Handling Full Set Accounts

Handling Full Set Accounts

Handling Full Set Accounts

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

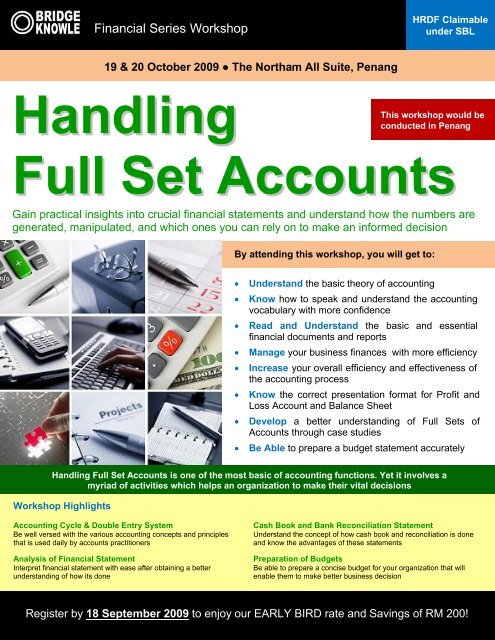

Financial Series Workshop<br />

HRDF Claimable<br />

under SBL<br />

19 & 20 October 2009 ● The Northam All Suite, Penang<br />

<strong>Handling</strong><br />

This workshop would be<br />

conducted in Penang<br />

<strong>Full</strong> <strong>Set</strong> <strong>Accounts</strong><br />

Gain practical insights into crucial financial statements and understand how the numbers are<br />

generated, manipulated, and which ones you can rely on to make an informed decision<br />

By attending this workshop, you will get to:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Understand the basic theory of accounting<br />

Know how to speak and understand the accounting<br />

vocabulary with more confidence<br />

Read and Understand the basic and essential<br />

financial documents and reports<br />

Manage your business finances with more efficiency<br />

Increase your overall efficiency and effectiveness of<br />

the accounting process<br />

Know the correct presentation format for Profit and<br />

Loss Account and Balance Sheet<br />

Develop a better understanding of <strong>Full</strong> <strong>Set</strong>s of<br />

<strong>Accounts</strong> through case studies<br />

Be Able to prepare a budget statement accurately<br />

<strong>Handling</strong> <strong>Full</strong> <strong>Set</strong> <strong>Accounts</strong> is one of the most basic of accounting functions. Yet it involves a<br />

myriad of activities which helps an organization to make their vital decisions<br />

Workshop Highlights<br />

Accounting Cycle & Double Entry System<br />

Be well versed with the various accounting concepts and principles<br />

that is used daily by accounts practitioners<br />

Analysis of Financial Statement<br />

Interpret financial statement with ease after obtaining a better<br />

understanding of how its done<br />

Cash Book and Bank Reconciliation Statement<br />

Understand the concept of how cash book and reconciliation is done<br />

and know the advantages of these statements<br />

Preparation of Budgets<br />

Be able to prepare a concise budget for your organization that will<br />

enable them to make better business decision<br />

Register by 18 September 2009 to enjoy our EARLY BIRD rate and Savings of RM 200!

Introduction<br />

Good record keeping is an essential function in any business and failure<br />

to do so may result in poor business decision, inadequate financial<br />

records for regulatory bodies (i.e. IRB) or worst misuse of company<br />

funds by employees or any other parties. Proper financial record<br />

keeping on the other hand helps the company in many ways including:<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Obtain sound knowledge on keeping full set of financial<br />

records for your company<br />

Learn to effectively manage the accounting system in<br />

your organization<br />

Discover ways to plan, organize and improve<br />

accounting records for increased effectiveness of your<br />

accounts department<br />

Be Skilled in analyzing and preparing accounting<br />

features like books of accounts, financial statements and<br />

other financial reports<br />

<br />

<br />

<br />

<br />

Preparation of accurate and timely financial statements<br />

Highlights both the strong and weak phases of one’s company<br />

Provide valuable information for executives to make sound<br />

business decision<br />

Obtaining financing from banks and providing confidence from<br />

your creditors on your business ventures<br />

Ensure accurate and complete tax return to avoid being audited or<br />

penalized by the Inland Revenue Board (IRB)<br />

It is therefore critical for all Finance and Accounting professionals to<br />

have a good basic knowledge on how to prepare full set accounts.<br />

Manager and Executive must also be aware of the implications of their<br />

existing accounting practices and how it would impact the organization<br />

operations on the whole.<br />

This workshop aims to provide participants with a detailed<br />

understanding of the documentation and recording process by which<br />

business transactions work their way from initial recognition to the<br />

preparation of financial statements. It also seeks to address the various<br />

issues, complications and challenges that accounting professional face<br />

on a daily basis.<br />

CALCULATOR - Please bring along your calculators as<br />

you would be performing computation from case studies<br />

and exercises provided by trainer.<br />

Key Benefits of Attending<br />

Make effective and efficient business decisions base on<br />

accurate and timely data<br />

Be Aware of any potential problems which may arise in<br />

your accounts department that may have an impact on<br />

your business decision<br />

Know the purpose and the need to analyze financial<br />

statement and the importance of it<br />

Familiarize yourself with the double entry system<br />

Day One<br />

9.00 am<br />

What is Accounting? The<br />

Fundamentals<br />

<br />

<br />

<br />

<br />

The Need for Preparing <strong>Accounts</strong><br />

Users of Accounting Information<br />

Qualities of Good Accounting<br />

Information<br />

Accounting Information for Decision<br />

Making<br />

10.30 am Tea Break<br />

10.40 am<br />

Starting a Business<br />

<br />

<br />

Group Activity and Discussion<br />

Factors to Consider<br />

Different Types of Businesses<br />

Structures and Accounting<br />

Implications<br />

<br />

<br />

<br />

Limited Liability Companies<br />

Partnerships<br />

Sole Proprietorships<br />

1.00 pm Lunch<br />

2.00 pm<br />

Key Components of Financial<br />

Statements<br />

<br />

<br />

<br />

<br />

<br />

Balance Sheet<br />

Income Statement<br />

Statement of Changes in Equity<br />

Cash Flow Statement<br />

Notes to the Financial Statement<br />

Double Entry System & Implications<br />

<br />

<br />

Recording in Accounting Records<br />

(Ledgers)<br />

Effects of Business Transactions<br />

3.30 pm Afternoon Tea Break<br />

3.40 pm<br />

Five Important Terms in Accounting<br />

<br />

<br />

<br />

<br />

<br />

Asset<br />

Liability<br />

Equity<br />

Income<br />

Expenses<br />

The Trial Balance<br />

<br />

<br />

Extracting a Trial Balance<br />

Balancing <strong>Accounts</strong> and Preparing<br />

Trial Balance to ensure Accuracy of<br />

Double Entry System<br />

Question and Answer Session

Day Two<br />

9.00 am<br />

Property, Plant and Equipment<br />

<br />

<br />

<br />

Depreciation<br />

Disposal<br />

Profit / Loss on Disposal<br />

10.30 am Morning Tea Break<br />

10.40 am<br />

Capital and Revenue Expenditure<br />

<br />

Inventory<br />

<br />

<br />

Effect of Wrong Classification<br />

Valuation Methods<br />

Effect on Profitability<br />

Accounting Conventions &<br />

Concepts<br />

<br />

<br />

<br />

<br />

<br />

Going Concerns<br />

Prudence<br />

Consistency<br />

Historical Cost<br />

Accruals / Matching<br />

1.00 pm Lunch<br />

2.00 pm<br />

Accounting Controls<br />

Bank Reconciliation Statements –<br />

Detection & Prevention of Fraud<br />

Control <strong>Accounts</strong><br />

Preparing Balance Sheet and<br />

Income Statement<br />

<br />

Activity on Preparing Balance<br />

Sheet and Income Statement of a<br />

Company<br />

3.30 pm Afternoon Tea Break<br />

3.40pm<br />

Presentation and Disclosures<br />

<br />

Discussion on Different Formats<br />

of Presentation<br />

Analysis of Financial Statements<br />

<br />

<br />

<br />

The Need and Purpose of<br />

Analyzing Financial Statements<br />

Important Accounting Ratios<br />

Activity on Interpreting a <strong>Set</strong> of<br />

Financial Statements<br />

Discussion of Case Studies and<br />

Best Practices<br />

Question & Answer Session, Course<br />

Evalation and End<br />

<br />

<br />

<br />

<br />

<br />

The objective of this workshop is to enable participants:<br />

<br />

<br />

<br />

<br />

Accounting Executives, Officers & Clerks<br />

Accounting Managers & Supervisors<br />

Human Resource & Administrative Managers & Executives<br />

Secretaries & Office Administrators<br />

Directors & Business Owners<br />

Who Should Attend<br />

Managers & Executives with limited knowledge on Accounting<br />

and wish to improve their knowledge on existing practices<br />

Speaker’s Profile<br />

Mr. Yoga Thevan is a Chartered Management<br />

Accountant by training. He holds an MBA from<br />

Strathclyde University Graduate School of Business<br />

in United Kingdom. During his early years, he served<br />

in many positions in a wide range of industries. He<br />

later furthered his studies in United Kingdom from<br />

1990 to 1992.<br />

Upon his return, he joined a Merchant Bank as an Audit Officer. He left<br />

the role as Head of the finance function of a factory in a Japanese<br />

Manufacturing Company in 2002. Besides auditing the banking<br />

operations, he was also seconded to their stock broking subsidiary<br />

during his stint at the Merchant Bank. This enhanced his hands-on<br />

knowledge in the back room operations of the financial services sector.<br />

No doubt, the manufacturing industry is the most challenging arena for<br />

accountants and Yoga had proven himself right from the initial phase of<br />

starting up the finance department of a new business, doing the<br />

rudiments of stock check and material flow planning to the setting up of<br />

a new MRP System a few years later. He is very thorough with the<br />

Business Planning process and chaired the Monthly Financial Review<br />

Meetings. During his tenure, he was also selected to attend an<br />

International Financial Management Programme in Osaka, Japan.<br />

In March 1997, he conducted AAT (Association of Accounting<br />

Technicians) with an Information Management workshop. He was called<br />

upon to host Strategic Business Review Videos for CIMA members.<br />

Besides this, he also reviewed Exposure Drafts of accounting standards<br />

for MASB (Malaysian Accounting Standards Board) before it was<br />

converted for the accounting standard. Yoga is a highly experienced<br />

trainer in the area of Corporate Finance and has received many<br />

excellent reviews from previous participants.<br />

Workshop Objectives<br />

Handle their company accounts with a greater confidence<br />

Gain knowledge in keeping full set of financial accounts to<br />

enable one to make better managerial decisions<br />

Understand the problematic areas in the accounts department<br />

and obtain solutions to unique problems<br />

Be able to maintain an effective accounting system for your<br />

organization with more efficiency

Workshop Details<br />

<strong>Handling</strong> <strong>Full</strong> <strong>Set</strong> <strong>Accounts</strong><br />

Date: 19 & 20 October 2009<br />

Time: 9 am – 5 pm<br />

Venue: The Northam All Suite, Penang<br />

Includes: Materials, Certificate, Lunch, Tea Breaks & Refreshments<br />

Contact Us<br />

Fax to : (03) 4270 3059<br />

Tel : (03) 4270 3013 / 3086<br />

Consultants : Ms. Diana Abdullah<br />

Email : diana@bridgeknowle.com<br />

Conf. Code: FN179EM<br />

Address : Bridge Knowle Events (M) Sdn Bhd<br />

Block B – 8/3, Jalan Selaman 1, Dataran Palma,<br />

(Off Jalan Ampang), 68000 Ampang, Selangor<br />

Company Details<br />

Registration Fee (per participant)<br />

Company:<br />

Address:<br />

Regular Fee<br />

(after 18 Sep 2009)<br />

Early Bird Fee<br />

(by 18 Sep 2009)<br />

RM 1480 1280<br />

Main Contact Person:<br />

Designation:<br />

Tel:<br />

Email:<br />

Authorized Signature:<br />

Company Stamp:<br />

Fax:<br />

No. of<br />

participants<br />

Total (RM)<br />

Payment Method (Please Tick)<br />

By Cheque<br />

Amount RM: __________________<br />

Bank: ____________ Cheque No: __________________<br />

Please Invoice Us<br />

Invoice to (Company Name):<br />

_______________________________________________<br />

Participant 1<br />

<strong>Full</strong> Name:<br />

Designation:<br />

Tel:<br />

Email:<br />

Participant 2<br />

<strong>Full</strong> Name:<br />

Designation:<br />

Tel:<br />

Email:<br />

Participant 3<br />

<strong>Full</strong> Name:<br />

Designation:<br />

Tel:<br />

Email:<br />

Fax:<br />

Fax:<br />

Fax:<br />

Terms & Conditions<br />

Registration & Fees Policy. Registration is confirmed once registration form is<br />

received via phone / fax / email / mail. <strong>Full</strong> payment must be made before program<br />

commence. The corporate Early Bird Rate only applies if registration form is received<br />

by 18 September 2009. Please send cheque or bank draft to the address above. All<br />

cheques should be crossed, marked A/C payee only and made payable to:<br />

Bridge Knowle Events (M) Sdn Bhd<br />

Cancellation Policy. A minimum of 10% administrative charge will be levied on all<br />

cancellations. Any cancellation must be received in writing within 8 working days<br />

prior to the event else full payment will be imposed. A substitute delegate is<br />

welcomed if substitution is received in writing before the program. Any no-show by<br />

registered delegates will be liable for full payment of the program fees.<br />

Disclaimer & Program Changes Policy. Bridge Knowle Events reserves the right to<br />

amend or cancel the event due to circumstances beyond its control. In the event of<br />

such, Bridge Knowle Events will provide an alternative arrangement to the<br />

delegate(s). Upon registration, you are deemed to have understood and agreed to<br />

the above terms and conditions.<br />

Hotel Accommodation, Parking, Special Meal Arrangements & Others. For<br />

accommodation reservations, kindly book directly with the hotel venue above and<br />

quote that you are a participant of Bridge Knowle Events to enjoy our Corporate<br />

Rates. You may also email us your reservations in which we will forward it to the<br />

hotel. All hotel accommodation bills and arrangements will be settled by the<br />

delegates directly with the hotel. Parking is available at a flat rate for participants. For<br />

special meal requirements (i.e. vegetarian), the organizer should be notified prior to<br />

the program and this is subject to availability from the hotel. For any other special<br />

arrangements, do notify us at least 3 working days prior to the program.<br />

Bridge Knowle Events (M) Sdn Bhd (Company Registration No. 789008-H) provide valuable workshops,<br />

seminars, conferences and training programs to help delegates enhance their skills and knowledge which will<br />

take them to a higher level. Our experience in a full array of professional programs includes critical business<br />

areas such as Finance, Accounting, Tax, Information Technology, Engineering, Quality, International Trade &<br />

Logistics, Human Resource and Management Strategies.