Automotive Parts

Autoparts_Top_Markets_Report

Autoparts_Top_Markets_Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

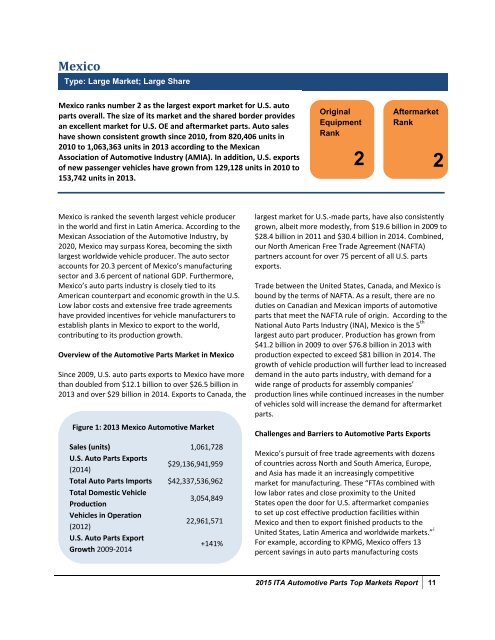

MexicoType: Large Market; Large ShareMexico ranks number 2 as the largest export market for U.S. autoparts overall. The size of its market and the shared border providesan excellent market for U.S. OE and aftermarket parts. Auto saleshave shown consistent growth since 2010, from 820,406 units in2010 to 1,063,363 units in 2013 according to the MexicanAssociation of <strong>Automotive</strong> Industry (AMIA). In addition, U.S. exportsof new passenger vehicles have grown from 129,128 units in 2010 to153,742 units in 2013.OriginalEquipmentRank2AftermarketRank2Mexico is ranked the seventh largest vehicle producerin the world and first in Latin America. According to theMexican Association of the <strong>Automotive</strong> Industry, by2020, Mexico may surpass Korea, becoming the sixthlargest worldwide vehicle producer. The auto sectoraccounts for 20.3 percent of Mexico’s manufacturingsector and 3.6 percent of national GDP. Furthermore,Mexico’s auto parts industry is closely tied to itsAmerican counterpart and economic growth in the U.S.Low labor costs and extensive free trade agreementshave provided incentives for vehicle manufacturers toestablish plants in Mexico to export to the world,contributing to its production growth.Overview of the <strong>Automotive</strong> <strong>Parts</strong> Market in MexicoSince 2009, U.S. auto parts exports to Mexico have morethan doubled from $12.1 billion to over $26.5 billion in2013 and over $29 billion in 2014. Exports to Canada, theFigure 1: 2013 Mexico <strong>Automotive</strong> MarketSales (units) 1,061,728U.S. Auto <strong>Parts</strong> Exports(2014)$29,136,941,959Total Auto <strong>Parts</strong> Imports $42,337,536,962Total Domestic VehicleProduction3,054,849Vehicles in Operation(2012)22,961,571U.S. Auto <strong>Parts</strong> ExportGrowth 2009-2014+141%largest market for U.S.-made parts, have also consistentlygrown, albeit more modestly, from $19.6 billion in 2009 to$28.4 billion in 2011 and $30.4 billion in 2014. Combined,our North American Free Trade Agreement (NAFTA)partners account for over 75 percent of all U.S. partsexports.Trade between the United States, Canada, and Mexico isbound by the terms of NAFTA. As a result, there are noduties on Canadian and Mexican imports of automotiveparts that meet the NAFTA rule of origin. According to theNational Auto <strong>Parts</strong> Industry (INA), Mexico is the 5 thlargest auto part producer. Production has grown from$41.2 billion in 2009 to over $76.8 billion in 2013 withproduction expected to exceed $81 billion in 2014. Thegrowth of vehicle production will further lead to increaseddemand in the auto parts industry, with demand for awide range of products for assembly companies’production lines while continued increases in the numberof vehicles sold will increase the demand for aftermarketparts.Challenges and Barriers to <strong>Automotive</strong> <strong>Parts</strong> ExportsMexico’s pursuit of free trade agreements with dozensof countries across North and South America, Europe,and Asia has made it an increasingly competitivemarket for manufacturing. These “FTAs combined withlow labor rates and close proximity to the UnitedStates open the door for U.S. aftermarket companiesto set up cost effective production facilities withinMexico and then to export finished products to theUnited States, Latin America and worldwide markets.” iFor example, according to KPMG, Mexico offers 13percent savings in auto parts manufacturing costs2015 ITA <strong>Automotive</strong> <strong>Parts</strong> Top Markets Report 11