INDIA SECURITIES LIMITED 2

INDIA SECURITIES LIMITED - Essar

INDIA SECURITIES LIMITED - Essar

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

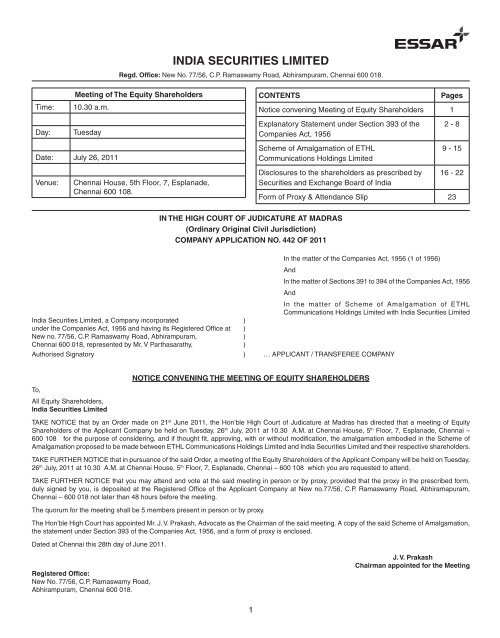

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>India Securities Limited, )a Company incorporated under the Companies )Act, 1956 and having its Registered Office at )New no. 77/56, C.P. Ramaswamy Road, )Abhirampuram, Chennai 600 018, )represented by Mr. V Parthasarathy, )IN THE HIGH COURT OF JUDICATURE AT MADRAS(Ordinary Original Civil Jurisdiction)COMPANY APPLICATION NO. 442 OF 2011In the matter of the Companies Act, 1956 (1 of 1956)AndIn the matter of Sections 391 to 394 of the Companies Act, 1956AndIn the matter of Scheme of Amalgamation ofETHL Communications Holdings LimitedwithIndia Securities LimitedAuthorised Signatory ) … APPLICANT / TRANSFEREE COMPANYEXPLANATORY STATEMENT UNDER SECTION 393 OF THE COMPANIES ACT, 19561. By an order dated 21 st June 2011, the Hon’ble High Court ofJudicature at Madras has directed that a meeting of EquityShareholders of the Applicant Company be held on Tuesday,26 th July, 2011 at 10.30 A.M. at Chennai House, 5 th Floor, 7,Esplanade, Chennai – 600 108 for the purpose of considering,and if thought fit, approving with or without modification, thearrangement embodied in the Scheme of Amalgamation of ETHLCommunications Holdings Limited with India Securities Limited.2. This statement explaining the terms of the scheme is beingfurnished as required under section 393(1) (a) of the CompaniesAct, 1956. In this Statement, the Applicant Company, IndiaSecurities Limited, is hereinafter also referred to as “TransfereeCompany”, and ETHL Communications Holdings Limited ishereinafter referred to as “Transferor Company”.3. The Transferee Company was originally incorporated under thename “Dear Leasing and Finance Limited” on 20 th July, 1984 in theUnion Territory of Delhi. The name of the Company was changedas “India Factors Limited” after obtaining necessary approval on1 st May, 1987. The registered office of the Applicant Companywas shifted to the state of Tamilnadu w.e.f. 28 th November, 1988and the name of the Company was changed as “India SecuritiesLimited” on 23 rd May, 1990. Subsequently, the registered office ofthe Company was shifted to the state of Maharashtra, with dueapprovals, w.e.f. 22 nd July, 1998. And finally w.e.f. 14 th May, 2010the registered office was shifted back to the State of Tamilnadu,after obtaining due approvals.4. The Registered Office of the Applicant Company is situated atNew no. 77/56, C.P. Ramaswamy Road, Abhirampuram, Chennai600 018.5. The Capital Structure of the Applicant Company as on 31 st March2010 is as follows:ParticularsAmount (Rs.)Authorised Share Capital:100,00,00,000 equity shares of Re.1 each 100,00,00,0005,00,000 preference shares of Rs. 2,000 100,00,00,000eachIssued, Subscribed and Paid-up ShareCapital:19,95,66,310 equity shares of Re.1 eachfully paid up2,00,000 1% Non - Cumulative CompulsorilyConvertible Preference Shares of Rs. 2,000each fully paid up19,95,66,31040,00,00,000Pursuant to the amalgamation of Essar TelecommunicationsHoldings Private Limited, a company incorporated under theAct and having its Registered Office at New No. 77/56, C. P.Ramaswamy Road, Abhirampuram, Chennai 600 018 with theTransferee Company approved by the High Court of Judicature atMadras by its order dated 21 st April 2011, the Share Capital of theTransferee Company is as follows:ParticularsAuthorised Share Capital:Amount (Rs.)90,00,00,000 equity shares of Re.1 each 90,00,00,00015,50,000 preference shares of Rs. 2,000eachIssued, Subscribed and Paid-up ShareCapital:87,57,96,310 equity shares of Re.1 eachfully paid up15,41,000 Non - Cumulative PreferenceShares of Rs. 2,000 each fully paid up310,00,00,00087,57,96,310308,20,00,0002

6. The Applicant Company obtained the Certificate forCommencement of Business on 27 th July, 1984 and commencedits business activities soon thereafter and is presently engaged inthe business of consulting and advisory services.7. ETHL Communications Holdings Limited, (“the TransferorCompany” or ECHL”) was incorporated on October 8, 2007 underthe Companies Act, 1956, in the State of Maharashtra.8. The Registered Office of the Transferor Company is situated atEssar House, 11,K.K. Marg, Mahalaxmi, Mumbai - 400 034.9. The Authorised Capital of the Transferor Company as on 31 stMarch 2010 is as follows:-ParticularsAuthorised Share Capital:Amount (Rs.)16,00,00,000 equity shares of Rs.10 each 160,00,00,000Issued, Subscribed and Paid-up ShareCapital:156,544,000 equity shares of Rs. 10 each 1,565,440,000Subsequent to March 31, 2010, there has been no change in theAuthorized, Issued, Subscribed and Paid up Capital.10. The Transferor Company commenced its business activities soonafter incorporation and is presently engaged in the business asinvestment holding company.11. The amalgamation of the Transferor Company with the TransfereeCompany will be effected by a Scheme of Amalgamation(hereinafter referred to as “the Scheme”) under Sections 391 to394 of the Companies Act, 1956 (hereinafter referred to as “theAct”).12. The Board of Directors of the Transferor Company and theTransferee Company have in their respective Board Meetings,held on 10 th May, 2011 and 16 th May 2011, approved and adoptedthe proposed Scheme of Amalgamation, a copy whereof is sentherewith. The proposed Scheme of Amalgamation under Sections391 and 394 of the Companies Act, 1956 is deemed to form partof this statement.13. The salient features of the Scheme are as follows:a) The Appointed date for this Scheme is 1 st April 2010 orsuch other date as the High Court of Judicature at Madrasmay direct or fix.b) Upon coming into effect of this Scheme and with effectfrom the Appointed Date, subject to the provisions of thisScheme in relation to the mode of transfer and vesting,the entire business and Undertaking of the TransferorCompany shall, without any further act or deed, be andstand transferred to and vested in or be deemed to havebeen transferred to and vested in the Transferee Companyas a going concern, pursuant to the provisions of Sections391 to 394 and other applicable provisions of the Act andthe provisions of this Scheme in relation to the mode oftransfer and vesting of assets.Provided that for the purpose of giving effect to the vestingorder passed under Sections 391 to 394 in respect ofthis Scheme, the Transferee Company shall at any timepursuant to the orders on this Scheme be entitled to get therecord of the change in the title and the appurtenant legalright(s) upon the vesting of such assets of the TransferorCompany in accordance with the provisions of Sections 391to 394 of the Act, at the office of the respective Registrarof Assurances or any other concerned authority, where anysuch property is situated.c) All assets, estate, rights, title, interest and authoritiesaccrued to and/or acquired by the Transferor Company afterthe Appointed Date and prior to the Effective Date shall bedeemed to have been accrued to and/or acquired for andon behalf of the Transferee Company and shall, upon thecoming into effect of the Scheme and with effect from theAppointed Date pursuant to the provisions of Sections 391to 394 and other applicable provisions of the Act, withoutany further act, instrument or deed, be transferred toand vested in and/or be deemed to be transferred to andvested in the Transferee Company so as to become as andfrom the Appointed Date, the estate, assets, rights, title,interests and authorities of the Transferee Company. Uponcoming into effect of this Scheme and with effect from theAppointed Date, all movable assets including cash in hand,if any, of the Transferor Company, capable of passing bymanual delivery or possession or by endorsement anddelivery, shall be so delivered or endorsed and delivered,as the case may be, to the Transferee Company upon thecoming into effect of the Scheme, without requiring anydeed or instrument of conveyance for transfer of the same.Such delivery shall be made on a date mutually agreedupon between the Board of Directors of the TransferorCompany and the Transferee Company.d) In respect of movables other than those specified in clause13 (c) above, including sundry debtors, outstanding loansand advances, if any, recoverable in cash or in kind or forvalue to be received, bank balances and deposits, if any,with Government, Semi-Government, local and otherauthorities and bodies, customers and other persons, thefollowing modus operandi for intimating to third partiesshall, to the extent possible, be followed:(i)(ii)The Transferee Company shall give notice in suchform as it may deem fit and proper, to each person,debtor, loanee or depositee as the case may be,that pursuant to the Courts having sanctioned theScheme, the said debts, loans, advances, bankbalances or deposits be paid or made good orheld on account of the Transferee Company as theperson entitled thereto to the end and intent that theright of the Transferor Company to recover or realisethe same stands extinguished and that appropriateentry should be passed in its books to record theaforesaid change;The Transferor Company shall also give notice insuch form as they may deem fit and proper to eachperson, debtor, loanee or depositee that pursuant tothe Courts having sanctioned the Scheme the saiddebt, loan, advance or deposit be paid or made goodor held on account of the Transferee Company andthat the right of the Transferor Company to recoveror realise the same stands extinguished.e) In relation to the assets, if any, belonging to the TransferorCompany, which require separate documents of transfer,the Transferor Company and the Transferee Company willexecute necessary documents, as and when required.3

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>f) For avoidance of doubt, upon the Scheme coming intoeffect and with effect from the Appointed Date, all therights, title, interest and claims of the Transferor Companyin any leasehold properties, including all the leases, of theTransferor Company shall, pursuant to Section 394(2) ofthe Act, without any further act or deed, be transferred toand vested in or be deemed to have been transferred toand vested in the Transferee Company.g) For avoidance of doubt and without prejudice to thegenerality of the foregoing, it is clarified that upon theScheme coming into effect and with effect from theAppointed Date, all consents, permissions, licences,certificates, clearances, authorities, powers of attorneygiven by, issued to or executed in favour of the Undertakingshall stand transferred to the Transferee Company as if thesame were originally given by, issued to or executed in favourof the Transferee Company, and the Transferee Companyshall be bound by the terms thereof, the obligations andduties thereunder, and the rights and benefits under thesame shall be available to the Transferee Company. TheTransferee Company shall make applications to anyGovernmental Authority as may be necessary in this behalf.Without prejudice to the other provisions of this Schemeand notwithstanding the fact that the vesting of theUndertaking occurs by virtue of this Scheme itself, theTransferee Company may, at any time after the Schemecoming into effect in accordance with the provisions hereof,if so required under any law or otherwise, execute deeds(including deeds of adherence), confirmations or otherwritings or tripartite arrangements with any party to anycontract or arrangements to which the Transferor Companyis a party or any writing as may be necessary to be executedin order to give formal effect to the above provisions. TheTransferee Company shall under the provisions of thisScheme, be deemed to be authorised to execute any suchwritings on behalf of the Transferor Company and to carryout or perform all such formalities, compliances referred toabove on the part of the Transferee Company to be carriedout or performed in relation to the Undertaking beingtransferred by the Transferor Company.h) To the extent there are debentures and inter-corporateloans, debts and claims, (including, amounts receivable),if any, by the Transferor Company from the TransfereeCompany or vice versa, the obligations in respect thereofshall come to an end on the Scheme coming into effect anda corresponding suitable effect shall be given in the booksof accounts and records of the Transferee Company. Ifrequired reduction/cancellation of such debentures, loans,debts and claims (including, receivables) shall be reflectedin the books of accounts and records of the TransfereeCompany. For removal of doubts, it is hereby clarified thatfrom the Appointed Date, there would be no accrual ofinterest or other charges in respect of any such debenturesand inter-corporate loans or debt (including, receivables)balances between the Transferee Company on the onehand and the Transferor Company on the other hand.With effect from the Appointed Date, and subject to theprovisions of this Scheme, all secured and unsecureddebts (whether in rupees or foreign currency), liabilities,contingent liabilities, duties and obligations of every kind,nature, description, whether or not provided for in the booksof accounts and whether disclosed or undisclosed in thebalance sheet of the Transferor Company shall also standtransferred or deemed to have been transferred without anyfurther act, instrument or deed to the Transferee Company,pursuant to the provisions of Sections 391 to 394 and otherapplicable provisions of the Act , so as to become as andfrom the Appointed Date, the debts, liabilities, contingentliabilities, duties and obligations of the Transferee Companywithout any consent of any third party or other person whois a party to the contract or arrangements by virtue of whichsuch liabilities have arisen, in order to give effect to theprovisions of this clause.i) With effect from the Appointed Date, all guarantees,indemnities and contingent liabilities, if any, of theTransferor Company shall also, under the provisions ofSections 391 to 394 of the Act, without any further act ordeed, be transferred to or be deemed to be transferred tothe Transferee Company so as to become as and fromthe Appointed Date, the guarantees, indemnities andcontingent liabilities of the Transferee Company and it shallnot be necessary to obtain the consent of any third party orother person who is a party to any contract or arrangementby virtue of which such guarantees, indemnities andcontingent liabilities have arisen or given, in order to giveeffect to the provisions of this Clause;j) The transfer and vesting of the Undertaking as aforesaid,shall be subject to the existing securities, charges,hypothecation and mortgages, if any, subsisting over or inrespect of the property and assets or any part thereof of theTransferor Company.Provided however, any reference in any security documentsor arrangements, to which the Transferor Company isa party, wherein the assets of the Transferor Companyhave been or are offered or agreed to be offered assecurity for any financial assistance or obligations, shallbe construed as reference only to the assets pertaining tothe Undertaking as are vested in the Transferee Companyby virtue of this Scheme, to the end and intent that suchsecurity, charges, hypothecation and mortgage shall notextend or be deemed to extend, to any of the other assetsof the Transferor Company or any of the assets of theTransferee Company.Provided further that the securities, charges, hypothecationand mortgages (if any subsisting) over and in respect of theassets or any part thereof of the Transferee Company shallcontinue with respect to such assets or part thereof andthis Scheme shall not operate to enlarge such securities,charges, hypothecation and mortgages to the end andintent that such securities, charges, hypothecation andmortgages shall not extend or be deemed to extend, toany of the assets of the Transferor Company vested in theTransferee Company,Provided always that this Scheme shall not operate toenlarge the security for any loan, deposit or facility createdby the Transferor Company which shall vest in the TransfereeCompany by virtue of the amalgamation of the TransferorCompany with the Transferee Company and the TransfereeCompany shall not be obliged to create any further oradditional security therefore after the amalgamation hasbecome operative.4

k) All loans raised and used and all debts, liabilities, dutiesand obligations incurred or undertaken by the TransferorCompany on or after the Appointed Date and prior to theEffective Date, subject to the terms of this Scheme, shallbe deemed to have been raised, used, undertaken orincurred for and on behalf of the Transferee Company andto the extent they are outstanding on the Effective Date,shall, upon the coming to effect of this Scheme, without anyfurther act or deed, be and stand transferred to and vestedin or be deemed to be have been transferred to and vestedin the Transferee Company and shall become the loans,debts, liabilities, duties and obligations of the TransfereeCompany.Further, all the loans, advances and other facilitiessanctioned to the Transferor Company by its bankers andfinancial institutions prior to the Appointed Date, which arepartly drawn or utilised shall be deemed to be the loansand advances sanctioned to the Transferee Companyand the said loans and advances shall be drawn andutilised either partly or fully by the Transferor Companyfrom the Appointed Date till the Effective Date and allthe loans, advances and other facilities so drawn by theTransferor Company (within the over all limits sanctionedby their bankers and financial institutions) shall on theEffective Date be treated as loans, advances and otherfacilities made available to the Transferee Company andall the obligations of the Transferor Company under anyloan agreement shall be construed and shall become theobligation of the Transferee Company without any furtheract or deed on the part of the Transferee Company.l) If any legal or other proceedings of whatever nature,whether civil or criminal (including before any statutory orquasi-judicial authority or tribunal) (the “Proceedings”) by oragainst the Transferor Company is pending, the same shallnot abate, be discontinued or be in any way prejudiciallyaffected by reason of the transfer of the Undertaking or ofanything contained in the Scheme, but the proceedingsmay be continued, prosecuted and enforced by or againstthe Transferee Company in the same manner and to thesame extent as it would be or might have been continued,prosecuted and enforced by or against the TransferorCompany as if the Scheme had not been made. On andfrom the Effective Date, the Transferee Company shall andmay initiate any legal proceedings for and on behalf of theUndertaking.m) Pending the sanction of the Scheme, the TransferorCompany shall, in consultation with the TransfereeCompany, continue to prosecute, enforce or defend, theproceedings, whether pending or initiated pending thesanction of the Scheme.n) Subject to the provisions of this Scheme, all contracts,deeds, bonds, debentures, notes or other debt securitiesagreements, arrangements and other instruments ofwhatsoever nature relating to the Undertaking whichis subsisting or having effect immediately before theEffective Date shall be in full force against or in favour ofthe Transferee Company and may be enforced as fullyand effectively as if, instead of the Transferor Company,the Transferee Company had been a party or beneficiarythereto with effect from Appointed Date or entering intosuch contracts, deeds and statutory contents, whichever islater. The Transferee Company shall, if necessary, to giveformal effect to this clause, enter into and/or issue and/or execute deeds, writings or confirmations or enter intoa tripartite arrangement, confirmation or novation to whichthe Transferor Company is a party.o) For the avoidance of doubt and without prejudice tothe generality of the foregoing, it is clarified that uponthe Scheme coming into effect and with effect from theAppointed Date, all consents, permissions, licenses,certificates, clearances and authorities given by, issuedto or executed in favour of the Undertaking shall standtransferred to the Transferee Company as if the samewere originally given by, issued to or executed in favourof the Transferee Company, and, the Transferee Companyshall be bound by the terms thereof, the obligations andduties thereunder and the rights and the benefits under thesame shall be available to the Transferee Company. TheTransferee Company shall make necessary applicationsto Governmental Authorities as may be necessary in thisbehalf.p) The Transferee Company shall be entitled, pending thesanction of the Scheme, to apply to the Central Government,State Government or any other agency, department orother authorities concerned as may be necessary underlaw, for such consents, approvals and sanctions which theTransferee Company may require to own and operate theUndertaking.q) With effect from the Appointed Date and upto and includingthe Effective Date:(i)(ii)The Transferor Company shall carry on the businessand activities till the vesting of the Undertaking onthe sanction of the Scheme by the High Courts andshall be deemed to have held or stood possessed ofand shall hold and stand possessed of all the assetsof the Undertaking for and an account of and in trustfor the Transferee Company;All acts, deeds and things done and executedby and/ or on behalf of the Transferor Companyshall be deemed to have been done and executedby the Transferor Company for and on behalf of,and in trust for and as an agent of the TransfereeCompany. Further, all transactions undertaken bythe Transferor Company shall be deemed to havebeen undertaken by the Transferor Company forand on behalf of, and in trust for and as an agentof the Transferee Company including any assetspurchased, acquired, transferred, sold or otherwisealienated by the Transferor Company which shallbe deemed to have been purchased, acquired,transferred, sold or otherwise alienated by theTransferee Company;Any of the rights, powers, authorities, privilegesexercised by the Transferor Company shall bedeemed to have been exercised by the TransferorCompany for and on behalf of, and in trust for andas an agent of the Transferee Company. Similarly,any obligations, duties and commitments that havebeen undertaken or discharged by the TransferorCompany shall be deemed to have been undertakenfor and on behalf of and as an agent for theTransferee Company;5

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>(iii)(iv)(v)Accordingly, all profits and income accruing orarising to the Transferor Company and losses andexpenditure arising or incurred by it (including taxes,if any, accruing or paid in relation to any profits orincome) shall, for all purposes, be treated as andbe deemed to be the profits, income, losses orexpenditure, as the case may be, of the TransfereeCompany;The Transferor Company shall not, without priorwritten consent of the Transferee Company, take anymajor policy decisions in respect of its assets andliabilities of those pertaining to the Undertaking andthe present capital structure;The Transferor Company shall not issue or allotany equity shares or any other security convertinginto equity shares or obtain any other financialassistance converting into equity shares during thependency of this scheme.r) The Transferor Company is a wholly owned subsidiary ofthe Transferee Company and the Transferee Companyholds the entire paid-up share capital of the TransferorCompany.s) Upon the Scheme, upon the Scheme coming into effect, allthe shares of the Transferor Company held by TransfereeCompany along with its nominee(s), if any, on the EffectiveDate, shall be cancelled and extinguished without anyfurther act or deed. No shares or consideration shall beissued / paid by the Transferee Company pursuant to theamalgamation of the Transferor Company, which is a whollyowned subsidiary of the Transferee Company.t) Upon the Scheme becoming effective, the TransferorCompany and the Transferee Company are expresslypermitted to revise, its financial statements and returnsalong with prescribed forms, filings and annexures underthe Income Tax Act, 1961, and other tax laws, and to claimrefunds and/or credits for taxes paid.i) All tax assessment proceedings/appeals ofwhatsoever nature by or against the TransferorCompany pending and/or arising at the AppointedDate and relating to the Transferor Company shallbe continued and/or enforced until the Effective Dateas desired by the Transferee Company. As and fromthe Effective Date, the tax proceedings/appealsshall be continued and enforced by or against theTransferee Company in the same manner and to thesame extent as would or might have been continuedand enforced by or against the Transferor Company.iv)surplus in the provision for taxation/ duties/ leviesaccount including advance tax and tax deductedat source as on the date immediately precedingthe Appointed Date will also be transferred to theaccount of the Transferee Company.Any refund under the Income Tax Act, 1961, or otherapplicable laws/ regulations dealing with taxes/duties/ levies allocable or related to the business ofthe Transferor Company due to Transferor Companyconsequent to the assessment made on TransferorCompany and for which no credit is taken in theaccounts as on the date immediately preceding theAppointed Date shall also belong to and be receivedby the Transferee Company.v) All taxes including income tax, minimum alternatetax, service tax, etc paid or payable by the TransferorCompany before the Appointed Date, shall be onaccount of the Transferor Company and, in so faras it relates to the tax payment (including, withoutlimitation, income tax, minimum alternate tax,service tax, etc.) whether by way of deduction atsource, advance tax or otherwise howsoever, bythe Transferor Company after the Appointed Date,the same shall be deemed to be the correspondingitem paid by the Transferee Company and shall,in all proceedings, be dealt with accordingly. TheTransferor Company shall not be liable to taxesin respect of transactions undertaken by theTransferor Company on or after the AppointedDate. The Transferee Company shall be liable totaxes in respect of such transactions undertakenby the Transferor Company for and on behalf of theTransferee Company.u) At any time upto the Effective Date;i) The Transferor Company shall not declare or paydividends which are interim or final to their respectivemembers relating to any period commencing on orafter the Appointed Date unless agreed to by theBoard of Directors of the Transferee Company.ii)The Transferor Company shall not issue or allotany equity shares or any other security convertinginto equity shares or obtain any other financialassistance converting into equity shares during thependency of this scheme unless agreed to by theBoard of Directors of the Transferee Company.v) Upon the Scheme coming into effect and with effect fromthe Appointed Date;ii)iii)Further, the aforementioned proceedings shallnot abate or be discontinued nor be in any wayprejudicially affected by reason of the amalgamationof the Transferor Company with the TransfereeCompany or anything contained in the Scheme.Any tax liabilities under the Income Tax Act, 1961, orother applicable laws/regulations dealing with taxes/duties/ levies allocable or related to the business ofthe Transferor Company to the extent not providedfor or covered by tax provision in the accounts madeas on the date immediately preceding the AppointedDate shall be transferred to Transferee Company. Anyi) The Transferee Company shall record all theassets and liabilities pertaining to the Undertakingtransferred to and vested in the Transferee Companypursuant to this Scheme, at their respective fairvalues as on the close of business on one day priorto the Appointed Date.ii)As on the Appointed Date, pursuant to theamalgamation of the Transferor Company with theTransferee Company, the inter company balancesappearing in the books of the Transferor Companyshall stand cancelled.6

iii)The excess or deficit , if any, of the value ofthe assets over the value of the liabilities of theTransferor Company, as recorded pursuant to thisScheme after taking into consideration:(a)(b)The cancellation of the value of investmentsin the Transferor Company appearing in thebooks of the Transferee Company; andThe cancellation of inter-company balancesbetween the Transferor Company andTransferee Company;Shall be recorded as and credited to theCapital Reserve or debited to Goodwillas the case may be in the books of theAmalgamated Company in accordance withpara 37 of Accounting Standard 14.iv) Notwithstanding the above, the TransfereeCompany, in consultation with the auditors, isauthorised to account any of these balances in anymanner whatsoever, if considered more appropriatein accordance with Accounting Standard 14.w) Upon the Scheme becoming effective, the TransferorCompany shall, without any further act or deed, standdissolved without winding up.x) This Scheme is specifically conditional upon and subjectto the sanction of the High Court of Judicature at Madrasbeing obtained under Sections 391 to 394 and otherapplicable provisions of the Act, if so required on behalf ofthe Transferee Company and the Transferor Company.14. The main benefits of the Scheme of Amalgamation will be asfollows:14.1 Transferor Company is wholly owned by TransfereeCompany and the amalgamation will result in reduction inthe shareholding layers and facilitate direct control overassets of Transferor in the hands of Transferee Company.14.2 Interests of any creditor of Transferor Company orshareholder or creditor of Transferee Company shall not beprejudiced as a result of the Scheme. The Amalgamationwill not impose any additional burden on the members ofTransferor Company or Transferee Company.15. The Scheme would not be prejudicial to the interests of thecreditors (secured and unsecured) of any of the Companies. Thelatest audited accounts for the year ended 31 st March 2010 of thecompanies indicate that they are in a solvent position and wouldbe able to meet liabilities as may arise in the course of business.Hence, the amalgamation will not cast any additional burden onthe shareholders of either Company, nor will it affect the interest ofany of the shareholders or creditors.16. In compliance with the Listing requirements, the ApplicantCompany has duly submitted a copy of the proposed Scheme tothe Bombay Stock Exchange Ltd., not less than one month beforefiling the application before the Hon’ble Court. The said stockexchange has accorded its consent to the Scheme vide its letterdated 7th June, 2011.17. Under Section 391 of the Companies Act, 1956, the proposedScheme will have to be approved by a majority in numberrepresenting three-fourths in value of the Equity Shareholderspresent and voting either in person or by proxy at the meeting. Aproxy form is enclosed. It is hoped that in view of the importanceof the business to be transacted, you will personally attend themeeting. The signing of the form or forms of proxy will, however,not prevent you from attending and voting in person, if you sodesire.18. The Resolution proposed to be considered in the above meeting,is given hereunder:“RESOLVED THAT the Scheme of Amalgamation of ETHLCommunications Holdings Limited with India Securities Limited,placed before the meeting and initialled by the Chairman for thepurpose of identification, be and is hereby approved.RESOLVED FURTHER that the Board of Directors of the Companybe and is hereby authorised to make and / or consent to anymodifications, alterations or amendments in the scheme, whichmay be deemed to be necessary by them or which are desired,directed or imposed by the Hon’ble High Court of Judicature atMadras or any other authority and to take all such steps as maybe necessary and desirable to implement the Scheme and to giveeffect to this resolution.”19. No investigation proceedings have been instituted or are pendingunder Sections 235 to 251 of the Companies Act, 1956, in respectof the Transferee Company or the Transferor Company.20. The Scheme does not in any way violate or override orcircumscribe the provisions of the Securities and ExchangeBoard of India Act, 1992, the Securities Contracts (Regulation)Act, 1956, the Depositories Act, 1996, the Companies Act, 1956,the rules, regulations and guidelines made under these Actsand the provisions of the Listing Agreement or the requirementsof the Stock Exchange where the equity shares of the ApplicantCompany are listed. Disclosure under Sections 391 to 394 of theCompanies Act, 1956, as required by the Securities and ExchangeBoard of India is enclosed as an addendum to this statement andshall be deemed to form part of this explanatory statement.21. (a) The Directors of the Applicant Company have no interestin the Scheme except as shareholders in general, theextent of which will appear from the Register of Directors’Shareholding maintained by the Transferor Company andthe Transferee Company, which are as follows:The Directors of the companies concerned are:ETHL CommunicationsHoldings Limited[Transferor Company]India Securities Limited[Transferee Company]1. Shri V. G. Raghavan 1. Shri S. V. Venkatesan2. Shri Amit Gupta 2. Shri M. P. Mehrotra3. Shri Girish Sathe 3. Shri Vikash Saraf7

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>(b) The shareholding of Directors of the Companiesparticipating in this Scheme is as under:(c)Name of DirectorETHLCommunicationsHoldings Limited[TransferorCompany](No of Shares)IndiaSecuritiesLimited[TransfereeCompany]Shri S. V. Venkatesan NIL NILShri M. P. Mehrotra NIL NILShri Vikash Saraf NIL NILShri V. G. Raghavan NIL NILShri Amit Gupta NIL NILShri Girish Sathe NIL NILNone of the Directors and Manager of Transferee Companyand Directors of Transferor Company have any materialinterest in the scheme, save and except to the extent oftheir shareholding in the respective companies or to theextent the said directors are common directors in thecompanies. Their interest shall not in any way be treateddifferently than other share holders.Shareholding Pattern of Transferee Company Pre & PostScheme of Amalgamation is as under :Category As on May 31, 2011PromotersNo. of sharesof face valueof Re 1 each% to totalcapitalEquity 65,66,46,250 74.98Foreign HoldingsNRIs & Non DomesticCompaniesSub total A 65,66,46,250 74.9837,09,377 0.42FIIs 18,34,77,030 20.95Sub total B 18,71,86,407 21.37Category As on May 31, 2011Institutional HoldingsInstitutions/Mutual funds/Banks & Other CompaniesNo. of sharesof face valueof Re 1 each% to totalcapital43,82,816 0.50Sub total C 43,82,816 0.50Others 2,75,80,837 3.15Sub total D 2,75,80,837 3.15Grand Total (A+B+C+D) 87,57,96,310 100.00There will not be significant change in the shareholdingpattern post scheme of amalgamation as no new sharesare being issued.22. The following documents will be open for inspection at theRegistered Office of the Applicant Company between 10.00 a.m.to 12 Noon on any working day of the Applicant Company exceptSaturday upto the date of the meeting:1. The Memorandum and Articles of Association of TransferorCompany and the Transferee Company.2. The Balance Sheet and Profit and Loss Account ofTransferor Company and the Transferee Company for theyear ended 31 st March, 2010.3. Copy of the Board resolution dated 10 th May, 2011 and16 th May, 2011 passed by Transferor Company andthe Transferee Company approving the Scheme ofAmalgamation.4. Proposed Scheme of Amalgamation.5. Register of Directors’ shareholdings of the ApplicantCompany.6. Certified copy of the Order dated 21 st June 2011 passed bythe Hon’ble High Court of Judicature at Madras in CompanyApplication No. 442 of 2011.7. Copy of the consent letter dated June 7, 2011 receivedfrom Bombay Stock Exchange Limited.Dated at Chennai this 28th day of June, 2011.J. V. PrakashChairman appointed for the meeting8

SCHEME OF AMALGAMATIONOFETHL COMMUNICATIONS HOLDINGS <strong>LIMITED</strong>(“ECHL” or “Transferor Company”)WITH<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>(“ISL” or “Transferee Company”)ANDTheir respective Shareholders and Creditors(Under Sections 391 to 394 of the Companies Act, 1956)The Scheme is divided into the following parts:Part IPart IIPart IIIPart IVPart VPart VIPART Ideals with the Definitions and Share Capital;deals with the Rationale;deals with Amalgamation of ETHL Communications HoldingsLimited with India Securities Limited;deals with the Accounting Treatment;deals with the General Clauses;deals with the General Terms and Conditions.DEFINITIONS AND SHARE CAPITAL1. DEFINITIONS1.1 In this Scheme, unless inconsistent with the subject or context,the following expression shall have the following meanings:1.1.1 “Act” means the Companies Act, 1956 including any statutorymodifications, re-enactments or amendments thereof for thetime being in force;1.1.2 “Appointed Date” means the 1 st April 20101.1.3 “Courts” or “High Courts” means the High Court of Judicatureat Bombay and High Court of Judicature at Madras, and shallinclude the National Company Law Tribunal, if applicable;1.1.4 “Effective Date” means the last of the dates on which thecertified copies of the Order(s) of the High Court of Judicatureat Bombay and High Court of Judicature at Madras sanctioningthe Scheme are filed with the Registrar of Companies,Maharashtra, Mumbai and the Registrar of Companies,Chennai respectively. All references in this Scheme to thedate of “coming into effect of the/this Scheme” shall mean theEffective Date;1.1.5 “Governmental Authority” means any applicable central,state or local government, legislative body, regulatory oradministrative authority, agency or commission or any court,tribunal, board, bureau, instrumentality, judicial or arbitral bodyhaving jurisdiction over the territory of India;1.1.6 “Scheme” or “the Scheme” or “this Scheme” means thisScheme of Amalgamation in its present form submitted tothe High Court of Judicature at Bombay and the High Courtof Judicature at Madras with modification(s), approved orimposed or directed by the High Courts;1.1.7 ‘’Transferor Company’’ or “ECHL” means ETHLCommunications Holdings Limited, a Company incorporatedunder the Act and having its Registered Office at Essar House,11, K.K. Marg, Mahalaxmi, Mumbai - 400 034 the State ofMaharashtra.1.1.8 “Transferee Company” or “ISL” means India SecuritiesLimited, a Company incorporated under the Act and having itsRegistered Office at New No. 77/56 C. P. Ramaswamy Road,Abhirampuram, Chennai. 600 018.1.1.9 “Undertaking” means and includes (as on the AppointedDate and as modified and altered from time to time upto theEffective Date):(a)(b)(c)All the assets of the Transferor Company as on theAppointed Date;All debts, liabilities, duties and obligations of theTransferor Company as on the Appointed Date;Without prejudice to the generality of sub-clauses(a) and (b) above, the Undertaking shall meanand include the whole of the undertaking of theTransferor Company, as a going concern, includingits business, all secured and unsecured debts,liabilities, duties and obligations, all the assetsand properties, whether movable or immovable,real or personal, fixed assets, in possession orreversion, corporeal or incorporeal, tangible orintangible, present or contingent assets includingstock, investments, claims, powers, authorities,allotments, approvals, registrations, contracts,engagements, arrangements, rights, titles, interests,benefits, advantages, lease-hold rights, tenancyrights, permits, authorisations, quota rights,including reserves, provisions, funds, equipmentand installations and utilities, electricity, water andother service connections, records, files, employees,benefits of agreements, contracts and arrangements,powers, authorities, balances with all regulatoryauthorities, liberties, advantages, easementsand all the right, title, interest, goodwill, reserves,provisions, advances, receivables, funds, cash,bank balances, accounts, earnest moneys/ securitydeposits and all other rights, claims and powers,of whatsoever nature and where so ever situatedbelonging to or in the possession of or granted in9

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>favour of or enjoyed by the Transferor Company, ason the Appointed Date and all earnest money and/or deposits including security deposits paid by theTransferor Company as on the Appointed Date andall other rights, obligations, benefits available underany rules, regulations, statutes including direct andindirect tax laws derived by the Transferor Company.1.1.10 All terms and words not defined in this Scheme shall, unlessrepugnant or contrary to the context or meaning thereof, havethe same meaning ascribed to them under the Act, the IncomeTax Act, 1961 or any other applicable laws, rules, regulations,bye laws, as the case may be, including any statutorymodification or re-enactment thereof from time to time.2. SHARE CAPITAL2.1 The Share Capital of the Transferee Company as on March 31,2010 is as under:ParticularsAmount (Rs.)Authorised Share Capital:100,00,00,000 equity shares of Re.1 each 100,00,00,0005,00,000 preference shares of Rs. 2,000 100,00,00,000eachIssued, Subscribed and Paid-up ShareCapital:19,95,66,310 equity shares of Re.1 each 19,95,66,310fully paid up2,00,000 1% Non-Cumulative Compulsory 40,00,00,000Convertible Preference Shares ofRs. 2,000 each fully paid upPursuant to the amalgamation of Essar TelecommunicationsHoldings Private Limited, a company incorporated underthe Act and having its Registered Office at New No. 77/56C. P. Ramaswamy Road, Abhirampuram, Chennai, into theTransferee Company approved by the High Court of Judicatureat Madras by its order dated 21st April 2011, the Share Capitalof the Transferee Company is as follows:ParticularsAuthorised Share Capital:Amount (Rs.)90,00,00,000 equity shares of Re.1 each 90,00,00,00015,50,000 preference shares of Rs. 2,000eachIssued, Subscribed and Paid-up ShareCapital:87,57,96,310 equity shares of Re.1 eachfully paid up15,41,000 Non-Cumulative PreferenceShares of Rs. 2,000 each fully paid up310,00,00,00087,57,96,310308,20,00,000The Share Capital of the Transferor Company as on March 31,2010 is as under:ParticularsAuthorised Share Capital:Amount (Rs.)16,00,00,000 equity shares of Rs.10 each 160,00,00,000Issued, Subscribed and Paid-up ShareCapital:15,65,44,000 equity shares of Rs.10 eachfully paid up156,54,40,000PART IIRATIONALEAll the Equity shares issued by the Transferor Company asabove are held by the Transferee Company and its nominees.Accordingly, the Transferor Company is a wholly ownedsubsidiary of the Transferee Company.3. RATIONALE FOR THE AMALGAMATION3.1 ECHL and ISL hold investments in various companies. Thefocus of activities of both the companies is similar. The activitiesof both companies complement each other and the combinedefforts and resources would lead to a more concentratedapproach towards development of the business of ISL.3.2 ECHL is wholly owned by ISL and the amalgamation will resultin reduction in the shareholding layers and facilitate directcontrol over assets of ECHL in the hands of ISL.3.3 Interests of any creditor of ECHL or shareholder or creditorof ISL shall not be prejudiced as a result of the Scheme. TheAmalgamation will not impose any additional burden on themembers of ECHL or ISL.PART IIIAMALGAMATION4. TRANSFER AND VESTING OF THE UNDERTAKING4.1 Upon coming into effect of this Scheme and with effect fromthe Appointed Date, subject to the provisions of this Scheme inrelation to the mode of transfer and vesting, the entire businessand Undertaking of the Transferor Company shall, without anyfurther act or deed, be and stand transferred to and vestedin or be deemed to have been transferred to and vested inthe Transferee Company as a going concern, pursuant tothe provisions of Sections 391 to 394 and other applicableprovisions of the Act and the provisions of this Scheme inrelation to the mode of transfer and vesting of assets.Provided that for the purpose of giving effect to the vestingorder passed under Sections 391 to 394 in respect of thisScheme, the Transferee Company shall at any time pursuantto the orders on this Scheme be entitled to get the recordof the change in the title and the appurtenant legal right(s)upon the vesting of such assets of the Transferor Companyin accordance with the provisions of Sections 391 to 394 ofthe Act, at the office of the respective Registrar of Assurancesor any other concerned authority, where any such property issituated.4.2 All assets, estate, rights, title, interest and authoritiesaccrued to and/or acquired by the Transferor Company afterthe Appointed Date and prior to the Effective Date shall bedeemed to have been accrued to and/or acquired for and onbehalf of the Transferee Company and shall, upon the cominginto effect of the Scheme and with effect from the AppointedDate pursuant to the provisions of Sections 391 to 394 andother applicable provisions of the Act, without any further act,instrument or deed, be transferred to and vested in and/orbe deemed to be transferred to and vested in the TransfereeCompany so as to become as and from the Appointed Date,the estate, assets, rights, title, interests and authorities of theTransferee Company. Upon coming into effect of this Schemeand with effect from the Appointed Date, all movable assetsincluding cash in hand, if any, of the Transferor Company,10

capable of passing by manual delivery or possession or byendorsement and delivery, shall be so delivered or endorsedand delivered, as the case may be, to the Transferee Companyupon the coming into effect of the Scheme, without requiringany deed or instrument of conveyance for transfer of the same.Such delivery shall be made on a date mutually agreed uponbetween the Board of Directors of the Transferor Company andthe Transferee Company.4.3 In respect of movables other than those specified in clause4.2 above, including sundry debtors, outstanding loans andadvances, if any, recoverable in cash or in kind or for valueto be received, bank balances and deposits, if any, withGovernment, Semi-Government, local and other authoritiesand bodies, customers and other persons, the following modusoperandi for intimating to third parties shall, to the extentpossible, be followed:(i)(ii)The Transferee Company shall give notice in suchform as it may deem fit and proper, to each person,debtor, loanee or depositee as the case may be,that pursuant to the Courts having sanctioned theScheme, the said debts, loans, advances, bankbalances or deposits be paid or made good orheld on account of the Transferee Company as theperson entitled thereto to the end and intent that theright of the Transferor Company to recover or realisethe same stands extinguished and that appropriateentry should be passed in its books to record theaforesaid change;The Transferor Company shall also give notice insuch form as they may deem fit and proper to eachperson, debtor, loanee or depositee that pursuant tothe Courts having sanctioned the Scheme the saiddebt, loan, advance or deposit be paid or made goodor held on account of the Transferee Company andthat the right of the Transferor Company to recoveror realise the same stands extinguished.4.4 In relation to the assets, if any, belonging to the TransferorCompany, which require separate documents of transfer, theTransferor Company and the Transferee Company will executenecessary documents, as and when required.4.5 For avoidance of doubt, upon the Scheme coming into effectand with effect from the Appointed Date, all the rights, title,interest and claims of the Transferor Company in any leaseholdproperties, including all the leases, of the Transferor Companyshall, pursuant to Section 394(2) of the Act, without any furtheract or deed, be transferred to and vested in or be deemedto have been transferred to and vested in the TransfereeCompany.4.6 For avoidance of doubt and without prejudice to the generalityof the foregoing, it is clarified that upon the Scheme coming intoeffect and with effect from the Appointed Date, all consents,permissions, licences, certificates, clearances, authorities,powers of attorney given by, issued to or executed in favourof the Undertaking shall stand transferred to the TransfereeCompany as if the same were originally given by, issued toor executed in favour of the Transferee Company, and theTransferee Company shall be bound by the terms thereof, theobligations and duties thereunder, and the rights and benefitsunder the same shall be available to the Transferee Company.The Transferee Company shall make applications to anyGovernmental Authority as may be necessary in this behalf.Without prejudice to the other provisions of this Scheme andnotwithstanding the fact that the vesting of the Undertakingoccurs by virtue of this Scheme itself, the TransfereeCompany may, at any time after the Scheme coming intoeffect in accordance with the provisions hereof, if so requiredunder any law or otherwise, execute deeds (including deedsof adherence), confirmations or other writings or tripartitearrangements with any party to any contract or arrangementsto which the Transferor Company is a party or any writing asmay be necessary to be executed in order to give formal effectto the above provisions. The Transferee Company shall underthe provisions of this Scheme, be deemed to be authorised toexecute any such writings on behalf of the Transferor Companyand to carry out or perform all such formalities, compliancesreferred to above on the part of the Transferee Company to becarried out or performed in relation to the Undertaking beingtransferred by the Transferor Company.4.7 To the extent there are debentures and inter-corporate loans,debts and claims, (including, amounts receivable), if any, bythe Transferor Company from the Transferee Company or viceversa, the obligations in respect thereof shall come to an endon the Scheme coming into effect and a corresponding suitableeffect shall be given in the books of accounts and records ofthe Transferee Company. If required reduction/cancellationof such debentures, loans, debts and claims (includingreceivables) shall be reflected in the books of accounts andrecords of the Transferee Company. For removal of doubts, itis hereby clarified that from the Appointed Date, there wouldbe no accrual of interest or other charges in respect of anysuch debentures and inter-corporate loans or debt (includingreceivables) balances between the Transferee Company onthe one hand and the Transferor Company on the other hand.With effect from the Appointed Date, and subject to theprovisions of this Scheme, all secured and unsecured debts(whether in rupees or foreign currency), liabilities, contingentliabilities, duties and obligations of every kind, nature,description, whether or not provided for in the books of accountsand whether disclosed or undisclosed in the balance sheet ofthe Transferor Company shall also stand transferred or deemedto have been transferred without any further act, instrument ordeed to the Transferee Company, pursuant to the provisionsof Sections 391 to 394 and other applicable provisions of theAct , so as to become as and from the Appointed Date, thedebts, liabilities, contingent liabilities, duties and obligations ofthe Transferee Company without any consent of any third partyor other person who is a party to the contract or arrangementsby virtue of which such liabilities have arisen, in order to giveeffect to the provisions of this clause;4.8 With effect from the Appointed Date, all guarantees, indemnitiesand contingent liabilities, if any, of the Transferor Company shallalso, under the provisions of Sections 391 to 394 of the Act,without any further act or deed, be transferred to or be deemedto be transferred to the Transferee Company so as to becomeas and from the Appointed Date, the guarantees, indemnitiesand contingent liabilities of the Transferee Company and it shallnot be necessary to obtain the consent of any third party orother person who is a party to any contract or arrangement byvirtue of which such guarantees, indemnities and contingentliabilities have arisen or given, in order to give effect to theprovisions of this Clause;11

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>4.9 The transfer and vesting of the Undertaking as aforesaid, shallbe subject to the existing securities, charges, hypothecationand mortgages, if any, subsisting over or in respect of theproperty and assets or any part thereof of the TransferorCompany.Provided however, any reference in any security documentsor arrangements, to which the Transferor Company is a party,wherein the assets of the Transferor Company have been orare offered or agreed to be offered as security for any financialassistance or obligations, shall be construed as reference onlyto the assets pertaining to the Undertaking as are vested in theTransferee Company by virtue of this Scheme, to the end andintent that such security, charges, hypothecation and mortgageshall not extend or be deemed to extend, to any of the otherassets of the Transferor Company or any of the assets of theTransferee Company.Provided further that the securities, charges, hypothecationand mortgages (if any subsisting) over and in respect of theassets or any part thereof of the Transferee Company shallcontinue with respect to such assets or part thereof and thisScheme shall not operate to enlarge such securities, charges,hypothecation and mortgages to the end and intent that suchsecurities, charges, hypothecation and mortgages shall notextend or be deemed to extend, to any of the assets of theTransferor Company vested in the Transferee Company.Provided always that this Scheme shall not operate to enlargethe security for any loan, deposit or facility created by theTransferor Company which shall vest in the Transferee Companyby virtue of the amalgamation of the Transferor Company withthe Transferee Company and the Transferee Company shallnot be obliged to create any further or additional securitytherefore after the amalgamation has become operative.4.10 Where any of the Transferor Company’s liabilities as on theAppointed Date transferred to the Transferee Company havebeen discharged by the Transferor Company on or after theAppointed Date and prior to the Effective Date, such dischargeshall be deemed to have been for and on account of theTransferee Company.4.11 All loans raised and used and all debts, liabilities, duties andobligations incurred or undertaken by the Transferor Companyon or after the Appointed Date and prior to the Effective Date,subject to the terms of this Scheme, shall be deemed to havebeen raised, used, undertaken or incurred for and on behalf ofthe Transferee Company and to the extent they are outstandingon the Effective Date, shall, upon the coming to effect ofthis Scheme, without any further act or deed, be and standtransferred to and vested in or be deemed to be have beentransferred to and vested in the Transferee Company and shallbecome the loans, debts, liabilities, duties and obligations ofthe Transferee Company.Further, all the loans, advances and other facilities sanctionedto the Transferor Company by its bankers and financialinstitutions prior to the Appointed Date, which are partly drawnor utilised shall be deemed to be the loans and advancessanctioned to the Transferee Company and the said loansand advances shall be drawn and utilised either partly or fullyby the Transferor Company from the Appointed Date till theEffective Date and all the loans, advances and other facilitiesso drawn by the Transferor Company (within the over all limitssanctioned by their bankers and financial institutions) shall onthe Effective Date be treated as loans, advances and otherfacilities made available to the Transferee Company and allthe obligations of the Transferor Company under any loanagreement shall be construed and shall become the obligationof the Transferee Company without any further act or deed onthe part of the Transferee Company.5. DISSOLUTION OF TRANSFEROR COMPANYOn the coming into effect of the Scheme, the TransferorCompany shall, without any further act or deed, stand dissolvedwithout winding up.6. CANCELLATION OF EQUITY SHARES6.1 ECHL is a wholly owned subsidiary of ISL and ISL holds theentire paid-up share capital of ECHL.6.2 As part of the Scheme, upon the Scheme coming into effect,all the shares of ECHL held by ISL along with its nominee(s), ifany, on the Effective Date, shall be cancelled and extinguishedwithout any further act or deed. No shares or considerationshall be issued / paid by the Transferee Company pursuant tothe amalgamation of the Transferor Company, which is a whollyowned subsidiary of the Transferee Company.7. COMPLIANCE WITH TAX LAWS7.1 Upon the Scheme becoming effective, the Transferor Companyand the Transferee Company are expressly permitted to revise,its financial statements and returns along with prescribedforms, filings and annexures under the Income Tax Act, 1961,and other tax laws, and to claim refunds and/or credits fortaxes paid.7.2 All tax assessment proceedings/appeals of whatsoever natureby or against the Transferor Company pending and/or arisingat the Appointed Date and relating to the Transferor Companyshall be continued and/or enforced until the Effective Date asdesired by the Transferee Company. As and from the EffectiveDate, the tax proceedings/appeals shall be continued andenforced by or against the Transferee Company in the samemanner and to the same extent as would or might have beencontinued and enforced by or against the Transferor Company.7.3 Further, the aforementioned proceedings shall not abate orbe discontinued nor be in any way prejudicially affected byreason of the amalgamation of the Transferor Company withthe Transferee Company or anything contained in the Scheme.7.4 Any tax liabilities under the Income Tax Act, 1961 or otherapplicable laws/regulations dealing with taxes/ duties/ leviesallocable or related to the business of the Transferor Companyto the extent not provided for or covered by tax provision inthe accounts made as on the date immediately preceding theAppointed Date shall be transferred to Transferee Company.Any surplus in the provision for taxation/ duties/ levies accountincluding advance tax and tax deducted at source as on thedate immediately preceding the Appointed Date will also betransferred to the account of the Transferee Company.Any refund under the Income Tax Act, 1961 or other applicablelaws/ regulations dealing with taxes/ duties/ levies allocableor related to the business of the Transferor Company due toTransferor Company consequent to the assessment made onTransferor Company and for which no credit is taken in theaccounts as on the date immediately preceding the AppointedDate shall also belong to and be received by the TransfereeCompany.12

7.5 All taxes including income tax, minimum alternate tax, servicetax, etc paid or payable by the Transferor Company beforethe Appointed Date, shall be on account of the TransferorCompany and, in so far as it relates to the tax payment(including, without limitation, income tax, minimum alternatetax, service tax, etc.) whether by way of deduction at source,advance tax or otherwise howsoever, by the TransferorCompany after the Appointed Date, the same shall be deemedto be the corresponding item paid by the Transferee Companyand shall, in all proceedings, be dealt with accordingly. TheTransferor Company shall not be liable to taxes in respect oftransactions undertaken by the Transferor Company on orafter the Appointed Date. The Transferee Company shall beliable to taxes in respect of such transactions undertaken bythe Transferor Company for and on behalf of the TransfereeCompany.PART IVACCOUNTING TREATMENT8. ACCOUNTING TREATMENT IN BOOKS OF THETRANSFEREE COMPANYUpon the Scheme coming into effect and with effect from theAppointed Date:8.1 The Transferee Company shall record all the assets andliabilities pertaining to the Undertaking transferred to andvested in the Transferee Company pursuant to this Scheme, attheir respective fair values as on the close of business on oneday prior to the Appointed Date.8.2 As on the Appointed Date, pursuant to the amalgamation of theTransferor Company with the Transferee Company, the intercompany balances appearing in the books of the TransferorCompany shall stand cancelled.8.3 The excess or deficit , if any, of the value of the assets over thevalue of the liabilities of the Transferor Company, as recordedpursuant to this Scheme after taking into consideration;8.3.1 the cancellation of the value of investments in the TransferorCompany appearing in the books of the Transferee Company;and8.3.2 the cancellation of inter-company balances between theTransferor Company and Transferee Company;shall be recorded as and credited to the Capital Reserveor debited to Goodwill as the case may be in the books ofthe Amalgamated Company in accordance with para 37 ofAccounting Standard 14.8.4 Notwithstanding the above, the Transferee Company, inconsultation with the auditors, is authorised to account any ofthese balances in any manner whatsoever, if considered moreappropriate in accordance with Accounting Standard 14.PART VGENERAL CLAUSES9. STAFF, WORKMEN AND EMPLOYEES9.1 On the Scheme coming into effect, all the staff, workmen andemployees of the Undertaking in service on such date shallbe deemed to have become staff, workmen and employeesof the Transferee Company with effect from the Effective Datewithout any break in their service and on the basis of continuityof service and the terms and conditions of their employmentwith the Transferee Company shall not be less favourable thanthose applicable to them with reference to the Undertakingon the Effective Date. The position, rank and designation ofthe employees would however be decided by the TransfereeCompany.9.2 In so far as the Provident Fund, Gratuity Fund or any otherSpecial Fund created or existing for the benefit of the staff,workmen and employees of the Undertaking is concerned,upon the Scheme coming into effect, the Transferee Companyshall, stand substituted for the Transferor Company for allpurposes whatsoever in relation to the administration oroperation of such Fund or Funds or in relation to the obligationto make contributions to the said Fund or Funds in accordancewith the provisions thereof as per the terms provided in therespective Trust Deeds, if any, to the end and intent thatall rights, duties, powers and obligations of the TransferorCompany in relation to such Fund or Funds shall becomethose of the Transferee Company and all the rights, duties andbenefits of the staff, workmen and employees employed in theUndertaking under such Funds and Trusts shall be protected,subject to the provisions of law for the time being in force. It isclarified that the services of the staff, workmen and employeesof the Undertaking will be treated as having been continuousfor the purpose of the said Fund or Funds.9.3 It is clarified that save as expressly provided for in thisScheme, the employees of the Transferor Company whobecome the employees of the Transferee Company by virtue ofthis Scheme, shall not be entitled to the employment policiesand shall not be entitled to avail of any schemes and benefitsexisting as on the Effective Date that may be applicable andavailable to any of the other employees of the TransfereeCompany, unless otherwise determined by the TransfereeCompany. The Transferee Company undertakes to continueto abide by any agreement/settlement, if any, entered into ordeemed to have been entered into by the Transferor Companywith any employee of the Transferee Company.10. CONTRACTS, DEEDS AND STATUTORY CONSENTS10.1 Subject to the provisions of this Scheme, all contracts, deeds,bonds, debentures, notes or other debt securities agreements,arrangements and other instruments of whatsoever naturerelating to the Undertaking which is subsisting or havingeffect immediately before the Effective Date shall be in fullforce against or in favour of the Transferee Company andmay be enforced as fully and effectively as if, instead of theTransferor Company, the Transferee Company had been aparty or beneficiary thereto with effect from Appointed Dateor entering into such contracts, deeds and statutory contents,whichever is later. The Transferee Company shall, if necessary,to give formal effect to this clause, enter into and/or issue and/or execute deeds, writings or confirmations or enter into atripartite arrangement, confirmation or novation to which theTransferor Company is a party.10.2 For the avoidance of doubt and without prejudice to thegenerality of the foregoing, it is clarified that upon the Schemecoming into effect and with effect from the Appointed Date,all consents, permissions, licenses, certificates, clearancesand authorities given by, issued to or executed in favour of theUndertaking shall stand transferred to the Transferee Companyas if the same were originally given by, issued to or executedin favour of the Transferee Company, and, the Transferee13

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>Company shall be bound by the terms thereof, the obligationsand duties thereunder and the rights and the benefits underthe same shall be available to the Transferee Company. TheTransferee Company shall make necessary applications toGovernmental Authorities as may be necessary in this behalf.10.3 The Transferee Company shall be entitled, pending thesanction of the Scheme, to apply to the Central Government,State Government or any other agency, department or otherauthorities concerned as may be necessary under law, forsuch consents, approvals and sanctions which the TransfereeCompany may require to own and operate the Undertaking.11. LEGAL PROCEEDINGS11.1 If any legal or other proceedings of whatever nature, whethercivil or criminal (including before any statutory or quasi-judicialauthority or tribunal) (the “Proceedings”) by or against theTransferor Company is pending, the same shall not abate, bediscontinued or be in any way prejudicially affected by reason ofthe transfer of the Undertaking or of anything contained in theScheme, but the proceedings may be continued, prosecutedand enforced by or against the Transferee Company in thesame manner and to the same extent as it would be or mighthave been continued, prosecuted and enforced by or againstthe Transferor Company as if the Scheme had not been made.On and from the Effective Date, the Transferee Company shalland may initiate any legal proceedings for and on behalf of theUndertaking.11.2 Pending the sanction of the Scheme, the Transferor Companyshall, in consultation with the Transferee Company, continueto prosecute, enforce or defend, the proceedings, whetherpending or initiated pending the sanction of the Scheme.12. CONDUCT OF BUSINESS TILL THE EFFECTIVE DATEWith effect from the Appointed Date and up to the EffectiveDate:12.1 The Transferor Company shall carry on the business andactivities till the vesting of the Undertaking on the sanction ofthe Scheme by the High Courts and shall be deemed to haveheld or stood possessed of and shall hold and stand possessedof all the assets of the Undertaking for and an account of and intrust for the Transferee Company.12.2 All acts, deeds and things done and executed by and/ oron behalf of the Transferor Company shall be deemed tohave been done and executed by the Transferor Companyfor and on behalf of, and in trust for and as an agent of theTransferee Company. Further, all transactions undertakenby the Transferor Company shall be deemed to have beenundertaken by the Transferor Company for and on behalf of,and in trust for and as an agent of the Transferee Companyincluding any assets purchased, acquired, transferred, sold orotherwise alienated by the Transferor Company which shall bedeemed to have been purchased, acquired, transferred, soldor otherwise alienated by the Transferee Company.Any of the rights, powers, authorities, privileges exercisedby the Transferor Company shall be deemed to have beenexercised by the Transferor Company for and on behalf of,and in trust for and as an agent of the Transferee Company.Similarly, any obligations, duties and commitments that havebeen undertaken or discharged by the Transferor Companyshall be deemed to have been undertaken for and on behalf ofand as an agent for the Transferee Company.12.3 Accordingly, all profits and income accruing or arising to theTransferor Company and losses and expenditure arisingor incurred by it (including taxes, if any, accruing or paid inrelation to any profits or income) shall, for all purposes, betreated as and be deemed to be the profits, income, losses orexpenditure, as the case may be, of the Transferee Company.12.4 The Transferor Company shall not, without prior written consentof the Transferee Company, take any major policy decisions inrespect of its assets and liabilities of those pertaining to theUndertaking and the present capital structure.13. RATIFICATIONThe Transferee Company shall accept all acts, deeds andthings relating to the Undertaking and executed by and/or onbehalf of Transferor Company on and after the Appointed Dateas acts, deeds and things done and executed by and/or onbehalf of, and in trust for and as an agent of the TransfereeCompany.14. DIVIDEND, PROFIT, BONUS, RIGHT SHARESAt any time upto the Effective Date:14.1 The Transferor Company shall not declare or pay dividendswhich are interim or final to their respective members relatingto any period commencing on or after the Appointed Dateunless agreed to by the Board of Directors of the TransfereeCompany.14.2 The Transferor Company shall not issue or allot any equityshares or any other security converting into equity shares orobtain any other financial assistance converting into equityshares during the pendency of this scheme unless agreed toby the Board of Directors of the Transferee Company.PART VIGENERAL TERMS AND CONDITIONS15. APPLICATION TO HIGH COURTSThe Transferor Company shall, with reasonable despatch,apply to the High Court of Judicature at Bombay for necessaryorders or directions for holding meetings of the membersof the Transferor Company for sanctioning this Scheme ofAmalgamation under Section 391 of the Act or for dispensingthe holding of such meetings and orders under Section 394 ofthe Act, for carrying this Scheme into effect and for dissolutionof the Transferor Company without winding up. The TransfereeCompany shall, if required by the High Court of Judicatureat Madras, apply to the High Court of Judicature at Madrasfor necessary orders or directions for holding meetings ofthe members of the Transferee Company for sanctioning thisScheme of Amalgamation under Section 391 of the Act or fordispensing the holding of such meetings and orders underSection 394 of the Act, for carrying this Scheme into effect.16. MODIFICATIONS, AMENDMENTS TO THE SCHEME16.1 The Transferee Company and the Transferor Company (by theirrespective Directors) may assent from time to time on behalf ofpersons concerned to any modifications/amendments to thisScheme or any conditions or limitations which the High Courtsor any authorities under the law may deem fit to approve orimpose and to resolve any doubt or difficulties that may arise14

for carrying out this Scheme and to do and execute all suchacts, deeds, matters and things necessary for putting theScheme into effect.16.2 For the purpose of giving effect of this Scheme or to anymodifications or amendments, thereof, the Directors of theTransferee Company and the Transferor Company maygive and are authorised to give all such directions that arenecessary or are desirable including directions for settling anydoubts or difficulties that may arise.16.3 If any part or provision of this Scheme hereof is invalid, ruledillegal by any Court of competent jurisdiction, or unenforceableunder present or future laws, then it is the intention of theParties that such part or provision, as the case may be, shallbe severable from the remainder of the Scheme, and theScheme shall not be affected thereby, unless the deletion ofsuch part or provision, as the case may be, shall cause thisScheme to become materially adverse to any Party, in whichcase the Parties shall attempt to bring about a modification inthe Scheme, as will best preserve for the Parties the benefitsand obligations of the Scheme, including but not limited to suchpart or provision.17. CONDITIONALITY OF THE SCHEMEThis Scheme is specifically conditional upon and subject to:17.1 The Scheme being agreed to by the respective requisitemajorities of the members of the Transferor and the TransfereeCompanies, if a meeting of Equity Shareholders of the saidCompanies is convened by the respective High Courts havingjurisdiction for sanction of this Scheme under the provisions oflaw.17.2 The sanction by the Courts under Sections 391 and 394 andother applicable provisions of the Act, being obtained by theTransferor Company and also the Transferee Company.18. DATE OF TAKING EFFECTThe Scheme shall have effect from the Appointed Date on thesame becoming effective.19. EFFECT OF NON-RECEIPT OF APPROVALSIn the event of any of the said sanction and approval referredto in the preceding clauses 17.1 and 17.2 above not beingobtained and/or the Scheme not being sanctioned by the HighCourts and/or the Order(s) not being passed as aforesaid within18 months of the first filing with the High Courts, whicheveris later or within such further period(s) as may be agreedupon from time to time between the Transferor Company andthe Transferee Company (through their respective Board ofDirectors), this Scheme shall stand revoked, cancelled andbe of no effect save and except in respect of any act or deeddone prior thereto as is contemplated hereunder or as to anyright, obligation and/or liabilities which might have arisen oraccrued pursuant thereto and which shall be governed andbe preserved or worked out as is specifically provided in thisScheme and or otherwise arise as per law. In such case eachcompany shall bear its own costs, charges and expenses orshall bear costs, charges and expenses as may be mutuallyagreed. For the purpose of giving full effect to this Scheme,the respective Board of Directors of the Transferor Companyand the Transferee Company are hereby empowered andauthorised to agree to and extend the aforesaid period fromtime to time without any limitations in exercise of their powerthrough and by their respective delegates.20. COSTS, CHARGES AND EXPENSES CONNECTED WITHTHE SCHEMEAll costs, charges, taxes including duties, levies and all otherexpenses of the Transferee Company and the TransferorCompany, respectively, in relation to or in connection with orincidental to this Scheme shall be borne by the TransfereeCompany.15

<strong>INDIA</strong> <strong>SECURITIES</strong> <strong>LIMITED</strong>Disclosures to the Shareholders for mergers through Scheme of Amalgamation under Sections 391 to 394 of the Companies Act, 1956as prescribed by Securities and Exchange Board of India.Sr.No.Details of theCompanies1 Names and RegisteredOffice of the Companies2 The extent to / manner inwhich the companies arerelated to each other.3 Capital Structure of theCompanies as on May31, 2011India Securities Limited [Transferee Company] ETHL Communications Holdings Limited [Transferor Company]Name: India Securities Limited (Formerly India Factors Limited & DearLeasing and Finance Limited)Registered Office: New No. 77/56, C. P. Ramaswamy Road,Abhirampuram, Chennai – 600 018.Transferee Company is holding 100 % of the equity share capital ofTransferor Company.AUTHORISED:90,00,00,000 Equity shares of Re.1/- each15,50,000 Preference shares of Rs.2,000/- eachISSUED, SUBSCRIBED AND PAID UP:87,57,96,310 equity shares of Re.1 each fully paid up(in Rs.)90,00,00,0003,10,00,00,00087,57,96,310Name: ETHL Communications Holdings LimitedRegistered Office: Essar House, 11, K. K. Marg, Mahalaxmi, Mumbai – 400 034Transferor Company is 100% subsidiary of Transferee Company.AUTHORISED:16,00,00,000 Equity shares of Rs.10/- eachISSUED, SUBSCRIBED AND PAID UP:156,544,000 Equity shares of Rs.10/- each, fully paid upTOTAL(in Rs.)1,60,00,00,0001,56,54,40,0001,56,54,40,00015,41,000 Non - Cumulative Preference Shares of Rs.2,000 each fully paid up3,08,20,00,0004 Shareholding patternclearly indicating thes h a r e s h e l d by t h epromoters and by personsother than promoters (Ason 31/05/2011)TOTALCategoryPromotersNRIs & Non DomesticCompaniesForeign InstitutionalInvestmentsNo. of shares65,66,46,25037,09,37718,34,77,0303,95,77,96,310%74.980.4220.95CategoryIndia Securities LimitedIndia Securities Limited and 6 nomineesTotalNo. of shares15,65,43,994615,65,44,000%100.000.00100.00Institution/Mutual Funds/Bank & Other Companies43,82,8160.50OthersTotal2,75,80,83787,57,96,310 3.15100.005 Line of Business Investment Holding & Consultancy and Advisory services Investment Holding Company6 Dates of Agreement, if any,with the other companies,which are parties to thescheme of arrangement.No Agreement has been entered between parties to the scheme No Agreement has been entered between parties to the scheme7 Names and profile of thepromoters and Directorsviz., age, educationalqualifications, experience,personal addresses etc. ofthe companies.Brief Profile of Directors is as per Annexure I (A) Brief Profile of Directors is as per Annexure I (B)16