Guinness Peat Group plc Cash Offer Facility for Staveley Industries plc

Guinness Peat Group plc Cash Offer Facility for Staveley Industries plc

Guinness Peat Group plc Cash Offer Facility for Staveley Industries plc

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

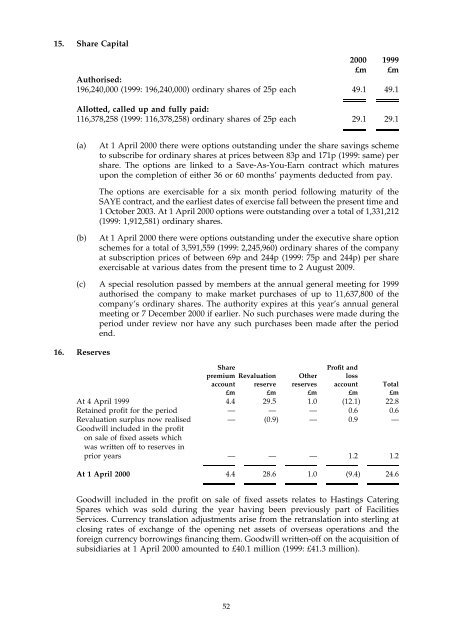

15. Share Capital2000 1999£m £mAuthorised:196,240,000 (1999: 196,240,000) ordinary shares of 25p each 49.1 49.1Allotted, called up and fully paid:116,378,258 (1999: 116,378,258) ordinary shares of 25p each 29.1 29.1(a)At 1 April 2000 there were options outstanding under the share savings schemeto subscribe <strong>for</strong> ordinary shares at prices between 83p and 171p (1999: same) pershare. The options are linked to a Save-As-You-Earn contract which maturesupon the completion of either 36 or 60 months’ payments deducted from pay.The options are exercisable <strong>for</strong> a six month period following maturity of theSAYE contract, and the earliest dates of exercise fall between the present time and1 October 2003. At 1 April 2000 options were outstanding over a total of 1,331,212(1999: 1,912,581) ordinary shares.(b)At 1 April 2000 there were options outstanding under the executive share optionschemes <strong>for</strong> a total of 3,591,559 (1999: 2,245,960) ordinary shares of the companyat subscription prices of between 69p and 244p (1999: 75p and 244p) per shareexercisable at various dates from the present time to 2 August 2009.(c) A special resolution passed by members at the annual general meeting <strong>for</strong> 1999authorised the company to make market purchases of up to 11,637,800 of thecompany’s ordinary shares. The authority expires at this year’s annual generalmeeting or 7 December 2000 if earlier. No such purchases were made during theperiod under review nor have any such purchases been made after the periodend.16. ReservesSharepremiumaccountProfit andlossaccountRevaluationreserveOtherreservesTotal£m £m £m £m £mAt 4 April 1999 4.4 29.5 1.0 (12.1) 22.8Retained profit <strong>for</strong> the period — — — 0.6 0.6Revaluation surplus now realised — (0.9) — 0.9 —Goodwill included in the profiton sale of fixed assets whichwas written off to reserves inprior years — — — 1.2 1.2At 1 April 2000 4.4 28.6 1.0 (9.4) 24.6Goodwill included in the profit on sale of fixed assets relates to Hastings CateringSpares which was sold during the year having been previously part of FacilitiesServices. Currency translation adjustments arise from the retranslation into sterling atclosing rates of exchange of the opening net assets of overseas operations and the<strong>for</strong>eign currency borrowings financing them. Goodwill written-off on the acquisition ofsubsidiaries at 1 April 2000 amounted to £40.1 million (1999: £41.3 million).52