TRANSPORT

A4 Application Form Resident.pmd - HDFC Bank

A4 Application Form Resident.pmd - HDFC Bank

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

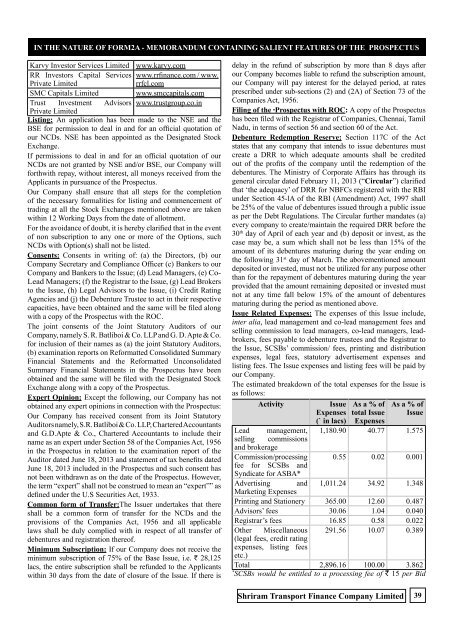

in the nature of FORM2A - MEMORANDUM CONTAINING SALIENT FEATURES OF THE PROSPECTUSKarvy Investor Services Limited www.karvy.comRR Investors Capital Services www.rrfinance.com / www.Private Limitedrrfcl.comSMC Capitals Limited www.smccapitals.comTrust Investment Advisors www.trustgroup.co.inPrivate LimitedListing: An application has been made to the NSE and theBSE for permission to deal in and for an official quotation ofour NCDs. NSE has been appointed as the Designated StockExchange.If permissions to deal in and for an official quotation of ourNCDs are not granted by NSE and/or BSE, our Company willforthwith repay, without interest, all moneys received from theApplicants in pursuance of the Prospectus.Our Company shall ensure that all steps for the completionof the necessary formalities for listing and commencement oftrading at all the Stock Exchanges mentioned above are takenwithin 12 Working Days from the date of allotment.For the avoidance of doubt, it is hereby clarified that in the eventof non subscription to any one or more of the Options, suchNCDs with Option(s) shall not be listed.Consents: Consents in writing of: (a) the Directors, (b) ourCompany Secretary and Compliance Officer (c) Bankers to ourCompany and Bankers to the Issue; (d) Lead Managers, (e) Co-Lead Managers; (f) the Registrar to the Issue, (g) Lead Brokersto the Issue, (h) Legal Advisors to the Issue, (i) Credit RatingAgencies and (j) the Debenture Trustee to act in their respectivecapacities, have been obtained and the same will be filed alongwith a copy of the Prospectus with the ROC.The joint consents of the Joint Statutory Auditors of ourCompany, namely S. R. Batliboi & Co. LLP and G. D. Apte & Co.for inclusion of their names as (a) the joint Statutory Auditors,(b) examination reports on Reformatted Consolidated SummaryFinancial Statements and the Reformatted UnconsolidatedSummary Financial Statements in the Prospectus have beenobtained and the same will be filed with the Designated StockExchange along with a copy of the Prospectus.Expert Opinion: Except the following, our Company has notobtained any expert opinions in connection with the Prospectus:Our Company has received consent from its Joint StatutoryAuditors namely, S.R. Batliboi & Co. LLP, Chartered Accountantsand G.D.Apte & Co., Chartered Accountants to include theirname as an expert under Section 58 of the Companies Act, 1956in the Prospectus in relation to the examination report of theAuditor dated June 18, 2013 and statement of tax benefits datedJune 18, 2013 included in the Prospectus and such consent hasnot been withdrawn as on the date of the Prospectus. However,the term “expert” shall not be construed to mean an “expert”” asdefined under the U.S Securities Act, 1933.Common form of Transfer:The Issuer undertakes that thereshall be a common form of transfer for the NCDs and theprovisions of the Companies Act, 1956 and all applicablelaws shall be duly complied with in respect of all transfer ofdebentures and registration thereof.Minimum Subscription: If our Company does not receive theminimum subscription of 75% of the Base Issue, i.e. ` 28,125lacs, the entire subscription shall be refunded to the Applicantswithin 30 days from the date of closure of the Issue. If there isdelay in the refund of subscription by more than 8 days afterour Company becomes liable to refund the subscription amount,our Company will pay interest for the delayed period, at ratesprescribed under sub-sections (2) and (2A) of Section 73 of theCompanies Act, 1956.Filing of the Prospectus with ROC: A copy of the Prospectushas been filed with the Registrar of Companies, Chennai, TamilNadu, in terms of section 56 and section 60 of the Act.Debenture Redemption Reserve: Section 117C of the Actstates that any company that intends to issue debentures mustcreate a DRR to which adequate amounts shall be creditedout of the profits of the company until the redemption of thedebentures. The Ministry of Corporate Affairs has through itsgeneral circular dated February 11, 2013 (“Circular”) clarifiedthat ‘the adequacy’ of DRR for NBFCs registered with the RBIunder Section 45-lA of the RBI (Amendment) Act, 1997 shallbe 25% of the value of debentures issued through a public issueas per the Debt Regulations. The Circular further mandates (a)every company to create/maintain the required DRR before the30 th day of April of each year and (b) deposit or invest, as thecase may be, a sum which shall not be less than 15% of theamount of its debentures maturing during the year ending onthe following 31 st day of March. The abovementioned amountdeposited or invested, must not be utilized for any purpose otherthan for the repayment of debentures maturing during the yearprovided that the amount remaining deposited or invested mustnot at any time fall below 15% of the amount of debenturesmaturing during the period as mentioned above.Issue Related Expenses: The expenses of this Issue include,inter alia, lead management and co-lead management fees andselling commission to lead managers, co-lead managers, leadbrokers,fees payable to debenture trustees and the Registrar tothe Issue, SCSBs’ commission/ fees, printing and distributionexpenses, legal fees, statutory advertisement expenses andlisting fees. The Issue expenses and listing fees will be paid byour Company.The estimated breakdown of the total expenses for the Issue isas follows:ActivityIssueExpenses(` in lacs)As a % oftotal IssueExpensesAs a % ofIssueLead management, 1,180.90 40.77 1.575selling commissionsand brokerageCommission/processing 0.55 0.02 0.001fee for SCSBs andSyndicate for ASBA*Advertising and 1,011.24 34.92 1.348Marketing ExpensesPrinting and Stationery 365.00 12.60 0.487Advisors’ fees 30.06 1.04 0.040Registrar’s fees 16.85 0.58 0.022Other Miscellaneous 291.56 10.07 0.389(legal fees, credit ratingexpenses, listing feesetc.)Total 2,896.16 100.00 3.862*SCSBs would be entitled to a processing fee of ` 15 per BidShriram Transport Finance Company Limited39