GPG Interim Report 2005 - Guinness Peat Group plc

GPG Interim Report 2005 - Guinness Peat Group plc

GPG Interim Report 2005 - Guinness Peat Group plc

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

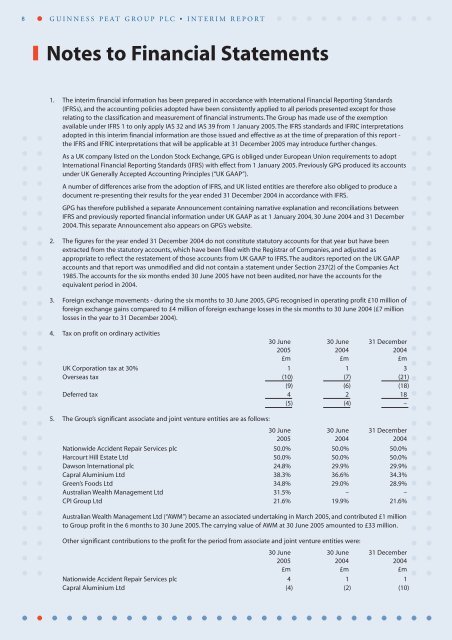

8 GUINNESS PEAT GROUP PLC • INTERIM REPORTNotes to Financial Statements1. The interim financial information has been prepared in accordance with International Financial <strong>Report</strong>ing Standards(IFRSs), and the accounting policies adopted have been consistently applied to all periods presented except for thoserelating to the classification and measurement of financial instruments. The <strong>Group</strong> has made use of the exemptionavailable under IFRS 1 to only apply IAS 32 and IAS 39 from 1 January <strong>2005</strong>. The IFRS standards and IFRIC interpretationsadopted in this interim financial information are those issued and effective as at the time of preparation of this report -the IFRS and IFRIC interpretations that will be applicable at 31 December <strong>2005</strong> may introduce further changes.As a UK company listed on the London Stock Exchange, <strong>GPG</strong> is obliged under European Union requirements to adoptInternational Financial <strong>Report</strong>ing Standards (IFRS) with effect from 1 January <strong>2005</strong>. Previously <strong>GPG</strong> produced its accountsunder UK Generally Accepted Accounting Principles (“UK GAAP”).A number of differences arise from the adoption of IFRS, and UK listed entities are therefore also obliged to produce adocument re-presenting their results for the year ended 31 December 2004 in accordance with IFRS.<strong>GPG</strong> has therefore published a separate Announcement containing narrative explanation and reconciliations betweenIFRS and previously reported financial information under UK GAAP as at 1 January 2004, 30 June 2004 and 31 December2004. This separate Announcement also appears on <strong>GPG</strong>’s website.2. The figures for the year ended 31 December 2004 do not constitute statutory accounts for that year but have beenextracted from the statutory accounts, which have been filed with the Registrar of Companies, and adjusted asappropriate to reflect the restatement of those accounts from UK GAAP to IFRS. The auditors reported on the UK GAAPaccounts and that report was unmodified and did not contain a statement under Section 237(2) of the Companies Act1985. The accounts for the six months ended 30 June <strong>2005</strong> have not been audited, nor have the accounts for theequivalent period in 2004.3. Foreign exchange movements - during the six months to 30 June <strong>2005</strong>, <strong>GPG</strong> recognised in operating profit £10 million offoreign exchange gains compared to £4 million of foreign exchange losses in the six months to 30 June 2004 (£7 millionlosses in the year to 31 December 2004).4. Tax on profit on ordinary activities30 June 30 June 31 December<strong>2005</strong> 2004 2004£m £m £mUK Corporation tax at 30% 1 1 3Overseas tax (10) (7) (21)(9) (6) (18)Deferred tax 4 2 18(5) (4) –5. The <strong>Group</strong>’s significant associate and joint venture entities are as follows:30 June 30 June 31 December<strong>2005</strong> 2004 2004Nationwide Accident Repair Services <strong>plc</strong> 50.0% 50.0% 50.0%Harcourt Hill Estate Ltd 50.0% 50.0% 50.0%Dawson International <strong>plc</strong> 24.8% 29.9% 29.9%Capral Aluminium Ltd 38.3% 36.6% 34.3%Green’s Foods Ltd 34.8% 29.0% 28.9%Australian Wealth Management Ltd 31.5% – –CPI <strong>Group</strong> Ltd 21.6% 19.9% 21.6%Australian Wealth Management Ltd (“AWM”) became an associated undertaking in March <strong>2005</strong>, and contributed £1 millionto <strong>Group</strong> profit in the 6 months to 30 June <strong>2005</strong>. The carrying value of AWM at 30 June <strong>2005</strong> amounted to £33 million.Other significant contributions to the profit for the period from associate and joint venture entities were:30 June 30 June 31 December<strong>2005</strong> 2004 2004£m £m £mNationwide Accident Repair Services <strong>plc</strong> 4 1 1Capral Aluminium Ltd (4) (2) (10)