Queensland Ballet

Click here to download our 2010 Annual Report - Queensland Ballet

Click here to download our 2010 Annual Report - Queensland Ballet

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

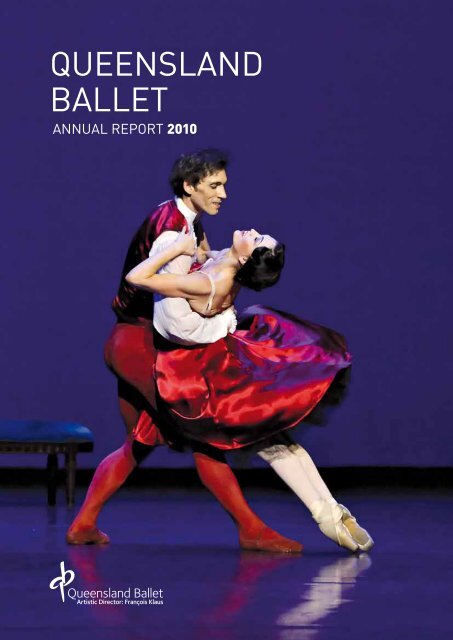

<strong>Queensland</strong><strong>Ballet</strong>2010 Annual Report

CONTENTSCompany profile 12010 highlights 250 year chronology 3Chair’s review 7Artistic Director’s report 8Chief Executive Officer’s report 102010 performance summary 11The Company 15Acknowledgements 17Directors’ report 19Lead Auditor’s Independence Declaration 25Financial report 26Independent auditor’s report 41Appendix A: 2010 strategic performance 42Appendix B: <strong>Queensland</strong> <strong>Ballet</strong> Friends 44QUEENSLAND BALLET

COMPANY PROFILE1<strong>Queensland</strong> <strong>Ballet</strong> is theflagship ballet company of theState of <strong>Queensland</strong>, with areputation for a fresh, energeticand eclectic repertoire rangingfrom short works for children tonew, full-length story ballets.Established in 1960 by Charles Lisner OBE,the Company is one of only three full-timeprofessional ballet companies in Australiaand has been under the artistic direction ofFrançois Klaus since January 1998.The Company makes a vital contributionto the performing arts in <strong>Queensland</strong> andAustralia through the presentation of ahigh quality annual season in Brisbane,performed in a variety of venues, andthrough tours throughout regional<strong>Queensland</strong>, as well as through participationin festivals.<strong>Queensland</strong> <strong>Ballet</strong>’s core objectives includethe provision of opportunities for Australianchoreographers and other creative artists.The Company also promotes and developsdance education, principally throughthe <strong>Queensland</strong> <strong>Ballet</strong> Professional Yearand Junior Extension Program, andthrough partnership with the <strong>Queensland</strong>Dance School of Excellence (QDSE). TheProfessional Year is a bridging programwhich provides intensive pre-professionaltraining in a company environment for giftedyoung dancers interested in pursuing aprofessional career in classical dance. TheJunior Extension Program gives a smallgroup of talented young dancers, aged11 to 14 years, the opportunity to furtherdevelop their skills by undertaking a weeklyclass with a group of their peers under theguidance of the Company’s Artistic Staff.The QDSE program is run under an MOUwith Education <strong>Queensland</strong> and providesadvanced dance training to students inYears 10, 11, and 12 at Kelvin Grove StateCollege as well as the introductory TrackDance and Mid-Trackdance programs forYears 3 to 9.Community education and outreach isachieved through a range of programs.These are the popular Vis-à-vis StudioSeries; Soirées Classiques, studioperformances of dance with live music; anOpen Doors program which enables thepublic to view the Company at work; andDANCE+, a program of dance educationactivities offered to schools and dancestudio teachers and students across<strong>Queensland</strong>.In addition to annual tours of full-scaleproductions to regional <strong>Queensland</strong>, since2006, the Company has been committed todeveloping an international touring program.The Company’s international experiencenow incorporates a guest performance inKorea, tours to Singapore and Japan, andthree European tours. In 2011 the Companywill embark on its first tour to China.Our missionTo develop, promote and perform dance,particularly classical ballet, of the highestinternational standard, both technically andartistically, in state, national and internationalarenas.Our goals<strong>Queensland</strong> <strong>Ballet</strong> will:»»be an efficient, profitable and wellgoverned business»»seek to increase our audience»»offer the highest standards ofperformance»»develop choreographers»»offer the highest standard of dancetraining»»seek to develop an interstate andinternational profile.Our dreamBy 2013, <strong>Queensland</strong> <strong>Ballet</strong> will berecognised, not only in <strong>Queensland</strong> butthroughout Australia and also overseas, for:»»creating and presenting a broadrepertoire of quality work which rangesfrom the great classics, throughcontemporary dance, new ‘story’ ballets,and works for children»»exciting and challenging both dancersand audiences»»developing choreographers»»training dancers to a consistently highstandard in classical ballet technique,and developing that technique throughexcellent coaching and creative artisticdevelopment»»having a strong and coherent artisticteam led by a strong Artistic Director andChief Choreographer»»best practice in company management.Strategic initiativesIn order to fulfil its mission and goals, andadvance towards achieving its dreams,<strong>Queensland</strong> <strong>Ballet</strong>’s three-year BusinessPlan features four strategic initiatives:»»to develop the art form, and the standardof our productions»»to develop our audience, in scope, depthand understanding»»to build our reputation and understandingof what we do»»to remain financially robust and maintainoperational excellence.The Company’s performance in relation toits strategic initiatives is detailed in AppendixA on page 42.ANNUAL REPORT 2010

22010 highlights»»50 th anniversarycelebrations including agala black tie dinner anda reception hosted by the<strong>Queensland</strong> Premier.»»Keeping the dreamalive, an exhibition ofcostumes and archives from<strong>Queensland</strong> <strong>Ballet</strong>’s 50 yearhistory presented at the TonyGould Gallery at QPAC.»»74 performances werepresented of 11 differentproductions in 9 differentvenues, including 6 regional<strong>Queensland</strong> venues.»»38 different works wereperformed, including 14new works by Australianchoreographers.»»A total audience of 45,356was achieved, comprising38,689 for productions inBrisbane and 6,667 forregional performances in<strong>Queensland</strong>.»»A surplus was deliveredfor the thirteenth year insuccession.»»Private giving reachedrecord levels, supported bya dollar-for-dollar donationmatching subsidy by theState Government.»»<strong>Queensland</strong> <strong>Ballet</strong>received a significantcash bequest from DrAlf Howard, allowing theCompany to undertake muchneeded renovations to theThomas Dixon Centre.»»Three dancers completingthe Professional Year in2010 were offered Traineecontracts with the Company.»»Over 500 teachers andstudents from schools anddance schools throughout<strong>Queensland</strong> participated inprofessional developmentand workshop activitiesin the Company’s newDANCE+ education program.»»<strong>Queensland</strong> <strong>Ballet</strong>facebook friendsnumbered 2,473 at theend of 2010.QUEENSLAND BALLET

5Rosetta Cook and Peter Lucadou-Wells in JacquiCarroll’s The Firebird, 1987.1988Charles Lisner dies from cancer.1989The company undertakes its firstinternational tour, travelling across theTasman to New Zealand.1991<strong>Queensland</strong> <strong>Ballet</strong> moves in to the ThomasDixon Centre in West End. Having beenpurchased by the <strong>Queensland</strong> Governmentin 1975, the former shoe factory wasrefurbished to provide offices and studiosfor <strong>Queensland</strong> <strong>Ballet</strong>, the <strong>Queensland</strong>Dance School of Excellence, and the<strong>Queensland</strong> Philharmonic Orchestra.Kimberley Davis and Shane Weatherby in HaroldCollins’ Alice – Memories of Childhood, 1994.Photographer: Phil HargreavesANNUAL REPORT 20101994The Charles Lisner Studio in the ThomasDixon Centre is opened for publicperformances, offering a unique experiencein an intimate and relaxed studio space.1996The company embarks on a majorinternational tour, visiting 26 cities acrossthe USA, performing A Midsummer Night’sDream, Scheherazade and Pirates! NewYork Post dance critic, Clive Barnes,declares, “ …the <strong>Queensland</strong> <strong>Ballet</strong> isabsolutely packed with dance talent.”1997Collins leaves <strong>Queensland</strong> <strong>Ballet</strong>, sayingof his 19 years as Artistic Director, “Itwas a great gift to be able to develop thecompany.”1998French-born François Klaus is appointedArtistic Director and Chief Choreographer,following an impressive career as a dancer,teacher and choreographer in Europe.Klaus had joined Stuttgart <strong>Ballet</strong> under JohnCranko, and continued working with himin Munich. He spent the greater part of hiscareer as a Principal Dancer of Hamburg<strong>Ballet</strong> under the direction of John Neumeier,and had toured extensively in Europe,the Americas and Japan. He had beenthe Artistic Director of Bern State <strong>Ballet</strong>in Switzerland, and established his owncompany, <strong>Ballet</strong>t Art.When François Klaus began his stewardshipof <strong>Queensland</strong> <strong>Ballet</strong>, the company wasstill recovering from the recession of theearly 90s and the financial impact of theUS tour. Careful management and creativeprogramming saw a rocky financial patchnegotiated, and the technical and artisticdevelopment of the dancers under Klaus’sguidance led to a resurgence of supportfor the company. Klaus introduced severaldifferent programs which have becomepopular features of the company’s annualprogram, including the International Gala,Vis-à-vis and Soirées Classiques series.François Klaus has continued to nurturethe creative spirit of <strong>Queensland</strong> <strong>Ballet</strong>.He has created numerous works himself,and overseen the growth of the company’srepertoire to include many popular classics,story ballets, and new works in a varietyof dance styles. Encouraging emergingchoreographic talent and giving the dancersopportunities to work with internationalchoreographers are also central to hisartistic philosophy.Nicole Galea as the Troll Princess in François Klaus’sPeer Gynt,2004. Photographer: Ken Sparrow1999Klaus and Artistic Associate, Robyn White,establish the Professional Year (PY),an innovative program for gifted youngdancers who are interested in pursuinga professional career in classical ballet.Since its inception over a decade ago, asignificant number of PY graduates havebeen accepted into the company.2001The Junior Extension Program, co-ordinatedby Artistic Associate Robyn White, is offeredto supplement the work of communitydance teachers.

62006<strong>Queensland</strong> <strong>Ballet</strong> undertakes its firstEuropean Tour in January 2006, visitingseven cities in Germany and Switzerland.The company is enthusiastically received,and is invited to return to many of thevenues.Rachael Walsh & Zachary Chant in François Klaus’sCloudland, 2004. Photographer: Ken Sparrow2007In March 2007, <strong>Queensland</strong> <strong>Ballet</strong> makesits first appearance in Asia, presenting fourperformances of Klaus’s whimsical Alicein Wonderland in the Victoria Theatre,Singapore. In September, the companyreturns to Europe, this time to presentKlaus’s acclaimed production of Cloudlandin six cities. In December, <strong>Queensland</strong> <strong>Ballet</strong>attracts an audience of over 15,000 peopleto its season of The Nutcracker in QPAC’sLyric Theatre.2008The company travels to Japan in April2008, performing François Klaus’s The LittleMermaid in Osaka and Kobe. Soon afterthey return, the centenary of the ThomasDixon Centre is celebrated with a verysuccessful Open Day on 19 April.In December 2008, a production milestoneis achieved with François Klaus’s SwanLake presented in the QPAC Playhouse thecompany’s first full-length production of thisclassic ballet.2009Timeless Dances, a collaborative work withindigenous musician William Barton, isthe centrepiece in the program for a thirdEuropean Tour. The company performsto sold-out houses in many of the sevencities they visit in Switzerland, Germany andDenmark. This tour does much to cementthe company’s excellent reputation: “WhenAustralia’s <strong>Queensland</strong> <strong>Ballet</strong> is on theprogram, a full house … is guaranteed,”enthused Christel Voith in the SchwäbischeZeitung, Friedrichshafen, Germany.2010<strong>Queensland</strong> <strong>Ballet</strong> celebrates the 50 thanniversary of its foundation with a numberof special events, including a gala dinner atwhich three of the company’s four ArtisticDirectors are present: Harry Haythorne,Harold Collins and François Klaus. ValerieLisner, widow of founder Charles Lisner,is also present and accepts a speciallycommissioned watercolour painting ofLisner’s ballet, Images Classique.The major new work for the year is FonteynRemembered. Choreographed by FrançoisKlaus, the production uses a partnershipof dance and drama, including spokendialogue. Distinguished <strong>Queensland</strong> actorsBille Brown, Carol Burns and EugeneGilfedder portray key figures in Fonteyn’slife, and the production is notable forits extensive use of spectacular backprojections. The company receives manyletters and emails from patrons who lovedFonteyn Remembered and were moved toshare their own stories about the legendaryballerina.Keeping the dream alive, an exhibition whichcelebrates the company’s 50-year history,opens at the Tony Gould Gallery, QPAC.Amelia Waller & Keian Langdon as Stella and Stanleyin François Klaus’s A Streetcar Named Desire, 2009.Photographer: Ken SparrowQUEENSLAND BALLET

7Chair’s review2010 marked the 50 th anniversary of theestablishment of <strong>Queensland</strong> <strong>Ballet</strong>, and itgives me great pride as Chair to be able tolook back on the Company’s achievementsand celebrations in that milestone year.From a tiny, fragile entity driven by thepassion, dedication and personal financialcommitment of the founding ArtisticDirector, Charles Lisner OBE, <strong>Queensland</strong><strong>Ballet</strong> has grown into a financially soundState flagship company housed in one ofBrisbane’s iconic historic buildings, withgenerous funding from both state andfederal governments, high productionvalues, dancers of international calibre, anenviable suite of training and educationprograms, and a growing audience. TheCompany’s 50 th anniversary provided manyopportunities to celebrate this success,beginning with the commissioning ofKeeping the dream alive, an illustratedhistory which was formally launched by ourPatron, the <strong>Queensland</strong> Governor, PenelopeWensley AC.The Company has traditionally taken thedate of the very first performance (29 April1960) as the true birthday of <strong>Queensland</strong><strong>Ballet</strong>, and this provided the impetus forHonorary Life Member and former CompanyPresident, Dr Neil McCormack, to host areunion at his Yeronga home. More than200 current and former dancers, staffand Board members came from as faraway as Melbourne and Adelaide for theoccasion and I extend my gratitude to DrMcCormack and his wife Dianne for notonly opening their home and garden for theevent but also generously providing musicalentertainment.The Company reserved its major birthdaycelebration for a Golden Gala Dinner on 4June. Among the 300 guests were currentArtistic Director, François Klaus, formerArtistic Directors Harry Haythorne andHarold Collins, and widow of the founder,Valerie Lisner. The Company was honouredto have the Patron, Penelope Wensley AC,as a speaker at the event. Her Excellencyhas been an exceptional supporter andadvocate for the Company since acceptingpatronage at the time of her appointment inJuly 2008.Yet another major anniversary highlight wasthe costume exhibition at the Tony GouldGallery in the <strong>Queensland</strong> Performing ArtsCentre which opened on 21 September.Sharing its title with the anniversarypublication, Keeping the dream alive, theexhibition was generously supported byQPAC and meticulously curated by the<strong>Queensland</strong> Performing Arts Museum’sChristopher Smith. As a regular costumeand set designer for <strong>Queensland</strong> <strong>Ballet</strong> inthe past, Christopher was able to bring hisextensive knowledge and experience to thetask of choosing representative garmentsfor the exhibition, working closely with theCompany’s current Head of Wardrobe andResident Designer, Noelene Hill.The anniversary was also reflected inproductions presented during the year.First, the Company thanked regional<strong>Queensland</strong> for its 50 years of support bytouring Swan Lake in June/July. This isthe largest production ever staged by theCompany and certainly the largest evertoured. Second, the program for the annualInternational Gala not only demonstratedthe international standard the Company hasnow reached, but showcased the depthof the Company’s training programs withCompany dancers and students from theProfessional Year and some students fromthe Junior Extension Program sharing thestage for a celebratory work created for theoccasion by François Klaus.However, the most significant productionof the anniversary year was unquestionablyFonteyn Remembered, an enormousundertaking which began as an idea fromDes Power almost three years ago andpremiered in October. My congratulationsgo to the creative team comprising Des,Artistic Director François Klaus, ArtisticAssociate Robyn White, writer Sue Rider,lighting designer David Walters, set designerGraham Maclean, and costume designerNoelene Hill. The ballet involved not onlythe Company dancers and members ofthe Professional Year and Junior ExtensionProgram, but three of <strong>Queensland</strong>’smost distinguished actors (Bille Brown,Carol Burns, and Eugene Gilfedder). TheCompany also used projected scenery forthe first time for this production, and CraigAllister Young arranged a special score,performed by an ensemble of 14 musiciansfrom the <strong>Queensland</strong> Symphony Orchestra.The launch of the 2011 season in Octoberprovided an opportunity to farewell retiringGeneral Manager, Judith Anderson, and towelcome her successor, Anna Marsden. Onbehalf of the Board, I acknowledge Judith’scontribution and thank her for the serviceshe gave to the Company for almost 13years, and look forward to working withAnna in 2011 and beyond.The year ended with a very successfulOpen Day in October at the Thomas DixonCentre and a celebration at ParliamentHouse to mark both <strong>Queensland</strong> <strong>Ballet</strong>’s50 th anniversary and QPAC’s 25 th . Hostedby Premier and Minister for the Arts, AnnaBligh, this was a fitting end to a year ofcelebrations.It has been a momentous year and I wishto put on record the Company’s thanks tothe State and Federal governments for theirongoing support, to our loyal and generoussponsors and donors, to the ticket-buyingpublic, to the <strong>Queensland</strong> <strong>Ballet</strong> Friendswho so tirelessly support us and particularlyto the committed and hard-working staffand the dancers who strive constantly forthe perfection demanded of them by thismost exacting of artforms. Finally I wouldlike to thank my fellow Directors for the timeand dedication they give so freely to thisremarkable organisation.Adjunct Professor Joan Sheldon AMChairANNUAL REPORT 2010

8Artistic Director’s reportWhen the Company was planning 2010, theworld was in the middle of the Global FinancialCrisis and there was concern that it may affectticket sales. There was also concern that the<strong>Queensland</strong> Performing Arts Centre, with thesupport of <strong>Queensland</strong> Events, was continuingits policy of inviting international companiessuch as Paris Opera <strong>Ballet</strong> to perform inBrisbane. Confronted by both of these factors,I decided to present a year with a strongfocus on well-known, full-length ballets whosepublic appeal would reduce the sensitivity toeconomic downturn. Accordingly, reprises ofthree classics (Swan Lake, Romeo and Juliet,and The Nutcracker) were programmed. TheCompany has its own unique versions of theseworks which are fresh, perfectly adapted to thetalents of our dancers, and, while respectfulof their origins, have enough dramatic twistand power to interest an audience of our time.In recent years, I have given more time andattention to the dramatic line in the execution ofour story ballets because I feel it is the downfallof many classic productions in which, whilesoloists may excel technically, they do so in atheatrical context which remains naïve and haslittle impact on audiences.In revisiting Romeo and Juliet, the Companybegan by working on the Shakespeareanscript with drama coach, Jennifer Flowers, toensure that everyone on stage fully understoodtheir role. While this may seem obvious, it isnot always the case in classical ballet. OurJuliets (Rachael Walsh and Clare Morehen)found it very satisfying to take on this role for asecond time. Despite having to work with newpartners, they demonstrated the confidenceand ability to push their performances further.They developed greater intensity and met thechallenge of matching the many symphonic andepic moments in the score and in the play whenJuliet is alone on stage. I was especially happyabout the third act, which is one of the mostdifficult to solve choreographically. It includesmany musical reprises from the previous actand some scenes are a priori difficult to expresswithout words.The next production, Live Attitude, wasour collaboration with Topology and KarakPercussion (Kerryn Joyce and Kevin Man).The production was originally planned forpresentation in the Brisbane Powerhouse,but the lack of suitable dates resulted in aQUEENSLAND BALLETdecision to perform it in the studio theatre inthe Thomas Dixon Centre. While the number ofperformances had to be increased to nine, thechange brought the advantages of closenessto the artists for the audiences, and goodacoustics for the musicians. It also gave thedancers an excellent opportunity to hone theirperformances.The program opened with a carefully craftedballet by Gareth Belling (The Equilibrium Level),including an impressive pas de deux performedby Clare Morehen and Keian Langdon.This was followed by Lisa Wilson’s piece, Blink,which used unusual vocabulary including floorwork which <strong>Queensland</strong> <strong>Ballet</strong> dancers do notoften have the opportunity to perform. Startingwith interesting and delicate choreography,the work portrayed snippets of differentrelationships and developed freely, progressivelyreducing its links to the music.At my suggestion, Soloist Yu Hui and Principaldancer, Rachael Walsh, choreographed twoshort pieces on themselves for this season,to refined and very intimate music performedby Kevin Man on the shakuhahi. Those twodancers, with their remarkable co-ordinationand sensitivity, executed the choreographybeautifully.Louise Deleur created X174, a challengingpiece for a cast of four. This was an excellentexperience for the cast as Louise chosedancers who, with the exception of ToddSutherland, do not normally perform solo roles.For my part, I choreographed Above Groundto a lovely piece of music written for Topologyand two virtuoso percussionists. The piecestarred Yu Hui, Teri Crilly, Todd Sutherland, ClareMorehen and Christian Tátchev, with a largecast of Company dancers to give them all a partin the evening. In developing the choreography, Idecided to reflect the ecstatic and joyous qualityof the music in order to balance the somewhatserious tone of the other works. The programwas generally well received, but not as well asI had hoped. Despite the inclusion of works byso many different choreographers, I think theprogram left the impression of lacking diversitybecause the studio does not permit scenechanges and the staging varied very little. WhileTopology’s music was brilliantly played and notdifficult to listen to, audiences unfamiliar with itsminimalist style, constant pulse, and demand foractive listening can find this genre of contemporarymusic monotonous.The regional <strong>Queensland</strong> tour of our full-lengthproduction of Swan Lake was an important andsymbolic achievement for our 50 th anniversary,particularly as it was the last <strong>Queensland</strong> tour withfunding delivered through the Arts Regional TouringService. A decade ago, without the number andquality of dancers necessary for such a production,this tour would not have been possible, and tohave done so was special and a testament to theprogress since made by the Company.This is a work that is close to my heart. It is botha classical ballet and a many-layered story withhistorical facts which add another dimension to thetale and interest for an audience with a knowledgeof history, particularly the history of ballet.The tour was expensive and ticket sales were notas strong as expected in some centres, possiblydue to a tour of The Nutcracker by a Russiancompany during the same period. However,this was compensated for by excellent sales inToowoomba, the Gold Coast, and Brisbane. Asthere was insufficient time to prepare the ballet forthe Brisbane season alone, the tour was invaluablein this regard and the Brisbane performances madethe whole Swan Lake season, including the tour,cost neutral.Our 50 th Anniversary International Gala openedwith a celebration, with the company being joinedby the Junior Extension Program and ProfessionalYear students in an overture, set to music byHandel and ending with the formation of a giantbirthday cake with more than 50 candles, held bythe dancers.For the first time, we had guests from China, YuYao and Wei Wei from Hong Kong and MengNingNing and Ma Xiaodong, who came toBrisbane fresh from winning the Silver Medal atVarna (Bulgaria) where the world’s most technicalballet competition is conducted. If their classicaldancing was brilliant, their contemporary work wastruly original, quite unexpected, and powerful.David Dawson’s Révérence and his version ofGiselle were masterpieces of co-ordination andtiming, performed by Andrea Parkin and RaphaelCoumes-Marquet.The Company looked impressive in Nils Christe’sFearful Symmetries, a choreography of extremepositions requiring great physicality and powerfrom the dancers. I do hope that such works can

9show audiences how effective contemporarydance can be. The Company’s performance ofan extract from Don Quixote included excellentinterpretations by Christian Tátchev as DonQuixote and Keian Langdon as Sancho Panza.Rachael Walsh and Yu Hui danced Le Spectrede la Rose with great style, and Clare Morehenand Florimond Lorieux from The Paris Opera<strong>Ballet</strong> danced Flower Festival in Genzano.In my view it was an excellent program offeringballet lovers creations from many differentcenturies and top quality dancing.Fonteyn Remembered was the big creativechallenge of the year. Des Power’s original ideaof creating a work about the extraordinary life ofPrima Ballerina Assoluta, Margot Fonteyn, wasvery filmic and required a great deal of effortby David Walters, Robyn White, Sue Rider andmyself to develop the scenario and bring theidea to the stage choreographically. It was veryrewarding and mutually enjoyable to be ableto work with the three excellent <strong>Queensland</strong>actors (Bille Brown, Carol Burns and EugeneGilfedder) who played many parts. A smallensemble from the <strong>Queensland</strong> SymphonyOrchestra, under the direction of Craig AllisterYoung, played with enthusiasm and greatprecision. Special mention should be made ofCraig for his excellent orchestrations and AnnaGrinberg for her remarkable performance atthe piano. As nearly always happens when oneundertakes such a big project, there were someparts of the work which did not balance as wellas I would have liked, particularly in Act 1, yetI was very happy with Act 2. Principal dancer,Rachael Walsh, is now an artist in her prime witha lot of knowledge, and she did beautifully inthe role of Margot. The sensitivity of our guestactors to what we were trying to do was heartwarmingand it was interesting to compare thevery different rehearsal processes of actorsand dancers. The work accomplished by ourdesign team of David Walters, Graham Macleanand Noelene Hill was enormous. They are aprecious team which is a tremendous asset tothe Company.The last major production of the year wasour production of The Nutcracker in theLyric Theatre, QPAC, with an orchestra largeenough to do justice to the score and a livechoir. Despite being the most popular balletin the Anglo-Saxon world, The Nutcracker isnot easy to choreograph. The musical moodsANNUAL REPORT 2010change very rapidly and dramatically, the oversimplificationof the original tale often makesthe ballet just a sweet thing for Christmas.Unlike The Sleeping Beauty and Swan Lake,it contains no really traditional choreographywhich can rank as a masterpiece with theexception of the grand pas de deux in Act 2. Ihave worked quite a lot on The Nutcracker andfrom my perspective, I have finally got it right.With humour, a lot of dancing, and the favouriteelement of Christmas, it has a dramatic linewhich is simple enough to be appreciated bya child while being satisfying to a balletomanewith a knowledge of dance and theatre.Our Vis-à-Vis and Soirées remain a greatsolution for many artistic purposes, allowingthe Company to show works in progress,create short ballets, give dancers opportunitiesto prepare different roles, and communicatedirectly with the audience. The fact that Ipersonally introduce and speak about the workswhich are performed has a proven appeal forthe audience.A special occasion during the year was ourperformance of Vis-à-Vis : Moving Stories in thePlayhouse in collaboration with the <strong>Queensland</strong>Shakespeare Ensemble. We presenteddifferent scenes of plays which have beenchoreographed including Othello, A MidsummerNight’s Dream, and A Streetcar Named Desire,with each scene presented as the original textand in its choreographed version. The audienceenjoyed it, and quite a few people asked if wecould do it on a regular basis. Unfortunately,this is not so simple because only part of theCompany’s repertoire is based on plays.Very significant for us was the departure of ourGeneral Manager, Judith Anderson. We startedtogether when the Company was in a difficultsituation, and with the help of a very supportiveBoard, we managed to turn the tide around andbring prosperity and success on many fronts.Materially alone, under Judith’s supervision,the Thomas Dixon Centre underwent manychanges with the support of the Departmentof Public Works, including new sprung floorsin four studios, a new seating bank in theCharles Lisner Studio, improved access to theperforming space by construction of a bridgeover the stairwell, installation of a ramp, liftand bridge for mobility impaired access to theperformance space, removal of asbestos andinstallation of a new roof, and restoration of theperimeter walls.Judith was not one for outside effect; she was acareful administrator with great compassion, anexcellent sense of humour, an immense capacityfor work, a desire to learn, and consequently anextensive knowledge. And I welcome Anna to ourteam and look forward to working with her in thecoming years.As a whole from my perspective, 2010 was avery good year, the Company dancing better andbetter and believing in what they do. One of ourdifficulties has been injuries to our principal maledancers which have been difficult to cure. It isalways hard for a Company which is quite smallfor the repertoire we perform.Looking back to where we have come from, I amtruly pleased. On the other hand, the Companystill faces the challenges which have been animportant factor in my choice of artistic policy:the difficulty of getting audiences of a commercialsize for anything with a title which is not familiar;the difficulty of access to venues and theexpense of venue hire; competition from visitingcompanies for audiences; the very small pool ofprofessional dancers, especially males; living in asociety where money always has the last word;and having the relevance of arts such as balletquestioned.On the other hand Brisbane has been thrivingrecently: the <strong>Queensland</strong> <strong>Ballet</strong> has wonderfulrehearsal facilities to work in; the stages in QPACare first class; the numbers of performance bythe Company are on the rise, and the spirit inthe company is excellent. If we make as muchprogress in the future as we have in the past 10years, it will be wonderful.François KlausArtistic Director

10Chief ExecutiveOfficer’s reportIn 2010 over 45,000 people enjoyed themagic and beauty of <strong>Queensland</strong> <strong>Ballet</strong>performances. This impressive figure topsoff what has been a momentuous yearfor an organisation that celebrated its 50 thanniversary and farewelled long-standingGeneral Manager Judith Anderson.As we embark on the next chapter for<strong>Queensland</strong> <strong>Ballet</strong>, we can all be proudof the very solid foundation that wasestablished over a half-century of success,hard work and determination. The manycelebratory activities during the past yearprovided opportunities to acknowledge theindividuals who have built this foundation,but I would like to once again thankeveryone who contributed to making our50 th anniversary so memorable.The foundation in place for the future isclearly built on a record of strong financialperformance. Despite challenging economiccircumstances, <strong>Queensland</strong> <strong>Ballet</strong> is ableto report its thirteenth successive profit, aswell as record results from sponsorship andfundraising efforts. As detailed on page 26of this report, <strong>Queensland</strong> <strong>Ballet</strong> ended theyear with a significant operating profit of$122,302, a result that has allowed us tobuild on our cash reserves, which currentlysit at 42% of annual costs.<strong>Queensland</strong> <strong>Ballet</strong> continues to enjoy strongcore funding support from the AustralianGovernment through the Major PerformingArts Board of the Australia Council for theArts and from the <strong>Queensland</strong> Governmentthrough Arts <strong>Queensland</strong>. To supplementthis significant support, <strong>Queensland</strong> <strong>Ballet</strong>is focused on growing revenue throughcommercial activities and development, inorder to deliver the highest standards inprogramming and education.As mentioned, our sponsorship andfundraising efforts in 2010 are especiallynoteworthy, particularly given increasedcompetition from other non-profitorganisations. The majority of this supportcomes from a small circle of long-standingprivate and corporate donors. I wouldlike to acknowledge the generosity theycontinue to show our organisation, dancersand programs.Significant support in 2010 was alsoprovided by Ernst & Young, who we weredelighted to welcome as the BrisbaneSeason Sponsor. <strong>Queensland</strong> <strong>Ballet</strong>shares a number of common values withErnst & Young, including a commitment toinnovation and to quality.Further, in recognition of the importance<strong>Queensland</strong> <strong>Ballet</strong> played to his life, wereceived a large bequest from the estate ofDr Alf Howard.With paid attendances averaging 79%across the season, box office receipts andattendances increased in 2010. Havingperformed to almost sell-out crowds,François Klaus’s The Nutcracker was thestandout production of the year, generatinga large profit for the organisation. Ourunique Vis-à-Vis and Soirées Classiquesseasons, staged at the Thomas DixonCentre, were also consistent sell-outs,giving audiences much-valued opportunitiesto view ballet in an intimate and personalsetting.Given the profile of <strong>Queensland</strong> <strong>Ballet</strong>’sperformances, it is sometime easy tooverlook the contribution the organisationmakes to dancer training and development.Our three training programs continued toperform well in 2010 with record turnouts topublic auditions and an increasing numberof students receiving contracts at balletcompanies in Australia and overseas. Iwould like to especially thank the PatriciaMacDonald Foundation, Eduard PaschzellaMemorial Gift and George Hartnett Funeralsfor their financial support for studentswishing to participate in these programs.Since joining the company in October, Ihave been overwhelmed by the personalattachment people have to our balletcompany and the high regard they hold forits programs. My focus for 2011 will be onstrengthening the long-term sustainabilityof the organisation and working alongsideFrançois to continue building a world-classballet company and delivering performancesthat delight and entertain our audiences.None of this would be possible withoutthe ongoing dedication and leadershipprovided by Joan Sheldon and membersof the Board; as well as the energy andcommitment of our staff and dancers.My personal gratitude goes to JudithAnderson, who so diligently and tirelesslysteered this organisation from strengthto strength over the past 12 years. Hercommitment to <strong>Queensland</strong> <strong>Ballet</strong> went farand beyond a professional capacity; and onbehalf of the entire Company we wish herevery success for the future.I am honoured to be part of this amazingorganisation and look forward to beingpart of its very bright future and sharing itssuccess with you over coming years.Anna MarsdenChief Executive OfficerQUEENSLAND BALLET

2010 Performancesummary11Romeo and JulietChristian Tátchev as Romeo & Rachael Walshas Juliet in François Klaus’s Romeo & Juliet;Photographer: Ken SparrowClare Morehen & Keian Langdon in GarethBelling’s The Equilibrium Level (…live attitude2011); Photographer: Ken Sparrow“Celebrating 50 years as <strong>Queensland</strong> <strong>Ballet</strong>,the company’s dancers are alive with passionand drive in their first main house season for2010.” Shaaron Boughen, The Australian“The performance and performers ‘spoke’to the audience through every nuance andmovement. Totally entrancing: a true danceof love and storytelling at its best.” MarikaBryant, Artshub10–24 April, QPAC Playhouse, BrisbaneChoreography François KlausSet Design Graham MacleanCostume Design Noelene HillLighting Design David WaltersPerformance figuresPerformances: 10Total attendance: 7792Box office income: $384,358...live attitude with Topologyand Karak Percussion“The Asian musical themes echoing Hui’sethnic heritage provide an ideal frameworkfor his explosive athleticism – soaring leaps,slicing legs and feline agility” Olivia Stewart,The Courier-Mail14–29 May, The Thomas Dixon Centre,BrisbaneThe Equilibrium LevelChoreographer Gareth BellingCostume Design Noelene HillGrowthChoreographerBlinkChoreographerCostume DesignYu HuiLisa WilsonNoelene HillX174ChoreographerCostume DesignLouise DeleurNoelene HillWish, Love, Pray to RememberChoreographer Rachael WalshAbove GroundChoreographerCostume DesignMusiciansFrançois KlausNoelene HillTopology: Christa Powell, Bernard Hoey/Antonio Bernal, Therese Milanovic, RobertDavidson, John BabbageKarak Percussion: Kevin Man and KerrynJoycePerformance figuresPerformances: 9Total attendance: 1333Box office income: $43,223Swan LakeRegional <strong>Queensland</strong> tour and Brisbaneseason23 June, The Brolga Theatre, Maryborough26–27 June, Townsville Civic Theatre,Townsville30 June, Mackay Entertainment andConvention Centre, Mackay3 July, Pilbeam Theatre, Rockhampton9 July, Empire Theatre, Toowoomba17 July, The Arts Centre, Gold Coast13–15 August, QPAC Playhouse, BrisbaneChoreography François KlausSet Design Graham MacleanCostume Design Noelene HillLighting Design David WaltersChristian Tátchev as Prince Siegfried & Rachael Walsh as Odette in François Klaus’s Swan Lake (Act 2);Photographer: Ken SparrowANNUAL REPORT 2010

13Carol Burns as Ninette DeValois and Rachael Walsh asMargot Fonteyn in FrançoisKlaus’s Fonteyn Remembered;Photographer: Ken SparrowTeri Crilly as Clara in FrançoisKlaus’s The Nutcracker:Photographer: Ken SparrowPerformance figuresPerformances: 10Total attendance: 4807Box office income: $243,229The NutcrackerWith the <strong>Queensland</strong> Symphony Orchestra“Emanating unforced expression andanimation, Crilly, 23, gives the truestportrayal of a young girl I’ve seen by anadult ballerina. She transforms the partinto the ballet’s centrepiece, rather thana conduit for its famous sections.” OliviaStewart, The Courier-Mail11–18 December, QPAC Lyric Theatre,BrisbaneChoreography François KlausSet Design Graham MacleanMusicians <strong>Queensland</strong> SymphonyOrchestraChoir St Peters Lutheran College Choir<strong>Queensland</strong> <strong>Ballet</strong> Principal GuestConductor Andrew MogreliaCostume Design Noelene HillLighting Design David WaltersPerformance figuresPerformances: 8Total attendance: 14,711Box office income: $789,455Vis-à-vis Studio SeriesVis-à-vis 1: The language of movement19 February – 6 March, The Thomas DixonCentre, BrisbaneBack to Bach, 1 st and 2 nd movementsChoreography: François KlausCostume Design: Noelene HillScarlet ShadowChoreography: Todd SutherlandDon Quixote pas de deuxChoreography: François KlausCostume Design: Selene CochraneExcerpt from Romeo and Juliet: BallSceneChoreography: François KlausCostume Design: Noelene HillExcerpt from RunChoreography: Gareth BellingSYNC pas de deuxChoreography: Nils ChristeCostume Design: Annegien SneepExcerpt from SYNCChoreography: Nils ChristeCostume Design: Annegien SneepBack to Bach, 3rd and 4 th movementsChoreography: François KlausCostume Design: Noelene HillVis-à-vis: Moving StoriesFeaturing <strong>Queensland</strong> <strong>Ballet</strong> and<strong>Queensland</strong> Shakespeare Ensemble21 April, QPAC Playhouse, BrisbaneA Midsummer Night’s Dream: Oberonand TitaniaActors: Rob Pensalfini, Liz VerbraakOthello: Iago and Othello, Othello andDesdemonaActors: Colin Smith, Rob Pensalfini, LizVerbraakPeer Gynt: Peer and Three Cowherds,Peer and Solveig pas de deuxANNUAL REPORT 2010

14Actors: Colin Smith, Rob Pensalfini, LizVerbraak, Clare PearsonA Streetcar Named Desire: Blanche andMitch, Blanche and StanleyActors: Clare Pearson, Rob Pensalfini, ColinSmithChoreographer François KlausCostume Design Noelene HillLighting Design David WaltersVis-à-vis 2: Technically Speaking29 October–12 November, The ThomasDixon Centre, BrisbaneExcerpt from Swan Lake: Danse russeChoreography: François KlausCostume Design: Noelene HillInter-twinedChoreography: Todd SutherlandExcerpt from The Nutcraker: Arabianpas de deuxChoreography: François KlausCostume Design: Noelene HillOpen Your EyesChoreography: Yu HuiExcerpt from The Nutcraker: Snow pasde deuxChoreography: François KlausCostume Design: Noelene HillHall of FlameChoreography: Rosetta CookExcerpt from The Nutcraker: RussiandanceChoreography: François KlausCostume Design: Noelene HillSuddenlyChoreography: Gareth BellingExcerpt from The Nutcraker:SnowflakesChoreography: François KlausCostume Design: Noelene HillSeries performance figuresPerformances: 17Paid attendees: 2989Box office income: $84,461Soirées ClassiquesSoirée Classique No. 113 March, The Thomas Dixon Centre,BrisbaneSoirée Classique No. 228 August, The Thomas Dixon Centre,BrisbaneChoreographers François Klaus, ToddSutherland, Gareth BellingCostume Design Noelene HillMusiciansSoirée Classique No. 1 Musicians: GwynRoberts (The University of <strong>Queensland</strong>),Jenni Flemming, Hayato Simpson, GlennChristensen, Susanna Ling, Kirsten BishopSoirée Classique No. 2 Musicians:<strong>Queensland</strong> Symphony OrchestraEnsemble: Warwrick Adeney, WayneBrennan, Kirsten Hulin-Bobart, David Lale,Paul O’Brien, Sarah Meagher, RichardMaddenPerformance figuresPerformances: 4Paid attendees: 582Box office income: $15,619Blair Wood as Iago & Piran Scott as Othelloin François Klaus’s Othello (Vis-à-vis - MovingStories); Photographer: Ken SparrowRachael Walsh & Keian Langdon in Nils Christe’s SYNC pasde deux (Vis-à-vis 1); Photographer: Ken SparrowQUEENSLAND BALLET

15The Company<strong>Queensland</strong> <strong>Ballet</strong> Company dancers and staffPatronHer Excellency Ms Penelope Wensley AC,Governor of <strong>Queensland</strong>Board of DirectorsChairAdjunct Professor Joan Sheldon AMDeputy Chair »Mark FentonDirectorsWinna Brown (from 11 April), Brett Clark,Dawid Falck, Leneen Forde AC, Peter Jans,Margaret Lucas OAM, Joanne PafumiHonorary Life Members»Harold Collins MBE, Pauline Crowe, LynetteDenny AM, Prof Ashley Goldsworthy AOOBE, Kevin Hodges, Patrick Kelly, ValerieLisner, John Matthews, Dr Neil McCormack,Neil SummersonArtisticArtistic Director & Chief ChoreographerFrançois KlausArtistic Associate »Robyn White<strong>Ballet</strong> Mistress/Rehearsal AssistantClaire Phipps, Wendy Laraghy (until 15August)Artistic Administrative AssistantNicole GaleaAccompanists »Brian Adamson, Shirley Coe, Gary DionysiusAdministrationGeneral ManagerJudith Anderson (until 15 October)Chief Executive OfficerAnna Marsden (from 11 October)Marketing ManagerJean AttwaterMedia & CommunicationsVanessa Delaney (until 2 July), Kathie Kelly(from 5 July until 10 September)Publicist and Communications »Co-ordinator »Natasha Spong (from 1 November)Marketing & Development Co-ordinatorAlison KardashBusiness DevelopmentPhilip BarkerSpecial ProjectsAnna JonesFinance Manager »Lynne MastersFinance Administraor »Narelle SuttonANNUAL REPORT 2010

16Office Co-ordinatorAmanda Newman (from 2 November)Administrative AssistantsAna Gray (until 24 June), Naomi KlahnProject Co-ordinator – EducationLauren McKean (from 25 October)Cleaning and MaintenancePaula SmithProductionProduction ManagerLeonie LeeStage Manager »Tanya MaloufTechnical Services Co-ordinatorDan Cook (until 23 April), Cameron Goerg(from 6 September)Head of Wardrobe & Resident DesignerNoelene HillPrincipal Cutter & Workroom SupervisorLouise GerardWardrobe AssistantFrances PyperDancersPrincipalsClare Morehen, Christian Tátchev, AlexWagner, Rachael WalshSoloistsKeian Langdon (from 27 April), NathanScicluna, Yu Hui, Amelia Waller (until 15August)DancersGareth Belling, Teri Crilly, Kathleen Doody,Lisa Edwards, Tamara Hanton, JanessaKimlin (until 15 August), AlexanderKoszarycz, Keian Langdon (until 26April), Iona Marques, Gemma Pearce,Todd Sutherland, Zenia Tátcheva (until 20August), Melissa Tattam, Tamara ZurvasTraineesDara Cust (until 15 August), Eric Gravolin(until 22 November), Lina Kim, Anne-Elizabeth Peters, Katherine Rooke, PiranScott, Sarah Thompson, Blair Wood<strong>Queensland</strong> <strong>Ballet</strong>Professional YearCo-ordinatorRobyn WhiteStudentsJessica Buckley, Eleanor Freeman,Robert McMillan, Kristian Pisano, AedenPittendreigh (until September), MelanieSmith, Joseph Stewart, Mia Thompson,Rian Thompson, Nicola Wills<strong>Queensland</strong> <strong>Ballet</strong> JuniorExtension ProgramCo-ordinatorRobyn WhiteStudents»Amy Anderson, Katya Bennett-Woodger,Jessica Brown, Brooke Cassar, HannahClark, Caitlin Clarke, Grace Clarke, EmilyCorkeron, Isobelle Dashwood, ShannonDoherty, Henry Driver, Ashley Fooks, LiamGeck, Helena Gjone, Bailey Harrison, AprilHarvey, Harry Hillcoat, Georgina Hills,Hannah Hughes, Jasmin Hunter, BridgetKelly, Matt Landel, Shene Lazarus, FrazerMcCabe, Mikayla Pearson, Amelia Platz,Chloe Powell, Georgina Scott-Hunter, AnyahSiddall, Lilly Smith, Kelsey Sparks, LucyStubbings, Alexia Teixeira, Alicia Townsend,Myra Turner, Emma Voevodin, MaddisonWallace, Brittany Worthington, MikaelaWatson, Michael Wellington, Zoe WhiteVolunteersKen Sparrow – PhotographerDoug Weis – Video LibraryGraham Bennett – LibrarianQUEENSLAND BALLET

17Acknowledgements<strong>Queensland</strong> <strong>Ballet</strong> would like to thank the following for their valued contribution in 2010.Government PartnersMedia SupportBrisbane SeasonPartner<strong>Queensland</strong> <strong>Ballet</strong> receives financialassistance from the <strong>Queensland</strong> Governmentthrough Arts <strong>Queensland</strong><strong>Queensland</strong> <strong>Ballet</strong> is assisted by theCommonwealth Government through the MajorPerforming Arts Board of the Australia Councilfor the Arts, its arts funding and advisory body.Media SupportInternational Corporate PartnersRegional Tour PartnersAssociate PartnersCorporate ClubAromas Tea & Coffee Merchants, Bees Nees City Realty, Colmar Brunton, DibbsBarker, First Place Inteternational Recruitment,German Australian Travel, Healthpoint Chemist, John Jones Florist, KPMG, McCullough Robertson Lawyers, DB Schenker,The Daily Mercury, the gun shop café, Theme & Variations Piano Services, The University of <strong>Queensland</strong> Union, Yellow Cab CompanyANNUAL REPORT 2010

18<strong>Queensland</strong> <strong>Ballet</strong> gratefullyacknowledges the generous support ofthe following patrons from 1 January to31 December 2010:Major GiftsLynette Denny, Eduard Paschzella MemorialGiftGrand Jeté Level ($1000 to $5000)Anon (3), Judith Anderson, GeorginaBlomfield, The Douglas Family, GriffithUniversity, Roy B. Hoskins, Andrea& Martin Kriewald, Diana & ElizabethLuker, The Patricia Macdonald MemorialFoundation, Dr Neil McCormack, JenniferMorrison, Paul Ralph, Detlef and CaroleSulzer, Jan & Deanne Syms, Stu & StephThomson, Gillian & Wally Wilton (IpswichPhysiotherapy)Pirouette ($500 to $999)Anon (10), Desleigh Byrne, Dr C Davison,Ben Duke, Brian & Ivy Finn, LeneenForde AC, Ana Gray-Doughty, Dr MarkHarrison, Dr Frank Leschhorn, Dr J DouglasMcConnell, Elizabeth TansleyPlie ($100 to $499)Anon (79), Ann & Peter Allen, Val Anderson,Dr Phil Barker, Dr S Frye & Georgia Bettens,Mary Jo Capps , Lucien Castand & DonaldRobson, Ann Caston, City Palms MotelFortitude Valley, Prof. Mat Darveniza, LaurieJames Deane, Prof. & Mrs David DoddrellAM, Mary Duggan, Joan Fadden, ThomasFalconer, R. Findlay, Mrs J M Finney,Troy and Karelia Gianduzzo, DeborahGreen, Ruth Hamlyn – Harris, The HantonFamily, Roy Henson, Patricia Jackson,T A Johnson, Dr Joan M Lawrence,Jennifer Martin, Ms Anne McPhee, Diane& Stephanie McPhee, Reg & Sally Marsh,Isa Maynard, Desmond B. Misso Esq.,Michael Nelson-Gracie, Gwenda Pegg, ProfColin Power AM, Premier Dance Academy,E Richers, Dr Spencer Routh, Alan Sim,Sabine Thiel-Siling, Sharyn Van Alphen, G.J& E.S Vickery, Michael & Beryl Ward<strong>Queensland</strong> <strong>Ballet</strong> gratefullyacknowledges the generous supportof the following philanthropic andcommunity funds:<strong>Queensland</strong> <strong>Ballet</strong>’s DANCE+ educationprogram is supported by the JohnChristopher Pascoe Memorial CharitableTrust, managed by Perpetual.QUEENSLAND BALLET

19Directors’ ReportWarehouse board, Brett currently sits on theMarket Reach and Bridgeworks Personnelboards.Director since June 2008.Dawid Falck – Non-Executive Director<strong>Queensland</strong> <strong>Ballet</strong> Board of Directors (left to right): Margaret Lucas OAM, Peter Jans, Mark Fenton,Winna Brown, Joan Sheldon AM, Brett Clark. Absent: Dawid Falck, Joanne Pafumi, Leneen Forde AC.Dawid Falck is General Manager ofTheCyberInstitute. Previously GeneralManager of Vodafone <strong>Queensland</strong>and Northern Territory, Dawid has heldnumerous positions in the informationtechnology sector, including over five yearswith Vodafone New Zealand, and variousroles at Datacom NZ, Infinity Solutions NZ,and Netscope South Africa. Educated at theUniversity of Stellenbosch in South Africa,Dawid is a qualified teacher and speaksEnglish, German and Afrikaans fluently. Healso holds several industry qualifications aswell as a diploma in adult education, andtaught special needs students in Romford,England. In addition to his membership ofthe Board of <strong>Queensland</strong> <strong>Ballet</strong>, he has aclose association with the Australia-IsraelChamber of Commerce, and an associatefellowship of the Australian Institute ofManagement.For the year ended 31 December 2010The Directors present their report togetherwith the financial report of The <strong>Queensland</strong><strong>Ballet</strong> Company Limited (“the Company”) forthe year ended 31 December 2010 and theauditors’ report thereon.DirectorsThe Directors of the Company at any timeduring or since the end of the financial yearare:Winna Brown - Non-Executive DirectorWinna is an assurance partner in Ernst &Young’s Brisbane office and has over 15years of experience in a variety of industriesincluding retail, life science, softwaretechnology, manufacturing and distributionand venture capital. Winna has significantexperience in servicing entrepreneurialand fast growing companies, taking themfrom start-up through to successful publiccompany status in Australia and the UnitedStates. This has included the preparationANNUAL REPORT 2010for and completion of initial public offeringson the Australian Stock Exchange and theNasdaq.Director since April 2010.Brett Clark, BPharm, MBA, AdvDipNutritional Pharmacy MAICD MPS MACPP- Non-Executive DirectorBrett Clark is the founder and managingdirector of ePharmacy and the managingpartner of Chemist Warehouse storesin <strong>Queensland</strong> and Northern NSW.Brett graduated from The University of<strong>Queensland</strong> with a Bachelor of Pharmacydegree in 1988 and a MBA in 2005. He alsohas an Advanced Diploma in NutritionalPharmacy and was a past national finalist ofErnst & Young’s Young Entrepreneur of theYear award as well as more recently actingas a judge of the award for the past 3 years.In 2009, Brett received a Griffith UniversityMedial for Management Innovation fromthe Australian Institute of Management.In addition to the ePharmacy/ChemistDirector since April 2009.Mark Fenton, AssDipBus, BBus, MBA,JP(Qual), FCPA, GAICD – Deputy ChairMark is a financial executive with 18 yearsexperience working with growth-orientedbusinesses in the private sector. He isthe Executive Manager Finance at TheRoyal Automotive Club of <strong>Queensland</strong> Ltd(RACQ). Mark is an experienced financeexecutive and has been employed as theChief Financial Officer for MCD Australia,The Perfume Connection chain of retailstores and also the General Manager ofMetromedia Technologies (MMT), theAustralian division of a global company thatmanufactures advertising signage. He held anumber of other roles within MMT, includingChief Financial Officer for the Asia-Pacificregion, and was Director of several MMTsubsidiary companies. Mark is a Non-Executive Director and Chairman of theBoard of Directors of John Paul College Ltd,one of <strong>Queensland</strong>’s largest schools.Director since February 2003, Deputy Chairsince April 2008.

20Mary (Leneen) Forde AC, LLB (UQ) –Non-Executive DirectorLeneen is Chancellor of Griffith University,and former Governor of <strong>Queensland</strong>.She holds an LLB from The Universityof <strong>Queensland</strong>, and her distinguishedlegal career is marked by outstandingachievement and contributions to<strong>Queensland</strong> in many roles. She remainsactive in <strong>Queensland</strong> and Australiancommunity life, serving on the boards ofmany organisations. She is Vice-Presidentof Scouts Australia, and is patron ofthe Forde Foundation, Rosies, and theNational Pioneer Women’s Hall of Fame(Alice Springs), among others. She isalso a former International President ofZonta International, a service organisationcommitted to advancing the status ofwomen worldwide. She was <strong>Queensland</strong>erof the Year in 1991 and five <strong>Queensland</strong>universities have bestowed upon her thehonorary award, Doctor of the University/Letters. In 2001 she was awarded aCentenary Medal in recognition of hercontribution as a former <strong>Queensland</strong>Governor, and in 2007 was recognised as a<strong>Queensland</strong> Great.Director since May 2000.Peter Jans, LLB (Hons)(Melb), MA (UQ) –Non-Executive DirectorPeter is a commercial lawyer withexperience in both the private and publicsectors in a broad spectrum of legal andcommercial disciplines. Peter is currentlyGroup General Counsel and CompanySecretary of ERM Power. Peter hasworked for over 30 years in private legalpractice, and has, in the last decade, heldpositions of General Counsel (and CompanySecretary) of various energy and resourcescompanies, including entities listed on theASX. In this role he has been responsiblefor providing specialised legal advice toboards and senior management teams, andfor ensuring compliance with statutory andregulatory matters.Director since December 2004.QUEENSLAND BALLETMargaret Lucas OAM – Non-ExecutiveDirectorMargaret is involved extensively in manyaspects of dance education, teaching,adjudication, and administration. She isChair of the Artistic and Advisory Committeeof the <strong>Queensland</strong> Dance School ofExcellence (QDSE), a role which includesmajor involvement in the development andco-ordination of QDSE’s allied Trackdance,Mid-Trackdance and QDSE Year 8/9Development programs at Kelvin GroveState College. Margaret is a life memberand accomplished registered teacher ofthe Royal Academy of Dance (RAD), andholds a Theatrical Teacher’s Diploma fromthe Commonwealth Society of Teachers ofDancing. She has served on several subcommitteesand reference groups coveringall aspects of dance, and for 35 years wasCo-Principal of her own studio, with manystudents going on to professional careersin Australia and overseas. Margaret is aTrustee of the Patricia Macdonald MemorialFoundation. She was a founding memberof the RAD South <strong>Queensland</strong> Panel in1982, and continued her dedication to thatorganisation, serving as Vice-Chair andTreasurer. In 1998 Margaret was awardedthe International Royal Academy of DancePresident’s Award for her dedication andservice to dance and the Academy.Director since May 1995.Joanne Pafumi, BBus (Comm), GradDipApplied Finance and Investment – Non-Executive DirectorJoanne is a specialist communicationadviser who has designed, led, driven, orimplemented programs involving brandand marketing strategy, stakeholderengagement and issues management aswell as investor, government and mediarelations. A practitioner with more than20 years experience, Joanne has workedwith the Australian Gas Light Company(AGL), property developer, the MUR Groupof Companies, communication consultingfirm, Rowland, and in March 2010 wasappointed as General Manager CorporateAffairs, Community Relations and HumanResources with Xstrata Zinc Australia.Joanne holds a Bachelor of Business –Communication from <strong>Queensland</strong> Universityof Technology, and a Graduate Diploma– Applied Finance and Investment from theSecurities Institute of Australia. Industryrecognition of her achievements includesawards conferred by the Public RelationsInstitute of Australia (PRIA) in <strong>Queensland</strong>,Victoria and nationally, several nationalawards from the Society of BusinessCommunicators (SBC), and industry-basedawards from the Australian Gas Associationand Enterprise Australia. Joanne alsowon the PRIA <strong>Queensland</strong>’s OutstandingCommunicator Award in 2006.Director since February 2008.Adjunct Prof. Joan Sheldon AM,BPhysio, FAICD, FAIM, LTCL – ChairJoan Sheldon ran her own physiotherapypractice and was actively involved inadvancement of the profession beforebecoming a Member of Parliament in 1990.In that role until her retirement in 2004, sheheld a range of senior positions includingDeputy Premier, Treasurer, and Minister forthe Arts. Other portfolios included Tourism,Consumer Affairs, Women’s Policy, Trade,Employment, Training, Industrial Relations,Economic Development, Health, FamilyServices, and Aboriginal and Islander Affairs.She also held a range of senior positions inthe Liberal Party and was leader of the Partyfrom 1991 to 1998. Throughout her timeas an MP, Joan was active in local affairs inCaloundra. She is also a Licentiate of TrinityCollege, London, in speech and drama, anda Fellow of both the Australian Institute ofManagement and the Australian Instituteof Company Directors. She is an AdjunctProfessor at the Sunshine Coast University,an Executive in Residence at the AustralianInstitute of Management, and the Chair ofboth Sunshine Coast Events and St Leo’sCollege within The University of <strong>Queensland</strong>.She is also Chair of the Sunshine CoastCommunity Foundation, a board memberof the Australian Major Performing ArtsGroup, and a Director of Forest Plantations<strong>Queensland</strong>.Director since March 2004, Presidentfrom April 2005 to April 2008, Chair fromApril 2008.

21Directors’ MeetingsThe number of Directors’ meetings, andnumber of meetings attended by each ofthe Directors of the Company during thefinancial year are indicated in the tablebelow. In addition, the annual Board retreatwas attended by Winna Brown, Brett Clark,Mark Fenton, Leneen Forde, Peter Jans,Margaret Lucas and Joanne Pafumi.DirectorNo. of meetingsattendedNo. of meetings held(during tenure asDirector in 2010)Winna Brown 5 7Brett Clark 8 10Dawid Falck 7 10Mark Fenton 9 10Leneen Forde 6 10Peter Jans 7 10Margaret Lucas 9 10Joanne Pafumi 7 10Joan Sheldon 6 10Principal ActivitiesThe following records the Company’s performance in the key areas of artistic vibrancy, access and outreach, employment and training,financial viability, and governance.Artistic Vibrancy2010 2009Total number of productions presented 11 13Total number of performances 74 88Total number of works presented 38 38Total full length works presented 4 3Total short works presented 19 16Total brief works/excerpts presented 15 19Total new works 16 13Total new Australian works 14 13Total remounted works 22 25Total remounted Australian works 13 16Access and Outreach2010 2009Regional <strong>Queensland</strong> TouringNumber of tours 1 1Number of venues 6 7Total audience 6667 7607International TouringNumber of tours 0 1 (Europe)Total audience 0 6437Education ProgramsOpen Doors participants 110 127Number of workshops 30 15Number of teachers 23 50Number of participants 511 647ANNUAL REPORT 2010

22Employment and TrainingEmployment statistics as at 31 December 20102010 2009Female Male Total Female Male TotalDancers 10 8 18 10 9 19Trainee Dancers 2 4 6 3 0 3Artistic 4 3 7 4 3 7Production and Wardrobe 5 1 6 6 6Marketing & Development 3 1 4 3 1 4Administration and6 6 6 6FinanceEducation 1 1Total 31 17 48 32 13 45In addition to the Company’s core artistic, administrative, production and wardrobe staff, the 2010 program also provided contract-basedemployment to a wide range of lighting and set designers, independent musicians, choreographers and production and wardrobe staff.<strong>Queensland</strong> <strong>Ballet</strong> also has support from a group of long-standing volunteers and hosted numerous week-long placements for workexperience students throughout the year.Dancer Training Programs2010 2009Female Male Total Female Male TotalProfessional Year 6 4 10 8 7 15Junior ExtensionProgram33 8 41 25 16 41Financial Viability2010 2009Government funding $2,391,609 $2,383,883Box office (gross income) $2,172,839 $1,529,476Paid attendees 45,356 paid attendees 41,994 paid attendeesSubscribers 1834 subscribers 1595 subscribersSponsorship and donations $329,960 $267,010QUEENSLAND BALLET

23Company membershipCompany membership increased slightlyin 2010, with a total of 337 members,compared to 294 in 2009.GovernanceAttendance at the Company’s 10 boardmeetings during 2010 featured overallaverage attendance of over 70%.The Board of <strong>Queensland</strong> <strong>Ballet</strong> recognisesthe respective roles and responsibilities ofthe Board and management. In additionto the Company constitution, the Boardis guided by a formal Charter specifyingprincipal functions, a Code of Conduct,and an agreed induction process whichincludes lists of documentation to beprovided to prospective Directors beforeand after appointment or election. EachDirector is protected by a deed of access,indemnity and insurance which is issued onappointment/ election.A balance of relevant skills is maintainedon the Board through a mix of expertisewhich includes finance, law, marketing,government, business, and artformknowledge.The Board receives reports at each meetingfrom the Artistic Director and Chief ExecutiveOfficer covering all key artistic and businessareas respectively, as well as a detailedFinancial Report prepared by the Company’sFinance Manager and presented by theChair of the Finance Committee. TheCompany has a robust Reserves Policy,and the budget and program of activitiesfor the forthcoming year are approved bythe Board by 1 September each year. Anymaterial variation from budget and any majorcapital expenses are required to have Boardapproval.In addition to normal meetings, the Boardholds a half-day retreat each year to reviewthe Company’s corporate strategy andperformance objectives.The Board annually evaluates its ownperformance and that of the Chief ExecutiveOfficer and Artistic Director. It also hasprocesses in place for staff Exit Interviewsconducted by an external consultant, andfor Peer Reviews of artistic quality.RESULTFor 2010 a net profit of $91,144 is reported(2009 net profit: $69,965).The 2010 year continued the positive trendsof the previous eleven years with a surplusat year end.Under François Klaus as Artistic Director,the Company continued to maintain its hightechnical and artistic standards and level ofcreative output.The Company has also demonstratedits ongoing commitment to developingemerging choreographers, and to providingleadership in artist and artform development,by exposing dancers and audiences tothe work of some of the best Australianand international choreographers andperformers.It has also actively pursued and promotedaccess through regional and internationaltouring, development of an educationprogram for teachers and students ofschools and community dance studios,and community engagement activities. TheCompany delivers programming which hasaudience education content, maintainsa strong and active web presence, anddistributes season programs free-of-chargeto patrons, to better inform its audiences.The Company has demonstrated itsstrong commitment to training throughthe Professional Year, <strong>Queensland</strong> DanceSchool of Excellence, and Junior ExtensionProgram, and to employment throughdirectly providing over 100 full-time, parttime,or casual jobs for <strong>Queensland</strong>ersduring 2010.The Company has demonstrated continuedgood governance through balanced Boardmembership, well-attended and regularmeetings, appropriate and timely reporting,continued development of policies andother documentation, and commitment toplanning and protocols.DividendsThe Company is prohibited by itsMemorandum of Association from payingor distributing any dividends to its membersand none has been paid or declared duringthe financial year.State of AffairsIn the opinion of the Directors, there were nosignificant changes in the state of affairs ofthe Company.Events Subsequent to »Balance DateAs a result of the January flood disaster inand around the Brisbane CBD, <strong>Queensland</strong><strong>Ballet</strong> was advised by QPAC that theirresident theatre, the Playhouse, hadsuffered significant flood damage to its fire,air conditioning and electrical systems. Thisevent resulted in the postponement of theseason of Carmen, which was scheduledin the Playhouse from 26 February – 12March, 2011.As a result of postponing Carmen,<strong>Queensland</strong> <strong>Ballet</strong> has rescheduled someof its 2011 season. While the assessmentof the financial impact of the postponementof the season is yet to be finalised, basedon a preliminary estimate, the company is ofthe view that they will be able to mitigate theimpact via the containment of costs and assuch it is not expected to be significant.ANNUAL REPORT 2010

24Other than the matters discussed above, there has not arisen in the interval between the end of the financial year and the date of this reportany item, transaction or event of a material and unusual nature likely, in the opinion of the directors of the Company, to affect significantly theoperations of the Group, the results of those operations, or the state of affairs of the Group, in future financial years.Environment RegulationThe Company’s operations are not subject to any significant environmental regulations under either Commonwealth or State legislation.However, the Board believes that the Company has adequate systems in place for the management of its environmental requirements and isnot aware of any breach of those environmental requirements as they apply to the Company.Directors’ EmolumentsSince the end of the previous financial year, no Director of the Company has received or become entitled to receive any benefit (other than abenefit included in the aggregate amount of remuneration received or due and receivable by Directors shown in the accounts) because of acontract made by the Company or a related body corporate with a Director or with a firm of which a Director is a member, or with an entity inwhich the Director has as substantial interest, except as stated in Note 17 to the accounts.Indemnification and Insurance of OfficersIndemnificationSince 2005, the Company has entered into agreements indemnifying Directors of the Company. In 2010, the following Directors wereindemnified: Ms Winna Brown, Mr Brett Clark, Mr Dawid Falck, Mr Mark Fenton, Mrs Leneen Forde, Mr Peter Jans, Mrs Margaret Lucas,Mrs Joanne Pafumi and Mrs Joan Sheldon against all liabilities to another person (other than the Company or a related body corporate) thatmay arise from their position as Directors of the Company, except where the liability arises out of conduct involving a lack of good faith. Theagreement stipulates that the Company will meet the full amount of any such liabilities, including costs and expenses.Insurance PremiumsThe Directors have not included details of the nature of the liabilities covered or the amount of premium paid in respect of the Directors’liability and legal expenses insurance contracts, as such disclosure is prohibited under the terms of the contract.Lead Auditor’s Independence DeclarationThe Lead Auditor’s Independence Declaration is set out on page 25 and forms part of the Director’s report for the year ended 31 December2010.Dated at BRISBANE this 28th day of March, 2011Signed in accordance with a resolution of the Directors:28 March 2011Joan Sheldon AMDirectorDated28 March 2011Mark FentonDirectorDatedQUEENSLAND BALLET

25Lead Auditor’s Independence Declaration underSection 307C of the Corporations Act 2001To: the directors of <strong>Queensland</strong> <strong>Ballet</strong> CompanyI declare that, to the best of my knowledge and belief, in relation to the audit for the financial year ended 31 December 2010 therehave been:(i)(ii)no contraventions of the auditor independence requirements as set out in the Corporations Act 2001 in relation to the audit; andno contraventions of any applicable code of professional conduct in relation to the audit.KPMGM J FitzpatrickPartnerBrisbane28 March 2011ANNUAL REPORT 2010

26Financial ReportStatement of comprehensive incomefor the year ended 31 December 2010Note 2010$2009$Revenue from ticket sales – subscriptions 522,690 405,344– single tickets 1,650,150 1,124,132Revenue from rendering of services 108,528 110,884Other income 5 3,054,590 3,084,3015,335,958 4,724,661Cleaning (34,506) (29,082)Costume and set expenses (242,907) (205,951)Depreciation expense (42,500) (41,196)Employee expenses (2,780,343) (2,656,585)External Performers & Representatives fees and allowances (111,148) (55,459)Insurance (32,577) (32,745)Marketing (391,242) (313,111)Printing & Postage (23,992) (24,143)Rental expense (61,344) (67,767)Royalties – Choreographic & Music (58,483) (46,179)Shoes & Tights (76,305) (53,526)Telephone & Communications (9,377) (8,793)Theatre expenses (813,092) (621,114)Travel Expenses (73,116) (131,224)Other expenses from ordinary activities (600,763) (433,516)Results from operating activities (15,737) 4,270Financial income (interest and dividends received) 6 106,881 65,695Financial expenses (impairment of available-for-sale financial assets) - -Net financing income 106,881 65,695Profit for the period 91,144 69,965Other comprehensive incomeNet change in fair value of available-for-sale financial assets 31,158 39,400Other comprehensive income for the period 31,158 39,400Total comprehensive income for the period 122,302 109,365The statement of comprehensive income is to be read in conjunction with the notes to and forming part of the financial statements set out on pages 30-39.QUEENSLAND BALLET

27Statement of financial positionas at 31 December 2010Note2010$2009$ASSETSCash and cash equivalents 7 592,905 1,711,988Trade and other receivables 8 7,432 15,465Other current assets 9 80,802 57,504Other investments 10 748,514 -Total current assets 1,429,653 1,784,957Plant and Equipment 11 117,673 122,336Other investments 10 918,242 863,920Total non-current assets 1,035,915 986,256Total assets 2,465,568 2,771,213LIABILITIESTrade and other payables 12 624,807 1,007,737Employee benefits 13 169,486 208,717Total current liabilities 794,293 1,216,454Employee benefits 13 38,900 44,686Total non-current liabilities 38,900 44,686Total liabilities 833,193 1,261,140Net assets 1,632,375 1,510,073EQUITYRetained earnings 14 1,550,282 1,459,138Fair value reserve 14 82,093 50,935Total equity 14 1,632,375 1,510,073The statement of financial position is to be read in conjunction with the notes to and forming part of the financial statements set out on pages 30-39.ANNUAL REPORT 2010 <strong>Queensland</strong> <strong>Ballet</strong> Company ABN 26 009 717 079

28Statement of changes in equityAs at 31 December 2010Fair valueReserveRetainedearningsTotalBalance at 1 January 2009 11,535 1,389,173 1,400,708Total comprehensive income for the periodProfit or loss - 69,965 69,965Other comprehensive incomeNet change in fair value of available-for-sale financial assets net of tax 39,400 - 39,400Total comprehensive profit for the period 39,400 69,965 109,365Balance at 31 December 2009 50,935 1,459,138 1,510,073Fair valueReserveRetainedearningsTotalBalance at 1 January 2010 50,935 1,459,138 1,510,073Total comprehensive income for the periodProfit or loss - 91,144 91,144Other comprehensive incomeNet change in fair value of available-for-sale financial assets net of tax 31,158 - 31,158Total comprehensive profit for the period 31,158 91,144 122,302Balance at 31 December 2010 82,093 1,550,282 1,632,375The statement of changes in equity is to be read in conjunction with the notes to and forming part of the financial statements set out on pages 30-39.QUEENSLAND BALLET

29Statement of cash flowsfor the year ended 31 December 2010Note 2010$2009$CASH FLOWS FROM OPERATING ACTIVITIESCash receipts from customers 2,530,729 2,867,859Government grants received 15 2,630,770 3,108,276Cash paid to suppliers and employees (5,572,725) (5,046,962)Net cash (used in) / from operating activities (411,226) 929,173CASH FLOWS FROM INVESTING ACTIVITIESInterest received 106,251 65,215Investment Income 630 480Proceeds from sale of investments - -Payments for Plant and Equipment (43,060) (32,817)Contributions to Reserve Incentives Scheme (23,164) (13,716)Payments for Investments (748,514) -Net cash provided by investing activities (707,857) 19,162Net increase in cash and cash equivalents (1,119,083) 948,335Cash and cash equivalents at 1 January 1,711,988 763,653Cash and cash equivalents at 31 December 7 592,905 1,711,988The statement of cash flows is to be read in conjunction with the notes to and forming part of the financial statements set out on pages 30-39.ANNUAL REPORT 2010 <strong>Queensland</strong> <strong>Ballet</strong> Company ABN 26 009 717 079

30Notes to the Financial Statementsfor the year ended 31 December 20101. Reporting entity<strong>Queensland</strong> <strong>Ballet</strong> Company Limited (“the Company”) is a company.2. Basis of preparation(a)(b)(c)(d)(e)Statement of complianceThe company early adopted AASB 1053 Application of Tiers of Australian Accounting Standards and AASB 2010-02 Amendmentsto Australian Standards arising from Reduced Disclosure Requirements for the financial year beginning on 1 January 2010 toprepare Tier 2 general purpose financial statements.The financial report of the Company are Tier 2 general purpose financial statements which have been prepared in accordance withAustralian Accounting Standards – Reduced Disclosure Requirements (AASB-RDRs) (including Australian interpretations) adoptedby the Australian Accounting Standards Board (AASB) and Corporations Act 2001.The financial report was authorised for issue by the Directors on 28 March 2011.Basis of measurementThe financial report is prepared on the historical cost basis except for financial instruments classified as available-for-sale which arestated at their fair value.Functional and presentation currencyThese financial statements are presented in Australian dollars, which is the Company’s functional currency.Use of estimates and judgmentsThe preparation of a financial report in conformity with Australian Accounting Standards requires management to make judgements,estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income andexpenses. Actual results may differ from these estimates.The estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised inthe period in which the estimate is revised and in any future periods affected.Changes in accounting policiesStarting as of January 2010, the Company has changed its accounting policies in relation to the application of reduceddisclosure requirements.3. Significant accounting policies(a)(i)The accounting policies set out below have been applied consistently to all periods presented in these financial statements.Property, plant and equipmentRecognition and measurementItems of property, plant and equipment are measured at cost less accumulated depreciation and impairment losses. Cost includesexpenditures that are directly attributable to the acquisition of the asset. The cost of self-constructed assets includes the cost ofmaterials and direct labour, any other costs directly attributable to bringing the asset to a working condition for its intended use,and the costs of dismantling and removing the items and restoring the site on which they are located. Purchased software that isintegral to the functionality of the related equipment is capitalised as part of that equipment.When parts of an item of property, plant and equipment have different useful lives, they are accounted for as separate items (majorcomponents) of property, plant and equipment.QUEENSLAND BALLET