ANNUAL REPORT - Ashburton Minerals

ANNUAL REPORT - Ashburton Minerals

ANNUAL REPORT - Ashburton Minerals

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

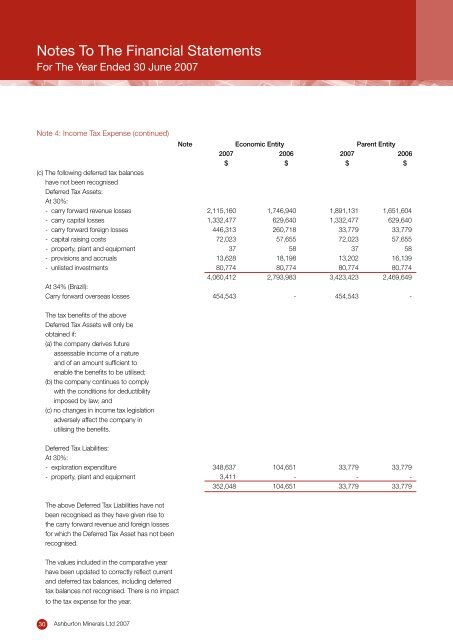

Notes To The Financial Statements<br />

For The Year Ended 30 June 2007<br />

Note 4: Income Tax Expense (continued)<br />

Note Economic Entity Parent Entity<br />

2007 2006 2007 2006<br />

$ $ $ $<br />

(c) The following deferred tax balances<br />

have not been recognised<br />

Deferred Tax Assets:<br />

At 30%:<br />

- carry forward revenue losses 2,115,160 1,746,940 1,891,131 1,651,604<br />

- carry capital losses 1,332,477 629,640 1,332,477 629,640<br />

- carry forward foreign losses 446,313 260,718 33,779 33,779<br />

- capital raising costs 72,023 57,655 72,023 57,655<br />

- property, plant and equipment 37 58 37 58<br />

- provisions and accruals 13,628 18,198 13,202 16,139<br />

- unlisted investments 80,774 80,774 80,774 80,774<br />

4,060,412 2,793,983 3,423,423 2,469,649<br />

At 34% (Brazil):<br />

Carry forward overseas losses 454,543 - 454,543 -<br />

The tax benefits of the above<br />

Deferred Tax Assets will only be<br />

obtained if:<br />

(a) the company derives future<br />

assessable income of a nature<br />

and of an amount sufficient to<br />

enable the benefits to be utilised;<br />

(b) the company continues to comply<br />

with the conditions for deductibility<br />

imposed by law; and<br />

(c) no changes in income tax legislation<br />

adversely affect the company in<br />

utilising the benefits.<br />

Deferred Tax Liabilities:<br />

At 30%:<br />

- exploration expenditure 348,637 104,651 33,779 33,779<br />

- property, plant and equipment 3,411 - - -<br />

352,048 104,651 33,779 33,779<br />

The above Deferred Tax Liabilities have not<br />

been recognised as they have given rise to<br />

the carry forward revenue and foreign losses<br />

for which the Deferred Tax Asset has not been<br />

recognised.<br />

The values included in the comparative year<br />

have been updated to correctly reflect current<br />

and deferred tax balances, including deferred<br />

tax balances not recognised. There is no impact<br />

to the tax expense for the year.<br />

30<br />

<strong>Ashburton</strong> <strong>Minerals</strong> Ltd 2007