Prefiled Direct Testimony of Robert B. Hevert on Behalf of ...

Prefiled Direct Testimony of Robert B. Hevert on Behalf of ...

Prefiled Direct Testimony of Robert B. Hevert on Behalf of ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Department <str<strong>on</strong>g>of</str<strong>on</strong>g> Public Service Regulati<strong>on</strong><br />

M<strong>on</strong>tana Public Service Commissi<strong>on</strong><br />

Docket No. 2012.9.94<br />

Natural Gas General Filing<br />

NorthWestern Energy<br />

PREFILED DIRECT TESTIMONY<br />

OF<br />

ROBERT B. HEVERT<br />

ON BEHALF OF<br />

NORTHWESTERN ENERGY

TABLE OF CONTENTS<br />

EXECUTIVE SUMMARY OF ROBERT B. REVERT ...........................................•... ES-l<br />

I. INTRODUCTION ........................................................................................................ 1<br />

ll. PURPOSE AND OVERVIEW OF TESTIMONY .....•.............................................. 2<br />

III. SUMMARY OF CONCLUSIONS ..•.......................................................................... 5<br />

IV. REGULATORY GUIDELINES AND FINANCIAL CONSIDERATIONS .......... 7<br />

V. PROXY GROUP SELECTION .................................................................................. 8<br />

VI. COST OF EQUITY ESTIMATION ........................................................................ 12<br />

Quarterly Growth DCF Model ...•.............................•................................................. 14<br />

Dividend Yield and Growth Rates for the Quarterly DCF Model.. ........................... 16<br />

Results for the Quarterly Growth DCF Model .......................................................... 21<br />

C<strong>on</strong>stant Growth DCF ModeL ...•................................................................................ 22<br />

Dividend Yield and Growth Ratesfor the C<strong>on</strong>stant Growth DCF Model ................ 22<br />

Results for C<strong>on</strong>stant Growth DCF ModeL. ................................................................ 23<br />

Multi-Stage DCF Model .............•............................................•.................................. 24<br />

Discounted Cash Flow Model Results ........................................................................ 29<br />

CAPM Analysis ........................................................................................................... 32<br />

B<strong>on</strong>d Yield Plus Risk Premium Approach .................................................................42<br />

VIT. BUSINESS RISKS ..................................................................................•.................. 45<br />

Small Size Premium ..................................................•................................................. 45<br />

Revenue Stabilizati<strong>on</strong> Mechanisms ............................................................................ 48<br />

Flotati<strong>on</strong> Costs ...•........................................................................................................ 49<br />

VIII. CAPITAL MARKET ENVIRONMENT ................................................................. 51<br />

Incremental Credit Spreads ........................................................................................ 52<br />

Yield Spreads ............................................................................................................... 55<br />

Equity Market Volatility and Return Correlati<strong>on</strong>s .................................................... 57<br />

IX. CONCLUSIONS AND RECOMMENDATION ..................................................... 62<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

EXHIBITS<br />

Exhibit<br />

Exhibit No. RBH-l<br />

Exhibit No. RBH-2<br />

Exhibit No. RBH-3<br />

Exhibit No. RBH-4<br />

Exhibit No. RBH-5<br />

Exhibit No. RBH-6<br />

Exhibit No. RBH-7<br />

Exhibit No. RBH-8<br />

Exhibit No. RBH-9<br />

Exhibit No. RBH-IO<br />

Exhibit No. RBH-ll<br />

Descripti<strong>on</strong><br />

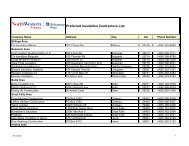

Quarterly Growth DCF Results<br />

C<strong>on</strong>stant Growth DCF Results<br />

Retenti<strong>on</strong> Growth Estimate<br />

Multi-Stage DCF Results<br />

Market Risk Premium Calculati<strong>on</strong>s<br />

Beta Coefficients<br />

CAPM Results<br />

B<strong>on</strong>d Yield Plus Risk Premium Analysis<br />

Small Size Premium<br />

Review <str<strong>on</strong>g>of</str<strong>on</strong>g> Proxy Group Revenue Stabilizati<strong>on</strong> Mechanisms<br />

Flotati<strong>on</strong> Costs<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

ES-l<br />

1 EXECUTIVE SUMMARY OF ROBERT B. HEVERT<br />

2 My direct testim<strong>on</strong>y establishes that, for NorthWestern Corporati<strong>on</strong>, which does business<br />

3 as NorthWestern Energy ("NorthWestern" or the "Company"), a Return <strong>on</strong> Equity<br />

4 ("ROE") <str<strong>on</strong>g>of</str<strong>on</strong>g> lO.50 percent is reas<strong>on</strong>able. My recommended 10.50 percent ROE c<strong>on</strong>siders<br />

5 a variety <str<strong>on</strong>g>of</str<strong>on</strong>g> factors that affect the required return to equity investors in the Company. My<br />

6 testim<strong>on</strong>y:<br />

7 • Discusses the multiple analytical approaches that were evaluated to develop the<br />

8 ROE;<br />

9 • Explains how the analysis to determine an appropriate ROE is affected by the<br />

10 various business and operating risks faced by the Company; and<br />

11 • Describes the current capital markets and ec<strong>on</strong>omic c<strong>on</strong>diti<strong>on</strong>s, and the degree to<br />

12 which those c<strong>on</strong>diti<strong>on</strong>s affect NorthWestern's ROE.<br />

13 Together with the exhibits attached to my testim<strong>on</strong>y, this evidence dem<strong>on</strong>strates that a<br />

14 10.50 percent ROE should be approved for NorthWestern in order to provide the<br />

15 Company with an opportunity to create earnings sufficient to provide an appropriate<br />

16 return to its equity investors.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 1 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3 Q.<br />

4<br />

DIRECT TESTIMONY OF ROBERT B. HEVERT<br />

I. INTRODUCTION<br />

PLEASE STATE YOUR NAME, AFFILIATION AND<br />

ADDRESS.<br />

BUSINESS<br />

5 A.<br />

My name is <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g>.<br />

I am Managing Partner <str<strong>on</strong>g>of</str<strong>on</strong>g> Sussex Ec<strong>on</strong>omic<br />

6<br />

7<br />

8 Q.<br />

9 A.<br />

10<br />

11<br />

12<br />

13 Q.<br />

14 A.<br />

15<br />

16<br />

17 Q.<br />

18<br />

19 A.<br />

20<br />

21<br />

22<br />

23<br />

Advisors, LLC ("Sussex"). My business address is 161 Worcester Road, Suite<br />

503, Framingham, MA 01701.<br />

ON WHOSE BEHALF ARE YOU SUBMITTING THIS TESTIMONY?<br />

I am submitting this direct testim<strong>on</strong>y ("<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g>") before the M<strong>on</strong>tana<br />

Public Service Commissi<strong>on</strong> ("Commissi<strong>on</strong>") <strong>on</strong> behalf <str<strong>on</strong>g>of</str<strong>on</strong>g> NorthWestern<br />

Corporati<strong>on</strong>, which does business as NorthWestern Energy ("NorthWestern" or the<br />

"Company").<br />

PLEASE DESCRIBE YOUR EDUCATIONAL BACKGROUND.<br />

I hold a Bachelor's degree in Business and Ec<strong>on</strong>omics from the University <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

Delaware, and an MBA with a c<strong>on</strong>centrati<strong>on</strong> in Finance from the University <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

Massachusetts. I also hold the Chartered Financial Analyst designati<strong>on</strong>.<br />

PLEASE DESCRIBE YOUR EXPERIENCE IN THE ENERGY AND<br />

UTILITY INDUSTRIES.<br />

I have worked in regulated industries for over twenty five years, having served as<br />

an executive and manager with c<strong>on</strong>sulting firms, a financial <str<strong>on</strong>g>of</str<strong>on</strong>g>ficer <str<strong>on</strong>g>of</str<strong>on</strong>g> a publiclytraded<br />

natural gas utility (at the time, Bay State Gas Company), and an analyst at<br />

a telecommunicati<strong>on</strong>s utility. In my role as a c<strong>on</strong>sultant, I have advised numerous<br />

energy and utility clients <strong>on</strong> a wide range <str<strong>on</strong>g>of</str<strong>on</strong>g> financial and ec<strong>on</strong>omic issues<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 2 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

including corporate and asset-based transacti<strong>on</strong>s, asset and enterprise valuati<strong>on</strong>,<br />

transacti<strong>on</strong> due diligence, and strategic matters. As an expert witness, I have<br />

provided testim<strong>on</strong>y in over 80 proceedings regarding various financial and<br />

regulatory matters before numerous state utility regulatory agencies and the<br />

Federal Energy Regulatory Commissi<strong>on</strong>. A summary <str<strong>on</strong>g>of</str<strong>on</strong>g> my pr<str<strong>on</strong>g>of</str<strong>on</strong>g>essi<strong>on</strong>al and<br />

educati<strong>on</strong>al background, including a list <str<strong>on</strong>g>of</str<strong>on</strong>g> my testim<strong>on</strong>y in prior proceedings, is<br />

included in Exhibit A to my <str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g>.<br />

8<br />

II.<br />

PURPOSE AND OVERVIEW OF TESTIMONY<br />

9 Q.<br />

10 A.<br />

WHAT IS THE PURPOSE OF YOUR TESTIMONY?<br />

The purpose <str<strong>on</strong>g>of</str<strong>on</strong>g> my <str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> is to present evidence and provide a<br />

11<br />

recommendati<strong>on</strong> regarding the Company's return <strong>on</strong> equity ("ROE").'<br />

My<br />

12<br />

13<br />

14<br />

15 Q.<br />

16<br />

17 A.<br />

analysis and c<strong>on</strong>clusi<strong>on</strong>s are supported by the data presented in Exhibit No. RBB-<br />

1 through Exhibit No. RBB-11, which have been prepared by me or under my<br />

directi<strong>on</strong>.<br />

WHAT ARE YOUR CONCLUSIONS REGARDING THE APPROPRIATE<br />

COST OF EQUITY?<br />

My analyses indicate that the Company's Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity currently is in the range<br />

18<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> 10.00 percent to 10.75 percent.<br />

Based <strong>on</strong> the quantitative and qualitative<br />

19<br />

20<br />

analyses discussed throughout my <str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g>, I c<strong>on</strong>clude that an ROE <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

10.50 percent is reas<strong>on</strong>able and appropriate.<br />

Throughout my testim<strong>on</strong>y, I interchangeably use the terms "ROE" and "Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity".<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 3 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 Q.<br />

2<br />

3 A.<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

PLEASE PROVIDE A BRIEF OVERVIEW OF THE ANALYSES THAT<br />

LED TO YOUR ROE RECOMMENDATION.<br />

As discussed in more detail in Secti<strong>on</strong> VI, in light <str<strong>on</strong>g>of</str<strong>on</strong>g> recent market c<strong>on</strong>diti<strong>on</strong>s,<br />

and given the fact that equity analysts and investors tend to use multiple<br />

methodologies in developing their return requirements, it is important to c<strong>on</strong>sider<br />

the results <str<strong>on</strong>g>of</str<strong>on</strong>g> several analytical approaches in determining the Company's ROE.<br />

In order to develop my ROE recommendati<strong>on</strong>, I therefore applied the Quarterly<br />

Growth, C<strong>on</strong>stant Growth, and Multi-Stage forms <str<strong>on</strong>g>of</str<strong>on</strong>g> the Discounted Cash Flow<br />

("DCF") model, the Capital Asset Pricing Model ("CAPM"), and the Risk<br />

10<br />

Premium approach.<br />

As discussed later in my testim<strong>on</strong>y, it is important to<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

c<strong>on</strong>sider a range <str<strong>on</strong>g>of</str<strong>on</strong>g> factors, both quantitative and qualitative, in arriving at an<br />

ROE determinati<strong>on</strong>.<br />

In additi<strong>on</strong> to the methodologies noted above, my recommendati<strong>on</strong> also<br />

takes into c<strong>on</strong>siderati<strong>on</strong> the regulatory and capital envir<strong>on</strong>ment in which the<br />

Company operates. In particular, I note that credit spreads between A -rated utility<br />

b<strong>on</strong>ds and Baa-rated utility b<strong>on</strong>ds have increased, which suggests that debt<br />

investors have increased their marginal return requirements. During the same<br />

period in which credit spreads increased, the correlati<strong>on</strong> between those spreads<br />

and the 30-year Treasury b<strong>on</strong>d was negative, indicating that required risk<br />

premiums increased as l<strong>on</strong>g-tenn Treasury yields decreased. I also note that the<br />

relati<strong>on</strong>ship between the 30-year Treasury yield and the proxy group average<br />

dividend yield has become inverted relative to its l<strong>on</strong>g-run norm. Finally, natural<br />

gas stocks have been somewhat more volatile than their historical average, and<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 4 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

their returns have become more correlated with the broader market than they<br />

2<br />

historically had been.<br />

As discussed in greater detail in Secti<strong>on</strong> VIII, the<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15 Q.<br />

16<br />

17 A.<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

c<strong>on</strong>tinuing instability in the capital markets indicates that the current historically<br />

low level <str<strong>on</strong>g>of</str<strong>on</strong>g> the 3D-year Treasury does not necessarily indicate that the Cost <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

Equity is at a commensurately low level.<br />

Since estimating the ROE is a market-based exercise, it is important to<br />

understand the risks faced by the Company relative to its peers. As such, I also<br />

took into c<strong>on</strong>siderati<strong>on</strong> business risks and costs which affect the Company, such<br />

as: (1) its relatively small size compared to the proxy group; (2) the lack <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

revenue stabilizati<strong>on</strong> mechanisms employed by the Company relative to the proxy<br />

group; and (3) flotati<strong>on</strong> costs. While I did not make any explicit adjustments to<br />

my ROE estimates for those factors, I did take them into c<strong>on</strong>siderati<strong>on</strong> in<br />

determining the appropriate estimate <str<strong>on</strong>g>of</str<strong>on</strong>g> the Company's Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity within the<br />

10.00 percent to 10.75 percent range.<br />

HOW DID YOU DETERMINE THE APPROPRIATE RANGE OF<br />

REASONABLENESS FOR THE COMPANY'S COST OF EQUITY?<br />

In order to develop the reas<strong>on</strong>able range for NorthWestern's Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity, I<br />

reviewed the results <str<strong>on</strong>g>of</str<strong>on</strong>g> the three DCF models, as well as the results <str<strong>on</strong>g>of</str<strong>on</strong>g> the CAPM<br />

analyses, and B<strong>on</strong>d Yield Plus Risk Premium approach.<br />

C<strong>on</strong>sistent with my prior practice, I did not apply specific weights to those<br />

analyses. As discussed further in Secti<strong>on</strong> VI, in my review <str<strong>on</strong>g>of</str<strong>on</strong>g> the DCF models I<br />

disregarded the mean low results, because the results are not a reas<strong>on</strong>able<br />

estimati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> any company's ROE. As noted above, I also c<strong>on</strong>sidered the effects<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 5 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> current capital market envir<strong>on</strong>ment, as well as the effect <str<strong>on</strong>g>of</str<strong>on</strong>g> specific business<br />

risks faced by the Company in determining my ROE range and estimate.<br />

In light <str<strong>on</strong>g>of</str<strong>on</strong>g> the factors noted above, I have set the low end <str<strong>on</strong>g>of</str<strong>on</strong>g> my range by<br />

reference to the average <str<strong>on</strong>g>of</str<strong>on</strong>g> the mean, and mean high results <str<strong>on</strong>g>of</str<strong>on</strong>g> my DCF models.<br />

The high end <str<strong>on</strong>g>of</str<strong>on</strong>g> the range generally is estimated by the average mean high results<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> my DCF models. That approach suggests a range <str<strong>on</strong>g>of</str<strong>on</strong>g> 9.96 percent to 10.73<br />

7<br />

percent.<br />

As discussed in Secti<strong>on</strong> VI, the CAPM and B<strong>on</strong>d Yield Plus Risk<br />

8<br />

Premium analyses corroborate the reas<strong>on</strong>ableness <str<strong>on</strong>g>of</str<strong>on</strong>g> that range.<br />

As such, I<br />

9<br />

10<br />

11<br />

12<br />

believe an ROE within the range <str<strong>on</strong>g>of</str<strong>on</strong>g> 10.00 to 10.75 is reas<strong>on</strong>able. In light <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

c<strong>on</strong>siderati<strong>on</strong>s discussed throughout the balance <str<strong>on</strong>g>of</str<strong>on</strong>g> my <str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g><br />

regarding the Company's relative business risks, it is my opini<strong>on</strong> that within that<br />

range, an ROE <str<strong>on</strong>g>of</str<strong>on</strong>g> 10.50 percent is reas<strong>on</strong>able and appropriate.<br />

13<br />

III.<br />

SUMMARY OF CONCLUSIONS<br />

14 Q.<br />

15<br />

16 A.<br />

17<br />

18<br />

19<br />

20<br />

21<br />

WHAT ARE THE KEY FACTORS CONSIDERED IN YOUR ANALYSES<br />

AND UPON WHICH YOU BASE YOUR RECOMMENDED ROE?<br />

My analyses and recommendati<strong>on</strong>s c<strong>on</strong>sidered the following:<br />

• The Hope and Bluefield decisi<strong>on</strong>s 2 that established the standards for<br />

determining a fair and reas<strong>on</strong>able allowed return <strong>on</strong> equity including;<br />

c<strong>on</strong>sistency <str<strong>on</strong>g>of</str<strong>on</strong>g> the allowed return with other businesses having similar<br />

risk; adequacy <str<strong>on</strong>g>of</str<strong>on</strong>g> the return to provide access to capital and support credit<br />

quality; and that the end result must lead to just and reas<strong>on</strong>able rates.<br />

2<br />

Bluefield Waterworks & Improvement Co., v. Public Service Commissi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> West Virginia, 262 U.S.<br />

679 (1923); Federal Power Commissi<strong>on</strong> v. Hope Natural Gas Co .• 320 U.S. 591 (1944).<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 6 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7 Q.<br />

8 A.<br />

9<br />

10<br />

11<br />

12<br />

• The effect <str<strong>on</strong>g>of</str<strong>on</strong>g> the current capital market c<strong>on</strong>diti<strong>on</strong>s <strong>on</strong> investors' return<br />

requirements, and in particular, the Company's c<strong>on</strong>tinuing need to access<br />

the capital markets.<br />

• The Company's business risks relative to the proxy group <str<strong>on</strong>g>of</str<strong>on</strong>g> comparable<br />

companies and the implicati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> those risks in arriving at the appropriate<br />

ROE.<br />

WHAT ARE THE RESULTS OF YOUR ANALYSES?<br />

Based <strong>on</strong> the analytical results presented throughout my <str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g>, and in<br />

light <str<strong>on</strong>g>of</str<strong>on</strong>g> the c<strong>on</strong>siderati<strong>on</strong>s discussed throughout the balance <str<strong>on</strong>g>of</str<strong>on</strong>g> my <str<strong>on</strong>g>Direct</str<strong>on</strong>g><br />

<str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g>, it is my view that a reas<strong>on</strong>able range <str<strong>on</strong>g>of</str<strong>on</strong>g> estimates is from 10.00<br />

percent to 10.75 percent, and within that range, an ROE <str<strong>on</strong>g>of</str<strong>on</strong>g> 10.50 percent is<br />

reas<strong>on</strong>able and appropriate.<br />

13 Q.<br />

HOW IS<br />

THE REMAINDER OF YOUR DIRECT TESTIMONY<br />

14<br />

15 A.<br />

ORGANIZED?<br />

The balance <str<strong>on</strong>g>of</str<strong>on</strong>g> my <str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> is organized as follows:<br />

16<br />

Secti<strong>on</strong> IV -<br />

Discusses the regulatory guidelines and financial c<strong>on</strong>siderati<strong>on</strong>s<br />

17<br />

pertinent to the development <str<strong>on</strong>g>of</str<strong>on</strong>g> the cost <str<strong>on</strong>g>of</str<strong>on</strong>g> capital;<br />

18<br />

Secti<strong>on</strong> V -<br />

Explains my selecti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the proxy group <str<strong>on</strong>g>of</str<strong>on</strong>g> natural gas<br />

19<br />

distributi<strong>on</strong> utilities used to develop my analytical results;<br />

20<br />

Secti<strong>on</strong> VI -<br />

Explains my analyses and the analytical bases for my ROE<br />

21<br />

recommendati<strong>on</strong>;<br />

22<br />

Secti<strong>on</strong> VII -<br />

Provides a discussi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> specific business risks that have a direct<br />

23<br />

bearing <strong>on</strong> the Company's Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity;<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 7 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4 IV.<br />

5 Q.<br />

6<br />

7<br />

8 A.<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15 Q.<br />

16<br />

17<br />

18 A.<br />

19<br />

20<br />

21<br />

22<br />

23<br />

Secti<strong>on</strong> VIII - Discusses current capital market c<strong>on</strong>diti<strong>on</strong>s and the effect <str<strong>on</strong>g>of</str<strong>on</strong>g> those<br />

c<strong>on</strong>diti<strong>on</strong>s <strong>on</strong> the Company's Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity; and<br />

Secti<strong>on</strong> IX - Summarizes my c<strong>on</strong>clusi<strong>on</strong>s and recommendati<strong>on</strong>s.<br />

REGULATORY GUIDELINES AND FINANCIAL CONSIDERATIONS<br />

PLEASE DESCRIBE THE GUIDING PRINCIPLES TO BE CONSIDERED<br />

IN ESTABLISHING THE COST OF CAPITAL FOR A REGULATED<br />

UTILITY.<br />

The United States Supreme Court's precedent-setting Hope and Bluefield cases<br />

established the standards for determining the fairness or reas<strong>on</strong>ableness <str<strong>on</strong>g>of</str<strong>on</strong>g> a<br />

utility's allowed ROE. Am<strong>on</strong>g the standards established by the Court in those<br />

cases are: (I) c<strong>on</strong>sistency with other businesses having similar or comparable<br />

risks; (2) adequacy <str<strong>on</strong>g>of</str<strong>on</strong>g> the return to support credit quality and access to capital;<br />

and (3) the principle that the specific means <str<strong>on</strong>g>of</str<strong>on</strong>g> arriving at a fair return are not<br />

important, <strong>on</strong>ly that the end result leads to just and reas<strong>on</strong>able rates.<br />

WHY IS IT IMPORTANT FOR A UTILITY TO BE ALLOWED THE<br />

OPPORTUNITY TO EARN A RETURN ADEQUATE TO ATTRACT<br />

EQUITY CAPITAL AT REASONABLE TERMS?<br />

A return that is adequate to attract capital at reas<strong>on</strong>able terms enables the utility to<br />

provide service while maintaining its financial integrity. In keeping with the<br />

Hope and Bluefield standards, that return should be commensurate with the<br />

returns expected elsewhere in the market for investments <str<strong>on</strong>g>of</str<strong>on</strong>g> equivalent risk.<br />

Based <strong>on</strong> those standards, the Commissi<strong>on</strong>'s decisi<strong>on</strong> in this case should provide<br />

the Company with the opportunity to earn an ROE that is: (I) adequate to attract<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 8 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

capital at reas<strong>on</strong>able terms, thereby enabling it to c<strong>on</strong>tinue to provide safe and<br />

reliable natural gas service; (2) sufficient to ensure its financial integrity; and (3)<br />

commensurate with returns <strong>on</strong> investments in enterprises having corresp<strong>on</strong>ding<br />

4<br />

risks.<br />

The allowed ROE should enable the Company to finance capital<br />

5<br />

6<br />

7<br />

8<br />

9<br />

lO<br />

11<br />

12<br />

13<br />

14 Q.<br />

15<br />

16<br />

17 A.<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

expenditures at reas<strong>on</strong>able cost rates and maintain its financial flexibility over the<br />

period during which rates are expected to remain in effect. While the "capital<br />

attracti<strong>on</strong>" and "financial integrity" standards are important principles in normal<br />

ec<strong>on</strong>omic c<strong>on</strong>diti<strong>on</strong>s, the practical implicati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> those standards are even more<br />

pr<strong>on</strong>ounced during periods <str<strong>on</strong>g>of</str<strong>on</strong>g> capital market instability. As discussed in more<br />

detail in Secti<strong>on</strong> VIII, for example, sustained increases in the incremental spread<br />

<strong>on</strong> utility debt (i.e., the difference in debt yields <str<strong>on</strong>g>of</str<strong>on</strong>g> utilities varying credit ratings)<br />

have intensified the importance <str<strong>on</strong>g>of</str<strong>on</strong>g> maintaining a str<strong>on</strong>g financial pr<str<strong>on</strong>g>of</str<strong>on</strong>g>ile.<br />

V. PROXY GROUP SELECTION<br />

AS A PRELIMINARY MATTER, WHY IS IT NECESSARY TO SELECT<br />

A GROUP OF PROXY COMPANIES TO DETERMINE THE COST OF<br />

EQUITY FOR NORTHWESTERN?<br />

First, it is important to bear in mind that the Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity for a given enterprise<br />

depends <strong>on</strong> the risks attendant to the business in which the company is engaged.<br />

According to financial theory, the value <str<strong>on</strong>g>of</str<strong>on</strong>g> a given company is equal to the<br />

aggregate market value <str<strong>on</strong>g>of</str<strong>on</strong>g> its c<strong>on</strong>stituent business units. The value <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

individual business units reflects the risks and opportunities inherent in the<br />

business sectors in which those units operate. In this proceeding, we are focused<br />

<strong>on</strong> estimating the Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity for the Company's gas distributi<strong>on</strong> operati<strong>on</strong>s in<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. Revert<br />

NorthWestern Energy

Page 9 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11 Q.<br />

12<br />

13<br />

14 A.<br />

15<br />

16<br />

17<br />

18<br />

19 Q.<br />

20<br />

21 A.<br />

22<br />

M<strong>on</strong>tana. Since the ROE is a market-based c<strong>on</strong>cept, and given the fact that the<br />

NorthWestern's M<strong>on</strong>tana jurisdicti<strong>on</strong>al gas operati<strong>on</strong>s do not make up the entirety<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> the publicly traded entity, it is necessary to establish a group <str<strong>on</strong>g>of</str<strong>on</strong>g> companies that<br />

are both publicly traded and comparable to NorthWestern to serve as its "proxy"<br />

for purposes <str<strong>on</strong>g>of</str<strong>on</strong>g> the ROE estimati<strong>on</strong> process.<br />

Even if NorthWestern's assets did c<strong>on</strong>stitute the entirety <str<strong>on</strong>g>of</str<strong>on</strong>g> the Company's<br />

operati<strong>on</strong>s, it is possible that transitory events could bias its market value in <strong>on</strong>e<br />

way or another over a given period <str<strong>on</strong>g>of</str<strong>on</strong>g> time. A significant benefit <str<strong>on</strong>g>of</str<strong>on</strong>g> using a proxy<br />

group, therefore, is to moderate the effects <str<strong>on</strong>g>of</str<strong>on</strong>g> anomalous, temporary events that<br />

may be associated with any<strong>on</strong>e company.<br />

DOES THE SELECTION OF A PROXY GROUP SUGGEST THAT<br />

ANALYTICAL RESULTS WILL BE TIGHTLY CLUSTERED AROUND<br />

AVERAGE (LE., MEAN) RESULTS?<br />

Not necessarily. Notwithstanding the care taken to ensure risk comparability,<br />

market expectati<strong>on</strong>s with respect to future risks and growth opportunities will<br />

vary from company to company. Therefore, even within a group <str<strong>on</strong>g>of</str<strong>on</strong>g> similarly<br />

situated companies, it is comm<strong>on</strong> for analytical results to reflect a seemingly wide<br />

range.<br />

PLEASE NOW PROVIDE A SUMMARY PROFILE OF<br />

NORTHWESTERN.<br />

NorthWestern distributes natural gas to approximately 182,000 customers in<br />

M<strong>on</strong>tana. The Company also serves an additi<strong>on</strong>al 31,000 customers through<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 10 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

c<strong>on</strong>tracts with other distributors. 3<br />

NorthWestern currently has l<strong>on</strong>g-term issuer<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

Q.<br />

A.<br />

credit ratings <str<strong>on</strong>g>of</str<strong>on</strong>g> BBB from Standard & Poor's and Fitch Ratings, and senior<br />

unsecured ratings <str<strong>on</strong>g>of</str<strong>on</strong>g> Baal, BBB and BBB+ from Moody's Investors Service,<br />

Standard & Poor's, and Fitch Ratings, respectively.4<br />

HOW DID YOU SELECT THE COMPANIES INCLUDED IN YOUR<br />

PROXY GROUP?<br />

I began with the universe <str<strong>on</strong>g>of</str<strong>on</strong>g> companies that Value Line classifies as Electric or<br />

Natural Gas Utilities, which includes a group <str<strong>on</strong>g>of</str<strong>on</strong>g> 59 domestic U.S. utilities, and<br />

applied the following screening criteria:<br />

• I excluded companies that do not c<strong>on</strong>sistently pay quarterly cash<br />

dividends;<br />

• I excluded companies not covered by at least two utility industry equity<br />

analysts;<br />

• All <str<strong>on</strong>g>of</str<strong>on</strong>g> the companies in my proxy group have investment grade senior<br />

b<strong>on</strong>d and/or corporate credit ratings from Standard and Poor's;<br />

• To ensure that my proxy group represents natural gas distributi<strong>on</strong><br />

operati<strong>on</strong>s, I included companies with at least 60.00 percent <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

c<strong>on</strong>solidated net operating income derived from regulated natural gas<br />

utility operati<strong>on</strong>s; and<br />

• I eliminated companies that are currently known to be party to a merger,<br />

or other significant transacti<strong>on</strong>.<br />

3<br />

4<br />

NorthWestern Corporati<strong>on</strong>, SEC Form 10-K for the fiscal year ended December 31,2011, at II.<br />

S<strong>on</strong>rce: SNL Financial.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 11 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 Q. DID YOU INCLUDE NORTHWESTERN IN YOUR ANALYSIS?<br />

2 A. No, in order to avoid the circular logic that otherwise would occur, it has been my<br />

3 c<strong>on</strong>sistent practice to exclude the subject company from the proxy group. In any<br />

4 event, the percentage <str<strong>on</strong>g>of</str<strong>on</strong>g> operating income derived from NorthWestern's regulated<br />

5 gas operati<strong>on</strong>s relative to the combined entity would not have met my 60.00<br />

6 percent threshold.<br />

7 Q. WHAT COMPANIES MET THOSE SCREENING CRITERIA?<br />

8 A. The criteria discussed above resulted in a proxy group <str<strong>on</strong>g>of</str<strong>on</strong>g> the following nine<br />

9 companies:<br />

10 Table 1: Proxy Group Screening Results<br />

11<br />

Company<br />

AGL Resources<br />

Atmos Energy<br />

Laclede Group<br />

New Jersey Resources<br />

Northwest Natural Gas<br />

Piedm<strong>on</strong>t Natural Gas<br />

South Jersey Industries<br />

Southwest Gas<br />

Washingt<strong>on</strong> Gas Light<br />

Ticker<br />

GAS<br />

ATO<br />

LG<br />

NJR<br />

NWN<br />

PNY<br />

SIT<br />

SWX<br />

WGL<br />

12 Q. DO YOU BELIEVE THAT A PROXY GROUP OF NINE COMPANIES IS<br />

13 SUFFICIENTLY LARGE?<br />

14 A. Yes, I do. The analyses performed in estimating the ROE are more likely to be<br />

15 representative <str<strong>on</strong>g>of</str<strong>on</strong>g> the subject utility's Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity to the extent that the chosen<br />

16 proxy companies are fundamentally comparable to the subject utility. Because all<br />

17 analysts use some form <str<strong>on</strong>g>of</str<strong>on</strong>g> screening process to arrive at a proxy group, the group,<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 12 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

by definiti<strong>on</strong>, is not randomly drawn from a larger populati<strong>on</strong>. C<strong>on</strong>sequently,<br />

there is no reas<strong>on</strong> to place more reliance <strong>on</strong> the quantitative results <str<strong>on</strong>g>of</str<strong>on</strong>g> a larger<br />

proxy group simply by virtue <str<strong>on</strong>g>of</str<strong>on</strong>g> the resulting larger number <str<strong>on</strong>g>of</str<strong>on</strong>g> observati<strong>on</strong>s.<br />

Moreover, because I am using market-based data, my analytical results<br />

will not necessarily be tightly clustered around a central point. Results that may<br />

be somewhat dispersed, however, do not suggest that the screening approach is<br />

inappropriate or the results less meaningful. In my view, including companies<br />

whose fundamental comparability is tenuous at best simply for the purpose <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

expanding the number <str<strong>on</strong>g>of</str<strong>on</strong>g> observati<strong>on</strong>s does not add relevant informati<strong>on</strong> to the<br />

analysis.<br />

11<br />

VI.<br />

COST OF EOUITY ESTIMATION<br />

12 Q.<br />

13<br />

14 A.<br />

PLEASE BRIEFLY DISCUSS THE ROE IN THE CONTEXT OF THE<br />

REGULATED RATE OF RETURN.<br />

Regulated utilities primarily use comm<strong>on</strong> stock and l<strong>on</strong>g-term debt to finance<br />

15<br />

their permanent property, plant, and equipment.<br />

The overall rate <str<strong>on</strong>g>of</str<strong>on</strong>g> return<br />

16<br />

17<br />

("ROR") for a regulated utility is based <strong>on</strong> its weighted average cost <str<strong>on</strong>g>of</str<strong>on</strong>g> capital, in<br />

which the cost rates <str<strong>on</strong>g>of</str<strong>on</strong>g> the individual sources <str<strong>on</strong>g>of</str<strong>on</strong>g> capital are weighted by their<br />

18<br />

respective book values.<br />

While the costs <str<strong>on</strong>g>of</str<strong>on</strong>g> debt and preferred stock can be<br />

19<br />

20<br />

21 Q.<br />

22 A.<br />

23<br />

directly observed, the Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity is market-based and, therefore, must be<br />

estimated based <strong>on</strong> observable market informati<strong>on</strong>.<br />

HOW IS THE REQUIRED ROE DETERMINED?<br />

The required ROE is estimated by using <strong>on</strong>e or more analytical techniques that<br />

rely <strong>on</strong> market -based data to quantify investor expectati<strong>on</strong>s regarding required<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 13 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

equity returns, adjusted for certain incremental costs and risks. By their very<br />

nature, quantitative models produce a range <str<strong>on</strong>g>of</str<strong>on</strong>g> results from which the market<br />

required ROE must be selected. As discussed throughout my <str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g>,<br />

that selecti<strong>on</strong> must be based <strong>on</strong> a comprehensive review <str<strong>on</strong>g>of</str<strong>on</strong>g> relevant data and<br />

informati<strong>on</strong>, and does not necessarily lend itself to a strict mathematical soluti<strong>on</strong>.<br />

C<strong>on</strong>sequently, the key c<strong>on</strong>siderati<strong>on</strong> in detennining the Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity is to<br />

ensure that the methodologies employed reas<strong>on</strong>ably reflect investors' view <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

financial markets in general, and the subject company (in the c<strong>on</strong>text <str<strong>on</strong>g>of</str<strong>on</strong>g> the proxy<br />

group) in particular.<br />

Although we cannot directly observe the Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity, we can observe<br />

the methods frequently used by analysts to arrive at their return requirements and<br />

expectati<strong>on</strong>s. While investors and analysts tend to use multiple approaches in<br />

developing their estimate <str<strong>on</strong>g>of</str<strong>on</strong>g> return requirements, each methodology requires<br />

certain judgment with respect to the reas<strong>on</strong>ableness <str<strong>on</strong>g>of</str<strong>on</strong>g> assumpti<strong>on</strong>s and the<br />

validity <str<strong>on</strong>g>of</str<strong>on</strong>g> proxies in its applicati<strong>on</strong>. In essence, analysts and academics<br />

understand that ROE models are tools to be used in the ROE estimati<strong>on</strong> process<br />

and that strict adherence to any single approach, or the specific results <str<strong>on</strong>g>of</str<strong>on</strong>g> any<br />

single approach, can lead to flawed and irrelevant c<strong>on</strong>clusi<strong>on</strong>s. That positi<strong>on</strong> is<br />

c<strong>on</strong>sistent with the Hope and Bluefield finding that it is the analytical result, as<br />

opposed to the methodology, that is c<strong>on</strong>trolling in arriving at ROE<br />

determinati<strong>on</strong>s. A reas<strong>on</strong>able ROE estimate therefore c<strong>on</strong>siders alternative<br />

methodologies, observable market data, and the reas<strong>on</strong>ableness <str<strong>on</strong>g>of</str<strong>on</strong>g> their individual<br />

and collective results.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 14 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 In my view, therefore, it is both prudent and appropriate to use multiple<br />

2 methodologies in order to mitigate the effects <str<strong>on</strong>g>of</str<strong>on</strong>g> assumpti<strong>on</strong>s and inputs<br />

3 associated with relying exclusively <strong>on</strong> any single approach. Such use, however,<br />

4 must be tempered with due cauti<strong>on</strong> as to the results generated by each individual<br />

5 approach. As such, I have c<strong>on</strong>sidered the results <str<strong>on</strong>g>of</str<strong>on</strong>g> the C<strong>on</strong>stant Growth and<br />

6 Multi-Stage forms <str<strong>on</strong>g>of</str<strong>on</strong>g> the DCF model, the Capital Asset Pricing Model, and the<br />

7 Risk Premium approach.<br />

8 Quarterly Growth DCF Model<br />

9 Q.<br />

10<br />

11 A.<br />

ARE DCF MODELS WIDELY USED IN REGULATORY<br />

PROCEEDINGS?<br />

Yes, in my experience the DCF model is widely recognized in regulatory<br />

12<br />

proceedings.<br />

N<strong>on</strong>etheless, neither the DCF nor any other model should be<br />

13<br />

14<br />

15 Q.<br />

16 A.<br />

17<br />

18<br />

19<br />

applied without c<strong>on</strong>siderable judgment in the selecti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> data and the<br />

interpretati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> results<br />

PLEASE DESCRIBE THE DCF APPROACH.<br />

The DCF approach is based <strong>on</strong> the theory that a stock's current price represents<br />

the present value <str<strong>on</strong>g>of</str<strong>on</strong>g> all expected future cash flows. In its simplest form, the DCF<br />

model expresses the Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity as the sum <str<strong>on</strong>g>of</str<strong>on</strong>g> the expected dividend yield and<br />

l<strong>on</strong>g-term growth rate, and is expressed as follows:<br />

20<br />

p = ~+~+ ... + D",<br />

(1+k) (1+k)2 (1+k)'"<br />

Equati<strong>on</strong> [1]<br />

21<br />

22<br />

Where P represents the current stock price, Dl ... D", represent expected<br />

future dividends, and k is the discount rate, or required ROE. Equati<strong>on</strong> [1] is a<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. Revert<br />

NorthWestern Energy

Page 15 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

standard present value calculati<strong>on</strong>, which can be simplified and rearranged into<br />

the familiar form:<br />

k -_ Do (Hg) + 9 Equati'<strong>on</strong> [2]<br />

p<br />

Equati<strong>on</strong> [2] <str<strong>on</strong>g>of</str<strong>on</strong>g>ten is referred to as the "C<strong>on</strong>stant Growth DCF" model, in<br />

which the first term is the expected dividend yield and the sec<strong>on</strong>d term is the<br />

expected l<strong>on</strong>g-term growth rate.<br />

In its simplest form, the DCF model expresses the Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity as the<br />

sum <str<strong>on</strong>g>of</str<strong>on</strong>g> the expected dividend yield and l<strong>on</strong>g-term growth rate. However, most<br />

dividend or distributi<strong>on</strong>-paying companies, including utilities, pay dividends <strong>on</strong> a<br />

quarterly, (as opposed to an annual basis). The yield comp<strong>on</strong>ent <str<strong>on</strong>g>of</str<strong>on</strong>g> the Quarterly<br />

Growth DCF model, therefore, accounts for the quarterly payment <str<strong>on</strong>g>of</str<strong>on</strong>g> dividends.<br />

Thus, the Quarterly Growth DCF model incorporates investors' expectati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the<br />

quarterly payment <str<strong>on</strong>g>of</str<strong>on</strong>g> dividends, and the associated quarterly compounding <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

those dividends as they are reinvested at investors' required ROE. As noted by<br />

Dr. Roger Morin:<br />

Clearly, given that dividends are paid quarterly and that the<br />

observed stock price reflects the quarterly nature <str<strong>on</strong>g>of</str<strong>on</strong>g> dividend<br />

payments, the market-required return must recognize quarterly<br />

compounding, for the investor receives dividend checks and<br />

reinvests the proceeds <strong>on</strong> a quarterly schedule ... The annual DCF<br />

model inherently understates the investors' true return because it<br />

assumes all cash flows received by investors are paid annually. 5<br />

23<br />

5<br />

Roger A. Morin, New Regulatory Finance, Public Utility Reports, Inc., 2006 at 344.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. Revert<br />

NorthWestern Energy

Page 16 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 Q. HOW IS THE DIVIDEND YIELD COMPONENT OF THE QUARTERLY<br />

2 GROWTH DCF MODEL CALCULATED?<br />

3 A. The dividend yield is calculated such that it incorporates the time value <str<strong>on</strong>g>of</str<strong>on</strong>g> m<strong>on</strong>ey<br />

4 associated with quarterly compounding. To do so, D comp<strong>on</strong>ent <str<strong>on</strong>g>of</str<strong>on</strong>g> the C<strong>on</strong>stant<br />

5 Growth DCF model is replaced with the following equati<strong>on</strong>:<br />

6 Equati<strong>on</strong> [3]<br />

7 where:<br />

8 db d 2 , d 3 , d 4 = expected quarterly dividends over the coming year<br />

9 k = the required return <strong>on</strong> equity<br />

10 Due to the fact that the required ROE (Ie) is a variable in the dividend calculati<strong>on</strong>,<br />

11 the Quarterly Growth DCF model is solved in an iterative fashi<strong>on</strong>.<br />

12 Dividend Yield and Growth Rates/or the Quarterly DCF Model<br />

13 Q.<br />

14<br />

15 A.<br />

16<br />

17<br />

18<br />

19<br />

20<br />

WHAT MARKET DATA DID YOU USE TO CALCULATE THE<br />

DIVIDEND YIELD IN YOUR QUARTERLY GROWTH DCF MODEL?<br />

To calculate the expected dividends over the coming year for the proxy group<br />

companies (i.e., db d20 d 3 , and d 4 ), I obtained the last four paid quarterly dividends<br />

for each company, and multiplied them by <strong>on</strong>e plus the growth rate (i.e., 1 +g).<br />

For the Po comp<strong>on</strong>ent <str<strong>on</strong>g>of</str<strong>on</strong>g> the dividends yield, I obtained the closing stock prices<br />

over the 30,90, and 180-trading days ended August 31, 2012 for each company in<br />

the proxy group.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. Bevert<br />

NortbWestern Energy

Page 17 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 Q. WHY DID YOU USE THREE AVERAGING PERIODS TO CALCULATE<br />

2 THE AVERAGE STOCK PRICE?<br />

3 A. I did so to ensure that the model's results are not skewed by anomalous events<br />

4 that may affect stock prices <strong>on</strong> any given trading day. At the same time, the<br />

5 averaging period should be reas<strong>on</strong>ably representative <str<strong>on</strong>g>of</str<strong>on</strong>g> expected capital market<br />

6 c<strong>on</strong>diti<strong>on</strong>s over the l<strong>on</strong>g term. In my view, the use <str<strong>on</strong>g>of</str<strong>on</strong>g> the 30-, 90- and 180-day<br />

7 averaging periods reas<strong>on</strong>ably balances those c<strong>on</strong>cerns.<br />

8 Q. IS IT IMPORTANT TO SELECT APPROPRIATE MEASURES OF<br />

9 LONG-TERM GROWTH IN APPLYING THE DCF MODEL?<br />

10 A. Yes. In its C<strong>on</strong>stant Growth form, the DCF model (i.e., as presented in Equati<strong>on</strong><br />

11 [2J above) assumes a single growth estimate in perpetuity. This same assumpti<strong>on</strong><br />

12 is made in the Quarterly Growth DCF model. Accordingly, in order to reduce the<br />

13 l<strong>on</strong>g-term growth rate to a single measure, <strong>on</strong>e must assume a c<strong>on</strong>stant payout<br />

14 ratio, and that earnings per share, dividends per share and book value per share all<br />

15 grow at the same c<strong>on</strong>stant rate. Over the l<strong>on</strong>g term, however, dividend growth<br />

16 can <strong>on</strong>ly be sustained by earnings growth. C<strong>on</strong>sequently, it is important to<br />

17 incorporate a variety <str<strong>on</strong>g>of</str<strong>on</strong>g> measures <str<strong>on</strong>g>of</str<strong>on</strong>g> l<strong>on</strong>g-term earnings growth into the C<strong>on</strong>stant<br />

18 Growth DCF model. That can be accomplished by averaging those measures <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

19 l<strong>on</strong>g-term growth that tend to be least influenced by capital allocati<strong>on</strong> decisi<strong>on</strong>s<br />

20 that companies may make in resp<strong>on</strong>se to near-term changes in the business<br />

21 envir<strong>on</strong>ment. Since such decisi<strong>on</strong>s may directly affect near-term dividend payout<br />

22 ratios, estimates <str<strong>on</strong>g>of</str<strong>on</strong>g> earnings growth are more indicative <str<strong>on</strong>g>of</str<strong>on</strong>g> l<strong>on</strong>g-term investor<br />

23 expectati<strong>on</strong>s than are dividend growth estimates. Therefore, for the purposes <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 18 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3 Q.<br />

4<br />

5<br />

6 A.<br />

the Quarterly Growth DCF model, growth in earmngs per share ("EPS")<br />

represents the appropriate measure <str<strong>on</strong>g>of</str<strong>on</strong>g>l<strong>on</strong>g-term growth.<br />

PLEASE SUMMARIZE THE FINDINGS OF ACADEMIC RESEARCH<br />

ON THE APPROPRIATE MEASURE FOR ESTIMATING EQUITY<br />

RETURNS USING THE DCF MODEL.<br />

The relati<strong>on</strong>ship between various growth rates and stock valuati<strong>on</strong> metrics has<br />

7<br />

8<br />

been the subject <str<strong>on</strong>g>of</str<strong>on</strong>g> much academic research. 6<br />

Charles Phillips in The Ec<strong>on</strong>omics <str<strong>on</strong>g>of</str<strong>on</strong>g> Regulati<strong>on</strong>:<br />

As noted over 40 years ago by<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

For many years, it was thought that investors bought utility stocks<br />

largely <strong>on</strong> the basis <str<strong>on</strong>g>of</str<strong>on</strong>g> dividends. More recently, however, studies<br />

indicate that the market is valuing utility stocks with reference to<br />

total per share earnings, so that the earnings-price ratio has<br />

assumed increased emphasis in rate cases. 7<br />

Philips' c<strong>on</strong>clusi<strong>on</strong> c<strong>on</strong>tinues to hold true. Subsequent academic research<br />

has clearly and c<strong>on</strong>sistently indicated that measures <str<strong>on</strong>g>of</str<strong>on</strong>g> earnings and cash flow are<br />

str<strong>on</strong>gly related to returns, and that analysts' forecasts <str<strong>on</strong>g>of</str<strong>on</strong>g> growth are superior to<br />

17<br />

other measures <str<strong>on</strong>g>of</str<strong>on</strong>g> growth in predicting stock prices. 8<br />

For example, Vander<br />

18<br />

19<br />

Weide and Carlet<strong>on</strong> state that, "[our] results ... are c<strong>on</strong>sistent with the hypothesis<br />

that investors use analysts' forecasts, rather than historically oriented growth<br />

20<br />

calculati<strong>on</strong>s, in making stock buy-and-sell decisi<strong>on</strong>s.,,9<br />

Other research<br />

21<br />

specifically notes the importance <str<strong>on</strong>g>of</str<strong>on</strong>g> analysts' growth estimates in determining the<br />

6<br />

7<br />

9<br />

See, for example, Harris, <str<strong>on</strong>g>Robert</str<strong>on</strong>g>, Using Analysts' Growth Forecasts to Estimate Shareholder Required<br />

Rate <str<strong>on</strong>g>of</str<strong>on</strong>g> Return, Financial Management, Spring 1986.<br />

Charles F. Phillips, Jr., The Ec<strong>on</strong>omics <str<strong>on</strong>g>of</str<strong>on</strong>g> Regulati<strong>on</strong>, Revised Editi<strong>on</strong>, 1969, Richard D. Irwin, Inc., at<br />

285.<br />

See, for example, Christ<str<strong>on</strong>g>of</str<strong>on</strong>g>i, Christ<str<strong>on</strong>g>of</str<strong>on</strong>g>i, Lori and Moliver, Evaluating Comm<strong>on</strong> Stocks Using Value<br />

Line's Projected Cash Flows and Implied Growth Rate, Journal <str<strong>on</strong>g>of</str<strong>on</strong>g> Investing (Spring 1999); Harris and<br />

Marst<strong>on</strong>, Estimating Shareholder Risk Premia Using Analysts' Growth Forecasts, Financial<br />

Management. 21 (Snmmer 1992); and Vander Weide and Carlet<strong>on</strong>, Investor Growth Expectati<strong>on</strong>s:<br />

Analysts vs. History, The Journal <str<strong>on</strong>g>of</str<strong>on</strong>g> Portfolio Management, Spring 1988.<br />

Vander Weide and Carlet<strong>on</strong>, Investor Growth Expectati<strong>on</strong>s: Analysts vs. History, The Journal <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

Portfolio Management, Spring 1988.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 19 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity, and in the valuati<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> equity securities. Dr. <str<strong>on</strong>g>Robert</str<strong>on</strong>g> Harris noted<br />

that "a growing body <str<strong>on</strong>g>of</str<strong>on</strong>g> knowledge shows that analysts' earnings forecast are<br />

indeed reflected in stock prices." Citing Cragg and Malkiel, Dr. Harris notes that<br />

those authors "found that the evaluati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> companies that analysts make are the<br />

sorts <str<strong>on</strong>g>of</str<strong>on</strong>g> <strong>on</strong>es <strong>on</strong> which market valuati<strong>on</strong> is based. ,,10 Similarly, Brigham, Shome<br />

and Vins<strong>on</strong> noted that "evidence in the current literature indicates that (i)<br />

analysts' forecasts are superior to forecasts based solely <strong>on</strong> time series data; and<br />

(ii) investors do rely <strong>on</strong> analysts' forecasts."ll<br />

To that point, the research <str<strong>on</strong>g>of</str<strong>on</strong>g> Carlet<strong>on</strong> and Vander Weide dem<strong>on</strong>strates<br />

that earnings growth projecti<strong>on</strong>s have a statistically significant relati<strong>on</strong>ship to<br />

11<br />

stock valuati<strong>on</strong> levels, while dividend growth projecti<strong>on</strong>s do not. 12<br />

Those<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

findings suggest that investors form their investment decisi<strong>on</strong>s based <strong>on</strong><br />

expectati<strong>on</strong>s <str<strong>on</strong>g>of</str<strong>on</strong>g> growth in earnings, not dividends. C<strong>on</strong>sequently, earnings growth<br />

not dividend growth is the appropriate estimate for the purpose <str<strong>on</strong>g>of</str<strong>on</strong>g> the C<strong>on</strong>stant<br />

Growth DCF model.<br />

Q. PLEASE DESCRIBE THE RETENTION GROWTH ESTIMATE AS<br />

APPLIED IN YOUR QUARTERLY GROWTH DCF MODEL.<br />

A. The Retenti<strong>on</strong> Growth model, which is a generally recognized and widely taught<br />

method <str<strong>on</strong>g>of</str<strong>on</strong>g> estimating l<strong>on</strong>g-term growth, is an alternative approach to the use <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

analysts' earnings growth estimates. In essence, the model is premised <strong>on</strong> the<br />

10 <str<strong>on</strong>g>Robert</str<strong>on</strong>g> S. Harris, Using Analysts' Growth Forecasts to Estimate Shareholder Required Rate <str<strong>on</strong>g>of</str<strong>on</strong>g> Return,<br />

Financial Management, Spring 1986.<br />

II Eugene F. Brigham, Dilip K. Shome, and Steve R. Vins<strong>on</strong>, The Risk Premium Approach to Measuring<br />

a Utility's Cost <str<strong>on</strong>g>of</str<strong>on</strong>g> Equity, Financial Management, Spring 1985.<br />

12<br />

Vander Weide and Carlet<strong>on</strong>, Investor Growth Expectati<strong>on</strong>s: Analysts vs. History, The Journal <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

Portfolio Management, Spring 1988.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 20 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 propositi<strong>on</strong> that a firm's growth is a functi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> its expected earnings, and the<br />

2 extent to which it retains earnings to invest in the enterprise. In its simplest form,<br />

3 the model represents l<strong>on</strong>g-term growth as the product <str<strong>on</strong>g>of</str<strong>on</strong>g> the retenti<strong>on</strong> ratio (i.e.,<br />

4 the percentage <str<strong>on</strong>g>of</str<strong>on</strong>g> earnings not paid out as dividends, referred to below as (''b'')<br />

5 and the expected return <strong>on</strong> book equity (referred to below as "r"). Thus, the<br />

6 simple ''b x r" form <str<strong>on</strong>g>of</str<strong>on</strong>g> the model projects growth as a functi<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> internally<br />

7 generated funds. That form <str<strong>on</strong>g>of</str<strong>on</strong>g> the model is limiting, however, in that it does not<br />

8 provide for growth funded from external equity.<br />

9 The "br + sv" form <str<strong>on</strong>g>of</str<strong>on</strong>g> the Retenti<strong>on</strong> Growth estimate used in my DCF<br />

10 analysis is meant to reflect growth from both internally generated funds (i.e., the<br />

11 "br" term) and from issuances <str<strong>on</strong>g>of</str<strong>on</strong>g> equity (i.e., the "sv" term). The first term, which<br />

12 is the product <str<strong>on</strong>g>of</str<strong>on</strong>g> the retenti<strong>on</strong> ratio (i.e., "b", or the porti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> net income not paid<br />

13 in dividends) and the expected return <strong>on</strong> equity (i.e., "r") represents the porti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

14 net income that is "plowed back" into the Company as a means <str<strong>on</strong>g>of</str<strong>on</strong>g> funding<br />

15 growth. The "sv" term is represented as:<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

(: - 1) x Growth rate in Comm<strong>on</strong> Shares Equati<strong>on</strong> [4]<br />

where : is the Market-to-Book ratio.<br />

In this form, the "sv" term reflects an element <str<strong>on</strong>g>of</str<strong>on</strong>g> growth as the product <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

(a) the growth in shares outstanding, and (b) that porti<strong>on</strong> <str<strong>on</strong>g>of</str<strong>on</strong>g> the market-to-book<br />

ratio that exceeds unity. As shown in Exhibit No. RBH-3, all <str<strong>on</strong>g>of</str<strong>on</strong>g> the comp<strong>on</strong>ents<br />

<str<strong>on</strong>g>of</str<strong>on</strong>g> the Retenti<strong>on</strong> Growth Model can be derived from data provided by Value Line.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 21 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 Q. HOW DID YOU CALCULATE THE mGH AND LOW DCF RESULTS?<br />

2 A. I calculated the proxy group mean high DCF result using the maximum EPS<br />

3 growth rate as reported by Value Line, Zack's, First Call and the retenti<strong>on</strong> growth<br />

4 estimate for each proxy group company in combinati<strong>on</strong> with the dividend yield<br />

5 for each <str<strong>on</strong>g>of</str<strong>on</strong>g> the proxy group companies. The average mean high result then<br />

6 reflects the average maximum DCF result for the proxy group as a whole. I used<br />

7 a similar approach to calculate the proxy group mean low results, using instead<br />

8 the minimum growth rate as reported by Value Line, Zack's, First Call and the<br />

9 retenti<strong>on</strong> growth estimate for each proxy group company.<br />

10 Results for the Quarterly Growth DCF Model<br />

11 Q. WHAT ARE THE RESULTS OF YOUR QUARTERLY GROWTH DCF<br />

12 ANALYSIS?<br />

13 A. As shown in Table 2 (below) (see also Exhibit No. RBH-l), the mean Quarterly<br />

14 Growth DCF results for my proxy group are 9.00 percent, 9.11 percent, and 9.09<br />

15 percent for the 30, 90, and l80-trading day periods, respectively. The mean high<br />

16 DCF result for the 30, 90, and 180-day averaging periods are 11.00 percent, 11.11<br />

17 percent, and 11.09 percent, respectively.<br />

18 Table 2: Quarterly Growth DCF Results<br />

30-Day Average<br />

90-Day Average<br />

180-Day Average<br />

Mean Low<br />

Mean<br />

7.34% 9.00%<br />

7.44% 9.11%<br />

7.42% 9.09%<br />

Mean Hiah<br />

11.00%<br />

11.11%<br />

11.09%<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 22 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 C<strong>on</strong>stant Growth DCF Model<br />

2 Q. WHAT ASSUMPTIONS ARE REQUIRED FOR THE CONSTANT<br />

3 GROWTH DCF MODEL?<br />

4 A. The C<strong>on</strong>stant Growth DCF model requires the following assumpti<strong>on</strong>s: (1) a<br />

5 c<strong>on</strong>stant average growth rate for earnings and dividends; (2) a stable dividend<br />

6 payout ratio; (3) a c<strong>on</strong>stant price-to-earnings multiple; and (4) a discount rate<br />

7 greater than the expected growth rate.<br />

8 Dividend Yield and Growth Rates for the C<strong>on</strong>stant Growth DCF Model<br />

9 Q.<br />

10<br />

11 A.<br />

12<br />

13<br />

14 Q.<br />

15<br />

16 A.<br />

17<br />

WHAT MARKET DATA DID YOU USE TO CALCULATE THE<br />

DIVIDEND YIELD COMPONENT OF YOUR DCF MODEL?<br />

The dividend yield is based <strong>on</strong> the proxy companies' current annualized dividend,<br />

and average closing stock prices over the 30, 90, and 180-trading days as <str<strong>on</strong>g>of</str<strong>on</strong>g><br />

August 31,2012.<br />

DID YOU MAKE ANY ADJUSTMENTS TO THE DIVIDEND YIELD TO<br />

ACCOUNT FOR PERIODIC GROWTH IN DIVIDENDS?<br />

Yes, I did. Since utility companies tend to increase their quarterly dividends at<br />

different times throughout the year, it is reas<strong>on</strong>able to assume that dividend<br />

18<br />

increases will be evenly distributed over calendar quarters.<br />

Given that<br />

19<br />

assumpti<strong>on</strong>, it is appropriate to calculate the expected dividend yield by applying<br />

20<br />

<strong>on</strong>e-half <str<strong>on</strong>g>of</str<strong>on</strong>g> the l<strong>on</strong>g-term growth rate to the current dividend yield. 13<br />

That<br />

21<br />

adjustment ensures that the expected dividend yield is, <strong>on</strong> average, representative<br />

13 See Exhibit No. RBH-2.<br />

<str<strong>on</strong>g>Direct</str<strong>on</strong>g> <str<strong>on</strong>g>Testim<strong>on</strong>y</str<strong>on</strong>g> <str<strong>on</strong>g>of</str<strong>on</strong>g> <str<strong>on</strong>g>Robert</str<strong>on</strong>g> B. <str<strong>on</strong>g>Hevert</str<strong>on</strong>g><br />

NorthWestern Energy

Page 23 <str<strong>on</strong>g>of</str<strong>on</strong>g>63<br />

1 <str<strong>on</strong>g>of</str<strong>on</strong>g> the coming twelve-m<strong>on</strong>th period, and does not overstate the dividends to be<br />