BUS 640 Week 1 Economics of Risk and Uncertainty Applied Problems./uophelp

BUS 620 Week 1 The Future of the New York Times For more course tutorials visit www.uophelp.com Read the article: The Future of the New York Times, BusinessWeek, January 17, 2005, 64-72 (Also Posted in the Announcement page). Readership through circulation and news quality are key ingredients to profitability in the newspaper business industry. In a 2-3 page paper, examine what Arthur Sulzberger can do to revive the failing newspaper whose “financial performance is lagging “. Can New York Times, with its journalistic pride compete with the digital media and still deliver the best news? Paper must be in the correct APA writing style and include a minimum of 2-3 resources, in which one resource must be peer reviewed

BUS 620 Week 1 The Future of the New York Times

For more course tutorials visit

www.uophelp.com

Read the article: The Future of the New York Times, BusinessWeek, January 17, 2005, 64-72 (Also Posted in the Announcement page).

Readership through circulation and news quality are key ingredients to profitability in the newspaper business industry. In a 2-3 page paper, examine what Arthur Sulzberger can do to revive the failing newspaper whose “financial performance is lagging “. Can New York Times, with its journalistic pride compete with the digital media and still deliver the best news?

Paper must be in the correct APA writing style and include a minimum of 2-3 resources, in which one resource must be peer reviewed

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

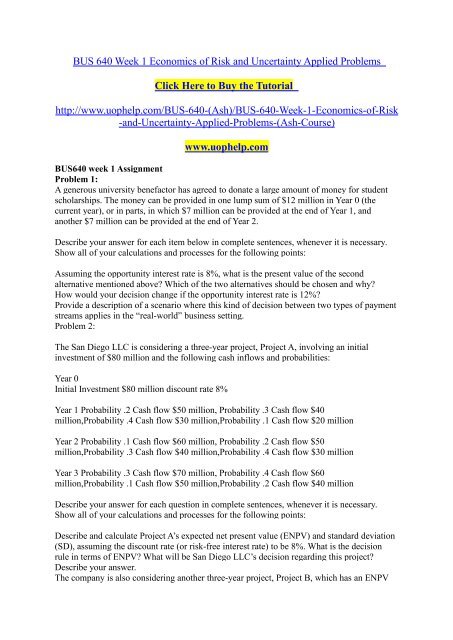

<strong>BUS</strong> <strong>640</strong> <strong>Week</strong> 1 <strong>Economics</strong> <strong>of</strong> <strong>Risk</strong> <strong>and</strong> <strong>Uncertainty</strong> <strong>Applied</strong> <strong>Problems</strong>Click Here to Buy the Tutorialhttp://www.<strong>uophelp</strong>.com/<strong>BUS</strong>-<strong>640</strong>-(Ash)/<strong>BUS</strong>-<strong>640</strong>-<strong>Week</strong>-1-<strong>Economics</strong>-<strong>of</strong>-<strong>Risk</strong>-<strong>and</strong>-<strong>Uncertainty</strong>-<strong>Applied</strong>-<strong>Problems</strong>-(Ash-Course)www.<strong>uophelp</strong>.com<strong>BUS</strong><strong>640</strong> week 1 AssignmentProblem 1:A generous university benefactor has agreed to donate a large amount <strong>of</strong> money for studentscholarships. The money can be provided in one lump sum <strong>of</strong> $12 million in Year 0 (thecurrent year), or in parts, in which $7 million can be provided at the end <strong>of</strong> Year 1, <strong>and</strong>another $7 million can be provided at the end <strong>of</strong> Year 2.Describe your answer for each item below in complete sentences, whenever it is necessary.Show all <strong>of</strong> your calculations <strong>and</strong> processes for the following points:Assuming the opportunity interest rate is 8%, what is the present value <strong>of</strong> the secondalternative mentioned above? Which <strong>of</strong> the two alternatives should be chosen <strong>and</strong> why?How would your decision change if the opportunity interest rate is 12%?Provide a description <strong>of</strong> a scenario where this kind <strong>of</strong> decision between two types <strong>of</strong> paymentstreams applies in the “real-world” business setting.Problem 2:The San Diego LLC is considering a three-year project, Project A, involving an initialinvestment <strong>of</strong> $80 million <strong>and</strong> the following cash inflows <strong>and</strong> probabilities:Year 0Initial Investment $80 million discount rate 8%Year 1 Probability .2 Cash flow $50 million, Probability .3 Cash flow $40million,Probability .4 Cash flow $30 million,Probability .1 Cash flow $20 millionYear 2 Probability .1 Cash flow $60 million, Probability .2 Cash flow $50million,Probability .3 Cash flow $40 million,Probability .4 Cash flow $30 millionYear 3 Probability .3 Cash flow $70 million, Probability .4 Cash flow $60million,Probability .1 Cash flow $50 million,Probability .2 Cash flow $40 millionDescribe your answer for each question in complete sentences, whenever it is necessary.Show all <strong>of</strong> your calculations <strong>and</strong> processes for the following points:Describe <strong>and</strong> calculate Project A’s expected net present value (ENPV) <strong>and</strong> st<strong>and</strong>ard deviation(SD), assuming the discount rate (or risk-free interest rate) to be 8%. What is the decisionrule in terms <strong>of</strong> ENPV? What will be San Diego LLC’s decision regarding this project?Describe your answer.The company is also considering another three-year project, Project B, which has an ENPV

<strong>of</strong> $32 million <strong>and</strong> st<strong>and</strong>ard deviation <strong>of</strong> $10.5 million. Project A <strong>and</strong> B are mutuallyexclusive. Which <strong>of</strong> the two projects would you prefer if you do not consider the risk factor?Explain.Describe the coefficient <strong>of</strong> variation (CV) <strong>and</strong> the st<strong>and</strong>ard deviation (SD) in connection withrisk attitudes <strong>and</strong> decision making. If you now also consider your risk-aversion attitude, asthe CEO <strong>of</strong> the San Diego LLC will you make a different decision between Project A <strong>and</strong>Project B? Why or why not?