ANNUAL REPORT - Ashburton Minerals

ANNUAL REPORT - Ashburton Minerals

ANNUAL REPORT - Ashburton Minerals

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

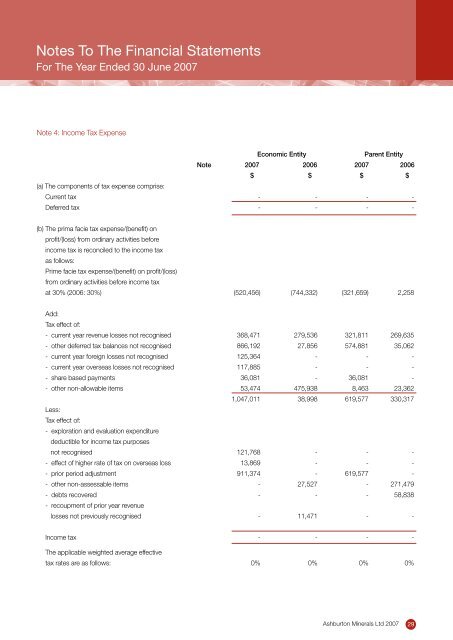

Notes To The Financial Statements<br />

For The Year Ended 30 June 2007<br />

Note 4: Income Tax Expense<br />

Economic Entity<br />

Parent Entity<br />

Note 2007 2006 2007 2006<br />

$ $ $ $<br />

(a) The components of tax expense comprise:<br />

Current tax - - - -<br />

Deferred tax - - - -<br />

(b) The prima facie tax expense/(benefit) on<br />

profit/(loss) from ordinary activities before<br />

income tax is reconciled to the income tax<br />

as follows:<br />

Prime facie tax expense/(benefit) on profit/(loss)<br />

from ordinary activities before income tax<br />

at 30% (2006: 30%) (520,456) (744,332) (321,659) 2,258<br />

Add:<br />

Tax effect of:<br />

- current year revenue losses not recognised 368,471 279,536 321,811 269,635<br />

- other deferred tax balances not recognised 866,192 27,856 574,881 35,062<br />

- current year foreign losses not recognised 125,364 - - -<br />

- current year overseas losses not recognised 117,885 - - -<br />

- share based payments 36,081 - 36,081 -<br />

- other non-allowable items 53,474 475,938 8,463 23,362<br />

1,047,011 38,998 619,577 330,317<br />

Less:<br />

Tax effect of:<br />

- exploration and evaluation expenditure<br />

deductible for income tax purposes<br />

not recognised 121,768 - - -<br />

- effect of higher rate of tax on overseas loss 13,869 - - -<br />

- prior period adjustment 911,374 - 619,577 -<br />

- other non-assessable items - 27,527 - 271,479<br />

- debts recovered - - - 58,838<br />

- recoupment of prior year revenue<br />

losses not previously recognised - 11,471 - -<br />

Income tax - - - -<br />

The applicable weighted average effective<br />

tax rates are as follows: 0% 0% 0% 0%<br />

<strong>Ashburton</strong> <strong>Minerals</strong> Ltd 2007<br />

29