Automotive Parts

Autoparts_Top_Markets_Report

Autoparts_Top_Markets_Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

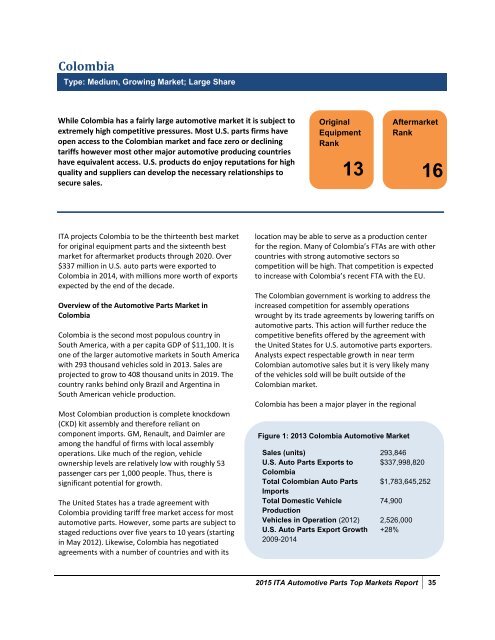

ColombiaType: Medium, Growing Market; Large ShareWhile Colombia has a fairly large automotive market it is subject toextremely high competitive pressures. Most U.S. parts firms haveopen access to the Colombian market and face zero or decliningtariffs however most other major automotive producing countrieshave equivalent access. U.S. products do enjoy reputations for highquality and suppliers can develop the necessary relationships tosecure sales.OriginalEquipmentRank13AftermarketRank16ITA projects Colombia to be the thirteenth best marketfor original equipment parts and the sixteenth bestmarket for aftermarket products through 2020. Over$337 million in U.S. auto parts were exported toColombia in 2014, with millions more worth of exportsexpected by the end of the decade.Overview of the <strong>Automotive</strong> <strong>Parts</strong> Market inColombiaColombia is the second most populous country inSouth America, with a per capita GDP of $11,100. It isone of the larger automotive markets in South Americawith 293 thousand vehicles sold in 2013. Sales areprojected to grow to 408 thousand units in 2019. Thecountry ranks behind only Brazil and Argentina inSouth American vehicle production.Most Colombian production is complete knockdown(CKD) kit assembly and therefore reliant oncomponent imports. GM, Renault, and Daimler areamong the handful of firms with local assemblyoperations. Like much of the region, vehicleownership levels are relatively low with roughly 53passenger cars per 1,000 people. Thus, there issignificant potential for growth.The United States has a trade agreement withColombia providing tariff free market access for mostautomotive parts. However, some parts are subject tostaged reductions over five years to 10 years (startingin May 2012). Likewise, Colombia has negotiatedagreements with a number of countries and with itslocation may be able to serve as a production centerfor the region. Many of Colombia’s FTAs are with othercountries with strong automotive sectors socompetition will be high. That competition is expectedto increase with Colombia’s recent FTA with the EU.The Colombian government is working to address theincreased competition for assembly operationswrought by its trade agreements by lowering tariffs onautomotive parts. This action will further reduce thecompetitive benefits offered by the agreement withthe United States for U.S. automotive parts exporters.Analysts expect respectable growth in near termColombian automotive sales but it is very likely manyof the vehicles sold will be built outside of theColombian market.Colombia has been a major player in the regionalFigure 1: 2013 Colombia <strong>Automotive</strong> MarketSales (units) 293,846U.S. Auto <strong>Parts</strong> Exports to $337,998,820ColombiaTotal Colombian Auto <strong>Parts</strong> $1,783,645,252ImportsTotal Domestic Vehicle74,900ProductionVehicles in Operation (2012) 2,526,000U.S. Auto <strong>Parts</strong> Export Growth +28%2009-20142015 ITA <strong>Automotive</strong> <strong>Parts</strong> Top Markets Report 35