Barlow, King & King – Updates August 2009-08-30 - Sweet & Maxwell

Barlow, King & King – Updates August 2009-08-30 - Sweet & Maxwell

Barlow, King & King – Updates August 2009-08-30 - Sweet & Maxwell

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

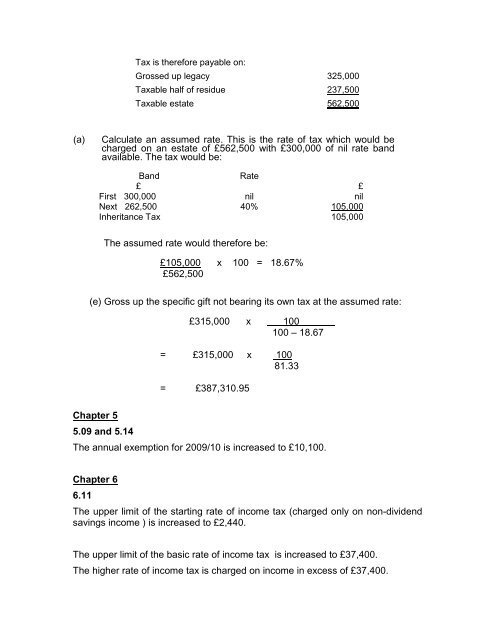

Tax is therefore payable on:Grossed up legacy 325,000Taxable half of residue237,500Taxable estate562,500(a)Calculate an assumed rate. This is the rate of tax which would becharged on an estate of £562,500 with £<strong>30</strong>0,000 of nil rate bandavailable. The tax would be:BandRate£ £First <strong>30</strong>0,000 nil nilNext 262,500 40%105,000Inheritance Tax105,000The assumed rate would therefore be:£105,000 x 100 = 18.67%£562,500(e) Gross up the specific gift not bearing its own tax at the assumed rate:£315,000 x 100100 <strong>–</strong> 18.67= £315,000 x 10<strong>08</strong>1.33= £387,310.95Chapter 55.09 and 5.14The annual exemption for <strong>2009</strong>/10 is increased to £10,100.Chapter 66.11The upper limit of the starting rate of income tax (charged only on non-dividendsavings income ) is increased to £2,440.The upper limit of the basic rate of income tax is increased to £37,400.The higher rate of income tax is charged on income in excess of £37,400.