Queensland Ballet

Click here to download our 2010 Annual Report - Queensland Ballet

Click here to download our 2010 Annual Report - Queensland Ballet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

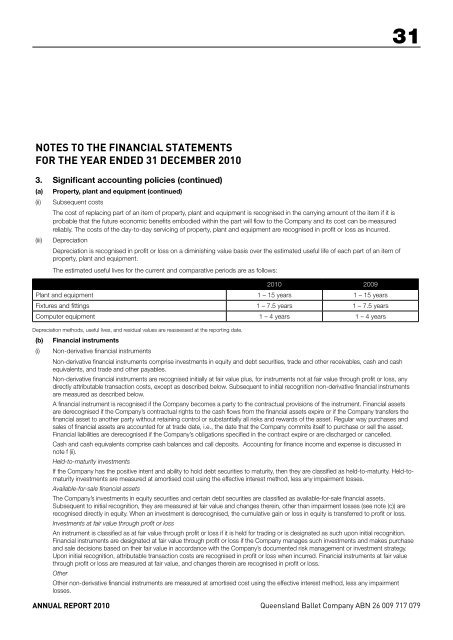

31Notes to the Financial Statementsfor the year ended 31 December 20103. Significant accounting policies (continued)(a)(ii)(iii)Property, plant and equipment (continued)Subsequent costsThe cost of replacing part of an item of property, plant and equipment is recognised in the carrying amount of the item if it isprobable that the future economic benefits embodied within the part will flow to the Company and its cost can be measuredreliably. The costs of the day-to-day servicing of property, plant and equipment are recognised in profit or loss as incurred.DepreciationDepreciation is recognised in profit or loss on a diminishing value basis over the estimated useful life of each part of an item ofproperty, plant and equipment.The estimated useful lives for the current and comparative periods are as follows:2010 2009Plant and equipment 1 – 15 years 1 – 15 yearsFixtures and fittings 1 – 7.5 years 1 – 7.5 yearsComputer equipment 1 – 4 years 1 – 4 yearsDepreciation methods, useful lives, and residual values are reassessed at the reporting date.(b) Financial instruments(i) Non-derivative financial instrumentsNon-derivative financial instruments comprise investments in equity and debt securities, trade and other receivables, cash and cashequivalents, and trade and other payables.Non-derivative financial instruments are recognised initially at fair value plus, for instruments not at fair value through profit or loss, anydirectly attributable transaction costs, except as described below. Subsequent to initial recognition non-derivative financial instrumentsare measured as described below.A financial instrument is recognised if the Company becomes a party to the contractual provisions of the instrument. Financial assetsare derecognised if the Company’s contractual rights to the cash flows from the financial assets expire or if the Company transfers thefinancial asset to another party without retaining control or substantially all risks and rewards of the asset. Regular way purchases andsales of financial assets are accounted for at trade date, i.e., the date that the Company commits itself to purchase or sell the asset.Financial liabilities are derecognised if the Company’s obligations specified in the contract expire or are discharged or cancelled.Cash and cash equivalents comprise cash balances and call deposits. Accounting for finance income and expense is discussed innote f (ii).Held-to-maturity investmentsIf the Company has the positive intent and ability to hold debt securities to maturity, then they are classified as held-to-maturity. Held-tomaturityinvestments are measured at amortised cost using the effective interest method, less any impairment losses.Available-for-sale financial assetsThe Company’s investments in equity securities and certain debt securities are classified as available-for-sale financial assets.Subsequent to initial recognition, they are measured at fair value and changes therein, other than impairment losses (see note (c)) arerecognised directly in equity. When an investment is derecognised, the cumulative gain or loss in equity is transferred to profit or loss.Investments at fair value through profit or lossAn instrument is classified as at fair value through profit or loss if it is held for trading or is designated as such upon initial recognition.Financial instruments are designated at fair value through profit or loss if the Company manages such investments and makes purchaseand sale decisions based on their fair value in accordance with the Company’s documented risk management or investment strategy.Upon initial recognition, attributable transaction costs are recognised in profit or loss when incurred. Financial instruments at fair valuethrough profit or loss are measured at fair value, and changes therein are recognised in profit or loss.OtherOther non-derivative financial instruments are measured at amortised cost using the effective interest method, less any impairmentlosses.ANNUAL REPORT 2010 <strong>Queensland</strong> <strong>Ballet</strong> Company ABN 26 009 717 079