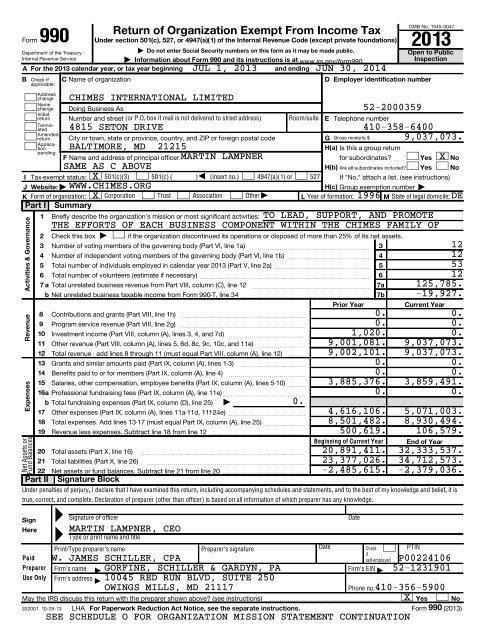

Form 990 - Chimes International Limited

Form 990 - Chimes International Limited

Form 990 - Chimes International Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Form</strong> <strong>990</strong> (2013)CHIMES INTERNATIONAL LIMITED 52-2000359Part III Statement of Program Service Accomplishments1Check if Schedule O contains a response or note to any line in this Part III Briefly describe the organization’s mission:TO LEAD, SUPPORT, AND PROMOTE THE EFFORTS OF EACH BUSINESS COMPONENTWITHIN THE CHIMES FAMILY OF SERVICES. (SEE SCHEDULE O FOR COMPLETEDESCRIPTION)Page 2X2344aDid the organization undertake any significant program services during the year which were not listed onthe prior <strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ?If "Yes," describe these new services on Schedule O.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization cease conducting, or make significant changes in how it conducts, any program services? ~~~~~~If "Yes," describe these changes on Schedule O.Describe the organization’s program service accomplishments for each of its three largest program services, as measured by expenses.Section 501(c)(3) and 501(c)(4) organizations are required to report the amount of grants and allocations to others, the total expenses, andrevenue, if any, for each program service reported.8,911,288.SUPPORTING ORGANIZATION:CHIMES INTERNATIONAL PROVIDES ACCOUNTING, PAYROLL, RISK MANAGEMENT, ANDOTHER MANAGEMENT SERVICES TO 11 RELATED ENTITIES THROUGHOUT THEMID-ATLANTIC AND IN ISRAEL. IN ADDITION TO DIRECT SUPPORT OF ITSRELATED ORGANIZATIONS IT TAKES AN ACTIVE ADVOCACY ROLE ON BEHALF OF THEPEOPLE IT SERVES. MANY MEMBERS OF ITS MANAGEMENT TEAM SERVE ON BOARDSOF LOCAL AND NATIONAL ORGANIZATIONS SUPPORTING THE NEEDS OF PEOPLE WITHDISABILITIES.( Code: ) ( Expenses $ including grants of $ ) ( Revenue $)YesYesXXNoNo4b( Code: ) ( Expenses $ including grants of $ ) ( Revenue $)4c( Code: ) ( Expenses $ including grants of $ ) ( Revenue $)4d4e33200210-29-13Other program services (Describe in Schedule O.)( Expenses $ including grants of $ ) ( Revenue $)Total program service expenses |<strong>Form</strong> <strong>990</strong> (2013)

<strong>Form</strong> <strong>990</strong> (2013)CHIMES INTERNATIONAL LIMITED 52-2000359Part IV Checklist of Required Schedules (continued)21222324a262728293031323334363738bcd25aSection 501(c)(3) and 501(c)(4) organizations. Did the organization engage in an excess benefit transaction with adisqualified person during the year? If "Yes," complete Schedule L, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~babcbDid the organization report more than $5,000 of grants or other assistance to any domestic organization orgovernment on Part IX, column (A), line 1? If "Yes," complete Schedule I, Parts I and II ~~~~~~~~~~~~~~~~~~Did the organization report more than $5,000 of grants or other assistance to individuals in the United States on Part IX,column (A), line 2? If "Yes," complete Schedule I, Parts I and III ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization answer "Yes" to Part VII, Section A, line 3, 4, or 5 about compensation of the organization’s currentand former officers, directors, trustees, key employees, and highest compensated employees? If "Yes," completeSchedule J ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization have a tax-exempt bond issue with an outstanding principal amount of more than $100,000 as of thelast day of the year, that was issued after December 31, 2002? If "Yes," answer lines 24b through 24d and completeSchedule K. If "No", go to line 25a ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization invest any proceeds of tax-exempt bonds beyond a temporary period exception? ~~~~~~~~~~~Did the organization maintain an escrow account other than a refunding escrow at any time during the year to defeaseany tax-exempt bonds? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization act as an "on behalf of" issuer for bonds outstanding at any time during the year? ~~~~~~~~~~~Is the organization aware that it engaged in an excess benefit transaction with a disqualified person in a prior year, andthat the transaction has not been reported on any of the organization’s prior <strong>Form</strong>s <strong>990</strong> or <strong>990</strong>-EZ? If "Yes," completeSchedule L, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization report any amount on Part X, line 5, 6, or 22 for receivables from or payables to any current orformer officers, directors, trustees, key employees, highest compensated employees, or disqualified persons? If so,complete Schedule L, Part II ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization provide a grant or other assistance to an officer, director, trustee, key employee, substantialcontributor or employee thereof, a grant selection committee member, or to a 35% controlled entity or family memberof any of these persons? If "Yes," complete Schedule L, Part III ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Was the organization a party to a business transaction with one of the following parties (see Schedule L, Part IVinstructions for applicable filing thresholds, conditions, and exceptions):A current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L, Part IV ~~~~~~~~~~~A family member of a current or former officer, director, trustee, or key employee? If "Yes," complete Schedule L, Part IV ~~An entity of which a current or former officer, director, trustee, or key employee (or a family member thereof) was an officer,director, trustee, or direct or indirect owner? If "Yes," complete Schedule L, Part IV~~~~~~~~~~~~~~~~~~~~~Did the organization receive more than $25,000 in non-cash contributions? If "Yes," complete Schedule M ~~~~~~~~~Did the organization receive contributions of art, historical treasures, or other similar assets, or qualified conservationcontributions? If "Yes," complete Schedule M ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization liquidate, terminate, or dissolve and cease operations?If "Yes," complete Schedule N, Part I ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization sell, exchange, dispose of, or transfer more than 25% of its net assets? If "Yes," completeSchedule N, Part II ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization own 100% of an entity disregarded as separate from the organization under Regulationssections 301.7701-2 and 301.7701-3? If "Yes," complete Schedule R, Part I ~~~~~~~~~~~~~~~~~~~~~~~~Was the organization related to any tax-exempt or taxable entity? If "Yes," complete Schedule R, Part II, III, or IV, andPart V, line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~35aDid the organization have a controlled entity within the meaning of section 512(b)(13)?~~~~~~~~~~~~~~~~~~If "Yes" to line 35a, did the organization receive any payment from or engage in any transaction with a controlled entitywithin the meaning of section 512(b)(13)? If "Yes," complete Schedule R, Part V, line 2 ~~~~~~~~~~~~~~~~~~~Section 501(c)(3) organizations. Did the organization make any transfers to an exempt non-charitable related organization?If "Yes," complete Schedule R, Part V, line 2 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization conduct more than 5% of its activities through an entity that is not a related organizationand that is treated as a partnership for federal income tax purposes? If "Yes," complete Schedule R, Part VI ~~~~~~~~Did the organization complete Schedule O and provide explanations in Schedule O for Part VI, lines 11b and 19?Note. All <strong>Form</strong> <strong>990</strong> filers are required to complete Schedule O 21222324a24b24c24d25a25b262728a28b28c29303132333435a35b3637YesXXPage 4NoXXXXXXXXXXXXXXXXXX38 X<strong>Form</strong> <strong>990</strong> (2013)33200410-29-13

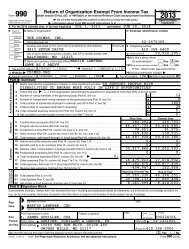

<strong>Form</strong> <strong>990</strong> (2013)CHIMES INTERNATIONAL LIMITED 52-2000359 Page 7Part VII Compensation of Officers, Directors, Trustees, Key Employees, Highest CompensatedEmployees, and Independent ContractorsCheck if Schedule O contains a response or note to any line in this Part VII Section A.¥ List all of the organization’s current officers, directors, trustees (whether individuals or organizations), regardless of amount of compensation.Enter -0- in columns (D), (E), and (F) if no compensation was paid.¥ List all of the organization’s current key employees, if any. See instructions for definition of "key employee."¥ List the organization’s five current highest compensated employees (other than an officer, director, trustee, or key employee) who received reportablecompensation (Box 5 of <strong>Form</strong> W-2 and/or Box 7 of <strong>Form</strong> 1099-MISC) of more than $100,000 from the organization and any related organizations.¥ List all of the organization’s former officers, key employees, and highest compensated employees who received more than $100,000 ofreportable compensation from the organization and any related organizations.¥ List all of the organization’s former directors or trustees that received, in the capacity as a former director or trustee of the organization,more than $10,000 of reportable compensation from the organization and any related organizations.List persons in the following order: individual trustees or directors; institutional trustees; officers; key employees; highest compensated employees;and former such persons.332007 10-29-13Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees1a Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the organization’s tax year.Check this box if neither the organization nor any related organization compensated any current officer, director, or trustee.(A) (B) (C) (D) (E) (F)Name and TitleAveragehours perweek(list anyhours forrelatedorganizationsbelowline)Position(do not check more than onebox, unless person is both anofficer and a director/trustee)Individual trustee or directorInstitutional trusteeOfficerKey employeeHighest compensatedemployee<strong>Form</strong>erReportablecompensationfromtheorganization(W-2/1099-MISC)Reportablecompensationfrom relatedorganizations(W-2/1099-MISC)Estimatedamount ofothercompensationfrom theorganizationand relatedorganizations(1) PATRICK J. BAGLEY 1.20CHAIRPERSON 1.60 X X 0. 0. 0.(2) BOBBY G. EDMONDSON 1.00VICE CHAIRPERSON/GOVERNANC 1.80 X X 0. 0. 0.(3) ARTHUR C. GEORGE 1.00VICE CHAIRPERSON/NOMINATIN 1.80 X X 0. 0. 0.(4) MICHAEL MAY 0.10SECRETARY/TREASURER 1.60 X X 0. 0. 0.(5) MATTHEW KAPLOWITZ 2.00DIRECTOR 0.00 X 0. 0. 0.(6) KAREN D. MCGRAW 2.00VICE CHAIRPERSON/COMPENSAT 0.00 X X 0. 0. 0.(7) ARTHUR D. SMITH, PH.D. 2.00DIRECTOR 0.00 X 0. 0. 0.(8) DOUGLAS M. SCHMIDT 1.00DIRECTOR 1.20 X 0. 0. 0.(9) GEORGE ZUMBANO, ESQ. 1.00DIRECTOR 2.00 X 0. 0. 0.(10) JUDITH I. MARTINAK 2.00DIRECTOR 2.00 X 0. 0. 0.(11) ASTRID SCHMIDT-KING, J.D., LL.M 2.00DIRECTOR 2.00 X 0. 0. 0.(12) JOHN J. VILLANI 2.00DIRECTOR 2.00 X 0. 0. 0.(13) MARTIN LAMPNER, CPA 40.00PRESIDENT/CEO 38.00 X 326,239. 0. 127,402.(14) MARY T. COLLARD 40.00EXEC VP/COO/CORE SVS/ASST SEC 38.00 X 230,399. 0. 11,354.(15) SHAWNA M. GOTTLIEB 40.00ASST TREASURER/CFO 38.00 X 185,534. 0. 6,023.(16) ALBERT BUSSONE 0.10VICE PRESIDENT/CHIEF DEVEL 45.00 X 212,920. 0. 28,768.(17) CECIL FOX 40.00SPECIAL ASST 2.00 X 104,410. 0. 14,440.<strong>Form</strong> <strong>990</strong> (2013)

<strong>Form</strong> <strong>990</strong> (2013)CHIMES INTERNATIONAL LIMITED 52-2000359 Page 8Part VII Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued)(A) (B)(C)(D) (E) (F)Name and titleAverage Position(do not check more than one ReportableReportable Estimatedhours per box, unless person is both an compensation compensation amount ofweek officer and a director/trustee)fromfrom relatedother(list anytheorganizations compensationhours fororganization (W-2/1099-MISC) from therelated(W-2/1099-MISC)organizationorganizationsand relatedbeloworganizationsline)Individual trustee or directorInstitutional trusteeOfficer(18) ALEXIS MELIN 40.00SP. ASST TO PRESIDENT 0.00 X 112,531. 0. 3,384.(19) JONATHON TURNBAUGH 40.00DIRECTOR OF FACILITIES 0.00 X 117,073. 0. 3,559.(20) RICHARD GONSMAN 40.00DIRECTOR, INFORMATION SYST 0.00 X 113,034. 0. 3,403.(21) SUZANNE CHRISTIE 40.00DIRECTOR, HUMAN RESOURCE M 0.00 X 122,263. 0. 3,692.Key employeeHighest compensatedemployee<strong>Form</strong>er1b234cd33200810-29-13Sub-total~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |Total from continuation sheets to Part VII, Section A ~~~~~~~~~~ |Total (add lines 1b and 1c) |Did the organization list any former officer, director, or trustee, key employee, or highest compensated employee online 1a? If "Yes," complete Schedule J for such individual ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~5 Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual for servicesrendered to the organization? If "Yes," complete Schedule J for such person Section B. Independent Contractors1(A) (B) (C)Name and business address Description of services CompensationRIGGS, COUNSELMAN, MICHAELS AND DOWNS, INC. THIRD PARTY ADMIN555 FAIRMOUNT AVE., BALTIMORE, MD 21286-549FOR INSURANCE 1,840,230.OFFIT KURMAN ATTORNEYS AT LAW, 8171 MAPLELAWN BLVD., STE 200, MAPLE LAWN, MD 20759 LEGAL SERVICES 365,531.AVF CONSULTING,INC., 1220 EAST JOPPAROAD,BUILDING C, SUITE 514, TOWSON, MD COMPUTER CONSULTANT 127,832.TBC SOFTWARE, INC., 3410 SOUTHWEST VANBUREN ST., TOPEKA, KS 66611 COMPUTER CONSULTANT 121,380.NEVINS & ASSOCIATES CHARTERED32 WEST ROAD,SUITE 310, TOWSON, MD 21204 PUBLIC RELATIONS 101,757.2Total number of individuals (including but not limited to those listed above) who received more than $100,000 of reportablecompensation from the organization |For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the organizationand related organizations greater than $150,000? If "Yes," complete Schedule J for such individual~~~~~~~~~~~~~Complete this table for your five highest compensated independent contractors that received more than $100,000 of compensation fromthe organization. Report compensation for the calendar year ending with or within the organization’s tax year.Total number of independent contractors (including but not limited to those listed above) who received more than$100,000 of compensation from the organization |51,524,403. 0. 202,025.0. 0. 0.1,524,403. 0. 202,025.345YesX10NoXX<strong>Form</strong> <strong>990</strong> (2013)

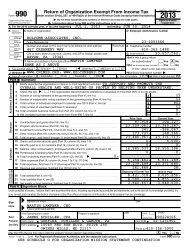

<strong>Form</strong> <strong>990</strong> (2013)CHIMES INTERNATIONAL LIMITED 52-2000359Part VIII Statement of RevenueContributions, Gifts, Grantsand Other Similar AmountsProgram ServiceRevenueOther Revenue1 a1233200910-29-13bcdefg Noncash contributions included in lines 1a-1f: $h2 a345bcdefg6 abcdbcd8 abc9 abc10 abc1a1b1c1d1e1fTotal. Add lines 1a-1f |Business CodeTotal. Add lines 2a-2f |abababMiscellaneous RevenueBusiness Code11 a MANAGEMENT FEES 541900 8,896,089.8,816,478. 79,611.b PRINTING INCOME 323100 77,520. 31,346. 46,174.c OTHER INCOME 900099 63,464. 63,464.dGovernment grants (contributions)All other contributions, gifts, grants, andsimilar amounts not included above ~~e Total. Add lines 11a-11d ~~~~~~~~~~~~~~~ |Total revenue. See instructions. |Page 9Check if Schedule O contains a response or note to any line in this Part VIII (A) (B) (C) (D)Total revenue Related or Unrelated Revenue excludedexempt function businessfrom tax undersectionsrevenue revenue 512 - 514Federated campaignsMembership dues~~~~~~~~~~~~~~Fundraising events ~~~~~~~~Related organizations~~~~~~All other program service revenue ~~~~~Investment income (including dividends, interest, andother similar amounts) ~~~~~~~~~~~~~~~~~ |Income from investment of tax-exempt bond proceedsRoyalties |Gross rents~~~~~~~Less: rental expenses~~~Rental income or (loss)~~Net rental income or (loss)7 a Gross amount from sales ofassets other than inventoryLess: cost or other basisand sales expenses~~~Gain or (loss) ~~~~~~~(i) Real|(ii) Personal |(i) Securities(ii) OtherNet gain or (loss) |Gross income from fundraising events (notincluding $ofcontributions reported on line 1c). SeePart IV, line 18 ~~~~~~~~~~~~~Less: direct expenses~~~~~~~~~~Net income or (loss) from fundraising events |Gross income from gaming activities. SeePart IV, line 19 ~~~~~~~~~~~~~Less: direct expenses~~~~~~~~~Net income or (loss) from gaming activitiesGross sales of inventory, less returnsand allowances ~~~~~~~~~~~~~Less: cost of goods sold~~~~~~~~ |Net income or (loss) from sales of inventory |All other revenue ~~~~~~~~~~~~~9,037,073.9,037,073.8,911,288. 125,785. 0.<strong>Form</strong> <strong>990</strong> (2013)

<strong>Form</strong> <strong>990</strong> (2013)CHIMES INTERNATIONAL LIMITED 52-2000359Part IX Statement of Functional ExpensesSection 501(c)(3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column (A).Check if Schedule O contains a response or note to any line in this Part IX Do not include amounts reported on lines 6b,(A) (B) (C) (D)Total expenses Program service Management and Fundraising7b, 8b, 9b, and 10b of Part VIII.expenses general expenses expenses1 Grants and other assistance to governments andorganizations in the United States. See Part IV, line 2123456789101112131415161718192021222324abcdefgabcdGrants and other assistance to individuals inthe United States. See Part IV, line 22 ~~~Grants and other assistance to governments,organizations, and individuals outside theUnited States. See Part IV, lines 15 and 16 ~Benefits paid to or for members ~~~~~~~Compensation of current officers, directors,trustees, and key employees ~~~~~~~~Compensation not included above, to disqualifiedpersons (as defined under section 4958(f)(1)) andpersons described in section 4958(c)(3)(B)Other salaries and wages ~~~~~~~~~~Pension plan accruals and contributions (includesection 401(k) and 403(b) employer contributions)Lobbying ~~~~~~~~~~~~~~~~~~Professional fundraising services. See Part IV, line 17Investment management fees ~~~~~~~~Other. (If line 11g amount exceeds 10% of line 25,column (A) amount, list line 11g expenses on Sch O.)Insurance ~~~~~~~~~~~~~~~~~Other expenses. Itemize expenses not coveredabove. (List miscellaneous expenses in line 24e. If line24e amount exceeds 10% of line 25, column (A)e All other expenses25 Total functional expenses. Add lines 1 through 24e26 Joint costs. Complete this line only if the organizationreported in column (B) joint costs from a combinededucational campaign and fundraising solicitation.Check here | if following SOP 98-2 (ASC 958-720)332010 10-29-13~~~Other employee benefits ~~~~~~~~~~Payroll taxes ~~~~~~~~~~~~~~~~Fees for services (non-employees):Management ~~~~~~~~~~~~~~~~Legal ~~~~~~~~~~~~~~~~~~~~Accounting ~~~~~~~~~~~~~~~~~Advertising and promotion~~~~~~~~~Office expenses~~~~~~~~~~~~~~~Information technology ~~~~~~~~~~~Royalties ~~~~~~~~~~~~~~~~~~Occupancy ~~~~~~~~~~~~~~~~~Travel~~~~~~~~~~~~~~~~~~~Payments of travel or entertainment expensesfor any federal, state, or local public officialsConferences, conventions, and meetings ~~Interest~~~~~~~~~~~~~~~~~~Payments to affiliates ~~~~~~~~~~~~Depreciation, depletion, and amortization ~~1,374,339. 1,374,339.2,064,160. 2,064,160.86,782. 86,782.189,059. 189,059.145,151. 145,151.240,648. 240,648.56,695. 56,695.367,374. 367,374.533,339. 533,339.190,030. 190,030.61,326. 61,326.164,311. 164,311.598,566. 598,566.1,837,636. 1,837,636.amount, list line 24e expenses on Schedule O.) ~~REPAIRS AND MAINTENANCE 746,023. 746,023.LICENSES & FEES 136,460. 136,460.TEMPORARY STAFF 52,762. 52,762.PUBLIC RELATIONS 36,485. 36,485.Page 1049,348. 49,348.8,930,494. 0. 8,930,494. 0.<strong>Form</strong> <strong>990</strong> (2013)

<strong>Form</strong> <strong>990</strong> (2013)CHIMES INTERNATIONAL LIMITED 52-2000359 Page 11Part X Balance SheetNet Assets or Fund BalancesLiabilitiesAssetsCheck if Schedule O contains a response or note to any line in this Part X (A)(B)Beginning of yearEnd of year1 Cash - non-interest-bearing ~~~~~~~~~~~~~~~~~~~~~~~~~ 694,719. 1 1,696,417.2 Savings and temporary cash investments ~~~~~~~~~~~~~~~~~~23 Pledges and grants receivable, net ~~~~~~~~~~~~~~~~~~~~~34 Accounts receivable, net ~~~~~~~~~~~~~~~~~~~~~~~~~~56,188. 4 108,067.5 Loans and other receivables from current and former officers, directors,trustees, key employees, and highest compensated employees. CompletePart II of Schedule L ~~~~~~~~~~~~~~~~~~~~~~~~~~~~56 Loans and other receivables from other disqualified persons (as defined undersection 4958(f)(1)), persons described in section 4958(c)(3)(B), and contributingemployers and sponsoring organizations of section 501(c)(9) voluntary7employees’ beneficiary organizations (see instr). Complete Part II of Sch L ~~Notes and loans receivable, net ~~~~~~~~~~~~~~~~~~~~~~~678 Inventories for sale or use ~~~~~~~~~~~~~~~~~~~~~~~~~~89 Prepaid expenses and deferred charges ~~~~~~~~~~~~~~~~~~ 369,001. 9 197,946.10aLand, buildings, and equipment: cost or otherbasis. Complete Part VI of Schedule D ~~~ 10a 7,420,293.b Less: accumulated depreciation ~~~~~~ 10b 5,898,673. 1,953,988. 10c 1,521,620.1112Investments - publicly traded securities ~~~~~~~~~~~~~~~~~~~Investments - other securities. See Part IV, line 11 ~~~~~~~~~~~~~~111213 Investments - program-related. See Part IV, line 11 ~~~~~~~~~~~~~1314 Intangible assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~1415 Other assets. See Part IV, line 11 ~~~~~~~~~~~~~~~~~~~~~~ 17,817,515. 15 28,809,487.16 Total assets. Add lines 1 through 15 (must equal line 34) 20,891,411. 16 32,333,537.17 Accounts payable and accrued expenses ~~~~~~~~~~~~~~~~~~ 3,847,404. 17 3,058,584.1819Grants payable ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Deferred revenue ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~181920 Tax-exempt bond liabilities ~~~~~~~~~~~~~~~~~~~~~~~~~2021 Escrow or custodial account liability. Complete Part IV of Schedule D ~~~~2122 Loans and other payables to current and former officers, directors, trustees,key employees, highest compensated employees, and disqualified persons.Complete Part II of Schedule L ~~~~~~~~~~~~~~~~~~~~~~~2223 Secured mortgages and notes payable to unrelated third parties ~~~~~~ 4,964,286. 23 9,588,541.24 Unsecured notes and loans payable to unrelated third parties ~~~~~~~~2425 Other liabilities (including federal income tax, payables to related thirdparties, and other liabilities not included on lines 17-24). Complete Part X of26Schedule D ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 14,565,336. 25 22,065,448.Total liabilities. Add lines 17 through 25 23,377,026. 26 34,712,573.Organizations that follow SFAS 117 (ASC 958), check here | X andcomplete lines 27 through 29, and lines 33 and 34.27 Unrestricted net assets ~~~~~~~~~~~~~~~~~~~~~~~~~~~ -2,485,615. 27 -2,379,036.2829Temporarily restricted net assetsPermanently restricted net assets~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~2829Organizations that do not follow SFAS 117 (ASC 958), check here |and complete lines 30 through 34.3031Capital stock or trust principal, or current funds ~~~~~~~~~~~~~~~Paid-in or capital surplus, or land, building, or equipment fund ~~~~~~~~303132 Retained earnings, endowment, accumulated income, or other funds ~~~~3233 Total net assets or fund balances ~~~~~~~~~~~~~~~~~~~~~~ -2,485,615. 33 -2,379,036.34 Total liabilities and net assets/fund balances 20,891,411. 34 32,333,537.<strong>Form</strong> <strong>990</strong> (2013)33201110-29-13

<strong>Form</strong> <strong>990</strong> (2013)CHIMES INTERNATIONAL LIMITED 52-2000359 Page 12Part XI Reconciliation of Net AssetsCheck if Schedule O contains a response or note to any line in this Part XI 1234567892abcbTotal revenue (must equal Part VIII, column (A), line 12)Total expenses (must equal Part IX, column (A), line 25) ~~~~~~~~~~~~~~~~~~~~~~~~~~Revenue less expenses. Subtract line 2 from line 1~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Net assets or fund balances at beginning of year (must equal Part X, line 33, column (A)) ~~~~~~~~~~Net unrealized gains (losses) on investmentsDonated services and use of facilitiesInvestment expensesPrior period adjustments~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other changes in net assets or fund balances (explain in Schedule O) ~~~~~~~~~~~~~~~~~~~10 Net assets or fund balances at end of year. Combine lines 3 through 9 (must equal Part X, line 33,column (B)) 10 -2,379,036.Part XII Financial Statements and ReportingCheck if Schedule O contains a response or note to any line in this Part XII XYes No1 Accounting method used to prepare the <strong>Form</strong> <strong>990</strong>: Cash X Accrual OtherIf the organization changed its method of accounting from a prior year or checked "Other," explain in Schedule O.Were the organization’s financial statements compiled or reviewed by an independent accountant? ~~~~~~~~~~~~If "Yes," check a box below to indicate whether the financial statements for the year were compiled or reviewed on aseparate basis, consolidated basis, or both:Separate basis Consolidated basis Both consolidated and separate basisWere the organization’s financial statements audited by an independent accountant? ~~~~~~~~~~~~~~~~~~~If "Yes," check a box below to indicate whether the financial statements for the year were audited on a separate basis,consolidated basis, or both:Separate basis X Consolidated basis Both consolidated and separate basisIf "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of the audit,review, or compilation of its financial statements and selection of an independent accountant?~~~~~~~~~~~~~~~If the organization changed either its oversight process or selection process during the tax year, explain in Schedule O.3aAs a result of a federal award, was the organization required to undergo an audit or audits as set forth in the Single AuditAct and OMB Circular A-133? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes," did the organization undergo the required audit or audits? If the organization did not undergo the required auditor audits, explain why in Schedule O and describe any steps taken to undergo such audits1234567899,037,073.8,930,494.106,579.-2,485,615.2a2b2c3aXX0.XX3b<strong>Form</strong> <strong>990</strong> (2013)33201210-29-13

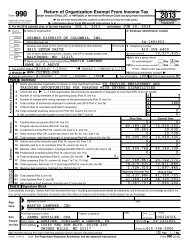

OMB No. 1545-0047SCHEDULE A(<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ)Public Charity Status and Public SupportComplete if the organization is a section 501(c)(3) organization or a section 20134947(a)(1) nonexempt charitable trust.Department of the Treasury| Attach to <strong>Form</strong> <strong>990</strong> or <strong>Form</strong> <strong>990</strong>-EZ.Open to PublicInternal Revenue Service| Information about Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) and its instructions is at www.irs.gov/form<strong>990</strong>. InspectionName of the organizationEmployer identification numberCHIMES INTERNATIONAL LIMITED 52-2000359Part I Reason for Public Charity Status (All organizations must complete this part.) See instructions.The organization is not a private foundation because it is: (For lines 1 through 11, check only one box.)1234567891011efghXXA church, convention of churches, or association of churches described in section 170(b)(1)(A)(i).A school described in section 170(b)(1)(A)(ii). (Attach Schedule E.)A hospital or a cooperative hospital service organization described in section 170(b)(1)(A)(iii).A medical research organization operated in conjunction with a hospital described in section 170(b)(1)(A)(iii). Enter the hospital’s name,city, and state:An organization operated for the benefit of a college or university owned or operated by a governmental unit described insection 170(b)(1)(A)(iv). (Complete Part II.)A federal, state, or local government or governmental unit described in section 170(b)(1)(A)(v).An organization that normally receives a substantial part of its support from a governmental unit or from the general public described insection 170(b)(1)(A)(vi). (Complete Part II.)A community trust described in section 170(b)(1)(A)(vi). (Complete Part II.)An organization that normally receives: (1) more than 33 1/3% of its support from contributions, membership fees, and gross receipts fromactivities related to its exempt functions - subject to certain exceptions, and (2) no more than 33 1/3% of its support from gross investmentincome and unrelated business taxable income (less section 511 tax) from businesses acquired by the organization after June 30, 1975.See section 509(a)(2). (Complete Part III.)An organization organized and operated exclusively to test for public safety. See section 509(a)(4).An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of one ormore publicly supported organizations described in section 509(a)(1) or section 509(a)(2). See section 509(a)(3). Check the box thatdescribes the type of supporting organization and complete lines 11e through 11h.a Type I b Type II c X Type III - Functionally integrated d Type III - Non-functionally integratedBy checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons other thanfoundation managers and other than one or more publicly supported organizations described in section 509(a)(1) or section 509(a)(2).If the organization received a written determination from the IRS that it is a Type I, Type II, or Type IIIsupporting organization, check this boxSince August 17, 2006, has the organization accepted any gift or contribution from any of the following persons?(i)(ii)(iii)~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~A person who directly or indirectly controls, either alone or together with persons described in (ii) and (iii) below,the governing body of the supported organization?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~A family member of a person described in (i) above? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~A 35% controlled entity of a person described in (i) or (ii) above? ~~~~~~~~~~~~~~~~~~~~~~~~Provide the following information about the supported organization(s).Yes11g(i) X11g(ii) X11g(iii) XNoX(i) Name of supported (ii) EIN (iii) Type of organization (iv) Is the organization (v) Did you notify the (vi) Is the(vii)(described on lines 1-9 in col. (i) listed in your organization in col.organization in col.Amount of monetaryorganization(i) organized in the supportabove or IRC section governing document? (i) of your support? U.S.?(see instructions) )Yes No Yes No Yes NoCHIMES METRO,INC. 52-1773885509(A)(1) X X X 1,548,000.CHIMESVIRGINIA, IN54-1691952509(A)(1) X X X 315,000.HOLCOMBASSOCIATES, 23-2093566509(A)(1) X X X 240,000.CHIMES, INC.52-0575305509(A)(1) X X X 1,760,004.CHIMESDISTRICT OF 54-1691953509(A)(1) X X X 4,953,474.TotalLHA For Paperwork Reduction Act Notice, see the Instructions for<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ.33202109-25-135 8,816,478.Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013

Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359 Page 2Part II Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A)(vi)(Complete only if you checked the box on line 5, 7, or 8 of Part I or if the organization failed to qualify under Part III. If the organizationfails to qualify under the tests listed below, please complete Part III.)Section A. Public SupportCalendar year (or fiscal year beginning in) |12345Total. Add lines 1 through 3 ~~~6 Public support. Subtract line 5 from line 4.Calendar year (or fiscal year beginning in) |78910111213assets (Explain in Part IV.) ~~~~Total support. Add lines 7 through 10(a) 2009 (b) 2010 (c) 2011 (d) 2012 (e) 2013 (f) Total(a) 2009 (b) 2010 (c) 2011 (d) 2012 (e) 2013 (f) TotalFirst five years. If the <strong>Form</strong> <strong>990</strong> is for the organization’s first, second, third, fourth, or fifth tax year as a section 501(c)(3)organization, check this box and stop here |Section C. Computation of Public Support Percentage141516a33 1/3% support test - 2013. If the organization did not check the box on line 13, and line 14 is 33 1/3% or more, check this box and17a10% -facts-and-circumstances test - 2013. If the organization did not check a box on line 13, 16a, or 16b, and line 14 is 10% or more,18Gifts, grants, contributions, andmembership fees received. (Do notinclude any "unusual grants.") ~~Tax revenues levied for the organization’sbenefit and either paid toor expended on its behalf ~~~~The value of services or facilitiesfurnished by a governmental unit tothe organization without charge ~The portion of total contributionsby each person (other than agovernmental unit or publiclysupported organization) includedon line 1 that exceeds 2% of theamount shown on line 11,column (f) ~~~~~~~~~~~~Section B. Total SupportAmounts from line 4 ~~~~~~~Gross income from interest,dividends, payments received onsecurities loans, rents, royaltiesand income from similar sources ~Net income from unrelated businessactivities, whether or not thebusiness is regularly carried on ~Other income. Do not include gainor loss from the sale of capitalGross receipts from related activities, etc. (see instructions) ~~~~~~~~~~~~~~~~~~~~~~~Public support percentage for 2013 (line 6, column (f) divided by line 11, column (f)) ~~~~~~~~~~~~Public support percentage from 2012 Schedule A, Part II, line 14 ~~~~~~~~~~~~~~~~~~~~~stop here. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |b 33 1/3% support test - 2012. If the organization did not check a box on line 13 or 16a, and line 15 is 33 1/3% or more, check this boxand stop here. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in Part IV how the organizationmeets the "facts-and-circumstances" test. The organization qualifies as a publicly supported organization ~~~~~~~~~~~~~~~ |b 10% -facts-and-circumstances test - 2012. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line 15 is 10% ormore, and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in Part IV how theorganization meets the "facts-and-circumstances" test. The organization qualifies as a publicly supported organization ~~~~~~~~ |Private foundation. If the organization did not check a box on line 13, 16a, 16b, 17a, or 17b, check this box and see instructions |121415Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013%%33202209-25-13

Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part III Support Schedule for Organizations Described in Section 509(a)(2)Calendar year (or fiscal year beginning in) |123456The value of services or facilitiesfurnished by a governmental unit tothe organization without charge ~Total. Add lines 1 through 5 ~~~7aAmounts included on lines 1, 2, and3 received from disqualified personsb Amounts included on lines 2 and 3 receivedfrom other than disqualified persons thatexceed the greater of $5,000 or 1% of theamount on line 13 for the year ~~~~~~c Add lines 7a and 7b ~~~~~~~8 Public support (Subtract line 7c from line 6.)Calendar year (or fiscal year beginning in) |9 Amounts from line 6 ~~~~~~~10a Gross income from interest,dividends, payments received onsecurities loans, rents, royaltiesand income from similar sources ~b Unrelated business taxable income(less section 511 taxes) from businessesacquired after June 30, 1975 ~~~~c111213332023 09-25-13(a) 2009 (b) 2010 (c) 2011 (d) 2012 (e) 2013 (f) Total(a) 2009 (b) 2010 (c) 2011 (d) 2012 (e) 2013 (f) Total14 First five years. If the <strong>Form</strong> <strong>990</strong> is for the organization’s first, second, third, fourth, or fifth tax year as a section 501(c)(3) organization,check this box and stop here |Section C. Computation of Public Support Percentage1516 Public support percentage from 2012 Schedule A, Part III, line 15 Section D. Computation of Investment Income Percentage1718Page 3Public support percentage for 2013 (line 8, column (f) divided by line 13, column (f)) ~~~~~~~~~~~~ 15%19a33 1/3% support tests - 2013. If the organization did not check the box on line 14, and line 15 is more than 33 1/3%, and line 17 is not20(Complete only if you checked the box on line 9 of Part I or if the organization failed to qualify under Part II. If the organization fails toqualify under the tests listed below, please complete Part II.)Section A. Public SupportGifts, grants, contributions, andmembership fees received. (Do notinclude any "unusual grants.") ~~Gross receipts from admissions,merchandise sold or services performed,or facilities furnished inany activity that is related to theorganization’s tax-exempt purposeGross receipts from activities thatare not an unrelated trade or businessunder section 513 ~~~~~Tax revenues levied for the organization’sbenefit and either paid toor expended on its behalf ~~~~Section B. Total SupportAdd lines 10a and 10b ~~~~~~Net income from unrelated businessactivities not included in line 10b,whether or not the business isregularly carried on ~~~~~~~Other income. Do not include gainor loss from the sale of capitalassets (Explain in Part IV.) ~~~~Total support. (Add lines 9, 10c, 11, and 12.)Investment income percentage for 2013 (line 10c, column (f) divided by line 13, column (f))Investment income percentage from 2012 Schedule A, Part III, line 17 ~~~~~~~~~~~~~~~~~~16~~~~~~~~ 17%more than 33 1/3%, check this box and stop here. The organization qualifies as a publicly supported organization ~~~~~~~~~~ |b 33 1/3% support tests - 2012. If the organization did not check a box on line 14 or line 19a, and line 16 is more than 33 1/3%, andline 18 is not more than 33 1/3%, check this box and stop here. The organization qualifies as a publicly supported organization~~~~ |Private foundation. If the organization did not check a box on line 14, 19a, or 19b, check this box and see instructions |18%%Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013

Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359 Page 4Part IV Supplemental Information. Provide the explanations required by Part II, line 10; Part II, line 17a or 17b; and Part III, line 12.Also complete this part for any additional information. (See instructions).332024 09-25-13Schedule A (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013

SCHEDULE C(<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ)Department of the TreasuryInternal Revenue ServiceFor Organizations Exempt From Income Tax Under section 501(c) and section 527J Complete if the organization is described below. J Attach to <strong>Form</strong> <strong>990</strong> or <strong>Form</strong> <strong>990</strong>-EZ.| See separate instructions. | Information about Schedule C (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) and itsinstructions is at www.irs.gov/form<strong>990</strong>.If the organization answered "Yes," to <strong>Form</strong> <strong>990</strong>, Part IV, line 3, or <strong>Form</strong> <strong>990</strong>-EZ, Part V, line 46 (Political Campaign Activities), then¥ Section 501(c)(3) organizations: Complete Parts I-A and B. Do not complete Part I-C.¥ Section 501(c) (other than section 501(c)(3)) organizations: Complete Parts I-A and C below. Do not complete Part I-B.¥ Section 527 organizations: Complete Part I-A only.Political Campaign and Lobbying ActivitiesIf the organization answered "Yes," to <strong>Form</strong> <strong>990</strong>, Part IV, line 4, or <strong>Form</strong> <strong>990</strong>-EZ, Part VI, line 47 (Lobbying Activities), thenIf the organization answered "Yes," to <strong>Form</strong> <strong>990</strong>, Part IV, line 5 (Proxy Tax) or <strong>Form</strong> <strong>990</strong>-EZ, Part V, line 35c (Proxy Tax), thenOMB No. 1545-0047Open to PublicInspection¥ Section 501(c)(3) organizations that have filed <strong>Form</strong> 5768 (election under section 501(h)): Complete Part II-A. Do not complete Part II-B.2013¥ Section 501(c)(3) organizations that have NOT filed <strong>Form</strong> 5768 (election under section 501(h)): Complete Part II-B. Do not complete Part II-A.¥ Section 501(c)(4), (5), or (6) organizations: Complete Part III.Name of organizationEmployer identification numberCHIMES INTERNATIONAL LIMITED 52-2000359Part I-A Complete if the organization is exempt under section 501(c) or is a section 527 organization.123Provide a description of the organization’s direct and indirect political campaign activities in Part IV.Political expenditures ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ J $Volunteer hours ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Part I-B Complete if the organization is exempt under section 501(c)(3).1 Enter the amount of any excise tax incurred by the organization under section 4955 ~~~~~~~~~~~~~ J $2 Enter the amount of any excise tax incurred by organization managers under section 4955 ~~~~~~~~~~ J $34aWas a correction made? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~b If "Yes," describe in Part IV.Part I-C Complete if the organization is exempt under section 501(c), except section 501(c)(3).1 Enter the amount directly expended by the filing organization for section 527 exempt function activities ~~~~ J $2345If the organization incurred a section 4955 tax, did it file <strong>Form</strong> 4720 for this year? ~~~~~~~~~~~~~~~~~~~Enter the amount of the filing organization’s funds contributed to other organizations for section 527exempt function activities ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ J $Total exempt function expenditures. Add lines 1 and 2. Enter here and on <strong>Form</strong> 1120-POL,line 17b ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ J $Did the filing organization file <strong>Form</strong> 1120-POL for this year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Yes NoEnter the names, addresses and employer identification number (EIN) of all section 527 political organizations to which the filing organizationmade payments. For each organization listed, enter the amount paid from the filing organization’s funds. Also enter the amount of politicalcontributions received that were promptly and directly delivered to a separate political organization, such as a separate segregated fund or apolitical action committee (PAC). If additional space is needed, provide information in Part IV.(a) Name (b) Address (c) EIN (d) Amount paid from (e) Amount of politicalfiling organization’s contributions received andfunds. If none, enter -0-. promptly and directlydelivered to a separatepolitical organization.If none, enter -0-.YesYesNoNoFor Paperwork Reduction Act Notice, see the Instructions for <strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ. Schedule C (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013LHA33204111-08-13

Schedule C (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359 Page 2Part II-A Complete if the organization is exempt under section 501(c)(3) and filed <strong>Form</strong> 5768(election under section 501(h)).A Check J if the filing organization belongs to an affiliated group (and list in Part IV each affiliated group member’s name, address, EIN,BCheckJexpenses, and share of excess lobbying expenditures).if the filing organization checked box A and "limited control" provisions apply.Limits on Lobbying Expenditures(The term "expenditures" means amounts paid or incurred.)(a) Filingorganization’stotals(b)Affiliated grouptotals1abcdefTotal lobbying expenditures to influence public opinion (grass roots lobbying) ~~~~~~~~~~Total lobbying expenditures to influence a legislative body (direct lobbying) ~~~~~~~~~~~Total lobbying expenditures (add lines 1a and 1b) ~~~~~~~~~~~~~~~~~~~~~~~~Other exempt purpose expenditures ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Total exempt purpose expenditures (add lines 1c and 1d) ~~~~~~~~~~~~~~~~~~~~Lobbying nontaxable amount. Enter the amount from the following table in both columns.If the amount on line 1e, column (a) or (b) is: The lobbying nontaxable amount is:Not over $500,00020% of the amount on line 1e.Over $500,000 but not over $1,000,000 $100,000 plus 15% of the excess over $500,000.Over $1,000,000 but not over $1,500,000 $175,000 plus 10% of the excess over $1,000,000.Over $1,500,000 but not over $17,000,000 $225,000 plus 5% of the excess over $1,500,000.Over $17,000,000$1,000,000.ghijGrassroots nontaxable amount (enter 25% of line 1f)Subtract line 1g from line 1a. If zero or less, enter -0-~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Subtract line 1f from line 1c. If zero or less, enter -0- ~~~~~~~~~~~~~~~~~~~~~~~If there is an amount other than zero on either line 1h or line 1i, did the organization file <strong>Form</strong> 4720reporting section 4911 tax for this year?4-Year Averaging Period Under Section 501(h)(Some organizations that made a section 501(h) election do not have to complete all of the fivecolumns below. See the instructions for lines 2a through 2f on page 4.)YesNoLobbying Expenditures During 4-Year Averaging PeriodCalendar year(or fiscal year beginning in)(a) 2010 (b) 2011 (c) 2012 (d) 2013 (e) Total2abLobbying nontaxable amountLobbying ceiling amount(150% of line 2a, column(e))cTotal lobbying expendituresdeGrassroots nontaxable amountGrassroots ceiling amount(150% of line 2d, column (e))fGrassroots lobbying expendituresSchedule C (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 201333204211-08-13

Schedule C (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part II-B Complete if the organization is exempt under section 501(c)(3) and has NOT filed <strong>Form</strong> 5768(election under section 501(h)).Page 3For each "Yes," response to lines 1a through 1i below, provide in Part IV a detailed descriptionof the lobbying activity.(a)(b)Yes No Amount1abcdefghijbcd If the filing organization incurred a section 4912 tax, did it file <strong>Form</strong> 4720 for this year? Part III-A Complete if the organization is exempt under section 501(c)(4), section 501(c)(5), or section501(c)(6).Yes123 Did the organization agree to carry over lobbying and political expenditures from the prior year? 3Part III-B Complete if the organization is exempt under section 501(c)(4), section 501(c)(5), or section501(c)(6) and if either (a) BOTH Part III-A, lines 1 and 2, are answered "No," OR (b) Part III-A, line 3, isanswered "Yes."1234abcDuring the year, did the filing organization attempt to influence foreign, national, state orlocal legislation, including any attempt to influence public opinion on a legislative matteror referendum, through the use of:Volunteers? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Paid staff or management (include compensation in expenses reported on lines 1c through 1i)?Media advertisements? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Mailings to members, legislators, or the public? ~~~~~~~~~~~~~~~~~~~~~~~~~Publications, or published or broadcast statements?Grants to other organizations for lobbying purposes? ~~~~~~~~~~~~~~~~~~~~~~Section 162(e) nondeductible lobbying and political expenditures (do not include amounts of politicalexpenses for which the section 527(f) tax was paid).~~~~~~~~~~~~~~~~~~~~~~Direct contact with legislators, their staffs, government officials, or a legislative body? ~~~~~~Rallies, demonstrations, seminars, conventions, speeches, lectures, or any similar means? ~~~~Other activities?~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Total. Add lines 1c through 1i ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~2aDid the activities in line 1 cause the organization to be not described in section 501(c)(3)? ~~~~If "Yes," enter the amount of any tax incurred under section 4912 ~~~~~~~~~~~~~~~~If "Yes," enter the amount of any tax incurred by organization managers under section 4912 ~~~Were substantially all (90% or more) dues received nondeductible by members? ~~~~~~~~~~~~~~~~~Did the organization make only in-house lobbying expenditures of $2,000 or less? ~~~~~~~~~~~~~~~~Dues, assessments and similar amounts from members ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Current yearCarryover from last year~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Total ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Aggregate amount reported in section 6033(e)(1)(A) notices of nondeductible section 162(e) duesIf notices were sent and the amount on line 2c exceeds the amount on line 3, what portion of the excessdoes the organization agree to carryover to the reasonable estimate of nondeductible lobbying and politicalexpenditure next year? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 45 Taxable amount of lobbying and political expenditures (see instructions) 5Part IV Supplemental InformationProvide the descriptions required for Part I-A, line 1; Part I-B, line 4; Part I-C, line 5; Part II-A (affiliated group list); Part II-A, line 2; and Part II-B, line 1.~~~~~~~~~Also, complete this part for any additional information.PART II-B, LINE 1(A), VOLUNTEERS & LINE 1(B) PAID STAFF OR MANAGEMENT:STAFF AND BOARD MEMBERS ARE PERIODICALLY ASKED TO REACH OUTTO FEDERAL, STATE, AND LOCAL ELECTED OFFICIALS AND LEGISLATORS IN REGARDTO ISSUES OF CONCERN FOR THE PEOPLE WE SERVE AND THAT MAY EFFECT THEORGANIZATION. THE COMPANY DOES NOT REQUIRE STAFF TO DO SO, NOR DOES ITXXXXXXXXXX1212a2b2c3No0.DICTATE WHEN A PERSON SHOULD MAKE SUCH AN OUTREACH IF THEY CHOOSE TO. AS33204311-08-13Schedule C (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013

Schedule C (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part IV Supplemental Information (continued)Page 4SUCH, IT IS POSSIBLE SOME STAFF MAY DO SO DURING THEIR WORKING DAY RATHERTHAN ON THEIR OWN TIME. STAFF ARE NOT GIVEN TIME OFF FROM ASSIGNED TASKSTO MAKE SUCH OUTREACH.33204411-08-13Schedule C (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>-EZ) 2013

SCHEDULE DOMB No. 1545-0047(<strong>Form</strong> <strong>990</strong>) | Complete if the organization answered "Yes," to <strong>Form</strong> <strong>990</strong>,Part IV, line 6, 7, 8, 9, 10, 11a, 11b, 11c, 11d, 11e, 11f, 12a, or 12b.Department of the Treasury| Attach to <strong>Form</strong> <strong>990</strong>.Open to PublicInternal Revenue Service | Information about Schedule D (<strong>Form</strong> <strong>990</strong>) and its instructions is at www.irs.gov/form<strong>990</strong>. InspectionName of the organizationEmployer identification numberCHIMES INTERNATIONAL LIMITED 52-2000359Part I Organizations Maintaining Donor Advised Funds or Other Similar Funds or Accounts. Complete if theorganization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 6.(a) Donor advised funds(b) Funds and other accounts1234561234567892abcdbabTotal number at end of year ~~~~~~~~~~~~~~~Aggregate contributions to (during year)Aggregate grants from (during year)Aggregate value at end of year(i)(ii)~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Did the organization inform all donors and donor advisors in writing that the assets held in donor advised fundsare the organization’s property, subject to the organization’s exclusive legal control?~~~~~~~~~~~~~~~~~~Did the organization inform all grantees, donors, and donor advisors in writing that grant funds can be used onlyfor charitable purposes and not for the benefit of the donor or donor advisor, or for any other purpose conferringimpermissible private benefit? Part II Conservation Easements. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 7.Purpose(s) of conservation easements held by the organization (check all that apply).Preservation of land for public use (e.g., recreation or education)Protection of natural habitatPreservation of open space2a2b2c2dYesYesPreservation of an historically important land areaPreservation of a certified historic structureComplete lines 2a through 2d if the organization held a qualified conservation contribution in the form of a conservation easement on the lastday of the tax year.Total number of conservation easements ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Total acreage restricted by conservation easements~~~~~~~~~~~~~~~~~~~~~~~~~~Number of conservation easements on a certified historic structure included in (a) ~~~~~~~~~~~~Number of conservation easements included in (c) acquired after 8/17/06, and not on a historic structurelisted in the National Register ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~NoNoHeld at the End of the Tax YearNumber of conservation easements modified, transferred, released, extinguished, or terminated by the organization during the taxyear |Number of states where property subject to conservation easement is located |Does the organization have a written policy regarding the periodic monitoring, inspection, handling ofviolations, and enforcement of the conservation easements it holds? ~~~~~~~~~~~~~~~~~~~~~~~~~Staff and volunteer hours devoted to monitoring, inspecting, and enforcing conservation easements during the year |Amount of expenses incurred in monitoring, inspecting, and enforcing conservation easements during the year | $Does each conservation easement reported on line 2(d) above satisfy the requirements of section 170(h)(4)(B)(i)and section 170(h)(4)(B)(ii)? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~In Part XIII, describe how the organization reports conservation easements in its revenue and expense statement, and balance sheet, andinclude, if applicable, the text of the footnote to the organization’s financial statements that describes the organization’s accounting forconservation easements.Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets.Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 8.1aIf the organization elected, as permitted under SFAS 116 (ASC 958), not to report in its revenue statement and balance sheet works of art,historical treasures, or other similar assets held for public exhibition, education, or research in furtherance of public service, provide, in Part XIII,the text of the footnote to its financial statements that describes these items.If the organization elected, as permitted under SFAS 116 (ASC 958), to report in its revenue statement and balance sheet works of art, historicaltreasures, or other similar assets held for public exhibition, education, or research in furtherance of public service, provide the following amountsrelating to these items:Revenues included in <strong>Form</strong> <strong>990</strong>, Part VIII, line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ | $Assets included in <strong>Form</strong> <strong>990</strong>, Part X~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |If the organization received or held works of art, historical treasures, or other similar assets for financial gain, providethe following amounts required to be reported under SFAS 116 (ASC 958) relating to these items:Revenues included in <strong>Form</strong> <strong>990</strong>, Part VIII, line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ | $Assets included in <strong>Form</strong> <strong>990</strong>, Part XSupplemental Financial Statements~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |$$2013YesYesNoNoLHA For Paperwork Reduction Act Notice, see the Instructions for <strong>Form</strong> <strong>990</strong>. Schedule D (<strong>Form</strong> <strong>990</strong>) 201333205109-25-13

Schedule D (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359 Page 2Part III Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets (continued)3 Using the organization’s acquisition, accession, and other records, check any of the following that are a significant use of its collection items45abcbcdefdeb If "Yes," explain the arrangement in Part XIII. Check here if the explanation has been provided in Part XIII Part V Endowment Funds. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 10.2bcdefgabcb(i)(ii)4 Describe in Part XIII the intended uses of the organization’s endowment funds.Part VI Land, Buildings, and Equipment.1a(check all that apply):Public exhibitionScholarly researchPreservation for future generationsLoan or exchange programsProvide a description of the organization’s collections and explain how they further the organization’s exempt purpose in Part XIII.During the year, did the organization solicit or receive donations of art, historical treasures, or other similar assetsto be sold to raise funds rather than to be maintained as part of the organization’s collection? YesPart IV Escrow and Custodial Arrangements. Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 9, orreported an amount on <strong>Form</strong> <strong>990</strong>, Part X, line 21.1aIs the organization an agent, trustee, custodian or other intermediary for contributions or other assets not includedon <strong>Form</strong> <strong>990</strong>, Part X? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~(a) Current year (b) Prior year (c) Two years back (d) Three years back (e) Four years back1c1d1e1fYesYes3a(i)3a(ii)(a) Cost or other (b) Cost or other (c) Accumulated (d) Book valuebasis (investment) basis (other)depreciationb Buildings ~~~~~~~~~~~~~~~~~~c Leasehold improvements ~~~~~~~~~~628,401. 233,994. 394,407.d Equipment ~~~~~~~~~~~~~~~~~2,551,962. 2,192,246. 359,716.e Other 4,239,930. 3,472,433. 767,497.Total. Add lines 1a through 1e. (Column (d) must equal <strong>Form</strong> <strong>990</strong>, Part X, column (B), line 10(c).) | 1,521,620.OtherIf "Yes," explain the arrangement in Part XIII and complete the following table:Beginning balanceAdditions during the year ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Distributions during the year~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Ending balance ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~2aDid the organization include an amount on <strong>Form</strong> <strong>990</strong>, Part X, line 21? ~~~~~~~~~~~~~~~~~~~~~~~~~1aBeginning of year balanceContributions ~~~~~~~~~~~~~~Net investment earnings, gains, and lossesGrants or scholarshipsOther expenditures for facilitiesand programsAdministrative expensesEnd of year balance~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Provide the estimated percentage of the current year end balance (line 1g, column (a)) held as:Board designated or quasi-endowment | %Permanent endowment | %Temporarily restricted endowment | %The percentages in lines 2a, 2b, and 2c should equal 100%.3aAre there endowment funds not in the possession of the organization that are held and administered for the organizationby:unrelated organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~related organizations ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~If "Yes" to 3a(ii), are the related organizations listed as required on Schedule R? ~~~~~~~~~~~~~~~~~~~~~~Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 11a. See <strong>Form</strong> <strong>990</strong>, Part X, line 10.Description of propertyLand ~~~~~~~~~~~~~~~~~~~~Amount3bYesNoNoNoNoSchedule D (<strong>Form</strong> <strong>990</strong>) 201333205209-25-13

Schedule D (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359 Page 3Part VII Investments - Other Securities.Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 11b. See <strong>Form</strong> <strong>990</strong>, Part X, line 12.(a) Description of security or category (including name of security) (b) Book value (c) Method of valuation: Cost or end-of-year market value(1)(2)(3)(H)Total. (Col. (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col. (B) line 12.) |Part VIII Investments - Program Related.Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 11c. See <strong>Form</strong> <strong>990</strong>, Part X, line 13.(a) Description of investment (b) Book value (c) Method of valuation: Cost or end-of-year market value(9)Total. (Col. (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col. (B) line 13.) |Part IX Other Assets.Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 11d. See <strong>Form</strong> <strong>990</strong>, Part X, line 15.(a) Description(b) Book value(1) SECURITY DEPOSITS 231,290.(2) DUE FROM RELATED PARTY 28,213,030.(3) INTANGIBLE ASSETS 365,167.(9)Total. (Column (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col. (B) line 15.) |Part X Other Liabilities.1.Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 11e or 11f. See <strong>Form</strong> <strong>990</strong>, Part X, line 25.(a) Description of liability(b) Book value(9)Total. (Column (b) must equal <strong>Form</strong> <strong>990</strong>, Part X, col. (B) line 25.) |2.Financial derivativesClosely-held equity interestsOther(A)(B)(C)(D)(E)(F)(G)(1)(2)(3)(4)(5)(6)(7)(8)(4)(5)(6)(7)(8)(1)(2)(3)(4)(5)(6)(7)(8)~~~~~~~~~~~~~~~~~~~~~~~~~~Federal income taxesDUE TO RELATED PARTY 21,107,230.DEFERRED COMPENSATION &POSTEMPLOYMENT BENEFIT OBLIGATION 958,218.22,065,448.28,809,487.Liability for uncertain tax positions. In Part XIII, provide the text of the footnote to the organization’s financial statements that reports theorganization’s liability for uncertain tax positions under FIN 48 (ASC 740). Check here if the text of the footnote has been provided in Part XIIIXSchedule D (<strong>Form</strong> <strong>990</strong>) 201333205309-25-13

Schedule D (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359 Page 4Part XI Reconciliation of Revenue per Audited Financial Statements With Revenue per Return.Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 12a.1 Total revenue, gains, and other support per audited financial statements ~~~~~~~~~~~~~~~~~~~ 1 9,037,073.234abcdeaAdd lines 2a through 2d ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 2eSubtract line 2e from line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~b Other (Describe in Part XIII.) ~~~~~~~~~~~~~~~~~~~~~~~~~~ 4bc Add lines 4a and 4b ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 4c0.5 Total revenue. Add lines 3 and 4c. (This must equal <strong>Form</strong> <strong>990</strong>, Part I, line 12.) 5 9,037,073.Part XII Reconciliation of Expenses per Audited Financial Statements With Expenses per Return.Complete if the organization answered "Yes" to <strong>Form</strong> <strong>990</strong>, Part IV, line 12a.1 Total expenses and losses per audited financial statements ~~~~~~~~~~~~~~~~~~~~~~~~~~ 1 8,930,494.234abcdeabAmounts included on line 1 but not on <strong>Form</strong> <strong>990</strong>, Part VIII, line 12:Net unrealized gains on investmentsDonated services and use of facilities ~~~~~~~~~~~~~~~~~~~~~~Recoveries of prior year grantsOther (Describe in Part XIII.)Add lines 2a through 2d~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Amounts included on <strong>Form</strong> <strong>990</strong>, Part VIII, line 12, but not on line 1:Investment expenses not included on <strong>Form</strong> <strong>990</strong>, Part VIII, line 7bAmounts included on line 1 but not on <strong>Form</strong> <strong>990</strong>, Part IX, line 25:~~~~~~~~Donated services and use of facilities ~~~~~~~~~~~~~~~~~~~~~~Prior year adjustments~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other losses ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Other (Describe in Part XIII.) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Subtract line 2e from line 1 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Amounts included on <strong>Form</strong> <strong>990</strong>, Part IX, line 25, but not on line 1:Investment expenses not included on <strong>Form</strong> <strong>990</strong>, Part VIII, line 7bOther (Describe in Part XIII.)~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~c Add lines 4a and 4b ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~5 Total expenses. Add lines 3 and 4c. (This must equal <strong>Form</strong> <strong>990</strong>, Part I, line 18.) Part XIII Supplemental Information.Provide the descriptions required for Part II, lines 3, 5, and 9; Part III, lines 1a and 4; Part IV, lines 1b and 2b; Part V, line 4; Part X, line 2; Part XI,lines 2d and 4b; and Part XII, lines 2d and 4b. Also complete this part to provide any additional information.2a2b2c2d4a2a2b2c2d4a4b32e34c50.9,037,073.0.8,930,494.0.8,930,494.PART X, LINE 2:UNDER ASC TOPIC, ACCOUNTING FOR INCOME TAXES, THEORGANIZATION IS REQUIRED TO RECOGNIZE OR DISCLOSE ANY TAX POSITIONS THATWOULD RESULT IN UNRECOGNIZED TAX BENEFITS. THE ORGANIZATION HAS NOPOSITIONS THAT WOULD REQUIRE DISCLOSURE OR RECOGNITION UNDER THE TOPIC.TAX YEARS ENDING JUNE 30, 2011 AND AFTER ARE STILL OPEN.33205409-25-13Schedule D (<strong>Form</strong> <strong>990</strong>) 2013

SCHEDULE J(<strong>Form</strong> <strong>990</strong>)Department of the TreasuryInternal Revenue ServiceFor certain Officers, Directors, Trustees, Key Employees, and HighestCompensated Employees| Complete if the organization answered "Yes" on <strong>Form</strong> <strong>990</strong>, Part IV, line 23.| Attach to <strong>Form</strong> <strong>990</strong>. | See separate instructions.| Information about Schedule J (<strong>Form</strong> <strong>990</strong>) and its instructions is at www.irs.gov/form<strong>990</strong>.OMB No. 1545-0047Open to PublicInspectionName of the organizationEmployer identification numberCHIMES INTERNATIONAL LIMITED 52-2000359Part I Questions Regarding Compensation1aCheck the appropriate box(es) if the organization provided any of the following to or for a person listed in <strong>Form</strong> <strong>990</strong>,Part VII, Section A, line 1a. Complete Part III to provide any relevant information regarding these items.X First-class or charter travelHousing allowance or residence for personal useTravel for companionsTax indemnification and gross-up paymentsDiscretionary spending accountCompensation InformationPayments for business use of personal residenceHealth or social club dues or initiation feesPersonal services (e.g., maid, chauffeur, chef)2013YesNo2bIf any of the boxes on line 1a are checked, did the organization follow a written policy regarding payment orreimbursement or provision of all of the expenses described above? If "No," complete Part III to explain~~~~~~~~~~~Did the organization require substantiation prior to reimbursing or allowing expenses incurred by all directors,trustees, and officers, including the CEO/Executive Director, regarding the items checked in line 1a? ~~~~~~~~~~~~1b2XX3Indicate which, if any, of the following the filing organization used to establish the compensation of the organization’sCEO/Executive Director. Check all that apply. Do not check any boxes for methods used by a related organization toestablish compensation of the CEO/Executive Director, but explain in Part III.X Compensation committeeX Written employment contractX Independent compensation consultantX Compensation survey or studyX <strong>Form</strong> <strong>990</strong> of other organizationsX Approval by the board or compensation committee4abcDuring the year, did any person listed in <strong>Form</strong> <strong>990</strong>, Part VII, Section A, line 1a, with respect to the filingorganization or a related organization:Receive a severance payment or change-of-control payment? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Participate in, or receive payment from, a supplemental nonqualified retirement plan? ~~~~~~~~~~~~~~~~~~~~Participate in, or receive payment from, an equity-based compensation arrangement? ~~~~~~~~~~~~~~~~~~~~If "Yes" to any of lines 4a-c, list the persons and provide the applicable amounts for each item in Part III.4a4b4cXXX56789ababLHAOnly section 501(c)(3) and 501(c)(4) organizations must complete lines 5-9.For persons listed in <strong>Form</strong> <strong>990</strong>, Part VII, Section A, line 1a, did the organization pay or accrue any compensationcontingent on the revenues of:The organization? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Any related organization?If "Yes" to line 5a or 5b, describe in Part III.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~For persons listed in <strong>Form</strong> <strong>990</strong>, Part VII, Section A, line 1a, did the organization pay or accrue any compensationcontingent on the net earnings of:The organization? ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Any related organization?If "Yes" to line 6a or 6b, describe in Part III.~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~For persons listed in <strong>Form</strong> <strong>990</strong>, Part VII, Section A, line 1a, did the organization provide any non-fixed paymentsnot described in lines 5 and 6? If "Yes," describe in Part III ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~Were any amounts reported in <strong>Form</strong> <strong>990</strong>, Part VII, paid or accrued pursuant to a contract that was subject to theinitial contract exception described in Regulations section 53.4958-4(a)(3)? If "Yes," describe in Part III ~~~~~~~~~~~If "Yes" to line 8, did the organization also follow the rebuttable presumption procedure described inRegulations section 53.4958-6(c)? For Paperwork Reduction Act Notice, see the Instructions for <strong>Form</strong> <strong>990</strong>. Schedule J (<strong>Form</strong> <strong>990</strong>) 20135a5b6a6b789XXXXXX33211109-13-13

Schedule J (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part II Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees. Use duplicate copies if additional space is needed.For each individual whose compensation must be reported in Schedule J, report compensation from the organization on row (i) and from related organizations, described in the instructions, on row (ii).Do not list any individuals that are not listed on <strong>Form</strong> <strong>990</strong>, Part VII.Note. The sum of columns (B)(i)-(iii) for each listed individual must equal the total amount of <strong>Form</strong> <strong>990</strong>, Part VII, Section A, line 1a, applicable column (D) and (E) amounts for that individual.Page 2(A) Name and Title(B) Breakdown of W-2 and/or 1099-MISC compensation (C) Retirement and (D) Nontaxable (E) Total of columns (F) Compensationother deferred benefits(B)(i)-(D) reported as deferred(i) Base (ii) Bonus & (iii) Othercompensation incentive reportablecompensationin prior <strong>Form</strong> <strong>990</strong>compensation compensation(1) MARTIN LAMPNER, CPA (i) 314,239. 0. 12,000. 104,100. 23,302. 453,641. 0.PRESIDENT/CEO (ii)0. 0. 0. 0. 0. 0. 0.(2) MARY T. COLLARD (i) 220,399. 0. 10,000. 5,793. 5,561. 241,753. 0.EXEC VP/COO/CORE SVS/ASST SEC (ii)0. 0. 0. 0. 0. 0. 0.(3) SHAWNA M. GOTTLIEB (i) 175,534. 0. 10,000. 5,260. 763. 191,557. 0.ASST TREASURER/CFO (ii)0. 0. 0. 0. 0. 0. 0.(4) ALBERT BUSSONE (i) 200,920. 0. 12,000. 5,638. 23,130. 241,688. 0.VICE PRESIDENT/CHIEF DEVEL (ii)0. 0. 0. 0. 0. 0. 0.33211209-13-13(i)(ii)(i)(ii)(i)(ii)(i)(ii)(i)(ii)(i)(ii)(i)(ii)(i)(ii)(i)(ii)(i)(ii)(i)(ii)(i)(ii)Schedule J (<strong>Form</strong> <strong>990</strong>) 2013

Schedule J (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part III Supplemental InformationProvide the information, explanation, or descriptions required for Part I, lines 1a, 1b, 3, 4a, 4b, 4c, 5a, 5b, 6a, 6b, 7, and 8, and for Part II. Also complete this part for any additional information.Page 3PART I, LINE 1A:LINES 1(A), 1(B) & 2:THE CHIMES FAMILY OF SERVICES PERMITS STAFF AT ALL LEVELS TO MAKE USE OFBUSINESS OR FIRST CLASS SEATING, WHEN THE TRIP WILL EXCEED MORE THAN 5HOURS OF INFLIGHT TIME AND THE PERSON WILL BE CALLED TO PERFORM THEIRDUTIES WITHIN 24 HOURS OF THE END OF THE FLIGHT. COACH TRAVEL IS PREFERREDFOR ALL TRIPS, HOWEVER IN THE EVENT THAT TRAVEL REQUIRES MORE THAN 5 HOURSOF TRAVEL IN ACTUAL FLIGHT AND MANAGEMENT FEELS THAT IT WILL NEGATIVELYIMPACT THE PERFORMANCE OF THE PERSON TRAVELING, THEY MAY PERMIT UPGRADEDTRAVEL.EXECUTIVE AND BOARD TRAVEL EXPENSES, INCLUDING AIRFARE, MUST BE REPORTED TOTHE GOVERNANCE COMMITTEE. THIS COMMITTEE, MADE UP OF EXCLUSIVELYINDEPENDENT BOARD MEMBERS, REVIEWS ALL TRAVEL EXPENSES AND HAS THE RIGHT TOCHARGE THE STAFF PERSON, OR THEIR MANAGER, BACK, IF THEY DO NOT BELEIVEUPGRADED ACCOMADATIONS WERE JUSTIFIED.IN THE EVENT A MEMBER OF THE COMMITTEE TRAVELS ON BEHALF OF THE COMPANY,THEY MUST RECUSE THEMSELVES FROM THE REVIEW OF EXPENSES. IF, FOR REASONS OFSchedule J (<strong>Form</strong> <strong>990</strong>) 201333211309-13-13

Schedule J (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part III Supplemental InformationProvide the information, explanation, or descriptions required for Part I, lines 1a, 1b, 3, 4a, 4b, 4c, 5a, 5b, 6a, 6b, 7, and 8, and for Part II. Also complete this part for any additional information.Page 3RECUSAL, THERE ARE NOT ENOUGH COMMITTEE MEMBERS LEFT TO MAKE A QUORUM, THEGOVERNING BOARD CAN APPOINT REPLACEMENTS FOR THE COMMITTEE ON EITHER APERMANENT OR AD HOC BASIS.ALL TRAVEL EXPENSES, EITHER DIRECTLY COVERED OR REIMBURSED BY THE COMPANY,MUST BE FULLY DOCUMENTED BY ACCURATE CONTEMPORANOUS DOCUMENTATION OR ISSUBJECT TO CHARGE BACK.PART II COLUMN BBASIC LIFE INSURANCE IN EXCESS OF $50,000 THAT IS PROVIDEDTO AN INDIVIDUAL BY THE COMPANY IS REPORTED IN COLUMN B-III.PART II COLUMN CTHE COMPANY MADE CONTRIBUTIONS TO THE 457(F) PLAN ACCOUNTOF M. LAMPNER, WHICH HAVE NOT YET VESTED.THESE CONTRIBUTIONS AREREPORTED IN COLUMN C.M. LAMPNER ACCRUED BENEFITS UNDER A 457(F) PLAN. TOTAL BENEFITS THATMAY BE PAYABLE UNDER THE PLAN ARE BASED UPON HIS LENGTH OF SERVICE ANDSchedule J (<strong>Form</strong> <strong>990</strong>) 201333211309-13-13

Schedule J (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part III Supplemental InformationProvide the information, explanation, or descriptions required for Part I, lines 1a, 1b, 3, 4a, 4b, 4c, 5a, 5b, 6a, 6b, 7, and 8, and for Part II. Also complete this part for any additional information.Page 3COMPENSATION. THE BENEFITS HAVE NOT YET VESTED.THE BENEFITS ACCRUEDDURING THE REPORTING YEAR ARE REPORTED IN COLUMN C.NOTES REGARDING 457(F) PLANS: THE INTERESTS UNDER THE ARRANGEMENTSDESCRIBED ABOVE ARE/WERE SUBJECT TO FORFEITURE IF THE PARTICIPANTVOLUNTARILY TERMINATES/HAD VOLUNTARILY TERMINATED EMPLOYMENT OR WASTERMINATED FOR CAUSE PRIOR TO HIS OR HER APPLICABLE VESTING DATE UNDEREACH ARRANGEMENT.IN ADDITION, UNDER CURRENT LAW, INTERESTS UNDER THOSE ARRANGEMENTS AREREPORTABLE AS TAXABLE COMPENSATION WHEN THEY BECOME VESTED, EVEN IFTHOSE AMOUNTS ARE NOT YET PAYABLE TO THE PARTICIPANT (AND EVEN IF THOSEAMOUNTS ARE NEVER PAID TO THE PARTICIPANT).NO ROLLOVER OR OTHERTAX-DEFERRAL OPTIONS ARE AVAILABLE TO PARTICIPANTS.PARTICIPANTS’ INTERESTS UNDER THESE ARRANGEMENTS ARE NOT GUARANTEED ORSECURED IN ANY WAY AND AT ALL TIMES ARE SUBJECT TO THE CLAIMS OF THEEMPLOYER’S BANKRUPTCY CREDITORS.Schedule J (<strong>Form</strong> <strong>990</strong>) 201333211309-13-13

Schedule J (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part III Supplemental InformationProvide the information, explanation, or descriptions required for Part I, lines 1a, 1b, 3, 4a, 4b, 4c, 5a, 5b, 6a, 6b, 7, and 8, and for Part II. Also complete this part for any additional information.Page 3IN THE MANNER REQUIRED BY APPLICABLE IRS RULES, THE DESIGN OF EACH OFTHESE ARRANGEMENTS WAS APPROVED AS REASONABLE, IN ADVANCE, BY ANINDEPENDENT COMPENSATION COMMITTEE, WHICH BASED ITS DECISION ON DATAPROVIDED BY AN INDEPENDENT COMPENSATION CONSULTANT.PART II COLUMN DTHE COMPANY PROVIDES BASIC LIFE INSURANCE AND LONG TERMDISABILITY TO ALL FULL TIME EMPLOYEES. BOTH BENEFITS ARE REPORTED INCOLUMN D.THE COMPANY’S CONTRIBUTION TOWARDS THE EMPLOYEE’S COMPANY-PROVIDEDHEALTH INSURANCE IS REPORTED IN COLUMN D.AS OF 6/30/14, THE ORGANIZATION ACCRUED $970,606 OF NON-TAXABLEPOSTEMPLOYMENT HEALTH BENEFITS ON BEHALF OF ALBERT BUSSONE, MARTINLAMPNER, TERRY PERL (PREVIOUS OFFICER), CECIL FOX, AND WHERE APPLICABLETHEIR SPOUSES. THIS ACCRUAL REPRESENTS AN ESTIMATE OF PREMIUMS TO BEPAID AFTER EMPLOYMENT HAS ENDED FOR THE ELIGIBLE INDIVIDUALS. PREMIUMSPAID DURING THE YEAR ENDED JUNE 30, 2014 WERE $18,572.Schedule J (<strong>Form</strong> <strong>990</strong>) 201333211309-13-13

Schedule J (<strong>Form</strong> <strong>990</strong>) 2013 CHIMES INTERNATIONAL LIMITED 52-2000359Part III Supplemental InformationProvide the information, explanation, or descriptions required for Part I, lines 1a, 1b, 3, 4a, 4b, 4c, 5a, 5b, 6a, 6b, 7, and 8, and for Part II. Also complete this part for any additional information.Page 3THE COMPANY’S CONTRIBUTIONS TO AN INDIVIDUAL’S 403(B) RETIREMENT PLANACCOUNT ARE REPORTED IN COLUMN D.THE COMPANY PROVIDES EMPLOYEES WITH 15 OR MORE YEARS OF SERVICE, OTHERTHAN A. BUSSONE & M. LAMPNER, LONG TERM CARE INSURANCE AT NO CHARGE TOTHE EMPLOYEE. THIS BENEFIT IS REPORTED IN COLUMN D. (BUSSONE & LAMPNERMUST PAY FOR THEIR OWN COVERAGE.)Schedule J (<strong>Form</strong> <strong>990</strong>) 201333211309-13-13