Strategies

Fall 2009 - Sares-Regis Group

Fall 2009 - Sares-Regis Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fall 2009<br />

S A R E S • R E G I S G r o u p N e w s l e t t e r<br />

<strong>Strategies</strong><br />

Smooth Lease-up<br />

In San Francisco<br />

Aggressive marketing<br />

led to an early<br />

lease-up of Strata at<br />

Mission Bay in San<br />

Francisco. The new<br />

community is among<br />

12 totaling 3,649<br />

units recently added<br />

to SRG’s Multifamily<br />

Property Management<br />

Division portfolio.<br />

See stories on pages<br />

8 and 9.<br />

In this Issue<br />

35'<br />

Page 2 SRG Plans Orange County’s<br />

first speculative “green” industrial<br />

project. The three buildings totaling<br />

120,000 square feet are unique in<br />

the market for their 30-foot clear<br />

heights and true dock-high loading<br />

positions not found in competing<br />

buildings.<br />

Page 3 Guest columnist Ronald<br />

Zuzack, Global COO of BlackRock<br />

Real Estate Equity, discusses risk<br />

strategies as “the probability of a<br />

market bottom is within sight –<br />

perhaps in the next six months,<br />

and investors should be gearing up<br />

to take advantage of the recovery.”<br />

Page 10 SRG expands its<br />

commitment to sustainability at<br />

the Corporate level and in all its<br />

ground-up commercial and multifamily<br />

developments. “This is something<br />

that’s critical and something<br />

we wholeheartedly endorse,” said<br />

Managing Director John Hagestad.<br />

SRG, Investors Advised By J.P. Morgan Buy<br />

390,000-Sq.-Ft. Redlands Industrial Building<br />

SARES•REGIS Group and institutional investors advised by J.P. Morgan Asset<br />

Management (“J.P. Morgan”) acquired a 390,000-square-foot industrial building in<br />

Redlands, Calif., the first purchase made by a new strategic alliance targeting highquality<br />

Southern California industrial buildings with the opportunity for added value<br />

through leasing and management.<br />

“This building fits nicely with our acquisition criteria of buying quality buildings with<br />

vacancies or short-term leases,” said Peter Rooney, president of the Commercial<br />

Investment Division of the diversified Irvine, Calif., real estate company.<br />

SARES•REGIS Group and the investors advised by J.P. Morgan purchased the property<br />

for $11.5 million, which is significantly less than replacement cost for the building<br />

that was completed in 2007, Rooney said. The building’s tenant, Sleep Innovations,<br />

a maker of memory-foam mattresses and pillows, leases and occupies about half of<br />

the building.<br />

The building is located at 9425 Nevada St. in a substantially built-out, master-planned<br />

industrial park with buildings owned by a number of prominent institutional real<br />

Continued on page 2<br />

SARES•REGIS Group is one of the leading developers and managers of commercial and residential real<br />

estate in the western United States. SARES•REGIS Group has a combined portfolio of property and feebased<br />

assets under management valued at more than $4 billion, including 15 million square feet of<br />

commercial and industrial space and 16,656 rental apartments. Since its inception the company has<br />

acquired or developed approximately 44 million square feet of commercial properties and 19,000<br />

multifamily and residential housing units. For more information, go to www.sares-regis.com.<br />

www.sares-regis.com

SRG <strong>Strategies</strong> . Fall 2009<br />

35'<br />

35'<br />

2<br />

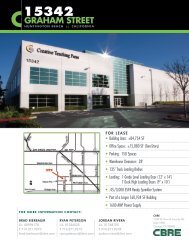

SARES•REGIS Group Plans OC’s First<br />

Speculative ‘Green’ Industrial Project<br />

SARES•REGIS Group plans to break ground this year<br />

on three Class-A industrial buildings, totaling 120,000 square<br />

feet in Anaheim, Calif. The buildings are registered with the<br />

United States Green Building Council and will be the first<br />

speculative green industrial buildings in Orange County.<br />

The project continues SARES•REGIS Group’s commitment to<br />

develop energy-efficient real estate projects and will be built<br />

to meet environmentally sustainable specifications needed<br />

for certification by the USGBC.<br />

There are several architectural features in this project in addition<br />

to its cost-saving location that should assure its success,<br />

company officials said. Additionally, it is in a market with the<br />

lowest industrial vacancy rate and the largest industrial base.<br />

But what will put the project in a class by itself is it will be<br />

constructed to earn the USGBC’s rating for Leadership in<br />

Energy and Environmental Design.<br />

“Green and sustainable commercial buildings are what<br />

companies want. Green buildings cost less to operate, and<br />

companies want to be recognized as socially responsible<br />

by their employees and customers,” said John Hagestad,<br />

Managing Director of SARES•REGIS Group.<br />

JPMorgan, SRG Buy Redlands Building<br />

continued from page 1<br />

estate investors. Jeff Cole and Ed Hernandez of Cushman &<br />

Wakefield represented the buyer and the seller.<br />

J.P. Morgan Asset Management is a global asset management<br />

leader providing world-class investment solutions to institutions,<br />

individuals and financial intermediaries. The firm is<br />

responsible for approximately $1.1 trillion in assets under<br />

management (based on assets under management for the<br />

Asset Management division of JPMorgan Chase & Co. as of<br />

June 30 2009), including approximately $42.7 billion in real<br />

estate and infrastructure assets managed by J.P. Morgan Asset<br />

Management – Global Real Assets. With a 39-year history of<br />

successful investing and a staff of approximately 375 professionals,<br />

J.P. Morgan Asset Management – Global Real Assets<br />

identifies, analyzes, negotiates, acquires, develops, redevelops,<br />

renovates, operates, maintains, finances and sells assets on<br />

behalf of its clients. J.P. Morgan Asset Management’s broad<br />

investment capabilities and framework for analyzing opportunities<br />

in today's complex real estate and infrastructure<br />

markets provide critical insights for its institutional clients in<br />

both the public and private markets.<br />

Rendering of Canyon Point, a three-building, 120,000-square-foot<br />

project in Anaheim to be built to USGBC LEED specifications.<br />

Completion is planned by mid-2010. The 6.3-acre site is on<br />

the southeast corner of Miraloma Avenue and Miller Street.<br />

It is in Anaheim’s “Canyon” district, a 2,600-acre redevelopment<br />

area where the city “has spent millions on infrastructure<br />

improvements. The city’s redevelopment agency has<br />

put all the pieces in place to encourage and support new<br />

development,” Hagestad said.<br />

Additionally, the site is in the heart of the high-demand<br />

North Orange County industrial submarket, which has a<br />

low vacancy rate of 4.97 percent.<br />

The project will consist of one 60,000-square-foot building<br />

and two 30,000-square-foot buildings each with about<br />

2,000 square feet of mezzanine and improved office space.<br />

The larger building will have a private truck court with six<br />

dock-high bays and one grade-level door. The smaller buildings<br />

will have three dock-high bays and will share a secured<br />

truck court. All truck courts will be paved with concrete<br />

instead of asphalt, reducing the heat-island effect.<br />

The buildings will have 30-foot clear height, heat- and lightreflecting<br />

“cool roofs” and T-5 interior fluorescent lighting<br />

on sensors, dramatically reducing electricity demand.<br />

Continued on page 16<br />

New JPMorgan/SARES•REGIS Group strategic alliance claims first<br />

acquisition, a 390,000-sq.-ft. industrial building in Redlands, Calif.,<br />

for $11.5 million.

Guest Column<br />

Risk Strategy For Returning<br />

Real Estate Opportunities –<br />

How Much And When?n<br />

Ronald E. Zuzack<br />

Global Chief Operating Officer<br />

BlackRock Real Estate Equity<br />

The summer of 2007 signaled the start of the most<br />

painful and dramatic series of changes the real estate market has<br />

experienced in the last 50 years, easily surpassing the significant<br />

downturn of the late 1980s and early ’90s.<br />

Property values have fallen up to 40% and the consensus is we<br />

have not reached bottom. Bank credit has all but evaporated,<br />

securitization of debt is a distant memory and, most important of<br />

all, investors (those supplying equity capital) have lost confidence<br />

in the asset class. Their confidence is not likely to be restored until<br />

it is clearly demonstrated that risk can be effectively managed<br />

and controlled. This is a critically important concept because as<br />

we approach the bottom of a cycle investors should be thinking<br />

about taking more risk, not less, as fortunes are made coming<br />

out of a downturn taking advantage of distressed situations and<br />

depressed values.<br />

The commercial real estate market was supposed to be different<br />

this time. Lessons learned from the past made for smarter<br />

investors. Securitization of debt and equity made the market<br />

more transparent. Additionally, with more real-time information,<br />

the threat of overbuilding was no longer a major issue and real<br />

estate returns were declining below historical levels. But on a<br />

relative basis they were still attractive, which led conventional<br />

thinking down the path that a structural and not a cyclical<br />

change was taking place.<br />

So what happened? This may sound like common sense and an<br />

oversimplification, but the fact is that risk was mispriced and too<br />

much risk was taken at the wrong time, namely at the top of<br />

the cycle. Taking risk should not necessarily be confused with<br />

negative outcomes. It is much more important to understand<br />

the implication of the levels of risk assumed in real estate<br />

investing relative to cyclical positioning.<br />

There are two basic facts about Real Estate that have always<br />

been valid:<br />

1. Real estate investing is a cyclical business<br />

2. The real estate asset class is illiquid<br />

If one buys into this premise, then it seems prudent to construct<br />

a risk model that allows for assuming more risk at the beginning<br />

of a cycle and dialing back risk levels as the cycle nears maturity.<br />

Getting caught with portfolio over-exposure (whether geographic,<br />

lifecycle, leverage or a property type) in an illiquid asset class when<br />

the market freezes is a recipe for disaster. There is no way out and<br />

the investor is stuck with positions that can only be liquidated at<br />

substantial losses.<br />

Ronald E. Zuzack<br />

Volume 13 . Number 1<br />

Building a risk model or “risk budget”<br />

has been used to describe a<br />

procedure for setting targets for the<br />

risk characteristics or components of<br />

a portfolio and for monitoring the<br />

portfolio over time to detect significant<br />

deviations from those targets.<br />

Central to any risk budgeting and<br />

monitoring system for real estate<br />

investing is establishing ranges or<br />

limits of exposure relative to a<br />

benchmark or model portfolio. The<br />

model portfolio is merely a reflection<br />

of the investor’s risk appetite or<br />

tolerance level.<br />

The key then is to have the investment discipline to adjust the<br />

actual exposures within the agreed upon ranges relative to where<br />

the investor perceives he is in the cycle. For example, a core<br />

investor might establish a leverage range of 0% to 50%. As the<br />

market cycle begins its recovery it seems more appropriate to<br />

assume a leverage position at the higher end of the range. As<br />

the cycle approaches maturity, consideration should be given to<br />

deleveraging the assets as valuations decline for those investors<br />

that mark to market will be magnified.<br />

For those investors not constrained by mark-tomarket<br />

issues it may make sense to secure longer duration<br />

financing enabling them to ride out the inevitable market decline.<br />

Another example is a forward commitment strategy, whereby an<br />

irrevocable promise is made to purchase a property at a set date<br />

in the future at a fixed price.<br />

The investor is betting that when closing occurs the market value<br />

will be equal to or greater than the purchase price. This strategy<br />

works nearly perfectly at the early stages of a market recovery as<br />

values are rising and there is less risk in assuming a higher proportion<br />

of forward commitments at the start of a market cycle.<br />

As the market cycle matures the exposure should be reduced as<br />

the probability of the market value being less than the contract<br />

prices increases at the future closing date.<br />

In conclusion, it appears the probability of a market bottom is<br />

within sight – perhaps in the next six months – and investors<br />

should be gearing up to take advantage of the recovery. The<br />

key is to adopt an investment philosophy that employs a robust<br />

risk management discipline and not become over-exuberant<br />

and assume excessive risk at the peak of the next cycle.<br />

Ronald E. Zuzack is responsible for the day-to-day operations of a<br />

US $26 billion AUM platform in the Americas, the UK, Continental<br />

Europe, Australia and Asia. The firm manages a variety of separate<br />

accounts, closed- and open-end funds with a focus on core, valueadded<br />

and opportunistic investment strategies. He is Chairman<br />

of the Operating Committee and a member of the Executive,<br />

Investment and Leadership Committees for the Real Estate Group.<br />

3

SRG <strong>Strategies</strong> . Fall 2009<br />

Leasing Activities Under Way On<br />

Two SRG Apartment Communities<br />

Leasing activities are under way on two apartment<br />

projects being built in Anaheim and Pasadena by SARES•REGIS<br />

Group.<br />

Both projects, The Crossing in Anaheim and Westgate Pasadena,<br />

are being built to environmental standards of the United States<br />

Green Building Council and combine to make SRG the largest<br />

privately held developer of green apartments in Southern<br />

California.<br />

In the first month of pre-leasing at Westgate, reservations<br />

have been made on 27 of the 110 units in the development’s<br />

first two phases. The project will be completed in early 2011.<br />

“We expect both developments to be very attractive to<br />

people seeking a greener lifestyle and who want to be near<br />

job centers, major freeways and rail transportation,” said<br />

Michael Bissell, President of SRG’s Multifamily Property<br />

Management Division.<br />

Westgate Pasadena is on 11.7 acres and planned for 820<br />

units. Westgate is two blocks from the Del Mar Station of the<br />

Metro Gold Line, which runs 98 trains daily to Union Station<br />

with connections to Long Beach, Mid-Wilshire, Warner Center<br />

and Los Angeles International Airport.<br />

Residents of The Crossing will have a three-minute walk to the<br />

Anaheim Canyon Station, the fifth in the 11-station Metrolink<br />

line from Riverside to San Juan Capistrano. Connecting transit<br />

at the station includes OCTA buses to key Orange County<br />

employment centers.<br />

The Crossing also is at the confluence of the 55, 91 and 57<br />

freeways.<br />

Westgate and The Crossing are smoke-free communities and<br />

feature an array of luxurious touches and convenient features.<br />

The residences offer high ceilings, hardwood-style<br />

floors, decorator two-tone paint colors, central air and heating<br />

and pre-wiring for multiple phone and data lines. High-speed<br />

internet and digital and cable television are available. The<br />

units also feature in-home washers and dryers, spacious bed-<br />

Continued on next page<br />

The Crossing in Anaheim is a true transit-oriented apartment community with 312 units and luxury amenities.<br />

4

Volume 13 . Number 1<br />

In the first month of pre-leasing, 25% of the apartments in Westgate Pasadena’s first two phases have been reserved.<br />

rooms and walk-in closets with mirrored doors and storage<br />

areas. Private patios and balconies and direct garage access<br />

are available in selected homes.<br />

Gourmet kitchens are equipped with gas cooktops and ovens,<br />

microwaves, dishwashers, refrigerators with icemakers, granite<br />

countertops, hardwood cabinets<br />

“We expect both<br />

developments<br />

to be very<br />

attractive to<br />

people seeking<br />

a greener<br />

lifestyle…”<br />

and pantries.<br />

Community amenities at each<br />

development include a heated<br />

resort-style pool and spa, poolside<br />

cabanas, barbecue area, outdoor<br />

fireplace and courtyards with seating<br />

areas. The clubhouse includes<br />

a catering kitchen, fitness center,<br />

theater and screening room,<br />

business and conference center<br />

and a game room.<br />

SARES•REGIS Group’s Multifamily<br />

–Michael Bissell Property Management Division<br />

has adopted an eco-management<br />

program aimed at reducing energy and water consumption,<br />

increasing recycling and use of non-toxic cleaning products.<br />

The division manages 59 apartment communities in California,<br />

Arizona and Colorado.<br />

Lease-Up, Completion To Coincide<br />

Construction and lease-up of The Grove’s 258 new apartments in<br />

Ontario should be completed concurrently by the end of the year.<br />

Despite a difficult economy with rising Inland Empire unemployment,<br />

60% of the SARES•REGIS-Group-developed and -managed<br />

project was leased up since mid-February without concessions.<br />

The Grove’s first residents began moving in May 1.<br />

5

SRG <strong>Strategies</strong> . Fall 2009<br />

Panasonic leased SRG’s second industrial building in Tijuana.<br />

SRG Signs Two Top-Tier Tenants<br />

To Leases In Tijuana, Colton<br />

SARES•REGIS Group has signed two blue-chip tenants<br />

to leases in two buildings totaling 263,000 square feet.<br />

Panasonic leased a 230,000-square-foot industrial building<br />

developed by SRG in Tijuana. The consumer electronics giant<br />

is using the recently completed building for the warehousing<br />

and distribution of flat-screen televisions it assembles in<br />

Mexico for the U.S. market.<br />

The second transaction was the five-year lease of a 33,000-<br />

square-foot office building in Colton to Castle & Cooke. Castle<br />

& Cooke is a diversified company that recently acquired<br />

Inland Cold Storage, the lessee of two cold-storage buildings<br />

on the six-building campus originally developed by regional<br />

grocer Stater Bros. as its headquarters.<br />

Larry Lukanish, Vice President in SRG’s Commercial Investment<br />

Division, said Panasonic signed a short-term lease in the stateof-the-art<br />

warehouse which has 34 dock-high doors, a 28-foot<br />

clear height and an additional yard for trailer storage. The<br />

building is located approximately 2.5 miles from the Otay<br />

Mesa Border Crossing in the Airport Submarket of Tijuana.<br />

“We are very excited to have completed this lease with<br />

Panasonic during a very challenging leasing environment,”<br />

Lukanish said.<br />

It is the second building SRG has developed in Tijuana. The<br />

first was in the El Florido Industrial Park. The 175,000-squarefoot<br />

warehouse-and-distribution facility was completed in<br />

2007 and leased by Mattel for a five-year term. Rich Kwasny,<br />

a broker at CB Richard Ellis’ downtown San Diego office who<br />

represented SRG in the transaction, says Tijuana’s industrial<br />

base is approximately 53 million square feet.<br />

Lukanish says the acquisition of Inland Cold Storage is part of<br />

a strategy by Castle & Cooke, which owns the Dole Pineapple<br />

Company, to expand its refrigerated warehouse capabilities<br />

to accommodate its growth in the fruit business.<br />

Castle & Cooke is owned by David Murdock, who is on<br />

Forbes’ list of the 400 Richest Americans. He also is an ardent<br />

health-food proponent. Murdock’s company owns the<br />

Hawaiian island of Lana’i, two premier Hawaiian resorts,<br />

mining and building material companies and a number of<br />

commercial and residential real estate developments chiefly<br />

in California, Hawaii, Florida and North Carolina.<br />

The total consideration for the lease for the building in<br />

the 21700 Barton Road business park is approximately $1<br />

million, Lukanish said. Colton’s ownership of local electric<br />

utility services and its proximity to key freeways and interstate<br />

transportation routes were attractions for Castle &<br />

Cooke, he said. Joe McKay of Lee & Associates’ Ontario<br />

office represented SRG and Castle & Cooke.<br />

Four Companies Renew Industrial<br />

Leases For 960,774 Sq. Ft. Of Space<br />

SARES•REGIS Group signed four tenants to lease<br />

renewals on 960,774 square feet of warehouse and distribution<br />

space that the company manages for institutional<br />

investors.<br />

Representing SRG was Mike Wood, Director of Leasing in the<br />

company’s Commercial Management Services Division.<br />

Crown Crafts Infant Products Inc., an importer of infant<br />

and toddler bedding, soft goods and accessories, signed a<br />

five-year renewal on a 157,400-square-foot building at 711<br />

W. Walnut in Compton. The lease is valued at $4.5 million.<br />

Crown Crafts was represented by Wood of SRG.<br />

National Retail Systems Inc., a leading provider of global<br />

logistics services to manufacturers, pharmaceutical companies<br />

and U.S. retailers, renewed its lease for 50 months<br />

of a 100,000-square-foot building at 425 W. Carob in<br />

Compton. The lease is valued at $2.5 million. The tenant<br />

was represented by Tres Reid of CB Richard Ellis’ Torrance<br />

office.<br />

Nissan signed an early renewal for the 380,000-square-foot<br />

building it’s occupied since 1976, extending this latest<br />

agreement for nine years. Lease terms were undisclosed.<br />

The car maker uses the facility at 941 W. Artesia in Compton<br />

as an auto parts warehouse and distribution center for the<br />

western United States. John Schumacher in CB Richard Ellis’<br />

Torrance office represented Nissan.<br />

A major national third-party logistics company extended<br />

its lease for five years on a 323,374-square-foot building<br />

at 2700 Imperial Highway in Lynwood. Lease terms were<br />

undisclosed. Steve Sprenger in Grubb & Ellis’ Anaheim<br />

office represented the tenant.<br />

6

Volume 13 . Number 1<br />

Altaire townhomes in Palo Alto are priced from $679,000<br />

and offer up to four bedrooms.<br />

Altaire Hits The Mark With Buyers<br />

Seeking Style, Features, Location<br />

Contemporary architecture, energy-saving<br />

features and a sought-after Palo Alto location are combining for<br />

the success of Altaire townhomes by Regis Homes of Northern<br />

California, which has sold 26 of the 103 homes – a pace of four<br />

sales a month – since the development’s grand opening early<br />

this year.<br />

Designed by the award-winning Steinberg Group, the twoand<br />

three-story townhomes include the most contemporary<br />

architecture paired with the latest interior finishes. Priced from<br />

$679,000 with state-of-the-art architecture and innovative floor<br />

plans, including homes with up to four bedrooms and three<br />

and a half baths and spacious patios, Altaire will provide new<br />

homeowners an ideal urban living arrangement. Along with its<br />

modern design, Altaire offers cutting-edge technology to satisfy<br />

residents’ needs. With all units connected to fiber-optic cable<br />

lines, residents can utilize the high-speed Internet and digital<br />

phone connection upon move-in.<br />

Altaire includes the latest architectural and interior innovations.<br />

Altaire is designed to meet the strict standards of the Department<br />

of Energy’s Energy Star program for buildings and be Green<br />

Point Rated by Build it Green, a nonprofit dedicated to promoting<br />

healthy, energy- and resource-efficient building practices.<br />

Included are Energy Star appliances and Anderson highperformance<br />

dual-pane windows, all which help the buildings<br />

exceed California’s Title 24 Energy Code by 15%. Indoor air<br />

quality includes CRI Green Label Plus carpeting and formaldehyde-free<br />

insulation. Sensitive to its exterior environment,<br />

Altaire offers beautiful landscape architecture with droughttolerant<br />

plants, and a water conserving irrigation controller<br />

alongside a home and community-recycling infrastructure.<br />

Altaire provides access to a complete community experience<br />

because of its ideal location in Palo Alto. The newly constructed<br />

town homes provide a low-maintenance lifestyle that allows<br />

families to enjoy their surrounding environment. With the close<br />

proximity of high-ranking schools, major shopping centers and<br />

Palo Alto’s vibrant downtown, the development also offers<br />

access to the 12-acre Taube-Koret Campus for Jewish Life being<br />

completed this fall.<br />

For more information on Altaire visit www.altairepaloalto.com.<br />

7

SRG <strong>Strategies</strong> . Fall 2009<br />

Brookwood Villas (left) is a 314-unit development in Corona, Calif. The Encore is a 174-unit development in Sherman Oaks, Calif.<br />

Twelve Apartment Communities Totaling<br />

3,649 Units Join SRG’s Management Portfolio<br />

SARES•REGIS Group’s Multifamily Property<br />

Management Division has added 12 apartment communities<br />

with 3,649 units to its management portfolio. The division<br />

now manages 59 properties totaling 16,850 units in<br />

California, Colorado and Arizona.<br />

The properties range from new Class-A, mixed-use and<br />

transit-oriented urban developments to mature garden-style<br />

communities. Three of the properties were developed by<br />

SARES•REGIS Group. They include two Southern California<br />

projects registered with the United States Green Building<br />

Council and built to LEED standards.<br />

“Property owners are choosing SARES•REGIS Group because<br />

of the superior expertise and professionalism of our people<br />

in the field and at regional levels and the strength of our<br />

accounting operations. We also have exceedingly strong<br />

training programs,” said Michael Bissell, division President.<br />

But there are other important elements responsible for the<br />

recent surge of new management assignments, Bissell said.<br />

The company has earned top-tier rankings in independent<br />

benchmarking surveys and blind resident-satisfaction polls<br />

(see related story on page 12). Additionally, SARES•REGIS<br />

Group has implemented a “rent optimizer program” that<br />

maximizes revenues in a way that is similar to sophisticated<br />

pricing models used by the hotel and airline industry, he said.<br />

“In a strong market, the program tells you how and when<br />

to push rents up faster. In a down market, you don’t lose<br />

tenants and revenues as fast as your competitors,” Bissell<br />

said.<br />

The following is a list of SARES•REGIS Group’s recent management<br />

assignments:<br />

Strata at Mission Bay is a new 192-unit apartment community<br />

in San Francisco that SRG leased up 45 days ahead of<br />

schedule.<br />

The Metro is a Class-A mid-rise apartment community of<br />

415 units in Denver, Colo.<br />

Winridge Apartments in Aurora, Colo., is a development<br />

of 364 garden apartments.<br />

The Hills of Corona (Calif.,) is a Class-B, 248-unit property.<br />

Bella Villagio in San Jose, Calif., is a Class-A, 231-unit<br />

property that was acquired by SRGNC with Cigna.<br />

Bridgwater is a 291-unit, Class-B development owned by Dick<br />

Eddy in the Denver, Colo., suburb of Greenwood Village.<br />

The Encore is a 174-unit, B-property in Sherman Oaks, Calif.<br />

The Fountains is a 370-unit, B-property in Moorpark, Calif.<br />

Brookwood Villas is a 314-unit, B-property in Corona, Calif.<br />

Three apartment communities are among the division’s new<br />

assignments that were developed in Southern California<br />

by SARES•REGIS Group. They are:<br />

Westgate in Pasadena, a transit-oriented development that<br />

is planned for a total of 820 apartments on completion.<br />

The project is being built to the United States Green<br />

Building Council’s LEED standards.<br />

The Crossing in Anaheim, a 312-unit transit-oriented<br />

development that also is being built to LEED standards.<br />

The Grove in Ontario, with 258 apartments.<br />

8

Volume 13 . Number 1<br />

Tough Economy?<br />

No Problem; SRG Leases<br />

Up Bay Area Apartments<br />

Ahead Of Schedule<br />

On paper, the new, mid-rise luxury<br />

apartment community of Strata at<br />

Mission Bay – less than a mile from AT&T<br />

Park where the San Francisco Giants play<br />

baseball – looked like a home run.<br />

The project was close to downtown and<br />

had views of the Bay Bridge. When<br />

Strata was in the planning and early construction<br />

stages, the developer believed<br />

leasing up its 192 units at peak rents<br />

would not be a particular challenge.<br />

By Strata’s grand opening in March,<br />

however, the economy was faltering.<br />

Brokerage firm Marcus & Millichap<br />

reported area rents had plunged as much<br />

as 15% since the height of the market.<br />

Despite the tough economy with rents<br />

sliding 2.7% in the second quarter and<br />

a competing 260-unit project opening<br />

nearby, SRG’s Multifamily Property<br />

Management Division leased up the<br />

project in August, 45 days ahead of<br />

schedule.<br />

SRG’s lease-up team described the<br />

strategy for Strata as a three-pronged<br />

approach that included a highly focused<br />

and diligently implemented marketing<br />

plan along with an experienced management<br />

team and leasing staff.<br />

SRGNC And CIGNA Acquire Luxury<br />

Apartment Community In San Jose<br />

Sares Regis Group of Northern California, L.P., and CIGNA<br />

Realty Investors acquired Bella Villagio Apartments, a 231-unit luxury apartment<br />

community in San Jose, Calif. The acquisition brings the number of Bay Area<br />

apartment communities purchased by SRGNC to 18, representing approximately<br />

3,400 multifamily units at a cost of more than $440 million.<br />

“We are pleased to once again invest with SRGNC, with whom we have had<br />

much success in the past, in the acquisition of Bella Villagio,” said Robert Fair,<br />

Acquisition Director for CREI. “We believe this represents an excellent opportunity<br />

to acquire a newer Class A multifamily property at a significant discount<br />

to replacement cost and with potential upside based on the quality of the<br />

location, the benefit of professional property management and the anticipation<br />

of an improving economy over the next several years.”<br />

“As a result of the downturn in the economy and housing markets, SRGNC<br />

has been aggressively pursuing both distressed assets and motivated sellers<br />

who control quality assets,” said Kenneth Gladstein, Senior Vice President of<br />

Investments for SRGNC. “Bella Villagio represents an ideal example of the<br />

latter – a five-year-old institutional-quality asset that was acquired for close to<br />

50% of what it would cost to build today. In addition, it represented a classic<br />

opportunity to acquire an under-managed property in a supply-constrained<br />

submarket.”<br />

Also attractive to SRGNC was the ability to assume the existing FNMA loan.<br />

“Being able to obtain 85% leverage at below 6% for over seven years was<br />

clearly accretive to the deal,” said Gladstein. “In addition, having over three<br />

years of interest-only payments helps to provide both attractive cash yields<br />

on our equity and a cushion should the economy remain soft longer than<br />

we anticipate.”<br />

Bella Villagio was built in 2004 and is just south of downtown San Jose with<br />

access to the light rail system and all major Silicon Valley highways. The<br />

property has Mediterranean architectural details, average 985 square foot<br />

units, secured underground parking, a modern fitness room, heated swimming<br />

pool, two spas and a yoga studio.<br />

Most importantly, it was SRG’s keen<br />

grasp of market demand which was<br />

needed to perfectly position the asset.<br />

This is critical in a lease-up because time<br />

is of the essence.<br />

Bella Villagio, an “under-managed property in a supply-constrained submarket.”<br />

9

SRG <strong>Strategies</strong> . Fall 2009<br />

SRG’s employees at the company’s headquarters show their<br />

support for heightened commitment to sustainability.<br />

On St. Paddy’s Day, SRG Says: ‘We’re A Greener Company’<br />

After years of hewing diligently to efficiency practices<br />

in the development and management of its commercial and<br />

residential real estate projects, it was fitting that the SARES•REGIS<br />

Group chose March 17, St. Patrick’s Day, to announce it was<br />

elevating its commitment to green and sustainable practices<br />

on all its projects and in its Corporate operations, too.<br />

The move was well received throughout the company and<br />

especially welcomed by SRG’s recently formed task force on<br />

sustainability practices, which has been instituting measures<br />

that include everything from recycling and reducing use of<br />

water and power to eliminating use of Styrofoam, encouraging<br />

employee carpools, public transit and use of alternative-fuel<br />

vehicles.<br />

In a few short months, for example, the company already has<br />

slashed its landscape water use by 30% and now is recycling<br />

75% of all corporate office waste.<br />

“It has been exciting to see our changes implemented so<br />

quickly and smoothly. The combination of bottom-up and<br />

top-down driven efforts have unified the company in this<br />

undertaking,” says Jennifer Simpson, Chair of “SRG Green”<br />

and Acquisitions Coordinator in SRG’s Multifamily Acquisitions<br />

& Investments Division. Simpson also has been accredited by<br />

the United States Green Building Council as a Leadership and<br />

Energy and Environmental Design Accredited Professional<br />

(LEED AP).<br />

John Hagestad, Jeff Stack and Bill Thormahlen – SRG’s three<br />

Managing Directors – made the announcement at back-toback<br />

presentations for the 135 employees at Corporate<br />

Headquarters. Everyone, including the three owners, was<br />

decked out for the event in bright green tee-shirts with “Think<br />

Green, SARES•REGIS Group” silkscreened across the front.<br />

After making the point that SRG has a long history of developing<br />

and managing real estate in an efficient manner, the<br />

company’s owners made it clear that SRG was moving to a<br />

new and heightened level in its public commitment by boosting<br />

all sustainable business practices.<br />

“This is something that’s critical and something we wholeheartedly<br />

endorse,” Hagestad said, adding later he hoped the<br />

steps being taken at SRG will influence company employees<br />

when they’re not at work. “If nothing else, they’ll become<br />

more aware. Maybe they’ll think twice about using a foam cup<br />

or how much energy they burn at home. That’s important.”<br />

The SRG Green Committee consists of representatives from<br />

each of the company’s divisions and meets monthly to review<br />

proposals, many of which are suggested by employees, aimed<br />

at reducing SRG’s carbon footprint while enhancing employee<br />

health and morale.<br />

So far, the committee has produced a number of green guidelines<br />

for employees to follow as well as recommendations that<br />

are on the way. They include:<br />

Encouraging daylighting, working by ambient sunlight.<br />

Chemical-free pest control and cleaning products.<br />

Source reduction of junk mail; switching to electronic<br />

magazines.<br />

Double-sided printing.<br />

Turning off electronics when not in use, including the use<br />

of power strips.<br />

Encouraging bicycling, carpooling, public transport.<br />

Comprehensive recycling program, including certified<br />

disposal of e-waste, batteries and fluorescents.<br />

Utilizing Microsoft SharePoint to go paperless.<br />

Distributing an employee newsletter electronically with tips<br />

for office sustainability.<br />

Tracking utility use and cost savings.<br />

Purchasing supplies that are made with a post-consumer<br />

component or responsible forestry.<br />

And, most importantly, employee education.<br />

10

Volume 13 . Number 1<br />

SARES•REGIS Group Showcases Its<br />

Past, Current Sustainability Efforts<br />

In an effort to highlight a history of sustainable real<br />

estate practices as well as showcase current sustainable developments<br />

and other in-house green measures, SARES•REGIS<br />

Group has created two green newsletters: “SRG Green,”<br />

which can be found on the company’s website, and “SRG<br />

Green Living,” available through the Multifamily Property<br />

Management Division’s site, srgliving.com.<br />

“We are proud of what we’ve done and where we are going in<br />

terms of sustainable real estate practices and at the Corporate<br />

level,” says SRG Managing Director John Hagestad. “These<br />

newsletters help us express our deep commitment to saving<br />

energy and cutting waste wherever possible.“<br />

The first issue of “SRG Green” contains short articles on steps<br />

being taken to protect the environment by every division of<br />

the company. To access “SRG Green,” go to SRG’s website,<br />

sares-regis.com, and click on About SRG. There are stories<br />

on sustainable commercial and apartment developments,<br />

a history of the impressive energy-saving achievements of<br />

SRG’s Commercial Property Management Division and what<br />

the apartment management division is doing. There’s even<br />

a story of SRG’s drive toward paperless accounting.<br />

Additionally, “SRG Green Living” can be found on srgliving.com,<br />

our consumer-oriented site by our Multifamily Property<br />

Management Division. This newsletter is aimed primarily at<br />

our tenants. It is packed with information on how they can<br />

save energy and reduce waste.<br />

SRG Green Living (right) online newsletter gives apartment<br />

residents guidance on resource-saving measures.<br />

SRG Green (below) touts the company’s achievements<br />

in commercial and multifamily sustainable real estate<br />

practices as well as cutting Corporate waste.<br />

June 2009<br />

News and tips<br />

for eco-friendly<br />

apartment living.<br />

SRG Sets Eco-Apartment<br />

Management Policy<br />

The Multifamily Property Management Division of SARES•REGIS Group<br />

is committed to reducing the stress on the environment from the approximately<br />

16,000 units in 56 apartment communities it manages in California, Arizona<br />

and Colorado… see page 2<br />

We’re Working To Provide You With<br />

A Healthier, More Efficient Home<br />

In an effort to provide healthier and more energy-efficient surroundings for<br />

our residents, SARES•REGIS Group is planning and implementing improved<br />

green and sustainable practices throughout our portfolio… see page 3<br />

It’s Our Responsibility To Recycle;<br />

Here Are Tips On How You Can Help<br />

Most of our residents, like us, want to protect the environment and are<br />

interested in doing all they can to reduce waste by recycling paper, glass and<br />

plastic… see page 4<br />

In A Drought, It’s Our Obligation<br />

To Change Our Old Habits And<br />

Learn To Save Water<br />

The persistent drought condition of the seven Western states in the<br />

Colorado River Basin is one of the most severe in 400 years, says the<br />

U.S. Geological Survey. California’s governor this year declared a water<br />

emergency as the state is experiencing its third year of drought. So, when<br />

it comes to our personal water use, each of us has an obligation to use<br />

water sparingly and change our wasteful ways… see page 5<br />

Take Your Green Habits<br />

From Home To Work<br />

For people concerned about saving water, energy and recycling, there are<br />

three ways to be responsible: Good, Better, Best. And they also take their<br />

good habits from home to work. If you are first to suggest some changes<br />

at your workplace, don’t be surprised when many like-minded colleagues<br />

express eagerness to help get the ball rolling. Here are some ideas for a<br />

greener workplace… see page 6<br />

“These newsletters<br />

help us express our<br />

deep commitment<br />

to saving energy<br />

and cutting waste<br />

wherever possible.”<br />

–John Hagestad<br />

11

SRG <strong>Strategies</strong> . Fall 2009<br />

SRG Is No. 1 In Resident<br />

Satisfaction In Separate Surveys<br />

SARES•REGIS Group earned No. 1 rankings from two<br />

independent apartment survey firms for leasing professionalism<br />

and resident satisfaction.<br />

SRG’s Multifamily Property Management Division finished first<br />

in the just-released third-quarter Ellis Benchmarking Report,<br />

which surveys and ranks leasing activities on a quarterly basis.<br />

The independent survey includes a number of prominent<br />

national management companies. The division placed second<br />

in the first and second quarters and consistently was ranked<br />

in the top five.<br />

Additionally, SRG earned a No. 1 ranking in a resident satisfaction<br />

survey by Kingsley Associates of Atlanta. The company<br />

engaged Kingsley to survey 40 of its properties totaling 8,724<br />

units and had a 40% resident response rate, the highest in<br />

Kingsley’s history, said Mike Bissell, division President.<br />

“It was the first time we participated in the Kingsley survey<br />

on a company-wide basis and we outperformed their index<br />

in every major category. Kingsley was pleasantly surprised at<br />

how well we rated and shocked at the high rate of response,”<br />

he said.<br />

Cool roofs at Commerce Office Park in Commerce, Calif., help SRG’s<br />

Commercial Property Management Division achieve a strong record<br />

of reduced CO 2 emissions.<br />

Commercial Property Management<br />

Division Saves 1-Million Tons Of CO 2<br />

An analysis shows that from 2002 through 2008<br />

energy-saving measures taken by SARES•REGIS Group’s<br />

Commercial Property Management Division has prevented<br />

the emission of 1,023,912 tons of carbon dioxide gas into<br />

the atmosphere.<br />

These savings were achieved by the retrofitting of Energy<br />

Star-rated ElastaHyde acrylic roof coating on 4.1 million<br />

square feet of roofs on office and industrial buildings managed<br />

by the division. Additionally, the division has installed<br />

25,356 low-voltage light fixtures and 3,983 tons of energyefficient<br />

HVAC systems.<br />

The reduced CO 2 is equivalent to:<br />

4,851 railcars’ worth of coal<br />

Annual C0 2 emissions from home energy: 84,520 homes<br />

C0 2 emissions from 2.1 million barrels of oil consumed<br />

C0 2 emissions from 105,434,427 gallons of gasoline<br />

consumed<br />

Annual greenhouse gas emissions from 170,124 cars<br />

Real Estate Roundtable Website<br />

Calls SRG A ‘Green’ Leader In West<br />

Real Estate Roundtable has published a case history of<br />

SARES•REGIS Group on its new “RealSustainable.org” website<br />

under the headline: “Leading In The West, SARES•REGIS<br />

Group Demonstrates That Apartments Can Be Green, Too”.<br />

In addition to the company’s commitment to green multifamily<br />

projects, the case history outlines SRG’s achievements in<br />

sustainable commercial development and management.<br />

Additionally, the case history touches on steps being taken<br />

to cut energy use and waste throughout SRG’s Corporate<br />

operations.<br />

12

Volume 13 . Number 1<br />

SARES•REGIS Group helps at-risk young adults train in construction<br />

trades through a group run by the Sisters of St. Joseph. Dan Hull<br />

(second from left), SRG Vice President of Construction, with the<br />

project’s management team.<br />

SRG Arranges Construction<br />

Apprenticeships For Local<br />

Low-Income Housing Program<br />

SARES•REGIS Group is playing a key role in providing<br />

training in construction trades to troubled young adults<br />

and helping to build new homes for three low-income<br />

families in Santa Ana, Calif.<br />

The program is a partnership of the city’s redevelopment<br />

agency and two non-profit groups: the Orange County<br />

Community Housing Corporation and Taller San Jose, which<br />

is Spanish for St. Joseph’s Workshop.<br />

Last year SRG volunteered to assist Taller San Jose, a program<br />

operated by the Sisters of St. Joseph of Orange, Calif., to<br />

teach unskilled and unemployed students valuable hands-on<br />

construction skills that will enable them to earn their living<br />

in the homebuilding industry.<br />

“When the students finish their training, they’ll have the<br />

needed skills to easily qualify for jobs in their trade. Without<br />

these skills, they’d have no chance,” says Dan Hull, an SRG<br />

Vice President of Construction.<br />

It’s a great opportunity for young adults who have been in<br />

trouble and lack much in the way of marketable skills to get<br />

a leg up. It gives them hope and a real future.<br />

SRG lined up a number of its key subcontractors in every<br />

facet of construction. They provided the one-on-one instruction.<br />

Under the guidance of SRG and supervision by Taller<br />

San Jose, the students built three homes that are being sold<br />

to low-income participants in a housing lottery. The homes,<br />

ranging from 1,800 square feet to 2,500 square feet, were<br />

built on Logan Street, which was settled in the 1880s.<br />

The expertise of SRG and its subcontractors isn’t just about<br />

building the houses. It’s for the purpose of making sure the<br />

job gets done correctly, Hull said. And the students learn<br />

home building – the right way and from the ground up.<br />

Under the program, students are paid an hourly wage while<br />

they attend day and night classes. In many cases, SRG’s<br />

subcontractors provided the building materials.<br />

“These companies share our commitment to help the community<br />

and many have worked with us on other charitable<br />

construction projects, including rebuilding homes in New<br />

Orleans following Hurricane Katrina,” Hull said.<br />

SRG has worked with Taller San Jose in the past, giving their<br />

students on-the-job experience on some of our apartment<br />

projects.<br />

The difference this time is that Taller San Jose has broadened<br />

its scope of services to look for opportunities to build its<br />

own projects. As with previous projects, this is an excellent<br />

complement to what students are learning in the classroom,<br />

Hull said.<br />

13

SRG <strong>Strategies</strong> . Fall 2009<br />

SRG Joins Emergency Housing Effort<br />

To Shelter Families Caught In Crisis<br />

SARES•REGIS Group is among three real estate<br />

companies working with Families Forward, an Irvine, Calif.,<br />

non-profit group, to provide emergency housing to families<br />

in crisis.<br />

The companies, which include Avalon Bay Communities Inc.<br />

and The Irvine Company, make a number of vacant apartments<br />

they own and manage available to Families Forward’s<br />

new program, Rapid Re-Housing, established in June of this<br />

year.<br />

“These are families with children who have either lost their<br />

homes or apartments. But, even if parents have new jobs, no<br />

one will rent to them because their credit has been ruined<br />

or they don’t have the thousands of dollars for rent and full<br />

deposit,” said Cathlyn Traughber, Program Coordinator.<br />

She said rising unemployment and plunging home values<br />

have increased demand for emergency, subsidized housing<br />

and other services provided by Families Forward.<br />

“Honestly, without this program they would be living in their<br />

cars or with friends,” Traughber said.<br />

In only three months, the effort has placed 13 families into<br />

Class A apartments. Their deposits are deferred and rent is<br />

subsidized for one year. The program requires that there are<br />

children in the family and the families can be headed by<br />

single mothers or fathers.<br />

“The apartment communities have been phenomenal, just<br />

phenomenal, to get this going and working,” she said, but<br />

added that the program is so new it only can help one quarter<br />

of the qualified families that apply. So far, the group has shied<br />

away from publicity, believing the program would be flooded<br />

with even more applicants, she said.<br />

“We have families whose income has fallen from more than<br />

$100,000 a year to $30,000 and are really struggling. For<br />

them and others, this is just a lifesaver,” she said.<br />

The program received $500,000 in federal stimulus money<br />

through the department of Housing And Urban Development.<br />

Two other local grants, for which the program has applied,<br />

are hoped to produce $400,000.<br />

Traughber, a licensed marriage and family counselor who<br />

created the program, said 10 more families will be housed in<br />

the next 60 days and 10 more starting in January.<br />

Families Forward was founded in 1984 in a collaboration of<br />

community leaders, the city of Irvine and The Irvine Company.<br />

In addition to Rapid Re-Housing, Families Forward offers other<br />

homeless prevention services, career coaching, a food pantry<br />

and life-skills counseling.<br />

Cystinosis Successfully Reversed<br />

Using Stem Cell Transplantation<br />

A new study by Scripps Research Institute scientists<br />

offers good news for families of children afflicted with the<br />

rare genetic disorder, cystinosis.<br />

In research funded by the<br />

Cystinosis Research Foundation<br />

in Irvine that holds out hope<br />

for one day developing a<br />

potential therapy to treat the<br />

fatal disorder, the study shows<br />

that the genetic defect in mice<br />

can be corrected with stem<br />

cell transplantation.<br />

“The results really surprised<br />

and encouraged us,” says<br />

Dr. Stephanie Cherqui principal investigator Stephanie<br />

Cherqui, who as a doctoral<br />

student in France in 1998 helped discover the gene involved<br />

in cystinosis. “Because the defect is present in every cell of<br />

the body, we did not expect a bone marrow stem cell<br />

transplant to be so widespread and effective.”<br />

In the study, which was published in the September 17,<br />

2009, print edition of the journal Blood, the Scripps Research<br />

team used bone marrow stem cell transplantation to address<br />

symptoms of cystinosis in a mouse model. The procedure<br />

virtually halted the cystine accumulation responsible for the<br />

disease and the cascade of cell death that follows.<br />

Cystine is a byproduct of the break down of cellular components<br />

the body no longer needs in the cell’s “housekeeping”<br />

organelles, called lysosomes. Normally, cystine is shunted<br />

out of cells, but in cystinosis a gene defect of the lysosomal<br />

cystine transporter causes it to build up, forming crystals<br />

that are especially damaging to the kidneys and eyes.<br />

The only available drug to treat cystinosis, cysteamine, while<br />

slowing the progression of kidney degradation, does not<br />

prevent it, and end-stage kidney failure is inevitable.<br />

“Cysteamine must be given every six hours, so children<br />

have to be woken up each night to take this drug, which<br />

has unpleasant side effects, and many others to treat various<br />

symptoms," Cherqui says. "So although there is treatment,<br />

it is difficult treatment that does not cure the disease.”<br />

In the new study, the researchers found that transplanted<br />

bone marrow stem cells carrying the normal lysosomal<br />

cystine transporter gene abundantly engrafted into every<br />

tissue of the experimental mice. This led to an average drop<br />

in cystine levels of about 80 percent in every organ. In<br />

addition to preventing kidney dysfunction, there was less<br />

deposition of cystine crystals in the cornea, less bone<br />

demineralization, and an improvement in motor function.<br />

14

Volume 13 . Number 1<br />

Mitch Albom (left) with Natalie Stack. Dr. Ranjan Dohil (from<br />

left), Nancy and Jeff Stack and Dr. Stephanie Cherqui. Separate<br />

studies by Drs. Dohil and Cherqui are being funded by the<br />

Cystinosis Research Foundation.<br />

Natalie’s Wish Raises $2.3 Million; Cure Plans Outlined For Disease<br />

Mitch Albom, author of the best-selling memoir<br />

“Tuesdays With Morrie,” along with a $1-million challenge<br />

grant helped raise $2.3 million for Natalie’s Wish, the<br />

fundraiser for the Cystinosis Research Foundation. All CRF<br />

donations go to research on cystinosis, a rare, metabolic<br />

and fatal disease. Foundation officials expect a cure will be<br />

developed within five years.<br />

Despite the recessionary economy, 320 people attended the<br />

eighth-annual fundraiser May 8 at the Balboa Bay Club in<br />

Newport Beach, Calif., including families of 12 children with<br />

cystinosis who came from all over the country. Three family<br />

foundations donated $373,000, and an anonymous donor<br />

gave $1 million that was offered in the form of a challenge<br />

grant.<br />

There are about 2,000 cystinosis sufferers, mostly children,<br />

worldwide. In patients with cystinosis the amino acid cystine<br />

accumulates in the tissue due to the inability of the body to<br />

transport cystine out of the cell. Over time, cystine damages<br />

various organs including the kidneys, liver, muscles, white<br />

blood cells, eyes and central nervous system. Other complications<br />

include muscle wasting and difficulty swallowing.<br />

As the cystine accumulates in the cells, all the body’s organs<br />

slowly deteriorate.<br />

Since its formation in 2003, the CRF has funded and committed<br />

more than $9 million in cystinosis research and fellowships<br />

in six countries and has made great strides to solve the<br />

mystery of the genetic disorder. Almost all patients succumb<br />

by 40 years old. The CRF is the world’s largest non-profit<br />

provider of funds for cystinosis research.<br />

Nancy Stack, President and Co-Founder of the CRF, said that<br />

if CRF-funded researchers’ aims on gene and bone-marrow<br />

stem-cell therapy are met this year, “The next step in the plan<br />

will be to test the efficacy of their discoveries using primates,<br />

bringing us one step closer to human clinical trials that will<br />

test for a cure for cystinosis.”<br />

Natalie Stack, 18, a daughter of Nancy and Jeff Stack, a<br />

Managing Director of SARES•REGIS Group, was diagnosed<br />

with cystinosis as an infant.<br />

Albom, an award-winning sports newspaper columnist and<br />

television and radio commentator, was the featured speaker.<br />

He turned the conversations with his late university professor<br />

Morrie Schwartz into the all-time best-selling memoir,<br />

“Tuesdays With Morrie,” which sold 11 million copies. Book<br />

proceeds paid for Schwartz’s medical care.<br />

Anaheim Chamber Honors SRG<br />

For New, Sustainable Project<br />

On the strength of a new transit-oriented, luxury<br />

apartment development in Anaheim, the Anaheim Chamber<br />

of Commerce has honored SARES•REGIS Group as “Green<br />

Business of the Year – Construction.”<br />

The Anaheim business chamber was impressed with SRG’s<br />

sustainable development and construction program for The<br />

Crossing, a 312-unit apartment development, being built<br />

to pass United States Building Council standards for LEED<br />

certification.<br />

The recognition came as part of the chamber’s 2009<br />

Anaheim Business Awards Program. SRG is the leading,<br />

privately owned developer of sustainable apartments in<br />

Southern California.<br />

15

SRG <strong>Strategies</strong> . Fall 2009<br />

Announcements<br />

Michael P. Bissell, President of SARES•REGIS Group’s Multifamily Property Management Division,<br />

was appointed to the California Apartment Association’s 2009 Board of Directors. The CAA is the nation’s<br />

largest statewide trade association for owners and managers of rental property. Bissell joined SRG in 2007.<br />

His 30-year career includes asset management, property acquisition and disposition, development,<br />

merchandising, marketing and sales on residential and commercial portfolios throughout the United<br />

States, Germany and Sweden.<br />

Jennifer Nessett, Vice President and Regional Manager in SRG’s Multifamily Property Management<br />

Division, was elected president of the Apartment Association of Metro Denver. Since 2002, Nessett has served<br />

on the board of the association, which represents the interests of the apartment industry to state and local<br />

government. She joined SRG in 2004.<br />

Jennifer Simpson, Acquisitions Coordinator in SRG’s Multifamily Acquisitions & Investments Division,<br />

has been certified by the United States Green Building Council as a Leadership and Energy and Environmental<br />

Design Accredited Professional. She is active on the Construction Quality and Sustainable Building Committee<br />

for the Orange County Chapter of the Building Industry Association and the USGBC’s Orange County<br />

Emerging Green Builders Committee.<br />

Orange County’s First Speculative ‘Green’ Industrial Project, continued from page 2<br />

Other green features will include: high-efficiency exhaust fans<br />

with energy conservation controls; high-performance glazing<br />

to minimize heat gain; deep overhangs at glazed entry areas;<br />

recycled water system for landscape irrigation; drought-tolerant<br />

landscape design and materials; pervious asphalt and<br />

storm-water reclamation to aquifer via Maxwell drains, percolation<br />

ponds and swales; roof drain water impoundment for<br />

percolation to aquifer; passive switching controls for outdoor<br />

lighting; low VOC paint; low Nox output during grading and<br />

recycled steel trusses.<br />

The SARES•REGIS Group Regional Offices<br />

Corporate Office<br />

John S. Hagestad, Managing Director<br />

Geoffrey L. Stack, Managing Director<br />

William J. Thormahlen, Managing Director<br />

Peter Rooney, President, Commercial<br />

Investment Division<br />

Vince Ciavarella, President, Commercial<br />

Property Services Division<br />

Michael Bissell, President, Multifamily<br />

Property Management Division<br />

Bill Albert, President, Multifamily<br />

Development & Construction Division<br />

Bill Montgomery, President, Multifamily<br />

Acquisitions & Investments Division<br />

18802 Bardeen Avenue<br />

Irvine, CA 92612<br />

(949) 756-5959 www.sares-regis.com<br />

Regis Homes & Regis Contractors<br />

18825 Bardeen Avenue<br />

Irvine, CA 92612<br />

(949) 756-5959<br />

Ventura/Los Angeles<br />

Russ Goodman, Regional President<br />

500 Esplanade Dr., #470<br />

Oxnard, CA 93031<br />

(805) 485-3193<br />

Phoenix–Residential<br />

Eric LaMora, Vice President<br />

Regional Manager<br />

4626 E. Shea Blvd., Suite C-200<br />

Phoenix, AZ 85028<br />

(602) 790-1576<br />

Denver–Residential<br />

Jennifer Nessett, Vice President<br />

Regional Manager<br />

900 E. Louisiana Ave., Suite 101<br />

Denver, CO 80210<br />

(303) 715-9600<br />

Sares Regis Group of Northern<br />

California, L.P.<br />

Regis Homes of Northern<br />

California, Inc.<br />

Robert W. Wagner, Principal<br />

Mark R. Kroll, Principal<br />

Jeffrey A. Birdwell, President,<br />

Commercial Division<br />

901 Mariners Island Blvd., Seventh Floor<br />

San Mateo, CA 94404<br />

(650) 378-2800<br />

www.srgnc.com www.regishomes.com<br />

Regis Homes of Sacramento, LLC<br />

Bill Heartman, President<br />

1800 3rd Street, Suite 250<br />

Sacramento, CA 95814<br />

(916) 442-7299<br />

16