IRS Form 8300 - Auction.com

IRS Form 8300 - Auction.com

IRS Form 8300 - Auction.com

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

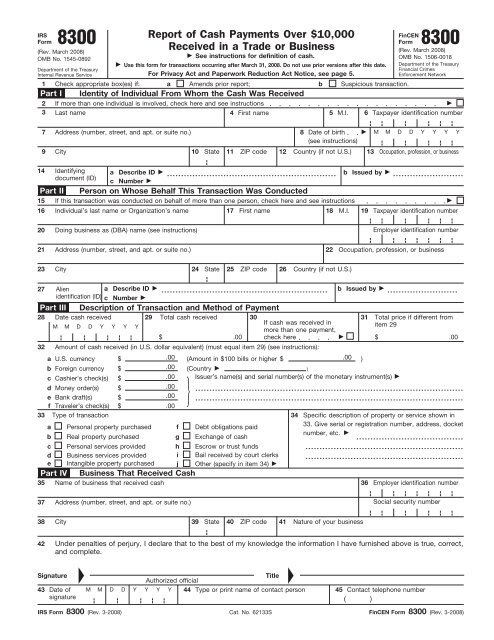

<strong>IRS</strong><strong>Form</strong> <strong>8300</strong>(Rev. March 2008)OMB No. 1545-0892Report of Cash Payments Over $10,000Received in a Trade or Business See instructions for definition of cash. Use this form for transactions occurring after March 31, 2008. Do not use prior versions after this date.Department of the TreasuryInternal Revenue Service For Privacy Act and Paperwork Reduction Act Notice, see page 5.1 Check appropriate box(es) if: a Amends prior report;Part I Identity of Individual From Whom the Cash Was Received2 If more than one individual is involved, check here and see instructions3 Last name4 First nameb5Suspicious transaction.M.I.6FinCEN<strong>Form</strong> <strong>8300</strong>(Rev. March 2008)OMB No. 1506-0018Department of the TreasuryFinancial CrimesEnforcement NetworkTaxpayer identification number7 Address (number, street, and apt. or suite no.)8 Date of birth (see instructions)9City10State11ZIP code12Country (if not U.S.)14 Identifying a Describe ID b Issued by document (ID)c Number Part II Person on Whose Behalf This Transaction Was Conducted15 If this transaction was conducted on behalf of more than one person, check here and see instructions16Individual’s last name or Organization’s name17First name18M.I.1913M M D D Y Y Y YOccupation, profession, or businessTaxpayer identification number20 Doing business as (DBA) name (see instructions)Employer identification number21Address (number, street, and apt. or suite no.)22Occupation, profession, or business23City24State25ZIP code26Country (if not U.S.)27 Aliena Describe ID b Issued by identification (ID) c Number Part III Description of Transaction and Method of Payment28 Date cash received29 Total cash received30 31 Total price if different fromIf cash was received inM M D D Y Y Y Yitem 29more than one payment,$ .00 check here $ .0032aabAmount of cash received (in U.S. dollar equivalent) (must equal item 29) (see instructions):U.S. currencyb Foreign currencyc Cashier’s check(s)d Money order(s) $e Bank draft(s) $f Traveler’s check(s) $33 Type of transactionPersonal property purchasedReal property purchased$$$c Personal services provided h Escrow or trust fundsd Business services provided i Bail received by court clerkse Intangible property purchased j Other (specify in item 34) Part IV Business That Received Cash35 Name of business that received cash.00.00.00.00.00.00fg(Amount in $100 bills or higher $ .00 )(Country )Issuer’s name(s) and serial number(s) of the monetary instrument(s) Debt obligations paidExchange of cash34Specific description of property or service shown in33. Give serial or registration number, address, docketnumber, etc. 36Employer identification number37Address (number, street, and apt. or suite no.)Social security number38City39State40ZIP code41Nature of your business42Signature43Under penalties of perjury, I declare that to the best of my knowledge the information I have furnished above is true, correct,and <strong>com</strong>plete.Date ofsignatureTitleAuthorized officialM M D D Y Y Y Y 44 Type or print name of contact person 45 Contact telephone number( )<strong>IRS</strong> <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)Cat. No. 62133SFinCEN <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)

<strong>IRS</strong> <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008) Page 2Multiple PartiesFinCEN <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)(Complete applicable parts below if box 2 or 15 on page 1 is checked)Part IContinued—Complete if box 2 on page 1 is checked3Last name4First name5M.I.6Taxpayer identification number7 Address (number, street, and apt. or suite no.)8 Date of birth M M D D Y Y Y Y(see instructions)9 City10 State 11 ZIP code 12 Country (if not U.S.) 13 Occupation, profession, or business14Identifyingdocument (ID)acDescribe ID Number b Issued by 3Last name4First name5M.I.6Taxpayer identification number7 Address (number, street, and apt. or suite no.)8 Date of birth M M D D Y Y Y Y(see instructions)9 City10 State 11 ZIP code 12 Country (if not U.S.) 13 Occupation, profession, or business14Identifyingdocument (ID)acDescribe ID Number b Issued by Part IIContinued—Complete if box 15 on page 1 is checked16Individual’s last name or Organization’s name17First name18M.I.19Taxpayer identification number20 Doing business as (DBA) name (see instructions)Employer identification number21Address (number, street, and apt. or suite no.)22Occupation, profession, or business23City24State25ZIP code26Country (if not U.S.)27Alienidentification (ID)acDescribe ID Number b Issued by 16Individual’s last name or Organization’s name17First name18M.I.19Taxpayer identification number20 Doing business as (DBA) name (see instructions)Employer identification number21Address (number, street, and apt. or suite no.)22Occupation, profession, or business23City24State25ZIP code26Country (if not U.S.)27Alienidentification (ID)acDescribe ID Number b Issued by Comments – Please use the lines provided below to <strong>com</strong>ment on or clarify any information you entered on any line in Parts I, II, III, and IV<strong>IRS</strong> <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008) FinCEN <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)

<strong>IRS</strong> <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)Section references are to the InternalRevenue Code unless otherwise noted.Important Reminders● Section 6050I (26 United States Code(U.S.C.) 6050I) and 31 U.S.C. 5331require that certain information bereported to the <strong>IRS</strong> and the FinancialCrimes Enforcement Network (FinCEN).This information must be reported on<strong>IRS</strong>/FinCEN <strong>Form</strong> <strong>8300</strong>.● Item 33 box i is to be checked only byclerks of the court; box d is to bechecked by bail bondsmen. See theinstructions on page 5.● The meaning of the word “currency”for purposes of 31 U.S.C. 5331 is thesame as for the word “cash” (See Cashon page 4).General InstructionsWho must file. Each person engaged ina trade or business who, in the courseof that trade or business, receives morethan $10,000 in cash in one transactionor in two or more related transactions,must file <strong>Form</strong> <strong>8300</strong>. Any transactionsconducted between a payer (or itsagent) and the recipient in a 24-hourperiod are related transactions.Transactions are considered relatedeven if they occur over a period of morethan 24 hours if the recipient knows, orhas reason to know, that eachtransaction is one of a series ofconnected transactions.Keep a copy of each <strong>Form</strong> <strong>8300</strong> for 5years from the date you file it.Clerks of federal or state courts mustfile <strong>Form</strong> <strong>8300</strong> if more than $10,000 incash is received as bail for anindividual(s) charged with certain criminaloffenses. For these purposes, a clerkincludes the clerk’s office or any otheroffice, department, division, branch, orunit of the court that is authorized toreceive bail. If a person receives bail onbehalf of a clerk, the clerk is treated asreceiving the bail. See the instructionsfor Item 33 on page 5.If multiple payments are made in cashto satisfy bail and the initial paymentdoes not exceed $10,000, the initialpayment and subsequent paymentsmust be aggregated and the informationreturn must be filed by the 15th dayafter receipt of the payment that causesthe aggregate amount to exceed$10,000 in cash. In such cases, thereporting requirement can be satisfiedeither by sending a single writtenstatement with an aggregate amountlisted or by furnishing a copy of each<strong>Form</strong> <strong>8300</strong> relating to that payer.Payments made to satisfy separate bailrequirements are not required to beaggregated. See Treasury Regulationssection 1.6050I-2.Page 3Casinos must file <strong>Form</strong> <strong>8300</strong> fornongaming activities (restaurants, shops,etc.).Voluntary use of <strong>Form</strong> <strong>8300</strong>. <strong>Form</strong><strong>8300</strong> may be filed voluntarily for anysuspicious transaction (see Definitionson page 4) for use by FinCEN and the<strong>IRS</strong>, even if the total amount does notexceed $10,000.Exceptions. Cash is not required to bereported if it is received:● By a financial institution required to file<strong>Form</strong> 104, Currency Transaction Report.● By a casino required to file (or exemptfrom filing) <strong>Form</strong> 103, CurrencyTransaction Report by Casinos, if thecash is received as part of its gamingbusiness.● By an agent who receives the cashfrom a principal, if the agent uses all ofthe cash within 15 days in a secondtransaction that is reportable on <strong>Form</strong><strong>8300</strong> or on <strong>Form</strong> 104, and discloses allthe information necessary to <strong>com</strong>pletePart II of <strong>Form</strong> <strong>8300</strong> or <strong>Form</strong> 104 to therecipient of the cash in the secondtransaction.● In a transaction occurring entirelyoutside the United States. SeePublication 1544, Reporting CashPayments of Over $10,000 (Received ina Trade or Business), regardingtransactions occurring in Puerto Ricoand territories and possessions of theUnited States.● In a transaction that is not in thecourse of a person’s trade or business.When to file. File <strong>Form</strong> <strong>8300</strong> by the15th day after the date the cash wasreceived. If that date falls on a Saturday,Sunday, or legal holiday, file the form onthe next business day.Where to file. File the form with theInternal Revenue Service, DetroitComputing Center, P.O. Box 32621,Detroit, Ml 48232.Statement to be provided. You mustgive a written or electronic statement toeach person named on a required <strong>Form</strong><strong>8300</strong> on or before January 31 of theyear following the calendar year in whichthe cash is received. The statementmust show the name, telephone number,and address of the information contactfor the business, the aggregate amountof reportable cash received, and that theinformation was furnished to the <strong>IRS</strong>.Keep a copy of the statement for yourrecords.Multiple payments. If you receive morethan one cash payment for a singletransaction or for related transactions,you must report the multiple paymentsany time you receive a total amount thatexceeds $10,000 within any 12-monthperiod. Submit the report within 15 daysof the date you receive the payment thatFinCEN <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)causes the total amount to exceed$10,000. If more than one report isrequired within 15 days, you may file a<strong>com</strong>bined report. File the <strong>com</strong>binedreport no later than the date the earliestreport, if filed separately, would have tobe filed.Taxpayer identification number (TIN).You must furnish the correct TIN of theperson or persons from whom youreceive the cash and, if applicable, theperson or persons on whose behalf thetransaction is being conducted. You maybe subject to penalties for an incorrector missing TIN.The TIN for an individual (including asole proprietorship) is the individual’ssocial security number (SSN). For certainresident aliens who are not eligible toget an SSN and nonresident aliens whoare required to file tax returns, it is an<strong>IRS</strong> Individual Taxpayer IdentificationNumber (ITIN). For other persons,including corporations, partnerships, andestates, it is the employer identificationnumber (EIN).If you have requested but are not ableto get a TIN for one or more of theparties to a transaction within 15 daysfollowing the transaction, file the reportand attach a statement explaining whythe TIN is not included.Exception: You are not required toprovide the TIN of a person who is anonresident alien individual or a foreignorganization if that person or foreignorganization:● Does not have in<strong>com</strong>e effectivelyconnected with the conduct of a U.S.trade or business;● Does not have an office or place ofbusiness, or a fiscal or paying agent inthe United States;● Does not furnish a withholdingcertificate described in §1.1441-1(e)(2) or(3) or §1.1441-5(c)(2)(iv) or (3)(iii) to theextent required under §1.1441-1(e)(4)(vii);or● Does not have to furnish a TIN on anyreturn, statement, or other document asrequired by the in<strong>com</strong>e tax regulationsunder section 897 or 1445.Penalties. You may be subject topenalties if you fail to file a correct and<strong>com</strong>plete <strong>Form</strong> <strong>8300</strong> on time and youcannot show that the failure was due toreasonable cause. You may also besubject to penalties if you fail to furnishtimely a correct and <strong>com</strong>plete statementto each person named in a requiredreport. A minimum penalty of $25,000may be imposed if the failure is due toan intentional or willful disregard of thecash reporting requirements.Penalties may also be imposed forcausing, or attempting to cause, a tradeor business to fail to file a required

<strong>IRS</strong> <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)report; for causing, or attempting tocause, a trade or business to file arequired report containing a materialomission or misstatement of fact; or forstructuring, or attempting to structure,transactions to avoid the reportingrequirements. These violations may alsobe subject to criminal prosecution which,upon conviction, may result inimprisonment of up to 5 years or fines ofup to $250,000 for individuals and$500,000 for corporations or both.DefinitionsCash. The term “cash” means thefollowing:● U.S. and foreign coin and currencyreceived in any transaction.● A cashier’s check, money order, bankdraft, or traveler’s check having a faceamount of $10,000 or less that isreceived in a designated reportingtransaction (defined below), or that isreceived in any transaction in which therecipient knows that the instrument isbeing used in an attempt to avoid thereporting of the transaction under eithersection 6050I or 31 U.S.C. 5331.Note. Cash does not include a checkdrawn on the payer’s own account, suchas a personal check, regardless of theamount.Designated reporting transaction. Aretail sale (or the receipt of funds by abroker or other intermediary inconnection with a retail sale) of aconsumer durable, a collectible, or atravel or entertainment activity.Retail sale. Any sale (whether or notthe sale is for resale or for any otherpurpose) made in the course of a tradeor business if that trade or businessprincipally consists of making sales toultimate consumers.Consumer durable. An item of tangiblepersonal property of a type that, underordinary usage, can reasonably beexpected to remain useful for at least 1year, and that has a sales price of morethan $10,000.Collectible. Any work of art, rug,antique, metal, gem, stamp, coin, etc.Travel or entertainment activity. Anitem of travel or entertainment thatpertains to a single trip or event if the<strong>com</strong>bined sales price of the item and allother items relating to the same trip orevent that are sold in the sametransaction (or related transactions)exceeds $10,000.Exceptions. A cashier’s check, moneyorder, bank draft, or traveler’s check isnot considered received in a designatedreporting transaction if it constitutes theproceeds of a bank loan or if it isreceived as a payment on certainpromissory notes, installment salescontracts, or down payment plans. SeePublication 1544 for more information.Part IPage 4Person. An individual, corporation,partnership, trust, estate, association, or<strong>com</strong>pany.Recipient. The person receiving thecash. Each branch or other unit of aperson’s trade or business is considereda separate recipient unless the branchreceiving the cash (or a central officelinking the branches), knows or hasreason to know the identity of payersmaking cash payments to otherbranches.Transaction. Includes the purchase ofproperty or services, the payment ofdebt, the exchange of a negotiableinstrument for cash, and the receipt ofcash to be held in escrow or trust. Asingle transaction may not be brokeninto multiple transactions to avoidreporting.Suspicious transaction. A suspicioustransaction is a transaction in which itappears that a person is attempting tocause <strong>Form</strong> <strong>8300</strong> not to be filed, or tofile a false or in<strong>com</strong>plete form.Specific InstructionsYou must <strong>com</strong>plete all parts. However,you may skip Part II if the individualnamed in Part I is conducting thetransaction on his or her behalf only. Forvoluntary reporting of suspicioustransactions, see Item 1 below.Item 1. If you are amending a priorreport, check box 1a. Complete theappropriate items with the correct oramended information only. Complete allof Part IV. Staple a copy of the originalreport to the amended report.To voluntarily report a suspicioustransaction (see Suspicious transactionabove), check box 1b. You may alsotelephone your local <strong>IRS</strong> CriminalInvestigation Division or call1-866-556-3974.Item 2. If two or more individualsconducted the transaction you arereporting, check the box and <strong>com</strong>pletePart I for any one of the individuals.Provide the same information for theother individual(s) on the back of theform. If more than three individuals areinvolved, provide the same informationon additional sheets of paper and attachthem to this form.Item 6. Enter the taxpayer identificationnumber (TIN) of the individual named.See Taxpayer identification number (TIN)on page 3 for more information.Item 8. Enter eight numerals for the dateof birth of the individual named. Forexample, if the individual’s birth date isJuly 6, 1960, enter 07 06 1960.Item 13. Fully describe the nature of theoccupation, profession, or business (forexample, “plumber,” “attorney,” or“automobile dealer”). Do not use generalor nondescriptive terms such as“businessman” or “self-employed.”Item 14. You must verify the name andaddress of the named individual(s).Verification must be made byexamination of a document normallyaccepted as a means of identificationwhen cashing checks (for example, adriver’s license, passport, alienregistration card, or other officialdocument). In item 14a, enter the type ofdocument examined. In item 14b,identify the issuer of the document. Initem 14c, enter the document’s number.For example, if the individual has a Utahdriver’s license, enter “driver’s license”in item 14a, “Utah” in item 14b, and thenumber appearing on the license in item14c.Note. You must <strong>com</strong>plete all three items(a, b, and c) in this line to make surethat <strong>Form</strong> <strong>8300</strong> will be processedcorrectly.Part IIFinCEN <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)Item 15. If the transaction is beingconducted on behalf of more than oneperson (including husband and wife orparent and child), check the box and<strong>com</strong>plete Part II for any one of thepersons. Provide the same informationfor the other person(s) on the back ofthe form. If more than three persons areinvolved, provide the same informationon additional sheets of paper and attachthem to this form.Items 16 through 19. If the person onwhose behalf the transaction is beingconducted is an individual, <strong>com</strong>pleteitems 16, 17, and 18. Enter his or herTIN in item 19. If the individual is a soleproprietor and has an employeridentification number (EIN), you mustenter both the SSN and EIN in item 19.If the person is an organization, put itsname as shown on required tax filings initem 16 and its EIN in item 19.Item 20. If a sole proprietor ororganization named in items 16 through18 is doing business under a name otherthan that entered in item 16 (forexample, a “trade” or “doing businessas (DBA)” name), enter it here.Item 27. If the person is not required tofurnish a TIN, <strong>com</strong>plete this item. SeeTaxpayer Identification Number (TIN) onpage 3. Enter a description of the typeof official document issued to thatperson in item 27a (for example, a“passport”), the country that issued thedocument in item 27b, and thedocument’s number in item 27c.

<strong>IRS</strong> <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008) Page 5FinCEN <strong>Form</strong> <strong>8300</strong> (Rev. 3-2008)Note. You must <strong>com</strong>plete all three items(a, b, and c) in this line to make surethat <strong>Form</strong> <strong>8300</strong> will be processedcorrectly.Part IIIItem 28. Enter the date you received thecash. If you received the cash in morethan one payment, enter the date youreceived the payment that caused the<strong>com</strong>bined amount to exceed $10,000.See Multiple payments on page 3 formore information.Item 30. Check this box if the amountshown in item 29 was received in morethan one payment (for example, asinstallment payments or payments onrelated transactions).Item 31. Enter the total price of theproperty, services, amount of cashexchanged, etc. (for example, the totalcost of a vehicle purchased, cost ofcatering service, exchange of currency) ifdifferent from the amount shown in item29.Item 32. Enter the dollar amount of eachform of cash received. Show foreigncurrency amounts in U.S. dollarequivalent at a fair market rate ofexchange available to the public. Thesum of the amounts must equal item 29.For cashier’s check, money order, bankdraft, or traveler’s check, provide thename of the issuer and the serial numberof each instrument. Names of all issuersand all serial numbers involved must beprovided. If necessary, provide thisinformation on additional sheets of paperand attach them to this form.Item 33. Check the appropriate box(es)that describe the transaction. If thetransaction is not specified in boxes a–i,check box j and briefly describe thetransaction (for example, “car lease,”“boat lease,” “house lease,” or “aircraftrental”). If the transaction relates to thereceipt of bail by a court clerk, checkbox i, “Bail received by court clerks.”This box is only for use by court clerks.If the transaction relates to cashreceived by a bail bondsman, check boxd, “Business services provided.”Part IVItem 36. If you are a sole proprietorship,you must enter your SSN. If yourbusiness also has an EIN, you mustprovide the EIN as well. All otherbusiness entities must enter an EIN.Item 41. Fully describe the nature ofyour business, for example, “attorney” or“jewelry dealer.” Do not use general ornondescriptive terms such as “business”or “store.”Item 42. This form must be signed by anindividual who has been authorized todo so for the business that received thecash.CommentsUse this section to <strong>com</strong>ment on orclarify anything you may have enteredon any line in Parts I, II, III, and IV. Forexample, if you checked box b(Suspicious transaction) in line 1 abovePart I, you may want to explain why youthink that the cash transaction you arereporting on <strong>Form</strong> <strong>8300</strong> may besuspicious.Privacy Act and Paperwork ReductionAct Notice. Except as otherwise noted,the information solicited on this form isrequired by the Internal Revenue Service(<strong>IRS</strong>) and the Financial CrimesEnforcement Network (FinCEN) in orderto carry out the laws and regulations ofthe United States Department of theTreasury. Trades or businesses, exceptfor clerks of criminal courts, are requiredto provide the information to the <strong>IRS</strong> andFinCEN under both section 6050I and 31U.S.C. 5331. Clerks of criminal courtsare required to provide the informationto the <strong>IRS</strong> under section 6050I. Section6109 and 31 U.S.C. 5331 require thatyou provide your social security numberin order to adequately identify you andprocess your return and other papers.The principal purpose for collecting theinformation on this form is to maintainreports or records which have a highdegree of usefulness in criminal, tax, orregulatory investigations or proceedings,or in the conduct of intelligence orcounterintelligence activities, by directingthe federal Government’s attention tounusual or questionable transactions.You are not required to provideinformation as to whether the reportedtransaction is deemed suspicious.Failure to provide all other requestedinformation, or providing fraudulentinformation, may result in criminalprosecution and other penalties underTitle 26 and Title 31 of the United StatesCode.Generally, tax returns and returninformation are confidential, as stated insection 6103. However, section 6103allows or requires the <strong>IRS</strong> to disclose orgive the information requested on thisform to others as described in the Code.For example, we may disclose your taxinformation to the Department of Justice,to enforce the tax laws, both civil andcriminal, and to cities, states, the Districtof Columbia, to carry out their tax laws.We may disclose this information toother persons as necessary to obtaininformation which we cannot get in anyother way. We may disclose thisinformation to federal, state, and localchild support agencies; and to otherfederal agencies for the purposes ofdetermining entitlement for benefits orthe eligibility for and the repayment ofloans. We may also provide the recordsto appropriate state, local, and foreigncriminal law enforcement and regulatorypersonnel in the performance of theirofficial duties. We may also disclose thisinformation to other countries under atax treaty, or to federal and stateagencies to enforce federal nontaxcriminal laws and to <strong>com</strong>bat terrorism. Inaddition, FinCEN may provide theinformation to those officials if they areconducting intelligence orcounter-intelligence activities to protectagainst international terrorism.You are not required to provide theinformation requested on a form that issubject to the Paperwork Reduction Actunless the form displays a valid OMBcontrol number. Books or recordsrelating to a form or its instructions mustbe retained as long as their contentsmay be<strong>com</strong>e material in theadministration of any law under Title 26or Title 31.The time needed to <strong>com</strong>plete thisform will vary depending on individualcircumstances. The estimated averagetime is 21 minutes. If you have<strong>com</strong>ments concerning the accuracy ofthis time estimate or suggestions formaking this form simpler, you can writeto the Internal Revenue Service, TaxProducts Coordinating Committee,SE:W:CAR:MP:T:T:SP, 1111 ConstitutionAve. NW, IR-6526, Washington, DC20224. Do not send <strong>Form</strong> <strong>8300</strong> to thisaddress. Instead, see Where to File onpage 3.