Orient Paper & Industries Ltd

Orient Papers Industries Ltd. - ANS Pvt. Ltd.

Orient Papers Industries Ltd. - ANS Pvt. Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

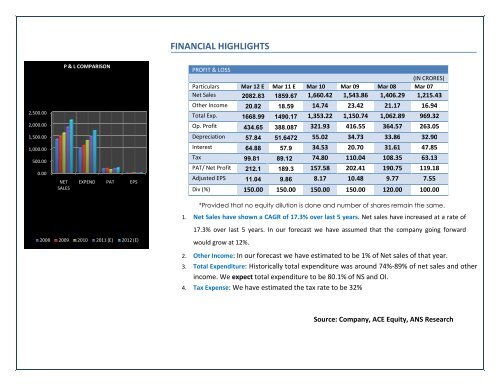

FINANCIAL HIGHLIGHTS2,500.002,000.001,500.001,000.00500.000.00NETSALESP & L COMPARISONEXPEND PAT EPSPROFIT & LOSSParticulars Mar 12 E Mar 11 E Mar 10 Mar 09Net Sales 2082.83 1859.67 1,660.42 1,543.86Other Income 20.82 18.59 14.74 23.42Total Exp. 1668.99 1490.17 1,353.22 1,150.74Op. Profit 434.65 388.087 321.93 416.55Depreciation 57.84 51.6472 55.02 34.73Interest 64.88 57.9 34.53 20.70Tax 99.81 89.12 74.80 110.04PAT/ Net Profit 212.1 189.3 157.58 202.41Adjusted EPS 11.04 9.86 8.17 10.48Div (%) 150.00 150.00 150.00 150.00(IN CRORES)Mar 08 Mar 071,406.29 1,215.4321.17 16.941,062.89 969.32364.57 263.0533.86 32.9031.61 47.85108.35 63.13190.75 119.189.77 7.55120.00 100.002008 2009 2010 2011 (E) 2012 (E)1.2.3.4.*Provided that no equity dilution is done and number of shares remain the same.Net Sales have shown a CAGR of 17.3% over last 5 years. Net sales have increased at a rate of17.3% over last 5 years. In our forecast we have assumed that the company going forwardwould grow at 12%.Other Income: In our forecast we have estimated to be 1% of Net sales of that year.Total Expenditure: : Historically total expenditure was around 74%-89% of net sales and otherincome. We expect total expenditure to be 80.1% of NS and OI.Tax Expense: We have estimated the tax rate to be 32%Source: Company, ACE Equity, ANS Research