Approaches

Approaches - Halifax Stanfield International Airport

Approaches - Halifax Stanfield International Airport

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OUR PEOPLE – Burton Wright, Ken Champion, Charles Clow, Mel Dinney, Bruce Loveridge, Twila Grosse, Donald Myers,<br />

Stephen Whalen, Joey MacPherson, Douglas Kinsman, Edward Dempsey, Todd Ball, Karen Harrie, Stephanie Gorman,<br />

Rick Garson, James Moulton, Paul Hood, Alastair Cox, Keith Conner, Thomas Morris, Robert Ettinger, Shawn Hicks,<br />

William D. Turple, Leigh Robinson, Lydia Bowie, Kim Oakley, Malcolm Phippen, Melissa Foley, Clayton Maynard, Jerry<br />

Staples, Harry McMullen, Deborah MacLeod, Kellie Hannam, Anita Chisholm, Kenneth Bayers, Eleanor Humphries, Laine<br />

Peters, Christopher Ball, Allan Pace, Garry Parsons, Reg Beeler, Steven Hilchie, Vernon Myers, Leonard Brown, William<br />

Cowan, Mike Sweet, Gilbert Chandler, Angela Hartt, Dan Tanner, Paula Cannon, Dan Pride, Cathy Walker, Joseph Young,<br />

Richard Gooding, Paul Tuttle, Jeff MacMillan, Brian Cutler, Peter Snair, Janet Ingraham, Kelly Martin, Rachael Robinson,<br />

Jamie Wilkins, Gary Christian, Robert Silver, Gary Porter, Michael Healy, Peter Clarke, Brian Gillette, Steven Nelson,<br />

Aaron Whynder, Tim Fisher,<br />

David Brown, Blair Christian,<br />

2007 WAS ALL ABOUT GETTING THE APPROACH<br />

Stephen Bezanson, Chris<br />

Catherine Huddleston, Wayne<br />

Collier, Thomas Maguire,<br />

RIGHT: DOING THE THINKING AND PLANNING<br />

DeCoste, Doug Eisan, Ron<br />

Barry Carroll, Alex Skinner, TO TAKE US TO THE NEXT STAGE OF CUSTOMER Conway, Larry Naugle, Peter<br />

Tom Murray, Sean Dempsey,<br />

Sworin, Jeremy Carrier, Paul<br />

SERVICE EXCELLENCE. THAT’S WHY “APPROACHES”<br />

Esther MacDonald, Carol<br />

Dalrymple, William Wellwood,<br />

IS THE THEME FOR THIS YEAR’S ANNUAL REPORT.<br />

Mackie, Catherine Towers,<br />

William A. Turple, Tim Zinck,<br />

Randall Clooney, Marcel Laforest, Greg Shackleton, Terry Hilchey, Delbert Geddry, Anil Mohan, John Melbourne, Milly<br />

Hardwick, Dean Letto, Howard Rose, Judy Snair, Barry Woynar, Art Nowen, David Dawe, Mario Carbonneau, Jane Scott,<br />

Frank Leavitt, Clifford Gillie, Joyce Carter, Don Lajoie, Roxanne Hilchie, Bill Crosman, James McKee, Bruce Gaudet, Michael<br />

MacEwan, Joseph MacLean, Kelly Zwicker, Theresa Conway, Mike Maxwell, Reg Verge, Shawn Delong, Troy Appleby, Donna<br />

Anderson, Tony McMillen, Kim Keeling, Robert Clarke, Mark Bowser, Rick Wyatt, Stephen Fudge, Kevin Mosher, Tonya<br />

McLellan, Kim Porter, Gord Duke, Larry Butler, Derek Forrest, Ivan Frame, Jack Weir, Timothy Bull, Andy Lyall, Kevin<br />

Boutilier, Alan O’Leary, Rhonda Brassard, Janet Menzies, Lee Nolter, Drake Clarke, Joyce Hoskin, Cecillia Anderson,<br />

Arnold Wood, Norman Ross, Mike Hartlen, Dave Snow, Nancy Fong, John Young, Michael Stewart, Richard Boutilier,<br />

Ron Moakler, Sherrie Clow, Peter Spurway, Karen Sinclair. (AS OF DECEMBER 31, 2007)

APPROACHING OUR DESTINATION<br />

Message from the Chair<br />

Frank Matheson<br />

For Atlantic Canada’s gateway airport, 2007 can<br />

best be described as a foundation-building year.<br />

A year where we consolidated the gains from our<br />

most recent phase of development and laid the<br />

groundwork for the next.<br />

Those following our progress will know that<br />

over the past few years we dramatically transformed<br />

the inside of our terminal and significantly<br />

upgraded our airside facilities. Much of that work<br />

was completed in 2006.<br />

In 2007, we geared up for our next stage of<br />

development. Our focus turned to the outside<br />

of the terminal, or “groundside”, as we finalized<br />

plans for an $82 million development that will<br />

include a large, new parking structure; enhancements<br />

to the roadway system; services for a new<br />

hotel; and other improvements that will complement<br />

the significant expansion of facilities and<br />

services in our terminal building.<br />

During the past 12 months, we also finalized<br />

plans for two other major projects that will take<br />

shape in 2008: a state-of-the-art, multi-tenant<br />

cargo facility and a much-needed combined services<br />

complex, housing our maintenance facility as<br />

well as our fire and emergency response services.<br />

As anyone who’s worked on a major project knows,<br />

the front-end part of the process – the planning,<br />

analyses, consultations, and approvals – is critical<br />

to project success. Getting it right at this stage paves<br />

the way for a smooth construction phase.<br />

And that’s why “<strong>Approaches</strong>” makes so much<br />

sense as the theme for this year’s annual report.<br />

2007 was all about getting the approach right: doing<br />

the thinking and planning to take us to the next<br />

stage of customer service excellence. You could<br />

think of it as a year of steady, focused progress.<br />

Fittingly, in February 2007, we renamed our<br />

airport to recognize the Right Honourable Robert<br />

L. Stanfield, one of our province’s and our country’s<br />

finest leaders and staunchest advocates, and<br />

a much-loved Canadian. Our Halifax Stanfield<br />

International Airport (HSIA) stands as an enduring<br />

tribute to his far-reaching vision.<br />

In August, our President & CEO, Eleanor<br />

Humphries, resigned. I want to express our thanks for<br />

what was accomplished during her two-year tenure.<br />

Halifax International Airport Authority’s Vice<br />

President, Finance and Chief Financial Officer,<br />

Joyce Carter, ably took the helm as Interim President<br />

& CEO for the remainder of the year. Her<br />

experience as a member of our executive management<br />

team served our partners, our customers<br />

and our organization well during this period, and<br />

I want to sincerely thank Joyce for her hard work,<br />

leadership and dedication.<br />

In January 2008, we welcomed Tom Ruth as our<br />

new President & CEO. Tom brings an outstanding<br />

record of achievement with two airlines, Canadian<br />

North and Northwest Airlines; a container ship<br />

firm, Oceanex; and an international logistics<br />

company, Livingston International. Tom’s the right<br />

person with the right skills and experience to take<br />

HIAA through the next stage of our development –<br />

and beyond. We are honoured he’s come on board.<br />

We also welcomed two new members to the<br />

HIAA Board of Directors in 2007: Michele A. Wood-<br />

Tweel, CEO and Executive Director of the Institute of<br />

Chartered Accountants of Nova Scotia, and Jeffrey<br />

R. Hunt, a Partner with the Truro office of Patterson<br />

Law. I also want to thank all my Board colleagues for<br />

their contributions this past year and their continuing<br />

commitment to the airport, our employees, partners,<br />

customers, volunteers and, of course, our community.<br />

Representatives from airports all over the<br />

world visit HSIA, wanting to learn what it is we’re<br />

doing that sets us apart.<br />

Our answer? It’s all in the approach. We believe<br />

in the power of partnership. After all, everything to<br />

do with air travel, whether access, security, safety,<br />

or service, starts on the ground – with cooperative<br />

partnerships among people dedicated to the<br />

common goal of making the passenger and visitor<br />

experience as positive as possible.<br />

We see ourselves at the hub of a network of key<br />

partnerships. People are at the core of how we do<br />

what we do. Our role is to support our partners and<br />

to enhance these relationships so that together we<br />

can best serve the millions of visitors we greet each<br />

year. When 5,500 people in the airport community<br />

work together and share responsibility, as we do,<br />

the results are outstanding.<br />

As you read through this annual report, you’ll see<br />

we met or exceeded every one of the goals set for<br />

ourselves in 2007. In a rapidly changing and competitive<br />

industry, HIAA is emerging as the standard-setter<br />

within our industry. A strategic economic asset to<br />

the community. An enabler of economic development<br />

in the region. That’s our approach, and one that will<br />

carry us through 2008 – and onwards.<br />

Frank Matheson<br />

Chair of the Board of Directors<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 1

2007 also marked the beginning of the next<br />

stage in the airport’s physical evolution when our<br />

Board of Directors approved, and we broke ground<br />

on, an $82 million Groundside Redevelopment<br />

Program. Until now, our infrastructure dollars were<br />

directed at improving the air terminal building and<br />

restoring the airfield. This new phase, featuring<br />

a 2,300-space parking structure connected to the<br />

terminal by a covered pedway, improvements to<br />

the roadways, and services for a future hotel, will<br />

significantly change the face of the airport and<br />

also offer our guests new levels of exceptional<br />

service and convenience.<br />

A good passenger year usually means a good<br />

revenue year, and 2007 was no exception. Even<br />

though we incurred new expenses from our<br />

expanded facilities, I am pleased to say HIAA<br />

posted record revenues of $56.6 million.<br />

In 2007, we bid farewell to Peter Clarke, our<br />

highly respected Vice President, Operations, after<br />

18 years of service. Everyone will miss his sound<br />

counsel, and we wish him good days ahead. I also<br />

want to sincerely thank Gord Duke, our Director,<br />

Operations, who so adeptly stepped in as Interim<br />

Vice President upon Peter’s retirement.<br />

On February 25, 2008, HIAA welcomed Paul<br />

Baxter as our new Vice President, Operations.<br />

Paul, who comes to us from Farmers Dairy, brings<br />

senior-level experience in operations, logistics<br />

and supply chain management. Safe and effective<br />

airport operations are at the core of what we do,<br />

and Paul’s background and accomplishments<br />

will strengthen this already effective and efficient<br />

department.<br />

Partnerships are fundamental to the way we do<br />

business at HIAA. The culture of teamwork and<br />

cooperation we’ve built permeates every decision,<br />

every initiative, and every interaction, and is at the<br />

core of our success as an organization. Looking<br />

back on 2007, I especially want to recognize:<br />

• The 5,500 airport community employees and<br />

volunteers, whose commitment to outstanding<br />

customer service brought us – yet again – international<br />

recognition with three first-place honours<br />

in the 2007 global Airport Service Quality Survey:<br />

for overall passenger satisfaction for airports<br />

worldwide with under five million passengers<br />

(the fifth year in a row), best domestic airport<br />

worldwide, and in the regional category of<br />

Airport People Awards;<br />

• Our partners in US Customs and Border<br />

Protection who worked so closely with us,<br />

and the airlines, to make our US Preclearance<br />

service an immediate success;<br />

• The several hundred HIAA and other airport<br />

employees plus our security and response<br />

agency partners who planned and participated<br />

in Exercise Navigator, our day-long emergencyresponse<br />

simulation in October;<br />

• The Air Access Forum conference team<br />

who once again brought together airlines and<br />

airports from around the world with the aim<br />

of building air service across Atlantic Canada;<br />

• Our joint union-management committee,<br />

who completed our job evaluation project<br />

after several years of hard work;<br />

• The dedicated group who worked extensively<br />

to get our Groundside Redevelopment Program<br />

started; and<br />

• Our employee team and my executive<br />

management colleagues – whose names<br />

you see on the inside front cover – for their<br />

commitment and dedication, and the Board<br />

of Directors for their support.<br />

While we’re a business – one worth more than<br />

$1.2 billion to the Nova Scotia economy – we know<br />

we’re also here to serve the community in its<br />

broadest sense. After all, when we do well, everyone<br />

does well: our employees, our partners, our<br />

province, our region.<br />

At HIAA, we’ve been entrusted with a public<br />

asset – this airport – and it is our responsibility<br />

to grow Halifax Stanfield International Airport into<br />

the facility our community and our region wants<br />

and needs. The facility we know it can be: the best<br />

airport in the world.<br />

Joyce Carter<br />

w<br />

Interim President & CEO<br />

Tom Ruth<br />

Tom joined HIAA as President<br />

& CEO in January 2008.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 3

APPROACHING COMPLETION<br />

Nearing Our Goal. Realizing Our Vision.<br />

“ WE’RE BRINGING THE RANGE<br />

AND QUALITY OF CUSTOMER<br />

SERVICES OFFERED OUTSIDE<br />

THE TERMINAL BUILDING UP<br />

TO THE SAME HIGH STANDARD<br />

WE’VE SET INSIDE.”<br />

w<br />

2007 marked the mid-point of HIAA’s initial<br />

10-year capital plan and the year we turned our<br />

attention outward from the terminal building to<br />

the groundside.“From this point on, you’ll see<br />

us focus on bringing the range and quality of<br />

customer services offered outside the terminal<br />

building up to the same high standard we’ve set<br />

inside,” says Michael Healy, HIAA’s Vice President,<br />

Infrastructure & Technology.<br />

Our multi-million-dollar Groundside Redevelopment<br />

Program (GRP) will accomplish this goal<br />

by offering airport visitors improved services and<br />

facilities while making access to and from the<br />

terminal easier. Several key pieces of this strategy<br />

were completed in 2007, such as an expanded<br />

Park’N Fly lot, featuring 1,300 new spaces, and the<br />

new north tunnel, connecting the public parking<br />

lot to the north end of the terminal. Preparatory<br />

work also started to create separate upper and<br />

lower access roads to the terminal – one for<br />

departures, the other for arrivals – designed to<br />

streamline traffic flow and reduce congestion in<br />

front of the building.<br />

By far, however, our most significant achievement<br />

of 2007 came in July with the Board of Directors’<br />

decision to approve plans for the full GRP, an $82<br />

million project that will significantly change the look,<br />

feel and function of the groundside of the airport.<br />

The cornerstone of this initiative? An efficient,<br />

2,300-space parking structure, connected to the<br />

terminal building by an over-road pedway with<br />

two moving sidewalks.“We worked with a team<br />

of designers to create a modern facility with<br />

an aviation-style look, featuring stainless steel<br />

screens on two facades,” explains Michael. The<br />

energy-efficient structure, incorporating a rental<br />

car facility on the main floor, will be the first of<br />

its kind in Eastern Canada.<br />

“We’ve seen these state-of-the-art parking<br />

structures in Europe and parts of the US, although<br />

never before here,” notes Michael. Construction of<br />

the facility is underway, with completion expected<br />

in early 2009.<br />

Complementing this next stage of groundside<br />

development is a proposed 175-room hotel,<br />

attached to the terminal. A request for proposals<br />

for its construction and management was issued<br />

in 2007 with construction of the hotel expected to<br />

start in 2009.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 4

w<br />

Not all our efforts last year were focused outside,<br />

however, as we wrapped up expansion of the airport<br />

terminal building.“The original building dates<br />

from the 1960s. With the new US Preclearance<br />

facility at the north end and the new commuter<br />

terminal at the south end, the middle section of<br />

the departures lounge didn’t match architecturally<br />

with the newer phases,” explains Michael. From<br />

fresh wall finishes to new flooring, floor-to-ceiling<br />

windows to new lighting and more, we’re literally<br />

putting the finishing touches on the public spaces<br />

and creating one cohesive, modern look for the<br />

inside and outside of the terminal.<br />

Airfields form the core of any airport’s operations.<br />

By virtue of their constant use, they must<br />

meet exacting federal quality and safety standards.<br />

In 2007, we marked the third year of a comprehensive<br />

six-year airfield restoration initiative.<br />

Over a period of five months, we restored onethird<br />

of our main runway 05/23 by installing new<br />

drainage, electrical systems, and runway lights,<br />

and widening the runway by adding stabilized<br />

shoulders, making snow removal easier, and milling<br />

and paving the existing surface. We also milled<br />

and replaced the asphalt on one-half of the apron<br />

(the area behind the aircraft parking positions at<br />

the terminal), with the second half scheduled for<br />

2008. This $10 million project, completed on time<br />

and under budget, was carried out with minimal<br />

disruption to our guests and air carriers.<br />

During 2007, we also moved forward with planning<br />

and consultation on the proposed combined<br />

services complex, designed to house our mobile<br />

equipment and a new fire station. This project is<br />

a major undertaking, critical to providing updated<br />

and expanded facilities, and one welcomed by our<br />

operations and emergency response crews.<br />

Our current maintenance facility, where we store<br />

and maintain all our heavy equipment for snow<br />

removal and runway maintenance, is housed in<br />

a 45-year-old groundside hangar, with no direct<br />

access to the airfield. By moving this facility<br />

airside, our snow ploughs, loaders, graders, and<br />

other heavy equipment will not only be closer to<br />

the runways, they’ll no longer be using public<br />

roads to get there.<br />

On the technology side, we leveraged our earlier<br />

investments in a common network infrastructure<br />

to realize new benefits in 2007 – such as free Wi-Fi<br />

access throughout the terminal. This popular<br />

service, enthusiastically embraced by both our<br />

business and leisure travellers, made HSIA the<br />

first major airport in Canada to offer this feature.<br />

This common-use platform also means that<br />

tenants and airlines can easily tap into our existing<br />

integrated network for telephone and Internet<br />

service. Not only is this an attractive convenience<br />

for our clients and a revenue stream for HIAA, it<br />

gives us better overall control of our technology<br />

infrastructure.<br />

From inside to outside, from airfield to groundside,<br />

our physical vision for this airport continues<br />

to take shape. As our facilities transform. As<br />

our services expand. In Michael’s words, “We’re<br />

approaching completion.”<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 5

APPROACHING BUSINESS<br />

Succeeding by Enabling Success.<br />

“ THE COMBINATION OF THE INCREASED NUMBER OF DIRECT FLIGHTS<br />

AND THE IMMEDIATE AND REMARKABLE SUCCESS OF THE NEW<br />

US PRECLEARANCE FACILITY ALONG WITH THE STRONGER CANADIAN<br />

w<br />

DOLLAR ENCOURAGED MORE TRAVELLERS TO CHOOSE OUR AIRPORT.”<br />

Passenger growth and new routes; one complements<br />

the other. Together they drive an airport’s<br />

success. In 2007, we enjoyed plenty of both,<br />

thanks in part to our approach of building partnerships<br />

within the community and throughout the<br />

aviation industry.<br />

A record 3,469,062 passengers passed through<br />

our gates in 2007, breaking our previous record<br />

set in 2006. Most of this growth came in our US<br />

and international markets, with a 15.5 per cent<br />

increase in both categories.<br />

“Without doubt, the combination of the increased<br />

number of direct flights and the immediate and<br />

remarkable success of the new US Preclearance<br />

facility along with the stronger Canadian dollar<br />

encouraged more travellers to choose our airport,”<br />

says Jerry Staples, HIAA’s Vice President, Marketing<br />

& Business Development.<br />

The convenience and increasing number of new<br />

routes and direct flights, whether domestic, transborder<br />

or international, benefits both business and<br />

leisure travellers.“And that’s a direct result of the<br />

work we do to cultivate rapport with the carriers<br />

at all levels and, in particular, the airline business<br />

analysts who make recommendations on new<br />

routes,” adds Jerry.“We’re constantly in the carriers’<br />

offices, building relationships and making the<br />

case for Halifax Stanfield International Airport.”<br />

It’s an approach that’s paying off. In 2007,<br />

we launched a number of new routes to major<br />

destinations solidifying our position as Atlantic<br />

Canada’s gateway airport.<br />

Among our major achievements on the US<br />

side, for example, was United Airlines’ decision<br />

to initiate year-round, non-stop daily service to<br />

Chicago. And as a direct result of our new US<br />

Preclearance facility, both Air Canada Jazz and<br />

American Eagle began daily, non-stop service into<br />

New York’s LaGuardia Airport.<br />

Our international routes showed similar strength.<br />

Icelandair returned to Halifax after a six-year absence<br />

with a seasonal, three-times-weekly service to<br />

Reykjavik. This alternative route to Europe, scheduled<br />

to go year-round in 2008, opens up Nordic<br />

destinations to Atlantic Canada – and is an added<br />

bonus for both business and leisure travellers.<br />

Zoom Airlines added weekly seasonal service<br />

to Paris and Belfast in 2007, while Air Transat<br />

offered twice-weekly seasonal flights to London<br />

(Gatwick). And in June 2008, we’ll welcome a new<br />

international carrier when Corsairfly launches<br />

a weekly seasonal service between Paris (Orly)<br />

and Halifax.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 6

Eighty per cent of our passenger travel is domestic,<br />

so expanding and diversifying our Canadian<br />

routes remains paramount. In June 2007, Porter<br />

Airlines began offering seasonal summer flights<br />

between Halifax and Toronto City Centre Airport, via<br />

Ottawa and Montreal. The route proved so popular<br />

that Porter extended the Ottawa-Toronto service<br />

to weekends year-round. As well, Air Canada<br />

launched a daily, non-stop service between Gander<br />

and Halifax and, along with WestJet, added seasonal<br />

service to Edmonton.<br />

We also introduced two new services in 2007<br />

designed to make transborder and international<br />

travel easier for both passengers and carriers.<br />

Working in partnership with Canada Border<br />

Services Agency (CBSA), HSIA was one of the first<br />

airports to introduce NEXUS technology to expedite<br />

border clearance between Canada and the US.<br />

This trusted traveller program allows low-risk,<br />

pre-approved individuals to bypass the customs<br />

line-up by using self-serve kiosks instead, a<br />

real convenience – especially for those who fly<br />

frequently.<br />

Our carriers benefited from CBSA’s move<br />

last year to 24/7 customs coverage. In the past,<br />

the cost of customs services used after standard<br />

working hours was borne by the airlines. The<br />

growth of air charter service in recent years,<br />

however, has meant an increase in early morning<br />

and late evening flights requiring customs clearance.<br />

Staying competitive requires paying constant<br />

attention to costs, and we’re pleased that<br />

our representations to government departments<br />

and our partners resulted in the decision by<br />

CBSA to offer 24/7 coverage. Not only can air<br />

carriers fly into Halifax at any time of the day<br />

or night and know their passengers can clear<br />

customs, the arrangement helps our carriers<br />

remain cost-competitive.<br />

Being the largest airport and the region’s gateway,<br />

we know our continued success depends<br />

on building the air network throughout Atlantic<br />

Canada. That’s why every two years we host the<br />

Air Access Forum. Our 2007 conference, Altitudes<br />

East, brought airports from across the region,<br />

other parts of Canada and the US together with<br />

airlines from around the world. Under one roof, the<br />

150 attendees networked, met one on one, built business,<br />

and created opportunities for each other – all<br />

with the aim of growing air service. After all, as<br />

Jerry says, “When the other airports in the region<br />

do well, we do well, too.”<br />

While most people think of airports from a<br />

passenger perspective, the air cargo business<br />

is a major revenue-generator, and one we want to<br />

grow aggressively. A feasibility study completed<br />

in 2007 demonstrated how HIAA could increase<br />

its cargo numbers by attracting more business<br />

– mainly seafood – that’s now trucked from the<br />

Maritimes to the US and then airlifted to international<br />

markets.<br />

Growing this business means building the right<br />

facility for our cargo clients, and we’re close to<br />

finalizing plans with a developer for the construction<br />

of a multi-use cargo facility. Once completed,<br />

this modern building will feature new apron space<br />

for aircraft and loading docks plus warehousing<br />

and equipment, including refrigeration space, so<br />

important for seafood.“Airlines like to fly full in<br />

both directions,” explains Jerry.“This new facility<br />

not only means exporters can fly, rather than<br />

truck, their product, we can also help the region’s<br />

importers grow their businesses.”<br />

We enjoyed positive cargo growth in 2007. Cargo<br />

activity increased to almost 29,800 metric tonnes,<br />

up 7.4 per cent over 2006. While business for<br />

most cargo carriers was up, Air Canada’s dedicated<br />

MD-11 service to Vitoria, Spain, accounted<br />

for the most significant increase, adding some<br />

1,500 metric tonnes.<br />

Woven through all we do is a belief in the value<br />

of partnerships. Whether within our industry or out<br />

in the community, with transportation colleagues<br />

in the Halifax Gateway Council or stakeholders like<br />

the Greater Halifax Partnership; Halifax Chamber<br />

of Commerce; Nova Scotia Department of Tourism,<br />

Culture and Heritage; Destination Halifax; Tourism<br />

Industry Association of Nova Scotia; Nova Scotia<br />

Department of Transportation and Infrastructure<br />

Renewal; Nova Scotia Business Inc.; and Nova Scotia<br />

Economic Development, we know that rapport,<br />

relationships and credibility are fundamental to our<br />

success – and the success of those who work with<br />

us, for us, and beside us.<br />

Quite simply, it’s how we approach business at HIAA.<br />

w<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 7

OUTSTANDING CUSTOMER SERVICE<br />

A Team Approach. A Shared Commitment.<br />

“ EVERYONE WHO SERVES A GUEST, DIRECTLY OR INDIRECTLY, IS A PART OF OUR TEAM.”<br />

Our objective is to provide a convenient, safe and<br />

seamless experience for every visitor to Halifax<br />

Stanfield International Airport. Whether it’s checking<br />

in, going through security, renting a car, or getting<br />

information, we work with our partners as a committed,<br />

focused team to reach this goal.<br />

Each of the 5,500 people who work at the airport<br />

is responsible for delivering outstanding customer<br />

service – every day, with every guest. And this collaborative<br />

approach is at the heart of our success.<br />

The Airport Service Quality (ASQ) Survey, a rigorous<br />

global rating system that assesses 90 airports<br />

worldwide, once again recognized HSIA with three<br />

first-place rankings in 2007: one for overall passenger<br />

satisfaction for airports with under five million<br />

passengers – for the fifth year in a row; one for the<br />

best domestic airport worldwide; and the Airport<br />

People Award, for cultivating a strong customer<br />

service culture among staff and business partners.<br />

We also earned one other award: second in the<br />

Americas for overall customer satisfaction.<br />

In the six years HSIA has participated in this international<br />

program, we have earned a total of 19 awards<br />

– 12 first place, five second place and two third places.<br />

“Everyone here contributes to creating the ‘wow’<br />

factor that places us among the best airports in<br />

the world,” explains Kelly Martin, HIAA’s Customer<br />

Relations Manager.“And we do it through training,<br />

recognition and communication.” For example,<br />

through our Airport Customer Service Council,<br />

we work in partnership with our colleagues from<br />

across the airport community to create a common<br />

focus, enhance programs and build on what we’re<br />

already doing so well.<br />

Four years ago, HSIA was named a SuperHost<br />

airport – the only airport in Canada so designated.<br />

We keep that designation by ensuring that every year<br />

at least 60 per cent of our employees, Volunteer Hosts,<br />

retail and service outlet employees, and other partners<br />

come together for refresher training sessions.<br />

Not only does the training reinforce that sense<br />

of shared purpose and commitment, the fact that<br />

employees from all levels of these organizations<br />

attend, from seasoned executives to new hires,<br />

makes the point crystal clear: each and every one<br />

of us is responsible for delivering customer service<br />

above and beyond what our guests expect.<br />

And no one embodies this pride of service better<br />

than the 110 tartan-vested Volunteer Hosts, always<br />

ready to give a friendly welcome and lend a helping<br />

hand. These dedicated individuals, many retired<br />

from all walks of life, go through the same rigorous<br />

screening and training program as airport employees.<br />

The Volunteer Hosts clearly love what they do<br />

on the front lines, whether it’s helping a mother<br />

struggling with luggage and a couple of children<br />

or sitting with an anxious passenger who needs<br />

a little reassurance. And when unexpected delays<br />

occur, airport staff and Volunteers quickly bring<br />

out water, blankets, baby food, even decks of<br />

cards for tired passengers. Says Kelly, “At times<br />

like this, there’s no one more appreciative than a<br />

mother who needs a diaper for her baby.”<br />

To consolidate and improve French-language<br />

services to the travelling public, in 2007 HIAA met with<br />

representatives of the Office of the Commissioner<br />

of Official Languages, who provided assistance and<br />

guidance with this customer service initiative.<br />

So what’s the secret of our award-winning approach<br />

to customer service? Quite simply, it’s the people and<br />

how they feel about the work they do. After all, happy<br />

employees mean happy visitors. “All we do is reinforce<br />

good habits, recognize a job well done and ensure that<br />

everyone – employees and partners, whether on the<br />

frontline or behind the scenes – feels proud to be a<br />

part of this extraordinary team,” says Kelly.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 8

Scheduled and Charter Passenger Services<br />

Scheduled and Charter Passenger Air Carriers<br />

1 5 D O M E S T I C<br />

1 9 I N T E R N AT I O N A L<br />

11 TRANSBORDER<br />

19 PASSENGER<br />

9 C A R G O<br />

DESTINATIONS<br />

DESTINATIONS<br />

(USA) DESTINATIONS<br />

AIR CARRIERS<br />

CARRIERS<br />

Calgary, AB<br />

Bermuda – Hamilton<br />

Atlanta, Georgia<br />

Air Canada<br />

Air Canada<br />

Charlottetown, PE<br />

Deer Lake, NL<br />

Edmonton, AB<br />

Fredericton, NB<br />

Gander, NL<br />

Goose Bay, NL<br />

Hamilton, ON<br />

Moncton, NB<br />

Montreal, QC<br />

Ottawa, ON<br />

Saint John, NB<br />

St. John’s, NL<br />

Sydney, NS<br />

Toronto, ON<br />

Cuba – Cayo Coco, Holguin,<br />

Santa Clara, Varadero<br />

Dominican Republic –<br />

La Romana, Puerto Plata,<br />

Punta Cana<br />

France – Paris<br />

Germany – Frankfurt<br />

Iceland – Reykjavik<br />

Ireland – Belfast<br />

Jamaica – Montego Bay<br />

Mexico – Cancun, Cozumel<br />

St. Pierre et Miquelon<br />

United Kingdom –<br />

Glasgow, London (Gatwick),<br />

London (Heathrow)<br />

Boston, Massachusetts<br />

Chicago, Illinois<br />

Detroit, Michigan<br />

Newark, New Jersey<br />

New York (JFK), New York<br />

New York (LGA), New York<br />

Orlando, Florida<br />

St. Petersburg, Florida<br />

Tampa, Florida<br />

Washington (IAD), DC<br />

Air Canada Jazz<br />

Air Georgian<br />

Air St. Pierre<br />

Air Transat<br />

American Airlines<br />

CanJet Airlines<br />

Condor Flugdienst<br />

Continental Airlines<br />

Delta Air Lines<br />

Icelandair<br />

Northwest Airlines<br />

Porter Airlines<br />

SkyService Airlines<br />

Sunwing Airlines<br />

Airborne Express<br />

CargoJet Airways<br />

Icelandair<br />

Kelowna Flightcraft (Purolator)<br />

Korean Air Lines<br />

Morningstar Express (FedEx)<br />

Provincial Airlines<br />

Prince Edward Air<br />

Thomas Cook (UK)<br />

United Airlines<br />

WestJet<br />

Zoom Airlines<br />

w<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 9

APPROACHING RESPONSIBILITIES<br />

Seeing Needs. Creating Solutions.<br />

“ WE’RE WEAVING SAFETY AND<br />

SECURITY INTO THE FABRIC OF<br />

HOW WE DO BUSINESS EVERY DAY.<br />

IF IT’S NOT SAFE AND SECURE,<br />

NOTHING ELSE YOU DO MATTERS.”<br />

w<br />

In the end, airports are about people: our employees,<br />

our guests, our partners, our community. As an<br />

employer and as a neighbour, we approach our<br />

responsibilities more as opportunities: opportunities<br />

to make a difference where it counts most –<br />

with people.<br />

Safety and security in the air starts on the ground.<br />

Here at HIAA, we take a community-based approach<br />

to both.“In fact, we’re weaving safety into the fabric<br />

of how we do business every day,” says Gord Duke,<br />

Interim Vice President, Operations.<br />

For example, we’re well ahead of schedule in<br />

implementing Phase One of Transport Canada’s<br />

Safety Management System for airports, with<br />

elements of Phase Two already in place. This fully<br />

integrated approach to safety, starting with a gap<br />

analysis and resulting in a comprehensive and<br />

ongoing action plan, involves the active participation<br />

of all employees.“Safety is a standing item<br />

at every executive management team meeting,”<br />

notes Gord.“Steps like this start to change the<br />

culture of an organization.”<br />

When it comes to airport security, employees<br />

are our best eyes and ears: they’re here, they’re<br />

aware, they notice anything out of the ordinary.<br />

And that’s the key to HIAA’s successful i-Watch<br />

program. This highly visible security-awareness<br />

initiative, designed in part by our employees,<br />

stresses constant vigilance and action. The awardwinning<br />

program is part of the security training for<br />

everyone who works at Halifax Stanfield International<br />

Airport, and it is a model for other airports.<br />

In October, we tested our emergencyresponse<br />

capabilities when we ran Exercise<br />

Navigator, a large-scale simulation replicating<br />

an aircraft hijacking, bomb threat and fire. This<br />

multi-agency exercise, the result of a planning<br />

process that began in January, involved hundreds<br />

of participants, including airport tenants, employees<br />

and emergency responders.“You need to<br />

train outside your comfort zone,” explains Gord.<br />

“Overall, we were pleased with our performance<br />

and agency cooperation through the exercise,<br />

and have already put a number of the recommendations<br />

in place.”<br />

HIAA enhanced its emergency-response capabilities<br />

with the acquisition of a new fire truck. The<br />

665-horsepower Rosenbauer Panther uses stateof-the-art<br />

technology including thermal imaging<br />

cameras, onboard computers, Holmatro rescue<br />

equipment, and a command light.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 10

w<br />

Firefighter Tim Bull worked on the Panther’s<br />

colours to reflect Emergency Response Services’<br />

new paint scheme, making the equipment bound<br />

to be noticed wherever it goes. Training has begun<br />

for both the firefighters and mechanics.<br />

In 2007, HIAA took a major step forward in airport<br />

operational response with the establishment of our<br />

new Maintenance Response Teams. Today, our<br />

rotating teams of two electricians and a millwright<br />

are on duty seven days a week, sixteen hours a<br />

day, supporting the maintenance needs of the busy<br />

international airport we’ve become.<br />

As a responsible corporate citizen, HIAA remains<br />

committed to a high level of environmental stewardship.<br />

We follow best practices for the environment,<br />

with ongoing attention to water treatment. In<br />

2007, we updated our Environmental Management<br />

Plan and, in partnership with the Canadian Environmental<br />

Assessment Agency, we developed a Model<br />

Class Screening Protocol to enhance and streamline<br />

our environmental-impact assessment studies,<br />

and provide HIAA and airport tenants with a series<br />

of predetermined environmental assessments,<br />

which will improve both the quality and timeliness<br />

of assessments.<br />

On the employee front, a joint labour-management<br />

committee spent much of 2007 designing<br />

and implementing a new system to evaluate all<br />

unionized positions in a fair and equitable manner.<br />

This framework, which complies with federal<br />

employment equity regulations, is intended to bring<br />

order and objectivity to the system. We sincerely<br />

thank the hard-working team, along with all the<br />

employees involved, for taking on this challenging,<br />

often strenuous, project.<br />

Over the course of 2007, we also moved forward<br />

on our plan to bring a more strategic, organized<br />

and methodical approach to succession planning,<br />

more akin to the private sector model. Besides<br />

ensuring succession plans were in place and implemented,<br />

we hired seven additional staff to support<br />

our expansion and, in the process, ensure a transfer<br />

of knowledge and skills.<br />

HIAA is committed to its employees and working<br />

with them for the benefit of our community.<br />

Our Humanities Fund is designed to help meet<br />

the needs of the community and bring hope to<br />

people. Created through the collective agreement<br />

between the HIAA and the Union of Canadian Transportation<br />

Employees Local 80829, union members<br />

contribute $.01 for every hour worked, and HIAA<br />

doubles that contribution. Every year, an employee<br />

committee solicits suggestions from throughout<br />

HIAA on how the fund should be distributed. In 2007,<br />

the Humanities Fund awarded $7,100 to six organizations<br />

that deal with a range of issues including<br />

children with special needs, homeless youth, and<br />

those struggling with addictions.<br />

HIAA employees also step forward to fundraise<br />

for a range of community causes. In 2007, they<br />

raised almost $12,300 for the United Way and<br />

$3,500 for amateur sport in Nova Scotia through<br />

the annual Manulife Dragon Boat Festival, and<br />

they donated more than $700 worth of school<br />

supplies and food to the Parker Street Food &<br />

Furniture Bank. As well, in December, a group<br />

of employees helped them make holiday dinner<br />

deliveries throughout the Metro area.<br />

By waiving our usual fees, HIAA provided inkind<br />

support to Air Canada’s Dreams Take Flight<br />

program that offers financially challenged children<br />

a chance to visit Walt Disney World Resort for a<br />

day. As well, HIAA firefighter Rhonda Brassard<br />

volunteered her time as a chaperone. Through our<br />

corporate donations we continue to support local<br />

initiatives that our employees tell us are important<br />

for the health and well-being of the communities<br />

in which they live.<br />

Seeing needs. Creating solutions. Whether on<br />

the tarmac, in the office or at the neighbourhood<br />

hockey rink, we know that success is all about making<br />

a difference. With people. In ways that matter.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 11

FINANCIAL STABILITY<br />

A Measured Approach . Solid Results.<br />

“IN 2007 WE REPORTED A STRONG BOTTOM LINE AS REVENUES EXCEEDED EXPENSES BY $5.1 MILLION.”<br />

Like so much of what’s happened this past year<br />

at HIAA, 2007 was the year the “pieces came<br />

together,” and we began reaping the financial<br />

benefits of our earlier investments.<br />

In the airline business, more people passing<br />

through our terminal means more people using<br />

our concessions, more people parking, more people<br />

getting on airplanes. Thanks to a record passenger<br />

year and the success of our new US Preclearance<br />

facility, HIAA earned revenues of $56.6 million, our<br />

highest to date.<br />

2007 also marked our first full year of operation<br />

in our new expanded facilities. And while that<br />

naturally meant increased costs, we are still able to<br />

report a strong bottom line with revenues exceeding<br />

expenses by $5.1 million.<br />

Growing transborder and international traffic<br />

is a cornerstone of our business strategy at HIAA,<br />

and this past year we added another incentive for<br />

carriers by blending landing fees. Prior to this, lower<br />

landing fees were charged for domestic flights than<br />

non-domestic, standard practice at many Canadian<br />

airports. Blending the two fees, however, means that<br />

no matter where flights originate all carriers now pay<br />

the same landing fees. While this resulted in a modest<br />

cost increase for domestic flights, transborder<br />

and international landing fees dropped significantly,<br />

giving HIAA yet another competitive advantage in<br />

attracting new routes and new carriers.<br />

CanJet’s decision in late 2006 to end scheduled<br />

service meant an initial drop in domestic traffic – and<br />

revenues – for HIAA. Yet despite this, and other current<br />

challenges in the industry, by the summer of 2007<br />

domestic traffic and revenues had fully recovered.<br />

We’re also pleased to report that our credit<br />

rating agency, Standard & Poor’s, affirmed our A+<br />

credit rating, first assigned in 2006 for our initial<br />

bond issue. This outstanding rating is one of the<br />

best among Canadian airport authorities.<br />

In 2007, total revenues for HIAA, including airport<br />

improvement fees (AIF), reached $56.6 million<br />

compared with $51.8 million in 2006. The growth in<br />

revenues is mainly attributed to the first complete<br />

year of operation of the US Preclearance facility and<br />

increases in AIF revenue due to record-breaking<br />

passenger levels.<br />

Total expenses were $51.4 million in 2007 compared<br />

to $41.3 million the previous year. This rise was<br />

due mainly to additional costs in providing commonuse<br />

facilities, which included the first full year of operating<br />

the US Preclearance facility, increased amortization<br />

associated with the expansion, and a full year<br />

of interest on our bonds along with the higher costs of<br />

maintaining the expanded air terminal building.<br />

Overall, revenues exceeded expenses by $5.1<br />

million in 2007 compared to $10.5 million in 2006.<br />

As per our madate, this excess will be reinvested<br />

in the airport.<br />

Looking ahead to 2008, HIAA will continue<br />

growing passenger and cargo business by investing<br />

in state-of-the-art infrastructure expected of<br />

a leading international airport. Over the next 12<br />

months, you can expect to see a number of major<br />

capital projects come to fruition including:<br />

• Construction of a 2,300-space parking structure<br />

along with awarding of the contract and negotiating<br />

arrangements for the new airport hotel as<br />

part of the $82 million Groundside Redevelopment<br />

Program;<br />

• Implementation of Phase Four of our six-phase<br />

runway restoration program; and<br />

• Development of a multi-use cargo facility<br />

designed to make HSIA the principal air<br />

cargo centre as part of the Atlantic Gateway.<br />

With our destination in sight, we remain solidly on<br />

course. Our measured approach to financial stability,<br />

driven by the vision of our airport as a dynamic,<br />

interconnected community, will continue to serve<br />

as our guiding principles throughout 2008.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 12

financial statements<br />

auditors’ report<br />

To the Directors of<br />

Halifax International Airport Authority<br />

w<br />

We have audited the balance sheet of the Halifax International Airport Authority<br />

as at December 31, 2007 and the statements of operations and changes in net<br />

assets and cash flows for the year then ended. These financial statements are the<br />

responsibility of the Authority’s management. Our responsibility is to express<br />

an opinion on these financial statements based on our audit.<br />

We conducted our audit in accordance with Canadian generally accepted<br />

auditing standards. Those standards require that we plan and perform an audit<br />

to obtain reasonable assurance whether the financial statements are free of<br />

material misstatement. An audit includes examining, on a test basis, evidence<br />

supporting the amounts and disclosures in the financial statements. An audit<br />

also includes assessing the accounting principles used and significant estimates<br />

made by management, as well as evaluating the overall financial statement<br />

presentation.<br />

In our opinion, these financial statements present fairly, in all material<br />

respects, the financial position of the Authority as at December 31, 2007<br />

and the results of its operations and its cash flows for the year then ended<br />

in accordance with Canadian generally accepted accounting principles.<br />

balance sheet As at December 31<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

assets<br />

Current<br />

Cash 60,917 77,354<br />

Accounts receivable 3,988 3,943<br />

Inventories 338 380<br />

Prepaid expenses 868 695<br />

66,111 82,372<br />

Capital assets, net (note 4) 185,850 170,223<br />

Deferred financing costs, net (notes 3 and 5) – 3,862<br />

Debt service reserve fund (note 5) 4,127 4,127<br />

Accrued benefit asset (note 8) 375 426<br />

256,463 261,010<br />

liabilities and net assets<br />

Current<br />

Accounts payable and accrued liabilities 14,458 20,569<br />

Deferred revenue 1,057 938<br />

Current portion of long-term debt (note 5) 80 80<br />

15,595 21,587<br />

Long-term debt (note 5) 149,495 150,644<br />

Security deposits 1,902 1,764<br />

166,992 173,995<br />

Net assets<br />

Equity in capital assets (note 6) 89,471 87,015<br />

256,463 261,010<br />

Halifax, Canada<br />

February 15, 2008<br />

Chartered Accountants<br />

Commitments (note 7)<br />

Contingencies (note 10)<br />

See accompanying notes<br />

On behalf of the Board:<br />

Director<br />

Director<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 13

financial statements<br />

statement of operations<br />

and changes in net assets Year ended December 31<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

revenues<br />

Terminal and passenger security fees 13,063 11,875<br />

Landing fees 9,009 9,148<br />

Concessions 8,563 8,301<br />

Parking 6,559 6,260<br />

Interest 3,164 1,756<br />

Rental 1,753 1,825<br />

Other 852 312<br />

42,963 39,477<br />

Airport improvement fees (note 6) 13,637 12,316<br />

56,600 51,793<br />

expenses<br />

Salaries, wages and benefits 12,668 11,655<br />

Materials, services and supplies 12,004 11,276<br />

Amortization 9,192 6,530<br />

Interest on long-term debt (note 5) 8,125 2,762<br />

Ground lease rent 4,093 4,271<br />

General and administrative 4,075 3,588<br />

Property taxes 1,306 1,265<br />

51,463 41,347<br />

Excess of revenues over expenses for the year 5,137 10,446<br />

Net assets, beginning of year 87,015 76,569<br />

Opening adjustment (note 3) (2,681) –<br />

Net assets, end of year (note 3) 89,471 87,015<br />

statement of cash flows Year ended December 31<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

operating activities<br />

Excess of revenues over expenses for the year 5,137 10,446<br />

Items not involving cash:<br />

Amortization 9,192 6,530<br />

Net change in non-cash working capital balances<br />

related to operations (10,143) (7,559)<br />

Cash provided by operating activities 4,186 9,417<br />

investing activities<br />

Expenditures on capital assets (20,542) (54,008)<br />

Cash used in investing activities (20,542) (54,008)<br />

financing activities<br />

Proceeds of bond issue – 150,000<br />

Repayment - CIBC term loan – (26,000)<br />

Deferred rent - Transport Canada (81) (81)<br />

Debt service reserve fund – (4,127)<br />

Deferred financing costs – (3,912)<br />

Cash (used in) provided by financing activities (81) 115,880<br />

Net (decrease) increase in cash during the year (16,437) 71,289<br />

Cash, beginning of year 77,354 6,065<br />

Cash, end of year 60,917 77,354<br />

See accompanying notes<br />

See accompanying notes<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 14

notes to financial statements December 31, 2007<br />

1. general<br />

Halifax International Airport Authority (the “Authority”) was incorporated<br />

on November 23, 1995 as a corporation without share capital under Part II<br />

of the Canada Corporations Act. On February 1, 2000, the Authority signed a<br />

60-year ground lease with Transport Canada and assumed responsibility for<br />

the management, operation and development of the Halifax Robert L. Stanfield<br />

International Airport. Excess revenues over expenses are retained and reinvested in<br />

airport operations and development.<br />

The Authority is a dynamic and multi-faceted aviation enterprise that provides<br />

air access to the world, facilitates personal and business connections and promotes<br />

regional economic growth.<br />

The Authority is governed by a Board of Directors whose members are<br />

nominated by the Halifax Regional Municipality, the Province of Nova Scotia<br />

and the Federal Government, as well as the Halifax Chamber of Commerce. The<br />

nominated members can also appoint additional members who represent the<br />

interests of the community.<br />

The Authority is exempt from federal and provincial income tax, federal large<br />

corporation tax, and Nova Scotia capital tax.<br />

2. summary of significant accounting policies<br />

The Authority’s financial statements have been prepared in accordance with<br />

Canadian generally accepted accounting principles. The preparation of financial<br />

statements requires management to make estimates and assumptions that affect<br />

the reported amounts of certain assets and liabilities at the date of the financial<br />

statements and the reported amounts of certain revenues and expenses during the<br />

year. Actual results could differ from those estimates.<br />

Inventories<br />

Inventories consist of materials, parts and supplies and are stated at the lower of<br />

cost, determined on an average cost basis, and estimated replacement cost.<br />

Ground lease<br />

The ground lease with Transport Canada is accounted for as an operating lease.<br />

Capital assets<br />

Capital assets are recorded at cost including interest on funds borrowed for<br />

capital purposes, net of contributions and government assistance and are<br />

amortized over their estimated useful lives on a straight-line basis as follows:<br />

2. summary of significant accounting policies (continued)<br />

Assets<br />

Rate<br />

Computer hardware and software 20% - 33%<br />

Leasehold improvements 2.5% - 10%<br />

Machinery, equipment, furniture and fixtures 5% - 20%<br />

Vehicles 5% - 17%<br />

Construction in progress is recorded at cost and is transferred to leasehold<br />

improvements when the projects are complete and the assets are placed into service.<br />

Revenue recognition<br />

Landing fees, terminal fees, parking revenues and passenger security fees are<br />

recognized as the airport facilities are utilized. Concession revenues are recognized<br />

on the accrual basis and calculated using agreed percentages of reported<br />

concessionaire sales, with specified minimum guarantees where applicable. Rental<br />

revenues are recognized over the lives of respective leases, licenses and permits.<br />

Airport improvement fees (“AIF”) are recognized when originating departing<br />

passengers board their aircraft as reported by the airlines.<br />

Deferred revenue consists primarily of a portion of the common-use terminal<br />

equipment fee required for future capital acquisitions.<br />

Employee benefit plans<br />

The Authority sponsors a pension plan on behalf of its employees which has<br />

defined benefit and defined contribution components. In valuing pension<br />

obligations for its defined benefit component, the Authority uses the accrued<br />

benefit actuarial method prorated on services and best estimate assumptions.<br />

Pension plan assets are valued at current market values. The excess of the<br />

accumulated net actuarial gain or loss over 10% of the greater of the accrued<br />

benefit obligation and the fair value of the plan assets is amortized over the<br />

average remaining service life of employees. Defined contribution component<br />

amounts are expensed as incurred.<br />

Derivative financial instruments<br />

Derivative financial instruments, including interest rate swaps, may be used from<br />

time to time to reduce exposure to fluctuations in interest rates. These financial<br />

instruments will be accounted for under the deferral method if the Authority<br />

meets the hedging requirements set out in existing accounting pronouncements<br />

and the Authority chooses to designate these financial instruments as hedges.<br />

Accordingly, the book value will not be adjusted to reflect the current market<br />

values. Payments and receipts under interest rate swap agreements will be<br />

recognized as adjustments to interest and financing costs where the underlying<br />

instrument is an Authority debt issue.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 15

notes to financial statements December 31, 2007<br />

2. summary of significant accounting policies (continued)<br />

Derivative financial instruments that are not designated by the Authority to be in<br />

an effective hedging relationship will be carried at fair value with the changes in<br />

fair value, including any payments and receipts made or received, being recorded<br />

in interest and financing costs.<br />

Realized and unrealized gains or losses associated with derivative financial<br />

instruments, which have been terminated, designated from a hedging relationship<br />

or cease to be effective prior to maturity, will be deferred and recognized in the<br />

period in which the underlying hedged item is realized. In the event a designated<br />

hedged item is sold, extinguished or matures prior to the termination of the related<br />

derivative financial instrument, any realized or unrealized gain or loss on such<br />

derivative financial instrument will be recognized in the statement of operations.<br />

3. changes in accounting policy<br />

On January 1, 2007, the Authority adopted the Canadian Institute of Chartered<br />

Accountants’ (“CICA”) revised standards on recognition and measurement and<br />

presentation of financial instruments. The standards are titled 3855 – Financial<br />

Instruments – Recognition and Measurement and 3861 – Financial Instruments<br />

– Disclosure and Presentation. The standards are retroactively applied, but are<br />

prospectively presented.<br />

Upon adoption, the Authority has elected to review contracts for embedded<br />

derivatives subsequent to the elected transition date of January 1, 2003 in<br />

accordance with 3855 – Financial Instruments – Recognition and Measurement.<br />

(a) Effective Interest Method<br />

The new rules require transaction costs to be included in the debt balances and<br />

recognized as an adjustment to interest expense over the life of the debt. The<br />

Authority is also required to use the effective interest method to recognize bond<br />

interest expense where the amount to be recognized varies over the life of the<br />

debt based on the principal outstanding. Previously, transaction costs were<br />

amortized on a straight-line basis into the statement of operations.<br />

As at January 1, 2007, the Authority reclassified deferred financing costs to longterm<br />

debt. This resulted in a decrease in deferred financing costs of $1.101 million<br />

and a corresponding decrease in long-term debt of $1.101 million.<br />

(b) Hedges<br />

The new rules require deferred amounts relating to cash flow hedges, which were<br />

discontinued before the end of the original hedge term, to be removed from the<br />

balance sheet and recorded in the accumulated unrealized changes in net assets.<br />

Accordingly, the deferred financing costs of $2.761 million were reclassified as at<br />

January 1, 2007.<br />

3. changes in accounting policy (continued)<br />

These deferred costs will continue to be amortized to interest and financing costs in the<br />

statement of operations over the remaining term of the previously hedged instruments.<br />

4. capital assets<br />

Capital assets consist of the following:<br />

(in thousands of dollars) 2007 2006<br />

Accumulated Net book Net book<br />

Cost amortization value value<br />

$ $ $ $<br />

Computer hardware and software 6,608 4,306 2,302 3,260<br />

Leasehold improvements 182,994 15,791 167,203 151,911<br />

Machinery, equipment, furniture<br />

and fixtures 6,659 2,740 3,919 4,173<br />

Vehicles 8,172 3,954 4,218 4,643<br />

Construction in progress 8,208 – 8,208 6,236<br />

5. long-term debt<br />

212,641 26,791 185,850 170,223<br />

Long-term debt consists of the following:<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

5.503%, non-amortizing Series A Revenue Bonds due<br />

July 19, 2041. Interest payable semi-annually in arrears<br />

on January 19 and July 19 of each year until maturity,<br />

commencing on January 19, 2007. 150,000 150,000<br />

Transport Canada deferred rent, non-interest bearing,<br />

repayment in monthly installments of $6,700 which<br />

commenced in 2006. 644 724<br />

150,644 150,724<br />

Less current portion 80 80<br />

Less transaction costs<br />

(net of accumulated amortization - $32,000) 1,069 –<br />

149,495 150,644<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 16

notes to financial statements December 31, 2007<br />

5. long-term debt (continued)<br />

Bond issue<br />

In July 2006, the Authority completed a $150 million Revenue Bond issue. The<br />

$150 million 5.503% Series A Revenue Bonds, are due on July 19, 2041. The net<br />

proceeds from this offering are being used to finance the 10 year Capital Plan, and<br />

for general corporate purposes. These include the funding of a $4.1 million Debt<br />

Service Reserve Fund and a $6.6 million Operating and Maintenance Reserve<br />

Fund required by the Master Trust Indenture entered into by the Authority in<br />

connection with the offering. The bonds are direct obligations of the Authority<br />

ranking pari passu with all other indebtedness issued under the Master<br />

Trust Indenture.<br />

Reserve funds<br />

Pursuant to the terms of the Master Trust Indenture, the Authority is required to<br />

establish and maintain with a trustee a Debt Service Reserve Fund with a balance<br />

at least equal to 50% of annual debt service costs. As at December 31, 2007, the<br />

Debt Service Reserve Fund included $4.1 million in interest bearing deposits<br />

held in trust. These trust funds are held for the benefit of bondholders for use in<br />

accordance with the terms of the Master Trust Indenture.<br />

The Authority is required to maintain an Operating and Maintenance<br />

Reserve Fund of approximately $6.6 million. The Operating and<br />

Maintenance Reserve Fund must be established and funded as required by<br />

the Master Trust Indenture, for the benefit of bondholders. The balance in the<br />

Operating and Maintenance Reserve Fund is equal to at least 25% of certain<br />

defined operating and maintenance expenses for the previous fiscal period. For<br />

2008, approximately $7.2 million will be required to fund the Operating and<br />

Maintenance Reserve Fund. The Operating and Maintenance Reserve Fund<br />

may be satisfied by cash, letters of credit, or the undrawn availability under a<br />

committed credit facility.<br />

Deferred Financing Costs<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

Deferred financing costs – 3,912<br />

Less Accumulated amortization – 50<br />

– 3,862<br />

In accordance with the adoption of CICA 3855 standards, certain balances<br />

previously classified as deferred financing costs, have now been reclassified on the<br />

balance sheet. (See note 3, Changes in Accounting Policy)<br />

5. long-term debt (continued)<br />

Capitalized interest<br />

Interest on long-term debt of $210,019 (2006 - $1,966,365) was capitalized as part<br />

of construction in progress during the year.<br />

6. airport improvement fees<br />

On January 1, 2001, the Authority implemented an AIF of $10 per local boarded<br />

passenger to fund the cost of a major capital program. These fees are collected by<br />

the air carriers for a fee of 6% under an agreement between the Authority, the Air<br />

Transport Association of Canada, and the air carriers serving the Halifax Robert<br />

L. Stanfield International Airport. Under the agreement, AIF revenue may only<br />

be used to pay for the capital and related financing costs as jointly agreed with air<br />

carriers operating at the Halifax Robert L. Stanfield International Airport.<br />

A summary of the AIF collected and capital and related financing expenditures<br />

are as follows:<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

AIF revenue (net):<br />

AIF revenue 14,489 13,122<br />

AIF collection costs (852) (806)<br />

13,637 12,316<br />

Interest on surplus funds 3,164 1,756<br />

Net funds received 16,801 14,072<br />

Capital expenditures funded by AIF 24,708 44,388<br />

Interest expense funded by AIF 8,125 2,762<br />

32,833 47,150<br />

Excess of expenditures over AIF revenue 16,032 33,078<br />

Prior years expenditures now ratified* 24,600 –<br />

Excess of expenditures over AIF revenue,<br />

beginning of year 92,803 59,725<br />

Excess of expenditures over AIF revenue,<br />

end of year 133,435 92,803<br />

*As per terms of the MOA with the air carriers.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 17

notes to financial statements December 31, 2007<br />

6. airport improvement fees (continued)<br />

From January 1, 2001 to December 31, 2007, the cumulative capital<br />

expenditures totaled $214,674,000 (2006 - $157,241,000) and exceeded the<br />

cumulative amount of AIF revenue by $133,435,000 (2006 - $92,803,000).<br />

Net assets of the Authority as at December 31 are as follows:<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

Net assets provided by airport improvement fees 54,630 55,147<br />

Net assets provided by other operations 37,522 31,868<br />

Opening adjustment to net assets (note 3) (2,681) –<br />

Net assets, end of year 89,471 87,015<br />

7. commitments<br />

Transfer agreement<br />

Effective February 1, 2000, the Authority signed a 60-year ground lease with<br />

Transport Canada which provides for the Authority to lease the Halifax<br />

Robert L. Stanfield International Airport. A 20-year renewal option may be<br />

exercised, but at the end of the term, unless otherwise extended, the Authority<br />

is obligated to return control of the Halifax Robert L. Stanfield International<br />

Airport to Transport Canada.<br />

On May 9, 2005, the Government of Canada announced the adoption of a<br />

new rent policy that will result in reduced rent for Canadian airport authorities,<br />

including the Authority. This reduced rent will be phased in over four years<br />

beginning in 2006, with the new formula achieving its full impact in 2010. The<br />

new formula is based on percentage of gross revenues on a progressive scale.<br />

The Authority finalized the amendment to its ground lease with Transport<br />

Canada in December 2005.<br />

The estimated lease obligations under the amended ground lease over the<br />

next five years are approximately as follows:<br />

(in thousands of dollars) $<br />

2008 3,826<br />

2009 3,290<br />

2010 3,890<br />

2011 4,000<br />

2012 4,164<br />

7. commitments (continued)<br />

Long term debt – bond issue<br />

The $150 million Series A Revenue Bonds yield interest of 5.503% per annum,<br />

payable on January 19 and July 19 of each year until maturity. The interest due<br />

over the next five years is as follows:<br />

(in thousands of dollars) $<br />

2008 8,255<br />

2009 8,255<br />

2010 8,255<br />

2011 8,255<br />

2012 8,255<br />

Construction in progress<br />

At December 31, 2007, the Authority had outstanding contractual construction<br />

commitments amounting to approximately $7 million (2006 - $1.5 million).<br />

8. pension plan<br />

The Authority sponsors a pension plan (the “Plan”) on behalf of its employees,<br />

which has defined benefit and defined contribution components. The defined<br />

benefit component is for former Transport Canada continuing full-time<br />

employees who were employed by the Authority on February 1, 2000 and<br />

previously participated under the Public Service Superannuation Act (“PSSA”)<br />

Plan. However, these employees had the option to elect to become members of<br />

the defined contribution component in lieu of the defined benefit component.<br />

All other employees will become members of the defined contribution<br />

component. An actuarial valuation has been prepared as of January 1, 2007, for<br />

purposes of funding the Plan.<br />

The existing Government of Canada pension plan assets and accrued benefit<br />

obligations for certain employees have been transferred to the Authority. The<br />

pension transfer agreement between Transport Canada and the Authority was<br />

finalized during 2004 and the total pension liability has been transferred, fully<br />

funded to the Authority.<br />

The following table provides information concerning the accrued benefit<br />

obligation, plan assets, funded status and prepaid (accrued) pension costs of the<br />

Plan as at December 31:<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 18

notes to financial statements December 31, 2007<br />

8. pension plan (continued)<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

8. pension plan (continued)<br />

2007 2006<br />

% %<br />

Plan assets 23,533 22,290<br />

Accrued benefit obligation (23,821) (23,093)<br />

Funded status – plan deficit (288) (803)<br />

Unamortized net actuarial gain 663 1,229<br />

Accrued benefit asset 375 426<br />

The significant actuarial assumptions adopted in measuring the Authority’s<br />

accrued pension benefits are as follows:<br />

2007 2006<br />

% %<br />

Discount rate 5.50 5.25<br />

Expected long-term rate of return on plan assets 6.75 6.75<br />

Rate of compensation increase 4.00 4.00<br />

Other information related to the Authority’s defined benefit component is<br />

as follows:<br />

2007 2006<br />

(in thousands of dollars) $ $<br />

Employers’ contribution 426 1,032<br />

Employees’ contributions 194 203<br />

Benefits paid 255 138<br />

Pension expense for 2007 amounted to $201,000 (2006 - $165,000) for the<br />

defined contribution component and $477,000 (2006 - $556,000) for the defined<br />

benefit component.<br />

Equity securities 50 60<br />

Fixed income securities 39 32<br />

Real estate securities 10 8<br />

Other 1 –<br />

100 100<br />

9. financial instruments<br />

Fair value<br />

The Authority’s primary financial instruments consist of cash, accounts receivable,<br />

long-term debt and accounts payable and accrued liabilities. The difference<br />

between the carrying values and the fair market values of the primary financial<br />

instruments, excluding long-term debt, are not material due to their short-term<br />

maturities. The fair values of long-term debt are based on amortized cost using the<br />

effective interest rate method.<br />

Credit risk<br />

The Authority is subject to credit risk through its accounts receivable. A significant<br />

portion of the Authority’s revenues, and resulting receivable balances, are derived<br />

from airlines. The Authority performs ongoing credit valuations of receivable<br />

balances and maintains reserves for potential credit losses.<br />

10. contingencies<br />

The Authority may, from time to time, be involved in legal proceedings, claims and<br />

litigation that arise in the ordinary course of business which the Authority believes<br />

would not reasonably be expected to have a material adverse effect on the financial<br />

condition of the Authority.<br />

11. comparative figures<br />

The comparative financial information has been reclassified to conform to the<br />

presentation adopted for 2007.<br />

HALIFAX INTERNATIONAL AIRPORT AUTHORITY 2007 ANNUAL REPORT 19

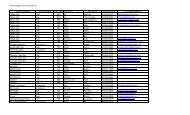

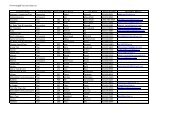

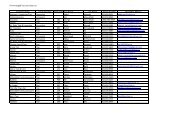

FIVE-YEAR FORECAST<br />

w<br />

A C T U A L<br />

F I V E - Y E A R F O R E C A S T<br />

YEAR 2005 2006 2007 2008 2009 2010 2011 2012<br />

Passenger Volume 3,229,111 3,378,601 3,469,062 3,626,566 3,766,119 3,897,039 4,005,090 4,109,970<br />

Per cent Change -0.4 % 4.6 % 2.7 % 4.5 % 3.8 % 3.5 % 2.8 % 2.6 %<br />

Total Aircraft Movements 86,393 86,110 89,251 95,142 99,518 103,797 107,430 111,083<br />