Capital Budgeting Practice Problems - Building The Pride

Capital Budgeting Practice Problems - Building The Pride

Capital Budgeting Practice Problems - Building The Pride

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

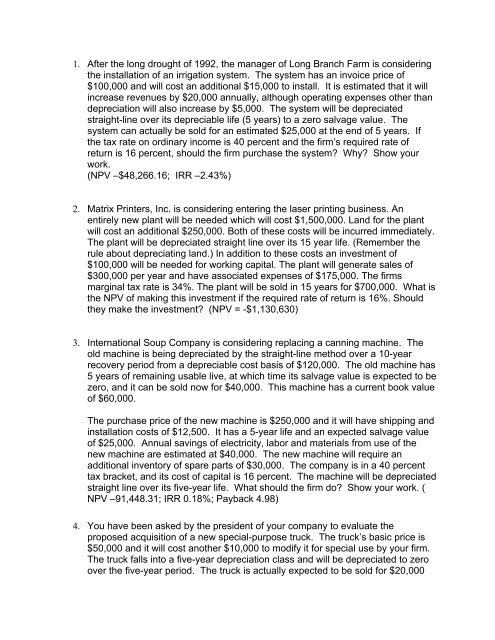

1. After the long drought of 1992, the manager of Long Branch Farm is considering<br />

the installation of an irrigation system. <strong>The</strong> system has an invoice price of<br />

$100,000 and will cost an additional $15,000 to install. It is estimated that it will<br />

increase revenues by $20,000 annually, although operating expenses other than<br />

depreciation will also increase by $5,000. <strong>The</strong> system will be depreciated<br />

straight-line over its depreciable life (5 years) to a zero salvage value. <strong>The</strong><br />

system can actually be sold for an estimated $25,000 at the end of 5 years. If<br />

the tax rate on ordinary income is 40 percent and the firm’s required rate of<br />

return is 16 percent, should the firm purchase the system? Why? Show your<br />

work.<br />

(NPV –$48,266.16; IRR –2.43%)<br />

2. Matrix Printers, Inc. is considering entering the laser printing business. An<br />

entirely new plant will be needed which will cost $1,500,000. Land for the plant<br />

will cost an additional $250,000. Both of these costs will be incurred immediately.<br />

<strong>The</strong> plant will be depreciated straight line over its 15 year life. (Remember the<br />

rule about depreciating land.) In addition to these costs an investment of<br />

$100,000 will be needed for working capital. <strong>The</strong> plant will generate sales of<br />

$300,000 per year and have associated expenses of $175,000. <strong>The</strong> firms<br />

marginal tax rate is 34%. <strong>The</strong> plant will be sold in 15 years for $700,000. What is<br />

the NPV of making this investment if the required rate of return is 16%. Should<br />

they make the investment? (NPV = -$1,130,630)<br />

3. International Soup Company is considering replacing a canning machine. <strong>The</strong><br />

old machine is being depreciated by the straight-line method over a 10-year<br />

recovery period from a depreciable cost basis of $120,000. <strong>The</strong> old machine has<br />

5 years of remaining usable live, at which time its salvage value is expected to be<br />

zero, and it can be sold now for $40,000. This machine has a current book value<br />

of $60,000.<br />

<strong>The</strong> purchase price of the new machine is $250,000 and it will have shipping and<br />

installation costs of $12,500. It has a 5-year life and an expected salvage value<br />

of $25,000. Annual savings of electricity, labor and materials from use of the<br />

new machine are estimated at $40,000. <strong>The</strong> new machine will require an<br />

additional inventory of spare parts of $30,000. <strong>The</strong> company is in a 40 percent<br />

tax bracket, and its cost of capital is 16 percent. <strong>The</strong> machine will be depreciated<br />

straight line over its five-year life. What should the firm do? Show your work. (<br />

NPV –91,448.31; IRR 0.18%; Payback 4.98)<br />

4. You have been asked by the president of your company to evaluate the<br />

proposed acquisition of a new special-purpose truck. <strong>The</strong> truck’s basic price is<br />

$50,000 and it will cost another $10,000 to modify it for special use by your firm.<br />

<strong>The</strong> truck falls into a five-year depreciation class and will be depreciated to zero<br />

over the five-year period. <strong>The</strong> truck is actually expected to be sold for $20,000

after three years when the project is ended. Use of the truck will require an<br />

increase in net working capital of $2,000 (spare parts). <strong>The</strong> truck will have no<br />

effect on revenue, but it is expected to save the firm $22,000 per year in beforetax<br />

operating costs, mainly labor. <strong>The</strong> firm’s marginal tax rate is 40 percent and<br />

the required rate of return on the project is 13 percent. What should you do?<br />

(NPV -$3143.27; IRR 10.39%)<br />

5. Blue Note Jazz Productions has decided to cash in on the country craze by<br />

starting a subsidiary that will promote concerts by "Country Jazz" artists for the<br />

next three years. <strong>The</strong> country music boom is expected to subside by this time<br />

and the subsidiary will be folded. Blue Note expects that average ticket prices will<br />

be $35 and that ticket sales for the three years will be 300,000 tickets per year.<br />

Fixed cost each year are expected to be $3,000,000 and variable costs are<br />

expected to be 25% of sales. <strong>The</strong> subsidiary will need $4,000,000 in new<br />

equipment to start up and requires a $300,000 investment in working capital. <strong>The</strong><br />

$4,000,000 in equipment will be depreciated straight-line over five years to a zero<br />

salvage value, but will be sold at the end of three years for an estimated<br />

$1,500,000. <strong>The</strong> firm's marginal tax rate is 40%. What is the NPV of this new<br />

investment if the firm's required rate of return is 12%? What is the IRR? Should<br />

the project be accepted?<br />

(IRR 37.20%; NPV $2,276,314.23; MIRR 29.04%)<br />

6. Southwest Airlines is considering the purchase of a new baggage-handling<br />

machine that moves bags quicker and with less damage. <strong>The</strong> cost is $160,000.<br />

<strong>The</strong> machine will be depreciated using the straight line method over its seven<br />

year life. If the machine is purchased, SWA will save $31,000 per year in<br />

damaged bags costs during the first five years. Because of higher maintenance<br />

costs during the last two years the savings will only be $28,000. the firm is in<br />

a34% tax bracket. Given that the firm’s required rate of return is 13%, compute<br />

the NPV and IRR of the investment. Should they make the investment? (NPV –<br />

36,936.03; IRR 5.08%)

7. Ball Corporation is currently evaluating two mutually exclusive projects which<br />

have the following net cash flows:<br />

A<br />

B<br />

0 -$5,000 -$10,000<br />

1 3,000 3,500<br />

2 3,000 3,500<br />

3 3,000 3,500<br />

4 3,500<br />

5 3,500<br />

6 3,500<br />

Both projects have a cost of capital of 10 percent. Totally new equipment must<br />

be procured in 6 years, but Project A would be replicated if it were chosen.<br />

Which project should Ball select, and why?<br />

8. Sony Corporation is considering the purchase of a new phone system for a sales<br />

office in Boise, Idaho. <strong>The</strong> Lucent Technologies system costs $54,000, has<br />

annual operating expenses of $4,000 and an expected life of 9 years. <strong>The</strong><br />

Toshiba system has a cost of $48,000, annual operating expenses of $4,000 and<br />

an expected life of 7 years. Ignoring depreciation and taxes and assuming a cost<br />

of capital of 9 percent for such an investment, which system should Sony<br />

purchase? You are free to use either replacement chain or EAA/EAC analysis.<br />

( Lucent EAA -13,007.14, NPV-77,980.99; Toshiba EAA -13,537.14, NPV -<br />

68,131.81)<br />

9. A small real estate office needs a new copier. <strong>The</strong>y have their choice between<br />

leasing a new copier for $2,000 per year with all maintenance included or they<br />

can purchase their own copier for $4,200 and would incur $1,200 per year in<br />

operating costs. Paper and cartridge costs for the copier would be identical in<br />

either case. <strong>The</strong> lease would be for a total of 6 years and the copier, if bought,<br />

would have a useful life of 6 years and no expected salvage value at the end of<br />

that time. Determine if owning the machine would be cheaper on a per-year basis<br />

than leasing the machine. <strong>The</strong>n firm’s tax rate is 34% and the proper required<br />

rate of return for the project would be 7%. (Annual after-tax cost of lease is<br />

$1,320 per year. NPV for purchase of copier is -$6840.66 giving an EAC of<br />

$1,435.14 per year. Take the one with the lowest annual cost – the lease.)<br />

10. You have become very successful and are considering the purchase of a plane<br />

for your firm. <strong>The</strong> Piper model has an initial cost of $375,000, annual operating<br />

costs of $24,000 and a salvage value of $150,000. Its estimated holding period<br />

is 7 years. <strong>The</strong> Cessna model has an initial cost of $325,000, but annual<br />

operating costs of $29,500 and an estimated salvage value of $100,000. Its<br />

estimated holding period is 8 years. Your cost of capital is fifteen percent.<br />

Ignoring depreciation and taxes, which model would be the best choice assuming<br />

they both would perform the required tasks?