2.3% in life <strong>and</strong> healthinsurance (excellent performance in a marketwhich was down 8.7%*), +2.1% in property<strong>and</strong> casualty insurance (in line with themarket which grew 2.3%*).*Source : FFSAOur vision of the marketA competitivebut structurally buoyant,European insurance marketOver the long term, our environment is determinedby underlying trends which spread across ourmodern societies. These include trends such asincreasing urbanisation, consumer versatility, longerlife expectancy with its social <strong>and</strong> economicimpacts <strong>and</strong> the government’s gradual withdrawalfrom social security systems, which create newneeds. These changes, along with a growingaversion to risk, are an opportunity for the Groupto strengthen its businesses, particularly in termsof health insurance, provident insurance <strong>and</strong>retirement products.In those fields, Groupama has recognisedknow-how <strong>and</strong> legitimacy as well as a solidpositioning. Taking account of the expectationsof its customers <strong>and</strong> members, the Group adaptsits offerings in line with consumer behavioursto better meet their lifelong needs. Those behav-iours are tending towards harmonisation acrossEurope due to increasing economic integration.While the power of information technology is callinginto question the issue of territoriality, Groupamais convinced that tomorrow its domestic marketwill no longer be national but European. Suchis the purpose of our international developmentstrategy. Acquiring a European size is themeans of capitalising on our know-how, achievingsynergies <strong>and</strong> diversifying risks.This is a major asset to withst<strong>and</strong> ever strongercompetitive pressure which requires increasinglysophisticated resources to offer innovative<strong>and</strong> efficient solutions suited to our customers’needs. This critical size is essential to guaranteeour independence <strong>and</strong> continuity in the face ofthe consolidation of the insurance sector underwayover recent years.

014 GROUPAMAActivity Report 2008Our strategic choicesPushing ahead with developmentTo become one of Europe’s leading insuranceplayers, Groupama intends to consolidate <strong>and</strong>develop its positions in France, accelerate itsinternational growth <strong>and</strong> increase its profitability.It deploys this strategy by making use of itsmain assets, its size <strong>and</strong> its general-purpose<strong>and</strong> diversified economic model. Groupamastrives to consolidate its first asset <strong>and</strong> optimisethe second. For this purpose, it has abalanced portfolio of property insurance <strong>and</strong> life<strong>and</strong> health insurance, an extensive, faithful <strong>and</strong>diversified clientele, two high-profile br<strong>and</strong>s, multichanneldistribution, <strong>and</strong> stakes in all insurancelines with leading positions in several of them.The Group’s financial soundness <strong>and</strong> flexibilitygive it the means to develop.Becoming France’s “benchmarkinsurance company”Groupama intends to strengthen its positions<strong>and</strong> gradually become the “benchmark insurancecompany” on the French market. TheGroup is already the No. . 1 insurer for individualhealth, agriculture <strong>and</strong> local authorities, the No. . 1home insurer, the No. . 2 French player in marine<strong>and</strong> transport insurance, <strong>and</strong> the No. . 3 motor <strong>and</strong>commercial insurer. We thus need to strengthenour positions on the strategic individual motor/home insurance market <strong>and</strong> boost our growthin life/health insurance for individuals <strong>and</strong> institutions.We also need to increase our presencein the insurance market for professionals<strong>and</strong> VSE-SMEs <strong>and</strong> consolidate our position asleading agricultural insurer. Moreover, the Groupis continuing to develop its banking offer, strivingto win new customers <strong>and</strong> extend its servicesto existing ones, using an ever more integratedcommercial approach.• Boosting organic growth, particularly in urbanareas. The Group will continue its significantmarketing <strong>and</strong> communication efforts to supportits Groupama, Gan <strong>and</strong> Amaguiz br<strong>and</strong>s<strong>and</strong> improve its customer knowledge. It willalso continue to diversify its customer portfolioin cities of over 100,000 people <strong>and</strong> in certainhigh-potential customer segments, while developingits historical positions with other typesof customers. Organic growth also involvesimproving the efficiency of the sales networks:increasing the commercial productivity <strong>and</strong> sizeof the networks <strong>and</strong> putting greater emphasison the multi-channel approach.

GROUPAMAActivity Report 2008015A Europe<strong>and</strong>evelopment strategy• Improving our property <strong>and</strong> casualty insuranceproducts. The product <strong>and</strong> service offer mustbecome a real differentiation factor, through<strong>innovation</strong> in risk products for individuals,professionals <strong>and</strong> enterprises, <strong>and</strong> through thesystematic integration of services in the offering.The Group will take position in new distributionchannels, such as direct selling – amaguiz.com<strong>and</strong> groupama.fr – <strong>and</strong> partnerships.• Growing on the life <strong>and</strong> health insurance market.The Group is getting ready to take advantageof the forthcoming regulatory changes <strong>and</strong>the emergence of new provident needs. It alsointends to rely on a comprehensive, innovativesavings offering to consolidate the potential of itscustomer portfolio in this area. At the sametime, it will continue to adapt its life insurancenetworks, for example through the developmentof networks of asset management advisers,<strong>and</strong> enhance its offering through new partners.• Continuing to develop its banking activitiesto increase the number of bank accounts <strong>and</strong>volume of outst<strong>and</strong>ing loans.Successful internationalgrowthThe Group is continuing its international growth.This is proving successful since revenues frominternational activities have increased from 18.8%of the total revenues of Groupama S.A. in 2004to 31.6% in 2008 (once the business activities ofthe latest acquisitions have been recorded overa full year). Its strategy is now giving rise to theconsolidation of its major positions in Italy, Spain<strong>and</strong> Great Britain in order to have more weight oneach market, the set-up of operations in highgrowth areas – Central <strong>and</strong> Eastern Europe <strong>and</strong>the Mediterranean area – <strong>and</strong> moves into Vietnam<strong>and</strong> China within the scope of a long-term vision.2008 was an eventful year in terms of acquisitions.The signing of a strategic partnership withthe Hungarian OTP Bank in Central Europe wasaccompanied by the acquisition of an 8% stakein the bank’s equity capital <strong>and</strong> takeover of itsinsurance subsidiary OTP Garancia. The Groupalso moved into Slovakia <strong>and</strong> Bulgaria. Furthermore,Groupama increased its presencein Turkey with the acquisition of Güven Sigorta<strong>and</strong> in Romania with the purchase of Asiban. InTunisia, the Group acquired a 35% stake in Star,the country’s leading insurance company.Internationalacquisitionsin 2007• Italy: Nuova Tirrena, transforming Groupamainto Italy’s No. . 9 non-life insurer (in 2007).• Greece: Phoenix, No. . 8 non-life insurer<strong>and</strong> No. . 10 life insurer.• Romania: BT Asigurãri, No. . 9 non-lifeinsurer <strong>and</strong> No. . 12 life insurer.• Great Britain: Bollington <strong>and</strong> Larkbrokerage firms.In 2008• Hungary (signed in February):OTP Garancia, No. . 3 Hungarian insurer<strong>and</strong> its subsidiaries in Bulgaria, Romania<strong>and</strong> Slovakia.• Romania (signed in April): Asiban,Asiban, No. . 3 Romanian insurer.• Great Britain: acquisition of brokerage firms.• Turkey (signed in June): Güven, No. . 1agricultural insurer <strong>and</strong> No. . 5 non-life insurer.• Tunisia (signed in July): strategic partnerof Star, No. . 1 in non-life insurance <strong>and</strong>No. . 9 in life insurance.

016 GROUPAMAActivity Report 2008Groupama is staying on track:• Continued organic growth in France<strong>and</strong> internationally.• Consolidation, improvement <strong>and</strong> searchfor stronger synergies.• Ongoing mobilisation of employeesin a socially responsible group.Groupama intends to continue its efforts tobecome a global player to anticipate the emergenceof a European insurance market, developgrowth links, <strong>and</strong> benefit from a size effect withdiversified risks. However, for 2009, the Groupwill put the emphasis on organic growth, like inFrance. Several targets have been set, such as:• The successful integration or merger of the companiesacquired over the past few years: merger ofNuova Tirrena <strong>and</strong> Groupama Assicurazioni in Italy,Güven <strong>and</strong> Basak Groupama in Turkey, GroupamaBiztosito <strong>and</strong> OTP in Hungary, <strong>and</strong> BT Asigurãri,Asiban <strong>and</strong> OTP Garancia in Romania to createthe No. . 3 player on the Romanian market.• Improving commercial efficiency: Boostinggrowth after the merger of the various companies.Profitable growth<strong>and</strong> increased synergiesGroupama intends to satisfy its members <strong>and</strong>customers by focusing on profitable growth.This is what gives us the investment capacitiesrequired to innovate, <strong>and</strong> enables us to achieveeconomies of scale <strong>and</strong> reduce costs in orderto be competitive on increasingly stiff markets.The constant efforts made to increase profit-

GROUPAMAActivity Report 2008017A Europe<strong>and</strong>evelopment strategyability help to further increase our self-financingcapacities <strong>and</strong> strengthen the Group’s financialsoundness in an economic situation which is nowmore difficult. The Group will thus make furtheruse of the synergies between its various entitiesto capitalise on its size.In France, a service division will be created forall Group companies. New pricing <strong>and</strong> subscriptiontools will also be deployed for the sales networks.Outside France, synergies will be increasedthrough new regional cooperation <strong>and</strong> the sharingof business expertise among entities <strong>and</strong>with Groupama SA. Groupama Systèmesd’Information, the economic interest entity (GIE)which manages all of the Group’s IT systems inFrance, will take on an international dimension, bypooling means of production <strong>and</strong> gradually harmonisingthe subsidiaries’ application systems.A common platform managed by GroupamaSystèmes d’Information will also be createdfor all Central European countries. In anothereffort to rationalise costs, the Group will finalisethe bank merger in 2009, push aheadwith the convergence of the IT systems of theGroup’s French companies <strong>and</strong> deploymentof the Apogée* programme for all of the Group’soperating processes (for all types of after-salesservice activities: management of claims, production/underwriting,etc.). The rationalisationof the Group’s purchasing policy will also continue.*APOGEE: Amélioration des Processus Opérationnelsde Groupama et des Entreprises (improving the operationalprocesses of Groupama <strong>and</strong> companies).Groupama has become an international Group<strong>and</strong> must upgrade its operational organisation<strong>and</strong> methods accordingly, with respect to itsbusiness lines <strong>and</strong> employees. This process isalready well underway within our Group.For Groupama, the human resource policy is akey lever to achieve its ambition, by securing thetalent required for the Group’s development <strong>and</strong>mobilising employees on the strategic objectives,in an approach encompassing social responsibility.(See the principles <strong>and</strong> actions of our HRpolicy on page 44).

GROUPAMAActivity Report 2008019Improvement in the combined ratioKey figures for the GroupAcceleration in growth:increase in revenues(€bn)13.414.214.9+ 9.2%16.22005 2006 2007 2008property <strong>and</strong> liability insurance101.5% 98.5%94.9% 99.4%99.7% 98.7%29.5% 30.2%28.3% 28.5%29.1% 29.6%72% 68.3%66.6% 70.9%70.6% 69.1%2007 2008 2007 20082007 2008France International Total• In France, the net combined ratio improved by3.0 points compared to 2007, boosted by asharp fall in net claims experience. It should benoted that in 2007, claims experience in Francewas hit by numerous climatic events (such ashurricane Dean <strong>and</strong> tropical cyclone Gamede,<strong>and</strong> an earthquake in West Indies etc). Theoperating expenses ratio rose largely due to anincrease in marketing <strong>and</strong> advertising costs.• In the International business, the net combinedratio deteriorated by 4.5 points, principally dueto a worse net claims experience ratio mainly inrelation to recent acquisitions.Net expense ratioNet claims ratioChange in economic operating profitstrong growth in economic operatingprofit (€ million)157351398+ 66.1%6612005 2006 2007 2008(€ million )18630711– 106Life <strong>and</strong> health insurance398Property <strong>and</strong> casualty insuranceInvestment <strong>and</strong> banking activitiesHolding activities+ 66.1%6612007 20084353731– 148Economic operating profit=Net profit group share–net realised capital gains <strong>and</strong> losses (shareholders’ share)net of corporate income tax–increases <strong>and</strong> write-backs to long-term impairment provisions(shareholders’ share) net of corporate income tax–unrealised capital gains <strong>and</strong> losses on financial assetsrecognised at fair value (shareholders’ share)net of corporate income tax–extraordinary items net of corporate income tax–impairment of goodwill <strong>and</strong> intangible assets,net of corporate income taxThe property <strong>and</strong> casualty business economicoperating profit rose +21.5%, boosted by strongunderwriting results (the 2008 Group combinedratio amounted to 98.7% down 1 point comparedto 2007) <strong>and</strong> by a rise in recurring investmentincome.Life <strong>and</strong> health insurance economic operatingprofit came in up +€249 million. A major proportionof this increase arose from a sharp improvementamounting to +€183 million before tax inthe underwriting margin net of health <strong>and</strong> othernon-life bodily injury. Indeed, the net combinedratio on these activities fell by 6.9 points (93.7% in2008 down from 100.6% in 2007) both in France<strong>and</strong> internationally. Investment activities turned ina €1 million economic operating profit in 2008,despite being hit by the financial crisis, whichaffected the asset management activities,considerably in this respect. Holding companyactivities: the rise in interest costs <strong>and</strong> expenseson mergers <strong>and</strong> acquisitions had a negativeimpact on the results for the year.

020 GROUPAMAActivity Report 2008A balanced portfolioNet profit hit by the crisislife <strong>and</strong> health insurance10%49% 16%5%9%6%5%Individual Retirement Savings Personal Provident InsuranceIndividual Health Insurance Group Retirement SchemeGroup Provident Scheme Group Health Other (indiv+group)property <strong>and</strong> liability insurance13%14%38%6%€ million 2007 2008 ChangeInsurance operating profit 493 808 + 63.9%Investment activities operating profit 11 1 NAHolding company operating profit – 106 – 148 – 39.6%Total operating profit (1) 398 661 + 66.1%Net realised capital gains 572 67 – 504Long-term impairment provisions 0 – 159 – 159Gains <strong>and</strong> losses on financial assetsrecognised at fair value19 – 190 – 210Other costs <strong>and</strong> income – 51 – 37 + 27.5%Net profit 938 342 – 63.5% (2)(1) Economic operating profit (see appended definitions).(2) Down – 56.9% excluding capital gains on SCOR shares in 2007 (€144 million)Net profit is down -56.9% without taking intoaccount the 2007 sale of SCOR shares.In the international financial crisis, the rise inoperating profit was completely offset by theimpact of the financial crisis, which amounted to€873 million after profit sharing <strong>and</strong> corporateincome tax that can be broken down as follows:• A sharp fall in net realised capital gains <strong>and</strong>losses. 2007 was boosted by €144 million innon-recurring capital gains from the sale ofSCOR shares <strong>and</strong> by a €158 million in capitalgains unlocked through the sale of the TourGan building, whereas there was no equivalentcapital gain in 2008;• A reduction in assets measured in the IFRSaccounts based on the fair value through incomemethod compared to 2007;• Net provision charges for long-term impairment.3%prudent asset management14%8%4%Breakdown of the asset portfolio (1)Investment income(€ million) (2)3,2373,419• Very secure bond portfolio comprising over93% of investments rated better than A.Motor insurance Home insurance Individual <strong>and</strong> businessproperty damage Fleets Construction Businesses <strong>and</strong> localauthorities property damage Transport Other68.3%20.5%2,1382,282• No toxic assets.• Under-valued but high-quality equity portfolio.0.1%11.1%3733574604672663132007 2008• High-quality real estate concentrated in Paris<strong>and</strong> surrounding suburbs.(1) Market value excluding unit linked investments.(2) Before management fees.Bonds Equities Real estate OtherBonds Equities Real estate Other

GROUPAMAActivity Report 2008021Breakdown in group net profitStrong <strong>and</strong> high-quality balance sheetKey figures for the Group(€ million)621366France insurance<strong>and</strong> services1512007 2008Internationalinsurance50 11 1158InvestmentactivitiesHoldingactivities– 53 – 3 – 21Other938Total342Balance sheet accounts€ million 2007 2008 VariationShareholders’ equity 8,511 5,562 – 34.6%Subordinated debt 1,245 1,245 –Gross underwriting reserves 70,007 69,150 – 1.2%Total balance sheet 94,881 91,777 – 3.3%Solvency margin (1) 277% 122% – 155 ptsUnrealised gains (losses) (2) 8,335 1,161 – 86.1%Debt ratio (3) 17.1% 28.3% + 11.2 pts(1) Estimate of the solvency margin based on European st<strong>and</strong>ards (Solvency I).(2) Shareholders’ share: €440 million vs. €3.53 billion at the end of 2007.(3) Excluding SILIC.Prudent asset managementExposure (€ million) 31/12/07 31/12/08US securitisationsUS subprime 0 0US ABS (consumer ABS) 92 85European securitisationsCLO/CDO 0 12RMBS 467 218CMBS – 23MonolinesDirect (debt or equity) 0 0Turnaround in bonds 125 90Lehman Brothers September 2008Equities 0Bonds 5Derivative products 1Madoff December 2008Indirect 8Insurance investments stood at €72.5 billion, down€7.1 billion from €79.6 billion as at 31 December2007 due to the fall in the financial markets. Notethat over 93% of balance sheet investments aremeasured at market value in accordance with IFRS.This environment naturally has an impact on theGroup’s unrealised capital gains. The –€6.4 billionreduction in unrealised capital gains on equitieswas caused by the fall in the equity markets (e.g.the CAC 40 index slumped –42.7%).Group shareholders’ equity automatically reducedin accordance with IFRS.The Group regulatory solvency margin (based onthe identical calculation method compared to 2007)st<strong>and</strong>s at a satisfactory level despite the slump inthe financial markets <strong>and</strong> the Group’s considerableexpansion abroad. Including the additionalitems as published by ACAM, the margin wouldbe 149%.Effective <strong>and</strong> prudent investment managementallowed the Group to post relatively modest impairmentcharges of just 0.2% of the investmentsdespite the huge swings on the financial markets.The Group’s exposure to complex structured or“toxic” products that are currently causing problems(subprimes, monolines, Madoff, etc.) is nilor negligible.

022 GROUPAMA2008 Activity ReportStrong resultsKey figures for Groupama S.A.Profitablegrowth<strong>and</strong> financialstrengthThe consolidated financialstatements of Groupama S.A. includethe insurance ceded by the regionalmutuals (about 40% of premiumincome) <strong>and</strong> the business of thesubsidiaries. Premium income keptby the regional mutuals is thereforenot consolidated in these financialstatements.€ million Groupama S.A. consolidation scopePremium income FranceInternational premium incomeAsset management <strong>and</strong> Investment activities9,1423,937362+2.1%+39.0%+3.4%TOTAL revenues 13,441 +10.8%Operating profit (1) 561 +49.6%Combined ratio property<strong>and</strong> liability insurance98.0% + 0.5 ptNET PROFIT 273 –65.6% (3)ROE (2) 12.2% –10.3 pts (4)Debt ratio(excluding Silic <strong>and</strong> holding companies’ cash)40.5% +17.2 pts(1) Economic operating profit (see appended definitions)*. (3) down –57.9% excluding Scor.(2) Based on shareholders’ equity. (4) down –6.5 pts excluding Scor.Strong diversification abroadBreakdown of revenuesFrance/International68.4%31.6%31.12.2008 proforma(Asiban, OTP, Güven annualised)Growth in all activitiesRevenues by activity(€ MILLION)12,1333508415,3941,9903,557+ 10.8 %+3.4%+6.4%+16.2%13,4413621,1252007 20085,5112,8133,631In a difficult environment, the sharp growth inbusiness, operating profit, up nearly +50%, <strong>and</strong>limiting the combined ratio to 98% reflect thesuccess of our business plans <strong>and</strong> investmentprogrammes. More than ever, this strong performance<strong>and</strong> the fact that net profit hold upwell attest to the Group’s capacity to developduring downturns.• Counter-cyclical performance in life insurance.• Deposits holding up well.• Initial return on investment for the plans launchedin 2007 (CAP 2008).• Growth in property <strong>and</strong> liability insurance premiumincome similar to market growth in a tough competitiveenvironment.• Growth in Groupama Banque in line with objectives:445,000 new customers in 2008.• Groupama Asset Management results hit by thefinancial markets.FranceInternationalAsset management <strong>and</strong> Investment activities International life <strong>and</strong>health insurance France life <strong>and</strong> health insurance <strong>and</strong> discontinuedactivities International property <strong>and</strong> liability France property <strong>and</strong>casualty insurance

GROUPAMA2008 Activity Report023Insurance: surgein operating profitProperty <strong>and</strong> casualty insurance:combined ratios (1) in line with our objectivesKey figures forGroupama S.A.Insurance operating profit (1)(in cm)129469 (2)+50.3%705 (2)359–2 pts98.9% 96.9%+1 pt29.7% 30.7%69.2% 66.2%–3 pts+4.5 pts99.4%94.9%28.3% 28.5%+0.2 pt66.6% 70.9%+4.3 pts+0.5 pt97.5% 98.0%29.2% 29.7%+0.5 pt68.3% 68.3%The property <strong>and</strong> liability insurance economicoperating profit increased by +1.8% to €346 million,boosted by 13.2% growth in recurring investmentincome, which was largely due to recent acquisitions,<strong>and</strong> a stable net combined ratio of 98.0%.The life <strong>and</strong> health insurance economic operatingprofit increased by +€230 million as at31 December 2007.3402007Life <strong>and</strong> health insuranceProperty <strong>and</strong> liability insurance20083462007 2008 2007 20082007 2008France International <strong>and</strong> Overseas Total Groupama S.A.Operating expenses ratio Claims experience ratio(1) Combined ratio = (net claims expense + operating expenses) / net earned premiums(1) Economic operating profit (see appended definitions).(2) Insurance operating profit does not include the operatingprofit of investment activities, banking <strong>and</strong> holdingcompanies.Net profit hit by the crisis€ million 2007 2008 ChangeOperating profit from life <strong>and</strong> health insurance 129 359 >100%Operating profit from property<strong>and</strong> casualty insurance340 346 +1.8%Operating profit from investment activities <strong>and</strong> banking 11 1 N/AOperating profit from holding activities –105 –145 –38.1%Economic operating profit 375 561 49.6%Net realised capital gains (1) 484 34 –€450 mImpairment provision charges (1) 0 –138 –a138 mGains <strong>and</strong> losses on financial assets recognised14 –147 –a162 mat net fair value (1)Other costs <strong>and</strong> income –80 –37 53.8%Net profit 793 273 –65.6% (2)(1) Shareholder’s share (net of profit sharing <strong>and</strong> corporate income tax).(2) Down –57.9% excluding capital gains on SCOR shares in 2007 (€144 million).In the international financial crisis, the rise in operatingprofit was completely offset by the impact ofthe financial crisis, which amounted to €750 millionnet of profit sharing <strong>and</strong> corporate income tax.Groupama S.A. consolidated shareholders’ equityautomatically fell under IFRS to €3.2 billion downfrom €5.9 billion as at 31 December 2007.

GroupamaInnovationMagazine of <strong>innovation</strong>Focus on<strong>innovation</strong>Amaguiz.comGroupama launches“pay as you drive”Page 29PartnershipGroupama <strong>and</strong> Cegidcreate a joint-venturePage 30

026Why innovate?By Jean Azéma, Groupama’sChief Executive OfficerDITOrialn a globalised economy, a company’s capacity forI <strong>innovation</strong> is a key factor in its competitiveness <strong>and</strong>adaptability. For Groupama, innovating primarilymeans being attentive to the needs <strong>and</strong> expectationsof its members <strong>and</strong> customers. It also means being ableto decipher the changes in our societies to better anticipatethe risks it generates <strong>and</strong> provide appropriate solutions.As a forerunner <strong>and</strong> pioneer in risk prevention since 1955,<strong>and</strong> through local presence to protect people <strong>and</strong> property,Groupama has turned <strong>innovation</strong> into a major leverof differentiation <strong>and</strong> leadership. For the Group, findingideas, transforming those ideas into products <strong>and</strong> services,successfully marketing them, <strong>and</strong> constantly improvingits organisation <strong>and</strong> processes are ways of ensuring itsdevelopment <strong>and</strong> continuity. The Group confirmed this overrecent years by being the first to offer a direct home <strong>and</strong>vehicle repair service <strong>and</strong> by launching one of the firstoffers of personal assistance services offer under the nameFourmi Verte. It has continued to confirm this stance withthe recent launch of its direct insurance site Amaguiz.com <strong>and</strong> its Groupama Renfort cover for major setbacks.As further proof that <strong>innovation</strong> is ingrained in its culture,Groupama also took part in the creation of the Chairof Entrepreneurial Innovation – in partnership withhigher education institutions, enterprises <strong>and</strong> charteredaccountants – tasked with helping <strong>and</strong> supporting headsof VSE-SMEs in their choices. Groupama has also set upa pilot experiment of participative <strong>innovation</strong> involvingall employees. This section provides an overview of ourlatest <strong>innovation</strong>s for the benefit of our customers.

GROUPAMA2008 Activity Report027Groupama <strong>innovation</strong>Groupama launches the 1 st alert servicevia a satellite beacons a world first, Groupama has reached a new stage in the field of personal protection<strong>and</strong> assistance by offering an optimal safety level thanks to the emergencyAbeacon deployed by Sécurité Sans Frontières (SSF). This new global servicefocused on finding <strong>and</strong> assisting people in emergency situations rests on the carrier’sactivation of an emergency beacon weighing 280 grams. The assistance operations arelaunched by SSF as soon as the distress signal is received. Mutuaide Assistance – theGroupama subsidiary specialised in assistance – h<strong>and</strong>les the emergency assistance <strong>and</strong>repatriation operations. For the first time, expatriates, tourists <strong>and</strong> hikers now have cuttinedgetechnology coupled with personal assistance <strong>and</strong> emergency services worldwide.Groupama Santé Active always offering more!s France’s leading personal healthA insurer*, Groupama has launched anew version of its spearhead solutionGroupama Santé Active (Gan Evolution Santéfor the Gan Assurances network). This is a customisedoffer which enables everyone to choosea health cover suited to their age <strong>and</strong> situation;it offers more choice in terms of available cover,including alternative medicine, <strong>and</strong> affords betterprotection in the event of hospitalisation. Thereare no less than 180 possible cover combinationsto choose from, according to each person’sneeds <strong>and</strong> budget, for city healthcare, dental <strong>and</strong>optical care <strong>and</strong> hospitalisation costs – a thirdnewly created healthcare module. Other strongpoints include emphasis on prevention (dietaryconsultation, coverage of vaccines not availableunder the national health service, free annualdental check-up, help to stop smoking) <strong>and</strong>the coverage of healthcare not available underthe national health service such as osteopathy,dental implants <strong>and</strong> visual defect operations,not to mention access to a partner network of1,400 opticians <strong>and</strong> over 3,200 dental surgeons.The solution also includes support services followingchildbirth, health problems or the deathof a loved one.* Excluding mutual insurance companies coming underFrench code 45 <strong>and</strong> provident insurance institutions.

028Amaguiz.com, 100% Internet-based insuranceecoming the new-generation Internet-basedinsurer, recognised asBthe benchmark player – such is theobjective that Groupama set itself when itlaunched “Amaguiz.com” in July 2008. Abr<strong>and</strong> dedicated entirely to direct sales.In July 2008, Groupama launched its subsidiarydedicated to direct insurance salesvia the Internet. With its new “Amaguiz.com”site, its goal is to meet the needs of customerswanting an adaptable offer, at a pricecalculated according to their needs <strong>and</strong> atruly personalised relationship. The customers?A relatively young, urban populationof Internet users among whom Groupamawishes to increase its clientele. The site, whichHelp in findinga vehicle withAuto Nuevouto Nuevo is a service whichA enables customers whose vehiclehas been scrapped or stolento find a new or used vehicle with orwithout additional financing (such as a bankloan via Groupama Banque), instead offinancial compensation.was launched on 1 July 2008, rests on aspecific economic model based on the offerof a “customised” products <strong>and</strong> servicesoffering. By using a different approach tothe insurance business, “Amaguiz.com” canoffer extremely competitive prices. With thebacking of Groupama, the br<strong>and</strong> is bankingon personalised customer relationships <strong>and</strong>services via the Internet. Thus, right from theinitial quote phase, the customer is assignedan adviser for the duration of his/her contract.Following on from its “pay as you drive” motorinsurance, Amaguiz will gradually extend itsrange to cover all personal needs. An innovativehome insurance offer is expected inthe first half 2009, followed by health cover<strong>and</strong> everyday accident cover.• Spain: with Clickseguros.com, GroupamaSeguros is the leading 100% internetbasedinsurer on the Spanish market. Internetusers can take out motor insurance<strong>and</strong> deal with all aspects of their claims onthe web, with the help of a virtual assistantor a call centre if they wish.• Also in Great Britain: Groupama Insuranceshas launched Clickinsurance, aninternet sales channel for Multi-Risk Homeinsurance.Help with vehicleresale, the little extra thatmakes a big differencen a booming used vehicle market, Groupama is innovatingI <strong>and</strong> enhancing its range of products <strong>and</strong> services to coverthe entire lifecycle of a vehicle. By offering its policyholdersa 6-month mechanical breakdown cover on their vehicle if theysell it to a private individual, Groupama simply makes it easier forthem to sell their vehicle by securing the trust of potential buyers.As a finishing touch, if the buyers decide to insure their vehiclewith Groupama, the cover is extended free of charge for another6 months. A totally reassuring competitive advantage.

GROUPAMA2008 Activity Report029Groupama <strong>innovation</strong>Coping with major setbackss confirmed by numerous surveys,A in France the drop in buying poweris currently people’s prime concern.Because numerous people want toprotect themselves against life’s setbacks,Groupama has created “Groupama Renfort”.According to an IFOP-Groupama survey,68% of French people are confident in theirfuture. Yet 55% would take out personalinsurance – if it existed – to protect themselvesagainst a financial setback due to ajob loss, long period of sick leave or nonpaymentof a maintenance allowance. Tomeet these new expectations, Groupamahas designed “Groupama Renfort” – the firstinsurance <strong>and</strong> service product to protectone’s budget. A single contract covers lossof income due to the three above-mentionedevents. Policyholders receive financial compensationas well as appropriate advice toget back on their feet – legal cover, assistanceservices to draft a CV for example <strong>and</strong>useful information.Customised “pay as youdrive”, motor insurance offerhe “pay as you drive” concept – well-known in Great Britain <strong>and</strong> Italy – is partT of the key offering from Amaguiz.com. Through the installation of a device inthe vehicle, this system makes it possible to offer each customer a contract inkeeping with their vehicle use. An attractive proposition when increased fuel costs <strong>and</strong> adrop in purchasing power incite people to drive less. On a monthly basis, the cost of theinsurance comprises a flat-rate subscription fee plus a per-kilometre fee based on theprice agreed in the contract. The price per kilometre is calculated according to the typeof vehicle <strong>and</strong> the driver’s history, like in a classic insurance contract. With its adaptable,consumption-based pricing, “pay as you drive” is a new way of buying insurance, in linewith the current vehicle cost-control requirements.

030 GROUPAMA2008 Activity ReportPartnership with Cegid:timely solution to meet theexpectations of the VSE-SMEsroupama – France’s No. 3 SMEinsurance provider – <strong>and</strong> its GanGAssurances subsidiary intend toincrease their share of the VSE-SME market <strong>and</strong> establish closer relationswith chartered accountants. To this effect,at the end of 2007 the Group entered into aninnovative partnership with Cegid, France’sleading management software publisher.Given the increasingly complex social, fiscal<strong>and</strong> legal requirements, business managers<strong>and</strong> accountants need “intelligent” information<strong>and</strong> decision-making tools. The partnershipwith Cegid has given rise to the creation<strong>and</strong> supply of five innovative solutions whichprovide chartered accountants with a technologicallead <strong>and</strong> access to new expertise<strong>and</strong> business channels.DManager status: tool to simulate theimpacts of a change from employeestatus to self-employed status in termsof remuneration <strong>and</strong> social securitycoverage.creation of an Innovation Department:DComptanoo services: two information<strong>and</strong> service portals dedicated to entrepreneurs<strong>and</strong> chartered accountants.DCollective Agreements: enhancementof the services offered by Cegid’s payrollsoftware, in terms of social security, toincrease the firm’s expertise, provide itwith better coverage for its missions <strong>and</strong>save time in their implementation.DMarketing module for the accountingfirm: customer segmentation tool whichenables the firm to identify the needs<strong>and</strong> expectations of managers of VSE-SMEs.DTraining modules covering the h<strong>and</strong>lingof these new tools <strong>and</strong> providing businessspecificexpertise on their environment.The copyrights for these new tools <strong>and</strong>services are held by a joint-venture equallycontrolled by Groupama S.A. <strong>and</strong> CegidGroup.In December 2008, Groupama increased itsstake in the equity capital of the softwarepublisher to 23.86%.In 2007, Groupama S.A. set up a dedicated department to boost <strong>innovation</strong> initiatives, for <strong>innovation</strong>,within the scope of the Group’s strategy <strong>and</strong> projects.Gan Assurances,the national partnerof Réseau Entreprendreo assert its positioning with entrepreneurs setting up newT businesses or taking over existing ones, Gan Assuranceshas entered into a national partnership with Réseau Entreprendre.Its advisers will thus support the efforts undertaken by thisnetwork <strong>and</strong> offer their skills to project leaders to help them withthe successful set-up of their businesses. As a major player in theset-up of new companies, Gan Assurances’ clientele comprises over151,000 compagnies.

Deexit, thesocial securityblogn September 2008, Gan Eurocourtage,a Groupama subsidiaryIdedicated to brokerage, launcheddeexit.net, a blog dedicated to brokers workingin partnership with its Group InsuranceMarket Department. Given the extremely complex<strong>and</strong> constantly changing social securitysituation, Deexit brings brokers together on adaily basis <strong>and</strong> allows specialists to compareviewpoints, obtain information <strong>and</strong> debatecurrent professional issues.Every week, a lawyer specialising in social law,experts <strong>and</strong> managers of Gan Eurocourtageintroduce <strong>and</strong> lead a debate attended by brokersfrom Paris <strong>and</strong> French provincial areaswho visit the blog on a regular basis.Branchesof a third kindn 27 May 2008, Groupama ParisO Val de Loire opened the first of its20 insurance shops in the Frenchcapital. This is an unprecedented insuranceconcept-store model which focuses on conviviality<strong>and</strong> the interactive presentation ofproducts. This innovative approach fits intothe scope of one of Groupama’s strategicobjectives – to capture urban markets.

Conqueringnew horizons

Proximityresponsibilitysolidarity5,400Local mutualsAN INSURERCOMMITTED TOTHE LONG TERMcreated in84%of the employees Trustin the future of the Group1900P. 36_A sustainable development storyA policy of prevention ofP. 38_Satisfying our members <strong>and</strong> customers in the long termP. 40_Prevention, a culture of responsibilityc4.5 Mcontribution from the Fondation Groupama pour la santé50 years oldP. 44_A human resource policy based on employeecommitment, <strong>innovation</strong> <strong>and</strong> social responsibilityP. 48_A responsible investorP. 48_Eco-responsible buyer <strong>and</strong> consumer500,000 %credit line for customers of l’ADIE** Association pour le droit à l’initiative économiqueP. 49_A partner involved in economic <strong>and</strong> social developmentP. 51_Sponsorship: priority to health <strong>and</strong> cultureP. 53_Sports patronage

GROUPAMA2008 Activity Report035A committed insurerA lasting commitment to peopleGroupama, a mutual insurance group <strong>and</strong> locally-basedinsurer, is naturally socially responsible,by way of its very mission – providing supportin the face of life’s challenges, whether professionalor private – <strong>and</strong> the way it performs itsrole in a spirit of local effort, responsibility <strong>and</strong>solidarity. Concern for individuals is at the heartof the Group’s vocation; it is the company’s veryreason for being.At Groupama, a commitment to social responsibilityfor over 50 years has resulted in high investmentin prevention, the source of our business’s socialresponsibility activities. This strategic orientationhas a major effect on the implementation of thefirm’s three pillars of social responsibility:• from an economic st<strong>and</strong>point, seeking theGroup’s long-term growth <strong>and</strong> sustainableeconomic performance, specifically throughefficient governance. The Group’s history testifiesto its adaptability, pragmatism, <strong>and</strong> abilityto meet its customers’ long-term needs.Groupama confirms its responsible commitmentto offering products that address society’smajor challenges, such as managing social protectionissues (retirement, healthcare), longerlife expectancies (assistance, dependent care)<strong>and</strong> the needs of daily life. Specifically, for itspolicyholders, the responsibility approach ofthe insurance business line yields an activepolicy of preventing risks in terms of road safety,health, <strong>and</strong> home safety, both in the company<strong>and</strong> through locally-based groups;• from a social st<strong>and</strong>point,Groupama combats the risks of discrimination,provides care for people with disabilities, <strong>and</strong>supports equal opportunity: adherence to theUnited Nations Global Compact; the diversitycharter; signing of an agreement on diversity <strong>and</strong>people with disabilities; application of a Codeof Ethics; signing of the national agreement toemploy youths from underprivileged areas; thelaunch of an opinion survey among all workers;preventive health measures for employees, etc.Moreover, with its high level of recruitment <strong>and</strong>centralised structure, Groupama is participatingin the dynamics of its territories; as a good corporatecitizen, Groupama prevents social exclusion<strong>and</strong> has instituted measures to discourageinequality through numerous solidarity partnerships(with ADIE for micro-credit, with the MadagascarSolidarity Association, against medicaldesertification <strong>and</strong> illiteracy). The commitmentfor the common good also takes the form of scientific<strong>and</strong> cultural patronage (Groupama HealthFoundation, Groupama Gan Cinema Foundation,Risk Foundation);• from an environmental st<strong>and</strong>point, Groupama isengaged in preventing environmental risks amongfarmers, manufacturers <strong>and</strong> locally-based authorities<strong>and</strong> offers an entire range of agreementscovering the repair of environmental damage.This respect for the environment may also beseen in its desire to reduce the direct impactof the Group’s management of its facilities.Created in 2008, the Groupama S.A. Ethics <strong>and</strong>Sustainable Development Department is responsiblefor promoting <strong>and</strong> coordinating initiativesat Group level. This department benefits from acapacity for action <strong>and</strong> mobilisation, specificallyby promoting a network of correspondents fromall Group entities (regional mutuals, French <strong>and</strong>international subsidiaries).2009 was marked by the implementation of aGroup code of ethics. This will contribute to uniting<strong>and</strong> mobilising Group employees around itsaction principles, defining Groupama’s commitmentto ethics, <strong>and</strong> directing it towards goodpractices <strong>and</strong> the rules of conduct to be followedwith regard to members <strong>and</strong> customers, suppliers,among employees, <strong>and</strong> vis-à-vis the Company,the Group <strong>and</strong> society.All these elements contribute to the Company’ssocial responsibility approach, whichwill continue to be applied throughout theGroup.Sustainable Development WeekFrom 1 to 7 April 2008 Groupama participatedfor the first time in National SustainableDevelopment Week. To increase awareness <strong>and</strong>mobilise the Group’s employees as to the stakesof this issue, on this occasion Groupama soughtto emphasise its efforts involving health, roadsafety <strong>and</strong> eco-responsible behaviour.

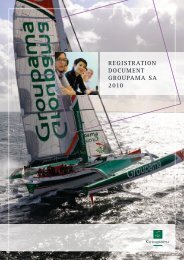

036 GROUPAMA2008 Activity ReporthistoryGroupama,a story ofsustainabledevelopmentFrom the birth of agriculturalmutual insurance to Groupama’semergence as a leading insurerin France, its developmentillustrates its ability to adapt<strong>and</strong> anticipate, dedicating itselfto member satisfaction. Createdin the 19th century to protect <strong>and</strong>serve farmers, agricultural mutualinsurance companies graduallybecame the main Europeanagricultural insurance method.Today, Groupama is a major multilinemutual insurance, banking <strong>and</strong>financial services group, with a widerange of customers <strong>and</strong> internationalactivities. The story continues…1900ANAGRICULTURALINSURANCEMUTUALDevelopment ofagricultural mutualinsurance <strong>and</strong> locallybasedmutuals.Agriculture represents80% of nationalwealth.1963A MULTI-LINEINSURERCoverage of allproperty risks;the Group quicklybecomes the leadinginsurer of Frenchcommunes.1972Launch of lifeinsurance.1986The largestagricultural insurancemutual takes thename Groupama.1995OPENING OF THESHAREHOLDERSTRUCTUREOpening ofmembership to allpolicyholders.1998A FRENCHLEADER ININSURANCEAND FINANCEAcquisition of Gan,France’s 4 th -largestinsurance company.The Group thuscontributes directlyto the restructuring ofthe French insurancesector. It is amongthe largest multi-lineinsurers in France.